|

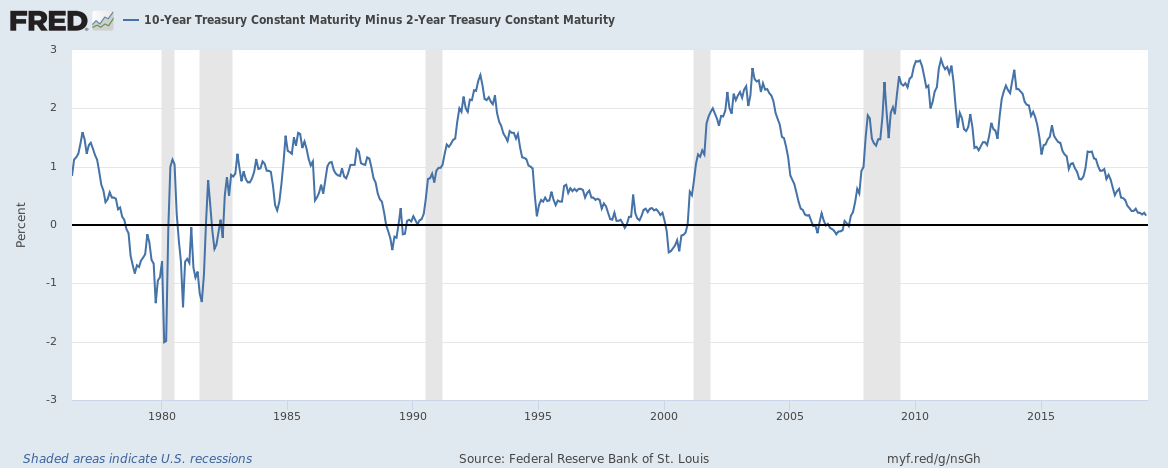

On March 28, 2019, Wells Fargo announced that their CEO Timothy Sloan had resigned on March 26, 2019 effective immediately. The board has elected an interim CEO and president (C. Allen Parker) to take his place for now. Mr. Sloan will retire from the company on June 30, 2019. Just like that, Sloan has been erased from the website. If you click on the link to his bio, it actually redirects to Parker. The abrupt departure of any CEO at the end of the quarter (and just a few weeks before the 1Q earnings report is released) is a massive red flag. Succession plans usually allow generously for a transition period. Immediate departures are alarming. Add in the fact that Sloan was Wells Fargo’s CFO and COO prior to being named the CEO and you’ve got a neon sign brighter than the Vegas Strip. The fake account scandal revealed a corrupt corporate culture. However, instead of bringing in new blood, Wells Fargo actually promoted the executive (Sloan) who most bragged about all of the new accounts on earnings calls to investors during the height of the scandal. So, why the rush for “fresh perspectives” now? All signs point to problems with Wells Fargo’s first quarter earnings report. All of the banks, including Wells, have been issuing new debt over the last few months. Could this be to beef up their cash positions to buffer against the rough tides of an inverted yield curve? Will earnings be negatively impacted now that the loans banks offer pays them less than their own borrowing rate? Inverted Yield Curve Over the past few years, many banks have been on a field day, reporting solid earnings growth and outstanding profit margins. In the last quarter, Wells Fargo’s revenue was only down 4.09% (for obvious reasons), while their profit margins were a solid 24.37%. Goldman Sachs, Bank of America and Citigroup all reported revenue increases of 14.0%-18.5% year over year, with profit margins in the 19%-31% range. However, the yield curve inverted on March 20th, and has been flat throughout the first quarter of 2019. That will have a very negative on bank revenue and income. The inverted yield curve is also 100% correlated with recessions for the past half century. Will Wells Fargo Post A Terrible Earnings Report? The departure of a CFO turned CEO, at the end of a quarter that we already know is going to be squeezed (GDP is predicted to drop under 2.0% in the 1st quarter of 2019), is never a good sign for earnings. We won’t know how bad Sloan’s earnings report card really is until Friday, April 12, 2019 at 8 am ET. However, this abrupt event is definitely inauspicious for Well’s Fargo’s 1st quarter 2019 earnings report. Buybacks May Save the Share Price Wells Fargo repurchased 375.5 million shares of their own stock in 2018, for around $21 billion (source: S&P Dow Jones Indices). That was more than double the amount that the company spent on share repurchases in 2017. Clearly the company plan under Sloan was to keep their share price afloat with their own buybacks. In 2019, it may be more difficult to continue at that aggressive pace. With $9.5 billion given out in dividends and $21 billion in share repurchases in 2018, Wells Fargo’s “return to investors” of $30.5 billion was higher than the company’s net income of $22.4 billion. General Electric was slammed for that policy, once investors learned of it (after the company slashed their dividend and the share price imploded by 2/3rds). Again, we’ll know more about how all of this impacts Wells Fargo’s earnings on April 12, 2019. Before then, it’s a good idea to double-check your own holdings and funds to make sure that you are not over-exposed to this beleaguered bank. If you wait for the headlines on these red flags, it will be too late to protect yourself. You don’t have to understand economics to employ a time-proven easy-as-a-pie chart nest egg strategy that earned gains in the last two recessions (when most people lost more than half) and outperformed the bull markets in between. Blind faith that someone else is doing this for you can be very expensive. (It’s a good idea to get a second and third qualified, unbiased opinion on your current plan, rather than just trusting that your money manager has protected you.) Wisdom is the cure. (Click to read more about the High Cost of Free Advice.) As the landscape changes rapidly, time proven systems will be your ally. Join me at my Colorado Investor Edu Retreat, where we’ll examine how to protect your assets, learn what's safe in a world where stocks and bonds are in a bubble and invest profitably in high growth opportunities (like cannabis). Call 310-430-2397 or email info @ NataliePace.com to learn more about the retreat, or to request an unbiased second opinion on your current budgeting and investing plan! Other Blogs of Interest Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed