|

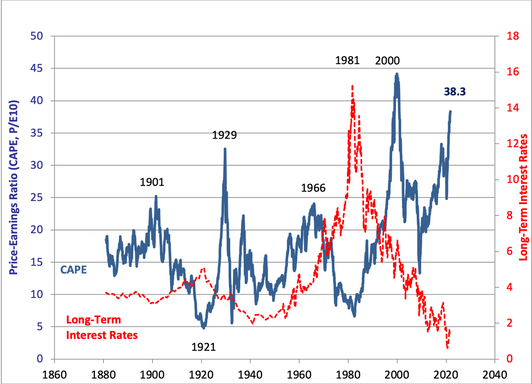

In a year when the S&P500 is boasting almost 25% gains year-to-date, the ARK Innovation ETF (ARKK) is down -23% on the year and -40% from its high of $159.70 set on February 12, 2021. Check out the chart below. ARRK's downward trajectory is in neon blue. The strong performance of the S&P500 is in orange. Many meme stocks have fallen hard from their soaring prices at the beginning of the year (following the Stimmy checks). Gamestop traded at $158 on Dec. 17, 2021, after summiting at $483/share on Jan. 27, 2021. AMC rests at $32 after soaring to $72.62 on June 2, 2021. Blackberry traded at $9, after spiking at $29 on Jan. 27, 2021. Tilray got high on $67/share on Feb. 10, 2021, and now sells for under $8/share. What is happening? Which of these funds/stocks are a value now, if any? What lessons can be gleaned from the rollercoaster ride? We’re going to look at the culprits that keep coming up over and again, namely: price, sales, P&L (profits and losses) and popularity (marketing/pump & dump). Ark Innovation ETF (symbol ARKK) What’s going on with ARKK? Price matters. All of the top holdings of this fund, with the exception of Teladoc, are still trading at astronomical multiples, even after the drop of 40% in the fund. Yes, the top holdings are all innovating. Sales growth is impressive. But the prices are just too high. One of the top holdings in the ETF is Tesla. Tesla’s sales growth was 57% year over year. That looks amazing compared to General Motors and Ford. Those companies saw declines in sales growth of -24% and -5%, respectively. However, the Chinese electric vehicle makers are doubling and tripling sales year over year. Many Chinese EVs are going to sell into the European market and compete with Tesla there, in addition to China. So, should a company like Tesla that earned less than a billion dollars last year be worth almost a trillion? Tesla’s price earnings ratio is 300. An average price earnings ratio is about 17. Most of the top holdings of the ARK Innovation Fund have less than a billion in earnings, or are losing money. Yet, almost all enjoy market values of close to $50 billion, or in the case of Tesla, $913 billion. Popularity Wanes Many people were very tempted to buy into ARK funds at their zenith. Ark ETFs benefited from a lot of media coverage when the company’s funds soared. Catherine Woods and her crew now face stinging criticism and pressure from the broadcasts and blogs about how poorly the funds have done in 2021 – losing money, while the S&P500 raked in the dough. Professional investors sell high – particularly when things get frothy. (Large investors are given priority treatment in trade order. Many use algorithms and high-frequency trading, in addition to professional analysts and researchers, to assist them.) Traders who follow headlines and charts are easy prey to the professionals because headlines most often put you on the wrong side of the trade – buying high and selling low – and charts rarely predict a reversal of fortune when the trendline keeps busting through the ceiling. Another concern is that Ark Funds is a relatively new fund company – founded in 2014. In a high-leveraged world, it’s safer to stick with fund companies that have been around a lot longer, have a high credit rating and are well-capitalized. You can access funds with targeted innovation and other desirable industries and specialties in through fund companies that have been around a lot longer than ARK. As just one example, iShares U.S. Technology Breakthrough ETF is up 18% on the year, even with the current sell-off in technology. (iShares is owned by Blackrock – an AA- rated company.) As I mentioned above, Teladoc is oversold. Investors were willing to pay $308 a share for Teladoc in February 2021. It’s now at about $95 a share. With growth expected to be about 43% in the fourth quarter and 2021 revenue doubling what 2020 was, it appears that Teladoc could be ripe for purchasing. Cyber Security Crowdstrike, Cloudflare and Okta are all trading 30-40% lower than their 52-week highs. This is another case of price and profitability matters. All of these companies had net losses last year, with noteworthy sales growth ranging from 50-65%. However, the price-sales ratios are 50 for Crowdstrike and 100 for Cloudflare – even after the rout. Elevated prices make professional investors skittish at the first sign of a data breach or resurgence in the pandemic. News of Omicron emerged in late November and cybersecurity firms have been on the selling block since. These companies are in demand. Once their prices come back to reality, there could be some excellent buying opportunities. Cryptocurrency Bitcoin is down -32%. It was trading at $46,829 a coin on December 19, 2021. On November 9, 2021, you could’ve sold your bitcoin for $69,000 a coin. The biggest issue in the crypto-world is the disconnect between investor hopes and reality. Crypto gurus convince their devotees to buy and hold, while whales trade. The average holding time for the most popular coins is under 90 days. (Bitcoin: 75 days, Ethereum: 69 days, Solana: 30 days, Cardano: 73 days, Dogecoin: 48 days.) You can’t have a currency that squirrels around with such nutty price fluctuations. Cryptocurrency is a trading platform where everyone is hoping to get rich and quit their day job. The other issue with Bitcoin and Ethereum is that they are energy hogs. According to energy experts, mining these OG crypto coins takes up far more energy than running a data center, and data centers are a real problem for technology firms that are trying to reduce their CO2 emissions. Tesla very famously used this excuse to get out of accepting Bitcoin for their products back in May 2021. A lot of Millennials and Gen Z, who are the most interested in cryptocurrency, are also the people who are the most concerned about healing our planet. What happens when their conscience weighs more heavily in the balance than fear and greed? That leads me to be more interested in altcoins, such as Cardano. Whatever coin we choose, in today’s Wild West World, we have to be an active trader, rather than a Buy & Hold investor. There may come a time when cryptocurrency is something that we use on a regular basis. However, for now it’s still the pot of gold at the end of the rainbow. It’s also very important to be diversified. Don’t place all of your eggs in the cryptocurrency basket. A hot slice or two to increase your portfolio performance may be appropriate, if you’re willing to babysit these investments. Meme Stocks With regard to meme stocks, it appears that at least some were pump and dump schemes. Bed Bath and Beyond and Blackberry’s prices have a giant knife-drop bisecting their year. After shooting the moon, both of these stocks plunged by more than half within a week. Tilray’s trajectory looks similar. However, Tilray’s sales growth is up 53% year over year, whereas Bed, Bath and Beyond and Blackberry sales have sunk by 32% and 26%, respectively. GameStop and AMC are still trading a lot higher than they were a year ago. However, they are also well off their 52-week highs. Both of these companies were problematic before the pandemic. AMC’s sales growth looks spectacular this year compared to last year, and was up 539% in the 3rd quarter. However, that is still quite dismal compared to 2019. AMC’s sales were $5.471 billion in 2019, $1.242 billion in 2020, and are on track for $2 billion in 2021. Even with $5.5 billion in sales in 2019, AMC lost -$149.1 million. 2020 saw net losses of -$4.6 billion, with as much as -$1.5 billion on track to be lost this year. Gamestop has a similar issue. Sales are far below what they were in 2018 and 2019. The company has been cash negative since 2018. Gamers are not shopping at Gamestop today as they did in yesteryear. Bottom Line Price matters. Knowing how to price stocks is a lot trickier than normal shopping on sale. Additionally, regular rebalancing will help you to be on the right side of the trade and prompt you to sell high rather than watch your gains plummet. It’s also important to always keep a proper amount safe – an amount equal to your age. (Knowing what’s safe in a Debt World is going to be key.) Our stock portfolio is actually our “at risk” side. If we’re keeping enough safe and we are not losing money on the “low risk” side that is our biggest protection against losses. It also affords us the ability to buy low. (Most people don’t buy low because they can’t. They’ve lost too much money and don’t have any liquidity.) When we are properly diversified in the “at risk” stocks and funds (equities) side, we have large, mid and small companies. We are not over concentrated in one sector or style, whether it is technology, value (out of favor right now) or dividends. Then, when stocks soar, our slice becomes too large, or sometimes even two or more slices, and it prompts us to sell high. When our slice gets too small, it’s prompting us to buy low (or replace the slice with something better). So, the Nest Egg Pie Chart System (that we teach at our Investor Educational Retreats) is itself helping you to become more professional. All you have to do is learn the ABCs of Money that we all should have received in high school. If our strategy only works when stocks are high or are always going up, then we have a flawed strategy. Buy & Hold is a last century strategy that hasn’t worked very well in the 21st-century. It’s time to update the software with a 21st Century time-proven plan. If you're interested in seeing the Stock Report Cards that informed this blog, email [email protected] with SRCs from 20211221 in the Subject Line. February 11-13, 2022 Online Financial Empowerment Retreat Early Bird pricing ends Dec. 24, 2021  Join us for our New Year New You Financial Empowerment Retreat. Feb. 11-13, 2022. Email [email protected] to learn more. Register by Dec. 24, 2021 to receive the best price. Click for testimonials & details. Join us for our Financial Empowerment Retreat February 11-13, 2022 online. Email [email protected] with Retreat in the subject line to learn more and to register now. Access additional information, including pricing, curriculum and testimonials, by clicking on the banner ad above. Other Blogs of Interest Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions Will There Be a Santa Rally? The Dangerous Debt Ceiling Game The Robinhood IPO. Will the Crypto Crash Hit Tesla, Square & Coinbase? China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. This year, our team is pleased to offer you a free holiday gift, stocking stuffers that are under $10 and a last-minute deal that is guaranteed to arrive on time. If you and your loved ones are interested in prosperity and sustainability, then these opportunities could be the perfect present. Free Join Natalie Pace in 21 days of prosperity, abundance and sustainability. There will be 21 days of video coaching designed to transform the holiday spirit into a New Year New You that is ready to shine and heal the planet in 2022. Simply email [email protected] with FREE HOLIDAY GIFT in the subject line. You will begin receiving your gift on Boxing Day (Dec. 26, 2021). Enjoy 21 days of video coaching from Natalie Pace that will break down the walls that keep you stuck in a rut. Activate abundance, while also increasing your environmental awareness and reducing your CO2 footprint. “Just following the 21 days changed my mindset so much that my business went from just barely profitable to reaching record sales and profits 2 months later! I have now played The Gratitude Game a second time and intend to play it at least once a year! Thank you, Natalie!” Suzie Stocking Stuffers Under $10 Natalie Pace updated two of her bestselling books this year, The ABCs of Money (5th edition) and Put Your Money Where Your Heart Is (2nd edition). Both ebooks are just $7.99. The ABCs of Money for College ebook costs just $3.49! The ABCs of Money (5th edition) offers the ABCs of money that we all should have received in high school in real estate, stocks, bonds, gold, debt reduction, the Thrive Budget, cryptocurrency and much more. This book remained in the top 10 on Amazon in its vertical for over 3 years with an average 5-star rating (mode). "The ABCs of Money will teach you how to stop getting buried in debt and start scoring gains for the home team. The more you score, the more you'll win financial freedom and enjoy your life. College students need the information before they get their first credit card. Young adults need it before they buy their first home. Empty-nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, former Chairman & CEO, TD AMERITRADE Put Your Money Where Your Heart Is (2nd edition) is an original ESG investing book that also outlines the strategies Natalie Pace developed and used to become ranked a #1 stock picker (above over 835 A-list pundits). “Many people, including educated men and women, often get into trouble when they neglect to follow these simple and fundamental rules. That is why I recommend this book with enthusiasm.” Professor Gary S. Becker Gary Becker won the 1992 Nobel prize in economics. The ABCs of Money for College teaches your tween or teen how to get a better degree for up to half the cost. Student loan debt is a crisis in the U.S., with 40% of loans in forbearance. Parents: start the process of college planning when your kids are young, and the entire family will enjoy a fruitful journey creating the career path of your dreams. This guide also includes the Jobs of Tomorrow, from trade positions to Ph.D.s, and the unique trajectory that is appropriate for each individual. “There are many strategies in Natalie Pace's book, The ABCs of Money for College, that prepare families - remember education is a family journey - to uplift and educate their children. Natalie also shares strategies for students who are not well-supported at home to create their own pathway to success. Given the central role that investments in the human capital of our children will play in the success of our children and our country, Natalie's book could not be more timely or important.” Kevin M. Murphy, McArthur “Genius” Award winner. George J. Stigler Distinguished Service Professor of Economics, Department of Economics, The University of Chicago Booth School of Business February 11-13, 2022 Online Financial Empowerment Retreat Early Bird pricing ends Dec. 24, 2021 Bring a friend or family member for a price that is so low you have to go to the flyer to see it (or peek at the group pricing at the end of this blog).  Join us for our New Year New You Financial Empowerment Retreat. Feb. 11-13, 2022. Email [email protected] to learn more. Register by Dec. 24, 2021 to receive the best price. Click for testimonials & details. Learn time-proven, 21st Century wealth strategies at the February Retreat, including: * Performance enhancing strategies, including Shoot the Moon stocks * Easy-as-a-Pie-Chart Nest Egg Strategies that earn gains in recessions and outperform in bull markets * Investing in cryptocurrency (Bitcoin, Ethereum, Cardano, Dogecoin and beyond), FANG, cannabis and other hot industries * What’s Safe in a world where bonds are negative-yielding, losing money & defaulting, and money market funds have redemption gates and liquidity fees. * What’s Hot and how to invest in industries and companies with interstellar upside * 1-3 Times a Year Rebalancing for a buy low, sell high financial plan on auto-pilot * Why Buy & Hope is riding the Wall Street rollercoaster, costing most Main Street investors more than half of their wealth in every recession, and using the bull markets to crawl back to even. * How a time-proven 21st-Century plan can earn money while you sleep (with no more stress). * How to protect your wealth from stock market volatility and bond market illiquidity * The hottest industries and countries in the world * Learn how to put your money where your heart is & profit, ESG investing * Discover how to divest your retirement from polluters and companies that are destroying our planet * Why Growth stocks have almost quadrupled the returns of value over the past 3 years * Take our Rebalancing IQ Test (click to access) Testimonials “I am so grateful to have this opportunity and knowledge that allows me to feel empowered rather than paralyzed and fearful. Thanks to you, Natalie!” SM "Stocks and investing are no longer rocket science. We give thanks just about every day that we met Natalie. I feel like I live on a different planet. I'm so grateful. Thank you for changing our lives, our peace of mind, our future and our vision of what is possible. We made a tectonic shift with you." AC & AM "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM "Thank you, Natalie, for saving my retirement." Nilo Bolden. I met a new financial advisor/money manager, David, at a conference. I wanted to trust someone since my knowledge was lacking in this arena. I asked David if he was a fiduciary. He said he was, that everything he did was for us. David had put us into a variety of high-risk investments that were good for him, in that they paid him a high commission! Many of these companies have been cash negative for years, borrowing from one investor to pay off another, and paying brokers a high commission to do that. We put in the paperwork last year to cash out of these. Nothing!!! Then we redid the paperwork in August. We did everything by the book. Waiting… waiting… nothing. David, the salesman who put us into these investments, is not even returning our calls!!!! Now, we’re in the process of filing complaints with FINRA, the SEC and the FTC on all of those involved. If I can impart any wisdom to you, it is to remember that “financial advisors” are sales people. They know how to listen and manipulate to serve their best interests, all the while making you believe that they truly are your friend. I am so angry at this system!!!! It is still hard for me to accept David’s lack of integrity and respect in not responding. I am grateful we are now educating ourselves. Studying with Natalie Pace is giving us this opportunity. I wish everyone could take these workshops. It would be great if this was taught in schools. D&T, Indiana Read their full story here Groups of 5 Pay Just $368.80/Person* to attend the Feb. 11-13, 2021 Retreat Ensure that everyone you love has the financial foundation necessary to successfully navigate a post-pandemic world by registering for the Feb. 11-13, 2022 Retreat as a group. We’ll help you achieve that goal by giving you an unbelievable price. The individual rate to attend (in the Early Bird pricing period) is $695. (An in-person retreat would normally cost $995-$1650/person, so this is already incredible savings.) A group of 5 will pay just $368.80/person – cutting the individual price almost in half. You must register by Dec. 24, 2021 to receive these dramatic cost savings. 2nd Opinion on Your Current Wealth Strategy If you were worried about your strategy in March, or missed the opportunity to enjoy FANG stocks dropping by more than half in March of 2020, consider getting an unbiased 2nd opinion on your current wealth strategy from Natalie Pace now. A good plan protects you from downturns, while allowing you to profit in the bull markets. It also has you leaning into the hottest areas, while avoiding the money pits. Whether you are thinking of purchasing (or selling) a home, wondering which boxes to check off in your retirement plan, worried about how to protect your wealth from another downturn or sick of making everyone else rich with the high cost of everything in your life, Natalie Pace’s life math blueprint offers you a time-proven, 21st Century action plan. Testimonials “We asked Natalie Pace for a second opinion on our investment portfolio. She researched and reviewed each stock and fund. She then explained to us in plain English how we were positioned in the market and how high our risk exposure was. Her knowledge was so profound that we decided to take her retreat in Arizona. My husband was still quite skeptical, but 20 minutes into the retreat he turned to me and said, ‘Thank you.’ It's been a summer of miracles. Natalie contributed greatly to this. She added sanity and peace to my life. I am forever grateful.” AC & AM *These special offers are good through Dec. 24, 2021 only. Other Blogs of Interest Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions Will There Be a Santa Rally? The Dangerous Debt Ceiling Game The Robinhood IPO. Will the Crypto Crash Hit Tesla, Square & Coinbase? China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. The volatility that we’re experiencing on Wall Street recently is not just about the new Omicron variant of the coronavirus. Yes, that is of concern. However, it’s not the only spark that is causing the fiery swings. Here are a few of the other important considerations which you should be factoring into your nest egg. The U.S. Markets are Overvalued Congress Must Raise the Debt Ceiling Again Now GDP was Revised Down Again to 5.0% (from 7.0% earlier this year) Inflation Is Not as Transitory as the Feds Said Over Half of the S&P500 is at or near Junk Status Corporate Buybacks And here is a little more information on each point. The U.S. Markets are Overvalued If you don’t understand price-earnings ratio, historic price-earnings ratio, and where we are in the cycle today, the chart below should give you the visual reflection alarms that you need. As you can see, the only time when stocks were more expensive was before the Dot Com Recession, when the NASDAQ Composite Index dropped by 78% (source: Shiller CAPE ratio). The Great Depression has now fallen to the 3rd most speculative time for stocks. You can also learn more by listening to my “Wall Street Secrets” and “What’s Safe in a Debt World” videoconferences. Click on the blue-highlighted links to access them. Subscribe at YouTube.com/NataliePace to be sure that you catch my videoconferences when they happen. Congress Must Raise the Debt Ceiling Again Now Government funding runs out this week, if a new budget or extension is not agreed upon. Secretary of the Treasury Janet Yellen predicts that the Treasury’s ability to pay bills without an increase in the Debt Ceiling runs out around December 15, 2021. So, the Debt Ceiling needs to be raised to borrow more money, to put some capital back in the kitty to pay bills. Congress has a habit of bickering and procrastinating until the last minute before raising the Debt Ceiling. Politicians know that a default in the U.S. could plunge the world into a recession and disrupt global financial functioning. So, while investors create volatility in the stock market to indicate their displeasure with the way that Congress is handling their business, in general everyone expects for the Debt Ceiling to be raised in time. That is why we are seeing selling activity one day, and buying activity the next. If investors really thought Congress wasn’t going to raise the Debt Ceiling, there would very likely be a swift race for the sidelines (a plunge in the stock market). It's important to remember that Congress did indeed raise the Debt Ceiling in time to avoid a default, on August. 2, 2011. However, that wasn’t enough to save the U.S. AAA credit rating with S&P Global. Fitch Ratings currently has the U.S. AAA rating on a negative outlook. Moody’s indicated that a failure to raise the Debt Ceiling would be a global crisis. The last time the U.S. credit was downgraded, on August 5 of 2011, gold and silver soared to all-time highs, and stocks fell. Stocks recovered pretty quickly, as investors clung to the Moody’s and Fitch Ratings AAA credit scores. During the next credit downgrade (in 2022?), the most popular cryptocurrencies could benefit, as crypto is the “new gold” for Millennials and Gen Z. The altcoins are a better bargain than Bitcoin and Ethereum. GDP was Revised Down Again to 5.0% (from 7.0% earlier this year) The 3Q 2021 GDP growth came in at 2.1%, after 6.7% and 6.3% in the 1st and 2nd quarters, respectively. Some economists, including the Atlanta Federal Reserve Bank’s GDPNOW, are predicting a great 4th quarter of GDP growth – above 8.0%. However, with the new 5.0% number being reported by Federal Reserve Board Chairman Jerome Powell (in his testimony to the U.S. Senate Banking, Housing and Urban Affairs Committee on Nov. 30, 2021), it’s possible that 4Q 2021 GDP will come in under 5.%. That’s still respectable, particularly given the pandemic, and one of the strongest annual GDP experienced by the U.S. in decades. However, it’s difficult to justify lofty price-earnings ratios when the GDP growth keeps getting revised down. This is why investors are so skittish and the swings are so dramatic. 2022 GDP growth is expected to come in at 3.8%, according to the Summary of Economic Projections (SEP) from the September 2021 Federal Reserve Board meeting. New economic projections will be released on Dec. 15, 2021, at the conclusion of the FOMC meeting. Inflation Is Not as Transitory as the Feds Said The Federal Reserve Board has been stressing that 2021 inflation is temporary. It was their belief that they needed to let inflation run up a bit to pull persistently low inflation into their target range. In Powell’s testimony on Nov. 30, 2021, he indicated that inflation could remain elevated throughout much of 2022, though forecasters continue to believe that “inflation will move down significantly over the next year.” What does that mean for investors? Interest rates are likely to tick up, at least twice, in 2022. By 2024, the Fed Fund rate is expected to have jumped from zero (where it is currently) to 1.8%. We’ll know how nervous the Feds are about inflation on Dec. 15, 2021, when the new SEP is released. This is not favorable for existing bondholders, and will put pressure on some of the most highly-leveraged firms on Wall Street, particularly those that are suffering most from the pandemic, including commercial real estate, airlines, travel, hospitality, casinos, etc. Over Half of the S&P500 as at or near Junk Status That includes a lot of banks, financial services companies, insurance companies and essentially all of the institutions that hold our future in their hands. Now is the time to know what kind of safeguards are in place for your cash, annuities, bonds, munis, CDs, and other assets that you have been told are “safe.” There is an entire chapter on “What’s Safe in a Debt World” in the 5th edition of The ABCs of Money. (At under $8 for the ebook, this makes a great stocking stuffer.) With U.S. equities overpriced and leverage quite high, value funds are not a value. Value funds are getting trounced by growth. The Growth-Rich NASDAQ Composite Index Compared to the Debt-Laden Dow Jones Industrial Average over the past 3 Years (Dec. 2019-Dec. 2021) Corporate Buybacks The one bright spot for Wall Street is that corporate repurchases of their own company stock is on fire. According to Howard Silverblatt, the senior index analyst of the S&P500® (and other S&P Dow Jones indices), the 3rd quarter of 2021 set a new record for corporate buybacks, at over $225 billion, and 2021 is expected to replace 2019 as the highest dollar amount of stocks repurchased within a year. Apple leads the charge with $85.5 billion worth of share repurchases in the first 3 quarters of 2021. Corporate buybacks are the primary reason why the U.S. equity markets have typically recovered the day after a sell-off, and also why equities are so overvalued. As long as the debt ceiling is raised on time, this is expected to continue. However, if Congress gets too close to the X date of defaulting on our payments, and Fitch or Moody's responds with a downgrade, all bets on the buybacks are off. The next Federal Reserve Board meeting will be Dec. 14-15, 2021. Bottom Line The Omicron Variant is sparking volatility because of the leverage and overpricing that is happening in the U.S. markets. Other countries are not as overvalued, including many countries with GDP above that of the U.S. (This is something that I will cover in the Dec. 2021 free videoconference. Email [email protected] if you’d like to join us on Thursday, Dec. 16, 2021 at 5 pm PT. If you’re already on the list, you don’t need to email.) What should you do to protect yourself from the pandemic and all of the other concerns listed above? Consider:

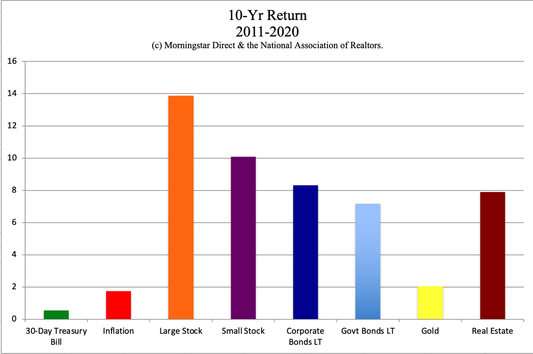

Your best strategy is not trying to market time, or jumping out of the market and into something you think is a hot safe haven. Never invest on headlines or with your emotions. Proper diversification with regular rebalancing protects your wealth and keeps an appropriate amount at risk, so that you can participate in the gains of the stock market, which are an impressive 21.6% year-to-date, after an equally stellar 16.3% gains in 2020. Stocks are typically the best game in town. This system is also a Buy Low, Sell High plan on auto-pilot that takes the emotions out of the mix, if you do it properly. If you’d like pricing and information on an unbiased second opinion, email [email protected] with Second Opinion in the subject line. You might also consider joining us for our Financial Empowerment Retreat February 9-11, 2022 online. Email [email protected] with Retreat in the subject line to learn more and to register now. Access additional information, including pricing, curriculum and testimonials, by clicking on the banner ad below.  Join us for our New Year New You Financial Empowerment Retreat. Feb. 11-13, 2022. Email [email protected] to learn more. Register by Dec. 24, 2021 to receive the best price. Click for testimonials & details. Other Blogs of Interest From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions Will There Be a Santa Rally? The Dangerous Debt Ceiling Game The Robinhood IPO. Will the Crypto Crash Hit Tesla, Square & Coinbase? China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed