|

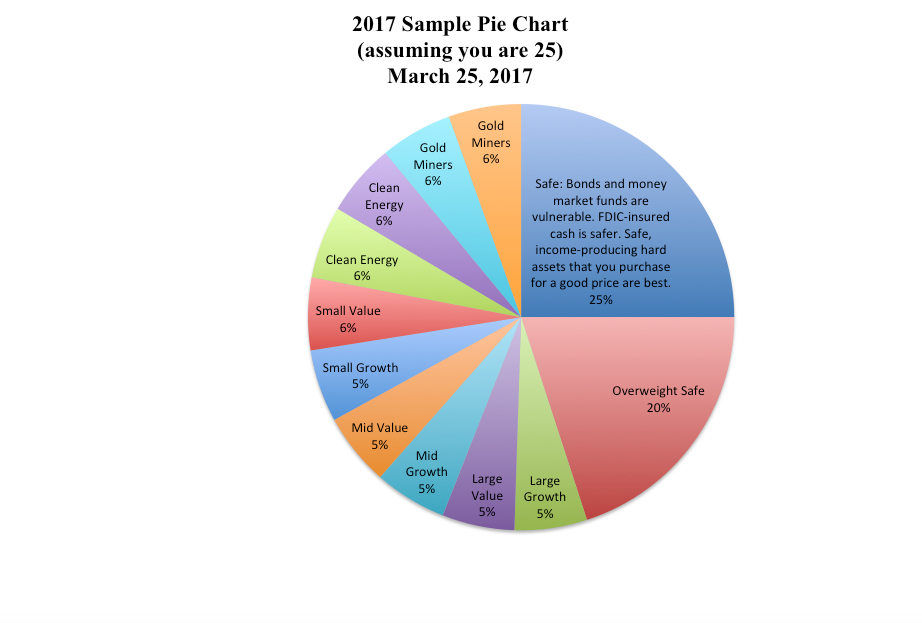

Dear Natalie, In 2015 I purchased two gold mining ETFs as my “hot slices” of my nest egg. They doubled, but are now trading closer to my purchase price. Should I have sold the slices when they doubled? Is gold a loser? Should I dump the gold funds now, and try for something else? Signed: It Was Fun While It Lasted. Dear It’s Fun, I know it feels like there is something wrong with an industry when the price falls out of favor. However, it’s actually fun to buy gold low, if you think that the price is going to explode going forward. That’s the real question here: “What’s the outlook for gold? Will it rally or sink further?” Below are a few tips to help you get to that point. Why Did Gold Drop? Gold dropped because there were more sellers than buyers in the gold ETF market in the U.S. In the U.S., the stock market is near its all-time high and the dollar has been strong. So, American gold ETFs lost strength on that news. At the same time, gold is becoming more and more popular with China, Russia, Turkey and Kazakhstan, as these countries trim back their U.S. treasury holdings. There is a move away from the “dollar monopoly” by Russia, China and other countries. (Here’s a link to a blog on that.) So, the rest of the world isn’t quite as optimistic about the future of U.S. stocks and the dollar as Americans are. What’s In Store For the Future? The truth is that when an investment rides higher than it has ever been and is stretched out beyond the scope of reason and fundamentals, it is likely that you are seeing a high and perhaps a bubble. Alan Greenspan, Warren Buffett and multiple economists have all said that stocks (and bonds) are in a bubble. Gold is a good hedge against a drop in the stock market or the dollar’s strength. Should I Buy More or Sell My Gold? The maxim is buy low; sell high. So, if the price drops, then you definitely want to consider buying more at a lower price -- if you believe that the fund is still hot. Once you gain greater experience in rebalancing once a year, then you’ll be on a buy low; sell high system on auto-pilot. Remember that the gold is a slice or two of your “at-risk” portion of your nest egg pie chart, not the only investment you want to own. Diversification is key in today’s world of low-interest rate fueled booms and busts, which we’ve seen in stocks, real estate, gold and more since 2000. Annual Rebalancing. Annual rebalancing of your nest egg is also key for maximizing gains, and would have helped you to capture some of the profits you saw in 2016 in your gold fund slices. Start by printing out a pie chart of what you have. (If you need help with this, call our office at 310-430-2397 to inquire about my second opinion, which includes a pie chart of what you currently have.) Print out a pie chart of what you should have. (You can personalize your own sample nest egg pie chart with my free web app.) Make what you have look like what you should have – a safe, diversified plan that is appropriate for your age and the market conditions. You can learn more about my nest egg pie charts in the revised 2nd Edition of The ABCs of Money and at my Investor Educational Retreats in Arizona and California. Buy Low; Sell High When a fund slice gets smaller (because the fund price became more affordable), you buy more at a lower price. When a slice gets nice and fat, that’s your signal to sell high and trim back to a normal-sized slice. Annual rebalancing makes buy low; sell high easy as a pie chart (rather than the outdated Buy and Forget About It that hasn’t worked since 2000). Rebalancing is what you missed out on in 2016 with the hot gold funds. That’s okay. Don’t expect yourself to be perfect. You did the right thing to ask now before acting because following your instinct in investing is often just following your fear and stomach acid and selling low. It takes time and experience to get excited about buying low; most people want to sell when the price drops. Wisdom, right action and sound information will always yield a better investment outcome. These are all things we go over in my 3-day Investor Educational Retreat. It might be time to immerse yourself in more learning. Call 310-430-2397 to learn more about my 3-day Financial Empowerment retreats. As Ben Franklin says, “An investment in knowledge pays the best interest.” Other Blogs and Links of Interest Russia Dumps T-Bills and buys Gold The Nest Egg Pie Chart Web App Unaffordability: The Unspoken Housing Crisis in America How a Strong GDP Report Could Go Bad. 5 Harbingers of Recessions. And how you can protect yourself. Cut Your Health Care Costs in Half. Interest Rates Keep Rising. Should you lock in a fixed? Social Security and Medicare Warn of Depletion. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience.

Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 14/9/2019 08:51:07 am

This over all report can help many buyers to know more about the coming rates of the gold and they will plan when to buy the gold. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed