|

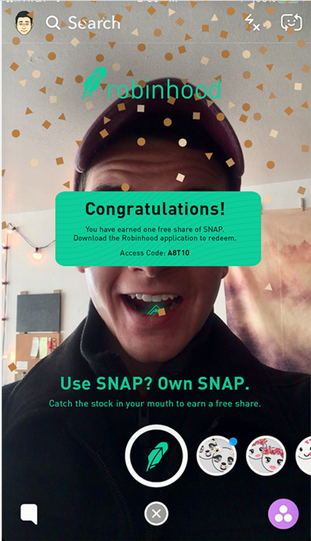

Trading for HOOD begins Thursday on the NASDAQ Stock Exchange. The price will be set on Wednesday. The company is currently looking for $38-$42/share, which equates to a market capitalization of about $33-$35 billion. The first meme stock brokerage is going public this week. In an unusual move designed to promote the company’s motto of “democratizing finance for all,” Robinhood is reserving up to one-third of its stock for its own clients. So, should you download the app and place your order? Impressive Growth vs. Regulatory Hot Water Robinhood’s revenue growth is very impressive at 309% year over year in the most recent quarter (1Q 2021), rising from $128 million to $525 million. Put into perspective, this should add up to over $2 billion in 2021 revenue. The 2nd quarter 2021 revenue is expected to be $546-574 million, an increase of 129% year over year, and 6.7% sequentially in the midpoint range. 2020 revenues were $959 million, with $7 million in net income. The company lost $1.4 billion dollars in 1Q 2021, mostly due to a one-time fair value write-down of its convertible notes and warrants. 2Q 2021 earnings will be hit with the $70 million fine imposed by FINRA on June 30, 2021, as well as reserves set aside to settle a money laundering matter with the New York State Department of Financial Services. Robinhood is expecting a 2Q 2021 net loss of $487 to $537 million, according to the S-1 filing. There will also be a one billion-dollar one-time charge in the 3rd quarter related to the IPO’s share-based compensation. With $4.8 billion in cash, and another $2 billion raised in the IPO, Robinhood should have enough capital to pay the fines and keep operating, even if 2021 remains in the red – unless something terrible happens. (With all of the Robinhood outages, trade halts, customer complaints, boycotts and regulators looking into everything, it does indeed seem as if something terrible is always happening. However, the company is savvy about SEO, which helps these stories to stay buried in searches.) Gamification: Memes, Emojis, Fractional Shares, Free Trading & Gold Margin Accounts About 50% of Robinhood clients are new to investing. Robinhood makes trading like a game, using emojis, lotteries, confetti, gifts and free stock to lure in retail investors. Unlike other brokerages, Robinhood offers fractional shares and crypto, but hasn’t yet entered into the retirement space. You’ll still have to rollover your IRAs and 401Ks elsewhere, although this is an area that Robinhood is looking to expand into. Robinhood’s gamification is an effective marketing ploy. However, it’s problematic in the financial services industry. Fiduciaries and regulators are constantly trying to figure out ways to educate and empower professionals and their clients to use risk tolerance and strategy, rather than emotions, to manage their wealth and future. Everything is sunny in a bull market. There are many heartbreaking examples of what happens when stocks head south, particularly with young, less-experienced investors. FINRA Fines Robinhood $70 Million On June 30th, 2021, FINRA (the financial services regulatory authority) levied the highest fine in its history on Robinhood. FINRA found multiple violations with Robinhood, including “millions of customers who received false or misleading information from the firm, millions of customers affected by the firm’s systems outages in March 2020, and thousands of customers the firm approved to trade options even when it was not appropriate for the customers to do so.” The false and misleading information included how much cash was in an account, downplaying the risk of trading options and approving margin trades for customers who didn’t understand the risk of a margin call. One Robinhood customer who had turned margin “off,” tragically took his own life in June 2020. According to FINRA, Robinhood had (allegedly) displayed an inaccurate negative cash balance in this investor’s account (and to other customers as well). There are strict regulations in place for determining whether or not a trader is experienced enough for options and margins trading. Robinhood assigned that task to bots that aren’t the Einsteins of the artificial intelligence industry. Apparently, the bots approved inexperienced traders who did not satisfy eligibility criteria or had other red flags in their accounts. Halted Trading on GameStop Other massive problems with Robinhood, which haven’t been problems at other brokerages, are power outages and restrictions on trading. Reddit’s Wall Street Bets traders are still infuriated about the GameStop trading fiasco, when Robinhood suspended trading of the stock during the height of the meme stock Short Squeeze. On March 2nd and 3rd, 2020, at the height of the volatility of the pandemic, Robinhood‘s website and app shut down. $12.6 million of FINRA’s fine is for restitution to “harmed” customers. Robinhood wrote in a blog on June 30, 2021 that the company is committed to enhanced customer support. Improvements include: more customer service support staff, better education, improved customer alerts and enhanced anti-fraud measures. Part of these measures were mandatory in the deal Robinhood made with FINRA. Reddit Boycott Robinhood is receiving a lot of negative publicity on Reddit‘s Wall Street Bets platform which is home to almost 11 million investors and traders. There you’ll find plenty of posts on “Robbing Hood,” comparing the company’s lack of customer service to having Beavis and Butthead as the call-center operators. There are posts with instructions on how to rollover your holdings to another brokerage and delete the app from your phone before the company’s IPO. No Lockup Period & Minimal Voting Rights New investors will have minimal voting rights. Existing employees and board members, with the exception of the founders and CFO, can sell up to 15% of their stock in the first day of trading. (The founders and CFO are limited to 5%.) Since Robinhood was founded in 2013, there is likely to be more than a few insiders who are ready to cash in their paper gains for dollars. In previous IPO insider liquidity events, the stock hits the board and then sinks the first day. Snap’s stock was underwater for 3 years. Zynga has never recovered to its IPO prices. Like Robinhood, Snap enjoyed amazing year-over-year revenue growth at its IPO, but struggled with multi-billion-dollar losses. Bottom Line There are 17.7 million monthly active users on Robinhood, according to the company’s S-1 filing. There are almost 11 million traders on Wall Street Bets. Will insider selling and the social media boycott doom Thursday’s Robinhood IPO? Should a company that only made $7 million last year be valued at $35 billion? When new investors rush in, while insiders sell sell sell, it can feel like trying to catch a falling knife. This is an unusual trading year, with an elevated appetite for risk. So, anything is possible. However, I’ll be looking for greener pastures in non-financial services industries for my investments in 2021. If you'd like to learn how to learn how to invest in great companies and manage volatile industries, like crypto, then join me for our 3-day Investor Educational Retreat. Our Company of the Year doubled in just two months, and we've had many Shoot the Moon stock picks in 2020 and 2021. You will also learn how to protect your wealth., while earning money while you sleep with a time-proven, 21st Century plan. Wisdom is the cure. It's time to become the boss of your money. Call 310-430-2397 or email [email protected] to learn more now.  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Families and friends registering together receive the best price. Click for testimonials & details. Other Blogs of Interest Will the Crypto Crash Hit Tesla, Square & Coinbase? China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed