|

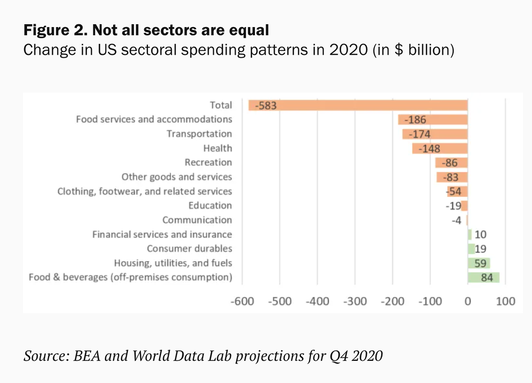

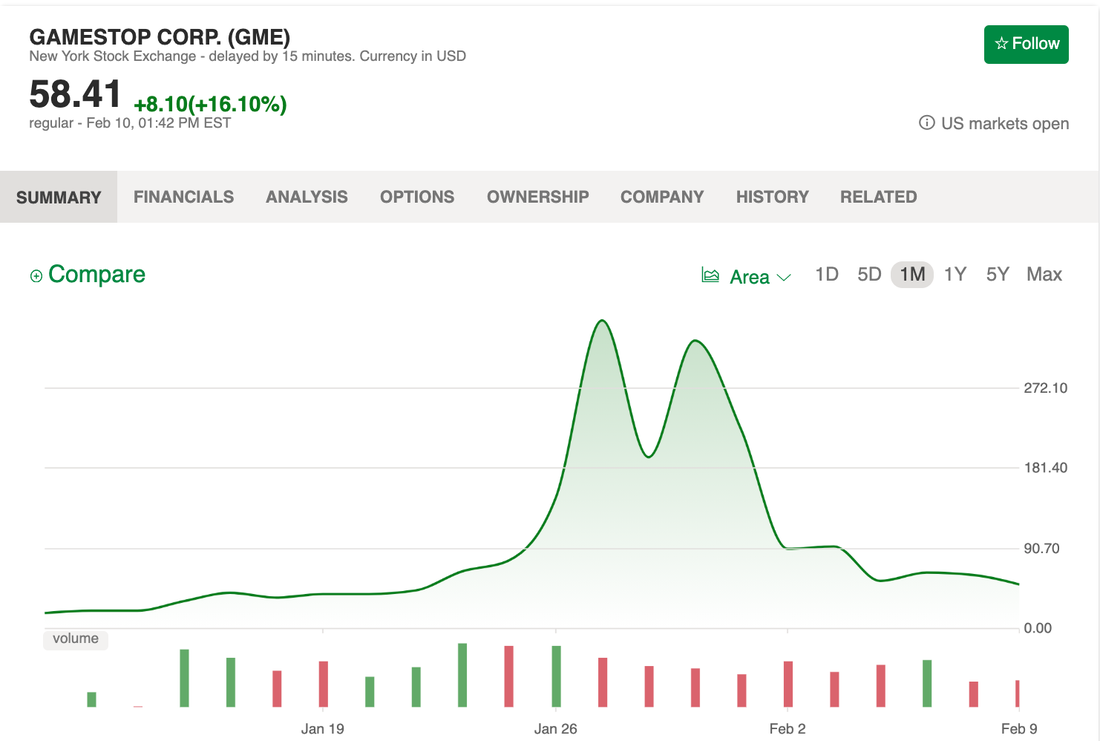

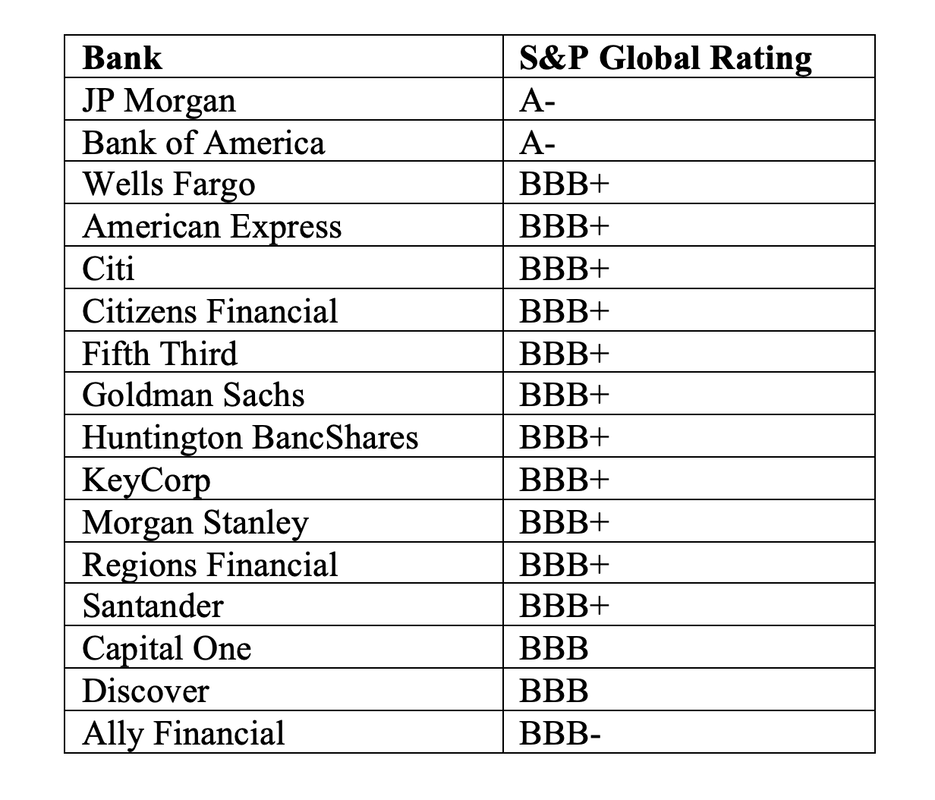

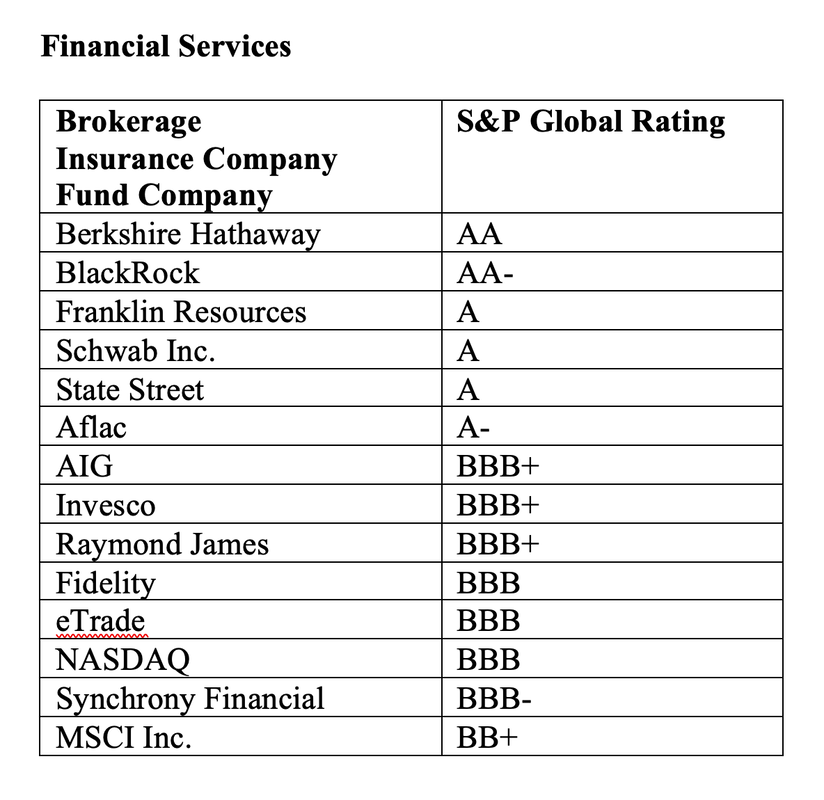

Since publishing my Spring Rally? blog on March 5, 2021, the Dow Jones Industrial Average has climbed to new highs. Bitcoin has soared 22%, to a new peak of $61,788.45 and a market capitalization of $1.1 trillion. The NASDAQ Composite Index has regained some lost ground, but is still 6.0% below its February 12, 2021 highs. Why is the NASDAQ so weak, particularly when artificial intelligence, electric vehicles, technology, biotechnology, cannabis and Zoom Video saw such strong demand and revenue growth during the pandemic? Why are the blue chips up, when so many suffered and took on more debt and are by many measures overleveraged and overpriced? Will the $1400 stimulus check make stocks soar even higher? Can anything stop Bitcoin’s winning streak? Let’s take a closer look at what is fueling the rise and fall of each index. Vaccine Optimism The U.S. economy is predicted to have a recovery in 2021 of about 3.1% (compared to 8.2% growth in China). The possibility of returning to a post-pandemic style of normal has everyone excited. We’re all hearing about instant Investor Millionaires, and who doesn’t want to join that party? However, all industries are not equal. Some simply imploded last year, and could take time to recover. Commercial real estate, retail, travel and hospitality are highly leveraged, with weak revenue and profit margins, and asset values that are being reappraised at sharp discounts (or at risk of such). Many have already been forced to restructure, or are on the precipice of doing so. Concerns about the massive amount of debt are certainly fueling a flight to Bitcoin as a perceived “safe haven.” The Stimulus Check The stimulus check is likely to fuel even more interest in Bitcoin and the meme stocks, like Gamestop, AMC, Blackberry, Bed, Bath & Beyond, and other companies that have become popular with Millennials and on Gen Z bulletin boards. Many of these companies were close to insolvency before the Robinhood tribe decided to use their “diamond hands” to short-squeeze the billionaire hedge funds. Although crypto enthusiasts are being sold into cryptocurrencies as a way to protect themselves from a devaluation in the dollar, currently crypto is a trading platform, not a currency. Having such wild swings in valuation means that no one can really use the coins for buying and selling. There have also been many crypto criminals. The most recent prosecution was of John McAfee. However, there have been many scamsters convicted and/or sanctioned by the SEC in this space, including Ripple Labs XRP. According to the SEC complaint, “Larsen—Ripple’s initial chief executive officer (“CEO”) and current chairman of the Board—and Garlinghouse—Ripple’s current CEO—orchestrated these unlawful sales and personally profited by approximately $600 million from their unregistered sales of XRP.” In 2008, Christian Larsen was sued by the SEC for a similar issue of misleading investors, withholding material information and personally profiting from the fundraising. The rise and fall of Reddit trends and certain crypto coins tend to mirror a typical Pump & Dump scheme. Buyer beware! If you’re on the right side of this volatile activity, you can pocket astronomical gains in a New York Minute. However, the top might actually last only a few seconds. Limit orders, which can typically help in this scenario, might actually cut off your gains before they reach their zenith. Volatility What is causing all of the volatility? How long can the stock market and Bitcoin keep soaring? What phantoms might be waiting in the wings to spoil the party? Will the good times last or could this all end very, very badly (like the last two recessions have)? The NASDAQ Composite Index slid over the last few weeks for one simple reason: profit-taking, even though the tech and biotech-rich index led the rally in February. There were a lot of Shoot the Moon Stocks on the NASDAQ. Investors were taking profits at an all-time high from companies that were trading at interstellar valuations. Bitcoin’s previous peaks and drop-offs were caused by valuation concerns as well. In fact, a year ago, Bitcoin’s price was just $4,432.30, having dropped by half from $9,610 on February 20, 2020, in tandem with the 35% drop in the Dow. Inflation and Bond Yields Sophisticated investors seeking returns have created volatility in the Repo Markets (an ongoing theme since before the pandemic). Main Street investors get spooked on stocks (particularly non-dividend paying tech stocks) when they hear that rising yields in the bond market might stir up inflation and offer them a better return on their investment. It is very likely that the sell-off in the NASDAQ, rather than the dividend-paying Dow, had to do with rising yields, in addition to overvaluation concerns. One problem with Dow stocks and bonds, which is not in the mainstream media at this time, is that the higher the yield (or dividend), the higher the risk. If your capital is at risk of losing a lot of value, it’s just not worth it to get paid a tiny dividend. Just ask any General Electric investor. Over half of the S&P500 is at or near junk bond status, including a lot of banks and financial services companies.  Bonds are losing money and are illiquid. (Click to read a blog on this important trend.) Warren Buffett warned about bonds in his 2021 annual letter, writing, “Bonds are not the place to be these days. Fixed-income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future.” We’re already seeing signs of that weakness. The COVID Relief bill gave an $86 billion bailout to multiemployer pensions that were in critical or declining status. Don’t Fight the Tide The institutional money is seeking a return on investment in a world where traditionally safe investments, such as bonds, are losing money. This is pushing equities to an all-time high. That’s great in the near-term for investors. However, whenever this happens, it tends to end poorly. It’s why there was a 35% plunge in equities from February 19, 2020 to March 23, 2020 – the fastest that a bull market had ever become a bear. That’s why there is such a staunch aphorism, “Don’t reach for yield.” The young money just wants to get rich quick. They’re banding together to push their favorite stocks to the moon. If you can figure out when those stocks are in favor, then you can get on a free ride. However, it’s important to acknowledge how fast the comet fizzles out and crash lands back to earth. Being on the right side of the trade requires driving the investment 24/7, and understanding a new audio/visual and metaphoric vernacular. Don’t Fight the Fed The Federal Reserve Board and U.S. Treasury will do everything in their power to keep asset prices as high as they can for as long as they can, in a new Price Rule policy. However, many assets are overleveraged, unaffordable and overpriced by many measures. As we saw with Kushner’s Times Square building, which is entering foreclosure, the correction can be swift and severe. (Click to access that blog.) So, in addition to having equity exposure to a market rise, you also want to make sure you have enough safe that won’t get wiped out in a downturn. You need to know what is safe in a world where bonds are losing money. Don’t Ignore the Storm Clouds on the Horizon This remains one of the most challenging economies of our lives, as you can see from the Asset Bubble chart above. The U.S. has a negative outlook on the AAA credit rating from Fitch Ratings. If there is a downgrade, there is unlikely to be forewarning. A downgrade would be negative for both stocks and bonds. Congress faces a Debt Ceiling on July 31, 2021. With a Blue House & Senate, the debt ceiling should get raised. However, you can expect more headlines than normal about the amount of money that has been printed up and the decades it will take to pay this crisis off. (Incidentally, you can see in the Asset Bubble chart above that asset valuations and debt were a severe problem before the pandemic.) One of the things that Fitch will be looking for during July of this year is the political will to put the U.S. back on track for lower unemployment, sustainable economic growth, while at the same time employing the husbandry needed to stop borrowing from tomorrow to pay off yesterday. If they don’t get what they need, the U.S. is at high risk of that downgrade. (This will be a difficult terrain to traverse.) Bottom Line Parties are fun. Bubbles taste as delicious as champagne. The fun can last longer than you might believe. However, the hangover can be devastating and enduring. We don’t want to party like it’s 1999. (The NASDAQ Composite Index dropped 78% between March of 2000 and October of 2002, and took 15 years to recover.) And we don’t want to miss the party either. So, how can you have your fun and still drive home sober? That’s exactly what our Nest Egg Pie Chart strategies were designed to do. You add in hot industries – including crypto, cannabis, AI, technology, clean energy, biotechnology, etc. – underweight risk and leverage, diversify and rebalance regularly to capture gains. While that might sound like a lot of work, it’s actually far easier than riding the Wall Street rollercoaster, particularly once you learn the ABCs of Money that we all should have received in high school. And keeping your wealth, instead of being at risk of losing half, is invaluable. Why not take our Investor IQ Test to see where you score in financial literacy? Register for our April 24-26, 2021 Investor Edu Retreat by Monday, March 15, 2021 to receive the best price. Call 310-430-2397 or email [email protected] to learn more now.  Natalie Pace Financial Empowerment Retreat. April 24-26, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price when you register by March 15, 2021. Other Blogs of Interest Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed