|

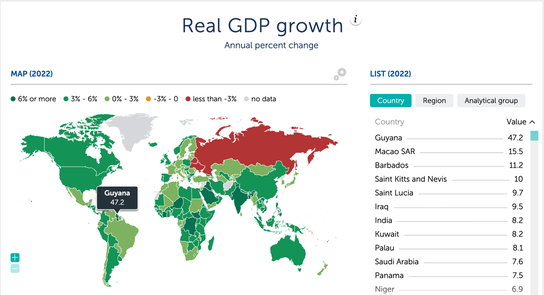

The Hottest and Coldest Countries in the World. The 1 Commodity Most Impacting Global GDP & the Dark Shadows Looming Over the World. The Hottest Countries Guyana‘s GDP is predicted to be the highest in the world at 47%. (Keep reading for the event that sparked such a leap.) Columbia will lead Latin America in GDP, at an estimated 5.8% in 2022. Indonesia’s 5.4% 2022 GDP growth projection is one of the strongest in Asia. That compares to a predicted 1.7% in the U.S., 3.3% in China and a recession in Russia and Belarus. What do the hot countries have in common, in a world where economies are posting much slower growth this year than last? They all export energy products. 3.2 billion barrels of oil was found off the coast of Guyana in 2018. The country began exporting in 2020. In 2021, Colombia was South America’s largest coal producer and second-largest petroleum and other liquids producer, after Brazil (source: EIA.gov). Last year, Indonesia was the world's largest exporter of coal by weight and the seventh-largest exporter of liquefied natural gas (LNG). The country also exports petroleum, and is the world’s largest supplier of nickel. (Watch my webinar on nickel-producing countries.) Russia is the 3rd largest producer of petroleum in the world (behind the U.S. and Saudi Arabia) and the 2nd largest producer of natural gas (behind the U.S.). However, the Russian economy is expected to contract by -7.8% in 2022, due to the worldwide boycotts, as a result of the country’s invasion of Ukraine (source: Reuters). The paradox is that had Russia not invaded Ukraine, it is unlikely that oil prices would have shot up to $110/barrel. 2021 ended the year at under $70/barrel (still high). Columbia and Indonesia ETFs With persistently elevated oil prices, why did the share price of the iShares MSCI Columbia ETF (symbol: ICOL) drop -26% this month? Even strong funds and companies can get drug down in a bear market. Another factor for Colombia was that the country just elected Gustavo Petro, the mayor of Bogota and a former leftwing guerilla fighter. He’s Colombia’s 1st socialist President. President Petro is promising pension reforms that could result in a 3% lowering of GDP for Colombia in 2022, if they materialize. While political reform can be glacial, the kneejerk reaction of investors rarely is. Is the country oversold? As one of the global leaders of GDP in 2022, is Colombia ripe for buying? While many investors are focusing on oil companies to capitalize on very high oil prices, if you are interested in energy, another play is to add some of these energy exporting emerging economies. There’s always heightened risk when you’re dealing with emerging countries. There can also be greater rewards. The Indonesia iShares MSCI ETF (EIDO) is down about 10% from its 52-week high. Will Energy Prices Remain So High? The big question is, “Will oil prices continue to be above $100 a barrel?” Oil prices are highly correlated with war. It takes a lot of oil and gas to fly planes, fuel tanks and truck soldiers to the battlefields. Another key factor to high prices is that Europe remains very dependent upon Russian oil and gas. Demand is high, and Russian boycotts create less supply, and higher prices. On the other hand, when consumers work-from-home, buy electric vehicles or trim back their travel because gas prices are too high, the plunge can be swift and steep – as we saw in the pandemic. The pandemic lockdowns in March of 2020 were the first time that oil prices were negative – when traders were paying others to take delivery of products they had no way of storing. Inflation and Interest Rates Politicians are keen to reduce oil prices as soon as possible to help out their consumers. Central bank governors are jacking up interest rates to battle inflation (of which energy is the biggest driver). When Will the War End? Another interesting development is that Western intelligence officials believe that Russia will exhaust their combat capabilities in a few months. Will this end the war in Ukraine? Bottom Line For now, there seems no end in sight for high oil prices. However, it’s always best to be forward-thinking when investing, and to be mindful of pricing in our entrance and exit strategies. It is certainly in most of our best interests to lower oil and gas prices, stamp-out inflation, and promote and sustain a more peaceful and productive world. If high energy prices persist, then Columbia, Indonesia, Guyana and other energy exporters (including companies) will benefit. If the war in Ukraine ends or if energy prices abate, what’s good for humanity and the healing of our planet might be very hard on investors’ wallets – particularly if you’ve purchased Chevron, Exxon Mobil or another oil company at an all-time high. The markets remain volatile, and the risk of a recession is real and heightened. The best approach in times of volatility and uncertainty is to be properly protected and diversified – and to rebalance regularly – particularly if a stock or fund has had a nice run (like both ICOL and EIDO did this year, before the June weakness. Personally, I'm bracing for a potentially hellish summer. However, it's never a matter of being all in or all out. If you're interested in learning stock and 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Oct. 8-10, 2022 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master. Get the best price and a free 4-part Protect Your Wealth Now webinar that will get you started immediately when you register before July 15, 2022.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register by July 15, 2022 to receive the best price and a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed