|

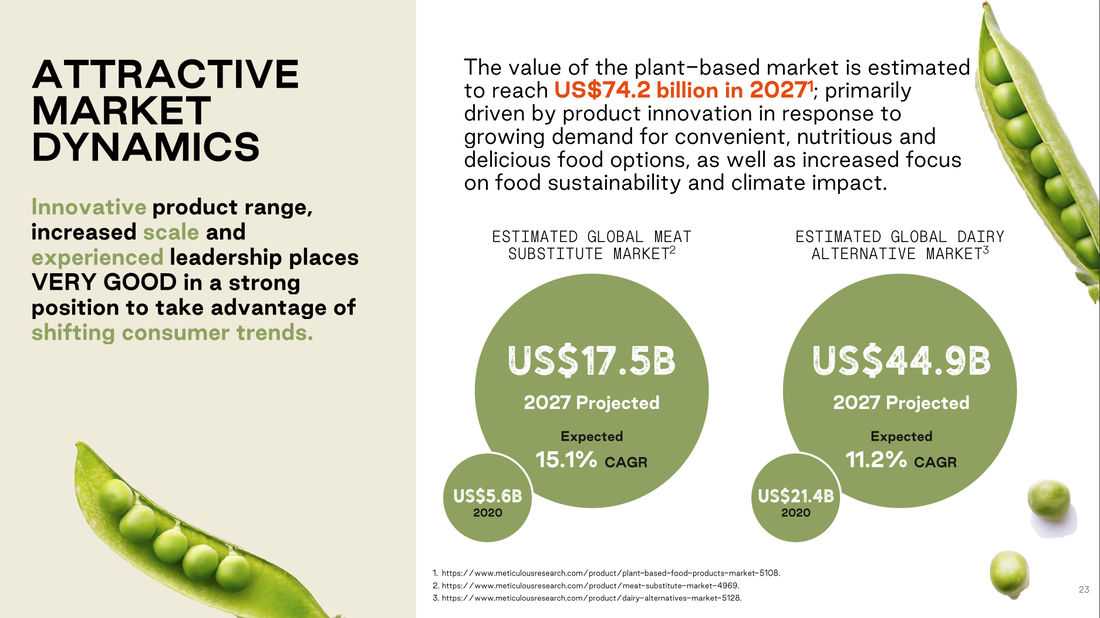

Beyond Meat Trades at a Pandemic Low Beyond Meat dropped to a 52-week low yesterday after announcing that the company had underestimated the effect the Delta Variant would have on restaurants (like McDonald’s) using their product. Other calamities included severe weather on the East Coast, which led to water damage in the inventory, and loss of potable water for two weeks in one of their factories. Beyond Meat’s revenue growth is still predicted to be about 12.3% higher than the third quarter of 2020. However, it will also be almost 30% lower sequentially. Investors responded by selling. The share price plunged by 13% at the market close yesterday, and is trading at prices we haven’t seen since the pandemic plunge in Spring of 2020. The Very Good Food Company’s Share Price Sinks The Very Good Food Company, a popular plant-based protein company out of Vancouver, has seen its share price implode by 77% off of the 52-week high. In December of 2020, the company was selling for $7.15 a share. Today you can buy it for $1.71. Oatly is near a 52-week low as well, trading at half of the $29 price investors were willing to pay in June of this year. Meanwhile, The Very Good Food Company’s year-over-year revenue growth is 156%, while Oatly’s annual sales gains are a respectable 53%. So why are plant-based protein companies experiencing a fire sale in their share prices? Are they experiencing supply chain bottlenecks? Has demand gone down? The Plant-Based Meat Market According to ResearchandMarkets.com, the plant-based meat market is projected to reach $35 billion by 2027, after hitting $13.6 billion in 2020. Having hot products in a game-changing space easily explains why The Very Good Food Company experienced 156% year-over-year revenue growth in the most recent quarter, compared to last year. 2021 will be the first year that The Very Good Food Company enjoys over $10 million in sales. The company recently expanded out of Canada and into California, and purchased The Cultured Nut in order to begin offering plant-based cheese. So, impressive growth at $VGFC (the NASDAQ ticker symbol) is built-in through M&A, as well as increased consumer interest in plant-based proteins and dairy. Beyond Meat sold $407 million of its product in 2020. They are building factories in China and the Netherlands. They are expanding globally. Both of the above-mentioned plant-based companies have competition from Impossible Foods (privately held), as well as the traditional meat companies that are expanding into this space. Legacy brands such as Tyson foods, Kellogg and ConAgra all have plant-based protein products. Plant-Based Dairy The Food Institute is projecting that the dairy alternative market will hit about $45 billion by 2027. Plant-based cheese sold about $1.01 billion in 2019, but is gaining traction. Plant-based milk, ice cream and yogurt are starting to hit the retail shelves. You can get Oatly‘s milk and yogurt at Starbucks. The Very Good Food Company advises that its cheese products will be available in retail stores by the fourth quarter of this year. Oatly hit the big boards with a bang on May 20, 2021, but has since seen its share price weaken. Shares are trading at half of where they were in June. The company has been one of the worst performers this year, at a time when the S&P500 keeps setting new all-time highs. Any fast-growing industry is bound to have challenges and setbacks as it invests in factories and expands. The pandemic and severe weather events exacerbate and complicate the plans of many businesses, particularly in consumer goods. However, there is no denying the explosive demand in the plant-based protein and dairy markets. Young Mavericks, like those mentioned above, can have wild fluctuations in the share price, as investor sentiment seesaws between undervalued and Shoot the Moon status. When I reported on this industry back in May, I was concerned about the valuations of these companies, particularly the share price of The Very Good Food Company. Today all of these companies are on a fire sale. While the old school food companies, such as Conagra, are less volatile, they are also slower growth and more heavily indebted. Their share prices don’t move as much in either direction, up or down. The companies rarely innovate themselves. Rather they tend to target the upstarts as acquisition candidates. That can be a good thing if you’ve invested in the most-beloved brand at a great price, before the suitors come calling. While the pandemic continues to pose challenges for all consumer goods, the plant-based protein and dairy market could be a bright spot on the horizon for investors. These companies make tasty food. Meatless Mondays are a treat many families look forward to. You don’t have to compromise flavor or culinary creativity. The Very Good Food Company has excellent recipe ideas all over Instagram, and even a barbecue rib product made out of jackfruit. Oatly and almond milk have become staples in the side door of many refrigerators. Once folks head back to restaurants, they can opt for a Beyond Meat McPlant Burger at McDonalds (in select locations). Beyond Meat reports 3rd quarter earnings on Wednesday, Nov. 10, 2021, after the markets close. The sell-off happened when the company revised their 3Q 2021 earnings expectations down (on Oct. 22, 2021). Investors will now be keen on the 4Q 2021 forward outlook when earnings are announced. Oatly will report on Nov. 15, 2021 before the U.S. markets open (at 9:30 am ET). The Very Good Food Company’s results should come around Nov. 19, 2021. Bottom Line I have been a fan of plant-based protein products for years. As someone who believes in putting your money where your heart is, the only thing that held me back from investing in the past was the price of the stocks. With the plant-based protein companies experiencing a fire sale, I’m in! Full disclosure: Really. I’m in. I own Beyond Meat and The Very Good Food Company. If you'd like to learn how to learn how to invest in great companies, like The Very Good Food Company and our 2021 Company of the Year (which tripled in share price), how to protect your wealth and how to manage volatile industries, like gold, cannabis and crypto, then join me for our 3-day Investor Educational Retreat. We've had many Shoot the Moon stock picks in 2020 and 2021. You will also learn how to earn money while you sleep with a time-proven, 21st Century plan. Wisdom is the cure. It's time to become the boss of your money. Call 310-430-2397 or email [email protected] to learn more now.  Join us for our New Year New You Financial Empowerment Retreat. Feb. 11-13, 2022. Call 310-430-2397 or email [email protected] to learn more. Register by Nov. 1, 2021 to receive a complimentary private, prosperity coaching session (value $300) and the best price. Click for testimonials & details. Other Blogs of Interest What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions Will There Be a Santa Rally? The Dangerous Debt Ceiling Game The Robinhood IPO. Will the Crypto Crash Hit Tesla, Square & Coinbase? China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed