|

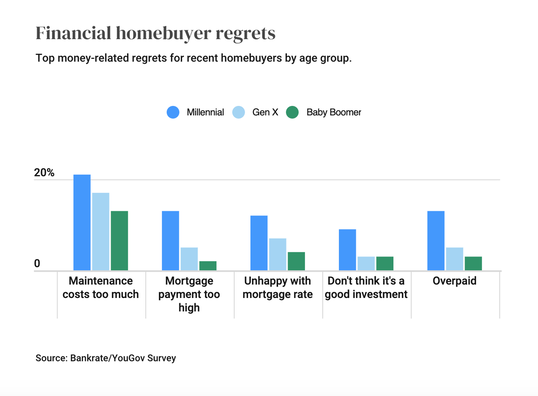

My 24-year-old son is itching to purchase a condo. He believes that he can purchase for about the same price that he is paying rent. Should I help him make the down payment? Signed, Rich Dad Dear Rich Dad, A recent survey conducted by BankRate shows that 2/3rds of Millennials are having a severe case of buyer’s remorse. After the fact, they are discovering that everything costs a lot more than they were originally told, including the mortgage and the upkeep of owning your own home. (Did your son factor in the HOA fees?) They also worry that they overpaid, and they don’t believe they made a good investment. When a real estate broker-salesman tells your son that he can buy a condo for the same price that he’s renting, there is a lot of the story missing:

Buy What You Can Afford When you think about buying a home, there is a lot more to consider than just the cost of rent. Are you limiting your purchase, including all of the expenses of homeownership, to under 28% of your budget? This is the most important, but not the only, consideration. The Thrive Budget When you limit your basic needs expenditures, including taxes, to 50% of your gross income, then you have 50% to thrive. Struggling to survive is a nightmare, and could put you in financial danger if you are property rich and cash poor. Click to personalize your own Thrive Budget. Some Other Important Considerations

Multi-Generational Housing Thinking bigger, having more people in the home and sharing community areas like the kitchen, dining and bathrooms, is a far more efficient use of space. What costs more in total can actually cost each individual much less than they are currently spending. You can have as much privacy living in your luxurious/spacious room in a big house, as you would living in a cramped apartment, where half of your space is taken up with cooking, eating and showering. Multi-generational housing is more popular today than it has been in a century (more popular than even in the Great Depression). FYI: the trend toward buying bigger homes is what has led to the dramatic increase in the median home sales price. Larger homes are more expensive, so with more being sold, the average price is soaring. Apply The 3-Ingredient Recipe for Cooking Up Profits Once you own your home it, it’s yours until you can sell it again (or lose it back to the bank). So, you must have an eye towards the future, on purchasing something you can afford and on buying it for a good price. Cast your vision at least 7-10 years out. Do you really want to be in this area when you are ten years older than you are today? Should you be downsizing, monetizing or moving in the relatives? The 3-Ingredient Recipe for Cooking Up Profits reminds you that purchasing a home is an investment, and must be evaluated as such. With all of the ads on the Internet, combined with the motivation of real estate broker salesman to make their commission, a lot of people feel pressured to buy now. However, it is always a good strategy to do your due diligence before you jump into any investment. The 3-Ingredient Recipe for Cooking Up Profits

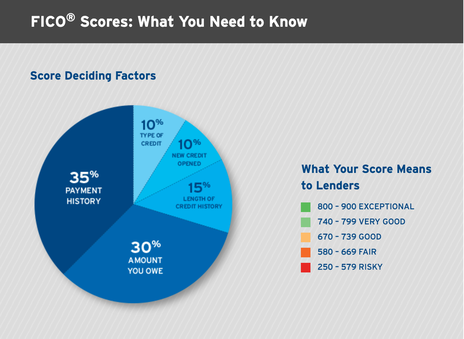

Buying High Can Ruin Your Life (and Your FICO score) Buying a home at the top of the market can ruin your life and your FICO score for a decade. If home prices fall beneath the mortgage commitment, your credit score goes in the toilet because 1/3 of your score is your assets to debt ratio. (After home prices hit an all-time high in 2006, they dropped by half between 2007 and 2011.) If your mortgage goes underwater, you won’t be able to sell it because you owe more than it’s worth. That means you’re locked in, and you probably can’t move, even if you were offered a better job in a different city. Purchasing high makes it harder to monetize. You might be stuck paying much more than you can rent it out for. Almost 5 Million Renters and Homeowners Skipped Their Payment in March 2021 It has been a seller’s market of late because there just aren’t a lot of listing on the Multiple Listing Service, especially in the starter home market. However, the pandemic has been the main cause of that. There has been a moratorium on foreclosures and evictions. Almost 5 million homeowners and renters skipped a payment in March 2021 – meaning there is more distress in residential real estate than most people are aware. Additionally, people have been afraid to list their homes because they don’t want strangers tramping through their quarantine and Work-From-Home office. With the end of the eviction and foreclosure moratoria at the end of June, more inventory will come to market. Additionally, with vaccinations and the opening up of the United States, Boomers who are ready to downsize should start listing their homes for sale. There are 2.6 million U.S. homeowners who are severely under water on the mortgage, meaning that the mortgage loan is 25% higher (or more) than the value of their home. That should be a red flag reminder of what hell it is to buy high. How is it that so many people are distressed when real estate prices keep soaring? These are people who have never recovered from the Great Recession. During the loan mod process, the bank packs the missed payments and penalties onto the lump sum of the mortgage. Homeowners are trapped into paying, even though they are in perpetual danger of foreclosure, because they don’t have any equity or life boat to escape the situation. (There are potential solutions. If you are in this predicament, email our office at [email protected] for resources.) More Inventory is Expected as Early as October More inventory should hit the marketplace by October of 2021. More inventory typically equates with lower prices. So, taking the time now to:

Will give you better odds of making a home purchase that can be your son’s sanctuary and not his hell. Bottom Line If your son wants to buy a home, he’s likely being fueled by FOMO, ads and salesmen. He might have dollar signs in his eyes thinking about all of the money that has been made this year in real estate. (Past performance doesn’t equal future performance. When you drive while looking in the rearview mirror, you might crash.) We can’t expect our kids to know about investing if we’ve never taught them the ABCs of money that we all should’ve received in high school. Therefore, your best move right now is to educate your son on successful investing, rather than contribute to something that could actually be a nightmare for him. Owning a home is absolutely one of the best ways to build wealth and to stop making the landlord rich. However, if you buy more than you can really afford or purchase at an all-time high, the opposite is the case. Being on the right side of the trade is always key to successful investing. More Real Estate Resources https://thriveglobal.com/stories/homeowners-are-worth-46-times-more-than-renters/ https://www.nataliepace.com/blog https://www.nataliepace.com/blog/almost-5-million-americans-are-behind-on-rent-mortgages-while-home-prices-hit-new-highs https://www.nataliepace.com/blog/sanctuary-sandwich-home-multigenerational-housing-replaces-the-nuclear-family https://www.nataliepace.com/blog/kushners-times-square-building-plunges-80-in-value Join us for our Oct. 9-11, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn how to make a smart investment in real estate, pick hot funds and companies (like Tilray and our 2021 Company of the Year), and how to incorporate hard assets, hot stocks, crypto and safe havens into a well-diversified wealth plan. You'll discover how to protect your wealth and save thousands annually in your budget with smarter big-ticket choices. The retreat is a complete Money Makeover that will transform your life forever. Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now. Register by June 13, 2021 (Sunday) to receive the lowest price and a complimentary, private, prosperity coaching session (value $300).  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price and a complimentary private prosperity coaching session (value $300) when you register by Sunday, June 13, 2021. Other Blogs of Interest Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed