|

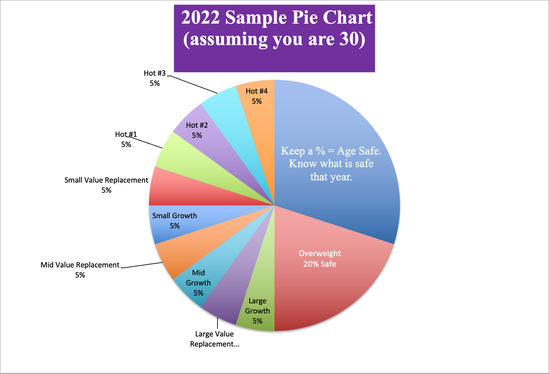

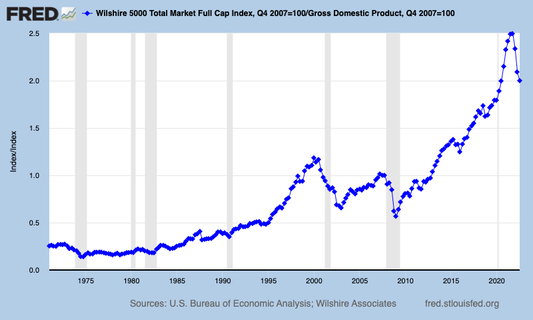

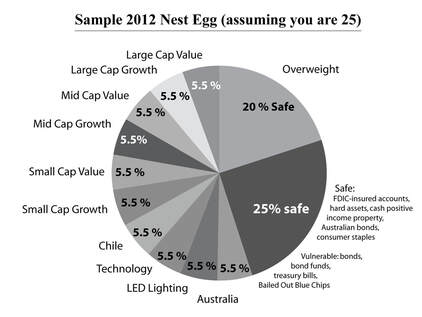

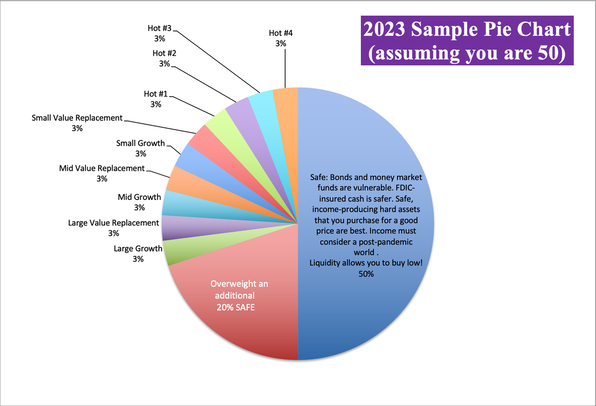

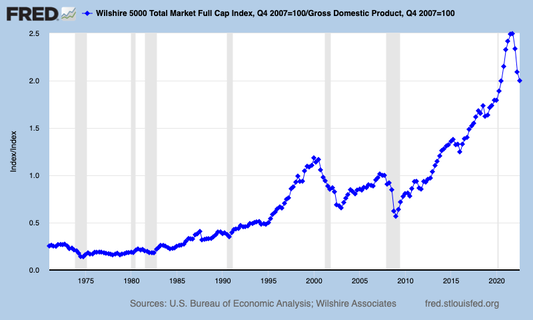

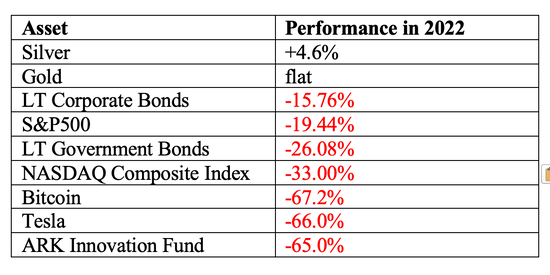

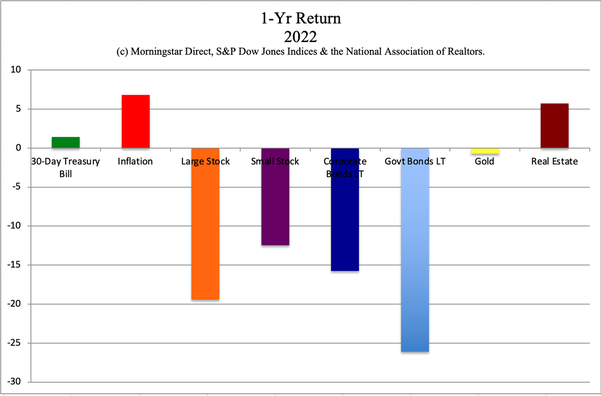

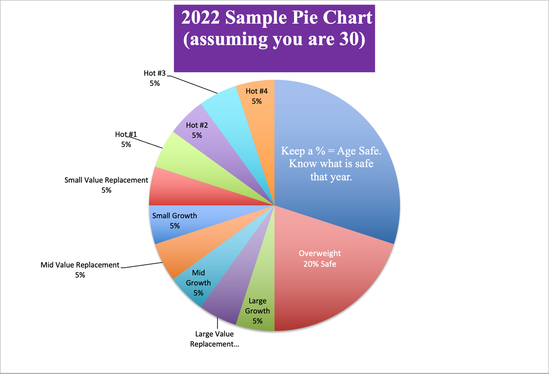

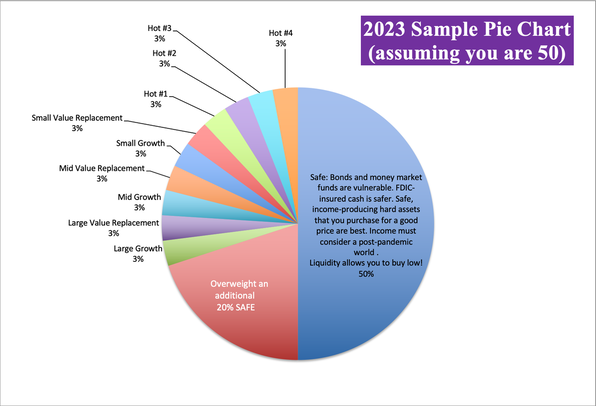

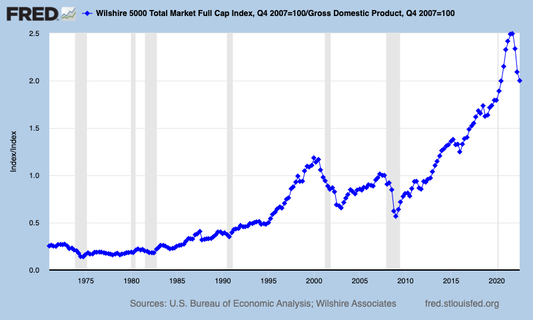

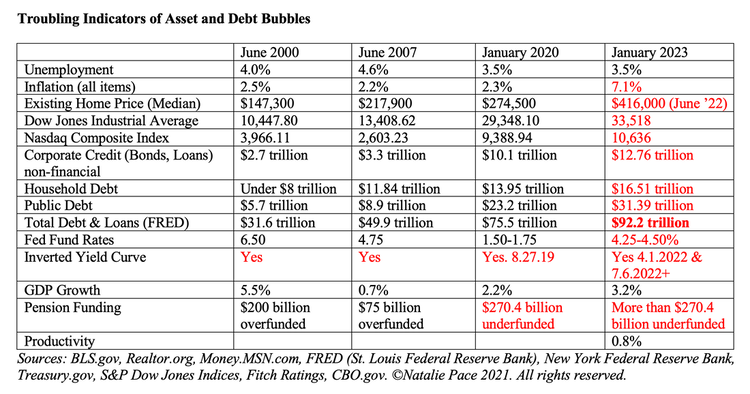

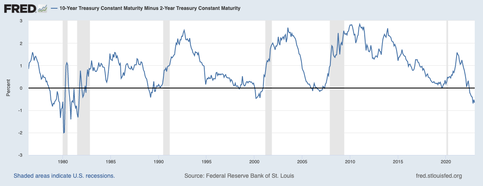

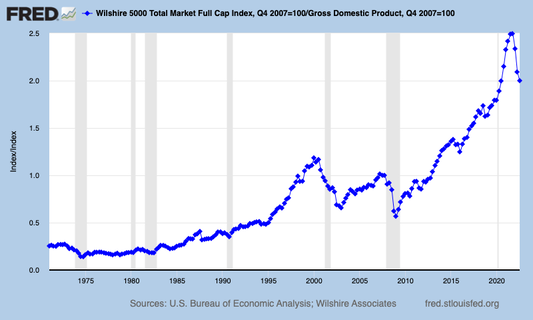

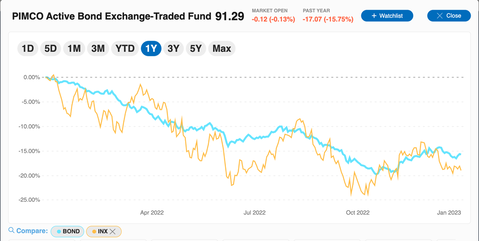

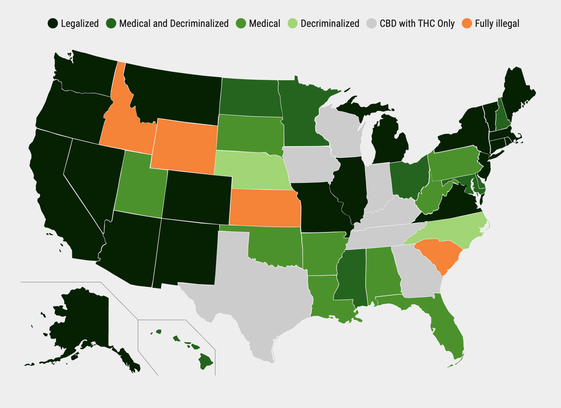

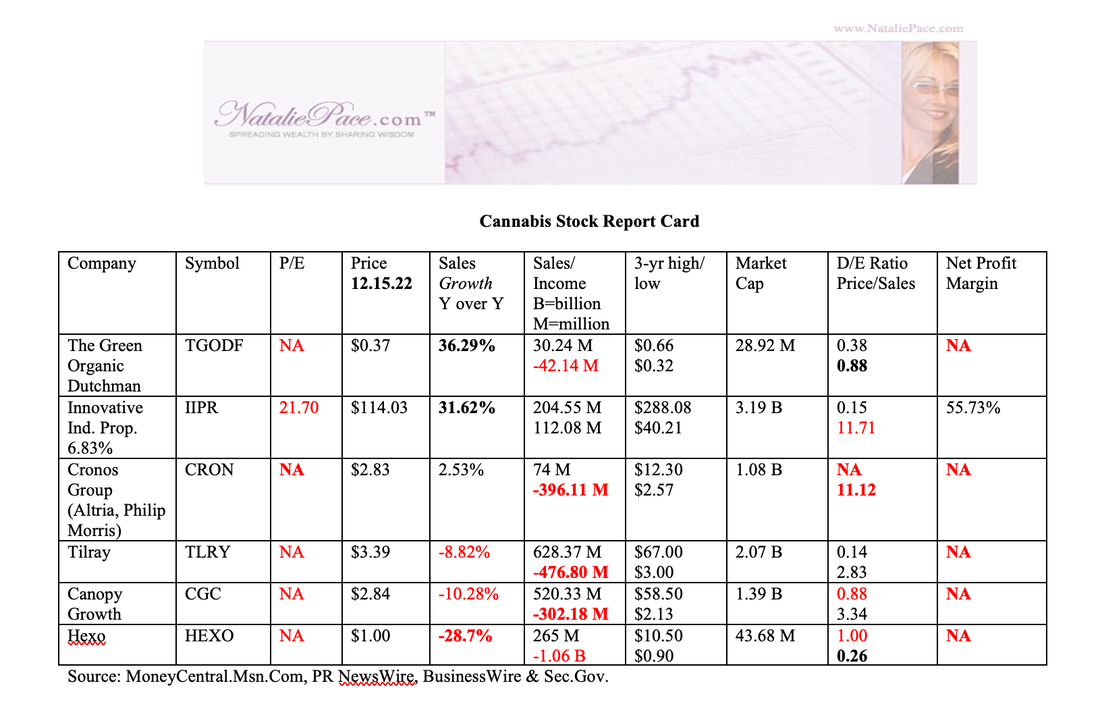

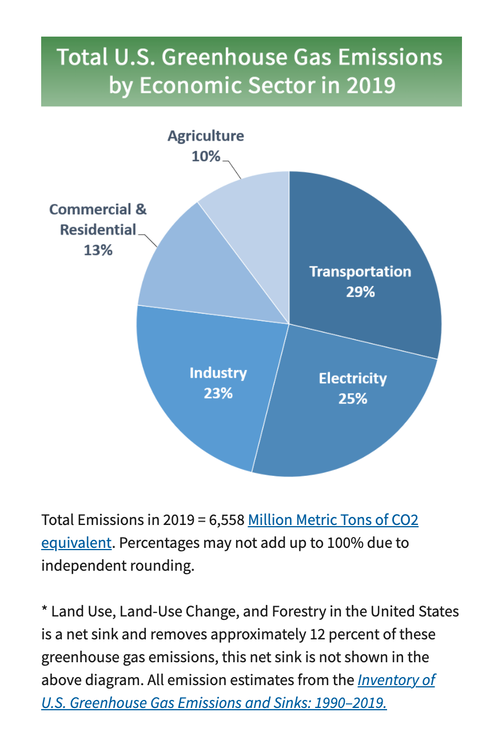

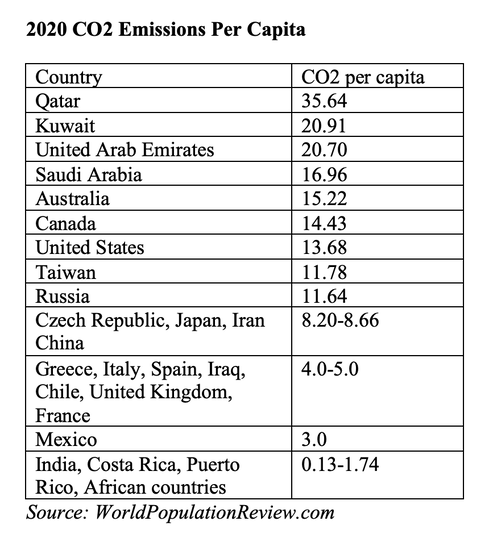

Are You Devastated Over Losses in Your Brokerage Account? Elated Because You Won? Includes 4 Reminders and Updates for 2023 Nest Egg Strategies It’s easy to be upset in a year that saw such losses in stocks and bonds. By far the most troubling response I’ve seen of late was a post on Reddit that read, “Just lost all my savings at 19, time to let depression win and kms!” There was a picture of a short on Snap Inc., which was out of the money due to the general market gains since the lows in October of 2022. While we all hope the user is getting the emotional support that s/he needs to get through this hardship, is it ever a good idea to invest everything in an options strategy? (Nope.) I’ve also heard others boasting that they are still up over a 3-year period. So, did the boasters “win?” Are those who are looking at their losses, “losers?” Most people under the age of 40 are spending 35-50% of their income on housing. Who wins and loses in that stranglehold? Are money and life merely a game of losers and winners, or is there more to the equation? After a loss, an athletic team will go over the game plan to identify the strengths and weaknesses of each play, in order to have a winning strategy in the coming game, rather than just feel good or bad about the outcome. Similarly, emotions are not valuable in investing. Whether we feel that our plan worked or didn’t, it’s equally important to make sure that we have a sound strategy in place now, particularly as we can see economic storms on the horizon. It’s easy to make money in a bull market, and easy to lose in a recession. So, rather than hope the troubles disappear, it’s a better idea to have a game plan that works in a harsh environment. Braggarts tend to be humbled in recessions. If your plan is “up” over the 3-year period, it could actually be a sign that you are not properly protected. In 1999, holiday parties were filled with people boasting about how much money they had made on their AOL stock. When the company merged with Time-Warner a few years later and posted the biggest write-down in history ($98.7 billion), those same folks were radio-silent. It’s very important to know our history, since stocks are even more expensive today than they were then, by Warren Buffett’s favorite valuation indicator – a comparison of GDP with the total value of the Wilshire 5000 companies. It’s also important to know the time-proven 21st Century strategy of proper diversification, regular rebalancing, and to know what is safe in the current environment. Long-term government bonds lost more than the S&P500 in 2022. We’ve been warning about bonds since 2012. Knowing how to protect our wealth is so tricky in a Debt World that we spend one full day on this topic at our Investor Retreats. (There are some excellent areas of low-hanging fruit to consider.) Why Putting Everything Into Perspective Is Imperative Losers never enjoy themselves, even when they are actually winning. Professional baseball players don’t spend a lot of time crying after they strike out. They don’t expect perfection, although they certainly do want to win the game and improve their performance. If we have a lot of things going right for us, it’s important to put any “losses” into the broader context of what is really happening, rather than complain about striking out in this or that at-bat. All investors lost something in 2022. The only way we didn’t have losses in 2022 was to have everything on the sidelines or in silver – which is not a good game plan. By simply acting our age, avoiding bonds and overweighting safe, the average losses in 2022 should have about 6% if we were 50 – less if we were older. Just like athletes, professional investors practice and perfect their craft, adopt a time-proven winning game plan and stick to it. In the finance world, it’s called sticking to your knitting. Here’s what a time-proven, 21st Century plan looks like. CEO Ben Horowitz Rescues His Company from 39 Cents/Share In July 2007, Hewlett Packard announced that it had agreed to acquire Opsware for $1.65 billion in cash ($14.25 per share). The acquisition closed on September 21, 2007. However, before that epic win, Ben Horowitz (CEO) and Marc Andreessen (chairman) had to endure a two and a half year slide. At the bottom of the Dot Com Recession in late 2002, Loudcloud was trading at 39 cents. Were these VC legends idiots in 2002 and geniuses in 2007? Anyone on the wrong side of the trade in 2002 or on the right side in 2007 would have said so. However, when I asked Ben Horowitz what the trenches were like (back in 2004, when his company was back to trading at about $6.00/share), he responded, “You have to listen to a lot of very smart people telling you how stupid you are.” (You can read my Q&A with Ben & Marc on Forbes.com. Click to access.) Even great businesses can meet challenges, or lose revenue, market share and/or share price, especially in recessions. Editor’s Note: Check out Ben Horowitz’s book, The Hard Thing About Hard Things. Mother Nature and Real Estate Tom and Stefanie Wurst lost their home, farm and many animals, which had been in the family for 5 generations, in the Kangaroo Island bushfire in Australia. The fire started on Dec. 20, 2019 and continued for several weeks. They are now recovering, and they are grateful to people from around the world who assisted them in their time of need. (At LoudCloud’s bottom, the entire team came together to pull off the success, instead of allowing the company to fold.) Whether our investments are being burned up by Mother Nature or Wall Street, it’s important to have a plan to protect ourselves. Diversification is key. Rebalancing is important. Knowing what you own is essential. Resilience and hard work matter a lot more than feelings. Success is linked with practice and having a good system, and getting back up after a setback. Hubris (“I won!”) or self-flagellation (“I’m a loser!”) work against our recovery. As we developed our easy nest egg pie chart strategies in 1999, we’ve seen how having discipline, combined with a time-proven 21st Century strategy, can earn gains in recessions (when most people lose more than half of their wealth) and outperform the bull markets in between. While we all hope that any recession in 2023 is as mild as some economists are calling for, it’s a better idea to have a plan in place that works any way the wind blows. Here Are a Few Reminders and Updates for Our 2023 Nest Egg Strategy Buy Low, Sell High Easy to Say, Hard to Do Did you neglect to rebalance (sell high) in early 2022? It’s easy to think that everything will keep going up when we’ve enjoyed the longest secular bull market in history. 2022 taught us just how dangerous complacency is. However, the lesson might not be over. The pie chart system outlined in The ABCs of Money 5th edition and taught in our Financial Freedom Retreats take the emotions out of investing and prompts us to do what investors are supposed to do – to capture gains in bull markets and to buy low in downturns. Overweighting Safe We always protect a percentage equal to our age. With economic storm clouds on the horizon, it’s a good idea to overweight safe now, before the recession is officially announced – to fix the roof while the sun is still shining. It’s also key to know what is safe in a world where bonds are losing so much money. Where Will Stocks Go in 2023? With very expensive equities, very high leverage, rising interest rates and a potential recession, stocks have a high likelihood of weakening. However, things can change and investors can do irrational and surprising things. Market timing doesn’t work. A balanced plan does. The Stock Layaway Plan For empty slices or areas that have weakened dramatically, rather than just filling up the slice all at once, we’re encouraging a plan that allows us to dollar-cost-average over the year. Are We Profiting From Polluters and the Companies We Protest? Once we get a plan that protects our wealth in recessions and grows in bull markets, then we can move up the path to wisdom even further, and understand that every time we invest or buy something we vote with our money. Did we lose a smoker parent to cancer? Are we profiting from tobacco gains? Do we drive an electric car and have a solid commitment to lowering our personal CO2 footprint, but hold fossil fuel companies in our retirement plan? Is it really a good idea to invest with the sole goal of making money at any cost, and then commit to cleaning up the mess with our profits? Does that make any sense? (Does it ever really happen?) The Bottom Line When we’re contemplating the unthinkable or boasting about our near-term gains, we’re using Wall Street as a casino. Passive income should be money while we sleep, not something we gamble with or obsess about. The quiet “stick to our knitting” plan allows us to act more like professionals do – to put emotions on the sideline and let a winning strategy be the game plan of protecting our future and growing our wealth. Email info @ NataliePace.com or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep and home buying solutions that will transform your life.  Join us for our New Year, New You Financial Freedom Retreat. April 22-24, 2023. Email [email protected] to learn more. Register by Jan. 31, 2023 to receive a complimentary, private prosperity coaching session and the best price (value over $800). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 2023 Investor IQ Test Are you an Einstein in investing? A complete novice? Check your Investor IQ with the 26 questions below. If you score 21 correct answers or higher, then you’re in great shape! If you score 18, then you are C-level. Below 18 correct indicates that you are in need of a refresher course in life math. (Even math geniuses might not know the basics of Wall Street…) So, consider joining us at our next Investor Educational Retreat.

Answers are listed in the article "Investor IQ Test Answers 2023" in my blog at https://www.nataliepace.com/blog/ https://www.nataliepace.com/blog/answers-to-the-2023-investor-iq-test Email info @ NataliePace.com or call 310-430-2397 if you have any questions about this test, or about the answers, or if you are interested in learning time-proven investing, budgeting, debt reduction, home buying solutions that will transform your life.  Join us for our New Year, New You Financial Freedom Retreat. April 22-24, 2023. Email [email protected] to learn more. Register by Jan. 31, 2023 to receive a complimentary, private prosperity coaching session and the best price (value over $800). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Answers to the 2023 Investor IQ Test. by Natalie Pace. If you score 21 correct answers or higher, then you’re in great fiscal shape! If you score 18, then you are C-level. Below 18 correct indicates that you are in need of a refresher course in life math. We’ve hosted attendees with a Ph.D. in math or computer science, with MBAs, options traders and other Wall Street pros. Our strategies are enthusiastically recommended by Nobel Prize-winning economist Gary Becker, former TD AMERITRADE chairman and CEO Joe Moglia and thousands of Main Street investors. So, consider joining us at our next Investor Educational Retreat. 1. What is the most important question you should ask your Certified Financial Advisor before hiring him/her? "How much of my portfolio should I keep safe?" This question will help you to determine whether you are dealing with a trusted professional who is looking after your best interest, or a salesman who is looking to make a quick buck. The answer to this question is, "A percentage equal to your age.” As stocks are trading at elevated prices, bonds are illiquid and negative-yielding, and there is a lot of talk about a recession, it would be even better if s/he adds, “But given the valuation and leverage concerns, we might consider overweighting into safety." If they just sidestep this question and redirect you to a risk tolerance questionnaire, that is a red flag. If they tell you not to worry because things always work out in the end, that it a sure sign that you are adopting the Buy & Hope plan, which wipes investors out in recessions. One more important thing. Since bonds are losing value, are highly leveraged, subject to credit risk, vulnerable to capital loss and are illiquid to boot, you need to understand what’s safe, rather than just rely upon bonds or money market funds. Now is the time to clearly know exactly what you own and why. Consider getting an unbiased 2nd opinion. Call 310-430-2397 or email [email protected] for pricing and details. 2. What are 3 red flags that your financial plan is on a Wall Street rollercoaster and at risk of losing half or more of its value?

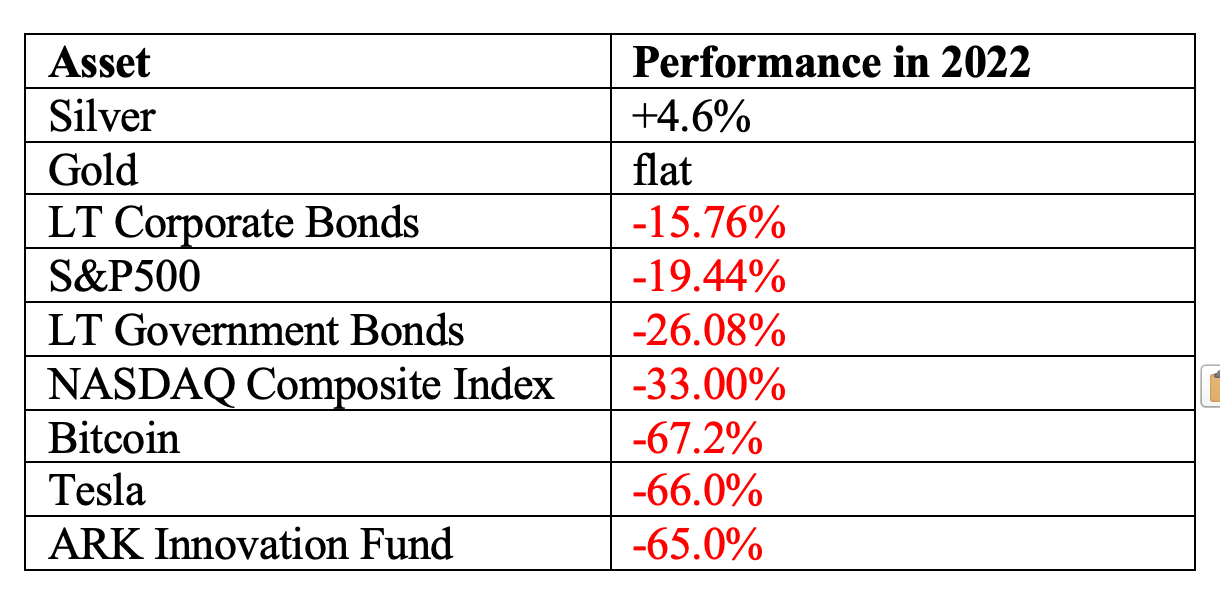

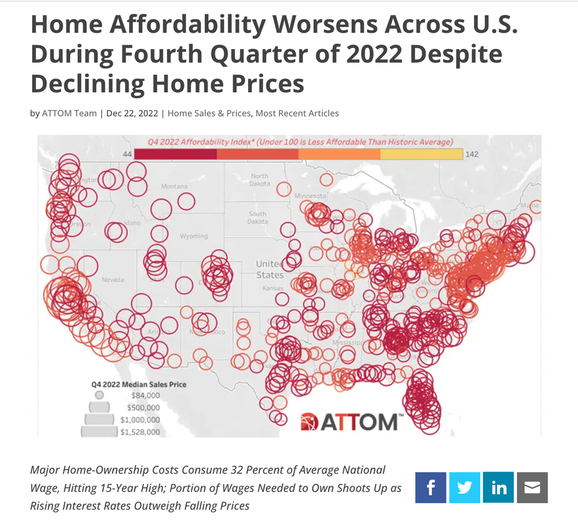

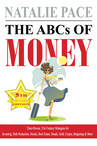

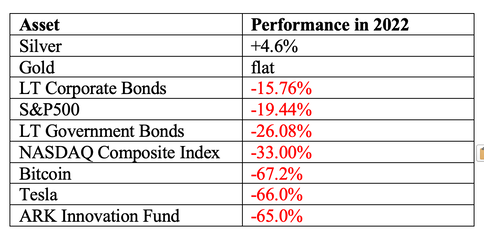

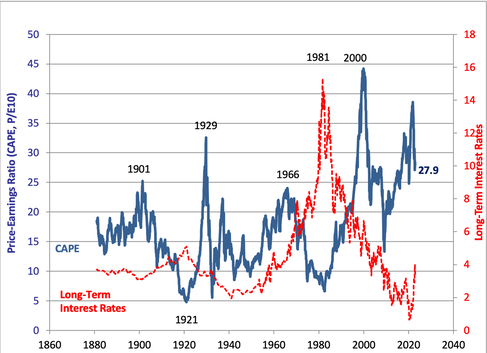

Remember: Your nest egg recovered in the pandemic because the Treasury printed up $4.5 trillion and threw free, easy cash at everyone. Student loans, foreclosures and evictions were paused. The wind has been at our backs. 2022 was one of the worst performing years of the 21st Century, and 2023 is expected to be challenging, with the risk of a recession in the U.S. and Europe. When/if the tides turn, losses can incur quite swiftly due to the high valuations. (The -38% plunge between February 19, 2020 and March 23, 2020 was the fastest that any bull market had ever about-faced into a bear.) Wisdom and time-proven systems are the cure. (Our easy-as-a-pie-chart nest egg strategies, with annual rebalancing, earned gains in the Dot Com and Great Recessions and have outperformed the bull markets in between.) 3. How much of your nest egg should you keep safe? A percentage equal to your age. Consider overweighting more into safety when assets are overpriced, the economy is stumbling, a pandemic is closing borders or you are nervous. Again, in today’s Debt World, it is important to know what’s safe. Long-term bonds are losing value and are illiquid, which makes them substantially riskier than most investors realize. (Our safe side isn’t supposed to lose money!) Money market funds have redemption gates and liquidity fees, are vulnerable to capital loss and are not FDIC-insured. Annuities are more vulnerable than most investors know because insurance companies are carrying a lot of risk and leverage, and annuities are not federally insured. 4. What's safe? Getting safe is a two-step process. First, you must keep your money, which means that you want to have as much of your cash as you can in federally insured accounts, such as FDIC or CDIC. Liquidity allows you to buy low, when everyone else is cash-strapped. After you have protected your wealth from a recession, you might consider short-term, creditworthy bonds, and take a laddering approach with them. Hard assets will hold their value better than paper assets in a Debt World. So, the mantra is “safe, income-producing hard assets that you purchase for a good price.” You have to also consider what will safely produce income in a post-pandemic world. Real estate is at an all-time high in the U.S., so it will be difficult to purchase for a good price in 2022. (There is low-hanging fruit in this area that many people never think about.) You don’t want to be all in on hard assets because you also need liquidity and cash flow. Some of the best hard asset investments are those that reduce your monthly expenses (for life). We spend one full day on What’s Safe at the Investor Educational Retreats. Educate yourself now on the best income-producing hard assets that are right for you, so that when prices are more attractive, you know what you want and have the means to take action and close the deal. Call 310-430-2397 to learn more. Interest rates rocketed up in 2022 and are expected to rise a little more in 2023. With a little searching, you might find a creditworthy short-term bond that pays you for the risk you take on. In the meantime, if you’re sold into something with a term of 10+ years, it could lose money, become illiquid and also carry an opportunity cost by tying your money up. 5. What is the average return of stocks over the last 10 and 30 years? Large cap stocks earned 12.56% annualized over the last decade and 9.65% over the 30-year period (source: Morningstar). Small cap stocks performed at 10.32% and 10.77%, respectively. (Asset performance graphs, and more data and resources, are distributed to Retreat Attendees.) 6. What is the average return of gold over the last 10 and 30 years? Gold returned 0.01% annualized over the 10-year period and 5.49% over the last 30 years. Gold mining stocks doubled in 2016, were flat in 2017, and doubled (again) off their 2018 lows by August, 2020. Regular rebalancing (1-3 times a year) prompts us to trim high and add low. The all-time high for gold of $2,089.20 was hit on January 5, 2021. The previous high of $1,895/ounce in gold in September of 2011, occurred the month after S&P Global Ratings stripped the U.S. of its AAA credit score. That was in the wake of a Congress/White House showdown over the Debt Ceiling. There could be another brawl this year, as the Debt Ceiling was hit on Jan. 18, 2023, and extraordinary measures to pay bills may only work until June of 2023. 7. What is the average return of real estate over the last 10 and 30 years? Over the last decade, real estate has performed at 8.8% annualized. (The devastating losses of the Great Recession, when over 20 million homes were foreclosed on, are no longer included in this statistic.) Over a 30-year period, real estate increased 8.2% annualized. Real estate prices are at an all-time high. However, the trend has been down since June. Real estate is largely unaffordable to many Americans in many cities. According to AttomData, average income-earners are unable to purchase a home in 99% of U.S. counties. Rising interest rates have made this problem a crisis. Buying a new home would cost 35% of the average national wage. 2.9% of U.S. homes are still seriously underwater on their mortgage – even with prices higher than ever. (This is largely due to loan mods.) There is nothing worse than buying high in real estate, and watching the value of your home sink below the amount that you owe on it! It can ruin your life and FICO score for years, if not decades. Be sure to read the Real Estate section of the 5th edition of The ABCs of Money. There are at least seven real-world case studies to inform your real estate decisions. 8. What was the top performing investment in 2022? Almost everything lost money in 2022, with the exception of oil and silver. It was more a question of how much was lost. Even bonds, which are supposed to be the safe side of your portfolio, were big losers. Oil gained 6.7% in 2022, after soaring as high as $130.50/barrel in June of 2022. Silver posted gains of 4.6%, while gold was flat. It’s important to remember that oil prices were the biggest losers of 2020. In April of 2020, oil prices went negative, for an all-time low price of -$37.63/barrel. (Futures investors were paying not to take delivery!) Of course, lockdowns are rare. However, there is another trend that could eat into oil prices – the popularity of electric vehicles. Long-term bonds lost -16-26%. (Again, the safe side of your nest egg is not supposed to lose money.) 9. How long will it take for you to have a nest egg as big as your annual salary if you put 10% of your income into a tax-protected (and financial predator proof) individual retirement plan and invest in stocks and bonds*? 7 ½ years. This is based upon 10% average annualized returns of stocks and bonds over a 30-year period, which is what happens normally. (Stocks still returned about 10% between 1993 and 2022. Bonds performed in the 4-5% range over that same period.) 10. How long will it take for your nest egg to earn more than you earn, if you put 10% of your income into a tax-protected (and financial predator proof) individual retirement plan and invest in stocks and bonds*? 25 years. This is based upon 10% average annualized returns of stocks and bonds over a 30-year period, which is what happens normally. (Stocks still returned about 10% between 1993 and 2022. Bonds performed in the 4-5% range over that same period.) 11. What’s the safest investment in a slow-growth, high-debt world? Bonds are starting to reward investors. However, avoiding the problems is tricky. Even FDIC-insured cash is paying a little. However, you have to know the loopholes and read the fine print. Hard assets hold their value better than paper assets when there is too much paper floating around (debt, like there is today). However, pouring everything into real estate can be vulnerable, as you still need liquidity. The safe side has opportunity and money pits, which is why we spend one full day on this topic at our Investor Educational Retreats. I’ll be hosting a Bond Master Class on Jan. 28, 2023 (Saturday). Email [email protected] to learn more. There are some excellent safe, income-producing, value-priced hard assets that are worth considering now, which most people are not aware of. Most, but not all, hard assets are overpriced right now. If you are equity-rich, you still want to do the analysis to make sure that will remain the case if real estate asset prices decline significantly in value, as they did in the Great Recession. Be sure to read the Real Estate section of the 5th edition of The ABCs of Money. In addition to looking for some return on the safe side, think capital preservation. Liquidity will allow you to buy low when things are on sale. 12. Which countries hold the most gold? The United States is the top holder of gold worldwide, by far, with 8,133.5 tons, followed by All ETFs, Germany, the International Monetary Fund, Italy, France, Russia and China. Though these countries didn’t add to their holdings in 2022, China and Russia have been on a gold buying spree since 2008. Reports are that they are trading oil and other commodities using their own currency backed by gold, in an effort to break free from the dollar hegemony. Additionally, there were multiple reports between 2011 and 2017 that the U.S. banks and brokerages were selling their client’s gold assets (sometimes without permission) in a price fixing scandal, which kept gold prices in the U.S. and Europe lower than the rest of the world. Deutsche Bank settled a lawsuit, and agreed on Dec. 2, 2016 to name names of other banks that were price-fixing gold. Was this the reason that gold was the worst performing asset over the last decade? 13. Are annuities safe? Insurance products, including life insurance and annuities, aren't insured by the FDIC. If we had not bailed out AIG in 2007, more than 50 million annuity holders would have been in real trouble. Your annuity product is only as safe as the insurance company that is selling it to you. Insurance companies don’t fare well in recessions, historically. Insurance products are like being a renter. If you can’t pay, you get tossed out. Many people pay for life insurance their entire working life, and then can’t pay when they retire – when they are really most in need. If you put that money into your own tax protected account, you could save on taxes, compound your gains, and it would be there for you when you retire, even offering some income, in addition to the capital. (Billionaire Peter Thiel reportedly has over $4 billion in his Roth IRA. Regular contributions, investing and compounding gains are that powerful.) When you can no longer contribute to your own retirement plan and Health Savings Account, they support you. You can be a better steward of your wealth than any insurance company, once you learn The ABCs of Money that we all should have received in high school. It’s time to be the boss of your money. 14. What were the top performing and the worst months for stocks over the past five years? July, November and April performed the best over the 5-year period (in that order), on average. February, March, September and December were all negative months. Retreat Attendees receive charts of the top-performing months and election year trends. If you’re interested in learning more about our 3-day, life transformational investor educational retreats, call 310-430-2397 or email [email protected]. 15. What was the top performing quarter for stocks over the past twenty years? October through December – the Santa Rally – performed the best over the 20-year period, but saw greater volatility in the 5-year trend, with negative returns in December. December 2018 was the worst performing December in history, killing the historical returns of the Santa Rally that year. Understanding seasonal trends can help you with your annual rebalancing in your nest egg, and with your selling strategy for your trading. We spend one full day on what’s hot, teaching you how to identify the best investments of the year, in our Investor Educational Retreats. 16. What was the worst investment in 2022, NASDAQ, gold, the Dow Jones Industrial Average, bonds, cannabis, oil or real estate? Cannabis, plant-based protein, Tesla and crypto were the worst investments in 2022. As one example, Tilray soared to $67/share on February 10, 2021. It was trading at under $3.00 on Jan. 19, 2023. Bonds were pretty poor performers, too, as you can see in the charts and comments above. Stay tuned into my blogs and videoconferences for ongoing news, analysis and vital investor information. Email [email protected] with VIDEOCON in the subject line to receive the logon information for the next monthly videoconference. 17. Which year is expected to perform better, 2023 or 2024, based upon historical returns of election years? 2023 is a pre-election year. Pre-election years are the strongest in the election-year cycle with annualized gains of 11.6%-16%. Election years can be good. However, we’ve seen some disasters, such as 2008 (Great Recession) and 2000 (beginning of the Dot Com Recession). 2023 may host a recession, which could reverse the pre-election year trend. Stocks drop in recessions, and have hosted devastating losses in the 21st Century. Over the last 10-20 years, mid-term years have been the worst performers, with annual gains of -5% over the 10-year period. U.S. stocks are still quite pricey, which could also mute gain possibilities this year. As you can see in the Buffett Indicator below (Warren Buffet’s favorite valuation tool), stocks are far more expensive now than they were before the Dot Com Recession or the Great Recession. Having expensive stocks and real estate, as government support is pulled back, has increased the volatility on Wall Street. There were wild rides last year and this is likely to continue as the hot and fast money seeks to find incremental gains. 18. How many companies are in the Dow Jones Industrial Average? 30 companies. Many are household brands. Most have been around for over half a century, and many are carrying far more debt than the value of the company. Leverage has begun to concern economists. Over 50% of the S&P500 corporate bonds are at the lowest rung of investment grade, or at junk bond status. This includes a lot of banks, brokerages, financial services and insurance companies. Ford Motor Company was downgraded to junk bond status in fall of 2019. If you don’t understand how much debt corporations are holding, you can learn how to use this valuable tool to increase the performance of your nest egg on the 2nd day of the Investor Educational Retreat. Click to access the names of the 30 companies. The Dow Jones Industrial Average was launched in 1896. 19. How many Dow Jones Industrial Average companies were bailed out or went bankrupt in the Great Recession? Most people don't realize that 20% of the companies of the DJIA (6 companies: AIG, American Express, Bank of America, Citi, JP Morgan and General Motors) were bailed out or went bankrupt in the Great Recession. Others, like General Electric and Ford, received support. Learn more about how to add in performance and avoid the bailouts in your funds and retirement account at the Investor Educational Retreat and in The ABCs of Money. Due to debt and leverage, it is important to remember that the higher the dividend is, the higher the risk is (read the chapter of the same name in The ABCs of Money for additional information). GE investors learned this the hard way. 20. Which index has performed better since the bottom of the pandemic in March of 2020, the Dow Jones Industrial Average or the NASDAQ Composite Index? The NASDAQ scored 43.6% gains in 2020, with the DJIA limping along at 7.2%. However, in 2022, the pain was more concentrated in the NASDAQ, with the index losing -33%. Today, both indices are on par over the 3-year period. This is why our pie chart system includes both value and growth, as well as annual rebalancing. Using this system, investors can capture gains in technology and biotechnology at the high, and buy low when recessions create opportunities. Learn more at the Investor Educational Retreat and in The ABCs of Money. 21. How much did investors lose between February 19, 2020 and March 23, 2020? Both the Dow Jones Industrial Average and the NASDAQ Composite Index dropped 35%. Some of the hottest stocks, including Nvidia (-38%), lost even more. However, technology stocks surged, once everyone started working and doing everything from home. 22. How much did investors lose during the Great Recession and the Dot Com Recession? The Dow Jones Industrial Average lost 55% in the Great Recession. The Dot Com Recession saw a drop in the NASDAQ Composite Index of up to 78%. It took the NASDAQ 15 years to crawl back to even. Returns of the Dow Jones Industrial Average Oct. 2007 – March 2009 Returns of the Nasdaq Composite Index March 2000 – Oct. 2002 You can’t afford to lose more than half every 8-10 years, crawl back to even, only to lose more than half again – particularly if you are over the age of 50. It’s time to step off of the Wall Street Rollercoaster and into time-proven, easy systems that protect your wealth, while outperforming the major indices. 23. Does Buy & Hope work? If not, what does? Buy & Hope lost more than half in 2000 and 2008 and 35% (or more) between February and March of 2020. Due to the amount of debt and leverage, and the slow rate of growth, Buy and Hold will not work going forward (until those problems are dealt with and cycled through). Our easy-as-a-pie-chart nest egg strategies earned gains in the Dot Com and Great Recessions and have outperformed the bull markets in between. Working off of the pie charts, instead of the brokerage statement, allows us to take the emotions out of the plan, and rely, instead, upon a time-proven system. This pie chart system, with annual rebalancing, is a buy low, sell high plan on auto-pilot – prompting you to do what you should be doing at each rebalancing session. Email [email protected] or call 310-430-2397, if you’d like to customize your own sample pie chart (free) or receive an unbiased 2nd opinion through our private coaching program. (We teach you this at the Investor Educational Retreat.) One more thing: low interest rates create asset bubbles. That is one of the reasons why assets drop so severely and swiftly in 21st Century recessions. Having the right amount safe and knowing what is safe in a Debt World is our best protection. 24. Why is it that so many investors are unable to Buy Low and Sell High? Buy low, sell high is a mantra that everyone knows. So, why do so few investors do it? There are a few reasons…