|

Next week hosts two key milestones, neither one of which portend good news for stocks. The 4th Quarter and full year 2018 GDP report finally lands on February 28, 2019 at 8:30 am ET. (We missed the advance estimate that should have been released on January 29, 2019, due to the government shutdown.) March 1, 2019 marks the date that we hit the Debt Ceiling again. The Treasury Department must use “extraordinary means” to pay bills until Congress raises the Debt Ceiling and allows the department to borrow more money – something that has become far too ordinary in today’s over-leveraged world. So, how bad will next Thursday’s GDP report & Debt Ceiling be? Is there a chance that the news will be better than expected? GDP Report Feb. 28, 2019 at 8:30 am ET. Last year, the 4th quarter GDP report was only slightly lower than the 3rd quarter. But it sparked a 3-month Wall Street rout at the beginning of 2018 that became the motif for the year. In 2018, the Dow Jones Industrial Average sank by 6%, while the NASDAQ Composite Index shed 4% of its value. On February 28, 2019, the 4th Quarter 2018 GDP growth is predicted to come in far lower than the growth in the 3rd Quarter, which was 3.4%. GDP NOW (The Atlanta Federal Reserve’s forecasting) pegs 4th Quarter 2018 GDP growth at 1.4%, while the New York Federal Reserve Bank projects that growth will be 2.5%. That spread is wide enough to be basically unusable. However, both are substantially lower than the 3rd Quarter 2018 GDP – something investors are not going to be happy with. So, unless there is a big upside surprise in these numbers, March could start off with an implosion. Forecasts have 2019 GDP growth at 2.3%, compared to 2018 full year growth of 3.0%. 2018’s tax cut helped corporations quite a lot. However, this year in order to show growth, business is tasked with selling more without the tax boost. Wall Street insiders are well aware of this… 2/3rds of business economists surveyed by Bloomberg in September of 2018 believed that the U.S. will enter a recession over the next 24 months – before the end of 2020, but not in 2019. The last two recessions cost investors more than half of their nest egg, and the next one looks to be as bad or worse. “When it comes, the next crisis and recession could be even more severe and prolonged than the last,” Nouriel Roubini and Brunello Rosa wrote in an Op-Ed for The Guardian last fall. Click to access their full blog and rationale. Asset prices and debt are even higher than they were before the real estate bubble popped in the Great Recession. It’s important to remember that politicians and the people they appoint never predict a recession. If you wait for the headlines that the economy is in trouble, it will be too late to protect yourself. Debt Ceiling March 1, 2019. As of February 22, 2019, the U.S. public debt is over $22 trillion. Our nation will have to borrow more money to pay our debt and budget obligations this year. However, the Treasury Secretary will not be able to borrow more money after March 1, 2019, until Congress raises the Debt Ceiling. In 2018, this was a non-issue due to a surprising move from the Republican President and Democratic leaders. On February 9, 2018, The President signed the Bipartisan Budget Act into law, after reaching across the aisle to cut a deal with the Democrats. This averted a review of the U.S. AAA sovereign credit rating. Both Fitch Ratings and Moody’s Investor Services have indicated that the U.S. debt is too high for a AAA rating, but have been giving the U.S. a pass due to the dollar being the reserve currency and our ability to control our own currency. So, will there be a Debt Ceiling Crisis and a Downgrade? You won’t hear much about the Debt Ceiling until late summer/early fall, even though Treasury Secretary Mnuchin will begin running the U.S. government like a “piggy bank” (his words) next week. The tax income will provide the necessary capital to pay bills for a few months. If the Administration cuts a deal with Congress to raise the Debt Ceiling before we run out of money, then chances are good that the U.S. will keep its AAA rating. Moody’s indicated on December 12, 2018 that rating pressures might emerge in the coming years due to the rising debt burden and “diminishing debt affordability.” However, the agency believes that “the US will increasingly rely on its exceptional economic strength and the unique roles of the dollar and Treasury bond market in the global financial system to preserve its Aaa credit profile.” Investors have grown accustomed to having a Debt Ceiling crisis every other fall, and to having leaders raise the Debt Ceiling at the last minute. As dysfunctional as this is, as long as more debt is issued and bills are paid, Wall Street won’t freak out. In the event that Secretary Mnuchin runs out of resources before the Debt Ceiling is raised, Fitch Ratings could be the one to downgrade the U.S. credit. Fitch’s analyst and economist Charles Seville noted on January 9, 2019 that the government shutdown shows that “there is a problem with the coherence of policymaking in the U.S.” A downgrade would be negative for stocks and positive for gold, just as it was in August/September of 2011, when Standard and Poor’s downgraded the U.S. credit from AAA to AA+. The bottom line on all of these events, and many more economic headwinds on the horizon, is that this business cycle is starting to show its age. If you don’t want to get caught in the maelstrom, it’s time to get a second opinion on just how safe and secure your nest egg is. As John F. Kennedy said, “The time to fix the roof is when the sun is shining.” Are You Interested in Learning The Thrive Budget and The ABCs of Money that we all should have received in high school? Join No. 1 stock picker Natalie Pace at a 3-day Investor Educational Retreat. Register for the Colorado Retreat in April 2019 now. Make sure that your financial house is secure enough to withstand the economic storms that are on the horizon. A diversified, hot plan that is annually rebalanced and underweights the over-leveraged companies and municipalities is your best defense against a market downturn. Sadly, most people are not diversified, are heavily invested in companies that are drowning in debt, and are still using Buy and Hope, instead of Annual Rebalancing and Modern Portfolio Theory. (Many broker-salesmen say they are using MPT; few are, however.) That’s why your first and best step is to Know What You Own. If you’re interested in an unbiased 2nd opinion, which includes a report of what you own, outlining areas of strength and weakness in your current plan, alongside a personalized sample nest egg pie chart, email [email protected]. Other Blogs of Interest

2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Do you think you’re a rock star investor? A complete novice? Check your Investor IQ with the 21 questions below.

Answers are listed in the blog "Investor IQ Test Answers 2019" in my blog at NataliePace.com. https://www.nataliepace.com/blog/ Email info @ NataliePace.com or call 310-430-2397 if you have any questions about this test, or about the answers, or if you are interested in learning time-proven investing, budgeting, debt reduction, home buying solutions that will transform your life. Other Blogs of Interest

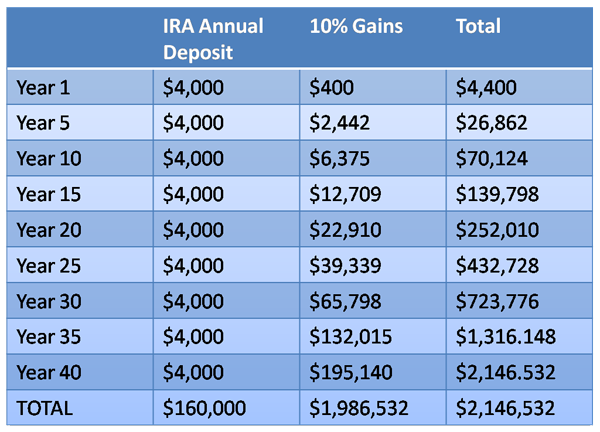

Answers to the 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Answers to the 2019 Investor IQ Test. by Natalie Pace. Feb. 12, 2019 1. What is the most important question you should ask your Certified Financial Advisor before hiring him/her? "How much of my portfolio should I keep safe?" This question will help you to determine whether you are dealing with a trusted professional who is looking after your best interest, or a salesman who is looking to make a quick buck. The answer to this question as we enter the 11th year of a bull market is, "A percentage equal to your age for sure. But this late in the business cycle, we might consider overweighting even more safe." One more important thing. Bonds are highly leveraged, subject to credit risk and vulnerable to capital loss. So, you need to understand what’s safe, rather than just relying upon bonds to keep you safe. Get 12 questions and answers to help you interview your Certified Financial Planner candidates in Put Your Money Where Your Heart Is (aka You Vs. Wall Street in paperback), in the chapter "Brokers are Salesmen, Not Surgeons." 2. What are 3 red flags that your financial plan is in peril? *If you lost 30% or more in the Great Recession and you haven’t made any changes, you’re more vulnerable today than you were then. Don’t confuse a bull market with wisdom. Everyone has made money since 2009, except 2018, when everyone lost money – even on their “safe” side, in bonds. *If you have more than just a few pages of holdings in your financial plan, your gains could be destroyed in fees and commission. You are not as diversified as you believe, as pages and pages of holdings can still just be the same type of holdings over and over again. You’re more at risk than you know. *The NASDAQ is up five times the low of March 9, 2009. The Dow Jones Industrial Average is up about 3.25 times. If your returns over the last decade is lower than this, your plan needs reviewing. Now is the time to do this assessment because Alan Greenspan, Warren Buffet and Robert Shiller have all been saying that stocks and bonds are in a bubble for over a year. During the last two corrections (2000 and 2008), most people lost more than half of their retirement. 15+ million homes were auctioned or repossessed by banks when the real estate bubble burst before the Great Recession. Wisdom and time-proven systems are the cure. The NASDAQ Composite Index Compared to the Dow Jones Industrial Average 1984-2019 If you’d like a second opinion on your current plan from an unbiased analyst with a time-proven track record of saving homes and nest eggs since 1999, while earning the ranking of No. 1 stock picker, call 310-430-2397. 3. How much of your nest egg should you keep safe? A percentage equal to your age. Consider overweighting more safe when the economy is stumbling or a bull market is going into its 11th year (as is the case in 2019). This simple strategy helped followers of Natalie Pace earn gains in the last two recessions, and then build upon that solid foundation in the bull markets in between. In today’s world, it is important to know what’s safe. Bonds lost money in 2018, and are riskier than most investors realize. Money market funds have redemption gates and liquidity fees. 4. What's safe? Hard assets will outperform paper assets in a world where there is too much monopoly money and broken pension promises floating around. So, the mantra is “safe, income-producing hard assets that you purchase for a good price.” It’s hard to buy real estate at a good price in 2019. You don’t want to be all in on hard assets because you also need liquidity and cash flow. That is why some of the best hard asset investments are those that reduce your monthly expenses (for life). That is why I spend one full day on What’s Safe at the Investor Educational Retreats. Shop for this year’s low-hanging fruit. Educate yourself on the best income-producing hard assets that are right for you now, so that when prices are more attractive, you know what you want and have the means to move on it. Call 310-430-2397 to learn more. 5. What is the average return of stocks over the last 10 and 30 years? Large cap stocks earned 13.12% annualized over the last decade and 9.97% over the 30-year period. Small cap stocks performed at 13.08% and 10.87%, respectively. (Asset performance graphs, and more, are available to 2019 Retreat Attendees.) 6. What is the average return of gold over the last 10 and 30 years? Gold returned 3.10% annualized over the 10-year period and 3.79% over the last 30 years. While gold doesn’t look like much on paper, gold mining stocks doubled in 2016, and are currently on sale for 75% off. The all-time high of $1,895/ounce in gold occurred in September of 2011, the month after Standard and Poor’s downgraded the U.S. credit. 7. What is the average return of real estate over the last 10 and 30 years? Real estate prices are higher today than they were before the Great Recession – meaning real estate is largely unaffordable in many areas, particularly for Millennials and the middle class. How does that play out in returns for homeowners? If you started owning your home 30 years ago, you’ve made 5.8% annualized – that is if you avoided using your home equity as an ATM machine pre-2006! If you purchased a decade ago, you might have been a victim of the more than 17 million auctions and bank REOs (repossessions). Over the last decade, real estate has performed at 4.90% annualized. (It took over a decade for real estate to recover from the Great Recession.) 8. What was the top performing investment in 2017? Publicly traded cannabis stocks Cronos and Canopy Growth saw explosive gains in their share price. Cronos is up almost five times from its low over the past 52-weeks, while Canopy Growth has doubled. Aphria and Aurora Cannabis have not enjoyed the same kind of success, however. Both stocks are slightly lower where they were a year ago. And there are also some fakers, particularly in the high risk penny pot stocks. So, cannabis is smoking hot, but not all investments are going to get you high. Bitcoin rose almost 14X in 2017. Since then, however, it’s tanked to become the worst performer, by far, in 2018. Bitcoin was valued at $20,000/coin in December of 2017. Today, it trades for $3,600, for losses of 82%! Sadly, cryptocurrency has been rife with pump and dump schemes and MLM Ponzi scams, so buyer beware! Most investors lost a lot of money in 2018. NASDAQ lost 5%, the Dow Jones Industrial Average dropped 6%, gold prices sank by 3% and oil prices tanked by 25%. With stock and bond prices back near their all-time highs, investors should be taking a more defensive stance. Companies have been borrowing cheap money and buying back their own stock – using financial engineering to make their earnings look strong and their share prices look on sale. However, with the amount of risk that has now entered the marketplace, it’s important to remember that there comes a time when the price you pay to borrow is prohibitive, and you have to pay back your loans with earnings (rather than borrowing from Peter to pay Paul). In other words, no Wall Street party built on leverage lasts forever. 9. How long will it take for you to have a nest egg as big as your annual salary if you put 10% of your income into a tax-protected (and financial predator proof) individual retirement plan and invest in stocks and bonds*? 7 years. Based upon 10% average annualized returns of stocks and bonds over a 30-year period, which is about what those assets have done over the 30-year period, from 1989-2018. 10. How long will it take for your nest egg to earn more than you earn, if you put 10% of your income into a tax-protected (and financial predator proof) individual retirement plan and invest in stocks and bonds*? 25 years. Based upon 10% average annualized returns of stocks and bonds over a 30-year period, which is about what those assets did from 1989-2018. 11. What’s the best investment strategy in a slow-growth, high-debt world? Hard assets hold their value better than paper assets when there is too much paper floating around. Market timing doesn’t work, and you still need liquidity. So, it’s not a good idea to just put everything into cash and real estate. So, learn how to diversify properly (you don’t need 18-pages of holdings), avoid the Bailouts, add in hot industries, keep enough safe, overweight safe in volatile times and rebalance 1-3 times a year. Most hard assets are overpriced right now, so it offers a good period of time to research and determine exactly what is right for you. Value capital preservation more than reaching for yield. It will allow you to buy low when things are on sale. 12. Which countries hold the most gold? The United States is the top holder of gold worldwide, by far, with 8,133.5 tons, followed by Germany, the International Monetary Fund, All ETFs, Italy, France, Russia and China. China and Russia have been on a gold buying spree since 2008. Reports are that they will start trading oil and other commodities using their own currency backed by gold, breaking free from the dollar. (Click to read my report on Russia and Gold.) There are multiple reports that the U.S. banks and brokerages have been selling their client’s gold assets (sometimes without permission) in a price fixing scandal, which has kept gold prices in the U.S. and Europe lower than the rest of the world. Deutsche Bank settled a lawsuit, and agreed on Dec. 2, 2016 to name names of other banks that were price-fixing gold. 13. Are annuities safe? Insurance products, including life insurance and annuities, aren't insured by the FDIC. If we had not bailed out AIG in 2007, more than 50 million annuity holders would have been in real trouble. Your annuity product is only as safe as the insurance company that is selling it to you. Recessions are hard on insurance companies, so we may see some troubled insurance companies in the next recession (as we did in the Great Recession). Insurance products are like being a renter. If you can’t pay, you get tossed out. Many people pay for life insurance their entire working life, and then can’t pay when they retire – when they are really most in need. If you put that money into your own tax protected account, you could save on taxes, compound your gains, and it would be there for you when you retire, even offering some income, in addition to the capital. 14. What is the 3-Ingredient Recipe for Cooking up Profits? 1. Start with what you know and love 2. Pick the Leader 3. Buy low; sell high (easy to say; hard to do) This recipe, along with my Stock Report Card, Four Questions, market strategies and data drilling are how I earned the ranking of number one stock picker. The recipe is easy. Learning how to use these tools requires practice. You must begin by locating and analyzing data, which is actually more less time and more informative than trying to read articles to figure out what to invest in. Articles provide a sliver of the data that is available, once you know where to look, and come with opinions, many of which are immature, incomplete and inexperienced. Come to my next Investor Educational Retreat to learn firsthand (from me) how easy and effective this strategy is, and why it has worked through bull and bear markets for more two decades now, while most strategies have bankrupted investors. 15. What are the Four Questions for Picking Winning Stocks? The Four Questions for Picking Winning Stocks. 1. What’s the product? 2. Who’s the customer? 3. Can the company continue to make a superior product going forward and get it to their customer at the best price before the competition? 4. Who’s the CEO and can s/he motivate the employees to make the best product faster, better and cheaper than the competition? As you can see, three out of four questions can be answered by being a good customer of the company, and the 3rd question can be answered by completing a Stock Report Card. So, the more you know about a company (ingredient #1 of the recipe for Cooking Up Profits), the easier it is to pick the leader. In Put Your Money Where Your Heart Is, I used these questions and tools to compare two companies. The one that everyone questioned, which I gave an A to, went on to become one of the most successful IPOs of all time (Google). The Wall Street darling Blue Chip, which I gave a D- to, went on to declare bankruptcy (General Motors). FYI: I identified both of these trends years before these major events occurred. The book was written in 2006, three years before GM went bankrupt. I applauded Google on national television before its IPO, when most pundits pooh-poohed it. This is the power of asking the right questions, rather than just listening to the mainstream media. 16. What were the top performing and the worst months for stocks over the past five years? November, July, February & May performed best over the 5-year period (in that order), on average. December, January and September were negative months. 2019 Retreat Attendees receive charts of the top-performing months and election year trends. If you’re interested in learning more about our 3-day, life transformational investor educational retreats, call 310-430-2397 or email info @ NataliePace.com. 17. What was the top performing 2-month period for stocks over the past twenty years? March & April – the Spring Rally – performed the best over the 10 and 20-year period, but saw only a little over 1% rise in the 5-year trend. December 2018 was the worst performing December in history, killing the historical returns of the Santa Rally. Understanding seasonal trends can help you with your annual rebalancing in your nest egg, and with your selling strategy for your trading. I spend one full day on what’s hot, teaching you how to identify the best investments of the year, in my Investor Educational Retreats. 18. What was the worst investment in 2018, NASDAQ, gold, the Dow Jones Industrial Average, bonds, cannabis or real estate? Bitcoin and cryptocurrency were the worst investments in 2018 – losing 3/4ths or more of their value. (If you were caught up in a pump-and-dump scam, then you likely lost it all.) It was easy to lose money in 2018. Stocks lost money. Bonds lost money. Oil tanked by 25%. Gold miners dropped another 13.7%. Real estate prices continued to rise, but remain unaffordable to locals in many of the cities with the strongest job opportunities. I spend one full day at the Investor Educational Retreats on What’s Safe and How to Get Safe. Call 310-430-2397 or email info @ NataliePace.com to learn more. 19. Which year is expected to perform better, 2019 or 2020, based upon historical returns of election years? 2019 is a pre-election year. Pre-election years are rock stars historically, boasting average annual gains of 15.6% over the last three decades. However, over the last decade, the pre-election year has been the worst performer. 2000, an election year, was the beginning of the Dot Com Recession. 2008, an election year, ushered in the devastating Great Recession. 20. How many companies are in the Dow Jones Industrial Average? 30 companies. Many are household brands. And many are carrying far more debt than the value of the company. Leverage has begun to concern economists. If you don’t understand how much debt corporations are holding, it’s time to learn The ABCs of Money that we all should have received in high school. General Electric isn’t the only blue chip that is likely to slash its dividend and lose market value. Click to access the names of the 30 companies. The Dow Jones Industrial Average was launched in 1896. 21. How many Dow Jones Industrial Average companies were bailed out or went bankrupt in the Great Recession? Most don't realize that 20% of the companies of the Dow (6 companies: AIG, American Express, Bank of America, Citi, JP Morgan and General Motors) were bailed out or went bankrupt in the Great Recession. Others, like General Electric and Ford, received support. New Chips are far safer, and higher performing, than Blue Chips, both in terms of growth, but also in terms of the fiscal health of their balance sheets. Learn more about how to add in performance and avoid the bailouts in your funds and retirement account at the Investor Educational Retreat and in The ABCs of Money. Since the Great Recession, the NASDAQ Composite Index has offered far superior returns than the Dow Jones Industrial Average, even factoring in dividends. In fact, the higher the dividend, the higher the risk. *All highlighted phrases are explained in greater detail at the Natalie Pace Investor Educational Retreats. Call 310-430-2397 or email [email protected] to learn now. Yesterday our team was told yet another story about someone who lost it all by trusting in the "free" advice of a financial advisor. Learn the truth about commissions & conflicts of interest & how to get a 2nd opinion now in my blog “The High Cost of Free Advice.” Know what you own. Stay free! Data Sources: (c) 2018 Morningstar Direct and The National Association of Realtors. All rights reserved. Used with permission. The information contained herein: (1) is proprietary; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar, the National Association of Realtors, Natalie Pace, nor any content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Other Blogs of Interest The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Santa Monica, California is a small, exciting, significant beach city. Within its 8.3 square miles, it hosts over 8 million visitors a year, boasts of the iconic Santa Monica Pier, is home to celebrities, locals and noteworthy architecture, powers 100% with renewable energy, is on track to be 100% self-reliant for its water needs and promotes healthy living in a number of ways. So, if you truly want to immerse yourself in the local ethos, start by planning your visit, without renting a car. The city makes it easy for you! 8 Days in Santa Monica Without a Rental Car Renting a car for a vacation in Santa Monica is a fruitless, costly endeavor. Since the city is so compact, parking can be expensive and vehicular grid lock can prevail, particularly during “rush hour,” from 8-9 am and then again from 4-6 pm. Of course, getting to a popular destination by car at any time will almost always include a slow, frustrating section of time wasted inching forward (while the bikes, scooters and even pedestrians pass you by). The nearest airport is LAX. Simply catch a 25-minute ride (taxi or ride-share, your choice) for about $30-$35 to Santa Monica. Once you are in Santa Monica, you can rent a bike or an e-scooter, starting at just a dollar, or take the bus or a ride-share taxi. There are many wide, bright green bike lanes to make your ride or scoot easy and safe. Some hotels offer free bikes for your commute around town. Walking in the downtown area near the beach, or on Montana Ave. or Main Street, is a vacation in and of itself, with interesting restaurants, cafes, designer shops, artists, street performers and stunning views every step of the way. Here are just a few suggestions for your 8 Green Days in the beautiful beach town of Santa Monica, California. Day 1: Biking on the Boardwalk. Day 2: The Beach. Day 3: Celebrity & Architectural Sightseeing. Day 4: View of the Century. The Penthouse at The Huntley Hotel. Day 5: Farmers’ Market and Yoga. Day 6: 3rd Street Promenade and Santa Monica Place. Day 7: Saturday Night: The Getty Center. Los Angeles Opera (Placido Domingo!). Day 8: Malibu Nature Hike. And here are more details on each suggestion. Day 1: Biking on the Boardwalk. The bike path along the beach actually runs 22-miles from Santa Monica down to Torrance. So, if biking with a view of the ocean is your idea of a great time, try the marathon full-length challenge. What I love about biking on the beach is that there is an attraction at every turn. Of course, the crashing of the waves and the view are bucket-list nirvana in and of themselves. Choices of fun on the way include: surfing, walking in the sand, playgrounds, the Annenberg Community Beach House, the Santa Monica Pier, Pacific Park rides and arcade, Venice Boardwalk and more. My friends and I used to bike or blade with our kids down to Marina del Rey for a quick bite of brunch early weekend mornings. The paths are still pretty empty until about10 am, even in the summer. Day 2: The Beach. Now that you’ve biked the length of the beach, you surely have seen something that you want to dive in more deeply. Do you want to challenge yourself to swing the rings near the pier? Have a swanky meal at a beachfront hotel? Draw your name in the sand? Try bodysurfing or boogie boarding or take a surfing lesson? Day 3: Celebrity & Architectural Sightseeing. Celebrity sightseeing is not guaranteed, but possible, in La La Land’s beach city. Many of the elite live North of Montana and in Rustic Canyon, so the best places for spotting the rich and famous are on Montana Avenue or at one of the restaurants on Entrada Ave. If you don’t want to spring for an expensive meal at Ivy By the Shore or Giorgio Baldi, tempt fate to deal you a hand of fame by doing “The Stairs.” There are wooden stairs (170 steps) that start at 526 Adelaide Drive and cement stairs (188 steps) at 406 Adelaide Drive. (Yes, just steps apart). Young and old, athletes, models, actors, firemen, moms and gardeners all congregate for their free fitness regimen on the stairs and the grassy verges on Adelaide Drive. How can you spot a celebrity there? They are more likely to be wearing a baseball cap to hide their identity! In addition to famous people, you can see a few world-renowned architectural and design wonders, many of which were designed by Frank Gehry. There’s the Norton House in Venice (Gehry), The Gehry Residence, the Binoculars Building on Main Street (Gehry, with Google tenants), The Penthouse and Casa del Mar. Day 4: View of the Century. The Penthouse at The Huntley Hotel. There is nothing more spectacular than sunset at the Penthouse restaurant and bar, located at the Huntley Hotel. There are gorgeous, breezy cabanas and a 180-degree view of the shoreline from Malibu down to Palos Verdes. Drinks and snacks are more affordable during Happy Hour (4-7 pm, Monday-Friday). If you want a bar cabana, arrive at least an hour before sunset to get the best seat, or reserve the cabana in advance. Day 5: 3rd Street Promenade and Santa Monica Place. If you want to continue your night life after sunset snacks and drinks at The Penthouse, then consider the many options within walking distance, including the 3rd Street Promenade and Santa Monica Place. The Bungalow at the Fairmont Miramar is a popular lounge bar for the fashion forward glitterati, while the Miramar pool lounge is a bit more low-key. The 3rd Street Promenade and Santa Monica Place offer street performers at every turn, with shopping, movies and restaurants. Day 6: Farmers’ Market. There are many farmers’ markets to choose from across the city, on Wednesdays, Saturdays and Sundays, offering fresh, local, organic produce. California supplies produce to all of the United States. However, this is your chance to get it just days from off the vine or tree. Taste the difference. It’s amazing! Organic farmers distinguish themselves with a flag to make it easy to see them from afar. Santa Monica is a plastic-free city, so be sure to bring your own canvas shopping bag or backpack. The Wednesday and Saturday morning markets are at the 3rd Street Promenade, meaning you can follow-up your shopping with a walk to the beach or pier, or sightseeing at the outdoor malls. If you bike or ride an e-scooter, you’ll save a lot of dough on parking, and likely get there faster than if you try to drive and park. Day 7: Saturday Night: The Getty Center. Los Angeles Opera (Placido Domingo!). Los Angeles has become a cultural center of the world. The Los Angeles Opera features Placido Domingo as its executive director. Placido stars or directs in at least one opera each season, and oversees the artistic vision of everything that hits the stage. Book your experience in advance to ensure that you get the best possible seats. The Getty Center features treasured art housed in the stunning architectural design of Richard Meier. One of my favorite things to do on a Saturday night is to book an 8:45 pm dinner at The Getty Center restaurant, and arrive at the museum around 5:00 p.m. (Of course, there is enough to see to arrive at 10 am, too.) Saturday nights The Getty Center stays open late – until 9:00 p.m. The restaurant is open even later. Not that many people know about the extended hours. So you have the museum to yourself, almost like it’s your own castle. On Saturday night, you can see more at The Getty Center in a few hours than you might see normally in an all-day visit, where you have to crane your neck over a sea of heads to get a close look at your favorite famous paintings. Some paintings that you don’t want to miss include masterpieces by Van Gogh, Rembrandt, Monet, Rubens and Degas. The museum is well-known for having collectible photographs, and features a timeline of great art from early Medieval to modern and contemporary. You can get to the Dorothy Chandler Pavilion (where the Los Angeles Opera is staged) from Santa Monica more easily by train than by car or ride-share. It’s an hour and 15 minute bus ride to The Getty Center from Santa Monica, so a better option would be to ride-share or carpool. Day 8: Malibu Nature Hike. If you’re interested in seeing Malibu and hiking the trails of the beautiful Santa Monica Mountains, this is a day-trip that might be worth renting a car for. There are so many outstanding hikes, from the easy Lower Loop of the Malibu Creek State Park Trail, where you’ll see everything from rock climbers to arid wildlife, to Leo Carillo State Park, where you’ll find barnacles, muscles, sea urchins and sponges in the tide pools, and kite surfers on the waves. You might stick to the world-famous Surf Rider Beach, next to the Malibu Pier, where you can grab a bite at Nobu (celebrity-studded) or Malibu Farm, which serves fresh, local, organic fare. Geoffrey’s Malibu, which is closer to Leo Carillo, offers an unforgettable outdoor dining experience overlooking the Pacific Ocean (expensive), while Neptune’s Net offers the Catch of the Day and beer to surfers, bikers and locals. Whether you want to try the posh life or the beach bum experience, there are plenty of choices in Malibu, California. The interesting thing about opting for a green vacation in Santa Monica, California, is that it will save you a lot of time and money, and likely add to your pleasure factor immensely. You’ll spend less time in the car looking for a parking spot, and more time immersed in the experience that you came for. With all of the savings on gas, car rental and parking, you can splurge on one more life-long memory – whether it is a celebrity-chef meal or the opera. (The Getty Center is free!) Other Blogs & Websites of Interest: Santa Monica Powers With 100% Renewable Energy. The Earth Gratitude Project. 7 Green Days in Rome. What The Experts Are Saying About the State of the Union. Including the Odds of a Recession.9/2/2019

It is common, and perhaps even fitting, that a president will tout his or her achievements in the State of the Union address. However, what is not said in a report is oftentimes more important than what is said. Learn what the experts are saying about the state of the union, including the odds of a recession in 2019 and 2020, and in the eight other areas listed below.

And here is additional information on each of these subjects. 1. The Debt Ceiling and Another Government Shutdown. The Debt Ceiling will be hit on March 1, 2019. You might not hear much about this until the U.S. gets close to the “X date,” which should be in late summer or early fall, when Congress has to raise the debt ceiling or risk not paying its bills. Additionally, lawmakers must reach a budget deal before February 15, 2019 to avert another government shutdown. The government shutdown hasn’t prompted Fitch Ratings or Moody’s to review the U.S. AAA credit rating. A Debt Ceiling crisis will. However, nobody expects this to happen. As a result, debt will continue to rise at a rapid pace, as it has for the last two years. 2. Public and Corporate Debt. U.S. public debt has soared by $2 trillion since 2017, to $22 trillion. Consumer debt is higher than ever. Corporate debt (nonfinancial) is unsustainably high, at $6.2 trillion. Municipal and state debt are a problem as well, with $7.3 trillion in liabilities. Pensions and other postemployment benefits are underfunded by corporations to the tune of $454 billion. 3. Economic Growth. Economic growth for 2018 is expected to end up at 3.0% for the year, largely due to the boost that many corporations received from the tax cut. However, the tax cut was a one-time event that’s not expected to help 2019 growth (although lower taxes do help corporations, in general). 2019 GDP growth is predicted to fall back to 2.3%. That compares to predicted 2019 GDP growth in China of about 6.1%. The 4th quarter and full year 2018 GDP initial report will be released on February 28, 2019. 4Q 2018 GDP should be in the 2.4-2.7% range -- far below the 2nd and 3rd quarters of 2018. 4. The Gig Economy. While unemployment numbers are low and wages are rising, Americans are still finding the need to fill in the gaps in their budget with gigs, like driving for Uber, and debt financing. The gap between wages, employment, the gig economy and the cost of living is seen in the escalation of consumer debt. Consumer debt is back to an all-time high, at $13.5 trillion, with student loan debt at $1.44 trillion, auto loans at $1.27 trillion and credit card balances at $844 million (the rest is housing debt). Student loan debt has doubled over the last 10 years. 9.1% of student loans are seriously delinquent, twice that amount if you factor in deferrals, forbearance and grace periods. Due to the heavy debt burden of education, Millennials are delaying their home purchases for seven years on average (source: National Association of Realtors). 5. The Cost-of-Living. The cost for basic needs such as housing, heating, eating, transportation and medical care are so unaffordable for many Americans that many retired boomers are finding bankruptcy to be the only solution, particularly if they need medical care. According to a study on the “Graying of U.S. Bankruptcy,” bankruptcies among Americans age 65 and over has doubled. The minimum income requirements for home purchases in the U.S. has increased 78% since 2012 – more than doubling in hot markets like San Francisco and Los Angeles (source: National Association of Realtors). In hot job markets, like San Francisco, Los Angeles, Seattle, Denver and more, less than 1/3 of the locals can afford to buy a home. By comparison, real wages increased 1.1% in 2018 (source: Bureau of Labor Statistics). If you wait for a raise, or for politicians, to solve this problem, you'll be waiting a long time. This crisis has been building for decades. There are innovative solutions that can save you thousands annually and put you on the Thrive Budget, instead of the Buried Alive in Bills budget. Call 310-430-2397 to learn more about these solutions. 6. The Yield Curve, Late Stage in the Economic Cycle, Trade War. These all bode toward getting more conservative in your investment stance, as each are correlated with recessions. For additional information on yield curves, read my blog, “Harbingers of Recessions." 7. Energy Independence. The U.S. has been the top producer of natural gas since 2009, and petroleum since 2013 (under the Obama Administration). This helps the economy because recessions are highly correlated with gas prices. However, with oil production being cut by OPEC and Russia, their clear goal is to increase oil prices. When we fight foreign wars, we have to purchase oil from Saudi Arabia. Additionally, oil prices are a global marketplace and U.S. oil companies seek profits, too. So, oil prices will increase, if Putin and Saudi Arabia have their way. Consumers can save thousands annually by reducing their reliance on these fossil fuels, while increasing the quality of their air, reducing greenhouse gas emissions and limiting the economic impact of an oil shock. A win-win-win. For additional information on how to save thousands annually with smarter choices, read that chapter in the 2nd edition of my book, The ABCs of Money. Reduce your commute. Reduce electric and heating by insulating better and by understanding your energy hogs and vampires. Green the grid. 8. Asset Bubbles. Low interest rates create asset bubbles. Many companies, particularly those with high debt and low revenue growth, have been borrowing money very cheaply, buying back their own stock and using that financial engineering to make their sales growth look stronger and their stock prices look cheaper. This is at the heart of the interest rate battle between the Federal Reserve and the White House. Learn more about asset bubbles, financial engineering and leverage in my blog on "FAANG. Asset Bubbles." 9. Recessions. Goldman Sachs CEO David Solomon, who gives the U.S. a 15% chance of a recession in 2019 and a 50% chance in 2020, notes that there are five red flags to watch for. They are: oil shocks, industrial disruptions (inventory rebalances), overheating, inflation, financial imbalances and a tightening cycle. So, the prudent investor would take the time today to make sure that their home is secure from the economic storms on the horizon. As John F. Kennedy noted, “The time to fix the roof is while the sun is shining.” Investors, politicians and citizens worldwide want economic expansion, and understand how intertwined our futures have become. Consensus and solutions are needed to solve the challenges of slow growth and high debt that the developed world faces. That is why it is so important to hold a microscope up to the State of the Union Address and reveal what’s misleading, what is untrue and what has been left out. The more we all understand the challenges we face and the solutions that we must embrace, the easier it will be to defuse the partisanship politics that prevail. A nation divided will never be as strong as a nation united, particularly now as we face very real challenges for our people and our economy. Despite low unemployment and 3.4% GDP growth in the 3rd quarter of 2018, there are many storms on the economic horizon that are ready to rain upon us as early as this month. It’s time to fix the roof. Are You Interested in Learning The Thrive Budget and The ABCs of Money that we all should have received in high school? Join No. 1 stock picker Natalie Pace at a 3-day Investor Educational Retreat. Only 2 seats remain available at the Valentine’s Retreat in Santa Monica. Register for the Colorado Retreat in April 2019 now. Make sure that your financial house is secure enough to withstand the economic storms that are on the horizon. A diversified, hot plan that is annually rebalanced and underweights the over-leveraged companies and municipalities is your best defense against a market downturn. Sadly, most people are not diversified, are heavily invested in companies that are drowning in debt, and are still using Buy and Hope, instead of Annual Rebalancing and Modern Portfolio Theory. (Many broker-salesmen say they are using MPT; few are, however.) That’s why your first and best step is to Know What You Own. If you’re interested in an unbiased 2nd opinion, which includes a report of what you own, outlining areas of strength and weakness in your current plan, alongside a personalized sample nest egg pie chart, email [email protected]. Other Blogs of Interest

CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed