Inflation. Café Lattes are Getting More Expensive. So Are Labor, Trees, Housing and Stock Prices.31/10/2021

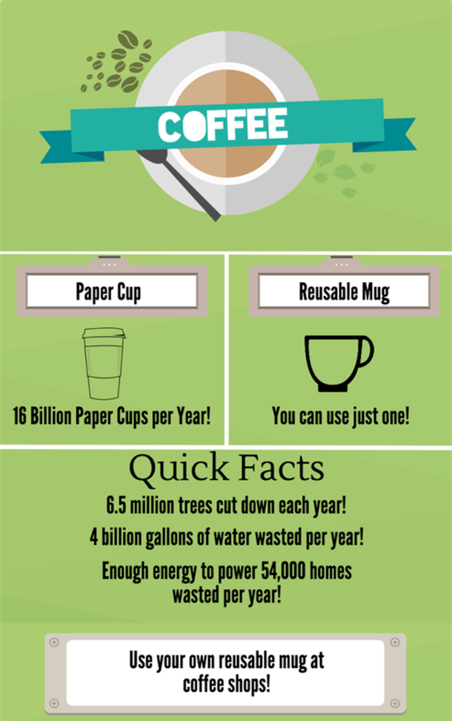

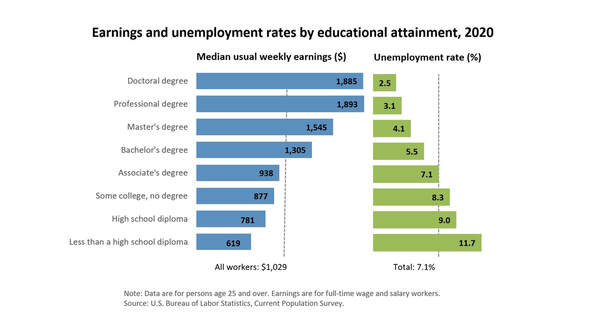

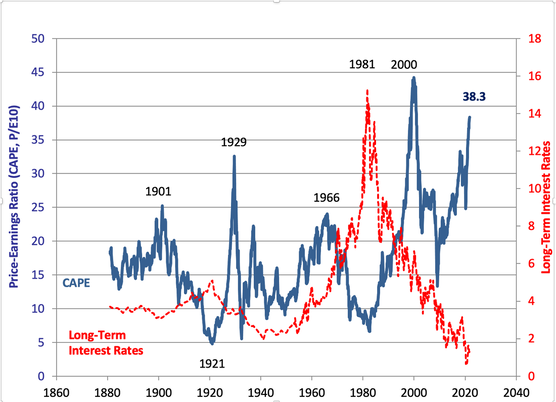

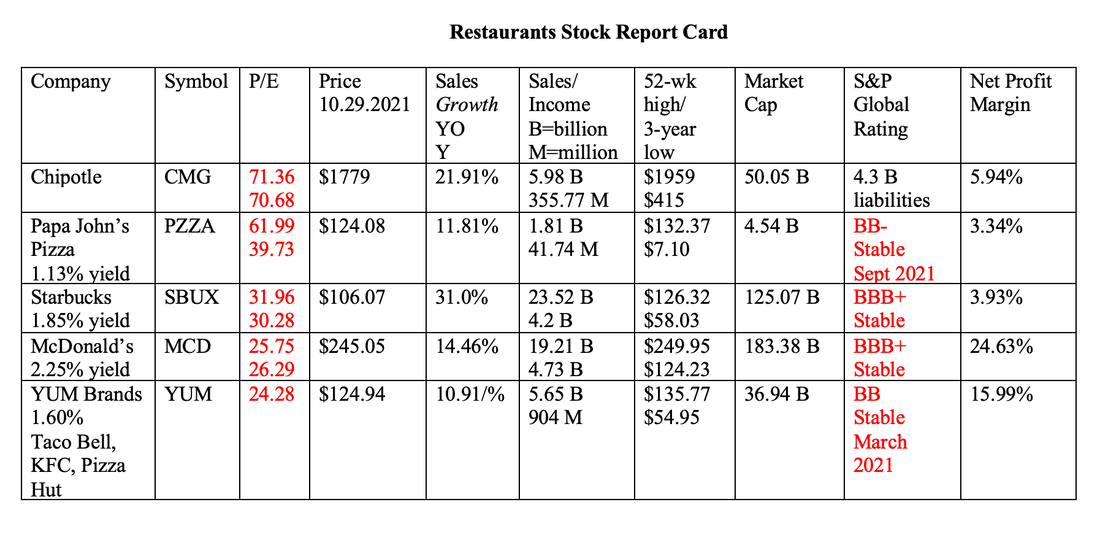

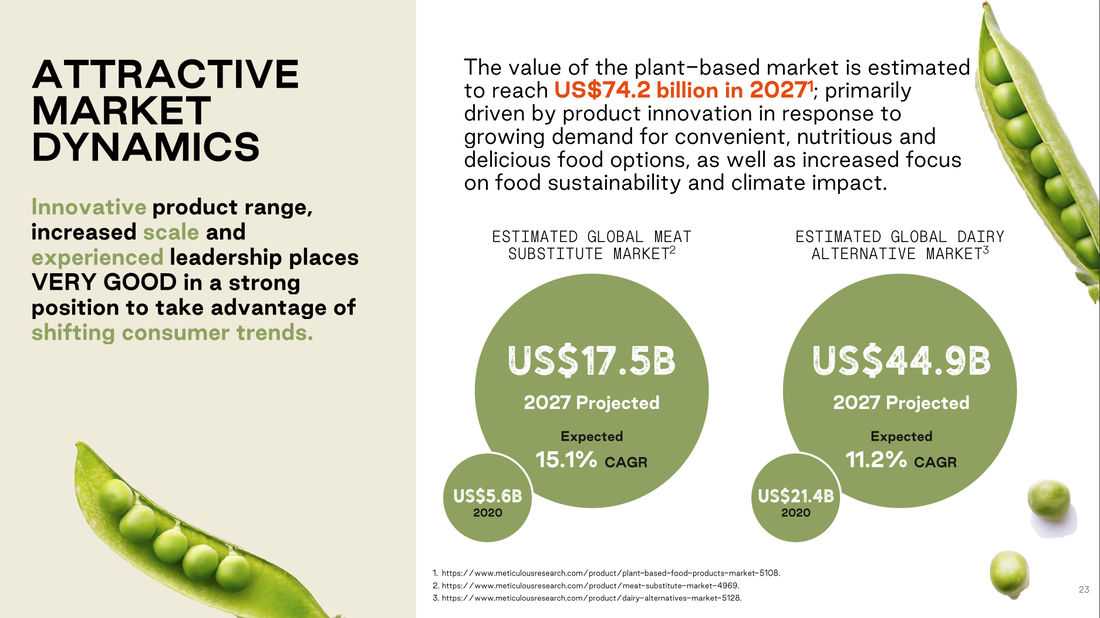

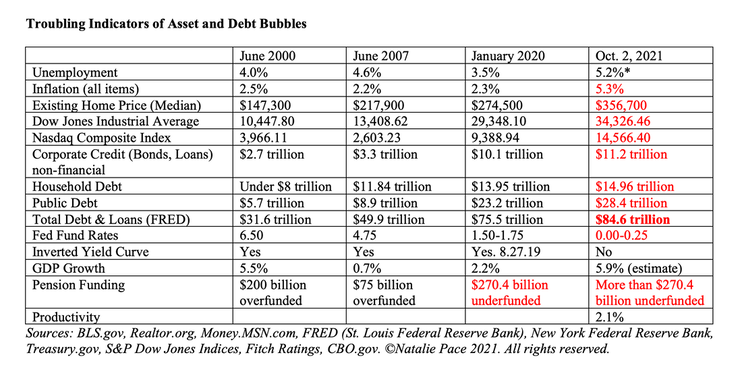

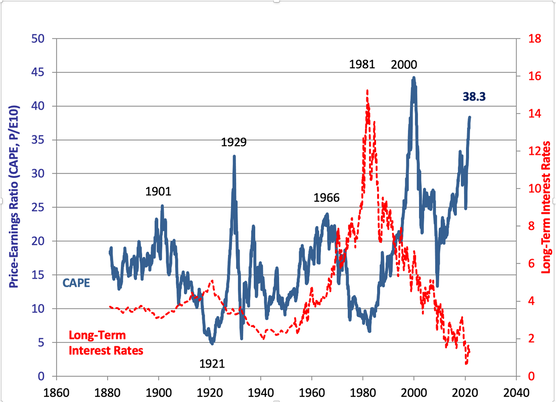

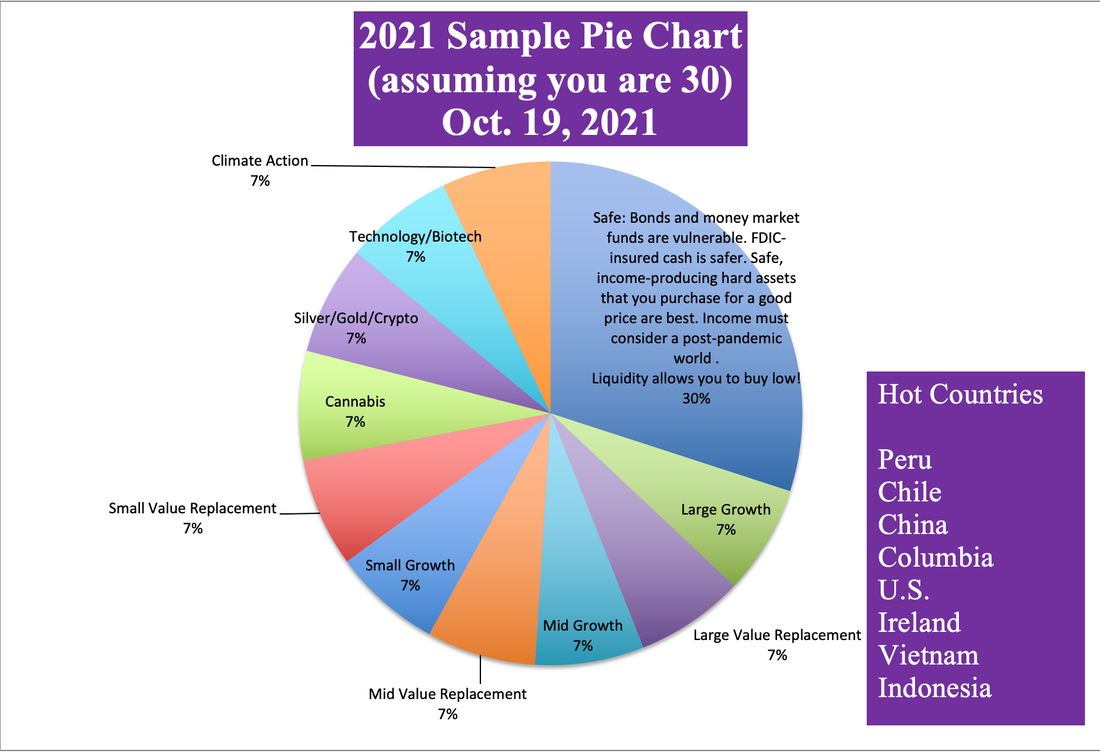

Inflation is affecting everything these days. Whether it’s buying gas or food, chances are you’re spending more at the pump and register. Labor shortages are forcing companies to raise their minimum wage in order to attract team talent. Housing is astronomical and unaffordable in half of the U.S., according to Attomdata. There’s one very expensive thing going on, however, that a lot of people are not factoring in. That is the cost of trees. How many trees do you drink and toss, or flush down the toilet, every year? What happens if we keep razing our rain forests for convenient coffee on the go? Are we factoring in the very real costs of calamities that are associated with climate change, increasingly intense weather events, desertification, oceanic acidification and global warming into our inflation assumptions and how we live our lives? Inflation We are keenly aware of how inflation is hitting gas and oil prices. Since coffee only goes up a few cents here and there, we might not be as aware of escalation. Housing is widely acknowledged as a crisis. But, how many of us are putting two and two together and acknowledging the drain that unaffordable housing has on the labor shortage? If we’re making $17 an hour, which equates to about $2946 a month before taxes, how can we afford to live in most cities in the U.S.? Renting and buying are completely out of reach for the lowest-paid workers in the U.S. This explains why we have more intergenerational homes today than in the Great Depression. It also prompts labor-strapped companies to replace workers with automation (self-ordering has become hugely popular) and to reduce hours of operation. Take a look at the unemployment rate for people without a high school education. It’s quadruple that of those with a Ph.D. Labor Shortages Businesses, particularly hospitality and entertainment that rely upon lower income staff, have been forced to streamline, automate, reduce operating hours and rely upon self-service. Chipotle has Chipotlane where you can pick up an order that you complete on an app rather than through a human-staffed order window. You can do the same thing at many Starbucks and Macdonald’s these days. In the MacDonald’s 3Q 2021 earning call, CEO Chris Kempczinski said the company is leaning into the three D’s for sustained growth and profitability: digital, delivery and drive-thru. The company wants to create “contactless channels” and “digital experiences that are seamless personalized and easy to use.” Supply Chain Bottlenecks Starbucks CEO Kevin Johnson assured analysts on the company’s 3Q 2021 earnings call that he has enough coffee to last for a few months, and prices locked in for more than a year. That ensures for a pretty risk-free holiday season. However, labor shortages are affecting factories and deliveries, while commodity prices are escalating. That is leading companies to raise prices incrementally. McDonald’s raised prices about 6%. Starbucks CEO Kevin Johnson believes there is still room to raise prices (again) if the company needs to. He told analysts that Starbucks has a “world-class pricing team backed up by world-class analytics and insight.” One of the commodities both companies are keeping their eyes on is the cost of paper, since fast food restaurants are still largely steeped in the convenience of single-use, disposable packaging, despite any claims to be socially-conscious and concerned about ESG (environmental, social & governance). Trees and Paper Goods Millennials and Gen Z are target markets of all casual dining and fast-food chains. These population cohorts place a strong emphasis on climate responsibility and sustainability. Somehow, they’ve missed the memo on how disposable paper goods are responsible for approximately 16 billion cups being trashed and 6.5 million trees being razed every year. Trees are the lungs of our planet and have a strategic capability of reducing carbon in the atmosphere and sequestering it in the soil. As Kathleen Rogers, the president of EARTHDAY.ORG told me in our interview for Earth Day, “Vegetation gives us the oxygen we breathe. We cannot solve climate change by planting trees, but we can push it way off down the field, if we do.” (Click to access the full interview.) What happens when consumers understand that the cup in their hand was sourced from an old-growth rainforest? Starbucks will put your personalized macchiato into your own reusable mug, as long as local mandates allow it (given the pandemic). I rarely see anyone (other than me) with a reusable mug at Starbucks. I’ve never seen anyone with a reusable container at MacDonald’s. This isn’t a contactless experience. It requires manual labor to take your cup and pour a drink into it, which spins us back into unaffordable housing and the labor crunch. It is also not as fast and convenient as coffee junkies would like. Will preserving our carbon-sequestration forests become more important than the current method of drinking our Morning Joe? One thing we’ve seen in 2021 with meme stocks and Reddit is that sentiment and campaigns can burgeon out of nowhere to become the norm. Expensive Stock Prices Another area of elevated prices are stock prices. The price-earnings ratios of the most popular casual dining and fast-food brands are astronomical. In general, U.S. companies are trading at speculative valuations not seen since The Dot Com Recession, and much higher than the Great Depression in 1929. Take a look below at the price-earnings ratios of five different brands. The historical average PE is about 17.5. Should a company like Chipotle that had under $400 million in net income last year be worth over $50 billion? Should MacDonald’s and Starbucks be worth $183 billion and $125 billion, respectively, when their net income is under $5 billion? Debt and Leverage Most of the companies listed above have a credit rating of the lowest rung of investment grade (BBB or higher) or are at speculative (junk) status (BB or lower). Debt and leverage in the U.S. today have become astronomical. We hear about the $29 trillion public debt frequently. Few of us are aware that the total U.S. debt and loans is above $85 trillion – a number never seen in our history. Economists have pointed out that the 21st-century has been characterized with wealth flowing to the investor class at the expense of workers. This is what happens when interest rates remain low for an extended period. Low interest rates create asset bubbles. Companies are willing to borrow money, letting their own credit rating fall to the lowest rung of investment grade, because they can do so and still borrow at under 5% in a low interest-rate world. They then use that borrowed money to buy back their own stock, rewarding investors with higher share prices and lower price-earnings ratios. Money flows to the top of the income ladder, rather than through to the team members or invested in R&D. Chipotle, Starbucks and MacDonald’s have each announced that they will repurchase their company shares. Yes, these companies are all increasing their minimum wage a little. At the same time, they are also automating more and reducing store hours, which results in a smaller workforce that is needed. Investors remain invested for the small amount of “income” they are making. Most are not aware that they are one credit downgrade from losing a chunk of their principal. When companies get cut to junk status from investment grade, their stock sinks. Bottom Line If you care about sustainability and ESG investing, it’s important to reduce the amount that you’re eating from these drink and toss dining options. With elevated price-earnings ratios, which is similar to paying $15 or more for an avocado, there is also the looming possibility that prices will decline rapidly and suddenly without notice, and before you can protect your wealth. According to the most recent Federal Reserve Financial Stability Report, “Should risk appetite decline from elevated levels, a broad range of asset prices could be vulnerable to large and sudden declines, which can lead to broader stress to the financial system.” For this reason, and others that are outlined in my What’s Safe in a Debt World blog and videoconference, we are using value replacements in our nest egg pie chart strategy. Email [email protected] or call 310-430-2397 to learn more now. If you'd like to learn how to learn how to invest in ESG companies including our 2021 Company of the Year (which tripled in share price), how to protect your wealth and how to manage volatile industries, like gold, cannabis and crypto, then join me for our 3-day Investor Educational Retreat. We've had many Shoot the Moon stock picks in 2020 and 2021. You will also learn how to earn money while you sleep with a time-proven, 21st Century plan. Wisdom is the cure. It's time to become the boss of your money. Call 310-430-2397 or email [email protected] to learn more now.  Join us for our New Year New You Financial Empowerment Retreat. Feb. 11-13, 2022. Call 310-430-2397 or email [email protected] to learn more. Register by Nov. 1, 2021 to receive a complimentary private, prosperity coaching session (value $300) and the best price. Click for testimonials & details. Other Blogs of Interest The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions Will There Be a Santa Rally? The Dangerous Debt Ceiling Game The Robinhood IPO. Will the Crypto Crash Hit Tesla, Square & Coinbase? China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Beyond Meat Trades at a Pandemic Low Beyond Meat dropped to a 52-week low yesterday after announcing that the company had underestimated the effect the Delta Variant would have on restaurants (like McDonald’s) using their product. Other calamities included severe weather on the East Coast, which led to water damage in the inventory, and loss of potable water for two weeks in one of their factories. Beyond Meat’s revenue growth is still predicted to be about 12.3% higher than the third quarter of 2020. However, it will also be almost 30% lower sequentially. Investors responded by selling. The share price plunged by 13% at the market close yesterday, and is trading at prices we haven’t seen since the pandemic plunge in Spring of 2020. The Very Good Food Company’s Share Price Sinks The Very Good Food Company, a popular plant-based protein company out of Vancouver, has seen its share price implode by 77% off of the 52-week high. In December of 2020, the company was selling for $7.15 a share. Today you can buy it for $1.71. Oatly is near a 52-week low as well, trading at half of the $29 price investors were willing to pay in June of this year. Meanwhile, The Very Good Food Company’s year-over-year revenue growth is 156%, while Oatly’s annual sales gains are a respectable 53%. So why are plant-based protein companies experiencing a fire sale in their share prices? Are they experiencing supply chain bottlenecks? Has demand gone down? The Plant-Based Meat Market According to ResearchandMarkets.com, the plant-based meat market is projected to reach $35 billion by 2027, after hitting $13.6 billion in 2020. Having hot products in a game-changing space easily explains why The Very Good Food Company experienced 156% year-over-year revenue growth in the most recent quarter, compared to last year. 2021 will be the first year that The Very Good Food Company enjoys over $10 million in sales. The company recently expanded out of Canada and into California, and purchased The Cultured Nut in order to begin offering plant-based cheese. So, impressive growth at $VGFC (the NASDAQ ticker symbol) is built-in through M&A, as well as increased consumer interest in plant-based proteins and dairy. Beyond Meat sold $407 million of its product in 2020. They are building factories in China and the Netherlands. They are expanding globally. Both of the above-mentioned plant-based companies have competition from Impossible Foods (privately held), as well as the traditional meat companies that are expanding into this space. Legacy brands such as Tyson foods, Kellogg and ConAgra all have plant-based protein products. Plant-Based Dairy The Food Institute is projecting that the dairy alternative market will hit about $45 billion by 2027. Plant-based cheese sold about $1.01 billion in 2019, but is gaining traction. Plant-based milk, ice cream and yogurt are starting to hit the retail shelves. You can get Oatly‘s milk and yogurt at Starbucks. The Very Good Food Company advises that its cheese products will be available in retail stores by the fourth quarter of this year. Oatly hit the big boards with a bang on May 20, 2021, but has since seen its share price weaken. Shares are trading at half of where they were in June. The company has been one of the worst performers this year, at a time when the S&P500 keeps setting new all-time highs. Any fast-growing industry is bound to have challenges and setbacks as it invests in factories and expands. The pandemic and severe weather events exacerbate and complicate the plans of many businesses, particularly in consumer goods. However, there is no denying the explosive demand in the plant-based protein and dairy markets. Young Mavericks, like those mentioned above, can have wild fluctuations in the share price, as investor sentiment seesaws between undervalued and Shoot the Moon status. When I reported on this industry back in May, I was concerned about the valuations of these companies, particularly the share price of The Very Good Food Company. Today all of these companies are on a fire sale. While the old school food companies, such as Conagra, are less volatile, they are also slower growth and more heavily indebted. Their share prices don’t move as much in either direction, up or down. The companies rarely innovate themselves. Rather they tend to target the upstarts as acquisition candidates. That can be a good thing if you’ve invested in the most-beloved brand at a great price, before the suitors come calling. While the pandemic continues to pose challenges for all consumer goods, the plant-based protein and dairy market could be a bright spot on the horizon for investors. These companies make tasty food. Meatless Mondays are a treat many families look forward to. You don’t have to compromise flavor or culinary creativity. The Very Good Food Company has excellent recipe ideas all over Instagram, and even a barbecue rib product made out of jackfruit. Oatly and almond milk have become staples in the side door of many refrigerators. Once folks head back to restaurants, they can opt for a Beyond Meat McPlant Burger at McDonalds (in select locations). Beyond Meat reports 3rd quarter earnings on Wednesday, Nov. 10, 2021, after the markets close. The sell-off happened when the company revised their 3Q 2021 earnings expectations down (on Oct. 22, 2021). Investors will now be keen on the 4Q 2021 forward outlook when earnings are announced. Oatly will report on Nov. 15, 2021 before the U.S. markets open (at 9:30 am ET). The Very Good Food Company’s results should come around Nov. 19, 2021. Bottom Line I have been a fan of plant-based protein products for years. As someone who believes in putting your money where your heart is, the only thing that held me back from investing in the past was the price of the stocks. With the plant-based protein companies experiencing a fire sale, I’m in! Full disclosure: Really. I’m in. I own Beyond Meat and The Very Good Food Company. If you'd like to learn how to learn how to invest in great companies, like The Very Good Food Company and our 2021 Company of the Year (which tripled in share price), how to protect your wealth and how to manage volatile industries, like gold, cannabis and crypto, then join me for our 3-day Investor Educational Retreat. We've had many Shoot the Moon stock picks in 2020 and 2021. You will also learn how to earn money while you sleep with a time-proven, 21st Century plan. Wisdom is the cure. It's time to become the boss of your money. Call 310-430-2397 or email [email protected] to learn more now.  Join us for our New Year New You Financial Empowerment Retreat. Feb. 11-13, 2022. Call 310-430-2397 or email [email protected] to learn more. Register by Nov. 1, 2021 to receive a complimentary private, prosperity coaching session (value $300) and the best price. Click for testimonials & details. Other Blogs of Interest What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions Will There Be a Santa Rally? The Dangerous Debt Ceiling Game The Robinhood IPO. Will the Crypto Crash Hit Tesla, Square & Coinbase? China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. What’s Safe in a Debt World? Includes 11 Essential Tips How many times have you seen or heard recently that Bitcoin or gold/silver will be the only thing worth anything when the dollar becomes worthless and the Federal Reserve Board is abolished? It’s easy to understand how alluring this sentiment is, or why Squid Game is the top show on Netflix. (Saturday Night Live’s skit on October 15, 2021, did a good job of synopsizing the show.) We live in a Debt World. For reference, check out the chart below, which shows a laundry list of economic indicators, including debt, from today and before the pandemic, the Great Recession and the Dot Com Recession. Below is another chart that should have you concerned. While debt levels are unprecedented and eyepopping, so are asset prices in stocks and real estate. In fact, the only time that stock prices have been higher was before the Dot Com Recession (when the NASDAQ Composite Index sank 78% between March 2000 and October of 2002). The Great Depression (yes, 1929) is now the 3rd most leveraged time for stocks in recorded U.S. history. Take a Historical Perspective What was safe during the Great Depression (or even the Great Recession)? Real estate? Owning a business? Owning stocks? Owning bonds? Would Bitcoin have saved the day at either time? Is a better currency the answer, or do the solutions lie elsewhere? According to the Federal Reserve Board’s Financial Stability Report from May of 2021, “Should risk appetite decline from elevated levels, a broad range of asset prices could be vulnerable to large and sudden declines, which can lead to broader stress to the financial system.” In plain English, now is the time to make sure that you are protected from the financial storms that could appear anytime on the horizon. (If you wait for them to arrive, it’s too late to prepare.) 11 Tips on Getting Safe in a Debt World 1. Bonds are a Big Part of the Problem 2. Market Timing Doesn’t Work 3. Don’t Fight the Fed 4. Proper Diversification 5. What’s Hot 6. Diversifying by Country 7. Liquidity Affords Us the Opportunity to Buy Low 8. Value is Getting Trounced by Growth 9. Dividends Don’t Pay When Your Principal Plunges 10. Safe, Income-Producing Hard Assets that You Purchase for a Good Price 11. Think Bigger and Get Creative 1. Bonds are a Big Part of the Problem Bonds are illiquid and negative-yielding. Those conditions become heightened when interest rates rise, whether it is due to interest rate risk or credit risk. Both scenarios are troublesome today. The Fed Fund rate is targeted to begin its ascent in 2022 and rise to 1.8% (from zero today) by 2024. Meanwhile, over half of the S&P500 companies are at or near junk bond status. Never reach for yield. Know what you own. Heed the advice of Roy Rogers, who once said, “I’m more concerned with the return of my money than the return on my money.” Don’t rely on an asset that is losing money to protect your wealth. 2. Market Timing Doesn’t Work The worst economic crisis of our lives became the shortest recession in history. The world’s economists have learned many lessons from the Great Depression, which they applied during the pandemic. Their theories were aided by a debt suspension, which meant they had a blank check on available funds. That’s one of the underreported points of contention in Congress. The Democrats want a suspension of the Debt Ceiling (as has been the case for decades). The Republicans want the Democrats to take ownership of an actual number (in the trillions) that they are willing to add to the public debt. Editor’s Note: Public debt increased $7.8 trillion under the Trump Administration. Before the pandemic, the public debt under the 45th President was increasing at a faster rate than it did in the Obama Administration. In 2009, the U.S. was using Keynesian economic tools to ameliorate a banking and insurance crisis that had brought many of the developed world’s economies and businesses to the brink of financial destruction. By 2016, the increased debt was due to tax cuts that were not paid for by economic growth. Trying to outthink the policymakers is hazardous to our fiscal health. A better plan is to be properly diversified and to rebalance regularly. A simple, time-proven, 21st Century, easy-as-a-pie-chart strategy is outlined in my book, The ABCs of Money (5th edition). 3. Don’t Fight the Fed In the Pandemic Recession, we learned a few things. If you wait for the headlines, you’re too late. The informed money had already sold off about 38% by March 23, 2021, which turned out to be the market bottom. That was the time that Main Street was ready to plunge into the Wall Street exodus that had been led for a month by the whales. When the Feds bought up distressed bonds and ETFs, the Treasury gave money to anything that moved and many Americans no longer had to pay rent or keep up with their student loan debt, all of the sudden buying stocks and homes became the life hack du jour. 4. Proper Diversification Being properly diversified, underweighting areas of distress, regular rebalancing and understanding what’s safe in a debt world position us best in today’s overleveraged existence. So, what is proper diversification?

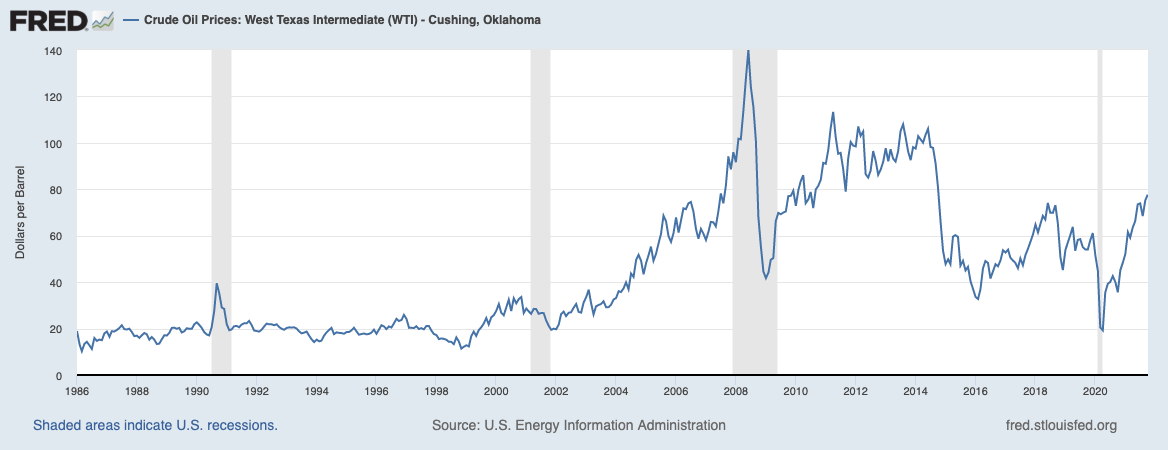

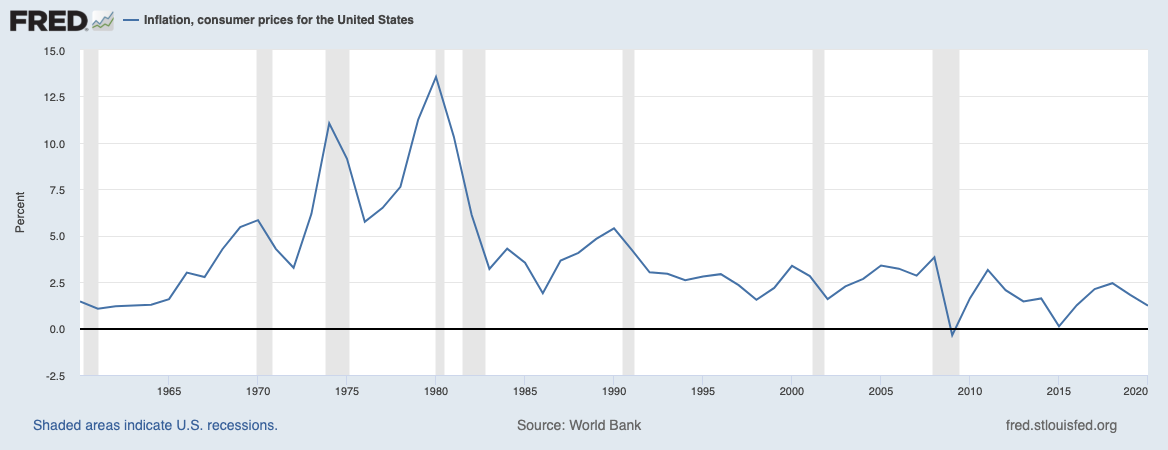

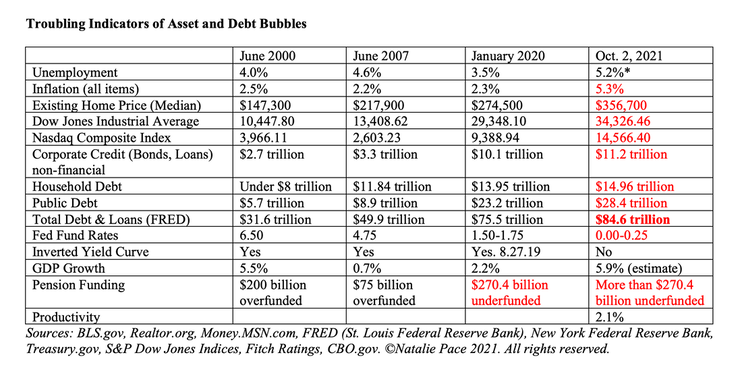

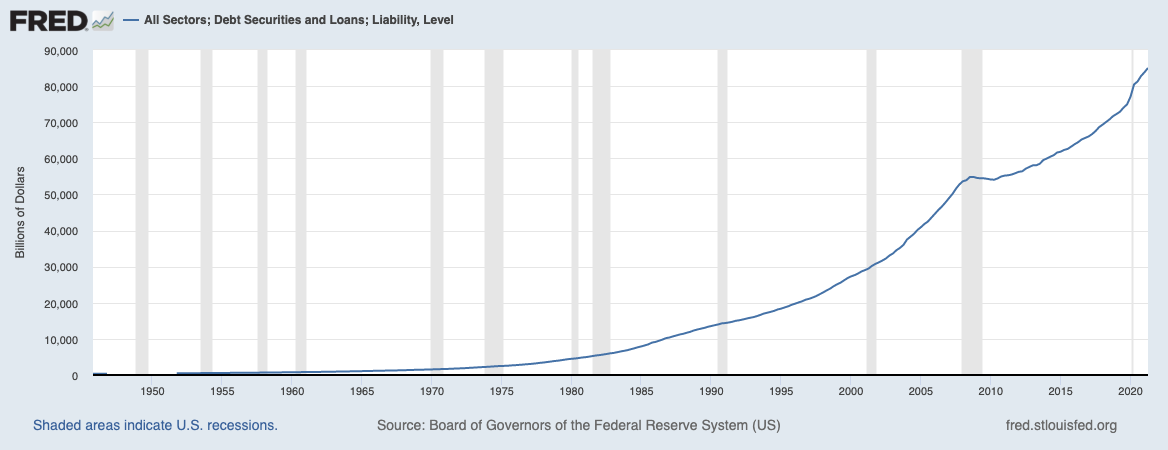

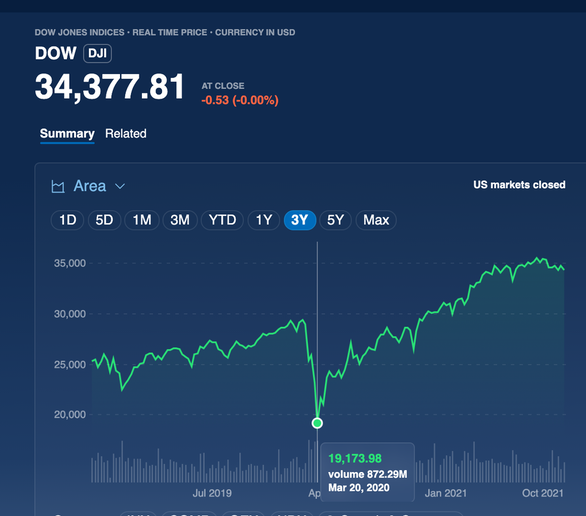

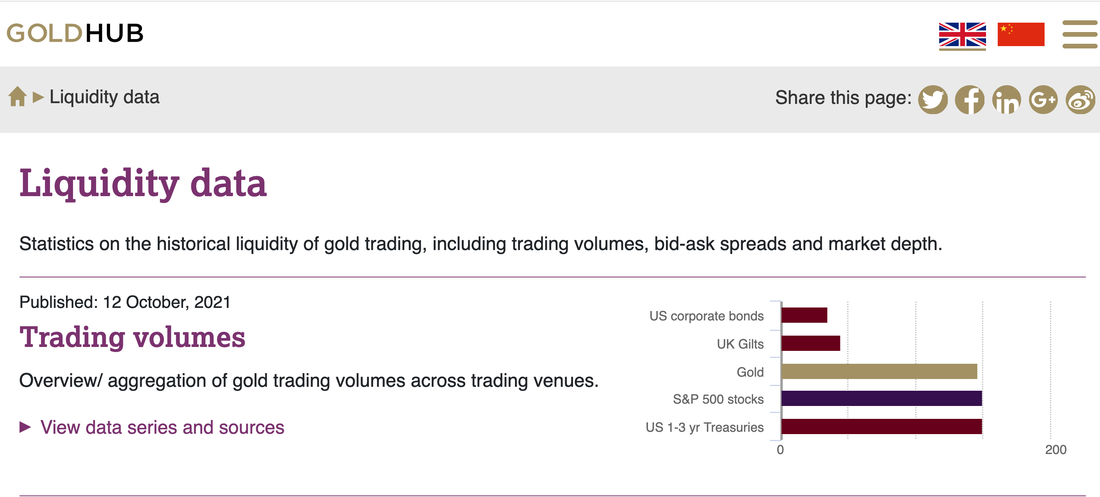

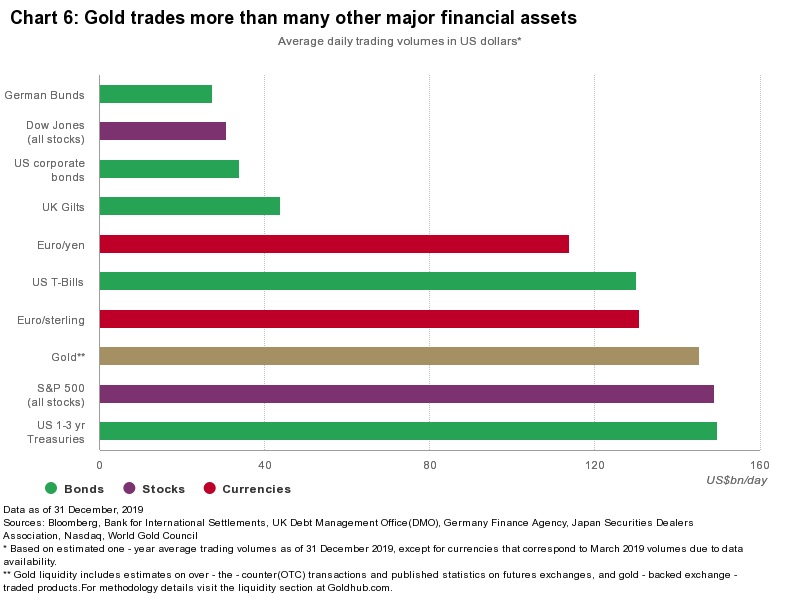

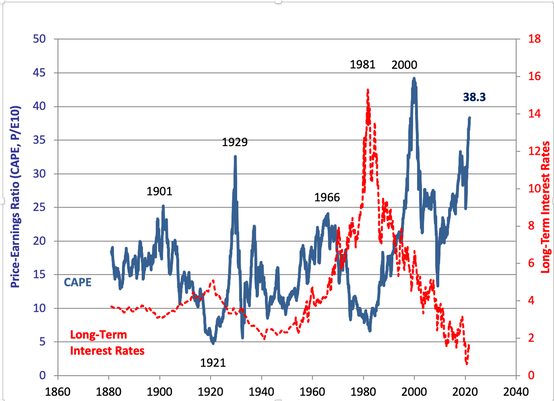

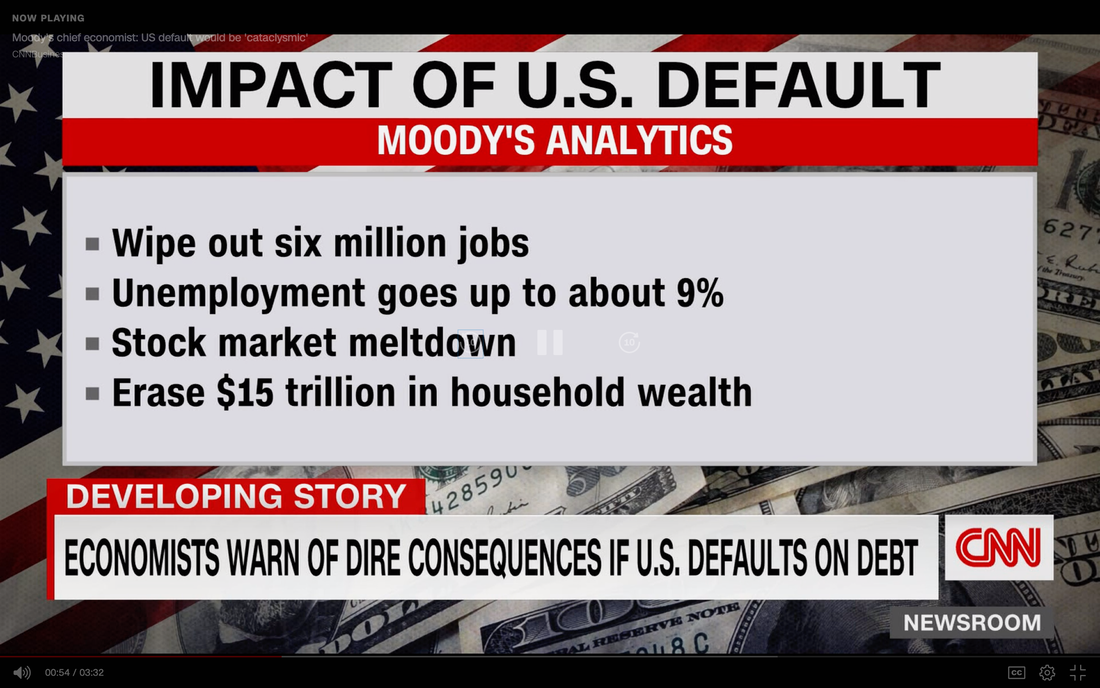

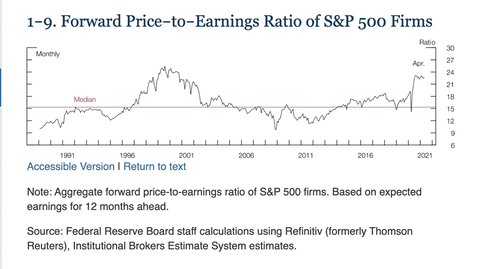

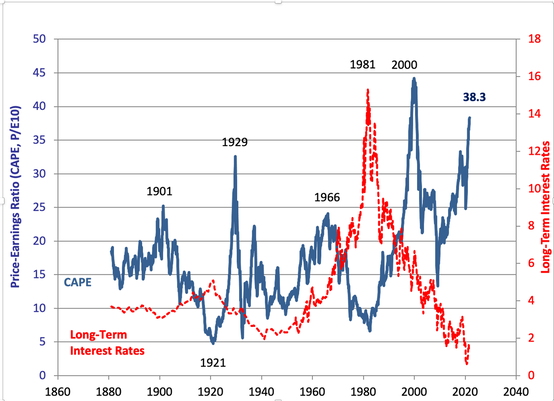

5. What’s Hot? The pandemic taught us that we can’t live without technology, communications, bleach and toilet paper. Biotechnology does quite well in a global pandemic. Copper prices are at an all-time high, which has pushed 2021 GDP growth expectations to 10 and 11 for Peru and Chile, respectively. Cannabis decriminalization bills are on tap in the House and Senate, and could take centerstage after the Budget and Debt Ceiling are resolved. (Perhaps this will be a Christmas present?) 6. Diversifying by Country One of the ways that you can get diversified in value is to look at foreign countries. For example, some of the countries that have the strongest growth in the world have a much more attractive price point today than U.S. equities, which are very expensive (like buying avocados for three or four times the normal price). I make my case for country diversification in the updated fifth edition of The ABCs of Money. Some of the highest growth countries in the world today include Chile, Peru, China and Colombia. Chinese equities were trading near their 52-week low in mid-October. The iShares ETFs for the other countries mentioned are trading near their 15-year lows. 7. Liquidity Affords Us the Opportunity to Buy Low The reason that most people don’t buy low is because they can’t buy low. When we lose more than half of our wealth, we are in a position to have to recover losses during the bull market. Preserving our capital means that we can shop when things go on sale. So, what is safe and liquid today? FDIC-insured cash. If you’re going to own bonds or Treasuries, keep the terms short and the creditworthiness high. Keeping your money is the 1st step of a 2-step safe strategy for today’s Debt World. (Keep reading.) 8. Value is Getting Trounced by Growth The technology and biotechnology-rich NASDAQ Composite Index (growth) has almost tripled the returns of the Dow Jones industrial average (value) over the last three years. There are reasons for that – having a lot to deal with too much debt, slow growth, financial engineering and expensive share prices. 9. Dividends Don’t Pay When Your Principal Plunges The higher the dividend, the higher the risk. It’s not worth it to take on an underperforming company that gives you a small dividend, commonly under 2%, if you’re at risk of losing your principal. When you subtract the fees, the promised yield becomes even more anemic. High-yield private placement REITs put your principal at risk and may charge you higher fees and commissions than you realize. They are typically very illiquid. They pay very high commissions to brokers, which is why you might be sold them if you tell your broker-salesman that you are concerned and want to get safe. Read D&T’s real-world warning, which is based on their personal experience. 10. Safe, Income-Producing Hard Assets that You Purchase for a Good Price Hard assets should hold their value better than paper assets in our Debt World – providing you don’t buy high, aren’t overleveraged or can truly (and easily) afford what you purchased. The mantra, and 2nd step in a Get Safe Plan, is to look for safe, income-producing hard assets that you purchase for a good price, considering a post-pandemic world. That’s difficult for two reasons. Real estate prices are at all-time highs and are unaffordable in many markets. Interest rates are rising, making it more difficult to finance. And it’s getting harder to be a landlord. According to the Mortgage Bankers Association, “Missed rental payments now total $41.7 billion, missed mortgage payments total $76.5 billion, and missed student loan payments total $155 billion” as of the 2nd quarter of 2021. With less travel, due to the pandemic and to many conferences being hosted online, AirBNB hosts may find far fewer guests. 11. Think Bigger and Get Creative Money is a means (not the end) to help us provide better for our families and to live a richer life. When we consider all of the things that are important to us, and become more holistic about our ability to change our own circumstances, then (and only then) do things change. Those loved ones we care about and the world at large benefit. When we expand our vision and embrace the power of our consumption and investing choices, our wealth and reach have a broader, positive affect. As just a few examples, intergenerational housing is on the rise and is actually higher today than it was in the Great Depression. This helps to keep the money in the family, and stops making the landlord rich. Rooftop solar is a great way to reduce your personal electric bill, while also cleaning up the grid. That leaves thousands of dollars annually in your budget for things you’d like more than paying electric bills. Oil companies are in business because we visit the pump regularly. How can you become part of the solution? Put Your Money Where Your Heart Is was written in 2006. It is imperative today. These are things we will discuss at the retreat this weekend, and also in the videoconference on October 28, 2021. Bottom Line There are solutions to protecting your wealth in a Debt World. These are so important (and so faintly highlighted in the mainstream media) that I spend one full day on this subject at our Investor Education Retreats. The age-old aphorisms and warnings should be billboards for investors today. Anytime someone tells you they have a safe investment that is earning above 1.5% that is a red flag (and a prevarication). Join me this weekend for our Investor Educational Retreat. We outline all of the strategies mentioned above and much more in three days of life-transformational, interactive, hands-on training. Email [email protected] or call 310-430-2397 to learn more now. If you’d like to join me live for our free videoconference on Oct. 28, 2021, email [email protected] with VIDEOCON in the subject line.  Natalie Pace Financial Empowerment Retreat. Oct. 23-25, 2021. Call 310-430-2397 or email [email protected] to learn more. Families and friends registering together receive the best price. Click for testimonials & details. Other Blogs of Interest Inflation, Gasoline Prices & Recessions Will There Be a Santa Rally? The Dangerous Debt Ceiling Game The Robinhood IPO. Will the Crypto Crash Hit Tesla, Square & Coinbase? China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden.  Dark clouds of smoke and fire emerge as oil burns during a controlled fire in the Gulf of Mexico, May 6, 2010. The U.S. Coast Guard, working with BP, local residents and other federal agencies, conducted the burn to help prevent the spread of oil following the explosion on Deepwater Horizon, an offshore drilling unit. Photo by the U.S. Dept. of Defense. Public Domain. Wiki Commons. High oil and gasoline prices are highly correlated with recessions. So is inflation. Check out the charts below. (The shaded areas are recession years.) The highest gasoline prices in the U.S. occurred right before the Great Recession, when a barrel of oil was trading at $141 and retail gasoline prices jumped to $4.11 a gallon. Today’s prices are $80.50 per barrel for oil, and $3.30/gallon at the pump. That’s lower than 2008, but much higher than normal (and what folks can afford). Inflation On Oct. 13, 2021, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index for All Urban Consumers (all items) rose 5.4% in September compared to September 2020. The “food and shelter” indices accounted for more than half of the increase (housing, food and gasoline). According to the National Association of Realtors, “Due to high home prices, 4.8 million fewer households can buy a residence versus two years ago, even though mortgage rates are lower than in 2019.” Additionally, this is the first time since 1972 that inflation is higher than the average rate on a 30-year mortgage, according to NAR’s senior economist and director of forecasting Nadia Evangelou. Consumer Spending and GDP Growth Consumer spending makes up about 70% of the US GDP growth each year. When consumers have to spend a lot more on gasoline and other basic needs (inflation), they have less to spend on other goods and services. When inflation-imposed belt tightening in the budget coincides with other household challenges, like high unemployment, a downturn in real estate or stock prices, or bond market gyrations, then the economy can experience a period of financial instability. The last such periods were in 2020 during the pandemic, in 2008 during the Great Recession, and in 2000-2002 when Dot Coms busted out. Before the Great Recession, real estate was overleveraged and equities were at an all-time high. Both assets tanked in tandem. Today, real estate prices are back to all-time highs, as are equities. Leverage Many of us are aware of the amount of public debt ($28.4 trillion). Fewer of us are aware of consumer and corporate debt. Over half of the S&P 500 is at or near junk-bond status. Consumer debt is higher than ever. Margin trading is also at an all-time high. 2/3 of millennials who purchased a home recently have buyer's remorse and worry that they purchased it at too high of a price. According to the St. Louis Federal Reserve Bank, the total amount of loans and debt in the U.S. is an eye-watering $85 trillion. The Federal Reserve Board has warned that risk appetite is elevated. According to their Financial Stability Report that was released in May of 2021, “Should risk appetite decline from elevated levels, a broad range of asset prices could be vulnerable to large and sudden declines, which can lead to broader stress to the financial system.” Financial Instability and Sudden Market Drops Low interest rates create asset bubbles. When asset prices get too lofty, the correction can look like a falling knife. During the pandemic, between February 19 and March 23, 2020, we saw the fastest switchback from a bull market to a bear, when the S&P 500 dropped 38% in about a month. 2021 GDP for the U.S. The U.S., China and world GDP growth rates have been revised downward. 5.9% in the U.S. and 8.1% in China are still impressive. However, it’s a good thing to remember that this is a bounce off a terrible year in 2020 for the world. In 2020, most of the world experienced an unprecedented economic contraction, due to the COVID-19 pandemic. (2020 is represented in red below; 2021 in green.) The resurgence of the Delta Variant of COVID-19 was responsible for a weaker than expected 3rd quarter. The 1Q and 2Q 2021 U.S. GDP growth were 6.3% and 6.7%, respectively. However, the 3Q 2021 growth is predicted to come in at under 4%. Since institutional investors and hedge funds are forward-thinking, a stock sell-off might happen before the data is released on the morning of Oct. 28th. This could be part of the reason that stocks dropped by 5% in September. Asset Prices are Elevated Wall Street analysts and economists are aware that stock prices are high, and bonds are illiquid and negative yielding. Below is the current liquidity data on bonds compared to gold and the S&P 500. The chart from December of 2019 (below) reveals that bonds were weak even before the pandemic. Dow Jones stocks had almost as much of a problem finding buyers as bonds in late 2019. The Dow Jones Industrial Average has a greater concentration of the legacy, indebted companies, while the NASDAQ Composite Index tends toward younger, low-debt, high-growth companies. (The S&P500 is a compilation of companies from both indices.) During the pandemic, the Federal Reserve Board printed up a lot of money and became a lender of last resort to a lot of slow-growth, debt-laden companies, including “fallen angels” such as Ford Motor Company, which is now rated BB+ with a negative outlook (speculative status). Very High Stock Prices As you can see in the CAPE chart below, the Great Depression has now fallen to the third highest period of stock speculation. The highest was before the Dot Com Recession, when the NASDAQ Composite Index lost up to 78% of its value between March 2000 and October 2002. Today is the second highest period of pricey equity valuations, per Professor Robert Shiller’s CAPE ratio, which is a 10-year average of price-earnings ratios. What Do You Do? Incorporating a time-proven, 21st Century system is your best strategy, rather than market timing or trying to outsmart policymakers, the Federal Reserve and the Treasury Department. A lot of U.S. publicly-traded companies provide things that the world relies upon daily for our interconnected world and technology-driven lives. March of 2020 afforded investors a rare opportunity to purchase many of our favorite FANG* stocks at a 50-75% discount off the prices being traded today. The pandemic showed us that even during the worst economic challenges we’ve seen in our lifetime, we still use (and pay for) technology, biotechnology, communications, Wi-Fi, utilities and even toilet paper (consumer staples). A Time-Proven 21st Century Strategy Our easy-as-a-pie-chart nest egg strategies with regular rebalancing are time-proven in the 21st Century, at a time when Buy & Hope is like riding a Wall Street rollercoaster. Research by Pew indicates that most Americans are worth less today than they were in the late 1990s. This has a lot to do with the severity of recessions in today’s world. Younger investors might be mistaken to think that recessions can last only two months and then everything goes back to normal. However, that has not been the case. The NASDAQ Composite Index took 15 years to come back to even from its losses in 2002. The Dow Jones Industrial Average took five years to recover from over 55% losses in the Great Recession. Using bull markets to make up losses is not an efficacious wealth strategy. When your wealth drops by half, your credit score plunges, your liquidity is constrained and you might have to take on another job to pay your bills. Our nest egg pie chart system protects you from losses by keeping the proper amount safe. You might far outperform the general market with hot industries. You’ll have the liquidity to buy low when stocks are trading cheap. Regular rebalancing is a buy low, sell high system on auto-pilot that takes the emotions out of investing. Most people do not buy low because they can’t. If you don’t have enough cash on hand, you can’t buy low. Another barrier to bargain prices on Wall Street is that when prices decline so far, people become afraid to invest. Bottom Line Inflation, political uncertainty, high unemployment, high gas prices, leverage, debt and financial instability continue to plague the world’s economies, even in a stellar recovery year, like 2021. Market timing won’t help you. A diversified plan that is regularly rebalanced will. You can read about it in The ABCs of Money and Put Your Money Where Your Heart Is. You can learn and implement it at our 3-day Investor Educational Retreats. You can secure an unbiased 2nd opinion on your current plan that includes a blueprint to better wealth protection and asset optimization. Email [email protected] with 2nd Opinion in the subject line for pricing and information. *FANG: Facebook, Apple, Amazon, Netflix, Nvidia, Google.  Natalie Pace Financial Empowerment Retreat. Oct. 23-25, 2021. Call 310-430-2397 or email [email protected] to learn more. Families and friends registering together receive the best price. Click for testimonials & details. Other Blogs of Interest Will There Be a Santa Rally? The Dangerous Debt Ceiling Game The Robinhood IPO. Will the Crypto Crash Hit Tesla, Square & Coinbase? China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Watch my free videoconference. Will there be a Santa Rally in 2021? Do you remember December of 2018, the worst December since the Great Depression, when the S&P500 dropped -14% in the last quarter of the year (with -9.2% losses in December)? Will dysfunction in the Beltway spoil the party on Wall Street? The Debt Ceiling Crisis On September 30, 2021, Congress passed a bill to fund the government through December 3, 2021. At that point they’ll either have to pass a full budget for the fiscal year of 2022 or punt the ball again. The good news is that it was in time to avert a government shutdown. However, the Debt Ceiling crisis is still looming. Although Congress technically has until October 18, 2021, before the Treasury Department runs out of money to pay their bills, the debt ceiling suspension should have already happened. There are many reasons for that. With Republicans blocking votes to raise the Debt Ceiling, the pathway to success is tricky. Additionally, brinkmanship can roil the markets. Wall Street has become inured to the Beltway circus. However, the closer the U.S. gets to the default date without a solution, the less patient investors will be. There is also the issue of the U.S. AAA credit rating with Moody’s and Fitch Ratings. On August 2nd of 2011 the Debt Ceiling was suspended on the exact day when the U.S. would have defaulted. There wasn’t any delay in payments. However, S&P Global Ratings downgraded the U.S. to AA+ rating. Fitch Ratings currently has the U.S. AAA rating on a negative outlook. Moody’s chief economist Mark Zandi warned on September 21, 2021, that failure to lift or suspend the Debt Ceiling could result in 6 million jobs lost, a stock market meltdown, $15 trillion of household wealth evanescing and unemployment skyrocketing to 9%. 5.9% GDP 5.9% GDP growth is the best we’ve seen in decades — since 7.2% GDP growth in 1984. That would normally signal a strong Santa Rally. Stock market performance can be highly correlated with GDP performance. Since 2008, it has been more highly correlated with Federal Reserve policy, which is why the phrase “Don’t fight the Fed” has become a Wall Street commandment. 3Q 2021 Slowed Down Third quarter 2021 GDP growth estimates will be released on October 28, 2021, at 8:30 AM eastern time. The second quarter grew at a rate of 6.7%. The first quarter came in 6.3% higher. 3Q2021 is predicted to slow down due to the Delta Variant and supply chain bottlenecks. Forecasters have pegged the rate at somewhere Between 3.2 and 3.8% GDP growth. That’s still respectable, particularly in a pandemic. However, it’s clearly far below the first and second quarters. That could spook some investors, particularly since stocks are very pricey. Stocks are High Stock valuations are very high. As an example, Amazon is worth $1.7 trillion, but has only $21.33 billion in annual net income. The company’s forward price-earnings ratio is 64. The historical average price-earnings ratio is 17 (according to S&P Global Indices). According to Federal Reserve data, forward PEs are so high that they are back to the very speculative status that occurred before the Dot Com Recession. As a reminder, that recession cost the NASDAQ Composite Index 78% of its value between March 2000 and October 2002. In the CAPE Ratio chart below (source: Professor Robert Shiller), the Great Depression has now fallen to the 3rd most highly speculative time in the last century, behind today, with the Dot Com Recession still claiming the top seat. In the words of the Federal Reserve Financial Stability Report issued on May 6, 2021, “Should risk appetite decline from elevated levels, a broad range of asset prices could be vulnerable to large and sudden declines, which can lead to broader stress to the financial system.” Very High Margin Trading Margin trading is also elevated. Many traders are borrowing to invest. That will spell trouble if the markets decline, and could speed up the pace of the rout. Brokerages have policies to liquidate holdings and cover their own loans, even without their client’s permission. What About Real Estate Real estate prices are also elevated. Mortgage rates are rising. The good news is that many homeowners have historically low fixed rates locked in. The bad news is that up to two-thirds of new Millennial home buyers are regretting their purchase. Bottom Line Even with the S&P500 down almost 5% in September, the market index is still up 16.4% on the year. That’s an excellent return. So, will the Santa Rally make investors even happier than they already are on the year? If the debt ceiling is raised or suspended within the next few days, if Fitch Ratings and Moody’s Analytics reaffirm the AAA credit rating of the US, if the pandemic abates, if corporations continue their robust stock buyback plans, if consumers keep spending and if investors remain optimistic, stocks should go up. There are a lot of ifs in that sentence. A Debt Ceiling debacle or a credit downgrade could easily spark a crash in the markets. That is why your best strategy right now would be to fix the roof while the sun is still shining. Know what you own. Make sure that you are safe, protected, hot and diversified, and that you know what is safe in a world where bonds and money market funds are vulnerable. Jumping all in or all out of the stock market doesn’t work. (Don’t fight the Fed.) However, being properly diversified and rebalancing regularly is a buy low, sell high plan on autopilot, particularly if you are using our nest egg pie chart system. If you’re interested in protecting your wealth now, consider joining us for our October 23-25, 2021 Investor Educational Retreat. You can also request information about receiving an unbiased second opinion of your current wealth, investing and retirement strategy. Email [email protected] with “Retreat” or “2nd Opinion” in the subject line.  Natalie Pace Financial Empowerment Retreat. Oct. 23-25, 2021. Call 310-430-2397 or email [email protected] to learn more. Families and friends registering together receive the best price. Click for testimonials & details. If you'd like to learn how to learn how to invest in great companies, how to protect your wealth and how to manage volatile industries, like gold, cannabis and crypto, then join me for our 3-day Investor Educational Retreat. Our Company of the Year has tripled in just four months. We've had many Shoot the Moon stock picks in 2020 and 2021. You will also learn how to earn money while you sleep with a time-proven, 21st Century plan. Wisdom is the cure. It's time to become the boss of your money. Call 310-430-2397 or email [email protected] to learn more now. Other Blogs of Interest The Dangerous Debt Ceiling Game The Robinhood IPO. Will the Crypto Crash Hit Tesla, Square & Coinbase? China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed