|

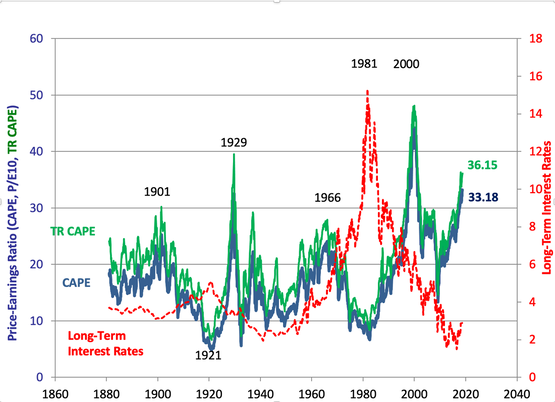

Includes 8 Ways to Protect Against Recessions, Pandemics and Other Wealth Viruses Have you ever been stressed out about money? (I know this is a rhetorical question.) Financial empowerment is personal to me because I lost a close friend to suicide. She was inconsolably distressed after her accountant convinced her to borrow against her home equity and invest in an income-producing REIT that went bankrupt. She had other losses from temporarily loaning money to a friend who didn’t return it as promised. I had warned her, but she believed that her "financial advisor" had her best interests at heart. (She didn't know that he earned a substantial commission for selling her into these risky propositions.) Watching what she went through, and then narrowly avoiding the same traps myself, prompted me to spend my life's work on financial literacy and sustainability. Money is one of the biggest stresses in modern life. It can lead to burnout, unhappiness and disease. Most of us don't talk about money. However, wealthy people do educate their families in financial matters -- not just how to balance a checkbook or helping them pay for college. You might have excellent mindfulness, visualization and meditation skills. However, these are band-aids if you wake up each day to the same fiscal ailments. So, embracing a lifestyle that supports our prosperity and abundance can go a long way to reducing stress and creating health and joy in our lives. It's easy to believe that our finances are in order when the markets are high and home prices keep going up. However, I’ve watched bubbles pop three times. You’re confident and exuberant when stocks and real estate prices are high, and devastated/destroyed when the bubbles burst. A better plan protects you from losses, while allowing you to grow your wealth in the good times. With 40% of students skipping out on their college loan payments, and over 6 million homeowners and renters missing a payment in September of 2020 (in the U.S.), there are clear signs of distress in the economy. According to Nobel Prize winning economist Robert Shiller, the only two times that stock prices were higher than they are today was in 2000 (before the Dot Com Recession brought losses of up to 78% in the NASDAQ Composite Index) and in 1929, before the Great Depression. Home prices are unaffordable in 63% of the U.S. cities, and 3.5 million homeowners are still underwater on their mortgages. If you wait for the headlines, it’s too late to protect your wealth. Now is the time to make sure that your financial home is strong enough to protect you from the economic storms that are on the horizon. The solutions are rather simple. However, they require making brave choices and blocking out the onslaught of constant news, hot tips and sales-speak. 8 Ways to Ensure That You are Protected Against Recessions, Pandemics and Other Wealth Viruses  You can watch me discuss these 8 Strategies in the free Burnout to Brilliant Global Conference Nov. 30, 2020, with Vanessa Bartlett. 8 Ways to Protect Against Recessions, Pandemics and Other Wealth Viruses

And here is more color on each point. 1. Adopt a Thrive Budget When you allocate 50% of your income to thrive and 50% to survive that assures that you have enough in your budget to:

How do you get there? You have to adopt the secrets of the wealthy. Rich people pay less in taxes, for medical insurance, and for a boatload of other big-ticket bills, including housing. When you are buried alive in bills and struggling to survive, it is impossible to thrive. This kind of existence is very hard on your health and relationships. Discover a better plan in The ABCs of Money and learn them at our Investor Educational Retreat. (I can’t pack 350 pages and 3 days of teachings into one short blog.) 2. Apply Modern Portfolio Theory to Your Nest Egg Buy & Hope is a last-century strategy that has been costing investors half or more of their wealth in the last two 21st Century recessions. They then spend most of the bull markets crawling back to even. That’s not a financial plan. That’s a Wall Street rollercoaster. Incidentally, most financial advisors will tell you that they use modern Portfolio Theory. I’ve been doing 2nd opinions, and I have yet to find one managed plan that was properly protected and diversified. Our easy-as-a-pie-chart system costs less time and money, and earned gains in the last two recessions, while outperforming the bull markets in between. (Again, most people lost more than half of their wealth in the last two recessions on the Buy & Hope plan.) You can read about these time-proven strategies in The ABCs of Money and learn them at our Investor Educational Retreat. If you were concerned about your investments in March of 2020, that’s a red flag that your plan is flawed. 3. Keep the Money in the Family Intergenerational housing is higher today than it was in the Great Recession. While it was born of necessity, it’s one way to stop making everyone else rich and keep more money in the family. Princes don’t buy their own castles. Wealthy people think a century in advance when they do their financial planning, and include provisions, including housing, for all of the kids. Think rich to become financially free. 4. Save Thousands Annually with Smarter Big-Ticket Budget Choices Housing is unaffordable in 65% of U.S. cities. The solution isn’t biting the bullet and paying more than half of your income on a place to sleep. We must get creative about housing, transportation, medical insurance, utilities, gasoline, taxes and other big-ticket bills. Billionaires like Warren Buffett and Bill Gates pay a tax rate that is half or lower to what their executive assistants pay. Passive income (money while you sleep) can protect your wealth from capital gains taxes if you set up tax-protected retirement plans. You can also save tens of thousands annually with smarter choices in your health insurance, utilities and transportation. Wisdom is the cure. This is another major theme in The ABCs of Money and our Investor Educational Retreat. 5. Learn the ABCs of Money That We All Should Have Received in High School When someone says, "Let me do it for you," you’ve just given up your power. When someone says, "Let me teach you how," you are setting the stage for personal freedom. There is nothing more expensive than free financial advice or having blind faith that someone else is managing your money for you. (As I mentioned at the top of this blog, it cost a close friend her life.) Learn the ABCs of Money that we all should have received in high school and watch how fast your life transforms. It’s time to take ownership of your wealth and future, and to be the boss of your money. 6. Take the 21-day Gratitude Game Challenge Wealth consciousness and vision, alongside a time-proven plan, are required to set the stage for your prosperity and abundance. We need the right mindset, toolkit and skillset. The 21-day Gratitude Game Challenge gives you a daily wealth mantra and an action plan. 21 days are needed to jettison the vices and establish new habits. This holiday season, I’ll be offering a free gift of the first seven days of the 21-day challenge outlined in The Gratitude Game. Simply email [email protected] with the subject I WANT MY FREE GIFT! to receive the links to the daily videos. 7. Put Your Money Where Your Heart Is Once you become financially literate and start building your own personal wealth, you can start fine-tuning your strategy to make sure that you are profiting from the things you believe in. There are many benefits to this, including financial benefits. When you remain uninformed about where your money is invested – whether that is through your tax dollars, your 401K, your managed brokerage account, your insurance plan, your annuity, or another financial vehicle – you are often profiting from the very companies that you picket. If you wish to stop supporting polluters, then learn how to put your money where your heart is and profit. 8. Start Preparing for College When Your Kids are ChildrenIt can feel overwhelming to be a parent these days. Life doesn’t add up. We’re in a pandemic. You might worry about your parents as much as your kids. So, it’s understandable that so many parents just follow the rote path for college and let their teens fall into the student loan debt trap. Student loan debt has reached a crisis, with a grand total of $1.55 trillion in student loan debt and 26 million borrowers who missed a payment in September. This is a crisis for Millennials and will become a toxic trap for Gen Z, too, unless we become more mindful of how to get a better, more employable degree for up to half the cost. There are many strategies with that goal in mind in The ABCs of Money for College. If you wait until your kids are in high school, it might be too late to put them on the right path. (By that time, they’re not listening to you as much as they listen to their friends.) However, when your family sows the seed of college planning when your kids are children, it becomes the way life is. Bottom Line You might feel great about your home equity and your stock portfolio right now. However, that doesn’t mean that your finances are in order. It just means that we’re in a bull market. Since we are also in a pandemic and an unprecedented recession, with many renters, homeowners and industries in extreme distress, now is the right time to make sure that you have battened down the hatches on your wealth. Call 310-430-2397 or email [email protected] to learn about our Jan. 16-18, 2021 Online Investor Educational Retreat, or to receive information on my unbiased 2nd opinion of your financial plan. Other Blogs of Interest Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed