|

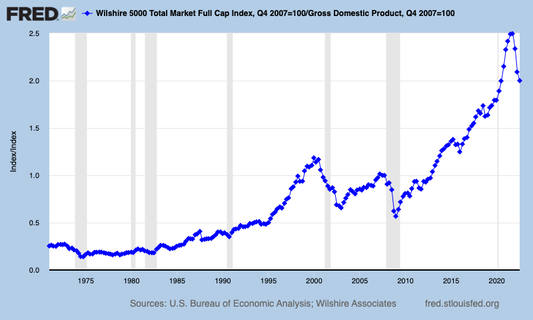

Ted Lasso. White Lotus. The Crown. Wednesday. Star Wars. Are You Subscribing to Everything? Should You Invest as Well? Walk into a movie theatre and it might be empty. Fire up a friend’s television, and you are likely to be bombarded with every streaminag choice available. Which companies win in that scenario? Streaming Wars or All in the Family? Each service has its own hits. One week White Lotus is the show everyone is watching, another week it is Wednesday. A few more users might even fire up their Apple TV subscriptions when Ted Lasso’s 3rd season finally drops this Spring. So, does the company revenue seesaw with the changing whims of pop culture, or is it fairly constant and hopefully increasing? Looking at revenue and paid memberships, both increased in the low single digits for Netflix. Warner Bros. Discovery saw a slight fall-off of revenue (-11.0%) and U.S. based TV-subscriptions year over year, but increased the DTC division by 2.8 million subscribers, to almost 95 million worldwide. A WBD/Amazon partnership expired in Sept. of 2021, which negatively impacted results in 2022. However, WBD CEO David Zaslav is very keen on activating multiple platforms that offer WBD content. In the 3Q 2022 earnings call, Zaslav said, “You can't be saying the only way to get me is to come through my portal.” While companies are getting more proprietary about viewing their content only on their page (except for perhaps WBD going forward), families and friends try to overcome the segregation by sharing their subscriptions. However, if budgets tighten in 2023, will we start seeing more selectivity? Will people hit the pause button on their subscription more frequently, to watch the hits when they’re hot and flip loyalties when the new content dries up? Will there be more content in general in 2023, now that the pandemic isn’t limiting production schedules so dramatically? Can advertising revenue bridge the gap? Netflix is warning that their new paid sharing platform has caused some cancellations in their Latin America test market. The plan is to start rolling out paid sharing in the U.S. in Q1 2023. Netflix is still expecting revenue growth of 4% in the first quarter (8% on a F/X neutral basis). Advertising Revenue Netflix just added advertising to their revenue stream. While diversifying a revenue stream is always good for business, other streaming services are reporting that the macroeconomic downturn has impacted ad spending. The CFO of Warner Bros. Discovery told investors in the 3Q 2022 earnings call that “advertising is by far the greatest variable impacting our financial performance for 2023.” Advertising revenue was down -11% in the 3rd quarter 2022 for WBD. FX The strength of the dollar creates a headwind for multinational businesses that are U.S. based. F/X reduced Netflix revenue by 8% of revenue and is expected to hit WBD revenues by $160 million for the full 2022 year. The real question is whether or not the dollar will continue to reign supreme in 2023. Debt, Leverage and Valuation Warner Bros. Discovery has the most leverage (and the lowest credit rating) of the streaming services, at BBB-, to Netflix’s BBB+, Apple’s AA- and Walt Disney Co.’s BBB+ (positive). As WBD CEO Davis Zaslav points out, most of the Warner Bros. Discovery debt is “cheap, largely fixed, and long dated debt.” WBD has about $2.4 billion cash on hand, with about $1 billion of debt coming due in 2023, and about $1.4 billion coming due in 2024. The company had to dip into their free cash flow in 3Q 2022, to the tune of about $192 million. So, investors will be interested to see if WBD was able to generate free cash flow, while cutting expenses, in the 4th quarter. The company reports earnings on Feb. 23, 2023 (at 4:30 pm ET). In addition to having legacy debt, WBD has legacy brands, such as Harry Potter, HBO, TNT, Discovery and more. They are also expanding the products of each brand, including launching a Hogwarts Legacy game. So, it is possible for the company to get on the right side of its mountain of leverage. Valuations Investors have marked the WBD share price down to a P/E of 7.23. So, if this company ever makes the kind of positive headlines that Netflix does, there could be upside. Of course, we still have the macro economy to deal with, which could weigh stocks down again in 2023. (NASDAQ dropped by a third last year, and is still down by -24%.) Most streaming companies are trading at very lofty valuations, with Disney at a P/E of 65, Netflix at 40 and Apple at 26. Should a company like Netflix that generated only $4.5 billion in net profit last year be worth $163 billion? As you can see in the Buffett Indicator chart below, when share prices get too outlandish, the plunge tends to be swift and severe. Only WBD and Paramount Plus are trading at low P/Es, at 7 and 5, respectively. Bottom Line While streaming is likely to remain a popular, low-cost form of entertainment in 2023, as household and ad budgets get constrained, ad spend could sink and subscriber churn could increase. Content will continue to be King. Cost increases, like paid sharing, could backfire. Most streaming companies are very overvalued. As we head into a year that most economists believe will see a recession, it will pay to be aware of the macro and industry-wide headwinds. If you’d like a Streaming Stock Report Card, email [email protected] with Streaming Stock Report Card in the subject line. Email info @ NataliePace.com or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep and home buying solutions that will transform your life at our next Financial Freedom Retreat.  Join us for our Online Financial Freedom Retreat. April 22-24, 2023. Email [email protected] to learn more. Register by Feb. 8, 2023 to receive the best price (value $200). Click for testimonials, pricing, hours & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed