|

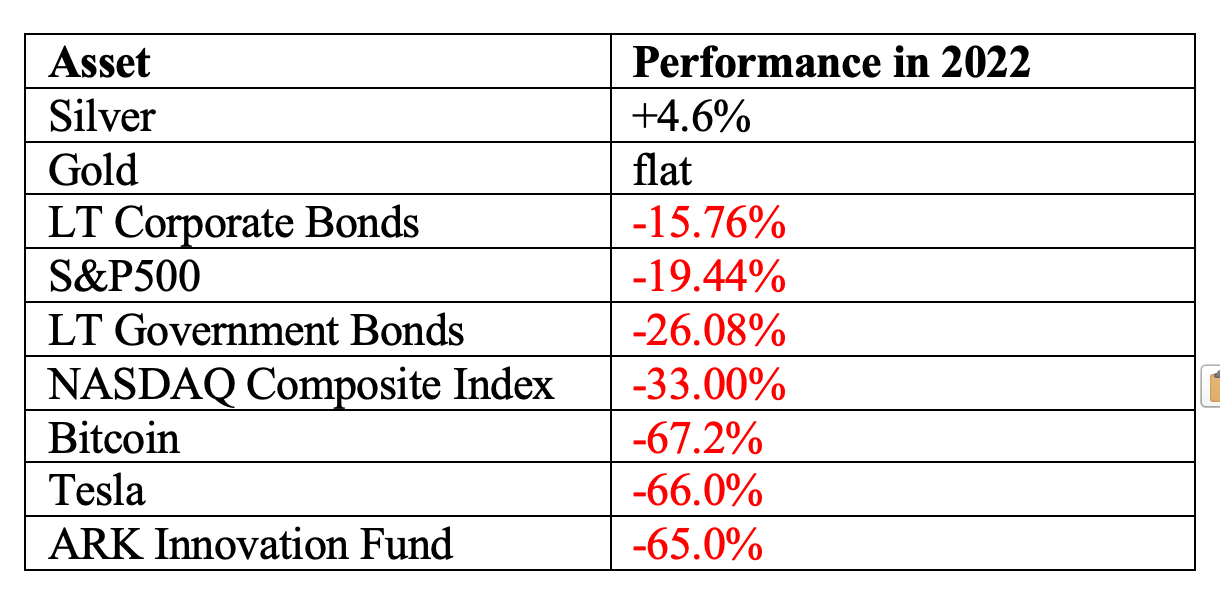

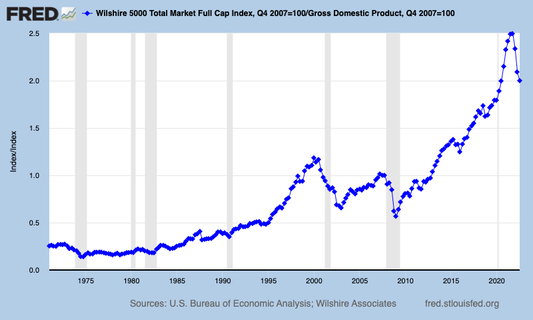

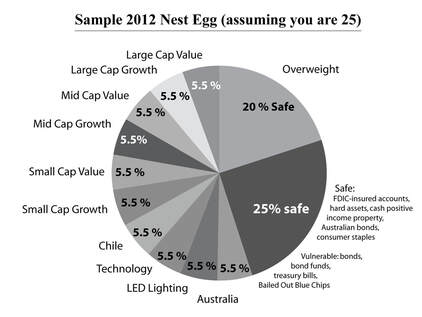

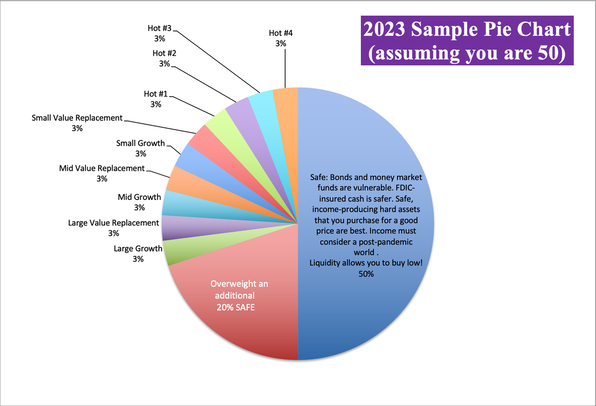

Are You Devastated Over Losses in Your Brokerage Account? Elated Because You Won? Includes 4 Reminders and Updates for 2023 Nest Egg Strategies It’s easy to be upset in a year that saw such losses in stocks and bonds. By far the most troubling response I’ve seen of late was a post on Reddit that read, “Just lost all my savings at 19, time to let depression win and kms!” There was a picture of a short on Snap Inc., which was out of the money due to the general market gains since the lows in October of 2022. While we all hope the user is getting the emotional support that s/he needs to get through this hardship, is it ever a good idea to invest everything in an options strategy? (Nope.) I’ve also heard others boasting that they are still up over a 3-year period. So, did the boasters “win?” Are those who are looking at their losses, “losers?” Most people under the age of 40 are spending 35-50% of their income on housing. Who wins and loses in that stranglehold? Are money and life merely a game of losers and winners, or is there more to the equation? After a loss, an athletic team will go over the game plan to identify the strengths and weaknesses of each play, in order to have a winning strategy in the coming game, rather than just feel good or bad about the outcome. Similarly, emotions are not valuable in investing. Whether we feel that our plan worked or didn’t, it’s equally important to make sure that we have a sound strategy in place now, particularly as we can see economic storms on the horizon. It’s easy to make money in a bull market, and easy to lose in a recession. So, rather than hope the troubles disappear, it’s a better idea to have a game plan that works in a harsh environment. Braggarts tend to be humbled in recessions. If your plan is “up” over the 3-year period, it could actually be a sign that you are not properly protected. In 1999, holiday parties were filled with people boasting about how much money they had made on their AOL stock. When the company merged with Time-Warner a few years later and posted the biggest write-down in history ($98.7 billion), those same folks were radio-silent. It’s very important to know our history, since stocks are even more expensive today than they were then, by Warren Buffett’s favorite valuation indicator – a comparison of GDP with the total value of the Wilshire 5000 companies. It’s also important to know the time-proven 21st Century strategy of proper diversification, regular rebalancing, and to know what is safe in the current environment. Long-term government bonds lost more than the S&P500 in 2022. We’ve been warning about bonds since 2012. Knowing how to protect our wealth is so tricky in a Debt World that we spend one full day on this topic at our Investor Retreats. (There are some excellent areas of low-hanging fruit to consider.) Why Putting Everything Into Perspective Is Imperative Losers never enjoy themselves, even when they are actually winning. Professional baseball players don’t spend a lot of time crying after they strike out. They don’t expect perfection, although they certainly do want to win the game and improve their performance. If we have a lot of things going right for us, it’s important to put any “losses” into the broader context of what is really happening, rather than complain about striking out in this or that at-bat. All investors lost something in 2022. The only way we didn’t have losses in 2022 was to have everything on the sidelines or in silver – which is not a good game plan. By simply acting our age, avoiding bonds and overweighting safe, the average losses in 2022 should have about 6% if we were 50 – less if we were older. Just like athletes, professional investors practice and perfect their craft, adopt a time-proven winning game plan and stick to it. In the finance world, it’s called sticking to your knitting. Here’s what a time-proven, 21st Century plan looks like. CEO Ben Horowitz Rescues His Company from 39 Cents/Share In July 2007, Hewlett Packard announced that it had agreed to acquire Opsware for $1.65 billion in cash ($14.25 per share). The acquisition closed on September 21, 2007. However, before that epic win, Ben Horowitz (CEO) and Marc Andreessen (chairman) had to endure a two and a half year slide. At the bottom of the Dot Com Recession in late 2002, Loudcloud was trading at 39 cents. Were these VC legends idiots in 2002 and geniuses in 2007? Anyone on the wrong side of the trade in 2002 or on the right side in 2007 would have said so. However, when I asked Ben Horowitz what the trenches were like (back in 2004, when his company was back to trading at about $6.00/share), he responded, “You have to listen to a lot of very smart people telling you how stupid you are.” (You can read my Q&A with Ben & Marc on Forbes.com. Click to access.) Even great businesses can meet challenges, or lose revenue, market share and/or share price, especially in recessions. Editor’s Note: Check out Ben Horowitz’s book, The Hard Thing About Hard Things. Mother Nature and Real Estate Tom and Stefanie Wurst lost their home, farm and many animals, which had been in the family for 5 generations, in the Kangaroo Island bushfire in Australia. The fire started on Dec. 20, 2019 and continued for several weeks. They are now recovering, and they are grateful to people from around the world who assisted them in their time of need. (At LoudCloud’s bottom, the entire team came together to pull off the success, instead of allowing the company to fold.) Whether our investments are being burned up by Mother Nature or Wall Street, it’s important to have a plan to protect ourselves. Diversification is key. Rebalancing is important. Knowing what you own is essential. Resilience and hard work matter a lot more than feelings. Success is linked with practice and having a good system, and getting back up after a setback. Hubris (“I won!”) or self-flagellation (“I’m a loser!”) work against our recovery. As we developed our easy nest egg pie chart strategies in 1999, we’ve seen how having discipline, combined with a time-proven 21st Century strategy, can earn gains in recessions (when most people lose more than half of their wealth) and outperform the bull markets in between. While we all hope that any recession in 2023 is as mild as some economists are calling for, it’s a better idea to have a plan in place that works any way the wind blows. Here Are a Few Reminders and Updates for Our 2023 Nest Egg Strategy Buy Low, Sell High Easy to Say, Hard to Do Did you neglect to rebalance (sell high) in early 2022? It’s easy to think that everything will keep going up when we’ve enjoyed the longest secular bull market in history. 2022 taught us just how dangerous complacency is. However, the lesson might not be over. The pie chart system outlined in The ABCs of Money 5th edition and taught in our Financial Freedom Retreats take the emotions out of investing and prompts us to do what investors are supposed to do – to capture gains in bull markets and to buy low in downturns. Overweighting Safe We always protect a percentage equal to our age. With economic storm clouds on the horizon, it’s a good idea to overweight safe now, before the recession is officially announced – to fix the roof while the sun is still shining. It’s also key to know what is safe in a world where bonds are losing so much money. Where Will Stocks Go in 2023? With very expensive equities, very high leverage, rising interest rates and a potential recession, stocks have a high likelihood of weakening. However, things can change and investors can do irrational and surprising things. Market timing doesn’t work. A balanced plan does. The Stock Layaway Plan For empty slices or areas that have weakened dramatically, rather than just filling up the slice all at once, we’re encouraging a plan that allows us to dollar-cost-average over the year. Are We Profiting From Polluters and the Companies We Protest? Once we get a plan that protects our wealth in recessions and grows in bull markets, then we can move up the path to wisdom even further, and understand that every time we invest or buy something we vote with our money. Did we lose a smoker parent to cancer? Are we profiting from tobacco gains? Do we drive an electric car and have a solid commitment to lowering our personal CO2 footprint, but hold fossil fuel companies in our retirement plan? Is it really a good idea to invest with the sole goal of making money at any cost, and then commit to cleaning up the mess with our profits? Does that make any sense? (Does it ever really happen?) The Bottom Line When we’re contemplating the unthinkable or boasting about our near-term gains, we’re using Wall Street as a casino. Passive income should be money while we sleep, not something we gamble with or obsess about. The quiet “stick to our knitting” plan allows us to act more like professionals do – to put emotions on the sideline and let a winning strategy be the game plan of protecting our future and growing our wealth. Email info @ NataliePace.com or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep and home buying solutions that will transform your life.  Join us for our New Year, New You Financial Freedom Retreat. April 22-24, 2023. Email [email protected] to learn more. Register by Jan. 31, 2023 to receive a complimentary, private prosperity coaching session and the best price (value over $800). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed