|

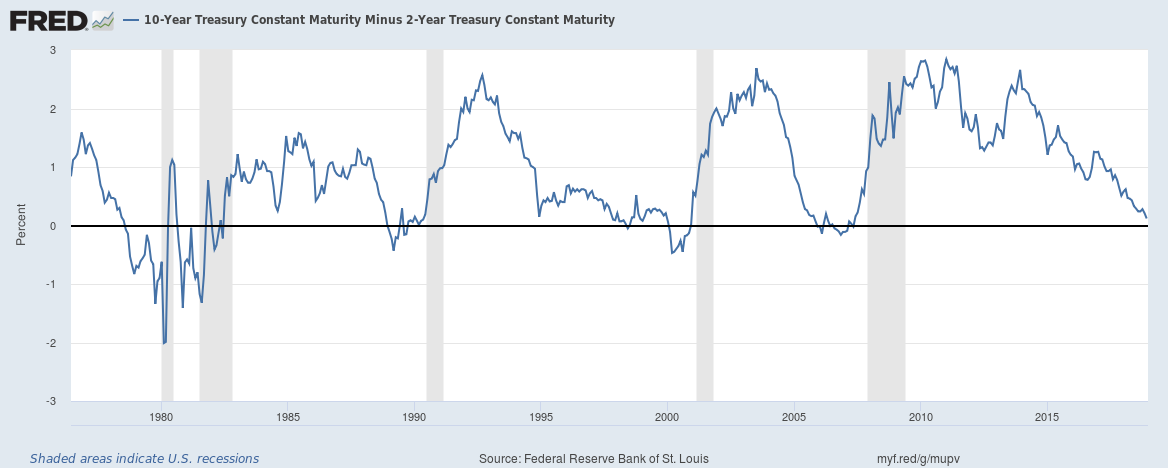

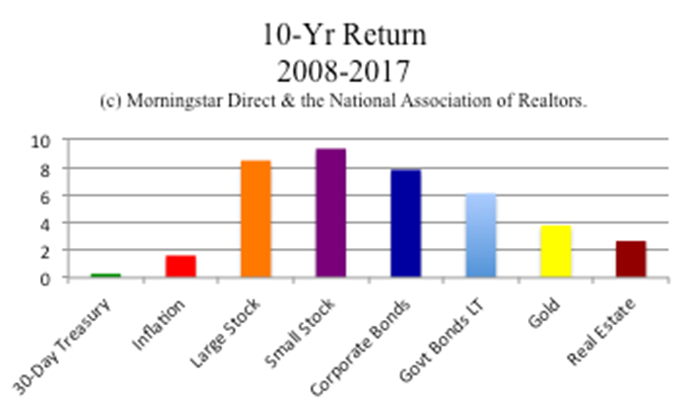

The Worst December Since The Great Depression is a Wake-Up Call. To date, U.S. stocks have seen the worst December since 1931, with 13.4% lost to date, and counting. In December 1931, the S&P500 dropped -14.53% (source: S&P Dow Jones Indices). I say “and counting” because the government shutdown is not going to instill confidence in investors. The only hope we have of averting another sell-off on Christmas Eve, when the stock market is open until 1 pm ET, is that everyone is out shopping. I know that we’d all rather be shopping and baking cookies. However, closing your eyes while hundreds of thousands (or millions) disappear from your assets is never a good idea. Everything But the Truth Last night, I examined the front pages of the news outlets, to learn what they were reporting about stocks and the economy. An anchor on CNBC actually advised everyone to bake cookies instead of looking at their retirement fund. The headline feature on CNBC.com was that “Strategists are optimistic that stocks will end higher in 2019.” Fox News had nothing about the rout in stocks on the home page. On the economy page, the headline blamed Powell for “investors feeling the hurt from the Fed’s Rate Hike.” On Monday, Cramer was advising everyone to buy into the lower prices. By Friday, he recommended capitalizing on a bull market in gold. Cramer, too, has been blaming the Federal Reserve for the economic issues faced in the U.S. and for the sell-off in stocks (just as he blamed the Feds, rather than the real estate bubble, on the Great Recession). The pundits who blame Jerome Powell for U.S. stocks having the worst December since 1931 are overlooking a few key facts. (See below.) In fact, if the headlines today hadn’t been about the Government Shutdown over the $5 billion border wall, the big news of the day could have been positive. The Bureau of Economic Analysis reported Friday morning that GDP growth came in at 3.4% in the 3rd quarter. That news was buried in the Congressional and White House Budget Blame Game. However, if we had a budget deal and positive economic growth news, Friday might have seen a mini-rally, rather than a 2% drop. (The fundamentals suggest that more perilous drops in prices are on the horizon, so don’t be suckered back in without a strategic plan). What’s Really Going On. 1. Astronomical Public Debt of just short of $22 trillion. 2. GDP Slowdown. GDP is expected to slow down to 2.3% GDP growth in 2019, and 2.0% in 2020. 3. The Trade Deficit. Larger than ever. Tariffs increased the trade deficit! 4. The Trade War (Tariffs). Tariffs typically hurt economies, rather than helping them. 5. Leverage. Astronomical debt abounds in every corner, from U.S. sovereign debt, to personal debt, to corporate and leveraged loans. 6. Financial Engineering. Many corporations have been borrowing to buy back their own stock, making their stock look more desirable and better priced than it really is. Lowe’s Corporation was downgraded by Standard & Poor’s last week for this practice. The trend of downgrades is accelerating. 7. The Gig Economy Doesn’t Add Up. Main Street is still struggling to get ahead. 8. Housing is Unaffordable in many cities. 9. Bubbles: Crypto, Stocks, Bonds, Housing, Cannabis. Low interest rates create bubbles. 10. The Yield Curve. An inverted yield curve is 100% correlated with recessions. As you can see from the chart below, the yield curve is flat. Get additional information on each of these points in the blogs listed at the end of this article. What You Can Do About It Simply put, it is imperative that you get a second opinion on your current plan to be sure that you are safe, protected, diversified and hot, and that you know what is safe in a world where stocks and bonds have lost a lot of money this year. Sadly, even with the losses we’ve seen, this is more likely the tip of the iceberg than the turning point where everything comes up roses and gains again. So, if you are being told to just hang on and wait that is a red flag that you need a 2nd opinion now. Call 310-430-2397 or email [email protected] to secure your session now. Buy and hope doesn’t work. A lot of people point to the recovery after the Great Recession and say, “Look, the markets came back!” That may be true, however, it is very likely that your portfolio hasn’t yet. Do the Math Most investors lost 55% in the Great Recession. If you had a million, it dropped down to $450,000. An 8.5% return on a million is $85,000 (what stocks have done on average over the last decade). However, with only $450,000 now, your return is just $38,250. At that rate, it will take you over 14 years to get back to where you started. It took over 15 years for investors to recover from their losses in the Dot Com Recession (with up to 78% losses on their NASDAQ stocks). So don’t buy into the Sales Pitch that Buy and Hold was a good idea. The pundits are right that market timing is not a good strategy it doesn’t work for many reasons. But that doesn’t mean that you should stick with a losing plan. Modern portfolio theory with annual rebalancing means that you are always safe, protected and hot, and capturing your gains. Annual rebalancing is an auto-pilot Buy Low; Sell High program. When a fund slice fattens up in your pie chart, it’s a signal to trim back and sell some high. When a fund slice has become a sliver, it’s a signal that prices are low and it’s time to beef up a bit. Keeping a percentage equal to your age safe is one of the easiest and most fundamental strategies to earning gains in bull and bear markets (although the 2018 correction is complicated with bonds losing money, too). This year and beyond, you need to know what’s safe in a bubblicious world. So learn The ABCs of Money that we all should have received in high school at the Santa Monica or Colorado Investor Educational Retreats. Bundle your retreat with a second opinion now through Dec. 23, 2018, and you’ll receive up to half off on your 2nd opinion coaching package. Check below for two holiday gifts from me. Two Holiday Gifts That Can Save Your Assets Buy and Hope hasn’t worked since 2000. You need to know what is safe in a world where stocks and bonds are losing money and real estate is completely unaffordable in many cities. This year I have two holiday gifts for you. I updated The ABC’s of Money 2nd edition using 2018 data. It’s exclusively available on Amazon Kindle for just $3.99. Imagine a stocking stuffer gift that can help your friends and family to transform their lives with financial (easy) wisdom! My free 21-day Gratitude Game coaching call series is designed to help you implement the strategies you’ll learn in The ABC’s of Money. The 21-day coaching call series is completely free, and is a great way to start the New Year. All you have to do to claim that gift is reply to this email with the subject “Send me my free gift please!” Remember: when the Santa Rally sucks, the next year is worse at least 2/3rds of the time. Wisdom is what is needed now more than ever. We haven’t seen a December this terrible since 1931, during the Great Depression. So stop listening to the blame game on the partisan media news channels and letting fear or blind faith lead your strategy. Get a time-proven system that scored gains in the last two recessions and has outperformed the bull markets in between. Call 310-430-2397 to learn more. Happy Holy Days! Be sure to claim your free holiday gift from me! Other Blogs of Interest Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.

Anita Pietrofitta

24/12/2018 03:28:42 pm

“Send me my free gift please!” 24/12/2018 07:09:56 pm

Hi Anita, Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed