|

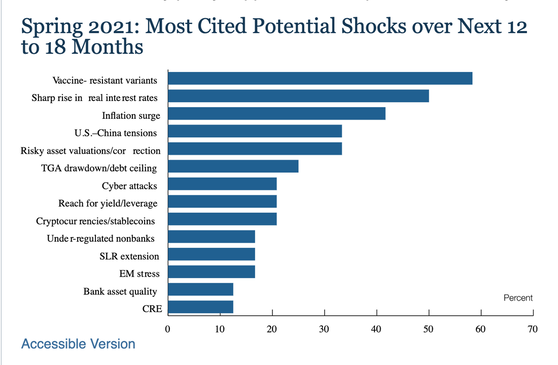

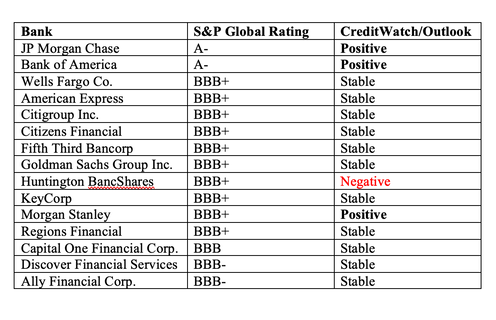

Bank Stress Tests. Fed Bond Sales. Debt Ceiling. Credit Downgrade? All Happening This Summer. The Federal Reserve Board will release the results from their bank stress tests this Thursday, June 24, 2021. This is expected to be a routine release. Since the last test showed strength in the banks and the stock market has been on a roar, there is unlikely to be any surprises. On June 30, 2021, banks may start repurchasing their own stock again – something that has fueled market gains for the past decade. That’s a tailwind for stocks, as is the great news that the U.S. economy is predicted to grow 7.0% in 2021 – the highest GDP growth in decades. The only country scoring higher is China (at 8.4%). Economic Storm Clouds The skies are blue for the economy this summer, with a few economic storm clouds on the horizon. Debt, asset valuations, structural shifts in a few industries, the Debt Ceiling, inflation and other bugaboos threaten to scuttle the smooth sailing into YOLO Shoot the Moon Eden. Below are a few economic storm clouds to watch out for, and a few reasons why you always want to be properly protected and diversified. (Call our office at 310-430-2397 or email [email protected], if you’d like an unbiased 2nd opinion whether your plan is properly diversified and protected.) Insurance Companies & Hedge Funds are “Highly Leveraged” Banks Are at the Lowest Rungs of Investment Grade Asset Prices are “Elevated” Feds Selling Bonds Margin Trading Debt Ceiling Insurance Companies & Hedge Funds are “Highly Leveraged” It is the nonregulated financial services industries, particularly insurance companies and hedge funds, that are of the greatest concern to financial stability. According to the Federal Reserve Board’s Financial Stability Report, which was released on May 6, 2021, “The leverage of some NBFIs [nonbank financial institutions], such as life insurance companies and some hedge funds, is high, exposing them to sharp drops in asset prices and funding risks.” Money market funds, bond and bank loan mutual funds are also at risk of “funding strains and sudden redemptions.” Life insurance companies tend to invest in corporate bonds, Collateralized Loan Obligations and commercial real estate. CRE is experiencing a structural shift (empty office buildings), and corporations are highly leveraged. (Over half of the S&P500 is at or near speculative status, at the lowest rung of investment grade.) Hedge funds are pretty opaque with regards to regulatory oversight. Meltdowns, such as happened with Archegos Capital Management in March of 2021, rarely come with any warning and can drag down stocks. Banks Are at the Lowest Rungs of Investment Grade Perhaps a better peak into the health of the banks is to look at their credit scores. Surprisingly, even though they are passing stress tests, many are at the lowest rung of investment grade. Revenue is down, risk is up and valuations are pretty pricey in the banking industry. Many banks have risk exposure to empty office buildings, vacant fashion malls and consumer debt. Companies and consumers borrowed to get through the pandemic, pushing debt levels to astronomical status. With the wind-down of the eviction and foreclosure moratoria, and with less unemployment benefits and easy money showing up in consumers’ checking accounts, stress could start showing up in housing, commercial real estate and credit card debt. In March of 2021, almost 5 million Americans didn’t make a housing payment, and over 26 million people skipped their student loan payment. Consumer debt keeps hitting new highs each month (source MBA.org). According to the Financial Stability Report, “Shares of commercial and industrial (C&I), CRE, and residential mortgage loans in loss mitigation have remained elevated.” Office buildings are still empty, even with the Return to Normal protocol happening across the U.S., and some (mostly banking) CEOs demanding their employees return to the office. Since bankers and REIT owners are smart enough not to flood the marketplace with empty buildings for sale, low transaction volumes are masking declines in property values, except in isolated incidents. (Read my article on the Times Square building that plunged 80% in value.) The Feds acknowledged this in their report. When the funding runs out and the business has to restructure, the value plunges overnight. Asset Prices are “Elevated” The markets have already priced in an amazing recovery year for 2021. According to the Federal Reserve’s Financial Stability Report, “Valuations are generally high.” As the report warns, “Asset prices may be vulnerable to significant declines should investor risk appetite fall, progress on containing the virus disappoint, or the recovery stall.” Between February 19, 2020 and March 23, 2021, the Dow Jones Industrial Average plunged 35% -- before most investors knew we were in a pandemic. Wall Street zips faster than Main Street and retail investors can respond, particularly when there is this much leverage in the system. Feds Selling Bonds One of the biggest problems during the dramatic drop and economic crisis of March 2020 was that bonds froze up. (So did money market funds, and even Treasury bills.) Bonds became illiquid. The Feds initiated a bond purchase program where they scooped up more than 1,200 distressed individual bonds and numerous junk bond ETFs. As of June 2, 2021, the Feds will now begin selling the bonds they purchased. The market is perceived to be functioning well enough for this to occur without any hiccups. It’s also a red flag for retail investors that you need to know what you own on the safe side of your nest egg. Illiquid, negative-yielding assets are not as safe as you believe. Margin Trading Retail investors are more leveraged today than ever (source: FINRA). When stocks are in the money, this is less of a problem than when things head south. The amount of leverage in margin trading provides fuel for a rapid, robust reverse of direction, if any bad news should make investors more risk-averse. Those trading on margin will be the most vulnerable. However, all investors could be impacted. Debt Ceiling The current U.S. Treasury borrowing authority ends on July 31, 2021. Congress will have to raise the Debt Ceiling (again) before that time to prevent a government shutdown. The fact that Fitch Ratings currently has the U.S. AAA credit rating on a negative outlook is yet another threat to smooth sailing to the land of endless market gains. This will become more problematic if the Debt Ceiling is not raised in a timely manner. Bottom Line 2021 should be an extraordinary recovery year for the U.S. However, it could also be rife with hurricanes. Have fun. But, also make sure that your financial home is secure enough to withstand any economic storms that might hit. Join us for our Oct. 9-11, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn what's safe in a Debt World, how to make a smart investment in real estate, pick hot funds and companies (like crypto, cannabis and our 2021 Company of the Year), and how to incorporate hard assets and safe havens into a well-diversified wealth plan. You'll discover how to protect your wealth and save thousands annually in your budget with smarter big-ticket choices. The retreat is a complete Money Makeover that will transform your life forever. Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now. Register by June 30, 2021 to receive the lowest price.  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price when you register by June 30, 2021. Click for testimonials & details. Other Blogs of Interest Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden.

Ms Webb

27/6/2021 10:28:21 pm

HIRE A PROFESSIONAL HACKER TODAY FROM CONTRACT HACKERS! Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed