|

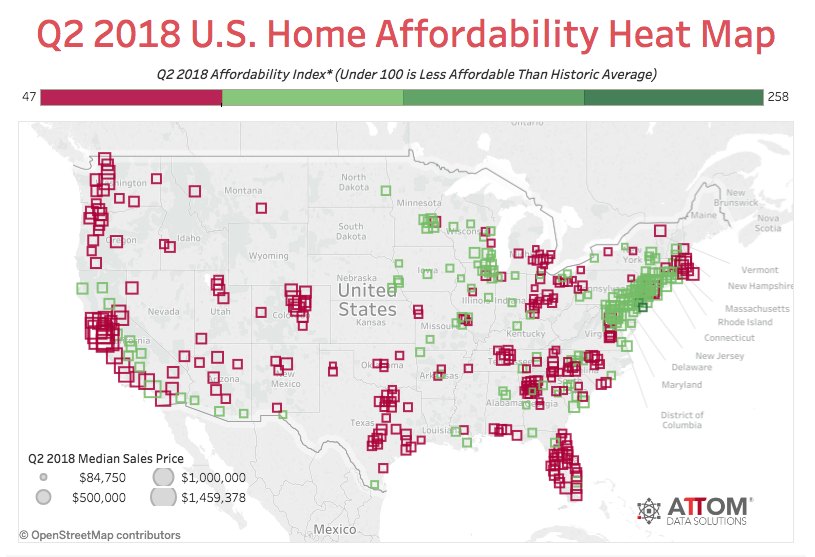

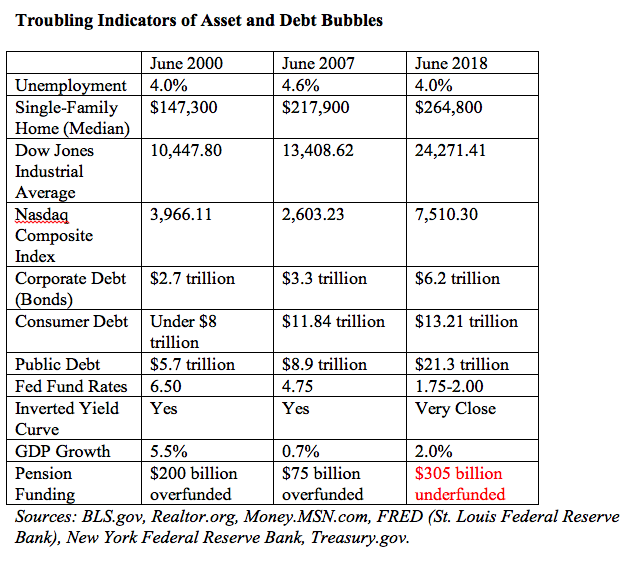

Unaffordability: The Unspoken Housing Crisis in America. Affecting Detroit, Austin, Denver and Nashville, Alongside NYC, San Francisco, Seattle, Los Angeles, Miami (and more). Housing, in many cities across the United States is unaffordable to the people who live there. “[This is] the worst home affordability we’ve seen in nearly 10 years,” according to Daren Blomquist, senior vice president at ATTOM Data Solutions. “Home price appreciation continued to outpace wage growth, speeding up the affordability treadmill for prospective homebuyers even without the rise in mortgage rates.” As you can see in the map below, the U.S. coastal cities are some of the most unaffordable. However, home prices in Detroit, Denver, Santa Fe and Nashville are also a problem. Real estate prices are higher than ever – much higher than they were when the real estate bubble popped in 2007 (on a nationwide media average). The same holds true for stocks, bonds, public debt, consumer debt and more. And yet, even with the highest prices in history, 5.2 million homes are still seriously underwater on their mortgage. Rising interest rates and unaffordability make the buying pool smaller. That is a major contributor to home sales falling three months in a row from April through June 2018. So, should you buy a home now while interest rates are low, even though you are buying high? Should you sell high? Where will you move if you sell now? What should professionals with a good income who are renting and getting killed in taxes do?

11-Point Check List for Homeowners, Home Buyers and Renters 1. The Mortgage Interest Deduction. 2. Buy What You Can Afford. 3. Have a 10-Year Or Longer Vision. 4. Lock-in a Fixed Interest Rate. 5. Align Your Mortgage Pay-Off Date With Your Retirement Date. 6. If You’re Still Underwater, Get a Second Opinion. 7. Hard Assets Will Hold Their Value Better Than Paper Assets in the Coming Years. 8. Safe, Income-Producing Hard Assets That You Purchase for a Good Price. 9. Interested in Buying a Home Abroad? Read my Blog. 10. Consider the Shadow Inventory. 11. Never Buy High. And here is additional information on each point. 1. The Mortgage Interest Deduction is one of the best ways to lower your tax bill and stop making Uncle Sam rich. You can write-off the cost of financing your home, or a second home, up to a cap of $1,000,000. If you are getting killed in taxes, this is a great solution. 2. Buy What You Can Afford. The Thrive Budget works like a charm when you limit your basic needs to 50% of your gross income. When you overspend on your home and become property rich and cash poor, you risk losing your home and ruining your credit score, and ensure sleepless nights and stress. If your city is unaffordable, there are creative solutions to your problem that are worth considering. Call our office for a private coaching session to discover some ideas that might work out great for you. 3. Have a 10-Year Or Longer Vision. 2018, when real estate prices are back to an all-time high, is not the time to buy and flip. If prices weaken, you could be locked into your home for a much longer period than you anticipate. So, it’s better to cast your vision out over a 10-year horizon and know what you’ll do if you receive a great career opportunity in another city, or if real estate values plunge, or if your family expands beyond the capacity of your current living space. 4. Lock-in a Fixed. Interest rates are still at a historic low, and they are predicted to double from where they started 2018, at minimum. Locking in a fixed mortgage interest rate now could save your budget in the coming months and years. 5. Align Your Mortgage Pay-Off Date With Your Retirement Date. One of the best things you can do to plan for retirement is to align your mortgage pay-off date with your retirement date. That way when your income is less, so are your bills. 6. If You’re Still Underwater, Get a Second Opinion. Not from your bank. If your mortgage is still severely underwater, as it is for over 5 million Americans, then it’s time to seek the counsel of a professional who is not in the banking industry. Paying a million dollars for a home that is only worth $800,000 makes the bank rich. And in the meantime, your credit score remains in the toilet due to your debt being so much higher than your assets. There might be solutions that you haven’t thought of. In this scenario, it is also exceedingly important to keep squirreling money away in your tax protected retirement accounts and health savings account. Draining those accounts to stay in a home your can’t afford is sinking your own life boat. 7. Hard Assets Will Hold Their Value Better Than Paper Assets in the Coming Years. Basic supply and demand dictate that an abundance of supply lowers value, which is what has happened in the developed world. Cheap, easy money has created bubbles in many assets, dramatically reducing the value of your dollar. What is in shorter supply is housing. That means that being a property owner could be the best way to retain wealth in the challenging years ahead. If you have a lot of equity in your home, or if you need to downsize in retirement, your current home might be a great way to earn income by renting it out when you retire. 8. Safe, Income-Producing Hard Assets That You Purchase for a Good Price. With stocks and bonds in a bubble, one of the best areas of “safety” is to consider safe, income-producing hard assets that you purchase for a good price. Every word in that sentence matters, which takes real estate off the table, for now, in most cities. There are other hard asset options that are not well-publicized, however, that are a great price, and offer 25% or more ROI. Curious? Attend my next Investor Educational Retreat! Call 310-430-2397 to learn more. 9. Interested in Buying a Home Abroad? Read my "Retiring Abroad" blog that includes a 10-Point Ex-Pat Check List. 10. Consider the Shadow Inventory. With 5.2 million homes underwater, that means there are lot of distressed homeowners, many of who are late on their payments. There are also homes being sold at auction, and others that are bank-owned. If you shop in the shadow inventory, you might achieve savings of 1/3 or more off of the multiple-listing service. RealtyTrac.com does a good job of mapping opportunities in your city, with tutorials on best practices for shopping in the shadow inventory (i.e. properties that are not listed on the MLS). 11. Never Buy High. Buying high in real estate creates far more problems than just being locked into your home and loan for an extended period of time. Be sure to buy only what you can afford and to find a home that is not overvalued. In most American cities, that will mean patiently waiting for rising interest rates to soften the real estate market and bring prices down. Click to listen to additional commentary on each of these points from my August 2018 teleconference. Owning your own home has many advantages. However, buying real estate high can be a nightmare that drains you dry for years. Over 10 million homes went to auction in the wake of the Great Recession. That stress is soul-killing and difficult to endure. It prevents you from investing in other opportunities that will make your life easier and ruins your credit-score – even if you keep making payments. So, getting the purchase and financing right is key to success in home-buying and investing in income-producing property. If you are interested in receiving private, prosperity coaching or a second opinion on your budgeting and investing strategy, call 310-430-2397. Join me at my Stargazers or Valentine’s Investor Educational Retreat to learn successful real estate investing and more. Click on the banner ads below to see the retreat flyers. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed