|

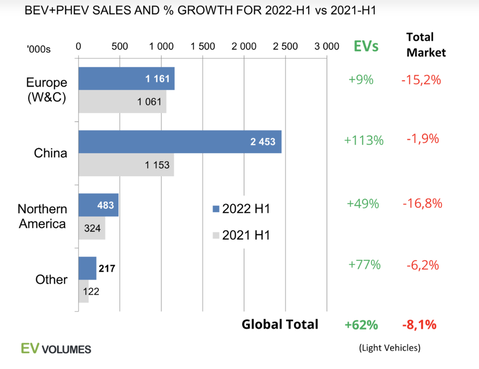

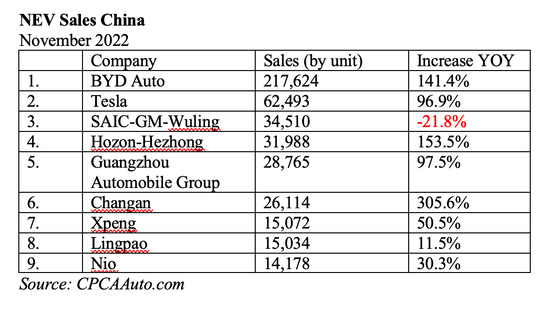

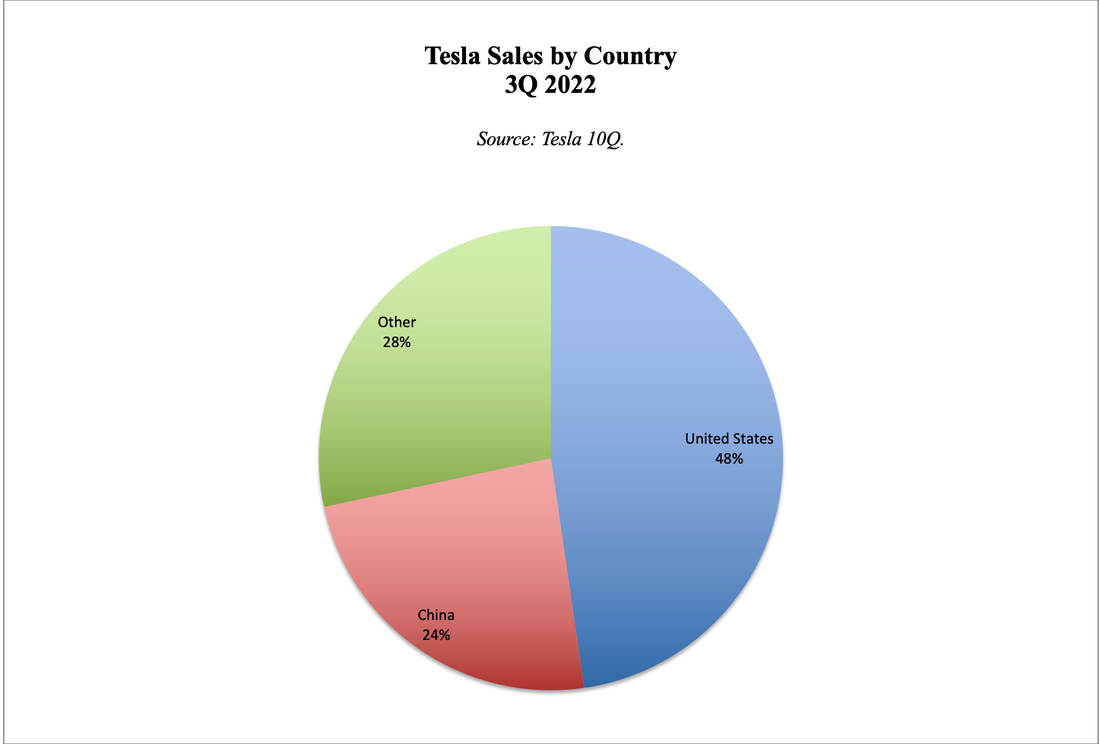

This blog was amended on 1.3.2023 to link to the EV tax credit information on the IRS.gov website and to correct the information on GM, Tesla & Toyota tax credit eligibility under the Inflation Reduction Act. Tesla’s $644 Billion Crash From Mars. A Tale of 2 Cs and one P/E: Covid, Competition, insider selling (by Musk) and a lofty valuation caused a crash landing from Tesla’s trillion dollar valuation (on Oct. 26, 2021). With a value of just $356 billion, is it time to buy the world’s most popular electric vehicle manufacturer? If you ask most people to name an electric vehicle, chances are they will immediately retort, “Tesla.” Tesla is as synonymous with EVs as Heinz is to ketchup – not just in the U.S., but all over the world. Models S3XY (sexy) are on the roads in Europe and China, with factories in Shanghai and Berlin. Year-over-year sales growth was an impressive 56% in the 3rd quarter of this year. So, why have investors dumped their Tesla shares? Who is Selling Tesla? Elon Musk is the biggest seller, having sold almost $40 billion over the last year (source: Bloomberg). While that doesn’t explain a drop of over $600 billion, it does send the wrong signal to investors. Is Elon protecting his wealth against a potential recession? Not necessarily. All billionaires are interested in diversifying their revenue streams. Also, Musk had to sell Tesla stock in order to buy Twitter. In Tesla’s 3rd quarter 2022 earnings call, Musk said that he believes Tesla is “recession-resilient” because “the public realizes that the world is moving toward electric vehicles, and that it's foolish to actually buy a new gasoline car at this point because the residual value of that gasoline car is going to be very low.” The EV Competition Of course, Tesla isn’t the only EV available. There are many challengers to Tesla’s stellar first-mover advantage, including in the world’s largest EV marketplace – China. A partial list of competitors includes: BYD Auto (the #1 EV automaker in China), GM (going all electric), XPeng, Nio, Genesis (Hyundai), Vinfast, Li Auto, Mercedes and Lucid. The publicly traded Chinese EV makers have had their share prices destroyed this, largely because China has been out-of-favor. There has been a great deal of pressure to get U.S. audits of their financial statements. That process has begun, and the outcome will likely be significant. In the event of good news, there could be a massive relief rally. In addition to selling cars in China, Nio has expanded into Norway and Europe. China: The #1 Electric Vehicle Market in the World (by far) China’s appetite for electric vehicles is ravenous. The China Association of Automobile Manufacturers projects that sales of electric cars and plug-in hybrids will reach 6.7 million units this year, up from 3.5 million units in 2021 (source: China Daily). See below for the country comparison of BEV and PHEV sales in the first half of 2022 by CleanTechnica. Forecasters are predicting that passenger car sales in China will be on par in 2023 compared to 2022, with EVs continuing to take up more of the pie. There has been a lot of news about Tesla lowering prices in China. This has a lot to due with the competition and also the COVID lockdowns. However, delivery snafus are also an issue. Tesla reported that deliveries were lower in the 3rd quarter because there were vehicles in transit that didn’t make it to the buyer in time. The same challenge is expected to be in play in the 4th quarter. According to the China Passenger Car Association’s November 2022 sales report, in November 2022, Tesla was #2 in sales of new energy passenger cars in China (by units), behind BYD. About a quarter of Tesla’s revenue came from China in 3Q 2022. Inflation Reduction Act EV Tax Credits EVs come with up to $7,500 in tax credits thanks to the Inflation Reduction Act. The lower-priced models of Tesla and GM models that previously didn't qualify, as the companies had already reached their 200,000 vehicles per manufacturer limit, are now allowed. Mercedes, Honda, Nissan, BMW, Ferrari, Fisker, Lucid and Toyota also should have models that qualify. (Some, like Toyota and Mercedes, were still pending as of the writing of this blog.) Mercedes might be one to watch, as the company began rolling out its mostly all-electric fleet this year. Click to check the IRS list for cars that meet the requirements. Growth & Valuation Concerns When Tesla sported that trillion dollar valuation, the price earnings ratio was over 400. The company was earning less than $5 billion, and its company value was over $1 trillion. This was during the Shoot the Moon Stimmy check phase – a runup caused by infatuation with Ark Investments and little regard for fundamentals. That was Fantasyland. Today, Tesla’s price-earnings ratio is 35 – still quite lofty, particularly given the natural gas crisis and recession in Europe, the COVID crisis in China and the slowdown (and potential recession) in the U.S. Tesla’s net profit should ring in about $15 billion in 2022, and the market value is still $384 billion. By comparison, General Motors could bring in around $12 billion, and the company’s market value is only $48 billion. Tesla’s valuation is still higher than the combined value of GM, Ford and Toyota combined. There is been concern that Tesla won’t meet analyst expectations in the 4th quarter. Zachary Kirkhorn, Tesla’s CFO, advised in the 3rd quarter earnings call that there were a lot of cars in transit that were being tied up in Shanghai harbors, and also due to local trucking issues in the U.S. While the company is clearly working to solve those bottlenecks, and to keep the materials supply chain from limiting production, the November COVID lockdowns and current COVID crisis in China have the potential to further complicate the problems. Tesla would have to deliver almost half a million vehicles in the 4th quarter of this year in order to meet the “almost 50% delivery growth” cited by Kirkhorn. That would represent a 44% increase in deliveries over the 3rd quarter’s 343,830. The production and deliveries report should be released on January 2, 2023, with the earnings report on or around Jan. 25, 2023. EVs are the hottest ticket in car sales, and Tesla has always performed impressively when the company is on the ropes. However, it doesn’t seem realistic that that many cars can be delivered in the last quarter of 2022. (Thus, the investor selloff of stock when Tesla started marking down the price in China.) Bottom Line Tesla is still the EV that people around the world want to own. However, there are a lot of options now, and a great deal of financial incentives (that Tesla is locked out of) that could start cutting into market share going forward (and is already impacting sales in China). Tesla’s $1 trillion fall from grace had a lot to do with being severely overvalued in the first place. This is why Tesla owners, and all shareholders, really need a “capture gains” rebalancing strategy (something we teach at our Investor Educational Retreats). Buy & Hope hasn’t worked well in the 21st Century, and has been spectacularly terrible in recessions – even with great companies that have become imbedded in our daily lives. Would I be buying Tesla right now? Weakness in stocks, combined with the potential of missing expectations are both negative for a rise in share price. Car sales slow way down in recessions. (Remember the bankruptcies of GM and Chrysler in 2009?) The trend toward EVs is likely to continue. However, if unemployment rises, car sales will falter. If I owned Tesla and had ridden the rollercoaster up and down, then I’d be looking at adopting a strategy that allowed me to retain ownership, while also keeping my portfolio in balance (a capture gains plan). We discuss this at our Financial Freedom Retreats and also in my private coaching. Email [email protected] to learn more. FYI: We had multiple alerts that Tesla was overpriced over the past year, including at $362 on March 31, 2022 and $272.24 on July 7, 2022, (Click to access the original blogs.) We’ve also been warning this in every retreat since the trillion dollar valuation. (You’ll learn how to do this yourself at the retreat.) Email [email protected] with Auto Stock Report Card in the subject line, if you’d like a copy of our updated Auto Stock Report Card. Full Disclosure: I own shares of Nio and Xpeng.  Join us for our New Year, New You Financial Freedom Retreat. Jan. 20-22, 2023. Email [email protected] to learn more. Register now to receive a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed