|

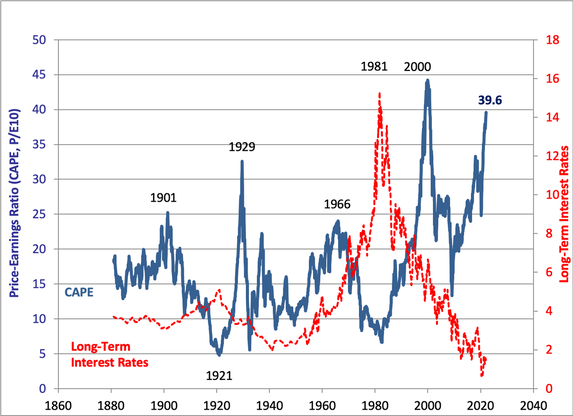

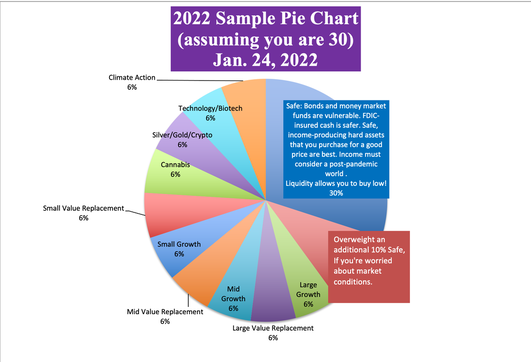

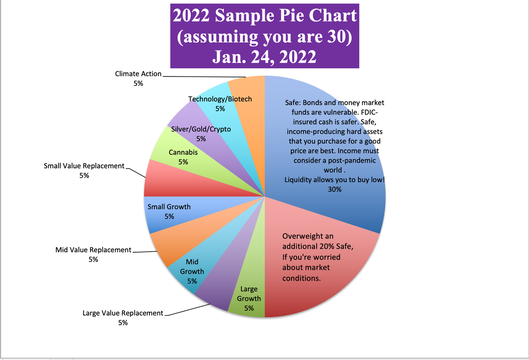

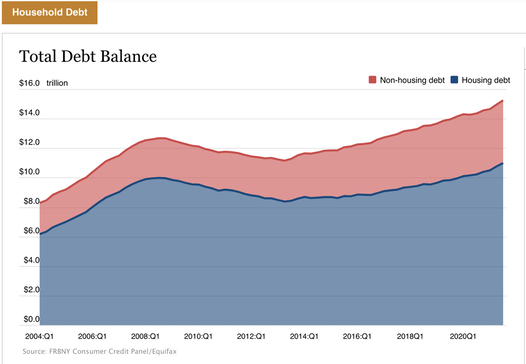

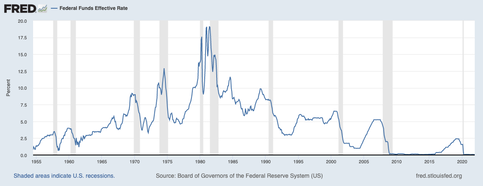

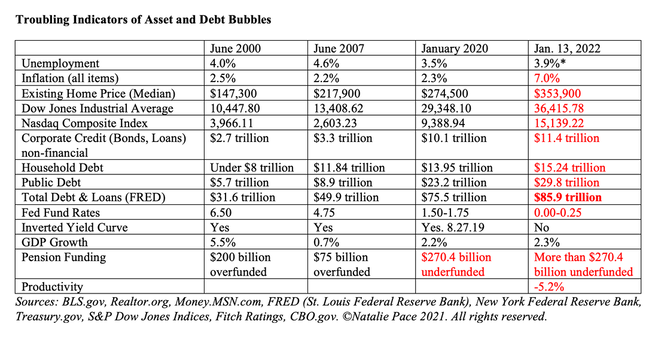

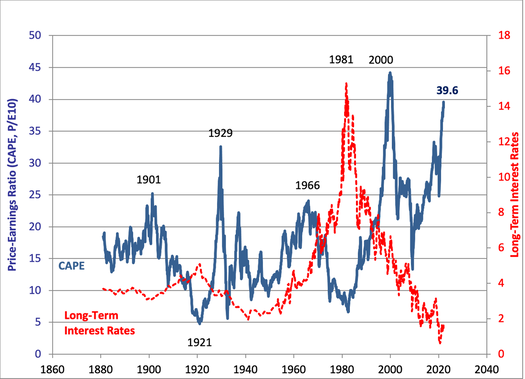

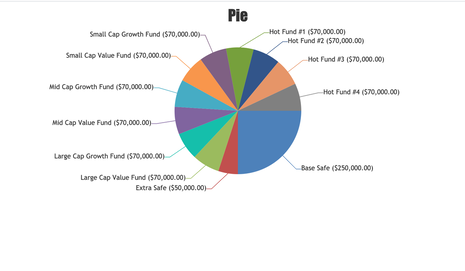

The NASDAQ Composite Index was down -15.1% from its 52-week-high (set on Nov. 19, 2021) and -12% since Jan. 1, 2022, as of Friday, Jan. 21, 2022. The S&P500 sank -10.7% on the year today (Jan. 24, 2022). Is this the beginning of another plunge a la Feb. 19-March 23, 2020 (-38% in the S&P500), or Oct. 2007-Oct. 2009 (-55% in the Dow Jones Industrial Average), or March 2000-October 2002 (-78% in the NASDAQ Composite)? What’s your best plan? Will stocks recover or continue to sink? Stocks in 2022: Churn As Liz Ann Sonders, the Chief Investment Strategist at Charles Schwab, told me in an interview on Thursday, the current weakness in the indexes is something that has been happening under the surface all last year on the individual company level. More than 90% of the NASDAQ Composite Index endured a correction of at least 10% in 2021, and almost half lost 50%. Of course, that’s an average. Some stocks had far wilder gyrations, while others were in a more limited range. The smaller the company, the more likely it was to experience rapid-fire, extreme volatility. Who’s Doing the Selling? According to Howard Silverblatt, the Senior Index Analyst of the S&P 500®, it appears that the selling is institutional. That means the big money is making the move. That is often the case early in a correction. It was institutional money that initiated all the selling that happened between February 19 and March 23 of 2020. The real question now is… Will Stocks Recover or Continue to Sink? There’s a lot of pressure on stocks these days. Equities are very overvalued. You can look at Professor Robert Shiller’s CAPE ratio below, or link to the Buffett Indicator in Liz Ann Sonders’ Market Outlook from Nov. 29, 2021. According to the Federal Reserve Financial Stability Report, when asset prices become elevated (as they are today), the correction can be swift and severe, and other financial risks become elevated. On Nov. 8, 2021, the report warned: Elevated valuation pressures tend to be associated with excessive borrowing by businesses and households because both borrowers and lenders are more willing to accept higher degrees of risk and leverage when asset prices are appreciating rapidly. The associated debt and leverage, in turn, make the risk of outsized declines in asset prices more likely and more damaging. What other headwinds are on stocks? Rising interest rates will slow the economy, as will the sunset of government programs. Inflation can be negative for stocks. The University of Michigan consumer sentiment survey indicates that the high prices of homes, cars and other consumer goods has tanked buyer intentions. With almost 70% of GDP linked to consumer spending, GDP will slow. It is predicted to still be relatively strong, at 4.0% in the U.S. (and 4.8% in China). However, the outlook might change if the headwinds get stronger. In fact, another way to look at the institutional selling could be a signal to Washington and the Feds that the economy and the consumer still need more support. What Could Help Stocks to Rise Again? The Federal Reserve Board has certainly been a friend to the stock market under Jerome Powell. However, the last meeting minutes indicated that the FOMC members were committed to stopping their purchase of assets, to rolling down their massive $8.9 trillion balance sheet and to raising interest rates. Interest rates are expected to climb to almost 1% this year and 1.75% by 2023. When money gets tighter, Wall Street gains are muted. It’s rare for a recession to occur in the first year of the tightening. Of course, with so much leverage and debt in the world and the elevated asset prices (on average, not on all stocks), there is always a more heightened risk of that “outsized decline.” In my Crystal Ball videoconference from last Thursday, I warned that there are many indicators that 2022 would be in the low single-digits for gains – far from the 26.6% S&P500 scorecard of 2021. The Feds are keenly aware of their influence on stock market movements. So, the Jan. 25-26, 2022 FOMC meeting will be a lively discussion. Inflation is forcing their hand to raise interest rates. Having too much on the balance sheet has definitely got them interested in reducing that. We’ll see whether or not the January plunge of stocks will inspire them to stay on course with their deleveraging and interest rate hikes, or offer language and a slower trajectory that calms the markets. If they decide to slow down their action to settle stocks, it may well do so. If they stay on course, it’s possible that the Taper Tantrum will continue. So, there will be a lot riding on the press release that comes out at 2 PM ET this Wednesday. Corporate Buybacks The large corporations have a lot of cash. 2021 set records for corporate buybacks, with about $850 billion of stock repurchased. Apple alone repurchased $92.5 billion of their own stock over the 12-month period (3Q 2021 – 3Q 2022). Corporate buybacks are a driver of market gains. According to Howard Silverblatt, corporations are expected to continue their buybacks in 2022. Speaking of buybacks, the last major downturn (outside of the pandemic recession between Feb. and March of 2020) in Dec. of 2018 had a lot to do with Apple stopping their repurchase plan that December. The company dropped from an average $20 billion a quarter in purchases to $10.1 billion for the 4th quarter in 2018, with almost no purchases in December. That resulted in the worst December on Wall Street since the Great Depression. 2019 then went on to rack up 28.9% gains, with Apple back on track for their quarterly $20 billion repurchases. There has been a high correlation between Apple’s purchases and general index performance over the last few years. Churn In 2021, we saw a substantial amount of churn. Moderna, with outstanding sales growth of over 3000% in the 3rd quarter of 2021, rocketed from $150/share to almost $500/share and then dropped back down to $160. Tilray is trading at $5.60 but soared to $67 in February 2021. The volatility has been more prevalent in smaller companies than larger companies, with micro caps suffering the most. Hedge funds and hot money adore volatility. If you’re going to own individual companies, particularly if they are in the small or midcap range, you have to babysit them. If you get lucky enough to shoot the moon, you have to have a strategy for taking your profits swiftly. Liz Ann Sonders phrase, “Add low, trim high” is applicable for a company you believe in that is experiencing extreme volatility (and also in your nest egg strategy). It doesn’t have to be all or nothing. Market timing just doesn’t work. What’s Your Best Plan? Early in 2021, when it was clear the year would be on fire, we took off the overweight safe on our pie charts, which had been in place in early 2019 (before the pandemic). With all of the volatility and market headwinds, it’s a good idea to overweight safe again in 2022. See below for what a 30-year-old overweighting 10% and 20% safe, with proper diversification, would look like. What does overweighting safe mean? You should always start your plan by keeping a percentage equal to your age out of stocks, and in a place that won’t lose principal. It’s very important to know what is safe in a Debt World. That’s tricky. Because in your retirement plan, if you overweight safe you might be in a money market fund. Money market funds can lose value. They have redemption gates and liquidity fees. They are not federally insured. Bonds are illiquid, highly leveraged and negative-yielding. Your best plan is knowing how to properly diversify and how to get as safe as you possibly can in a world where that is difficult. By 2023, yields may be high enough that you can take on a midterm creditworthy bond that pays you a nice dividend of at least 5% or 6%. If you try to get a 5%-6% yield in today’s world, you have to go into junk bond territory, where your principal is at risk. You can read about our time-proven 21st-century strategies in The ABCs of Money, or you can learn and implement this time-proven plan by attending our February 11-13, 2022 Financial Empowerment Retreat. A small investment of time and money could save your nest egg! These time-proven 21st Century strategies earned gains in the Dot Com and Great Recessions, and outperformed the bull markets in between. Call 310-430-2397 or email [email protected] to learn more now. You can also click on the banner ad below to get testimonials, to learn the 15 things you’ll learn at the retreat, and to get pricing and hours information. It’s going to be conducted online, so it feels like it’s you and I talking directly in your living room. It’s a great way to learn, and you have no travel or lodging expenses.  Join us for our New Year New You Financial Empowerment Retreat. Feb. 11-13, 2022. Email [email protected] to learn more. Register with a friend or family member to receive the best price. Click for testimonials & details. Other Blogs of Interest Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Investor IQ Test 2021. Investor IQ Test Answers 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. 2022 Investor IQ Test Are you an Einstein in investing? A complete novice? Check your Investor IQ with the 26 questions below. If you score 21 correct answers or higher, then you’re in great shape! If you score 18, then you are C-level. Below 18 correct indicates that you are in need of a refresher course in life math. (Even math geniuses might not know the basics of Wall Street…) So, consider joining us at our next Investor Educational Retreat.

Answers are listed in the article "Investor IQ Test Answers 2022" in my blog at NataliePace.com. https://www.nataliepace.com/blog/ Email info @ NataliePace.com or call 310-430-2397 if you have any questions about this test, or about the answers, or if you are interested in learning time-proven investing, budgeting, debt reduction, home buying solutions that will transform your life.  Join us for our New Year New You Financial Empowerment Retreat. Feb. 11-13, 2022. Email [email protected] to learn more. Register with a friend or family member to receive the best price. Click for testimonials & details. Other Blogs of Interest Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Investor IQ Test 2021. Investor IQ Test Answers 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Answers to the 2022 Investor IQ Test. by Natalie Pace. If you score 21 correct answers or higher, then you’re in great fiscal shape! If you score 18, then you are C-level. Below 18 correct indicates that you are in need of a refresher course in life math. We’ve hosted attendees with a Ph.D. in math or computer science, with MBAs, options traders and other Wall Street pros. Our strategies are enthusiastically recommended by Nobel Prize-winning economist Gary Becker, former TD AMERITRADE chairman and CEO Joe Moglia and thousands of Main Street investors. So, consider joining us at our next Investor Educational Retreat. 1. What is the most important question you should ask your Certified Financial Advisor before hiring him/her? "How much of my portfolio should I keep safe?" This question will help you to determine whether you are dealing with a trusted professional who is looking after your best interest, or a salesman who is looking to make a quick buck. The answer to this question is, "A percentage equal to your age.” As stocks are trading at elevated prices and bonds are illiquid and negative-yielding, it would be even better if s/he adds, “But given the valuation and leverage concerns, we might consider overweighting more safe." If they just sidestep this question and redirect you to a risk tolerance questionnaire, that is a red flag. One more important thing. Since bonds are highly leveraged, subject to credit risk, vulnerable to capital loss and are illiquid to boot, you need to understand what’s safe, rather than just rely upon bonds or money market funds. Now is the time to clearly know exactly what you own and why. Consider getting an unbiased 2nd opinion. Call 310-430-2397 or email [email protected] for pricing and details. 2. What are 3 red flags that your financial plan is on a Wall Street rollercoaster and at risk of losing half or more of its value?

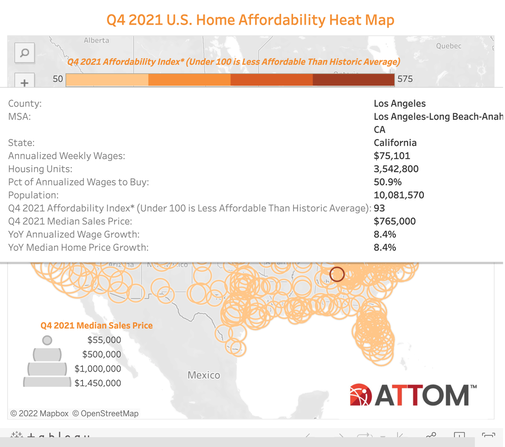

Remember: Your nest egg recovered in the pandemic because the Treasury printed up $5.4 trillion and threw free, easy cash at everyone. Student loans, foreclosures and evictions were paused. The wind has been at our backs. 2022 will be slower and more challenging than 2021. When/if the tides turn, losses can incur quite swiftly due to the high valuations. (The 38% plunge between February 19, 2020 and March 23, 2020 was the fastest that any bull market had ever about-faced into a bear.) Wisdom and time-proven systems are the cure. (Our easy-as-a-pie-chart nest egg strategies, with annual rebalancing, earned gains in the Dot Com and Great Recessions and have outperformed the bull markets in between.) 3. How much of your nest egg should you keep safe? A percentage equal to your age. Consider overweighting more safe when assets are overpriced, the economy is stumbling, a pandemic is closing borders or you are nervous. Again, in today’s Debt World, it is important to know what’s safe. Bonds are losing money and are illiquid, which makes them substantially riskier than most investors realize. (Our safe side isn’t supposed to lose money!) Money market funds have redemption gates and liquidity fees, are vulnerable to capital loss and are not FDIC-insured. Annuities are more vulnerable than most investors know because insurance companies are carrying a lot of risk and leverage, and annuities are not federally insured. 4. What's safe? Getting safe is a two-step process. First, you must keep your money, which means that you want to have as much of your cash as you can in federally insured accounts, such as FDIC or CDIC. Liquidity allows you to buy low, when everyone else is cash-strapped. Hard assets will hold their value better than paper assets in a Debt World. So, the mantra is “safe, income-producing hard assets that you purchase for a good price.” You have to also consider what will safely produce income in a post-pandemic world. Real estate is at an all-time high in the U.S., so it will be difficult to purchase for a good price in 2022. You don’t want to be all in on hard assets because you also need liquidity and cash flow. That is why some of the best hard asset investments are those that reduce your monthly expenses (for life). We spend one full day on What’s Safe at the Investor Educational Retreats. Educate yourself now on the best income-producing hard assets that are right for you, so that when prices are more attractive, you know what you want and have the means to take action and close the deal. Call 310-430-2397 to learn more. Interest rates will rise in 2022 and 2023, so there will come a time when you can get a creditworthy mid-term bond that pays you for the risk you take on. In the meantime, if you’re sold into something it could lose money and also carry an opportunity cost by tying your money up. 5. What is the average return of stocks over the last 10 and 30 years? Large cap stocks earned 16.55% annualized over the last decade and 10.65% over the 30-year period (source: Morningstar). Small cap stocks performed at 13.69% and 12.05%, respectively. (Asset performance graphs, and more data and resources, are distributed to Retreat Attendees.) 6. What is the average return of gold over the last 10 and 30 years? Gold returned 0.68% annualized over the 10-year period and 5.31% over the last 30 years. Gold mining stocks doubled in 2016, were flat in 2017 and were worth almost double their 2018 lows by Jan. 17, 2022. The all-time high for gold of $2,089.20 was hit on January 5, 2021. The last high of $1,895/ounce in gold occurred in September of 2011, the month after S&P Global Ratings stripped the U.S. of its AAA credit score. Fitch Ratings currently has the U.S. on a negative outlook, meaning the AAA rating from Fitch could be downgraded this year. (Moody’s still has a stable outlook for the U.S. AAA, as of Dec. 1, 2021.) 7. What is the average return of real estate over the last 10 and 30 years? Over the last decade, real estate has performed at 9.6% annualized. (The devastating losses of the Great Recession are no longer included in this statistic.) Over a 30-year period, real estate increased 8.0% annualized. Real estate prices are at an all-time high. However, the trend has been down since October. Real estate is largely unaffordable to many Americans. According to AttomData, average income-earners are unable to purchase in their community in 77% of U.S. counties. Rising interest rates will make this problem even more pronounced. 1.9 million U.S. homes are still underwater – even with prices higher than ever. (This is largely due to loan mods.) There is nothing worse than buying high in real estate, and watching the value of your home sink below the amount that you owe on it! It can ruin your life and FICO score for years, if not decades. Be sure to read the Real Estate section of the 5th edition of The ABCs of Money. There are at least seven real-world case studies to inform your real estate decisions. 8. What was the top performing investment in 2021? Bitcoin gained 57% in 2021. Oil came in second, with gains of 55%. The NASDAQ Composite Index scored 21.4% gains, with real estate soaring 14.45%. Oil prices were the biggest losers of 2020. In April of 2020, oil prices went negative, for an all-time low price of -$37.63/barrel. (Futures investors were paying not to take delivery!) Bonds performed poorly as well, with negative yields and illiquidity issues. The total bond fund return was -3.3%. (Again, the safe side of your nest egg is not supposed to lose money.) 9. How long will it take for you to have a nest egg as big as your annual salary if you put 10% of your income into a tax-protected (and financial predator proof) individual retirement plan and invest in stocks and bonds*? 7 ½ years. This is based upon 10% average annualized returns of stocks and bonds over a 30-year period, which is about what those assets did between 1992-2021. 10. How long will it take for your nest egg to earn more than you earn, if you put 10% of your income into a tax-protected (and financial predator proof) individual retirement plan and invest in stocks and bonds*? 25 years. This is based upon 10% average annualized returns of stocks and bonds over a 30-year period, which is about what those assets did between 1992-2021. 11. What’s the safest investment in a slow-growth, high-debt world? Hard assets hold their value better than paper assets when there is too much paper floating around. However, pouring everything into real estate can be vulnerable, as you still need liquidity. It’s not a good idea to just put everything into cash and real estate. So, learn how to diversify properly (you don’t need 18-pages of holdings), avoid the Bailouts, add in hot industries, keep enough safe, overweight safe in volatile times and rebalance 1-3 times a year. Market timing doesn’t work. This may sound complicated, but it is actually easy-as-a-pie-chart, once you learn our strategies. Most, but not all, hard assets are overpriced right now. If you are equity-rich, you still want to do the analysis to make sure that will remain the case if real estate asset prices decline significantly in value, as they did in the Great Recession. Be sure to read the Real Estate section of the 5th edition of The ABCs of Money. There are some excellent safe, income-producing, value-priced hard assets that are worth considering now, which is why we spend one full day on What’s Safe at the Investor Education Retreats. Think capital preservation. Liquidity will allow you to buy low when things are on sale. In other words, don’t be suckered into a risky investment with the idea that you are earning nothing on the safe side. You have to take on a lot of risk to earn anything when interest rates are at zero – which isn’t safe. 12. Which countries hold the most gold? The United States is the top holder of gold worldwide, by far, with 8,133.5 tons, followed by All ETFs, Germany, the International Monetary Fund, Italy, France, Russia and China. China and Russia have been on a gold buying spree since 2008. Reports are that they are trading oil and other commodities using their own currency backed by gold, in an effort to break free from the dollar hegemony. Additionally, there were multiple reports between 2011 and 2017 that the U.S. banks and brokerages were selling their client’s gold assets (sometimes without permission) in a price fixing scandal, which kept gold prices in the U.S. and Europe lower than the rest of the world. Deutsche Bank settled a lawsuit, and agreed on Dec. 2, 2016 to name names of other banks that were price-fixing gold. © The World Gold Council at Gold.org. Used with permission. 13. Are annuities safe? Insurance products, including life insurance and annuities, aren't insured by the FDIC. If we had not bailed out AIG in 2007, more than 50 million annuity holders would have been in real trouble. Your annuity product is only as safe as the insurance company that is selling it to you. According to the Federal Reserve Board’s Nov. 2021 Financial Stability Report, leverage is high at insurance companies. Insurance products are like being a renter. If you can’t pay, you get tossed out. Many people pay for life insurance their entire working life, and then can’t pay when they retire – when they are really most in need. If you put that money into your own tax protected account, you could save on taxes, compound your gains, and it would be there for you when you retire, even offering some income, in addition to the capital. When you can no longer contribute to it, it supports you. You can be a better steward of your wealth than any insurance company, once you learn the ABCs of money that we all should have received in high school. It’s time to be the boss of your money. 14. What were the top performing and the worst months for stocks over the past five years? April, November, July and January performed best over the 5-year period (in that order), on average. February, March and September were negative months. Retreat Attendees receive charts of the top-performing months and election year trends. If you’re interested in learning more about our 3-day, life transformational investor educational retreats, call 310-430-2397 or email info @ NataliePace.com. 15. What was the top performing quarter for stocks over the past twenty years? October through December – the Santa Rally – performed the best over the 20-year period, but saw greater volatility in the 5-year trend. December 2018 was the worst performing December in history, killing the historical returns of the Santa Rally that year. Understanding seasonal trends can help you with your annual rebalancing in your nest egg, and with your selling strategy for your trading. We spend one full day on what’s hot, teaching you how to identify the best investments of the year, in our Investor Educational Retreats. 16. What was the worst investment in 2021, NASDAQ, gold, the Dow Jones Industrial Average, bonds, cannabis, oil or real estate? Cannabis was by far the worst investment in 2021. As one example, Tilray soared to $67/share on February 10, 2021. It was trading at $6.86 on Jan. 14, 2022. Gold lost money, too, with prices down 7.1%. Bonds were pretty poor performers, offering limp yields and capital losses. Will the U.S. decriminalize cannabis? Will cannabis stocks shoot the moon again, fueled by Reddit bulletin boards and Robinhood investors? Stay tuned into my blogs and videoconferences for ongoing news, analysis and vital investor information. Email [email protected] with VIDEOCON in the subject line to receive the logon information for the next monthly videoconference. 17. Which year is expected to perform better, 2022 or 2023, based upon historical returns of election years? 2022 is a mid-term year. Over the last 10-20 years, mid-term years have been the worst performers, with annual gains of 1-5%. 2022 GDP growth could be just 4.0%, lower than the GDP growth of 2021 (which is expected to come in at about 5.0%). Pre-election years (2023) can be some of the strongest in the election year cycle with annualized gains of 11.6%-16%. However, 2023’s GDP growth is predicted to slow to just 2.2% (as interest rates rise), which is a negative for returns. U.S. stocks in 2022 are quite pricey, which could mute gain possibilities this year. Having expensive stocks and real estate, as government support is pulled back, will increase the volatility on Wall Street. There could be some wild rides this year. 18. How many companies are in the Dow Jones Industrial Average? 30 companies. Many are household brands. Most have been around for over half a century, and many are carrying far more debt than the value of the company. Leverage has begun to concern economists. Over 50% of the S&P500 corporate bonds are at the lowest rung of investment grade, or at junk bond status. This includes a lot of banks, brokerages, financial services and insurance companies. Ford Motor Company was downgraded to junk bond status in fall of 2019. If you don’t understand how much debt corporations are holding, you can learn how to use this valuable tool to increase the performance of your nest egg on the 2nd day of the Investor Educational Retreat. Debt and leverage, along with subdued sales, are the main reasons why the DJIA has underperformed the NASDAQ Composite Index in the 21st Century. Click to access the names of the 30 companies. The Dow Jones Industrial Average was launched in 1896. 19. How many Dow Jones Industrial Average companies were bailed out or went bankrupt in the Great Recession? Most people don't realize that 20% of the companies of the Dow (6 companies: AIG, American Express, Bank of America, Citi, JP Morgan and General Motors) were bailed out or went bankrupt in the Great Recession. Others, like General Electric and Ford, received support. New Chips, like Google, Amazon, Nvidia, Meta and Zoom, are far safer, and higher performing, than the debt-laden Blue Chips, both in terms of growth, but also in terms of the fiscal health of their balance sheets. (Apple and Microsoft are now a part of the DJIA.) You’ve probably heard the acronym FANG. We’ve now changed it to ZANA MAD MAAX. (Click to read that blog.) Learn more about how to add in performance and avoid the bailouts in your funds and retirement account at the Investor Educational Retreat and in The ABCs of Money. Value was such a dismal performer over the past few years that Wall Street is coming up with a new definition for this style of investing. (What’s of value when stocks are trading at all-time highs?) Remember: the higher the dividend, the higher the risk (read the chapter of the same name in The ABCs of Money for additional information). 20. Which index has performed better since the COVID-19 pandemic hit in February of 2020, the Dow Jones Industrial Average or the NASDAQ Composite Index? The NASDAQ scored 43.6% gains in 2020, with the DJIA limping along at 7.2%. 21. How much did investors lose between February 19, 2020 and March 23, 2020? Both the Dow Jones Industrial Average and the NASDAQ Composite Index dropped 35%. Some of the hottest stocks, including Nvidia (-38%), lost even more. However, technology stocks surged, once everyone started working and doing everything from home. 22. How much did investors lose during the Great Recession and the Dot Com Recession? The Dow Jones Industrial Average lost 55% in the Great Recession. The Dot Com Recession saw a drop in the NASDAQ Composite Index of up to 78%. It took the NASDAQ 15 years to crawl back to even. Investors haven’t fully recovered from those ruts. According to Pew Research, most Americans are worth less today than they were in 1995. You can’t afford to lose more than half every 8-10 years, crawl back to even, only to lose more than half again. It’s time to step off of the Wall Street Rollercoaster and into time-proven, easy systems that protect your wealth, while outperforming the major indices. 23. Does Buy & Hope work? If not, what does? Buy & Hope lost more than half in 2000 and 2008 and 35% (or more) between February and March of 2020. Due to the amount of debt and leverage, and the slow rate of growth, Buy and Hold will not work going forward (until those problems are dealt with and cycled through). That is why Buy & Hope investors are worth less today than they were worth in 1995. Our easy-as-a-pie-chart nest egg strategies earned gains in the Dot Com and Great Recessions and have outperformed the bull markets in between. Working off of the pie charts, instead of the brokerage statement, allows you to take the emotions out of the plan, and rely, instead, upon a time-proven system. This pie chart system, with annual rebalancing, is a buy low, sell high plan on auto-pilot – prompting you to do what you should be doing at each rebalancing session. Email [email protected] or call 310-430-2397, if you’d like to customize your own sample pie chart. (We teach you this at the Investor Educational Retreat.) One more thing: low interest rates create asset bubbles. That is one of the reasons why assets drop so severely and swiftly in 21st Century recessions. Having the right amount safe is our best protection. 24. Why is it that so many investors are unable to Buy Low and Sell High? Buy low, sell high is a mantra that everyone knows. So, why do so few investors do it? There are a few reasons…