|

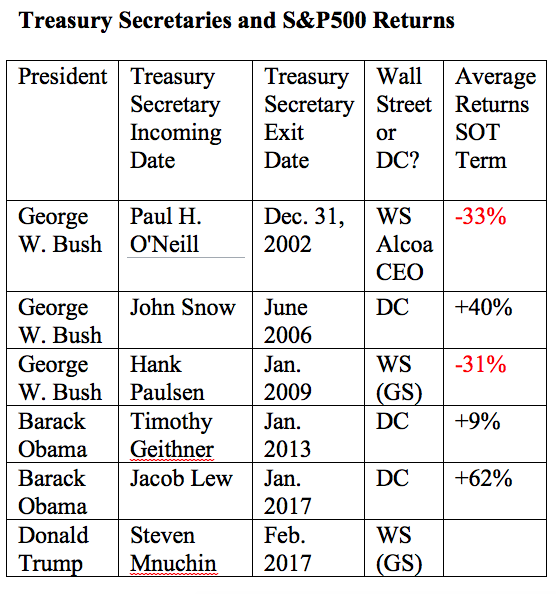

What’s The Smart Money Doing? Basic supply and demand tells you that prices decline when people sell en masse, and increase when there is colossal buying. Knowing what the big money is doing can help the Main Street investor get it right. So, what’s the smart money doing these days? The Federal Reserve Board The Federal Reserve Board announced that they will begin divesting themselves of the bonds they are carrying in a timely manner “relatively soon,” assuming the economy doesn’t tank. They are selling their long-term Treasury bonds and their mortgage-backed securities. Kathy A. Jones, SVP and the chief fixed income strategist of Charles Schwab Inc. & Co. believes this will impact interest rates on mortgages, and encourages everyone who is able to secure a fixed-rate on their mortgage to do so now (from my interview with her on July 19, 2017). Corporations The stock market gains of the last few years have been thanks to cheap, easy money. The Feds kept interest rates at zero. Companies, even heavily indebted companies, could borrow almost free capital, and buy back their own stock. Thus, stock buybacks were robust, just as they were prior to 2007 (the year before the Great Recession). Buybacks have come to a screeching half of late. Buybacks were down 17.7% year over year in the first quarter of 2017. As Howard Silverblatt, the senior index analyst for S&P Dow Indices wrote on June 21, 2017, “Companies may need to make money the old-fashioned way – earn it.” (For information on how companies can push up earnings by buying back their own stock, read my blog on “Financial Engineering.”) Less insider buying also means less price support. Companies are relying upon future push-ups in stock price to come from investors. The bottom line is that the corporate “smart money” has pulled back on purchases of their own stock. What Happens When Wall Street Invades Washington? A 17-year Goldman Sachs veteran is the Secretary of the Treasury. A hedge fund owner is now the head of communications at the White House. Is it “smart” for someone who earns in the multi-millions annually to lop two zeroes off of his income and take a job in government that pays $170,000 or less? The answer is yes, sometimes. When someone is willing to take that kind of pay cut, Main Street should be alarmed and take note. First of all, here’s how the math works. A salary of under $200,000 doesn’t come close to funding the lifestyle of a one-percenter! How can they even afford to do this? Hmmm… What few Americans realize is that at the top of a bull market, taking the government job and being forced to sell high (when otherwise there might be constraints on how much they can sell, and when) and having the taxes on that sale deferred can be the biggest payday of all. As one example, Henry Paulsen was “forced” to sell over $500 million of Goldman Sachs stocks to become the Treasury Secretary in June of 2006. He was allowed to use the proceeds to purchase government bonds, under a Certificate of Divestiture, which means he paid no taxes on the sale of that half a billion (or more) in stock. When he sells the T-bills, he’ll be liable for the capital gains then. However, the sale can be spaced out, and the tax rate on long-term capital gains is currently 20%, roughly half of what the earned income tax rate can be. So, guess how closely correlated market losses are with having a Wall Street Treasury of the Secretary? As you can see in the chart above, since 2000, Wall Street rallies were all under the tenure of Treasury Secretaries who came from politics. The crashes occurred under the aegis of the one-percenter Wall Street veterans. It just doesn’t pay for Wall Street executives to take a salary that is a rounding error of their earning potential during bull markets. The payday comes when they get to sell en masse high without taxes, while their colleagues are vulnerable to losses, and would go to jail if they tried to dump all of their insider holdings at once. Not surprisingly, Anthony Scaramucchi is seeking a federal tax break for his sale of Skybridge Capital. He calls it “taking a mega-opportunity cost for getting rid of all of your assets.” Others might see it as selling high and keeping all of the money, while deferring taxes, which can be the biggest payday of all, particularly if the markets head south. The bottom line is that having so many Wall Street guys (i.e. the “smart money”) willing to take a meager salary for a job on Capitol Hill is not a good sign for investors. They don’t do that unless it adds up. Remember that market timing doesn’t work. The systems that I’ve taught in my Investor Educational Retreats have outperformed the bull markets and earned gains in the bear markets since 1999, at a time when most people have lost more than half in two of the worst recessions the U.S. has seen since the Great Depression. Call 310-430-2397 to register for my Old West Financial Empowerment and Healing Retreat, which will be held in Arizona Oct. 13-15, 2017. Register by Monday, July 31, 2017 to receive the lowest price. Have you become confused (or alarmed) at the new acronyms flying around, or the potential service disruptions that you’ve been learning about of late? Or (even more alarming), is your Bitcoin Club not even advising you about the events that are happening in just a few days?

Important Information That You Need to Know Now About the User Activated Forks.

The bottom lines on Bitcoin, Ethereum, Litecoin and other crypto currency is that the gains have been meteoric in 2017, and so has the volatility and the amount of speculation and outright scams. It’s very important to get informed before you buy or trade crypto currency. If you don't understand the necessary confirmations, how to get a a reliable wallet, which websites are legit and which aren't, etc., then your first investment should be in information and wisdom (not crypto currency). I’ve penned two important blogs over the last month. (See below for links.) And I will spend some time at the Old West Retreat Oct. 13-15, 2017 outlining how to embrace the opportunities and avoid the dangers of crypto currency. Call 310-430-2397 or email info @ NataliePace.com with your questions, or to learn more. Crypto Currency Crashes and the Bitcoin Chain Split of July 31, 2017. (published on July 16, 2017). Bitcoin and the Crypto Currency Flash Crash. (published on June 25, 2017). Crypto Currency Crashes and Bitcoin’s July 31st Network Disruption. Ethereum is down 60% in just a few weeks. Bitcoin is off 34% from its high of $2,894, set on June 10, 2017. So, is this a buying opportunity? Before we jump in, let’s figure out what’s causing all of the volatility. Bitcoin Network Disruption on July 31, 2017 Bitcoin.org is warning of a potential network disruption on July 31, 2017 during the User Activated Soft Fork (UASF). The official website for Bitcoin is recommending to stop accepting Bitcoin on July 28, 2017, and to “be wary of storing your bitcoins on an exchange or any service that doesn’t allow you to make a local backup copy of your private keys.” GDAX, the leading crypto currency exchange will be monitoring the situation closely. According to Adam White, the general manager of GDAX, GDAX will " temporarily suspend the deposit and withdrawal of bitcoin on GDAX and may pause the trading of bitcoin as well." For a full list of the action points, and further explanation on the Bitcoin chain split, go to BitCoin.org and read the alert. You can also follow GDAX and Coinbase (GDAX' owner) on Twitter and on the exchange website for live updates during the chain split. Ultimately, the chain split should sort itself out. It's mainly the transition leading up to August 1, 2017 and the days/weeks thereafter where existing and potential bitcoin investors need to be more cautious. Is this potential disruption what is behind the current sell-off of BitCoin, Ethereum and LiteCoin? Investors don’t like uncertainty, and they love gains. The July 31st event offers an incentive for anyone who has seen an extraordinary run-up of their investment to make sure that those paper gains are translated into their local, traditional currency. We’ll know in just a few weeks whether the July 31st chain split goes more smoothly than expected. Until then, I’d expect to see more volatility. Bitcoin.org is advising everyone that the currency could see “significant price fluctuations.” However, Ethereum is experiencing even more volatility more Bitcoin. Ethereum’s Flash Crash On June 13, 2017, investors were buying Ethereum at $381. The rapid rise from just $7 a year ago, prompted a multi-million dollar sell order on June 21, 2017 that triggered a cascade of chaos, where limits and stops were triggered. In a matter of seconds, an Ethereum flash crash caused an implosion of the price to just ten cents! GDAX, the premiere crypto currency trading exchange, is honoring the purchases and reimbursing the forced sales. This will help to reinforce legitimacy, and reduce the customers’ righteous indignation of massive, instant losses. However, the flash crash illustrates one of many concerns of investing early in any disruptive innovation. (See below.) Refer to my first report of the Flash Crash and other problems with crypto currency in June 2017. Other Concerns Flash Crashes Early Adopters Cashing In Schumpeter’s Creative Destruction Lessons from Skype Hucksters and Hackers Opportunities Become an Early Adopter Being on the Right Side of Massive Opportunity That 10 Cent Trade And here’s additional information on each Concern and Opportunity. Other Concerns Flash Crashes Flash crashes – massive drops in an investment – are exacerbated by High Frequency Trading, automated programs and derivatives. Ethereum’s drop to 10 cents on June 21, 2017 was the result of a multi-million dollar sell order that triggered multiple stop-loss and margin covers. Because those orders are automated, the crash occured in nano-seconds – before GDAX had a chance to halt trading. The large exchanges – NYSE and the Nasdaq stock exchanges – have breakers to stop rapid drops in the overall exchange. However, the May 6, 2010 Flash Crash, which saw a drop of 9% in the Dow Jones Industrial Average in less than half an hour, exhibits just how far and how fast the mood can change in an investment. Incidentally, Flash Crashes are one of the reasons why it is critically important to have a Capture Gains strategy, rather than a Stop Loss mentality. I teach this important distinction at my Investor Empowerment Retreats. Call 310-430-2397 to learn more about the Oct. 13, 2017 retreat now. Early Adopters Cashing In Whenever you see gains of 1000% or more, like we’ve seen this year Ethereum, you have to worry about the early adopters cashing in their gains. If you’re trying to buy while most are selling, it’s like trying to catch a falling knife. You’re bound to get cut. Schumpeter’s Creative Destruction Disruptors and unicorns are the hallmark of the tech industry today. They were in 1999 as well before the Dot Com REcession. As Schumpeter pointed out in his econ classic, Capitalism, Socialism and Democracy, there are two waves of innovation. The first is fast and furious, which is followed by a big crash that wipes out most of the investors and the more vulnerable companies. The second wave of the new technology, after all the chaff has been winnowed away, tends to be longer and more prolonged. For instance, Bitcoin was the first, but is LiteCoin (developed by Charlie Lee) or Ethereum (co-founded by Vitalik Buterin) the better platform? And what about all those Bitcoin clubs that are sprouting up? Hucksters and Hackers I’ve seen a massive amount of questionable opportunities (i.e. most likely scams) associated with Bitcoin lately. They have all of the hallmarks of hucksters, including claims of fast, easy profits and demands that you “join now or miss out.” Behind these billboards, are multiple red flags, including toll-free 800 numbers and P.O. boxes, often without any mention of where the company operates or who is running it. Over the past few years, hackers have breached Bitcoin Wallet providers. Hucksters have faked Bitcoin Wallets, photoshopping in multi-millions of dollars worth of the crypto currency. And scam artists have faked Bitcoin wallet apps that they’ve successfully made available in your smart phone store. If you want to be sure that you’re dealing with a legitimate wallet source or exchange platform, then rely on information from BitCoin.org and CoinBase.com. Lessons from Skype Bitcoin has become a religion for people who are fed up with banksters preying on the Middle Class American. Be careful drinking the Kool-Aid that crypto currency will replace the banking industry altogether, however. Even Bitcoin.org, in its alert on the July 31, 2017 chain split, recommends that you only hold as much Bitcoin as you can afford to lose. A lot of the same predators who were selling you gold a few years ago as the apocalypse currency are now cashing in on Bitcoin hype. Skype was marketed as a disruptive technology that would put the telecom industry out of business. That never happened, though the industry now enjoys video conferencing as a result of the innovations that Skype pushed forward. The financial industry is moving fast to figure out how Bitcoin's block-chain might benefit the industry. Opportunities Become an Early Adopter Getting in early on a trend always pays off. Investing fundamentals must still be applied, however. Buying high, or at the top of a market, is never a good idea. Investing in Amazon pre-Dot Com crash would have cost you 80% in losses -- something that would have taken a decade to recover from. Being on the Right Side of a Massive Opportunity There is no doubt that purchasing any crypto currency in January of this year was a great idea, particularly if you’re cashing in with 1000% gains, as some Ethereum investors are. However, whenever you start hearing about sure-fire investments on Facebook, that’s often your sell signal, not your buy opportunity. I started getting inundated with requests to report on crypto-currency in June, after a number of Bitcoin clubs started emerging from highly questionable founders and ads were everywhere touting gains. In my blog then, I warned of many scams and of high prices. Since that 4-alarm warning, all of the currencies have fallen 27-70%. Click here to access my June 2017 Bitcoin blog. Though I do believe that crypto currency is a unicorn. It may have to spend some time back in the stable before it grows to its full glory. I’ll report again on the currency soon – after the July 31, 2017 Bitcoin chain split. However, the crypto currency environment right now is the Wild, Wild West. Be sure that you associate yourself with a town that has a sheriff, and buy your bank at a great price. That 10-Cent Trade The investor who is sitting pretty with an Ethereum investment that s/he picked up for just 10-cents on June 21, 2017, the day after someone else paid $318 has a Capture Gains, Buy on Opportunity mentality. Most clubs that I’m reading about are talking about a Stop Loss strategy, a losing strategy that is wiping out wallets, with egregiously high fees piled on top of the losses. Successful investing requires learning the fundamentals. Join me for my Investor Educational Retreat in October, where you can learn how to swim in this sea of opportunity. Otherwise, you could be jumping in without your water wings, and drown. Are Bitcoin, Ethereum and Litecoin Great Buys Now? All of the currencies are experiencing extreme volatility this summer. If you are an experienced trader who knows how to be on the right side of volatility, then there’s opportunity. If you’re a novice who is interested in jumping into the hottest investment of the year, your first investment should be in wisdom so that you learn how to be on the right side of the Wild, Wild West, in the first phase of a disruptive innovation. Call 310-430-2397 to learn more about our #finlit #fintech training. Receive the best price when you register by July 31, 2017. Are You Gambling With Your Future? My question to you is this. Are you gambling on your future, without even knowing it? Here are just a few of the concerns that I have. *Congress is not taking the Debt Ceiling seriously enough. They’ve been warned to raise it before July 31, 2017. However, internal documents show that they believe they can wait until Sept. 30, 2017. If they cut it too close, we risk getting a credit downgrade from Fitch Ratings and Moody’s. The last time that the U.S. received a credit downgrade, on August 5, 2011, stocks sank and gold soared. *The Feds are de-levering. The Smart Money always moves first. *We are in a Bubble economy. Buy and Forget About It doesn’t work, and hasn’t worked since 1999. *Wages have stagnated for three decades, while expenses have tripled or quadrupled (or more) in the basics of housing, insurance, transportation and food. Life doesn’t add up. *The public debt is expected to soar to $30 trillion in the next decade. It’s at $20 trillion currently. *Housing costs and consumer debt levels are higher than they were before the Great Recession. *The total debt and loans in the U.S. exceed $66 trillion. *Social Security went cash negative in 2010 (5 years early). Disability dried up completely in 2016, and is currently borrowing from Social Security. Social Security accounts for 28% of the public debt and is one of the reasons why the debt is ballooning. *Financial engineering has been keeping stocks artificially high, and making them look like a better buy than they really are. However, the funds for that ruse are becoming more expensive, and reversed the trend starting in 2015. *”Income-producing” retirement plans designed by broker-salesmen are actually losing money, due to high fees, in an up market! Imagine how poorly these plans will perform in a downturn. *Financial predators and scams are proliferating and preying on everyone’s fear and anxiety. Worry and doubt are warranted, but require a real cure, not snake oil. These scams include Gold IRAs, Bitcoin clubs and penny pot stocks, most of which are being run out of "offices" with PO Box addresses by people with a history of predatory practices. *The financial experts predict that the U.S. will have GDP growth of 1.9-2.2% over the next 3 years, while the politicians are basing their plans on 3% growth. *REITs and annuities pay very high commissions and are being sold like hot cakes without the buyer truly understanding the risks of these products. Yup. That’s right, you just read a dozen concerns. (There are many highlighted links in the list above, where I offer even more details on the issues.) And I could continue, until you passed out from boredom and exasperation. But rather, I’m going to give you the important information about how you can protect yourself. You don’t need to know anything about the above list to protect what you have, adopt a safe plan for your nest egg and even start saving thousands of dollars in your annual budget. It’s The ABCs of Money that we all should have received in high school, and it is easy as a pie chart. I know you have heard phrases like this bantered about by other people, but there is a simple difference. The systems and strategies that I developed in 1999 have a Ph.D. in results. They worked fantastically in two of the worst recessions the U.S. has ever experienced (The Dot Com and The Great Recessions), at a time when almost nothing else has worked. The Easy-as-a-Pie-Chart Nest Egg Strategies and Thrive Budget have proven right on the money, time and again, for two decades now. The last time I wrote a blog with this much alarming language in it was December 23, 2007 – right before the Great Recession. If you heeded that warning (as many did), then you earned gains in the Great Recession. If you did not, chances are that you lost more than half of your nest egg. Over seven million people lost their homes in the Great Recession. Incidentally, I began sounding the alarms on the real estate bubble in April of 2005 – in plenty of time for my readers to have avoided that problem. You know that I am optimistic and a fundamentally happy person. When I turn serious on you, you should take it as a call to action to learn and adopt the systems that you need to protect yourself now. I do not put myself on the line and make claims idly. It may sound like a brash statement, but it is a true and provable one nonetheless. I began talking like this in Christmas of 1999, just a few months before the Dot Com recession, in April of 2005 before the real estate bubble burst and then again in December of 2007, before the Great Recession. No one wanted to hear about it then either. Here is a mental test. Did you lose more than 25% in any or all of those downturns? If so, once again, you might be on the wrong side of a bubble that is ready to burst. The problem is that this time it is even more difficult to get safe because so much of the “safe” investments are now very vulnerable, including bonds, bond funds and money market funds. Investing wisely does not require more time or money. It is simply understanding that you are the boss of your money and that, more often than not, the broker-salesman you are relying on is making a commission to sell you things that might not be in your best interest. You might have been told that you don’t pay them a commission. However that doesn’t mean that they don’t earn a commission from the fund provider. Buy and forget about it stopped working in 2000 and will not work going forward. Some, but not all, of the biggest dangers right now lie in the areas that have been traditionally known as safe. I will be discussing all of this in a teleconference on August 3, 2017 (Thursday). You can call into (347) 215-7305 at noon ET (9 am PT), or listen back to the show 24/7 on demand at the link below. If you have questions feel free to email them to Heather now. http://www.blogtalkradio.com/nataliepace/2017/08/03/risks-in-the-us-economy-and-how-to-protect-yourself July 31, 2017 is the last day to register for my boardroom Investor Educational Retreat at the lowest price. It is also the deadline day for raising the Debt Ceiling to ensure that the U.S. does not receive a credit downgrade. Join me at the October 13-15, 2017 Old West Retreat, and you will learn the easy-as-a-pie chart investing strategy that has worked fantastically through bull and bear markets and will work for you for the rest of your life. It is as simple as getting the ABCs of money that you should have received in high school. Does it pay off? Retreat attendees earned money during the Great Recession using the Natalie Pace system, while those around them lost half or more of their net worth. My 2009 Company of the Year earned up to 19X gains; my 2013 Company of the Year tripled, while the 2014 Company of the Year quadrupled! Two of the hot funds doubled last year. This is no accident, and it is not rocket science. It is a system that you need to learn in order to protect and grow your assets during the volatile economic times that we face now and in the decades to come, as we try to cycle through an unsustainable debt load. Do you have any idea how much of your nest egg is at risk and how much is safe from a downturn? Did your investments crash in 2008 and 2001? Have you had difficulty getting rich on the software you purchased or the program you signed up for? Are you still underwater on your home? Are you having trouble making ends meet, or contributing to your own retirement plan due to high bills or high debt? If you answer yes to any of these questions, you have a lot to gain by attending my Old West Retreat in October, and a lot to lose if you don’t. If you lost money in 2008 and haven’t made any changes to your plan, if you do not have a clue what holdings you have in your retirement plan, if you have a pattern of chasing or losing money, if you are relying on blind faith (and hope) in someone else to manage your money for you, whether you have $10,000 or $10 million invested in your account, you need to move heaven and earth to be at my retreat this October. Here is why. At the retreat, we will look at what is hot, what is not, and the danger zones that you need to avoid NOW before the retail implosion starts to spread into REITs and the general economy. You will learn how you can carefully (and easily) restructure your nest egg so that you are better protected against a downturn. You will learn sound, higher performing, less risky investment alternatives that could provide you with a great income and are not being offered by other pundits (largely because they can’t make money off of selling them to you). And you will learn which industries could be poised to soar above the rest, no matter what the market conditions are. I have been looking at a lot of purported “income-producing” portfolios, which are actually losing money now (in an up market!) and are extremely vulnerable to severe capital loss in the years ahead. Whether you are a Millennial or a Baby Boomer, there’s no reason to make everyone else rich at your own expense. Wisdom is the cure. A better strategy could deliver as much as ten times the ultimate wealth creation, income and security over your lifetime. It is not more money invested. It is simply getting more performance for the money that you work so hard to earn and invest. I have put together a 3-day process that is extremely unique, powerful and result certain. On Day One, we cover nest egg strategies. On Day 2, you learn what’s safe and how to get safe, including very low risk investments that can earn you thousands or tens of thousands annually with very low capital outlay. On Day 3, I open up my time-proven bag of tricks to teach you what’s hot and how to avoid the money pits. The rich are getting richer in America these days. You can join them because the Smart Get Richer, too. Now I have to stop for a minute and introduce the secret weapon that is going to make this work so well for you, not just in the moment, but now and forever in your everyday life. I’m not handing you a fish, and then forcing you to buy fish from me for the rest of your life. This is a hands-on conference, where I teach you how to fish. You will learn and do and practice, so that you walk out with a plan that works instantly and for the rest of your life. With seven billion people on the planet to protect, I’ll have my work cut out for my entire lifetime, without having to rely on making you dependent upon me. In truth, financial independence requires financial wisdom, and that is what I’m offering you. By the time you leave that room on the third day, you will no longer be the same person. I cannot promise you that you will make a billion dollars, but I can tell you that if you have enough capital in play and you invest with the foundation and strategies we will teach you, it is certainly possible. The one thing I will promise is that these three days will absolutely be the most enriching, the most important and the most valuable three days of your investment life, and that your results will be in direct proportion to the amount of effort you invest in learning and perfecting my strategies. As you can see from the testimonials below, the only thing people ever regret about my retreat is that they didn’t come sooner. Speaking of which, I am not charging the $5,000 or $10,000 that most investment training programs ask. I am not even charging half of that. I am creating a value-priced, valuable retreat where I can work deeply, intimately and personally with my most motivated, serious and ambitious retreat attendees. The information you will receive and experiences and opportunities you will enjoy are quite simply not available anywhere else – not in universities, other seminars or even your brokerage. If this resonates with you, register now by calling 310-430-2397 and speaking with Heather. I am holding a limited amount of rooms at a deliciously low rate for an Old West Inn that is surrounded by natural hot springs and healing waters. Mark your calendar right now and clear it for the dates October 13-15, 2017. The place is Thatcher, Arizona. You need this information now, especially given all of the economic pressures that we are facing. There is no downside to you attending my October retreat, outside of the costs of travel and the modest hotel. You do not want to miss this unique opportunity. You may never get the chance again to save, protect and nurture your nest egg. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed