|

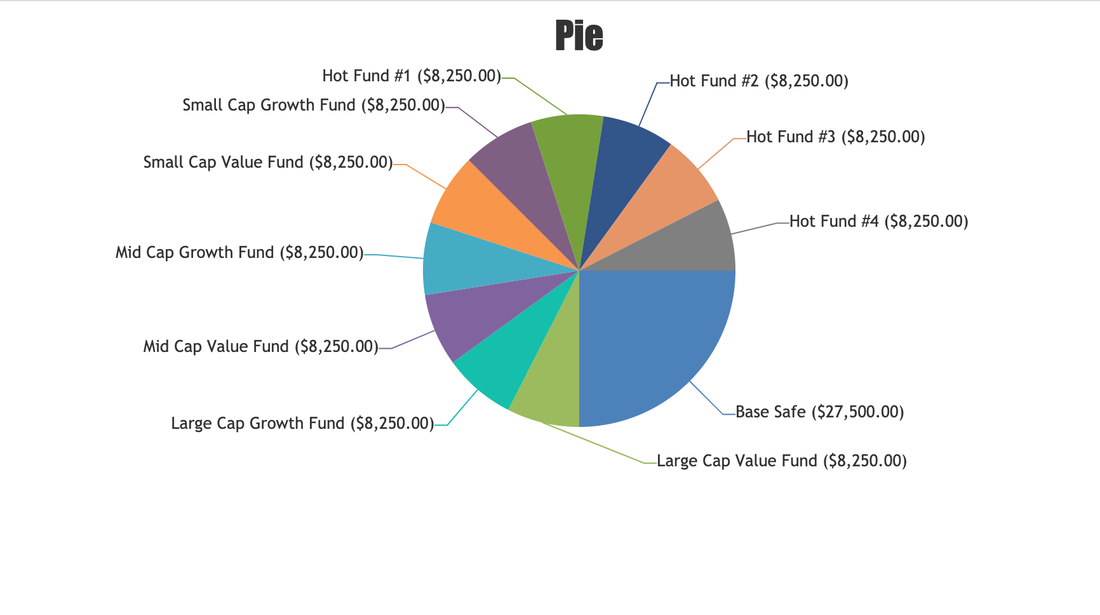

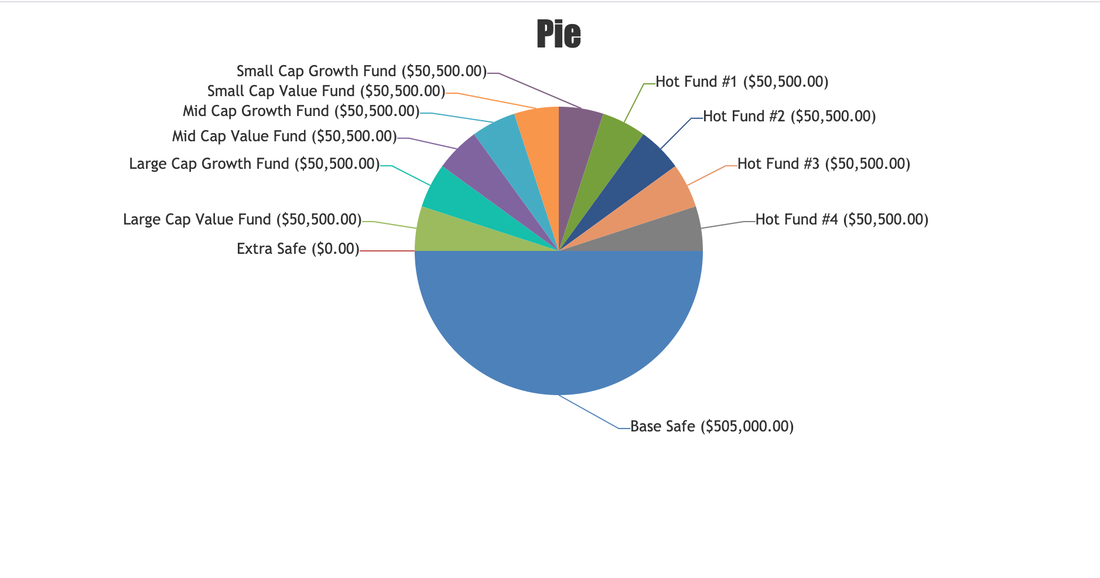

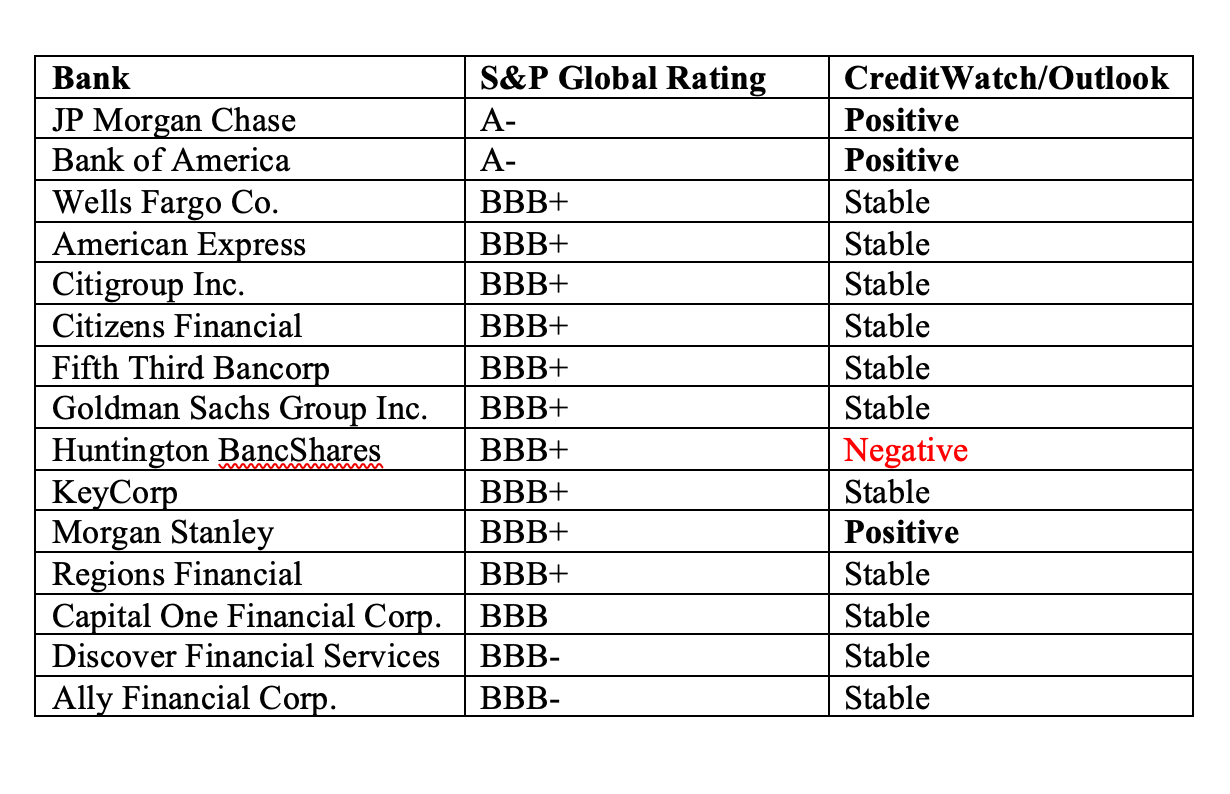

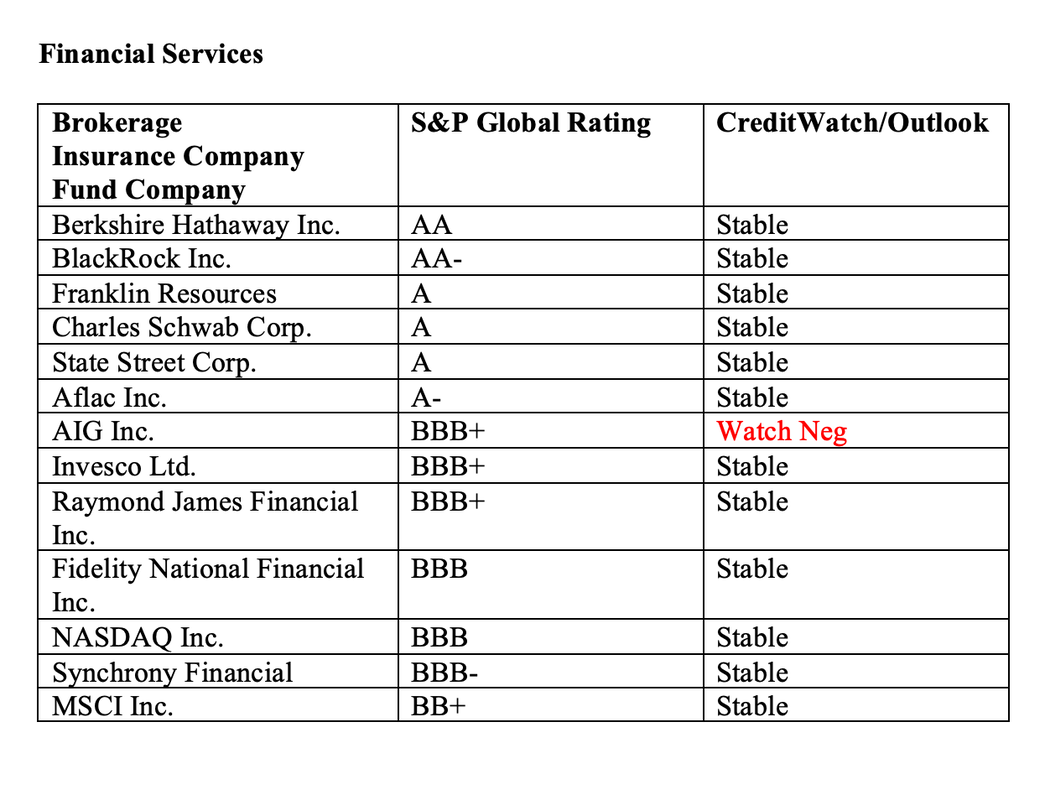

The 12-Step Guide to Successful Investing. Your easy-as-a-pie-chart plan to lasting wealth & money while you sleep. Follow the 12-step program below to get started. 12 Steps to The ABCs of Investing 1. Tithe 10% to your Buy My Own Island Fund. 2. Keep a percent equal to your age safe, not in stocks. 3. Overweight or underweight safe based on market conditions. 4. Know what is safe. 5. Diversify into 10 funds. 6. Underweight the bailouts & vulnerable companies or industries. 7. Get hot. 8. Rebalance 1-3 times a year. 9. Use limit orders to capture gains, not stop losses. 10. Be the boss of your money. 11. Buy & Hope is a last-century strategy. 12. Real estate. And here are more details on each step. 1. Tithe 10% to your Buy My Own Island Fund Remember to put 10% of your gross income into tax protected retirement accounts. (Rich people don’t put money in jars.) You want your investments in retirement accounts so that your wealth grows without you having to pay capital gains taxes. These plans are also financial predator proof (debt collectors can’t put a lien on your retirement accounts). Match your employer’s contribution in the 401(k), but not more, IMHO. The good news is that the employer’s contribution is free money. The bad news is there is not very much freedom of choice in your 401K. That’s why it’s important to also contribute to your Health Savings Account, your own IRA, your kids’ college or dependent IRA funds, etc. (The college funds should be coming out of your education fund.) Self-directed IRAs typically have freedom to invest in the universe of stocks and funds. This is where you can add in hot industries and countries that might not be found in your 401K selections. Name your funds with goals. That will make it more exciting to do your regular rebalancing, as you see just how much progress you are making toward the desired destination. 2. Keep a percent equal to your age safe, not in stocks. The rule of thumb is to always have a percentage equal to your age safe, not in stocks, equity funds, mutual funds, etc. Most people have far more at risk than they realize. The last two recessions have lost investors more than ½ of their at-risk investments. Simply keeping the proper amount safe protects your wealth from these devastating drops. 3. Overweight or underweight safe based on market conditions. In 2021, the U.S. economy is expected to grow at 6.5% GDP. That’s better than it’s done in decades. If stocks and real estate weren’t already so high priced, it would be smart to overweight into equities (stocks). When the economy is expected to contract, overweighting safe is a good idea. (This is something we encouraged before the last three recessions. Yes, the data is that reliable.) Basing your strategy on data is far better than running with your emotions, such as those risk tolerance questionnaires that many broker salesman will give you. Your emotions are rarely your friend in investing, particularly if you are a newbie. Most people have a lot of risk tolerance when stocks are high. Market tops are when you want to sell high and get more conservative, however. Few people have any tolerance for risk at the market bottom because they feel that we are in an Apocalypse. Often, they’ve already lost a lot of money. However, the market bottom is the time when you could be thinking about leaning into risk, particularly if the recovery is looking strong. 4. Know what is safe. We live in a world of debt, where many things are very highly leveraged. That adds credit risk to the “safe” side of the traditional retirement strategy. At the same time interest rates are at rock-bottom. So, you have credit risk and interest rate risk in bonds. Bonds are traditionally thought of as safe. However, today they are vulnerable to capital loss, and they can also be illiquid. Getting safe in 2021 is so tricky that we spend one full day on it at our Investor Educational Retreat. If you have a lot of bonds and wonder if you might be more vulnerable than you know, then I strongly encourage you to read the Bond section of The ABCs of Money. Consider getting an unbiased second opinion from me or attending our June 4-6, 2021 Investor Educational Retreat. We host retreats at least three times a year, so check out the NataliePace.com homepage for an upcoming retreat. Call 310-430-2397 or email [email protected] for pricing, testimonials and additional information. 5. Diversify into 10 funds. Diversifying into 10 funds makes your investment strategy easy-as-a-pie-chart. 10 funds are all you need for proper diversification, and they are far easier to manage when you’re doing your rebalancing session. If you have pages and pages of holdings, chances are you actually only have 2-4 slices, rather than the 10 funds. (That many holdings is a red flag that you are on the Buy & Hope, last-century strategy – riding the Wall Street rollercoaster and losing half of your wealth in recessions.) What are the 10 funds you should be diversified into? Small, medium and large, value and growth, and four hot industries or countries. See the sample pie chart below. FYI: the target date retirement funds are not well-diversified and typically perform below the market index. They do not allow you to rebalance regularly, which is an essential strategy in today’s world. 6. Underweight the bailouts & vulnerable companies and industries. Over half of the S&P500 is at or near junk bond status. There are companies that have very strong revenue growth, almost no debt and a boatload of cash (like many technology firms), there are also companies that have been borrowing from Peter to pay Paul for a very long time, have very low credit ratings, have very high debt, and are either losing revenue or have flat revenue growth (like Boeing, Ford, most of the major U.S. banks, and many more companies that were founded more than 50 years ago). General Electric is proof of what happens when you invest in highly leveraged companies for the dividends. So be careful of your value funds and dividend funds. We address that as well at the Investor Educational Retreat. 7. Get hot. Have you been seduced into the crypto craze? Even with the correction of the past month, Bitcoin is still up more than 3-fold on a 12-month basis. Whatever you think is going to Shoot the Moon this year, whether it is crypto, cannabis, electric vehicles, artificial intelligence or biotechnology, if you have a slice of it in your nest egg that can increase the performance and your wealth. Also, because shooting stars can drop back to Earth, the pie chart system and regular rebalancing helps you to be on the right side of the trade. If your slice of Bitcoin becomes 10 slices, as it did in April of this year, the pie-chart system is prompting you to sell high and trim your 10 slices back to one or two slices. Not only does that allow you to keep your money, it also affords you the opportunity and the emotional fortitude to buy more at a lower price, if the asset value tanks (and you still think it’s hot). 8. Rebalance 1-3 times a year. Rebalancing 1-3 times a year is one of the most important things that you can do. Every year you get a little bit older, and should have more on the safe side. In a bull market, your wealth increases. Most of your slices swell in size. When you compare a sample pie chart of what you should have with what you do have, rebalancing becomes easy and quite visual. If the slice is bigger than it should be, it is prompting you to sell high. Conversely if a correction has plunged prices and your slices are slim, they are prompting you to buy low. In this way, the system puts your emotions on the right side of the trade, whereas brokerage statements do quite the opposite, with losses in red and gains in green. The safe side and overweighting protect you from the plunge. Market timing doesn’t work. When you feel like selling, that’s usually the best time to buy, and vice versa. Rebalancing regularly is a buy low, sell high plan on auto-pilot. It’s important to remember that the reason people don’t buy low is that they cannot buy low. If they have suffered massive losses, they have no liquidity – no money on hand to take advantage of opportunities. When you are keeping an appropriate amount liquid, as the pie chart system instructs you to do, you have the capital to buy low. 9. Use limit orders to capture gains, not stop losses. Think capture gains, not stop losses. A lot of people think they should be using stop losses to prevent themselves from losing money. Your best protection from a correction is keeping a percent equal to your age safe. Overweight a little more (act older than you are) if you think the economy is weak. Because of the volatility in equities, bonds and real estate, if you set stop losses you will be losing over and over again. If you simply changed your strategy to a capture gains system, which is what the diversification and regular rebalancing is all about, then every time the markets shoot the moon, you’re selling high. Every time the stocks tank, you’re buying low. Limit orders can help this process. We talk about this at the retreat as well. 10. Be the boss of your money. Your accountant should be well-versed in tax strategies. Your broker-salesman should be helpful in setting up a new account, making a contribution, rolling over a 401(k) into an IRA and other brokerage transactions. Be careful getting stock tips or strategies from “financial advisors” (who are most often hired as salesmen) or accountants (who should be buried in tax strategies, not equity analysis). There are still a lot of brokerages and broker-salesman that adhere to the last-century Buy and Hope strategy, which has been a disaster in the 21st-Century. Be the boss of your money. Adhere to the time-proven 21st-century strategy of proper diversification and regular rebalancing. Your financial team works for you. It’s your money and your future at risk, not theirs. Once you know what a healthy nest egg looks like, you can take charge, rather than having blind faith that someone else is doing the right thing for your money. Select your financial team as if your life depends upon it because your lifestyle does. 11. Buy & Hope is a last-century strategy. Buy & hope is a strategy that has lost over half in the last two recessions. On this plan, investors have to use the bull markets to make up losses, rather than build their wealth. That is not a financial plan; that is a Wall Street rollercoaster. The easy-as-a-pie-chart nest egg strategy with annual rebalancing earned gains in the last two recessions and has outperformed the bull markets in between. It’s less time and less money. It’s easy and logical. It works. 12. Real estate is part of your wealth, but not part of your liquid assets (nest egg). When you were constructing your sample Nest Egg Pie Chart, do not include the equity you have in your home or any other hard asset in the line that asks for your liquid assets. Real estate and other hard assets are an important piece of your wealth. However, you want liquidity (savings, stocks, bonds) and stability (hard assets). Owning your own home is one of the best ways to build wealth – unless you purchase at too lofty of a price or buy more than you can afford. For important real estate strategies, read the Real Estate section of The ABCs of Money. This is also covered in our Investor Educational Retreats. My May 14, 2021 blog talks about how the real estate market will be impacted by the end of the eviction and foreclosure moratoria. Since almost five million Americans are behind on their payments, and real estate prices are unaffordable in many cities, is important to get your strategy from the data – not a real estate broker-salesman. You can personalize your own pie charts using our free web apps. Simply go to NataliePace.com and click on the app badge. Or you can email [email protected] with the subject line, “I want my free web apps.” Fix the Roof While the Sun is Still Shining You wouldn’t wait for the rain to see whether or not your roof is leaking. You want to make sure your house is secure before any natural disasters occur. In a world where financial disasters are coming pretty regularly, it’s a very good idea to make sure that your fiscal house is sound now, while stocks and real estate are hitting all-time highs. It’s very easy to be complacent when everything is going well. However, stocks and real estate can’t keep shooting the moon forever. Both are very expensive. In the 21st-century, the corrections come swift and deep. If you wait for the headlines that trouble has arrived, it is always too late to protect yourself. (The next headlines about the Debt Ceiling will happen at the end of July.) So, make sure that your wealth is properly diversified, hot & protected now. Fix the roof while the sun is still shining. Join us for our June 4-6, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn how to pick hot funds and companies (like our 2021 Company of the Year, Moderna), and how to incorporate them into a well-diversified wealth plan. You'll discover how to protect your wealth and save thousands annually in your budget with smarter big-ticket choices. The retreat is a complete Money Makeover that will transform your life forever. Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now.  Natalie Pace Financial Empowerment Retreat. June 4-6, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price when you register with friends and family. Other Blogs of Interest Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Dr. Sherridan Ross wasn’t ready to take it easy when he retired from medicine. He was, rather, determined to get his hands dirty and clean up some issues at home. Compton, California has a rich history – a past that sleeps in the soil. It’s not that easy to see it today, amidst a farrago of car exhaust, blaring sirens, eye-blight vacant lots and nutrition-deficient fast-food restaurants. Obesity is a crisis in food deserts like Compton. Dr. Sherridan knew that a big piece of the answer was hiding beneath their feet. Compton was once an agricultural mecca of the U.S. It is still today one of the few cities permitted for agriculture – where you can raise horses, chickens and pigs, if you have enough land. When the city was being developed, no one tore up the soil. The houses and concrete were just strewn on top. Dr. Ross, who is a master gardener, knew just how to “wake the soil up,” with something as simple as egg shells (calcium) and banana peels (magnesium). So, he rallied some volunteers, convinced the owner of a vacant lot to come on board, and in just two weekends created the Compton Community Gardens. The Fire Department was the first to sign up for having their own garden beds at the Compton Community Gardens. Locals pay $50 every six months for their own box, which can feed a family of four for that entire period of time. Dr. Ross points out that folks with a yard could get rid of the grass and sow their own lettuce, tomato and zucchini seeds instead… Once you wake up the soil in Compton, you’re in for a rich yield. There are free gardening classes available to get anyone started, regardless of whether they have a bed in the community. Why Gratitude is Important One of the first things you’ll see when you visit the gardens is that every bed has an empowering message painted on it. Gratitude. Rebirth. Forgiveness. According to TemuAsyr Martin Bey, a Cordon Bleu trained chef who has become an integral partner to the Compton Community Gardens, “We put affirmations all around the garden to create a more positive vibration. Gratitude helps us to operate from a higher place. Once you feel good, it’s easier to do good.” The Compton Community Gardens team encourages seed sharing and community. They organize volunteers to help with planting and harvesting, and offer ongoing training through their free classes. The Compton Community Gardens have expanded into a second plot and into nine local elementary schools. Kids are learning where their food comes from, and just how delicious fresh produce can be. The Gleaning Beds The Compton Community Gardens is also dedicated to helping the neighborhood. Though most of the garden beds are rented, there are always “gleaning” beds set aside for the public good. Using Dr. Ross’ companion method, people are harvesting 70 pounds of tomatoes out of one plant in a 4’x 8’ bed – far more than any one family can eat. The food delivered by the Gardens’ volunteers was a Godsend in the pandemic for thousands of families in need, and will continue to play a role in the recovery. Fast Healthy Organic Food New gardeners are always surprised at just how fast food grows in healthy soil. According to Dr. Ross, a head of lettuce grows to maturity in just 33 days. Zucchini grows four inches a day in the biodynamic Compton soil. Tomatoes that have a strawberry plant next to them don’t suffer from the attack of the tomato hornworm. The guidance of a master gardener makes all the difference. As Dr. Ross told me: We teach people how to grow their garden. Once your garden is growing, you should be able to stand at the end of your garden and not see any soil at all. When you plant a diverse garden, you confuse the insects. Now they don’t get the smell they want to attack your vegetables. You’re cutting down the water by 2/3rds. If the sunlight can’t get to the soil, it can’t dry out the soil. You have to water once or twice a month, instead of once or twice in a week. It’s About Much More Than a Garden Dr. Ross’ vision was to get people eating healthy food and roll back the obesity crisis in his beloved birthplace. He works with teens, not just to give them food, but also to give them hope. Temu believes that fresh, healthy, organic food creates a memory and can actually reduce crime. In fact, the inspiring messages on the garden beds were all painted by local teens, some of which are affiliated with gangs. According to Temu, “Developing a relationship with food helps us to have healthier relationships overall. When you create a healthier life, it’s easier to create a healthy community. This is life-changing. It can revolutionize and uplift our community.” As Temu speaks, someone stops their planting to say, “Amen.” Heads nod in agreement all around the garden, as everyone acknowledges the grander vision and mission of creating health and sanctuary in their city. You can learn more about gardening in Dr. Sherridan Ross’ book Introduction to Organic Gardening. Follow The Compton Community Gardens on Instagram to learn when the next volunteer planting or harvesting day will be. (The next Harvest Day is May 28th.) You can support their work by ordering a t-shirt or tote bag at https://www.ComptonCommunityGarden.com/. Click to watch Temu and Dr. Ross discussing the Compton Community Gardens. See more inspiring Earth Gratitude stories on our YouTube channel. Read about conservation and sustainability projects from around the world in the Earth Gratitude free ebooks. There are actually two companies that top the charts for 2021. They are providing things that most of us need most right now, which we didn’t concern ourselves at all with a year ago. They are not the only companies doing what they do. However, they are doing it best. Discovering which company is the best in a hot field requires going to the basics of what makes a company great. What is the product? Who are the customers? Why is that company‘s product superior and why does everyone want it more than the competition’s version? Who is leading the company and can the leadership team and Board of Directors continue to produce a superior product and keep the competition at bay? The Product and Customers When you think of the one thing that everyone is clamoring to get, which none of us cared about a year ago, it’s the coronavirus vaccine. The marketplace is the largest one we’ve ever seen – potentially everyone in the world. The Competition Many major biotech companies have launched a vaccine. Pfizer and Moderna have a leg up on the competition with FDA approvals and solid distribution. Johnson & Johnson and AstraZeneca have been dogged with production malfunctions, side effects or regulatory concerns. With over 1/3 of U.S. adults vaccinated (or in the process of receiving their 2nd shot), you might think that the party will be over for the companies that are currently approved. However, there is still the rest of the world, and any booster shot that might be needed, which many experts agree is likely. When I was analyzing companies that are competing with the Covid-19 vaccine, I also put in a company that provides Covid testing and companies that are developing immunology and therapeutic solutions for the virus. What I discovered was that the revenue growth of two of the companies on my Stock Report Card was positively eye-popping. Moderna’s revenue increased to $1.9 billion in the 1st quarter, from just $8 million in the year prior – an increase of 23,000%. The company expects to deliver 800 million doses of their vaccine in 2021, with a goal of increasing that to 1 billion. At that level, Moderna’s revenue in 2021 could easily reach the $19.2 billion indicated by the APAs (Advance Purchase Agreements). MSN.com pegs Moderna’s forward price-earnings ratio at just 6.47, which is astonishing for a company with this kind of growth. Fulgent Genetics, makers of a Covid-19 test, along with many other diagnostic tests, saw revenue increase by 4,500% to $359.4 million, with net income of $200.7 million. Fulgent is another company with a very low P/E of just 4.54. Biotechnology Risks Biotechnology is a very volatile sector. The Covid-19 vaccine came out quickly, without any longitudinal testing. Many folks had already received the Johnson and Johnson vaccine, when they were advised that there was a small risk of blood clotting. If any major health side effects should be revealed and tied to Moderna (or Pfizer), you can expect the stock to drop pretty suddenly. (This makes an investment in Fulgent slightly safer.) The only thing that saves publicly traded biotechs from share price volatility is a preauthorized buyback plan. (That’s what Boeing has done for the past two years to keep its stock high, amidst the multiple problems with their airlines and the airline industry itself.) Immunology If you might be interested in how the body can be aided in healing itself, then you might be more interested in Regeneron, Adaptive and Vir Biotechnology. These companies all have benefits beyond Covid-19. All of these companies have strong connections to The National Institute of Health and the CDC. Adaptive has partnerships with Amgen and Microsoft, to name a few. Vir Biotechnologies partners include The Gates Foundation. Smaller companies like Vir Biotech and Adaptive Biotechnologies have extreme share price volatility. Vir’s price soared to $140 a share earlier this year. Today’s price is quite a bargain compared to that, if it can reach those heights again. The pipeline, trial results and FDA approvals are what tend to fuel investor interest. 3-Ingredient Recipe for Cooking Up Profits Whether you are interested in Moderna, Fulgent, Vir or Adaptive, after you’ve found your leader, you must then purchase the stock for a good price to make sure that you are on the right side of the trade. There’s no reason to think about price, until you’ve found the leader. (Take the ingredients in order.) 3-Ingredient Recipe for Cooking Up Profits

Price-earnings ratio can be one tool for making sure that you are purchasing for a reasonable price. For instance, Moderna is trading close to an all-time high. However, based upon the 2021 and 2022 sales potential, the price is actually quite low. As more and more headlines emerge about the astonishing revenue growth of Moderna, the price could be pushed up from where it currently is. So, if you try and wait for a better price, it may never come. On the other hand, if there is any problem with the vaccine, then the price could plummet. Biotech offers higher risk, and higher rewards. Fulgent is trading at a 62% discount from the highs set in January of 2021. If you think there will be no need for Covid-19 testing going forward, then Fulgent isn’t the company for you. However, Fulgent is projecting revenue of $830 million this year, which is double last year’s. That’s amazing growth, particularly for a company that is trading at a P/E of 4.54. Companies of the Year 2021’s Company of the Year designation is shared by Moderna and Fulgent. In 2021, the world needs a Covid-19 vaccine. Beyond 2021, we will likely need a booster. We will also continue to need Covid testing, particularly if we want to travel. Regular Rebalancing & Babysitting Whenever you are investing in an individual company, it requires babysitting. If the company shoots the moon, it’s a very good idea to do a little profit taking and take some gains off the table, just in case there is any kind of bad news down the pike. Here’s where the pie chart system and regular rebalancing can help you. Buy & Hold is not a strategy that has worked in the 21st-Century – not for stocks, gold, crypto or real estate. Proper diversification with regular rebalancing does. The Macro Environment 2021 is predicted to bring 6.5% GDP growth in the U.S. (compared to 8.4% in China). That would usually equate to a stellar year for stocks. However, the recovery is already priced into most stocks. (Moderna and Fulgent are some of the only stocks I’ve seen that are trading at a value). There is a Debt Ceiling debate coming up for the end of July in Congress. Additionally, the U.S. has a negative outlook on their AAA credit rating from Fitch Ratings. A downgrade or Congressional gridlock would be negative for stocks. It’s important to remember that the macro environment can influence the trajectory of any company’s share price. A rising tide lifts all ships. A sinking tide can ground them. Join us for our June 4-6, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn how to pick great companies (like Moderna and Fulcrum), and how to incorporate them into a well-diversified wealth plan. You'll discover how to protect your wealth and save thousands annually in your budget with smarter big-ticket choices. The retreat is a complete Money Makeover that will transform your life forever. Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now. Call 310-430-2397 or email [email protected] to learn more.  Natalie Pace Financial Empowerment Retreat. June 4-6, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price when you register with friends and family. Other Blogs of Interest Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Almost 5 Million Americans are Behind on Rent & Mortgages, While Home Prices Hit New Highs.14/5/2021

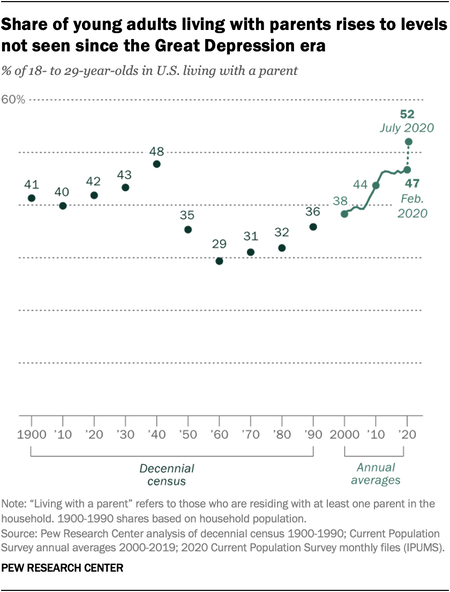

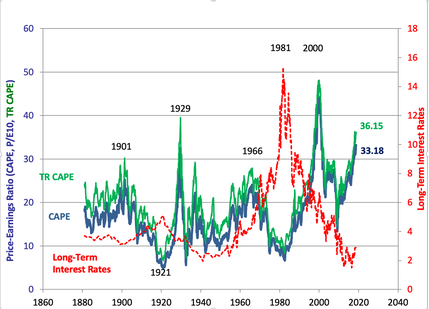

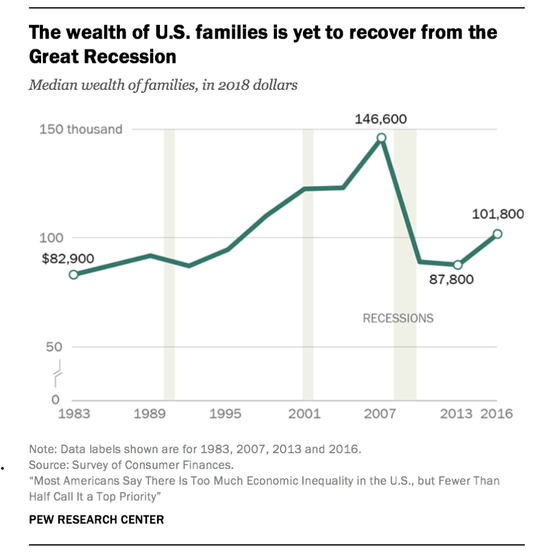

Almost 5 Million Americans are Behind on Rent & Mortgages, While Home Prices Hit New Highs. Real Estate: Beyond the Looking Glass. 11 Critically Important Facts to Factor in if You’re Considering Purchasing or Selling Real Estate 2.56 million renters and 2.33 million homeowners are behind on their payments (households). Missed rental payments are at about $35 billion, with missed mortgages at about $68 billion. In addition, 41.4% of student debt borrowers (26 million) have missed payments on their college loans, totaling $122.3 billion in missed payments (source: RIHA). The U.S. Treasury has been busy writing checks to try and slow down any foreclosures and evictions. On May 13, 2021, the department announced that $742 million has been distributed to a Homeowner Assistance Fund, while $21.6 billion has been allocated for Emergency Rental Assistance. If you are in need of assistance, click on the blue highlighted links to get additional information. Be aware, however, that the HAF and ERA funds are going to “governmental entities,” not directly to landlords or renters. If you qualify, then you should be able to apply for assistance through your state agency. The new funding came just at a time when the rental and foreclosure moratoria was slated to end on June 30, 2021. (A federal judge threw out the moratoria last week as well.) We all know someone who is touched by these missed payments. However, the news is telling us that real estate is on fire – creating a thirst for buying among Millennials, who are bidding up already unaffordable home prices. These new bailouts, alongside the moratoria, have kept a massive amount of shadow inventory, all of this distressed property, from hitting the multiple listing services. That would have been devastating to real estate, causing a plunge in prices, which could sink the economy back into a crisis. That is something the Feds, U.S. Treasury and The Administration are all trying to prevent. New homebuyers are simply not factoring the big picture into their decisions, but are being seduced into purchasing at an all-time high from the sexy ads and sophisticated real estate broker/salesmen. Almost 1/3 of purchasers are first-time home buyers (31%). It’s a seller’s market.  As Lawrence Yun said in our interview in late March of this year, “Understand that the market that has been hot will not be hot for very long. If you want to consider selling, now may be a good time because it should be easy to find buyers.” Check out my interview with Lawrence Yun, the chief economist of the National Association of Realtors, for additional information on the housing market. The high price of real estate is helping with the land value of commercial real estate, even if malls, hotels and office buildings are still largely vacant. Despite what you hear about real estate that puts you in a frenzy to own a new home, it pays to understand what is really going on and to be patient about a purchase that will affect your life for the next decade or longer. Real estate is not a short-term investment. If you buy high and the price drops, it becomes an illiquid nightmare with octopus arms that reach into every vein of wealth you might have, making your FICO score plunge and draining your nest egg dry. As a warning of how quickly things can head south, a Times Square mixed-use building plunged 80% in value over the last few years. Below are some Beyond the Looking Glass facts and indicators that tell a richer story than what you are seeing and hearing in the mainstream media. Factoring this data into the mix will help you to understand how to navigate your own home and real estate investments, with a view beyond the near-term. Just how could the economy and a general repricing affect your retirement and stock/bond portfolio, in addition to the value of your home? 11 2021 Real Estate Facts Landlords are hitting a wall Renters get another bailout Intergenerational Housing Hotels Malls are turning into Amazon warehouses Earnings are everything but Office buildings are incorporating social distancing Shadow inventory Exodus Credit ratings High price-earnings ratios And here is more color on each point. 11 2021 Real Estate Facts Landlords are hitting a wall. Some have had to reduce the rent for struggling tenants. Others have tenants that haven’t paid at all since the pandemic started. The arrears are technically due. However, will the money ever be collected? Can the landlords afford to write off the unpaid rent, or will they lose their property? Renters get another bailout. Renters may qualify for relief. However, many understand this is a short-term fix for housing costs that were unaffordable to begin with. As a result, we’re seeing a dramatic increase in intergenerational housing. Intergenerational Housing. 18% of the homes that Gen Z are purchasing, and 12% overall, are multigenerational homes – pushing up the prices of larger homes. Folks are thinking, while I’m getting an extra room or two for my Work-from-Home office, why not move the parents in (who can help out with the mortgage)? Vice-versa, when a young professional gets behind, their first call might be to the parents for room at the inn until the financial trouble subsides. As you can see in the chart below, intergenerational housing has hit a record high – higher than it was during the Great Depression (another time of necessity). Hotels. Hotels are hoping for a renaissance in the 2021 summer vacation market. Others are remodeling to become multi-unit housing. In the meantime, revenue was down by 50% or more in many casinos and hospitality/travel companies. Despite that fundamental weakness, many companies are trading near their all-time highs and unsustainably high prices. Booking Holdings (Priceline) has a 65 forward price-earnings ratio, while Las Vegas Sands Corp’s P/E is 389. Malls are turning into Amazon warehouses. Amazon has been buying up empty malls and turning them into fulfillment centers. The concept has struggling mall REITs, like Simon Property Group, trading near 52-week highs, though revenue is still down (and being propped up by earnings that are everything but sales). Earnings are everything but When S&P Global downgraded Cushman & Wakefield from BB- to B+ on March 21, 2021, the note included a revealing fact. “The majority of the company's EBITDA came from add-backs for interest expense ($197.6 million) and depreciation and amortization ($263.6 million), which we view as lower quality compared with core earnings,” S&P reported. Office buildings and malls are vacant and empty, so how are they reporting earnings at all? The answer lies in add-backs and other financial engineering. In other words, be careful about investments in REITs and other distressed property that is undergoing a structural shift in its business model. Office buildings are incorporating social distancing. Work-from-Home and the pandemic changed the business model for office buildings overnight, and look to be a structural shift going forward. Salesforce’s President Brent Snyder announced on February 9, 2021, that ”the 9-to-5 workday is dead.” According to Snyder, most of their staff will work remotely or “flex,” coming into the office only 1-3 days/week for “team collaboration, customer meetings and presentations.” This “work-from-anywhere model” means that Salesforce will be able to reduce its real estate footprint. I reported on this more in depth while I was in New York City in March. Click to read that blog. Shadow inventory. According to AttomData, 1/3 of mortgaged homes are considered to be equity-rich. (If this describes you, be sure to read my Equity-Rich blog, to be sure you can withstand a world where housing takes a downward spiral.) However, 2.6 million homes are also severely underwater (where the loans are 25% higher than the home value). 2.3 million households are behind on their mortgage, with probably some cross-over in the two. This distress is not showing up on the MLS. However, these homes are vulnerable to foreclosure and auction. (If you’re in this position, contact our office at [email protected] or 310-430-2397 for some key information that might save your life boat.) Patient home buyers who purchase in the shadow inventory, where prices can be discounted by up to 1/3, will find better bargains than those relying solely upon a broker-salesman. Exodus. California’s population fell by 182,000 in 2020, costing it one Congressional seat. New York City’s population fell by 108,000 in 2020. Sadly, part of the drops were due to COVID-19 deaths. However, unaffordable housing costs in both areas are pushing residents to more affordable areas, particularly now that employers have become more flexible with working from home. Areas like Sacramento and Modesto have attracted former San Francisco residents, according to Lawrence Yun. Credit ratings. REIT investors should be alerted that many have very high debt and very low credit scores. Companies in junk bond status include: Cushman & Wakefield, Wynn Resorts and Beazer Homes, among many others. High price-earnings ratios. Revenue growth in 2021 could start to look good even for severely distressed companies, simply because it’s not difficult to look better than 2020 – the worst year, economically speaking, of our lifetime. 2021 is projected to produce the best year in decades, with 6.4% GDP growth. However, this is already priced into the stock market. The forward outlook for price-earnings ratios are historically high… As you can see in the chart below, the only two times in history when price-earnings ratios have been this high were before the Dot Com Recession (2000) and before the Great Depression (1929). Now would be a good time to know exactly what you own in your managed brokerage account and your retirement account, and to be sure that you are comfortable with the amount of risk that you have. Bottom Line There has been a massive, historic effort by the U.S. Treasury and the Federal Reserve Board to keep prices of real estate and stocks right where they are. This has resulted in the bull market we are enjoying in both markets, even while the economic fallout of the pandemic is still swirling in the clouds, soil and shadow inventory. In the short-term, if you purchase a home or any real estate right now, it might look like you are a genius. However, buying high in any hard asset can be a decades-long nightmare. Here are a few key strategies that should pay off.

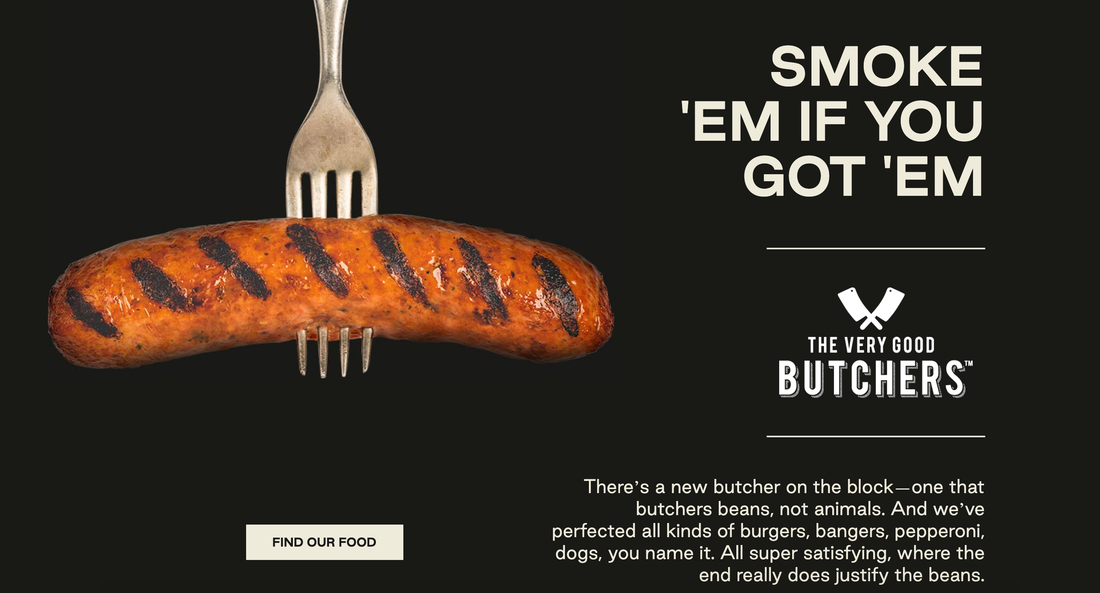

Also, read the Real Estate Blogs & Interviews below. Interview with Lawrence Yun, the Chief Economist of the National Association of Realtors Blog Videoconference Times Square Building Plunges 80% in Value Real Estate Prices are Going Up Real Estate Challenges & Opportunities Real Estate: Feeling Equity-Rich? Real Estate Solutions We spend one full day mastering time-proven real estate investment strategies, including income-producing property, at the Financial Empowerment Retreat June 4-6, 2021. Join us! Join us for our June 4-6, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn how to pick great companies (like Beyond Meat, The Very Good Food Co., Oatly, Zoom Video, Tesla, Aphria, Veritone and Nio), and incorporate them into a well-diversified wealth plan. You'll discover how to protect your wealth and save thousands annually in your budget with smarter big-ticket choices. The retreat is a complete Money Makeover that will transform your life forever. Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now. Get the best price when you register by Saturday, May 15, 2021. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. The plant-based protein market is steadily growing. In 2019, global sales were $17.2 billion. By 2027, vegan meat substitutes and plant-based protein liquids (like Oatly) are projected to ring up almost $28 billion in sales. While Beyond Meat® and Impossible® were the pioneers in vegan burgers, Canada’s The Very Good Company is gaining traction with its savvy branding and chef-inspired recipes. Even old-school food makers like Kellogg, Conagra, Archer Daniels and Midland and Dupont Food are all showing up at the party. So, which is the best horse to bet on? Oatly is launching its U.S. IPO with $421 million in sales and a global footprint. The Very Good Food Company, which started in Canada and is expanding into the U.S., is lapping the competition in revenue growth. 2020 revenue was $3.8 million (U.S.), up 364% year over year. Beyond Meat enjoys partnerships with large restaurant chains, and one hundred times the sales of the Very Good Company, at $407 million in 2020. Below is a more detailed examination of the strengths and weaknesses of: