|

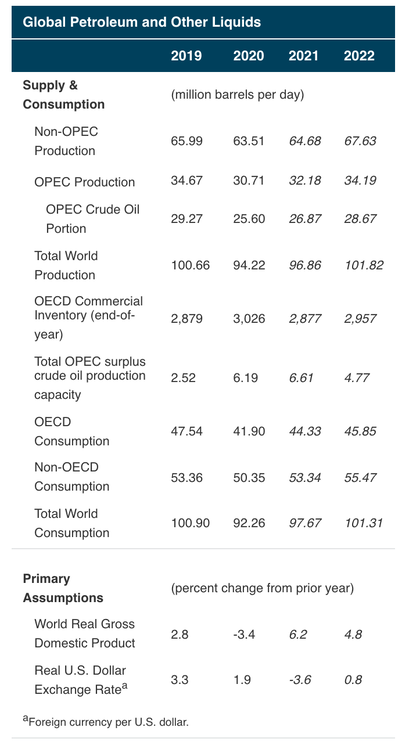

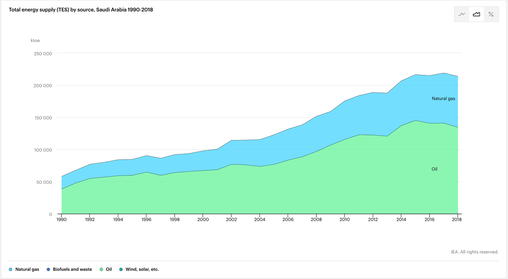

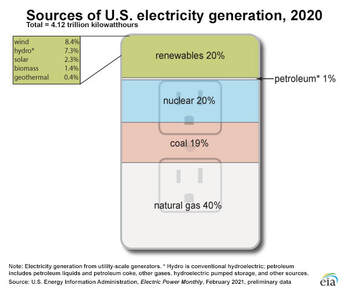

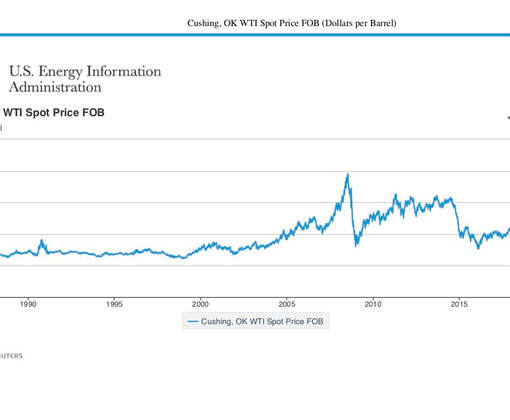

A recent survey by Citrix revealed that 90% of Gen Z and Millennials do not want to return to the office full-time. While some are okay with flex work, over half prefer to work at home full-time. Add in the popularity of electric vehicles, and you might think that the oil industry is doomed. Fortunately for the industry, and sadly for anyone who is concerned about the environment, oil and gas consumption is expected to reach pre-pandemic levels in the fourth quarter of 2021 (source: EIA.org). Before you race to your brokerage account to purchase some oil and gas stock, there is a lot more to the story to consider. With so many people working from home or switching to hybrids and electric vehicles, how in the world is consumption expected to be even higher in 2022 than it was in 2019? The answer is population growth, particularly in developing countries like China and India. Saudi Arabia actually burns oil for its electrical needs. Oil, followed by natural gas, make up most of the power generation in the country. About 40% of the US power generation is natural gas. 60% of U.S. power is sourced from fossil fuels (natural gas & coal). Less than 1% of the power generation in the U.S. is sourced from petroleum. Strong Demand Does Not Equal Strong Profits The oil industry has been plagued with wild swings in prices, low or negative profit margins and catastrophes for most of the 21st century. Massive Losses & Debt The industry was already on the ropes before the pandemic – so much so that by mid-2000, there was a wave of bankruptcies. Chesapeake Energy, Extraction Oil and Gas, Whiting Petroleum, Noble Corporation, Diamond Offshore and Valaris are but a few of the bankruptcies in the industry. Occidental teetered very close to the tip, as did Transocean. Neither company is out of the woods on having to restructure their debt. Both are junk bonds. All oil and gas companies lost a massive amount of money in 2020. BP lost over $20 billion. Exxon Mobil lost over $22 billion. Occidental lost over $15 billion. Meanwhile, Occidental’s market value is only $31 billion. A number of companies in this industry received a downgrade from S&P Global recently. Exxon Mobil and Chevron were downgraded to AA- this year. Exxon Mobil was removed from the Dow Jones Industrial Average on August 31, 2021. In a research report on May 25, 2021, S&P Global described the issues facing the oil and gas industry, writing that “energy transition, price volatility, and weaker profitability are increasing risks for the oil and gas producers.” The Secretary General of OPEC admits as much, noting in a press release on May 31, 2021, “There are many moving parts when it comes to factors affecting the global oil market, such as the pace of change during the COVID-19 pandemic.” Price Stability? The EIA is projecting that oil prices will remain near current levels, averaging about $68 a barrel through the end of 2021. In 2022, they are projecting that Brent will average $60 a barrel. It is unclear whether these projections are factoring in a meaningful shift towards electric vehicles and working from home. Many business and government leaders are trying to push everyone to return to a pre-pandemic lifestyle, while consumers and workers are recalcitrant to get sucked back into the office and long commutes. Additionally, as the pandemic schooled all of us in 2020, Acts of God can change the game entirely overnight. No one predicted that oil would drop into negative territory, as it did in April 2020. Clean Skies, Healthy Air and Climate Change In 2020 when the world stopped driving and flying, the skies were bluer than they had been in my lifetime. There was a 7% in global carbon emissions. If the projections are right, however, the gains will all be reversed in a few short months. The oil industry is trying to promote a circular carbon economy as its solution for climate change. The rest of the world is leaning into renewable clean energy rather than fossil fuels. Even in more “normal” years, fossil fuels have all kinds of costs and damage associated with the industry. There are oil spills, many of which never make the headlines. Combustion engines pollute our air. Respiratory illnesses plague our population in far greater percentages than ever before. And that is not even taking into consideration the climate change that has occurred from putting too much carbon into our atmosphere. Last Century Products I’m sure all of us are very happy that we don’t have to ride our horse to go on a vacation or to get to work. A century ago, even though electric vehicles were better back then, too, the choice was made to manufacture gas guzzlers. Today, electric vehicles are the future. General Motors has promised to take its fleet 100% electric for a future of “zero crashes, zero emissions and zero congestion.” Tesla Motors has been the leader for over a decade, but has many all-electric Chinese challengers, such as Nio. Put Your Money Where Your Heart Is. Invest in the World of Tomorrow. Successful investing is about gazing into the future and imagining, investing and creating the products and services to get us there. None of us are that interested in investing in typewriters these days. There will come a time when oil goes the way of the typewriter. It doesn’t look like it’s going to happen in 2021 or 2022, unless an unexpected catastrophe occurs. However, the very high debt levels, combined with very slim profit margins, are indicative of an industry that is over-leveraged and on the ropes. No one wants more pollution, climate change and dirty energy (outside of the oil industry and its lobbyists). The Higher the Dividend, the Higher the Risk The companies paying the highest dividends are also those with the greatest losses, the slowest revenue growth and the most debt. This is important to realize not only for your individual holdings but also for your dividend or value funds. If your principal is at risk of capital loss, 4-5% annual yield is not adequate compensation to take on the risk. So be aware that dividend-paying companies today are not the darlings they were a couple of decades ago. Bottom Line With stock prices in most of the oil and gas companies trading near their 52-week highs, now is a great time to evaluate whether this industry is right for you. Make sure your portfolio analysis also includes a look at your dividend and value funds. Join us for our Oct. 9-11, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn how to evaluate your funds, including dividend and value funds, what's safe in a Debt World, how to make a smart investment in real estate, pick hot funds and companies (like crypto, cannabis and our 2021 Company of the Year), and how to incorporate hard assets and safe havens into a well-diversified wealth plan. You'll discover how to protect your wealth and save thousands annually in your budget with smarter big-ticket choices. The retreat is a complete Money Makeover that will transform your life forever. Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now. Register by June 30, 2021 to receive the lowest price.  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price when you register by June 30, 2021. Click for testimonials & details. Other Blogs of Interest Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed