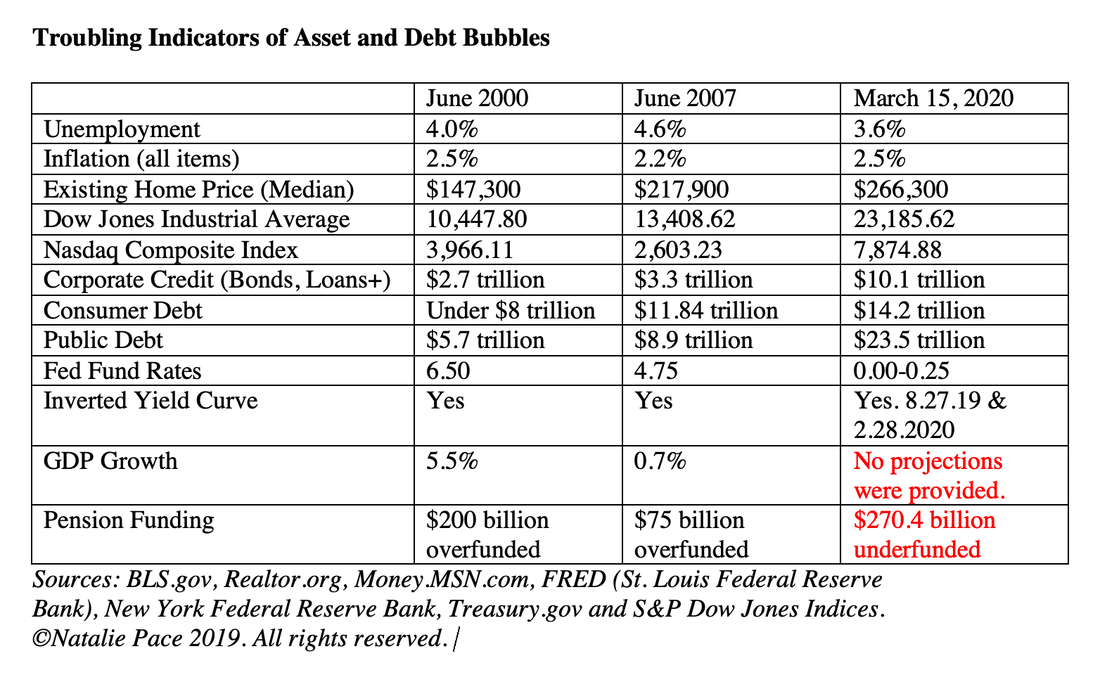

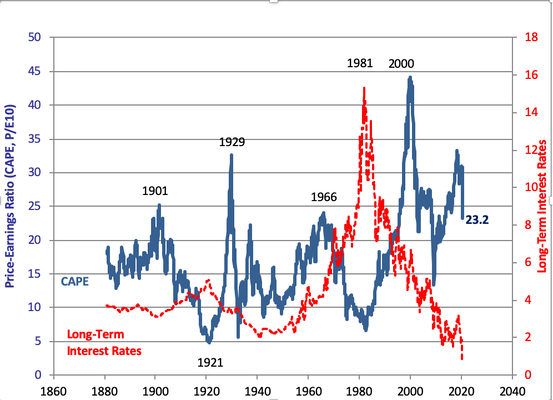

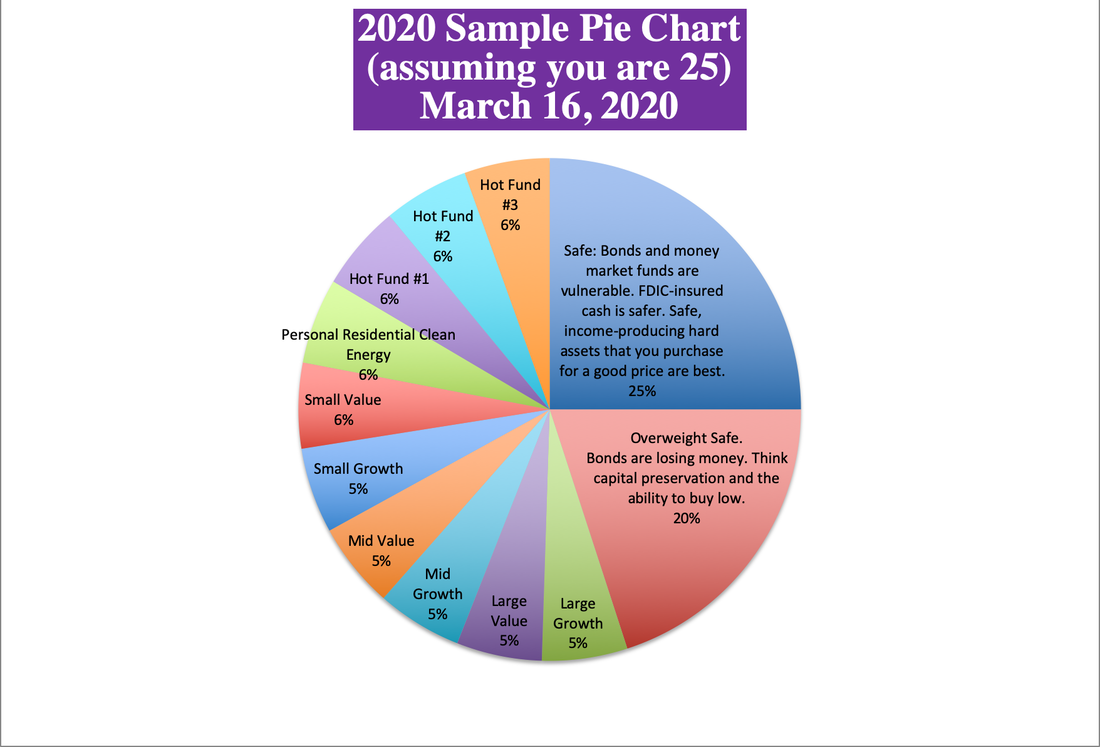

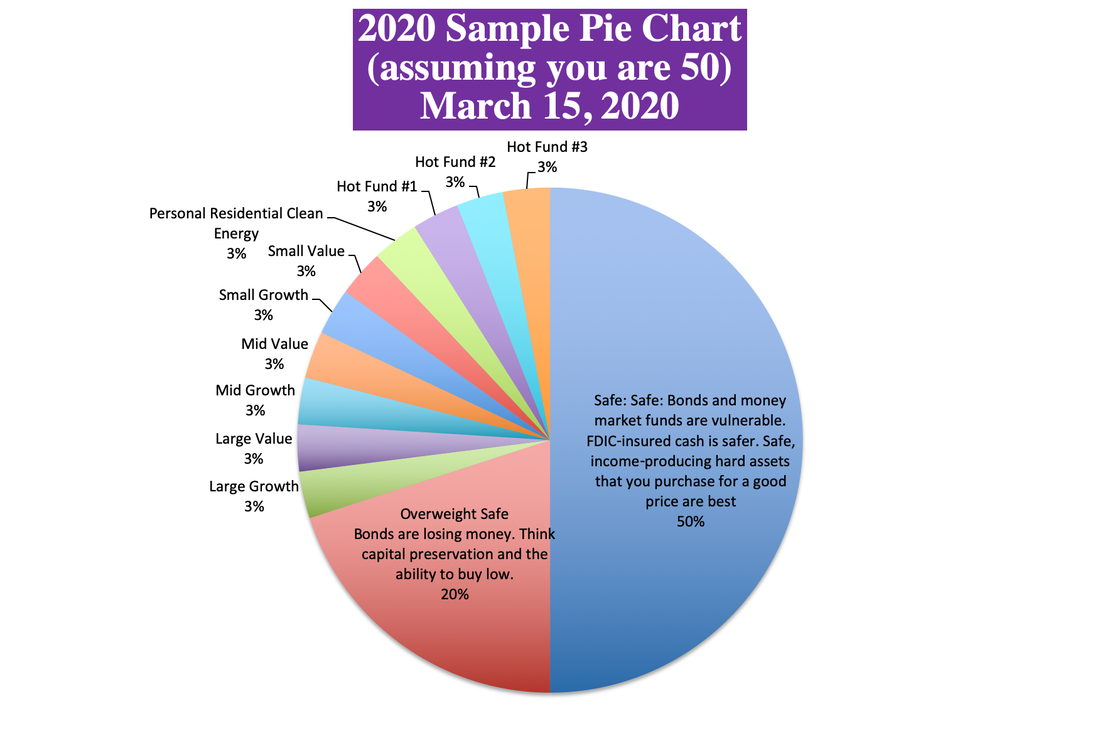

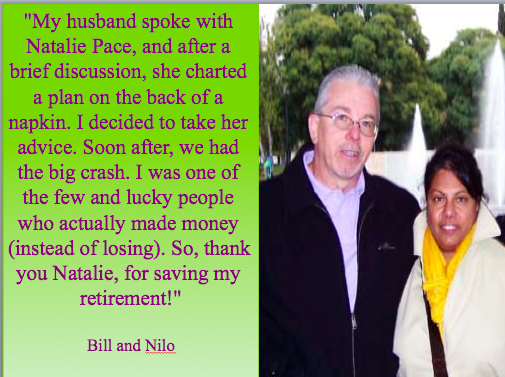

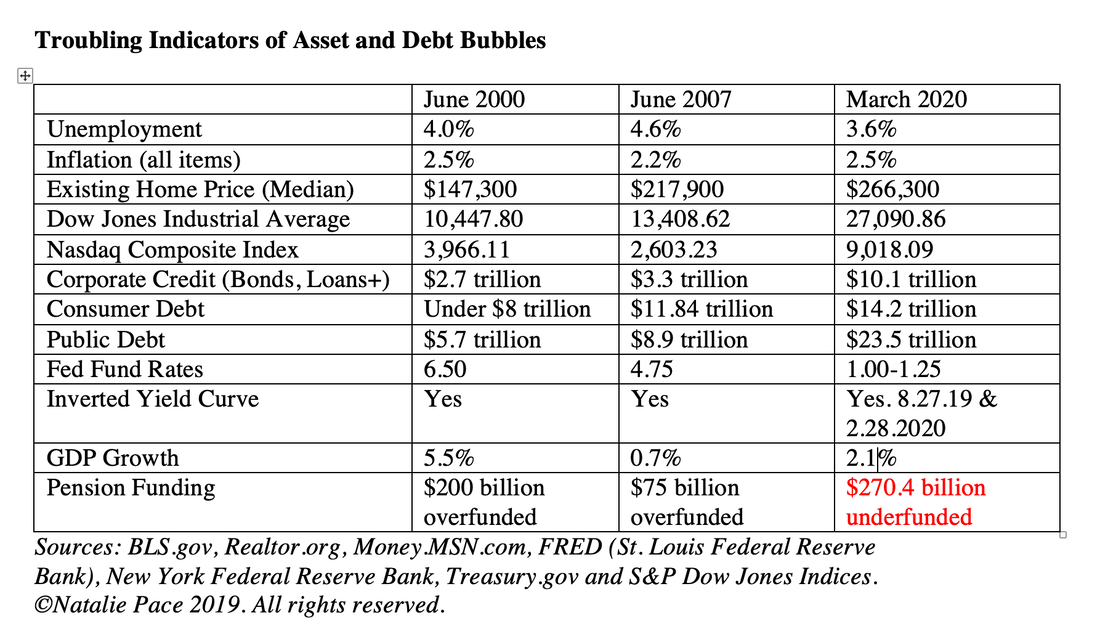

Natalie Pace is the author of The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. Natalie Pace is the author of The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. I recently spoke to somebody whose broker-salesman had told her that bond funds will go up when the markets go down. She’s already lost hundreds of thousands of dollars on that idea. “So… when will I start making money?” she asked him. After more confusing sales-speak from her advisor, she finally called our offices. The Old Rules Don’t Apply. Stocks are losing money. Bonds are losing money. Money market funds have redemption gates and liquidity fees. Annuity providers and insurance companies are vulnerable. Mortgage backed securities are asking for a bailout. Even Treasury bills have had liquidity issues. Policy Impotence There are two problems with bonds in the Coronavirus Recession. First of all, interest rates are at zero, so there is no room for the Feds to cut. This is something that Jerome Powell, the Federal Reserve Board chairman has been warning about for years. In his most recent testimony before Congress on February 11, 2020, he testified, “This low interest rate environment may limit the ability of central banks to reduce policy interest rates enough to support the economy during a downturn.” As you can see in the chart below, in the prior two recessions interest rates started out much higher. It was easy to get safe in bonds in 2000 and 2008. When the recession hit, the Federal Reserve cut interest rates. That action helped the bond value go up, and the safe side of your nest egg perform well. Bonds were one of the best performing assets in 2001, during the Dot Com Recession. All of that changed in 2009. Central bank interest rates dropped to zero, or negative, and stayed there for the next decade to stimulate the economy during the Great Recession. The Federal Reserve Board and the White House Administration fought very publicly about the need to raise interest rates in 2018. When the Federal Open Market Committee (FOMC) bumped rates up to a mere 2.25-2.5% in December of 2018, the U.S. had the worst December on Wall Street since the Great Depression. Over-Leverage and Creditworthiness The other problem with bonds is over-leverage. Over 50% of corporate bonds are congregated just above junk bond status. This has been the case for months – well before the coronavirus crisis. There was simply no downside to going that low. Corporations could still borrow money very cheaply – in the 5-6% range. When I was discussing this with MacArthur genius award winner Kevin Murphy a few months ago, he said, “If you think the corporate bonds are scary, the municipal bonds are downright terrifying.” Your investment grade bonds can include a lot of bonds that are vulnerable to being downgraded to junk. Many investment grade bond funds can include up to 20% of junk. At least 10% of the speculative bonds are expected to default in the wake of the coronavirus crisis. Credit was not available to these vulnerable companies over the weekend of March 14-15, 2020, which is why the Federal Reserve Board stepped in with their first wave of bail-outs. Jerome Powell admitted in his press conference briefing that “The cost of credit has risen for all but the strongest borrowers.” In short, bonds are vulnerable to capital loss. The safe side of your portfolio is there to protect you from losses. If bonds can’t do that, then you need to find a strategy that will. (I spend one full day discussing what’s safe in my 3-day Investor Educational Retreats. I’ve been hosting them online every weekend since this crisis hit.) Stocks. The Coronavirus Recession set the record for the fastest that a bull market became a bear – ever (source S&P Dow Jones Indices). This has a lot to do with the amount of debt in the world, and also that stocks were in a bubble. Again, all of this was a problem before the coronavirus crisis hit. Robert Schiller has been saying since at least 2018, that the only two times that price to earnings ratios have been higher was in 1929 and in 2000. As you probably recognize, 1929 was right before the Great Depression. Between the highs of March 2000 and the lows of October 2002, the NASDAQ Composite Index lost 78%. The index took about 15 years to crawl back to even. Robert Shiller CAPE Ratio Chart March 24, 2020 Annuities and Life Insurance Aren’t as Safe as You Think Either In an interview on CNBC, Warren Buffett recently warned that annuity providers and insurance companies get into trouble when interest rates get cut. Why? If they have promised you even something as low as a 3% return, and Treasury bills are now paying nothing, they have no profitability. They also get into trouble because these companies invest in equities. When stocks drop, they have losses. These are two of the contributors to the bailout of the insurance industry in the Great Recession. There are more. In 2008, AIG was also caught in the Collateralized Debt Obligations (CDO) and Structured Investment Vehicles (SIV) implosion. Annuities and insurance companies are not FDIC-insured. So, if the company gets into trouble, you don’t have a lot of recourse to get your money back other than State Guarantee funds. The safety net will be much lower than you’ve been promised. And those funds will be overwhelmed if many annuity customers and insurance policyholders need help at the same time. It’s a safer bet to keep your own money than to reach for yield. As Roy Rogers was fond of saying, “I’m more concerned with the return of my money than the return on my money.” Money Market Funds Money market funds have redemption gates and liquidity fees. They offer banks, insurance companies and brokerages a “bail-in” plan on your dime, if financial services get into trouble. (Hint: they are in trouble. The U.S. stock market has lost 30% since the highs set on February 19, 2020.) As I mentioned, there was a liquidity crisis that forced the Federal Open Market Committee to have an emergency meeting over the weekend on March 14-15, 2020 – a few days before its regularly scheduled meeting. At that time, the FOMC took a number of extreme actions to jumpstart Treasury bills, money market funds, bonds and other areas where liquidity had dried up. According to Federal Reserve Board Chairman Jerome Powell, in his statement before the press conference on March 15, 2020, “In the past week, several important financial markets, including the market for U.S. Treasury securities, have at times shown signs of stress and impaired liquidity.” The Bottom Line There is just too much debt in the world. We were borrowing from Peter to pay Paul in every corner. Consumer debt is higher than ever. Student loan debt is crushing Millennials. Corporate debt is staggering. Public debt is absolutely astronomical. (See the chart above.) Real Estate prices have actually been coming down since July of 2019. However, they are still unaffordable in 71% of cities. It’s very important to understand how to properly protect your wealth. Market timing doesn’t work. (Most people sell low, and buy high.) Blind faith cost Main Street investors more than half of their wealth in the last two recessions. Buy & Hope worked better in the 20th Century than it has in the 21st Century. Since 2000, B&H investors have been riding the Wall Street rollercoaster, losing more than half in the recessions and then spending most of the bull market crawling back to even. There are time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between. This time around, in addition to being properly diversified and keeping an appropriate amount safe, you’ll also need to know what’s safe in a world where bonds are losing money, annuities are risky and money market funds have redemption gates and liquidity fees. Since we’re all in quarantine, why not join us and learn the ABCs of Money that we all should have received in high school. We live in the 21st Century. Last century strategies don’t work. The sooner you adapt, the faster your life transforms. The Thrive Budget and Easy as a Pie Chart Nest Egg Strategies will be essential tools for a post coronavirus world. March 28-31, 2020 Online Investor Retreat Our most affordable Easy access… Other Blogs of Interest Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. Win a Seat at a Retreat The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. This week we have many important events on calendar for your consideration. Click to access a special video message from me on what will be happening at each event. 1. Tuesday, March 24, 2020. 4:30 ET (1:30 PT). Special Videoconference Update on the economy and markets. Are we in a recession? How bad is it? What's your best strategy? Free. Private. Register by emailing [email protected] with the subject line: March 24, 2020 Videoconference. 2. Thursday, March 26, 2020. noon ET (9 am PT). Interview with Rob McEwen, the Chief Owner of McEwen Mining and a 30-year veteran of the gold mining industry. Free. Public. A link to join us will be sent out to everyone on our mailing list and posted on my Twitter feed. 3. Saturday-Monday. March 28-31, 2020. 9 am to 6 pm ET. 3-day Online Investor Educational Retreat. Learn the ABCs of Money that we all should have received in high school. Protect your wealth. Learn how to save thousands annually in your budget with smarter big ticket choices. Position yourself best for the 21st Century and a post-coronavirus crisis. Click on the flyer link above to learn more, to read testimonials and to get pricing information. Register by emailing [email protected] with the subject line: March 28, 2020 Retreat. Read the 3rd edition of The ABCs of Money and Natalie Pace's new book The ABCs of Money for College. Click on the blue-highlighted title to access. Other Blogs of Interest Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. Win a Seat at a Retreat The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Premarket trading hit the circuit breakers, meaning that stocks were already down 5%, just minutes after the Federal Reserve Board concluded an emergency meeting and published their actions. The FOMC cut interest rates to zero on Sunday, March 15, 2020 at 5 p.m. ET, and took a number of steps to provide liquidity to the global and domestic credit markets. The chatter from all of my friends on Wall Street was alarming overnight, as texts flew back and forth past midnight, and again as early as 4 am this morning. As you know, I’ve been warning about this for a while. And I also warned you that if you waited for the headlines, it would be too late to protect yourself. The global economic squeeze that we are currently experiencing was triggered by the coronavirus. However, it is amplified by the asset bubbles and leverage. Things are far from over. It is still a very good idea to adopt the Nest Egg Pie Chart® and Thrive Budget® strategies. See below for a few tips on how to do this. Teleconferences. Yes, we will have a teleconference or video conference this week. It will either be on Tuesday or Thursday. I will keep you posted on this blog. So just come back to NataliePace.com/blog frequently over the next 24 hours for updates. I will not be emailing you with each update. However, I will be providing ongoing information in this blog and on my page in the Twitter feed. What should you do? Panic is not a plan. Market timing doesn’t work. Buy and Hope is a last century strategy that doesn’t work in the 21st Century. You can access Web Apps to personalize your own sample Nest Egg Pie Chart® and Thrive Budget® by going to the home page at Natalie Pace.com and clicking on the free Web app badge. Knowing what a time-proven strategy looks like is a very good start. If you are having difficulty understanding what you currently own, or how to make what you have look like the sample, then consider getting a 2nd opinion. Call 310-430-2397 or email [email protected] for pricing and information. The nest egg and budget strategies will make more sense if you have read The ABCs of Money. I will be posting the 3rd edition as soon as I can over the next few days. The 2nd edition is pretty up-to-date, as it was published in 2018. However, the 3rd edition will include coronavirus information. The world has changed a lot in two years. Again, I will have updates. I am here to help you navigate. There are so many people in need of help, who didn’t prepare properly beforehand, that we may need to host a few video conferences/mini retreats. I’ll keep you posted here, in this blog, about those as well. I strongly encourage you to share the free Nest Egg Pie Chart® and Thrive Budget® web apps with your friends. If you are interested in learning more, I have done quite a few blogs over the past few months. Scroll through the list below, and you are likely to find something that you desire to read. “Riding it out” is not a time-proven plan. Buy and Hold has been losing more than half in the last two corrections. Proper diversification with annual rebalancing protects you from downturns and allows you to profit from bull markets and strength (instead of praying and hoping to gain back the losses you endured by riding it out). In today’s world you have to know what is safe because there are a lot of historically safe products that are vulnerable to capital loss this time around. Consider getting a second opinion on your current plan now. Call 310-430-2397 or email info @ NataliePace.com to learn more. Other Blogs of Interest Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. Win a Seat at a Retreat The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Price matters. Stock Prices are Still Too High. Dow futures are pointing to another down day. It's hard to know who to trust. Trust results that include the Great Recession. If you’re looking at your gains in the bull market, then you are not properly prepared for what your plan will do (and has done) in bear markets. Buy & Hope lost more than half in the last two recessions. Our easy-as-a-pie-chart nest egg strategies, with annual rebalancing earned gains in the last 2 recessions, when most investors lost more than half, and have outperformed the bull markets in between. Market timing doesn't work either. In fact, this time around, the safe (fixed income) side is as vulnerable as the equity side. Annuity providers and insurance companies are going to be hit hard by lower interest rates and by the stock decline. These products are not FDIC-insured. Money market funds have redemption gates and liquidity fees. Bonds are overleveraged. (Click for additional information on each blue highlighted word.) Time-Proven Strategies Work "Thank you Natalie for saving my retirement!" Nilo Bolden. Watch Nilo Bolden discuss this in her video testimonial at the link below. https://www.youtube.com/watch?v=gMmsuT84S7E "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human capital. "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Price Matters. They are Still Too High. You’re going to start hearing a lot of pundits and economists talking about the price of stocks. That is because price matters, and prices are still too high – even with a 20% correction. If you’ve been following my news you know that I’ve been reporting on this for a while. (Click to see my blog on the topic.) If you’re a data lover, here’s the rub: historical price to earnings ratios are 16-17. Today, even with the correction, they are at 26. Once earnings are reported in the 1st quarter, which is predicted to be very ugly, the earnings side goes down, which makes the P/E ratio higher. The gist of that is that stock prices were very high historically when earnings were strong – way too high. Earnings weakness, combined with weakness in consumer spending and supply chain disruptions, make the market very vulnerable to a continued correction. In Nobel Prize winning economist Robert Shiller’s words, “The only time in history going back to 1881 when [CAPE] has been higher are, A: 1929 and B: 2000. We are at a high level, and it’s concerning. People should be cautious now.” I’ve had this warning in my blogs for over a year. Click to read my interview with Professor Shiller from a few months ago. How Can You Protect Yourself? What can you do to protect yourself? If you’ve been following my work for a few decades you know that my strategies have been saving homes and nest eggs since 1999. There are very few strategies that achieved that. Easy-as-a-pie-chart nest egg strategies with annual rebalancing are actually quite simple. The Thrive budget is simple in theory, but requires brave, innovative and bold choices to increase your income and reduce your expenses. So, you have to get educated now, and it’s a good idea to do that quickly, so that you can protect your wealth now, before the situation gets worse. That is why I’m offering a 2nd opinion on your current plan. You’ll receive a pie chart of what you currently have, a pie chart of a better plan and my commentary on the areas of strength and weakness in your budgeting and investing strategy. That provides you with an action plan. You’re the boss of your money. I’m not a broker. I don’t sell financial products. My business is financial wisdom and time-proven systems, so that you truly know what you own and can make strong, sound choices to protect your wealth and live a rich, sustainable life. I have included a list of my blogs below. If there’s anything that is of interest to you just click on that blog. Chances are I’ve already written about the things you are most concerned about. If you have other questions, or are interested in a 2nd opinion or in attending my next retreat, call 310-430-2397 or email our office at [email protected]. I’d love to see you at the June Retreat in Santa Monica, or the October Retreat in Arizona. However, I would not wait that long to get your assets safe, protected and properly diversified, if I were you. “Riding it out” is not a time-proven plan. Buy and Hold has been losing more than half in the last two corrections. Proper diversification with annual rebalancing protects you from downturns and allows you to profit from bull markets and strength (instead of praying and hoping to gain back the losses you endured by riding it out). In today’s world you have to know what is safe because there are a lot of historically safe products that are vulnerable to capital loss this time around. Consider getting a second opinion on your current plan now. Call 310-430-2397 or email info @ NataliePace.com to learn more. Other Blogs of Interest Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. Win a Seat at a Retreat The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  Dear Natalie, On Monday March 9, 2020, when the stock market posted the worst point loss on record, I called up my financial advisor to discuss our strategy. Her response was, “Just ride it out.” I looked at various blogs online, and that seemed to be the consensus. A lot of them said, “Market timing doesn’t work.” However, I lost more than half in the Great Recession, and quite a lot in the Dot Com Recession, too. So, I’m just not comfortable sitting on my hands for the next downturn. I’m too close to retirement to lose that much again. However, I have no clue of what to do. Stressed Out and Clueless Dear Smart to be Stressed Out, Here are a few facts to consider.

If you lost more than half twice in the 21st Century, that’s a big red flag that you have far too much at risk. If we are entering a recession, and your strategy is to ride it out, you are risking losing half of your wealth again – just as you did in the last two downturns. If you are close to retirement, you aren’t supposed to have very much at risk in the stock market. Even if you are just entering the work force, it would be a good idea to overweight safe since this could be a recessionary year. If you don’t know how to read your brokerage statement or your retirement plan, you may need to get an outside, unbiased 2nd opinion to know what you really own and how much you really have at risk. If you’re being counseled to ride it out, then you might just hit a lot more sales-speak when you for details to understand exactly what you own and why. So, in summation, “Ride it out” is never a good idea. If you are on a losing team, then you would work hard to get a new game plan and to strengthen the areas that are weak. It’s true for winning in sports. It’s true for winning in life. It’s true for winning in investing. Wisdom, a good plan and right action are the cure. You are stressed out because you know deep down that your plan is wrong. That's smart. However, now you need to learn what a better plan looks like. We're here to help. Call 310-430-2397 or email [email protected]. If you’d like to see what a personalized sample nest egg pie chart looks like, just email [email protected] or call 310-430-2397 to access our free web apps. If you’re interested in knowing exactly what you own, how much at risk you are for losses, and what you can do to protect your wealth, then consider getting an unbiased 2nd opinion on your current financial plan. Call 310-430-2397 or email for pricing and information. Other Blogs of Interest 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. Win a Seat at a Retreat The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Before we dig into the data, I want to offer a word of warning. If you wait for the headlines that the economy is in a recession, it will be too late. Below are two examples of this… 1. On February 14, 2020, I warned in my blog (click to access it) that Apple, and many other companies, were going to miss their earnings guidance. That was just a few days before the S&P500 hit an all-time high. On February 17, 2020, Apple issued a statement that they would miss their guidance. Between February 20, 2020 and the end of the month, stocks dropped over 12.4%. Over 100 companies in the S&P500 have gone on to state that they will miss their earnings projections. 2. On December 27, 2007, we warned that the economy was headed for a very deep recession, and encouraged everyone to overweight 20% safe, in addition to keeping a percentage equal to their age safe, in their nest egg. The market high was in October of 2007. Between the high and the low of September 9, 2009, the Dow Jones Industrial Average lost 55%. Most Americans were unaware of how deep and costly the Great Recession would be, until they had already lost half. The politicians didn’t admit we needed a bailout until October of 2008. The big questions on everyone’s mind today are: “Will things get even uglier? Are we headed into a recession? Will the stock market losses this time around be as terrible and terrifying as the last time?” Again, if you wait for the headlines, it’s too late. What does work is reading the data. So, here’s the crystal ball reading, by the numbers. If the explanation puzzles or confuses you, just scroll to the end for the summation. Below are 7 Recession Indicators, all of which portend bad news. 1. Moody’s Warning. 2. Emergency Rate Cut of 50 Basis Points. 3. Worst 12-Day Move. 4. Inverted Yield Curve. 5. Executive Exodus. 6. Earnings Warnings. 7. Manufacturing Recession. And here is a little more color on each point. 1. Moody’s Warning. On March 6, 2020, Moody’s Investors Services issued a warning that Global Recession Risks had risen. In particular, a sustained pullback in consumption and store/factory closures would “hurt earnings, drive layoffs and weigh on sentiment.” Since that alert was published, Italy has locked down the northern part of the country. Major conferences have been postponed. Cities are encouraging their citizens to stay at home and away from social contact. In truth, this is a flu virus. So, the crisis should start abating at some point over the next few months. However, the damage of having the entire world on lockdown during the first quarter of 2020 will ripple throughout the global economy. 2. Emergency Rate Cut of 50 Basis Points. The last time that the Federal Reserve cut rates by 50 basis points was in December of 2008 – just before General Motors and Chrysler declared bankruptcy. The market bottom in the Great Recession occurred just three months later, on March 9, 2009. 3. Worst 12-Day Move. The loss of 12.4% between February 19, 2020 and March 6, 2020 was one of the worst 12-day moves that the markets have seen. Other terrifically bad 12-day moves happened in 2011, in 2009 (multiple times) and in 2008. What I find interesting is that none of the downturns have triggered a halt in trading. That tells me that the sell-off is from Wall Street insiders who are strategically selling with a plan not to trip the halt trading switch. The “smart money” tends to move first. Main Street tends to wait for the headlines before reacting, which is always too late. 4. Inverted Yield Curve. An inverted yield curve is 100% correlated with recessions, since the 1980s. The grey bars below mark the recessions. 5. Executive Exodus. Since the coronavirus outbreak was announced, we’ve seen an executive exodus. This is always a bad sign. Bob Iger suddenly decided that he’d give his job as CEO up, but remain the executive chairman (essentially the boss of the new CEO). That ensures that Iger keeps his stellar track record of increasing Disney’s market capitalization five-fold under his tenure, largely through the acquisitions of Pixar, Marvel, Lucasfilm and 21st Century Fox. Iger is going out on top. Steve Ells, the chairman and founder of Chipotle, announced on March 6, 2020 (Friday) that he would step down as executive chairman of Chipotle. Ells is going out on top, too. According to Business Insider, January 2020 set a record for the most CEO departures in one month, at 219. Other companies where executives are leaving their offices include Hulu, Tinder/Match, MedMen, Salesforce, IBM, LinkedIn, Mastercard and more. 6. Earnings Warnings. Apple, Microsoft and over 400 companies have warned that the coronavirus will impact their 1st quarter earnings. Which industries and companies will be the hardest hit? Read my Coronavirus blogs. 7. Manufacturing Recession. Manufacturing has been in a recession since mid-2019. Boeing’s 737 Max problems are hitting the manufacturing industry very hard. Spring Rally 2020 It’s important to remember that it takes two quarters of negative growth for the economy to be declared in a recession. That means that if we enter a recession in the first quarter, it won’t be proclaimed until July 30, 2020. That is one of the reasons why there could still be a Spring Rally in stocks between now and April. We have seen ample indicators of a dramatic slowing of the worldwide economy, and plenty of reasons to suspect that we’ll have a very ugly GDP showing in the 1st quarter. However, the results won’t be announced until April 29, 2020. Additionally, accelerated buyback plans were announced recently by AT&T and Citrix. Apple has been repurchasing up to $80 billion a year of its own stock. This bull market has been largely fueled by companies borrowing money very cheaply and then buying back their own stock. Even the beleaguered Boeing company, with 737 Max planes grounded, repurchased almost $3 billion of its own stock in 2019 (though the two most recent quarters have all but halted the buybacks). With a real crisis, like the coronavirus is posing, prudent management has to consider utilizing cash flow for operations, rather than financial engineering, so this could put a stop to buybacks. It could also be why the drop has been so severe and sudden. Forecasters are still projecting GDP growth at this time. However, they are including a lot of caveats and warnings in the statements. China is still predicted to grow by 4.8% in 2020, with the U.S. GDP growth projections at 1.5% (source: Moody’s). The Bottom Line: How to Survive a Recession. It’s always a smart plan to keep a percentage equal to your age safe. Overweighting safe when there are 7 recession indicators flashing red is prudent as well. In today's world, you also need to know what is safe. 50% of corporate bonds are at the lowest rung, just above junk bond status. GE & Ford are not the only companies that have borrowed money to buyback their own stock (making their executives rich). Also, money market funds have redemption gates and liquidity fees. I'm listing blogs below that address all of this. However, if you want to get safe now, consider receiving a 2nd opinion from me. If you’d like to see what a personalized sample nest egg pie chart looks like, just email [email protected] or call 310-430-2397 to access our free web apps. If you’re interested in knowing exactly what you own, how much at risk you are for losses, and what you can do to protect your wealth, then consider getting an unbiased 2nd opinion on your current financial plan. Call 310-430-2397 or email for pricing and information. Other Blogs of Interest Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. Win a Seat at a Retreat The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed