|

In the late stage of the business cycle, we start seeing an avalanche of advertising that encourages us to jump into high-priced investments. In 2017, it was Bitcoin at $20,000/coin. In 2007, it was stocks and real estate, and before that the New Economy promised that Dot Coms would be your ticket to Dream Come True Living. Today is no different. People are calling me to brag about their recent real estate purchase, or cryptocurrency, or cannabis, offering a long litany of the merits of the plan, without enough consideration to the price that they are paying. It is never a good idea to buy high. Buying high risks the following.

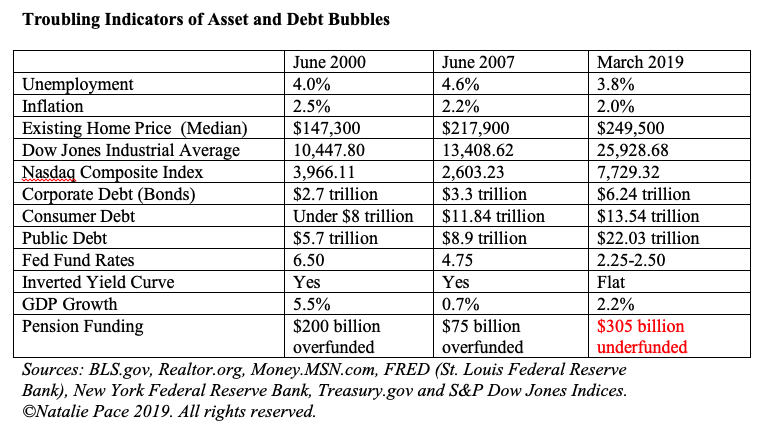

It’s important to remember that your strategy for purchasing real estate, stocks and bonds should be based in real data and information, not headlines, ads or the opinion of a “financial expert” who might have incentives to sell you more than you really should take on (at a high price). As you can see in the chart below, real estate and stocks are back to all-time highs, while debt (bonds) has shot to the moon. If you buy today, you are paying a premium over what you would have paid just a few years ago, and likely far above the true value of the asset. Most of these assets lose value when the economy slows or runs into a recession. Below are a few key points of how to navigate and think about these assets as we enter the 11th year of the bull market. Fast Facts for Successful Investing in Real Estate, Stocks & Bonds in 2019 & Beyond Real Estate

Homeowners are worth 46 times more than renters, so owning your own home is definitely something you want to do. However, purchasing real estate high can destroy your life for a decade or more, so buying for a good price is an essential key in the equation. Millions of homes went to auction, were foreclosed on or sold in short sales during the Great Recession. Most cities saw home prices lose more than half in the Great Recession. If you were on the Buy Side of that equation – buying low in 2009-2011– then you have doubled your money (in many cities). The 3-Ingredient Recipe for Cooking Up Profits

Learn more about the 3-Ingredient Recipe in the chapter of the same name in my first book, Put Your Money Where Your Heart Is. Stocks There is a lot of risk in stocks these days. Alan Greenspan, Professor Robert Shiller and Warren Buffett have all warned that stocks (and bonds) are in a bubble. Stocks are…

Proper diversification, keeping enough safe, knowing what’s safe in a world where stocks and bonds are in a bubble, and annual rebalancing works in your nest egg. These strategies earned gains in the last two recessions and have outperformed the bull markets in between. In individual stock investing (something you should not be doing in your nest egg), you need to apply the 3-Ingredient Recipe for Cooking Up Profits, and take your profits early and often. The Stock Report Card and 4 Questions that are outlined in my first book, Put Your Money Where Your Heart Is, can help you pick the leader. When determining the right buy low and sell high prices, you’ll consider what the company can do, what the industry can do and what the general marketplace can do. This is something that I teach in my Investor Edu Retreats. Bonds There is far too much debt in the world. Companies have borrowed money very cheaply and used that to buyback their own stock. This makes their earnings look stronger than they really are and their share price look lower than it really is. Borrowing from Peter to pay Paul has an expiration date. The leverage in corporates is at an all-time high, and has the Feds concerned.

Financial Engineering Companies like Apple, Oracle, QualComm, Cisco, Wells Fargo, Amgen, Microsoft, Citigroup, Pfizer, Abbvie and Broadcom all spent more money on buybacks and dividends than they earned in income. Apple spent $88 billion on buybacks and dividends in 2018! The rest of the companies spent between $15 billion and $32.8 billion. This is all money that rewarded investors, but didn’t add employees, invest in R&D or upgrade tools and factories. In other words, it’s a short-term financially engineered fix, rather than a long-term vision and investment toward a better business with innovative products. The last time that buybacks were at an all-time high, before 2019, was 2007. We all know how that story ended... You can educate yourself further by reading my 3 books (links are below), by receiving a 2nd opinion on your current investing plan and by attending my Wild West Investor Educational Retreat. It’s time to mute all of the noise, bad ideas and advertising that you hear constantly in the mainstream media and online. Wisdom is the cure. Listen back to my free teleconference on this subject at BlogTalkRadio.com/NataliePace. If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more. Register by June 30, 2019 to receive the lowest price and a complimentary 50-minute private prosperity coaching session (value $300). I'm also offering an unbiased 2nd opinion on your current retirement plan. Call 310.430.2397 for pricing and information. Other Blogs of Interest Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 26/3/2020 11:22:45 pm

Thanks for the tips for buying. My wife and I want to buy a home soon, and I need to look at our budget to see what we can afford. 27/3/2020 07:28:43 am

The 3rd Ed. of The ABCs of Money (just released) has an entire section on real estate. You might want to check it out. https://www.amazon.com/dp/B0863J38L3 Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed