|

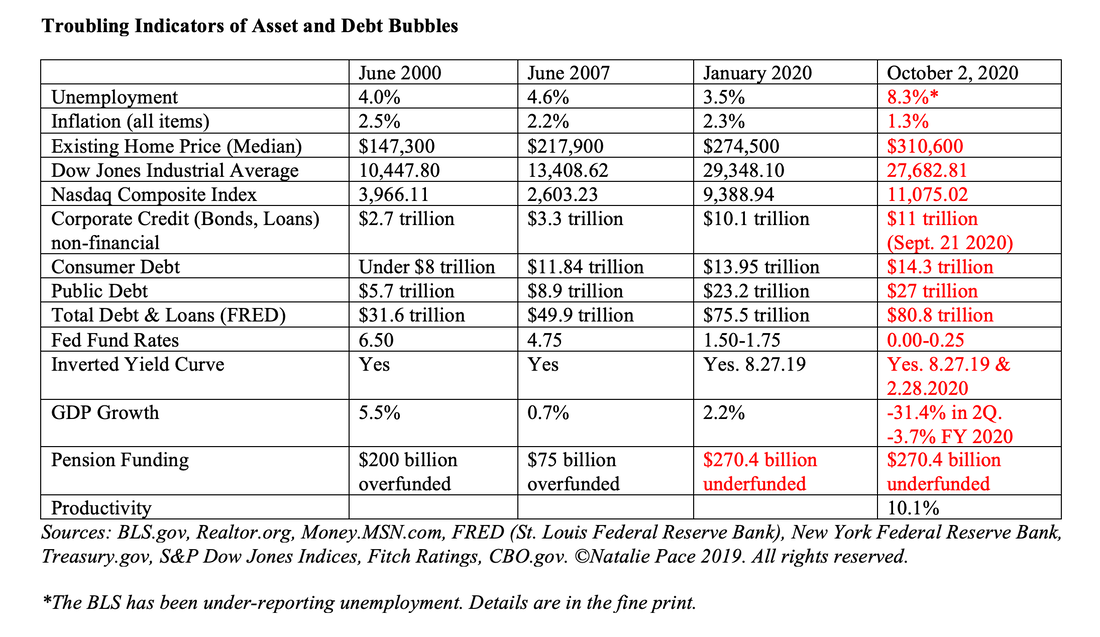

The October Surprise turned out to be quite a bit different than any of us were expecting. (As you’re aware, The President and First Lady tested positive for the coronavirus on Oct. 1, 2020. The President was moved to the Walter Reed Hospital on October 2, 2020.) However, there is another built-in October surprise that’s going to come up on October 29, 2020 that investors should be aware of. -3.7% 2020 Contraction in the Economy In the September 2020 meeting, the Federal Reserve Board projections predicted the contraction in the U.S. economy in 2020 will be -3.7%. Since the first quarter contraction was -5% and the second quarter contraction was -31.4%, the third and fourth quarters are clearly expected to perform much better. Indeed, it is easy to imagine that with many cities easing restrictions on businesses and consumers, there was more commerce going on in the third quarter than there was in the second quarter. Things are certainly not back to normal. However, sequentially the growth could look pretty good. Particularly since, as the Administration does with the astronomically high unemployment figures, where they tout how many jobs have been created, there will be no emphasis on the Recession, and a lot of emphasis on the “recovery.” The Numbers are Greased The contraction would certainly be worse if there was not a moratorium on foreclosures and evictions. The recession would also look substantially more dire if there weren’t a lot of employees at companies like Disney and the airlines that were paid not to go to work. There are a lot of corporations that would be in serious trouble if the Federal Reserve had not purchased almost 1000 short-term bonds. So, it’s very important to understand that the GDP growth numbers are not really telling the full story. Politicians Like to Brag While you heard crickets every time the second quarter contraction was mentioned, which was one for the history books and the worst on record, you can expect to hear a lot of braggadocio once the third quarter GDP growth statistics are released at 8:30 AM ET on October 29, 2020. Rather than talk about how serious the contraction is, how some industries have changed for the foreseeable future and what we’re going to do to put millions of unemployed folks back to work, we will likely hear that the GDP growth in the third-quarter was one of the best in the past two decades. Those kind of Tweets and headlines might make people believe that the economy is stronger than it really is, and could influence who they vote for. Will Stocks Rally on the News Will stocks rally on the news? That is less clear. The stock market is overpriced. Investors are already banking on a recovery. The Santa Rally is pretty common in normal times. However, in recessions, stocks can tank in October, November and even December. It’s definitely not a given that stocks will rally. When the third-quarter numbers are released at the end of October, investors could just heave a sigh of relief because the news is already priced in (overpriced in). If the numbers are not as strong as everyone hopes for, then there could definitely be a sell-off, or if anything else occurs that makes people less confident in their government, business and economy. The Economic Situation Stocks are overpriced by almost every measure. Bonds are highly illiquid and are negative-yielding. Money market funds have redemption gates and liquidity fees. Many banks, brokerages, insurance companies and financial services firms are at or near junk bond status, as is over half of the S&P 500. Unemployment is above 8%. 26.5 million people are taking some sort of unemployment. 22.7% of the workforce is working from home. Some industries have changed for the foreseeable future, including airlines, oil, office buildings, hotels and small businesses. Office buildings and apartment buildings in overpriced cities like New York and San Francisco have become ghost towns. Things won’t return to normal until people feel safe being inside again in close proximity to others. Some of the changes may be more lasting simply because they are now preferred, such as Work from Home. The Bottom Line These are unprecedented times. The economy is suffering greatly. The Federal Reserve, Treasury Secretary and The Administration are trying to keep asset prices high by buying up corporate bonds and bond ETFs, by handing out money, through the eviction and foreclosure moratorium and through other measures. This may result in a positive October GDP growth surprise on Oct. 29, 2020. However, real growth is when productive people create the products of tomorrow that citizens around the world can’t live without – not by paying people not to work. A well-diversified 401K, IRA and investment strategy allows you to profit if stocks and real estate prices go up, while protecting you from another rout, such as we saw between February 19, 2020 and March 23, 2020. With the risk of overpriced stock heading south as high as it is, even given the improving, propped-up economy, it is a very good idea to know what you own and have confidence in your financial plan now. If you wait for the headlines that we’re in trouble, it is always too late to protect your wealth. You can read about our time-proven, easy-as-a-pie-chart nest egg strategies, in my book The ABCs of Money. (The 4th edition will be published very soon.) You can learn these transformational tools at our Investor Educational Retreats. (Go to NataliePace.com to discover then the next retreat will be.) You can call or email our office for pricing and information on an unbiased 2nd opinion of your current plan, which comes with a roadmap for safety and diversification. Call 310-430-2397 or email [email protected]. Other Blogs of Interest Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Price Matters. Will There be a Santa Rally? It's Up to Apple. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. The Lyft IPO Hits Wall Street. Should you tak Cannabis Doubles. Did you miss the party? 12 Investing Mistakes The High Cost of Free Advice. 2018 Was the Worst December Since the Great Depression. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 3rd edition of The ABCs of Money was released in 2020. The 4th edition, updated to include the COVID-19 Recession, will be released soon. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed