|

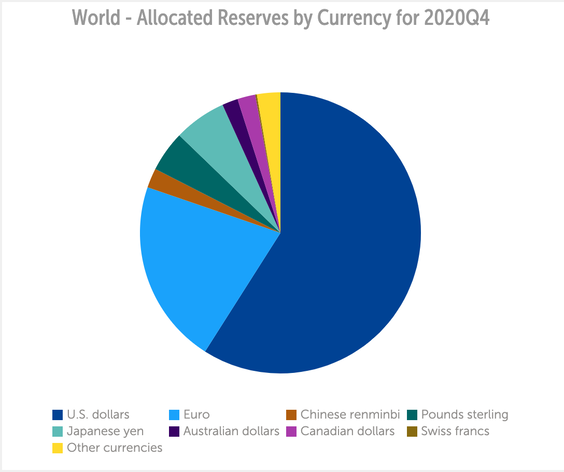

Is cryptocurrency the new gold? When Boomers are worried about a weak dollar or the U.S. economy being buried in debt, they think of gold as a hedge. Gen Z and Millennials get excited about cryptocurrency – peer-to-peer money that bypasses banks. When Jerome Powell compared cryptocurrency to gold this year (multiple times), his rationale is that both are vehicles for speculation. Cryptocurrency, like gold, is not being used to pay for things. Yes, theoretically you can buy a Tesla with Bitcoin, and secure, peer-to-peer monetary transactions could indeed take hold in the future. However, when word on the street is that Bitcoin is going to hit $100,000/coin or a million a coin, the heart of that hyperbole is the hope of getting rich quick. Speculation. Tesla was by far the hottest investment of 2020, rising more than 8-fold on the year. Bitcoin almost quadrupled. Gold scored a respectable gain of 22.3%. 2021 saw Bitcoin soar even higher. The coin hit $64,899 on April 13, 2021, and is currently at $54,905. The volatility in crypto is not for the faint of heart. (See below when we discuss the Crypto Crash of 2018.) All cryptocurrencies are not created equal. Some were created as a joke (Dogecoin). Others are out and out scams (those #WallStreetBets crypto schemes, MLM coin clubs, and Joff Paradise and his Trade Coin Club scam, which I warned of in my blog of June 25, 2017). Some are run by executives who have been in trouble with the SEC in previous ventures (Ripple XRP). Also, since crypto is a traders’ paradise right now – and is not being used as currency – it’s important to apply tried and true investing strategies. Buying high, hoping to sell higher, is rarely a good idea. The Buy and Hold strategy wiped out crypto investors just a few years ago. It’s easy to lose sight of the lessons of the past (the very recent past) when stocks and crypto are trading at all-time highs. However, it’s better to be sobered up by data and statistics than by reality. Elon and Jack Bitcoin‘s most recent surge has a lot to do with Elon Musk and Jack Dorsey. Both have gotten behind Bitcoin in big ways. When they added the Bitcoin symbol to their Twitter profiles, popularity in Bitcoin began to soar. Jack has 5.3 million followers; Elon has 52.7 million. (The symbol is no longer in Elon’s profile, but is still on Jack’s.) On March 15, 2021, Tesla’s CFO Zach Kirkhorn added the title Master of Coin to his CFO standing. (Elon became the Technoking.) Tesla has begun accepting Bitcoin in the U.S. (but not Bitcoin fork products, like Bitcoin Cash or Bitcoin SV). In 2020, Square’s 2020 total net revenue was $9.5 billion, more than double that of 2019. If you exclude Bitcoin revenue, the total drops to $4.93 billion – a mere 17% increase over 2019. Square enjoyed a $4.6 billion revenue bump by offering Bitcoin to its Cash App customers. Since the company has to purchase Bitcoin in order to sell it, there isn’t a great deal of profit yet. Square’s Bitcoin costs in 2020 were $4.47 billion. According to the Square 4Q 2020 Shareholder Letter, “In January 2021, more than one million customers purchased Bitcoin for the first time.” Both Tesla and Square claim to be Bitcoin believers for the long run. However, Tesla sold 10% of its holdings, according to an Elon Tweet on April 26, 2021. Both Square and Tesla also acknowledge that if the price of Bitcoin goes down, they will be forced to take a charge. Value of investments must reflect the current market fair price, according to accounting rules. If the price of Bitcoin falls as precipitously as it did in 2018, or if a downtrend starts developing, both companies might decide to do a little profit-taking, while the getting is good – in order to avoid a massive, devastating write-down. CFOs are in charge of liquidity, ROI and good earnings reports. Having a large markdown won’t please their shareholders. On face value, you might think that with the support of Square and Tesla, Bitcoin almost has to stay high. However, with Bitcoin’s trillion-dollar market value, Tesla and Square investments are a smaller piece of the pie. There are many hedge funds, private equity and even venture capital funds that are invested in Bitcoin. Finance geniuses are well aware that making a return on investment involves selling to capture your gains. No one wants to be caught holding the bag. So, once a whale starts selling, the knife drop can slice rather quickly, which is exactly what happened in 2018, and in April when Bitcoin dropped by $10,000/coin. The April 2021 Bitcoin rally to $64,899/coin was led by retail traders (Main Street), with whales taking profits, according to Coindesk. The Crypto Crash of 2018 Bitcoin ballooned to a value of $20,000 in December 2017. Within two short months, the coin crashed by 60%. At the end of the year, it was down more than 80% making the correction worse than the Dot Com crash (of -78%). No one stepped forward to claim that they were the ones who pocketed all the gains. However, a crash of that magnitude inevitably involved the whales. The individual Main Street investor is the one who typically gets caught on the wrong side of the trade. Many Bitcoin millionaires were destroyed in 2018. An online search should reveal some pretty heartbreaking tragedies (and, sadly, suicides). That’s why it’s very important to adhere to a time-proven system for investing when you are considering a crypto trade in 2021. Invest Within Reason Volatility is one of the reasons why it’s a good idea to think of cryptocurrency investments as a slice of your wealth strategy and not the whole banana. If you really believe in Bitcoin or another coin, then mock up a sample pie chart using my free Nest Egg Pie Chart web app. (Email [email protected] with Web App in the subject to receive links to it.) Consider investing a couple of the hot slices in the cryptocurrencies you most believe in. If the coin shoots the moon, and your slice becomes ten slices, it is prompting you to sell high. (Keep a slice or two if it’s still hot.) If the coin drops in price and you still believe in it, you are prompted to buy more at a lower price. Learn more about nest egg rebalancing in this Nest Egg IQ Test. Crypto Criminals Be very wary of any cryptocurrency investment tips that you receive by email or as a hot tip from a friend. Grade your guru before you listen to anything they say. (Click to read a blog on why this is imperative.) Whenever any asset or industry gets hot, the thieves and rats crawl out of the woodwork. They will try to hide their predatory nature in the cloak of something that really appeals to you – like an investment you’re infatuated with or a brand you believe in. If someone is demanding that you act now or miss out on the opportunity, that’s a common hard-sell technique. If the amount that you’re offering to invest is too small and they say you have to up the commitment because they’re already making an exception for you, same thing. Big red flag. Dogecoin This is a coin that started out as a joke. The creator was active in warning against speculative trading in cryptocurrencies, and is no longer a part of the company. He now works for Adobe. (Click to see an interview from 2018 with Jackson Palmer.) Elon purchased Dogecoin for his one-year-old son on February 10, 2021 (according to his Tweet) and is promising Dogefather will appear on SNL on May 8, 2021. Mark Cuban also purchased some Dogecoin for his son. All of that press made Dogecoin the top mover in crypto trades today. The coin hit a high of $0.57, after starting at 7 cents before Elon’s Feb. 10, 2021 Tweet. Be careful with this coin because it is a meme stock. Many meme stocks have the parabolic arc of a shooting star. Always choose a reputable platform, such as Coinbase, for your crypto trading and wallet. Therein lies another problem. Dogecoin hasn’t met the criteria to begin trading on Coinbase’s crypto platform. What is Currency? Currency is essentially a promise. Any promise is only as good as the person making it. We’ve seen crypto criminals who tried to entice investors in by saying their crypto would be backed by gold. MLM Bitcoin clubs tout the slick words of serial scam artists. Venezuela launched a coin that was backed by oil. Since their economy wasn’t stable, the coin faltered. China has launched a coin. Most of the world still uses fiat currencies, with the U.S. dollar still the dominant currency in the basket of currencies that have become the world’s reserves. Crypto 2021 is a Trading Platform As mentioned at the beginning of this blog, currently investors are interested in cryptocurrency as a way to get rich quickly. That’s not a currency. Buy Low, Sell High The investing commandment of buy low, sell high is easy to say, but hard to do. It’s hard to decline the invitation to the party when you see Bitcoin rocketing from a low of $5,000/coin in March of 2020 to $54,900 today. It’s equally hard to say, “I see opportunity,” when crypto crashes, as it did in 2018. And that is why a simple pie chart diversification strategy can be very beneficial and useful. The other benefit is that if you take profits off the table when the price soars, you’ll be emotionally prepared to buy more, and will have the cash on hand to do just that, when/if crypto crashes again. Bottom Line Cryptocurrency is the new gold for Gen Z and Millennials. Bitcoin was definitely the hottest investment in 2020 (behind Tesla) and could be in 2021, too, if we don’t have a crypto crash like 2018. Now that people can buy a Tesla with their Bitcoin, and there are a number of nascent Bitcoin millionaires, the trend toward further adoption of peer-to-peer exchange via crypto could be on its way. (There is still an issue of the amount of energy it takes to produce a Bitcoin.) Mass adoption doesn’t mean that Bitcoin can be worth millions of dollars per coin, however. (That’s a speculative trading bubble, not a stable currency.) In 2021, there will be a tightrope between traders who want to lock in gains and newbie investors who are late to the party and are willing to buy high. Newbies are always at great risk for being on the wrong side of the trade. Each currency must be forensically examined to ensure that it is a coin, company and team that is worthy of your trust. Meme stocks rarely are. Musk and Mark Cuban have a few bucks they can lose, while teaching their kids a lesson about investing. Join us for our June 4-6, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn how to pick great companies (like Zoom Video, Tesla, Aphria, Veritone and Nio), incorporate them into a well-diversified wealth plan, receive a complete Money Makeover and transform your life forever! Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now.  Natalie Pace Financial Empowerment Retreat. June 4-6, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price when you register by May 15, 2021. Other Blogs of Interest Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. 9/5/2022 10:36:52 pm

Thanks for sharing this useful information! Hope that you will continue with the kind of stuff you are doing. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed