|

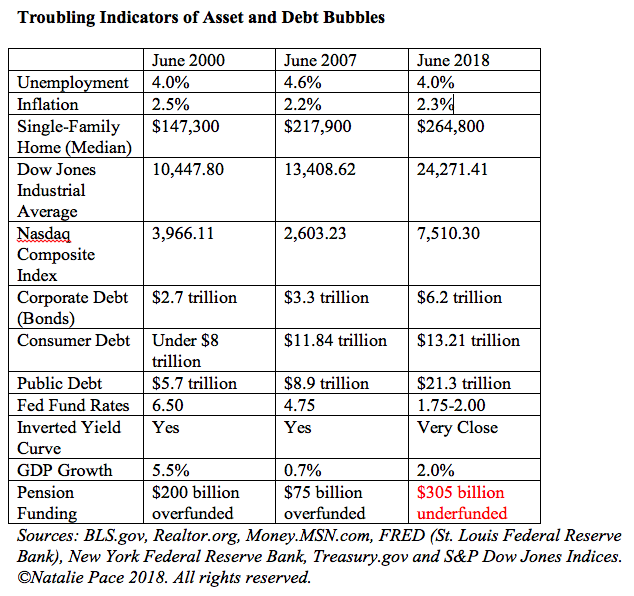

In today’s world, it’s easy to get caught up in trying to earn more to make ends meet. However, there are certain moments in time when protecting what you have, and learning how to stop making everyone else rich at your own expense, becomes the most important thing you can do for your future. That time is now. Cheap money has fueled bubbles in real estate, stocks and bonds. As interest rates rise, all of those over-leveraged and over-priced industries will become vulnerable to capital loss. You don’t want the lost capital to be on your dime. Yes, the GDP growth, low unemployment and low inflation are all good things. However, they are not indicators of corrections. All of these healthy signs were present in 2000 and 2008. Click to learn more about why asset bubbles are the top concerns in the New Millennium. Asset Bubbles and other Harbingers of a Recession are here, which means now is the time to make sure the roof and foundation of your money house are secure enough to withstand the financial storms on the horizon. As John F. Kennedy Jr. said, “The time to repair the roof is when the sun is shining.” Below are risky investments, red flags you need to be aware of, and one easy way to know whether or not you can trust someone who is offering you investing tips. 6 Risky Investments that are being Sold as Safe.

12 Red Flags that You’re Dealing with a Scam Artist or a Salesman.

Whom should you trust with your money? Trust results. Click to read my blog on that. And here is a little more information on each point. Learn 6 Risky Investments that are being Sold as Safe. In 2018 and beyond, the big issue is one of over-leverage and over-valuation. Low interest rates create bubbles, which is why we’ve seen real estate, stocks and bonds soar to the highest prices ever seen. As interest rates rise, all of these assets are under pressure. What’s more troublesome is that many are where you are placing your safe money, where you don’t want to worry about losing money. 1. Bonds. Particularly long-term bonds.Bonds lose value as interest rates rise. Many bond funds can have 20% or more in junk bonds. Over 50% of investment grade corporations are at the lowest rung, just one step above junk bond status. In the worst-case scenario, bonds can become illiquid or the corporation will declare bankruptcy. 2. High-Dividend Stocks.The higher the dividend, the higher the risk. High-dividend paying stocks are seducing investors with the “fixed income,” without properly advising them of the leverage risk. General Electric isn’t the only legacy corporation that is borrowing from Peter to pay Paul. When the dividend gets cut, the stock drops precipitously. GE’s dividend is now one of the lowest on Wall Street, and the stock has lost 72% of its value. 3. Private Placement Real Estate Investment Trusts (REITs).Private placement REITs lure salesmen in with high commissions. One retiree had all of her nest egg put into REITs without realizing that every one of the companies she invested in had been cash negative for years. She was told that she owns real estate, rather than the truth, which is she owns stock in high-risk cash negative companies. As interest rates rise, these companies will become a serious problem for their investors, who may have to try to get a portion of their return of part of their money in a bankruptcy court. 4. Annuities. Annuities are one of the few investments where you lose money the minute you purchase them. (They call it a surrender fee.) The largest annuity and insurance provider in the U.S. wouldn’t be in business if we hadn’t bailed it out in 2008. This company is back to being the largest. In 2017, it lost $6.08 billion. If an insurance corporation goes belly-up, your annuity and life insurance product is not FDIC-insured. If your annuity’s value is tied to the stock market performance, then you are vulnerable if the market corrects (which it does in recessions). 5. Money Market Funds. Money market funds are now subject to redemption gates and liquidity fees. If you want to ensure that you have access to your own money, without paying for it, then FDIC-insured cash accounts are a safer bet. 6. PensionsAnother little known Wall Street secret is that U.S. corporations are underfunded on their pensions and Other Post Employment Benefits by $453.6 billion (almost half a trillion). Multiemployer funds, government employees and others who have been promised pensions are likely linked to underfunded accounts as well – something that is more of a problem than most realize. According to W. Thomas Reeder, the director of the Pension Benefit Guaranty Corporation, “The [PBGC] Multiemployer Program faces very serious challenges and is likely to run out of money by the end of fiscal year 2025.” These funds are supposed to do better in bull markets, but that hasn’t happened this time. In fact, prior to the last two recessions, pensions were overfunded… 12 Red Flags that you’re Dealing with a Scam Artist or a Salesman. Learn more about all of these red flags in my blog on the Elon Musk cryptocurrency scams that made the rounds this year, and the penny pot stock scams that made the rounds in 2017. If something fishy turns up in your email box or on social media, let us know and we’ll look into it for you! Call 310-430-2397, email info @ NataliePace.com or ask your question on my Twitter or Facebook pages. 1 Easy Way to Know Whom to Trust! Whom should you trust with your money? Trust results. If you have a managed account, ask your financial advisor for a chart of the performance of your portfolio, including fees, compared to the NASDAQ Composite Index for a 10-year-period and for a 15-year-period. The first will let you know how well you’ve done in the bull market. The second will let you know how protected you are from the next stock market downturn. Most people are performing far below the NASDAQ because they are more invested in large cap value stocks than they are in hot, growth stocks. Additionally, when you add in the fees, your performance sinks even further. Click to learn more in my teleconference from Thursday November 8, 2018. If you are interested in receiving an unbiased second opinion on your current investing strategy, email [email protected] or call 310-430-2397. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a complimentary private, prosperity coaching session (value $300) when you register for the Colorado Retreat by November 30, 2018. Other Blogs of Interest Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers

Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed