|

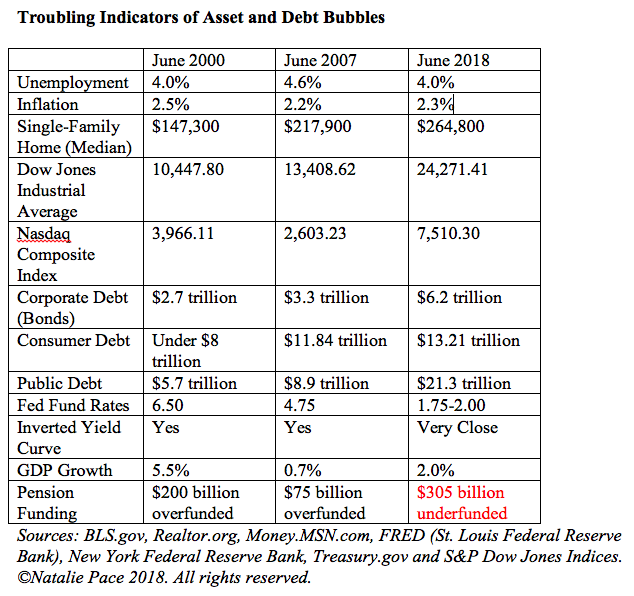

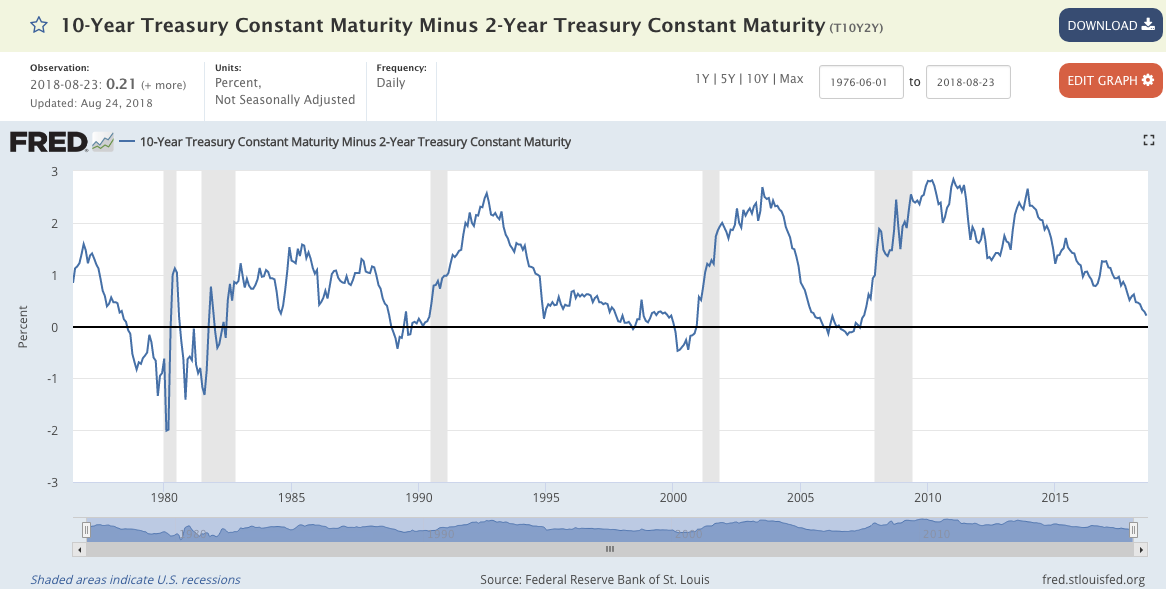

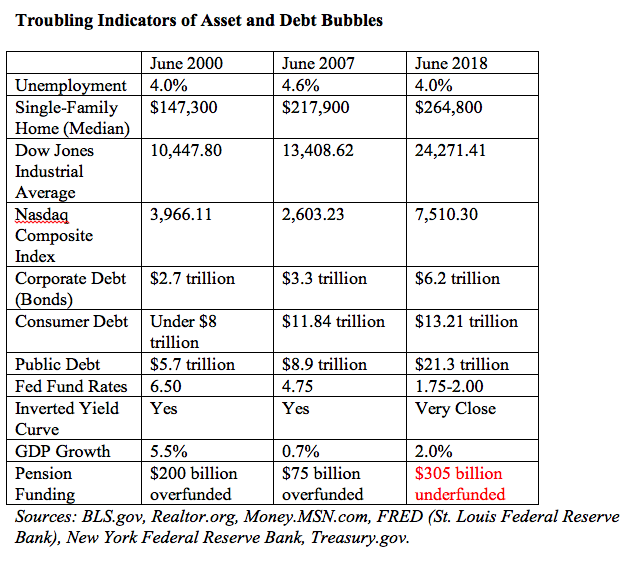

Odds of an Interest Rate Hike September 26, 2018 Are At 90%. And other important take-aways from Federal Reserve Chairman Jerome Powell’s speech on August 24, 2018 at Jackson Hole, Wyoming and the FOMC minutes of the August 1, 2018 Meeting. This blog was updated on September 22, 2018. According to the minutes of the July 31-August 1, 2018 Federal Open Market Committee meeting, the Fed Funds futures contracts put the odds of a Fed Funds rate increase at the September 26, 2018 meeting at higher than 90%, even though the yield curve has flattened. If Federal Reserve Chairman Jerome Powell raises rates, as is expected, this will be in direct opposition to the Tweets of the President. So should interest rates rise, or is this slaying the 10-year old bull market before its time? There are many takeaways from Federal Reserve Chairman Jerome Powell’s speech on August 24, 2018 at Jackson Hole, Wyoming and the FOMC minutes of the August 1, 2018 Meeting that explain why the Feds are raising the Fed Fund rate at this time. For additional information on the case for raising interest rates, refer to my blog, “The Federal Reserve vs. The White House.” Jerome Powell explained why he and his colleagues are looking beyond just unemployment and inflation as harbingers of the next recession in his speech at Jackson Hole on August 24, 2018, saying, “In the run-up to the past two recessions, destabilizing excesses appeared mainly in financial markets rather than in inflation. Thus, risk management suggests looking beyond inflation for signs of excesses.” This is easily seen in the chart below. Before the Dot Com Recession and the Great Recession, unemployment was historically low (below 5%) and inflation was also low (at 2.5% or below). However, there was a lot of free, easy money flowing into asset bubbles. Low interest rates create bubbles. In 2000, it was the Dot Com Bubble. In 2008, it was the housing bubble. Today the asset bubbles in stocks, bonds and real estate are more troublesome than they were in 2000 or 2008, and debt has become absolutely astronomical. This has been something the Feds have been concerned about for at least two years. At a special meeting of the Federal Advisory Council and the Board of Governors on September 7, 2016, it was recorded that “If rate normalization happens in a steady and more predictable approach, the economy can incorporate this change in rates and psychology and make investment decisions based on the best allocation of capital to productive sources versus riding the asset bubble being generated by the easy-money policies around the globe.” Rate hikes have caused market volatility (on the downside) this year, so it is likely that the afternoon of September 26, 2018 will be an active day. The following morning will be another strong GDP report -- the 3rd estimate of the 2nd quarter 2018 GDP, which should come in close to 4.2%. There could be another rate hike at the November or December Federal Reserve Board Meetings, and the 3rd quarter 2018 GDP growth report is expected to come in lower than the 2nd quarter. Will this kill a Santa Rally? I'll keep an eye on things as we move through these events and keep reporting here in this blog. However, the 10th year of a bull market is a very good time to get defensive, and make sure that you have enough safe and know what is safe in a world where both stocks and bonds are in a bubble (according to Alan Greenspan, Warren Buffett, Robert Shiller and multiple economists). It’s never a good idea to go all or nothing, or try market timing. My easy-as-a-pie-chart nest egg strategies work great, having earned gains in the last two recessions and outperforming the bull markets in between. (Call 310-430-2397 to learn more about these time-proven strategies.) Here are a few more take-aways from the August 1, 2018 Federal Open Market Committee meeting and Jerome Powell’s speech of August 24, 2018. 1. The strong 2Q 2018 GDP report was bumped up (temporarily) as much as 1% by a rush to avoid tariffs. Exports, led by “agricultural products (particularly soybeans) and capital goods, increased strongly and imports increased only modestly. In June, however, advance data suggested that nominal goods exports fell and imports rose,” according to the FOMC minutes. GDP growth for the rest of the year is expected to cool off from the 2Q GDP growth of 4.1%. 2.8% is the expected full-year 2018 GDP growth rate. We’ll see if the estimates change at the Sept. 26, 2018 FOMC meeting. 2. The Flat Treasury Yield Curve. “Every U.S. recession in the past 60 years was preceded by an inverted yield curve,” according to Michael D. Bauer and Thomas M. Mertens of the San Francisco Federal Reserve Bank. Every rate hike takes the data closer to an inversion. So, why not do everything in your power to avoid that? During the August 1, 2018 FOMC meeting, some participants said, “Inferring economic causality from statistical correlations was not appropriate.” They noted that a worldwide desire for safe assets and central bank asset purchases could be responsible for the Yield Curve phenomenon and that it just might not be relevant this time. The more likely reason for ignoring the Yield Curve is that keeping interest rates low and letting the asset bubbles grow even more out of whack would only create a longer and more severe recession. The last two recessions have been more like depressions in terms of their losses to household balance sheets. The Dot Com Recession saw losses of 78% in the NASDAQ, which took 15 years to crawl back to even. The Great Recession saw losses of 55% in the Dow Jones Industrial Average, and over 10 million homes went to auction. 3. Asset Bubbles. The most telling phrase of monetary policy was buried in the FOMC minutes section on financial stability: “Vulnerabilities associated with asset valuation pressures continued to be elevated, with no major asset class exhibiting valuations below their historical midpoints.” The job of the Feds is to correct imbalances before they erupt into a catastrophe. In this period, which has now been labeled The Global Financial Crisis, reading the tea leaves of indicators beyond inflation and unemployment is critically important. Asset Bubbles were not properly addressed before the Dot Com Recession (“irrational exuberance”) and the Great Recession (using your home as an ATM machine). Jerome Powell is reading data and white papers from history, which appear to be determining his Fed Fund rate policy more than Presidential Tweets. Powell also warns that Federal Monetary policy cannot do much about wage stagnation, the federal deficit or economic mobility – all American problems that have been on an unsustainable path for over a decade. Jerome Powell ended his speech at Jackson Hole, saying, “The economy is strong. Inflation is near our 2 percent objective, and most people who want a job are finding one. My colleagues and I are carefully monitoring incoming data, and we are setting policy to do what monetary policy can do to support continued growth, a strong labor market, and inflation near 2 percent.” Click to access the FOMC Minutes and the speech from Federal Reserve Chairman Jerome Powell from Jackson Hole, Wyoming on August 24, 2018. Other Blogs of Interest It's Fun to Buy Gold Low. Russia is Dumping U.S. Treasuries and Buying Gold Instead. The Federal Reserve Vs. The White House. How a Strong GDP Report Can Go Wrong. 5 Harbingers of Recessions. And how you can protect yourself. Social Security and Medicare Warn of Depletion. Warren Buffett on the Sidelines. GE Investors Lose Half. Can the American Consumer Carry This Economy. 4 Things the 1,175 Dow Drop on Monday Taught Us. If you want to make sure that you are safe and protected before the next recession and stock market downturn, come to my next Investor Educational Retreat. Call 310-430-2397 or email info @ NataliePace.com to learn more now. Important Disclaimers

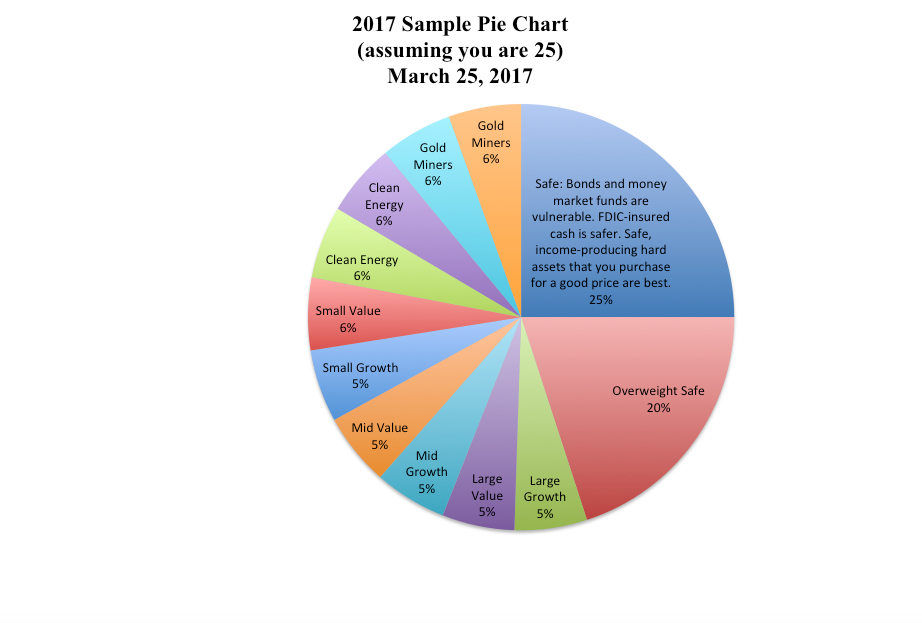

Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Dear Natalie, In 2015 I purchased two gold mining ETFs as my “hot slices” of my nest egg. They doubled, but are now trading closer to my purchase price. Should I have sold the slices when they doubled? Is gold a loser? Should I dump the gold funds now, and try for something else? Signed: It Was Fun While It Lasted. Dear It’s Fun, I know it feels like there is something wrong with an industry when the price falls out of favor. However, it’s actually fun to buy gold low, if you think that the price is going to explode going forward. That’s the real question here: “What’s the outlook for gold? Will it rally or sink further?” Below are a few tips to help you get to that point. Why Did Gold Drop? Gold dropped because there were more sellers than buyers in the gold ETF market in the U.S. In the U.S., the stock market is near its all-time high and the dollar has been strong. So, American gold ETFs lost strength on that news. At the same time, gold is becoming more and more popular with China, Russia, Turkey and Kazakhstan, as these countries trim back their U.S. treasury holdings. There is a move away from the “dollar monopoly” by Russia, China and other countries. (Here’s a link to a blog on that.) So, the rest of the world isn’t quite as optimistic about the future of U.S. stocks and the dollar as Americans are. What’s In Store For the Future? The truth is that when an investment rides higher than it has ever been and is stretched out beyond the scope of reason and fundamentals, it is likely that you are seeing a high and perhaps a bubble. Alan Greenspan, Warren Buffett and multiple economists have all said that stocks (and bonds) are in a bubble. Gold is a good hedge against a drop in the stock market or the dollar’s strength. Should I Buy More or Sell My Gold? The maxim is buy low; sell high. So, if the price drops, then you definitely want to consider buying more at a lower price -- if you believe that the fund is still hot. Once you gain greater experience in rebalancing once a year, then you’ll be on a buy low; sell high system on auto-pilot. Remember that the gold is a slice or two of your “at-risk” portion of your nest egg pie chart, not the only investment you want to own. Diversification is key in today’s world of low-interest rate fueled booms and busts, which we’ve seen in stocks, real estate, gold and more since 2000. Annual Rebalancing. Annual rebalancing of your nest egg is also key for maximizing gains, and would have helped you to capture some of the profits you saw in 2016 in your gold fund slices. Start by printing out a pie chart of what you have. (If you need help with this, call our office at 310-430-2397 to inquire about my second opinion, which includes a pie chart of what you currently have.) Print out a pie chart of what you should have. (You can personalize your own sample nest egg pie chart with my free web app.) Make what you have look like what you should have – a safe, diversified plan that is appropriate for your age and the market conditions. You can learn more about my nest egg pie charts in the revised 2nd Edition of The ABCs of Money and at my Investor Educational Retreats in Arizona and California. Buy Low; Sell High When a fund slice gets smaller (because the fund price became more affordable), you buy more at a lower price. When a slice gets nice and fat, that’s your signal to sell high and trim back to a normal-sized slice. Annual rebalancing makes buy low; sell high easy as a pie chart (rather than the outdated Buy and Forget About It that hasn’t worked since 2000). Rebalancing is what you missed out on in 2016 with the hot gold funds. That’s okay. Don’t expect yourself to be perfect. You did the right thing to ask now before acting because following your instinct in investing is often just following your fear and stomach acid and selling low. It takes time and experience to get excited about buying low; most people want to sell when the price drops. Wisdom, right action and sound information will always yield a better investment outcome. These are all things we go over in my 3-day Investor Educational Retreat. It might be time to immerse yourself in more learning. Call 310-430-2397 to learn more about my 3-day Financial Empowerment retreats. As Ben Franklin says, “An investment in knowledge pays the best interest.” Other Blogs and Links of Interest Russia Dumps T-Bills and buys Gold The Nest Egg Pie Chart Web App Unaffordability: The Unspoken Housing Crisis in America How a Strong GDP Report Could Go Bad. 5 Harbingers of Recessions. And how you can protect yourself. Cut Your Health Care Costs in Half. Interest Rates Keep Rising. Should you lock in a fixed? Social Security and Medicare Warn of Depletion. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience.

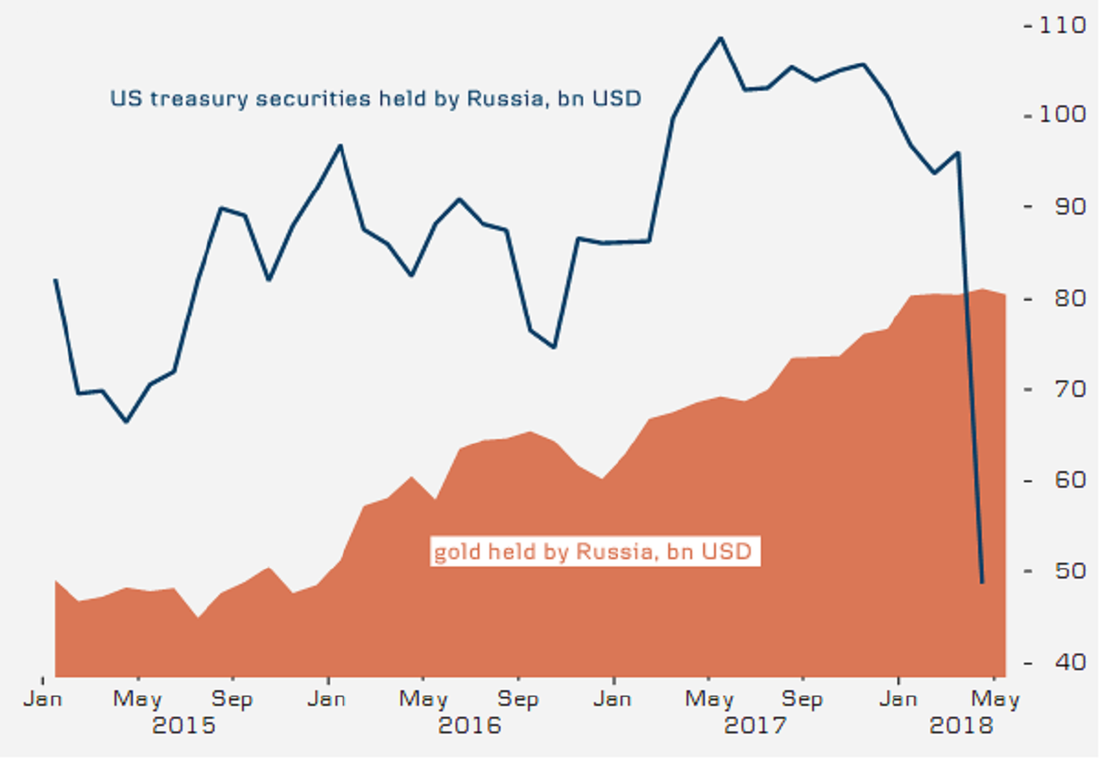

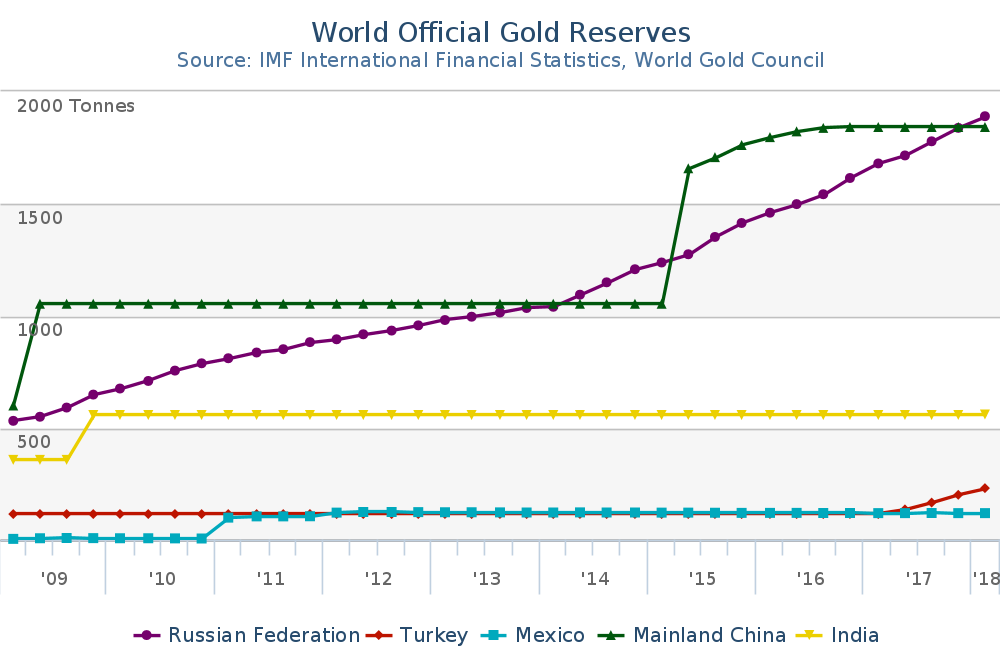

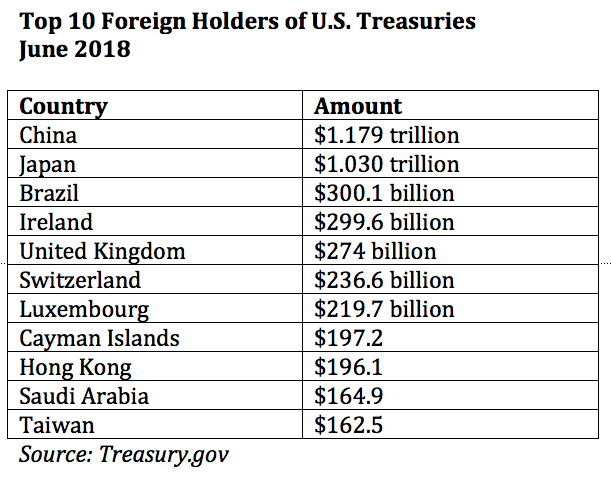

Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. In February of 2013, Russia was one of the top holders of U.S. treasury securities, with $165 billion invested. China was number one at $1.252 trillion. As of June 2018, China is still the top foreign holder of U.S. treasuries with $1.179 trillion. However, Russia has dumped virtually everything, with only $15 billion in U.S. Treasuries remaining. At the same time, both China and Russia have been on a gold buying spree for the last decade. As you can see from the chart below, both countries have almost tripled their gold reserves since 2009. (If you are interested in reading more about gold and the top holders in the world, read my updated 2nd Edition of The ABCs of Money, which was just released this month.) According to the Q2 2018 Report from the World Gold Council (Gold.org), “Russia’s voracious appetite for gold is strategic – amidst geopolitical tensions it looks to diversify away from the US dollar.” On May 8, 2018, Russian President Vladamir Putin said that he wants to break away from the dollar to establish “economic sovereignty.” Selling Russia’s U.S. T-bills is only part of that strategy. Putin wants to take the oil trade off of the dollar standard as well. “The whole world sees the dollar monopoly is not reliable; it is dangerous for many, not only for us,” according to Putin. (Click to see a video with subtitles.) China is very interested in trading oil with Russia (and others) in yuan instead of U.S. dollars, as well. Reuters reported on March 29, 2018, that China is launching a Pilot Program to pay for oil in yuan. China is the world’s largest oil importer (and 2nd largest consumer behind the U.S.). China imports most of their oil from Russia, Angola and Saudi Arabia. The pilot program with Russia, Iran and Angola could launch anytime now. To make the trade more attractive, China is offering to convert their currency into gold on demand. As the trade war heats up with China, there is also concern about what China will do with their U.S. Treasury holdings. The Grand Total of the foreign T-Bill holdings as of June 2018 was $6.212 trillion. The total U.S. public debt is currently $21.4 trillion. So, who holds the majority of the debt? Actually, it is us (U.S.). If you check your retirement account, you probably hold Treasury bills there. Additionally, $5.7 trillion has been borrowed from the “intragovernmental holdings” such as the Social Security trust, Medicare, Federal Employees, Disability, Unemployment and others. So should you be following Russia’s lead and trading in your T-bills for gold? I will examine that in greater detail an upcoming blog. However, for the past year, we’ve had two slices of gold in our hot funds diversification, and have emphasized having a 2-step process for the safe side of your nest egg. Step 1 is to hold your “safe” money in FDIC-insured cash, and then to consider what safe, income-producing hard assets that you might purchase for a good price. (There are a few to consider right now!) In a world where major world powers are dumping U.S. treasuries, and there is far too much U.S. debt floating around, hard assets should hold their value better than paper assets. Since we hold the majority of our own debt (71%), government policy and political rhetoric can keep the value of T-bills stable – even while Russia dumps the U.S. like a bad date. However, if China dumps T-bills, too, that could make headlines. Bonds, including T-bills, remain vulnerable to capital loss and illiquidity, which takes them out of the safe category. If you want to be sure that you keep your nest egg intact and protect your assets, then it is definitely time to replace blind faith and hope with time-proven systems and real data. You have to be the boss of your money in a world where stocks and bonds are both in a bubble and vulnerable to capital loss. Call 310-430-2397 or email Heather @ NataliePace.com to learn more about our time-proven systems that earn gains in recessions and outperform the bull markets in between. Other Articles of Interest

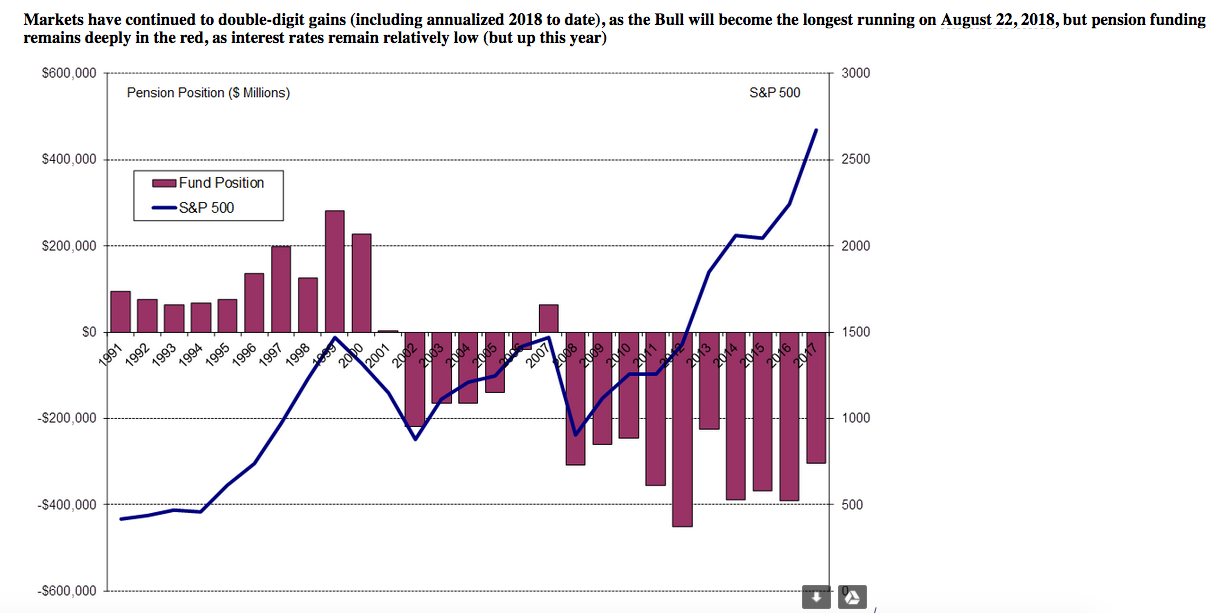

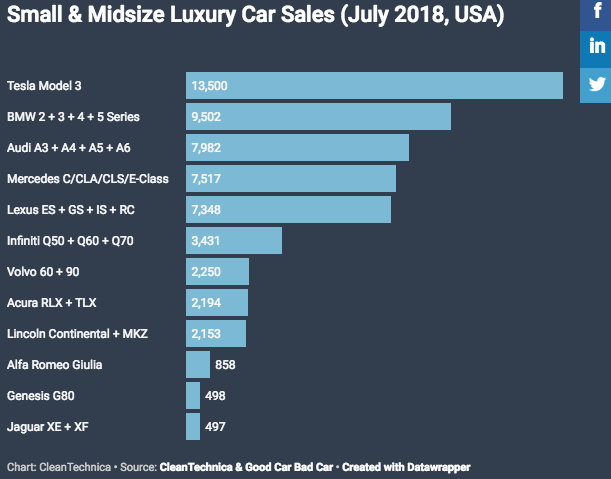

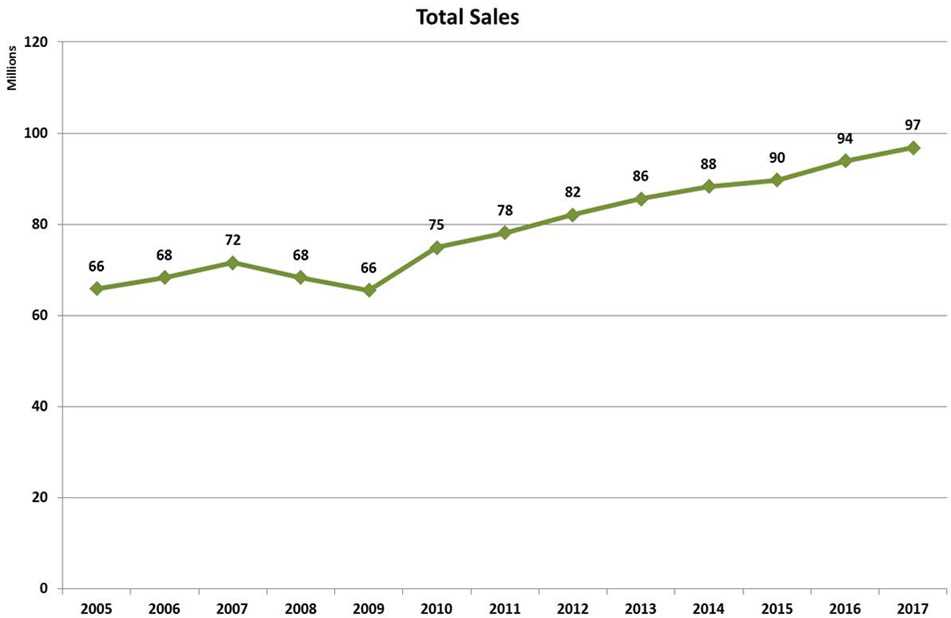

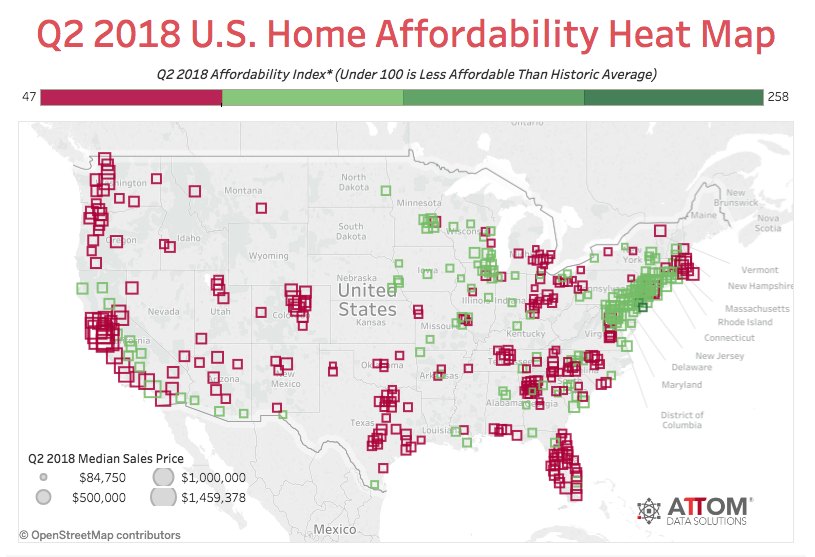

Pensions in Peril. Unaffordability: The Unspoken Housing Crisis in America How a Strong GDP Report Could Go Bad. 5 Harbingers of Recessions. And how you can protect yourself. Cut Your Health Care Costs in Half. Interest Rates Keep Rising. Should you lock in a fixed? Social Security and Medicare Warn of Depletion. If you'd like a second opinion on your current budgeting and investing strategy, call 310-430-2397. Attend Natalie Pace's next life transformational Investor Education Retreat to protect what you have, earn money while you sleep and save thousands annually with smarter big-ticket choices. Watch how fast your life transforms when wisdom and time-proven strategies are the foundation of your fiscal health! Call 310-430-2397 or email Heather @ NataliePace.com to learn more now. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Pensions In Peril. Verizon & AT&T Top the Underfunded OPEBs List. Teamsters & UFCW. New Jersey, Kentucky & Illinois. The Pension and Health Care Crisis. Are You Banking on a Broken Promise? 160 multiemployer pensions have received notices from the Department of Labor notifying the trustees that the plans are in critical or endangered status, with some plans predicted to dry up in just a few years. (Click to check if yours is one of them.) The Pension Benefit Guaranty Corporation, the U.S. government agency that steps in when plans fail, is also expected to become insolvent in just a few years – by full year 2025 (7 years). S&P500 Corporations are underfunded on their Pension and Other Post Employment Benefits by almost half a trillion dollars, at $453.6 billion (source: S&P Dow Jones Indices). Social Security and Medicare have also announced insolvency dates of 2034 (16 years) and 2026 (8 years), respectively. So, are you banking your future on a promise that is likely to be broken? 2017 was a great year for stocks. The Dow Jones Industrial Average rewarded investors with over 25% returns. That improved things somewhat, but not as much as you might expect out of the longest bull market ever. This year, so far, the returns have been rather tepid, at just 2.5% in the DJIA, as of August 10, 2018. That and actuary projections have prompted many pension funds to lower their expectations for returns going forward, with CalPERS planning on 6.2% annualized returns over the next decade. Lower returns mean that increased employer contributions have to pick up the slack, which might actually exacerbate the problem. According to a CalPensions press release on April 16, 2018, “The new rates may force some service cuts, employee reductions, tax increases and test the “sustainability” of current pensions.” CalPERS services 3000 local governments – over half of which are schools. Another problem is that if your fund does fail, and the PBGC picks up the slack, your benefits are likely to be cut dramatically. United Airlines pilots discovered this in 2005. The maximum monthly payment for 65-year-olds of a single-employer plan is $5,420 in 2018. If you are in a multiemployer plan, like the Teamsters or the Radio Television and Recording Arts Pension Fund, the PBGC payout for 30 years of service is substantially lower, at a paltry $12,870 per year or less. So, it pays to make sure that your union’s pension is not on life-support. Once it is, you will not be able to receive a pay-out, and may receive a very large pay-cut. In addition to the pension problems, there is even greater underfunding in Other Post Employment Benefits, such as health care. Pensions in the S&P500 were 85.6% funded in 2017, while OPEBs were only funded at a level of 32%. The companies most underfunded on their Other Post Employment Benefits in 2017 were: Verizon ($18.3 billion), AT&T ($18.1 billion), Exxon Mobil ($7.7 billion), General Motors ($6.4 billion) and Ford ($6.2 billion). The public sector is in an even more perilous situation than the private sector. Only Wisconsin is fully funded on its pension promises. New Jersey, Kentucky, Illinois, Connecticut and Colorado had less than 50% in their coffers for pensioners in 2017 (source: Bloomberg). Politicians are trying to find piecemeal solutions for the endemic crisis that stems from people living longer, with medical care costs that have soared astronomically since 1980. The pension system was created after World War II, when the average life expectancy was 65 in the U.S. Today, people are living to 78 on average in the U.S. (Higher in Canada). Corporations have given up making these promises, leaving individuals with the task of funding their own self-directed retirement plans. It is the older corporations, the public sector and the union-based multiemployer plans with legacy promises that are struggling, and sometimes failing, to keep their pension and OPEB promises. What can you do about this crisis? Perhaps one of the most important remedies is to start funding health savings accounts and retirement funds for yourself and for the younger generation, who will have little to no safety net going forward. Educate them on the importance of this, and how the tax credits can lower their tax bill (meaning this is not an extra burden on their budget). Downsize now to make sure that your lifestyle is sustainable with less income. (You can learn how to save thousands in your budget with smarter big-ticket choices in my books, my coaching and at my retreats.) Consider supporting legislation that eliminates the current age limits on contributing to your own traditional retirement and health savings accounts*. You might also weigh the benefits of taking a buyout from your pension provider, if it is still possible. According to the LA Times, LAPD police chief Michel Moore received a $1.27 million DROP payment for retiring as chief of operations, then returned to the same job at the same pay a few weeks later, before he accepted the top position at the police force. If he had not done this, he would have had to choose between accepting the million-dollar-plus retirement package or becoming police chief. There are arguments made for both sides of this dilemma. However, clearly if everyone gamed the system in this way, pensions and OPEBs only race more recklessly toward demise. “For individuals, the impact of personal wealth depletion – via diminished home equity, low-yield savings and fixed income investments, prolonged high unemployment, lower paying jobs and reduced pensions and OPEB – has left retirees with little ability to retire,” according to Howard Silverblatt, the senior index analyst of S&P Dow Jones Indices. Howard disclosed in this year’s pension report that he has his two kids contributing to their Roth IRAs already, in preparation for a future without a public safety net. *You can contribute to a 401k and a Roth IRA, regardless of age. You can’t make regular contributions to a traditional IRA in the year you reach 70½ and older. After retirement, and beginning with the first month that you are enrolled in Medicare, you are no longer eligible to make contributions to an HSA. Other Articles of Interest Unaffordability: The Unspoken Housing Crisis in America How a Strong GDP Report Could Go Bad. 5 Harbingers of Recessions. And how you can protect yourself. Cut Your Health Care Costs in Half. Interest Rates Keep Rising. Should you lock in a fixed? Social Security and Medicare Warn of Depletion. If you'd like a second opinion on your current budgeting and investing strategy, call 310-430-2397. Attend Natalie Pace's next life transformational Investor Education Retreat to protect what you have, earn money while you sleep and save thousands annually with smarter big-ticket choices. Watch how fast your life transforms when wisdom and time-proven strategies are the foundation of your fiscal health! Call 310-430-2397 or email Heather @ NataliePace.com to learn more now. This blog was updated on September 16, 2018. On August 7, 2018 Tesla’s stock soared on a great earnings report, followed by a Tweet from Elon Musk reading that he was considering taking the company private at $420 a share. There were many 420 jokes that circulated, casting a shadow of doubt on the veracity of the Tweet, before Elon followed up his Tweet with an internal email that outlined his rationale and confirmed that the funding had already been secured. Of course, that position was ultimately reversed, with Tesla committing to staying public. So, should you become a Tesla investor? 8 Things to Consider Before Buying Tesla Stock 1. The Rationale 2. The Potential 3. The Marketplace 4. The Competition 5. Other Tesla Products 6. Do You Have the Stomach for it? 7. 2019 Tesla. Tax Credits Are Phasing Out. 8. The Macro Economy And here are additional details on each point. 8 Things to Consider Before Buying Tesla Stock 1. The Rationale Why take Tesla private in the first place? According to Musk, “Basically, I'm trying to accomplish an outcome where Tesla can operate at its best, free from as much distraction and short-term thinking as possible, and where there is as little change for all of our investors, including all of our employees, as possible,” Musk wrote in his internal memo. SpaceX, another company that Elon is the CEO of, has become a leading, privately owned, space launch and exploration company in the U.S. Musk promises investors who stick with the company through the LBO a chance to liquidate once or twice a year. 2. The Potential Electric vehicle sales are increasing by leaps and bounds over gas guzzlers. In July 2018, the Tesla Model 3 became the #1 vehicle in its class, outselling the closest premium sedan (the Lexus IS) by a factor of 3. Tesla’s year over year sales growth was 47% in the 2nd quarter of 2018, compared to flat sales at General Motors and Ford and single-digit growth at Toyota. On September 9, 2018, CleanTechnica reported that the Tesla Model 3 became the top-selling car in the U.S. by revenue in August of 2018, and the 5th topselling car by units. On September 7, 2018, Tesla issued a company update, writing "We are about to have the most amazing quarter in our history, building and delivering more than twice as many cars as we did last quarter." 3. The Marketplace There were 97 million vehicles sold worldwide in 2017, according to the International Organization of Motor Vehicle Manufacturers (OICA.net). Tesla’s is currently producing 7,000 vehicles a week (350,000/year). The next major expansion is into China. According to Tesla’s 2nd Quarter 2018 Update, “Initial capacity is expected to be roughly 250,000 vehicles and battery packs per year, and will grow to 500,000, with the first cars expected to roll off the production line in about three years.” 4. The Competition There is definitely competition in the EV space, with the Nissan Leaf, the Mitsubishi MiEV and more. However, Tesla broke the book on safety and performance. The Tesla S sedan earned the highest safety rating ever, and when the Roadster was first introduced it quite famously beat a Porsche – at a time when most electric vehicles drove like golf carts. Every carmaker has plans for a luxury sedan and SUV EV. However, ramping up production and rolling out infrastructure to recharge the vehicle can take 5-7 years, at which point one can imagine an innovative company like Tesla will already be building the first EV that flies to the moon. 5. Other Tesla Products Tesla is rapidly becoming a vertically integrated company, with an energy storage division and an innovative solar roof design. Tesla’s goal is to triple the energy storage deployments in 2018 over last year, and to market the benefits of an integrated solar/storage solution to existing Tesla vehicle owners through their app to drive growth in solar power generation going forward. 6. Do You Have the Stomach for it? Investing in individual companies is a bit like playing tennis with Roger Federer. You have to know how to compete, otherwise the profits will just whiz by you. The market is moving to electric vehicles and Tesla is the clear winner. However, in the twilight of the bull market, even great companies can have their share price and value impacted negatively. So, when investing in any individual company, you need to understand the macro concerns and have an exit strategy that makes sense in bull and bear markets. 7. 2019 Tesla. Tax Credits Are Phasing Out. If you want to take advantage of the $7,500 tax credit for purchasing a Tesla, then you need to have your car delivered in 2018. Tesla has sold 200,000 cars, so the tax credit will phase out in 2019. See the Tesla company blog for the 2019 phase-out schedule. That means that Teslas will be even more expensive in 2019, or that Tesla will have to reduce prices to remain competitive. Sales could be impacted. 8. The Macro Economy In the 10th year of a bull market that is overpriced according to many economists, all stock investments are more at risk. A rising tide lifts all ships, and a sinking tide grounds them. Tesla makes great cars and has disrupted and transformed an old-school industry. However, even great companies can take a hit in share price in a general market correction. Tesla is now the most valuable car company in the U.S., with a market capitalization of $50+ billion, and the sexiest growth curves in the world. That’s an attractive proposition, when you look at the products and the promise of the Tesla products, and avoid the headlines and noise. On Friday, Sept. 14, 2018, the company was trading at a 24% discount from its all-time high. You can learn the strategies I used to become ranked the #1 stock picker in my 3 bestselling books and at my 3-day Investor Educational Retreats. Call 310-430-2397, email Heather @ NataliePace.com or visit NataliePace.com to learn more. I just revised The ABCs of Money (the 2nd edition) this year. It’s available on Amazon.com now for just $3.99. Other Blogs of Interest Has Elon Musk Lost It? Russia is Dumping U.S. Treasuries and Buying Gold Instead. Are Electric Cars Safe? from May 20, 2018 Odds of an Interest Rate Hike are Above 90%. 5 Harbingers of Recessions How a Strong GDP Report Can Go Wrong. Unaffordability: The Unspoken Housing Crisis in America Social Security and Medicare Warn of Depletion. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Full Disclosure: I own shares of Tesla in my investment clubs. Unaffordability: The Unspoken Housing Crisis in America. Affecting Detroit, Austin, Denver and Nashville, Alongside NYC, San Francisco, Seattle, Los Angeles, Miami (and more). Housing, in many cities across the United States is unaffordable to the people who live there. “[This is] the worst home affordability we’ve seen in nearly 10 years,” according to Daren Blomquist, senior vice president at ATTOM Data Solutions. “Home price appreciation continued to outpace wage growth, speeding up the affordability treadmill for prospective homebuyers even without the rise in mortgage rates.” As you can see in the map below, the U.S. coastal cities are some of the most unaffordable. However, home prices in Detroit, Denver, Santa Fe and Nashville are also a problem. Real estate prices are higher than ever – much higher than they were when the real estate bubble popped in 2007 (on a nationwide media average). The same holds true for stocks, bonds, public debt, consumer debt and more. And yet, even with the highest prices in history, 5.2 million homes are still seriously underwater on their mortgage. Rising interest rates and unaffordability make the buying pool smaller. That is a major contributor to home sales falling three months in a row from April through June 2018. So, should you buy a home now while interest rates are low, even though you are buying high? Should you sell high? Where will you move if you sell now? What should professionals with a good income who are renting and getting killed in taxes do?

11-Point Check List for Homeowners, Home Buyers and Renters 1. The Mortgage Interest Deduction. 2. Buy What You Can Afford. 3. Have a 10-Year Or Longer Vision. 4. Lock-in a Fixed Interest Rate. 5. Align Your Mortgage Pay-Off Date With Your Retirement Date. 6. If You’re Still Underwater, Get a Second Opinion. 7. Hard Assets Will Hold Their Value Better Than Paper Assets in the Coming Years. 8. Safe, Income-Producing Hard Assets That You Purchase for a Good Price. 9. Interested in Buying a Home Abroad? Read my Blog. 10. Consider the Shadow Inventory. 11. Never Buy High. And here is additional information on each point. 1. The Mortgage Interest Deduction is one of the best ways to lower your tax bill and stop making Uncle Sam rich. You can write-off the cost of financing your home, or a second home, up to a cap of $1,000,000. If you are getting killed in taxes, this is a great solution. 2. Buy What You Can Afford. The Thrive Budget works like a charm when you limit your basic needs to 50% of your gross income. When you overspend on your home and become property rich and cash poor, you risk losing your home and ruining your credit score, and ensure sleepless nights and stress. If your city is unaffordable, there are creative solutions to your problem that are worth considering. Call our office for a private coaching session to discover some ideas that might work out great for you. 3. Have a 10-Year Or Longer Vision. 2018, when real estate prices are back to an all-time high, is not the time to buy and flip. If prices weaken, you could be locked into your home for a much longer period than you anticipate. So, it’s better to cast your vision out over a 10-year horizon and know what you’ll do if you receive a great career opportunity in another city, or if real estate values plunge, or if your family expands beyond the capacity of your current living space. 4. Lock-in a Fixed. Interest rates are still at a historic low, and they are predicted to double from where they started 2018, at minimum. Locking in a fixed mortgage interest rate now could save your budget in the coming months and years. 5. Align Your Mortgage Pay-Off Date With Your Retirement Date. One of the best things you can do to plan for retirement is to align your mortgage pay-off date with your retirement date. That way when your income is less, so are your bills. 6. If You’re Still Underwater, Get a Second Opinion. Not from your bank. If your mortgage is still severely underwater, as it is for over 5 million Americans, then it’s time to seek the counsel of a professional who is not in the banking industry. Paying a million dollars for a home that is only worth $800,000 makes the bank rich. And in the meantime, your credit score remains in the toilet due to your debt being so much higher than your assets. There might be solutions that you haven’t thought of. In this scenario, it is also exceedingly important to keep squirreling money away in your tax protected retirement accounts and health savings account. Draining those accounts to stay in a home your can’t afford is sinking your own life boat. 7. Hard Assets Will Hold Their Value Better Than Paper Assets in the Coming Years. Basic supply and demand dictate that an abundance of supply lowers value, which is what has happened in the developed world. Cheap, easy money has created bubbles in many assets, dramatically reducing the value of your dollar. What is in shorter supply is housing. That means that being a property owner could be the best way to retain wealth in the challenging years ahead. If you have a lot of equity in your home, or if you need to downsize in retirement, your current home might be a great way to earn income by renting it out when you retire. 8. Safe, Income-Producing Hard Assets That You Purchase for a Good Price. With stocks and bonds in a bubble, one of the best areas of “safety” is to consider safe, income-producing hard assets that you purchase for a good price. Every word in that sentence matters, which takes real estate off the table, for now, in most cities. There are other hard asset options that are not well-publicized, however, that are a great price, and offer 25% or more ROI. Curious? Attend my next Investor Educational Retreat! Call 310-430-2397 to learn more. 9. Interested in Buying a Home Abroad? Read my "Retiring Abroad" blog that includes a 10-Point Ex-Pat Check List. 10. Consider the Shadow Inventory. With 5.2 million homes underwater, that means there are lot of distressed homeowners, many of who are late on their payments. There are also homes being sold at auction, and others that are bank-owned. If you shop in the shadow inventory, you might achieve savings of 1/3 or more off of the multiple-listing service. RealtyTrac.com does a good job of mapping opportunities in your city, with tutorials on best practices for shopping in the shadow inventory (i.e. properties that are not listed on the MLS). 11. Never Buy High. Buying high in real estate creates far more problems than just being locked into your home and loan for an extended period of time. Be sure to buy only what you can afford and to find a home that is not overvalued. In most American cities, that will mean patiently waiting for rising interest rates to soften the real estate market and bring prices down. Click to listen to additional commentary on each of these points from my August 2018 teleconference. Owning your own home has many advantages. However, buying real estate high can be a nightmare that drains you dry for years. Over 10 million homes went to auction in the wake of the Great Recession. That stress is soul-killing and difficult to endure. It prevents you from investing in other opportunities that will make your life easier and ruins your credit-score – even if you keep making payments. So, getting the purchase and financing right is key to success in home-buying and investing in income-producing property. If you are interested in receiving private, prosperity coaching or a second opinion on your budgeting and investing strategy, call 310-430-2397. Join me at my Stargazers or Valentine’s Investor Educational Retreat to learn successful real estate investing and more. Click on the banner ads below to see the retreat flyers. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed