|

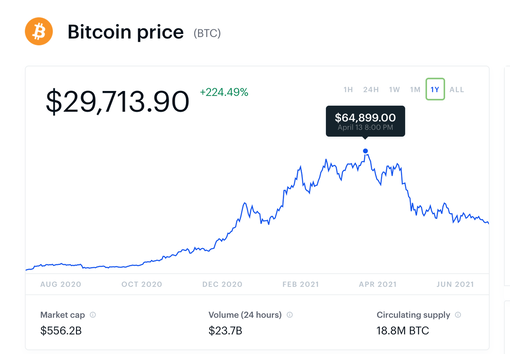

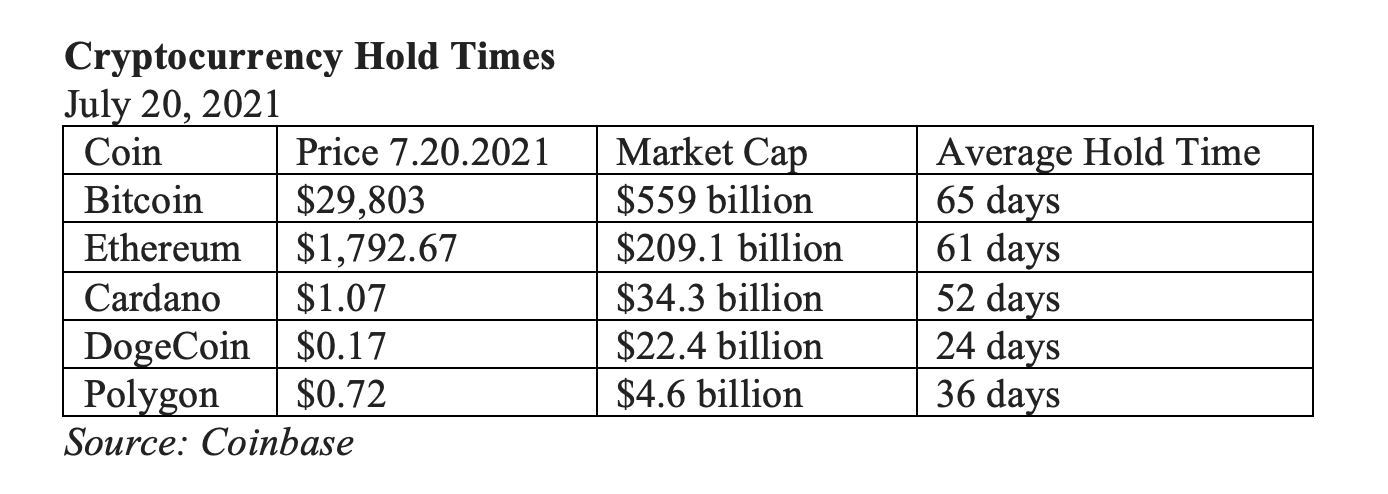

Bitcoin High: $64,899/coin on April 13, 2021. Bitcoin Price: $29,713.90 on July 20, 2021 This week, two crypto founders announced that they were departing the industry. They have different reasons. One of them cited security concerns. The other one believes that the space has become rife with billionaire parasites essentially baiting and then sucking the life out of retail Main Street investors. According to Jackson Palmer, the founder of Dogecoin, “The cryptocurrency industry leverages a network of shady business connections, bought influencers and pay-for-play media outlets to perpetuate a cult-like “get rich quick” funnel designed to extract new money from the financially desperate and naive.” Anthony Di Iorio, the co-founder of Ethereum, doesn’t like the “risk profile” of crypto and believes that he would be safer personally if he were in a different industry. (He’s a billionaire, so personal security is undoubtedly a part of his future no matter where he focuses his attention.) Should the disenchantment of these mavericks be a concern? Yes. Executive exodus is always a red flag. Jeff Bezos stuck through Amazon through thick and thin – through three recessions. Andreessen and Horowitz have been all things technology throughout their careers. Tim Cook keeps figuring out new ways to put his products in our hands, and keep us glued to all things Apple. If you believe in pirating a corrupt industry, like fiat currency, then why not stay on board and finish the job? Palmer believes that "despite claims of 'decentralization,' the cryptocurrency industry is controlled by a powerful cartel of wealthy figures who, with time, have evolved to incorporate many of the same institutions tied to the existing centralized financial system they supposedly set out to replace." The exit of Di Iorio and Palmer doesn’t doom crypto to the grave, or wipe out the possibility that digital coins and blockchain will play a role in the future. Short-term traders might still make money by speculating. However, when you’re hearing that such-and-such coin is a buy and hold play because it will be the only thing of value in the future when the dollar becomes worthless, you’re in the clutches of those pay-to-play infomercials that Palmer is warning about. The average hold time for even the most well-known coins is in weeks, not years. For the purposes of this blog, I am focusing on a few of the companies that benefitted from the crypto rally in the first quarter, and how those companies will be impacted by the crypto crash of the second quarter. Square, Tesla and Coinbase will all announce results over the next few weeks. Tesla Tesla earnings: July 26, 2021 2:30 PT In the first quarter 2021 earnings call on April 27, 2021, Tesla CFO Zachary Kirkhorn talked up Bitcoin’s “liquidity,” and Tesla’s long-term commitment to the coin (although they’d captured gains in March on 10% of their $1.5 billion in holdings). The sale offered a “small gain” to the 1st quarter financials, according to Kirkhorn. Suddenly, an about-face occurred on May 12, 2021, when Elon Musk tweeted that Tesla would no longer accept Bitcoin, citing concerns over the amount of power used in mining and transacting with the cryptocurrency. Why was this an issue suddenly, when clearly any C-level should have known about the energy problem before plunking down a billion dollars? Did it have to do with the regulatory credits that Tesla receives for manufacturing electric vehicles. In the 1st quarter of 2021, credits offered a boost of $518 million to Tesla’s revenue. Can Tesla sell carbon credits to gas guzzling manufacturers when its currency is forged with coal emissions? Was it a moral or a financial incentive that set Tesla’s executives straight? Did regulators knock on the door, or was it investor activists, Grimes, a plummet in the price of Bitcoin or EARTHDAY.ORG that sobered Tesla’s leadership up? By the date of Elon’s Bitcoin Exit tweet, Bitcoins were trading down significantly from the high of $64,899 (hit on April 13, 2021), at $49,499/coin. Anything purchased with cryptocurrency before the Bitcoin suspension would have lost money. Tesla’s $1.5 billion in Bitcoin at the end of the 1st quarter would be worth about $895 million on June 30, 2021. Since cash and cash equivalents have to be recorded at fair value, this should have a negative impact on Tesla’s income. From a revenue perspective, however, Tesla will have a spectacular 2nd quarter. For the first time in the company’s history, more than 200,000 vehicles were produced and delivered (206,421 and 201,250, respectively). Deliveries are up 121% year over year, with production up 151%. That could put revenue in the range of $13.34 billion, which would be more than enough to absorb the drop in Bitcoin value, unless there were quite a large number of cars purchased with Bitcoin (unlikely?). We’ll know the details on July 26, 2021, when Tesla announces earnings. Square Square earnings: August 5, 2021 2 pm PT Square’s net income in the first quarter of 2021 was $39 million, with net revenue of $5.06 billion. Square’s net revenue included $3.51 billion of Bitcoin revenue (which was up 11X year over year). Square acknowledges that Bitcoin’s volume and price fluctuates, which will affect their bitcoin revenue. The question is, “How much?” Assuming Square’s Bitcoin revenue dropped 40% in the 2nd quarter due to the price correction, and Square’s other revenue remained constant, Square’s 2Q 2021 revenue could be in the range of $3.656 billion. That would still be impressive year-over-year growth of about 90%. Is that enough to justify a price-earnings ratio of 382? Should a company with under $200 million in annual net income be worth $111 billion? Coinbase Coinbase earnings August 13, 2021 (ish?) On April 13, 2021, Bitcoin’s market capitalization was over a trillion. Today, Bitcoin is worth $556.6 billion. While Coinbase forecasted in the 1st quarter earnings release that the 2nd quarter revenue was looking to meet or exceed the 1st quarter, that didn’t pan out. The crypto crash will materially impact Coinbase earnings. However, Bitcoin prices were in the $9,000/coin range in June of 2020. So, even though the 2nd quarter 2021 crash has been substantial (down by more than half from the high in April), prices are still 3X higher than a year ago. If Coinbase revenue drops by 40% to the $1 billion range (from $1.8 billion total revenue in the 1st quarter), it would still be up 5.4 times on a year-over-year basis. That kind of growth in today’s world is astonishing (outside of the COVID-19 vaccine manufacturers). However, when a company boosts a price-earnings ratio of 84.60, investors are looking for forward momentum. Having a 40% contraction on revenue quarter over quarter will concern investors. Bottom Line The crypto crash has caught many retail investors on the wrong side of the trade. (Downturns tend to be initiated by hedge funds and institutional investors.) But it will also impact the platforms and early adopters, such as Coinbase, Square and Tesla. Those three companies are trading at intergalactic multiples. When lofty valuations meet a crash in fundamentals, repricing and losses can occur. Investors have had a gluttonous appetite for risk, and 2021 GDP growth of 7.0% is the best in decades. Investors have become so forward-thinking -- looking beyond pandemics and crashes -- that a drop in share price is not a given, even with outlandish price-earnings ratios. I don’t expect crypto impairments to impact Tesla's earnings as much as Coinbase and Square, due to the impressively strong 2nd quarter deliveries of Tesla. Tesla’s income will be impacted by Bitcoin’s volatility, but the company should have room in the revenue growth to report solid earnings nonetheless. Both Coinbase and Square look solid compared to last year. But the plunge in quarter-over-quarter revenue might be too volatile for investors’ appetites, particularly since the revenue of both companies is highly dependent on Bitcoin and Ethereum. If the crypto executive exodus continues, cryptocurrency runs the risk of a continued rout, taking the revenue of these two companies down the drain with it. Learn more about Tesla, Coinbase and cryptocurrency in my previous blogs. (Click to access.) If you'd like to learn how to learn how to invest in great companies and manage volatile industries, like crypto,, then join me for our 3-day Investor Educational Retreat. You will also learn how to protect your wealth., while earning money while you sleep with a time-proven, 21st Century plan. Wisdom is the cure. It's time to become the boss of your money. Call 310-430-2397 or email [email protected] to learn more now.  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Families and friends registering together receive the best price. Click for testimonials & details. Other Blogs of Interest China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed