|

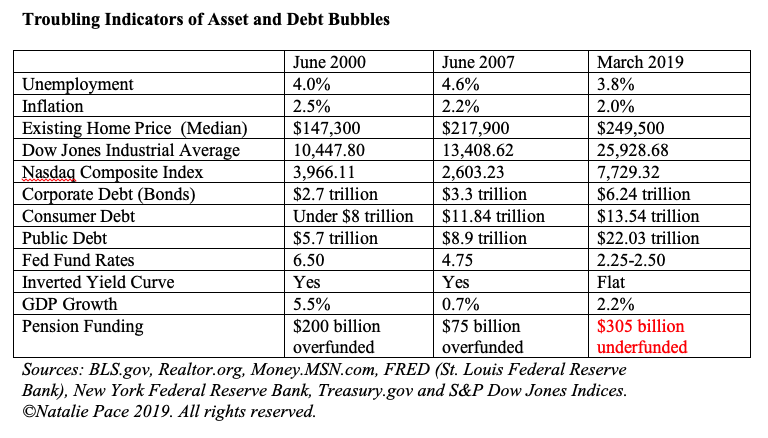

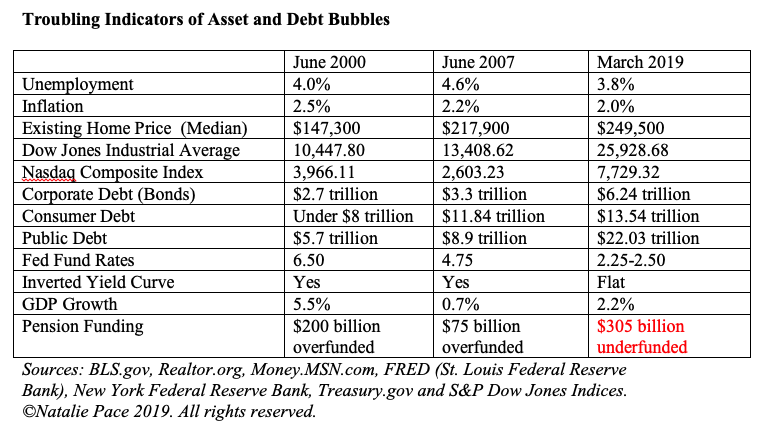

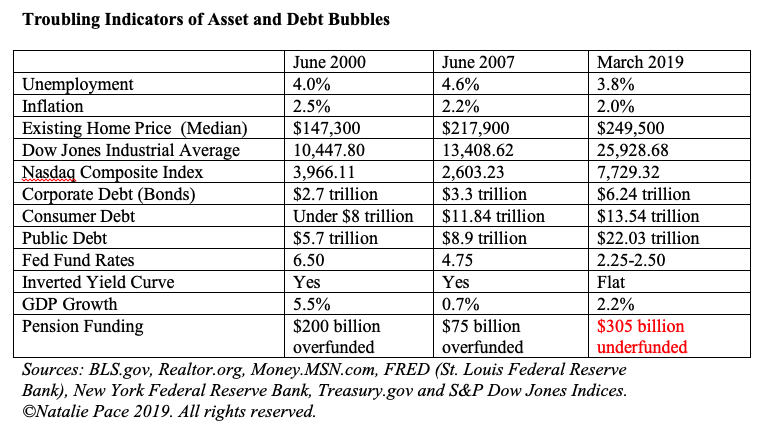

Recently one of our tribe reached out and said she was thinking of buying tesla stock. Earning gains in any investment is never as simple as clicking the buy button. So I encouraged her to make sure that she had an exit strategy and examined how this investment would fit into her overall financial plan. These are two very common problems in investing. When you have a gut feeling about something and pull the trigger before you aim and before you know what you’re shooting at (what your goal and exit strategies are), then you are going to have a hard time being successful – particularly this late in the business cycle. All of this becomes more perilous if you’re running and trying to shoot over your shoulder while being chased by a pack of wild boar, which is kind of like what investing in the 11th year of a bull market is like. Today, the markets are not in a “wind at your back” position. The economic forecast is not clear and sunny with smooth sailing. Rather, we are embroiled in a dark stormy night with lots of phantoms looming in the shadows that you’re probably not even aware of. (See the Asset Bubble Chart at the end of this blog for reference.) What are the two most common mistakes you might make investing today? 1. Not understanding how this one investment fits into your overall financial plan. 2. Not having an exit strategy. Individual Stocks Are Not Appropriate for Your Retirement Plan Individual stocks require babysitting. So they are really not appropriate for your retirement plan, where the goal is to make money while you sleep so that you can earn a good living and live a rich life instead of babysitting your stocks. If you have pages of individual stocks in your retirement plan, you’re probably not as diversified as you think and paying more in fees than you realize. It is also likely that you lost money in 2018. Invest Fun or Education Money (Vegas Money) in Individual Stocks So if you’re not willing to babysit, and invest fun money or education money, i.e. not your nest egg, then investing in Tesla today at a 2 ½ year low is not the right choice for you. If you do want to invest and babysit then the amount you invest should be limited to the amount that you are willing to lose. Treat the investment like a trip to Vegas. Most investors are not as adept as Warren Buffett at buying low and selling high, and are going to be vulnerable to the person on the other side of the trade, who may be a hedge-fund manager with high-frequency trading systems and software on his side. What’s Your Exit Strategy? A solid exit strategy requires at least three considerations.

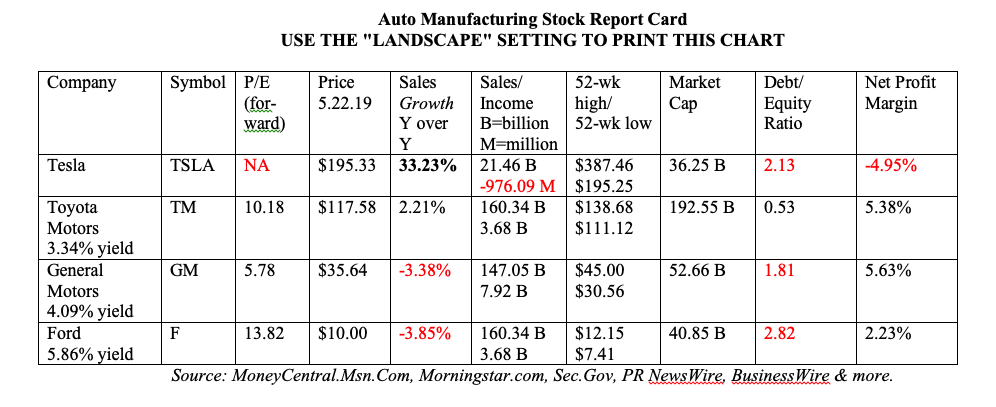

What Can Tesla Do? Tesla’s next quarterly earnings report, which will be released at the end of July/early August, is expected to be quite strong. In the 1st quarter 2019, Tesla delivered only 63,000 cars; in the next report there should be 90 to 100,000 cars delivered. That’s a lot more revenue for Tesla – with revenue conceivably above $6 billion, compared to $4.5 billion in the 1st quarter 2019 and $4 billion in the 2nd quarter of 2018. That kind of revenue should also put Tesla closer to cash positive again. (Tesla posted net income of $139 million in the 4th quarter of 2018, on $7.2 billion in revenue.) That could excite investors in the short term. However, sophisticated investors will also be looking at the macro economy and the industry itself. The Tesla Model 3 makes up 60% of the electric car market and is the top-selling luxury sedan in the U.S. (source: CleanTechnica.com). Tesla’s Model 3 sales have been so spectacular that GM and Ford have thrown in the towel on sedan manufacturing. The Auto Industry The auto industry is under attack on many fronts. Tariffs make the cost of steel and other widgets that go into our new smart cars more expensive. This is an industry that is seeing the slimmest profit margins on the planet already, and these new costs could definitely take them all into the red. Check out the Auto Stock Report Card below. Additionally, only 25% of 16-year-olds are getting drivers’ licenses today. Gen Z and Millennials prefer living in urban areas close to where they work, and taking a bike or an electric scooter for dinner and other local events. For longer distances, they grab a ride-share, rent a car or fly. So this means softer demand for cars going forward. Tesla actually benefits from that in that the Model 3 has become the fastest selling car in America by far, on consumer choice. Additionally, the company is already a leader in autopilot and artificial intelligence. On his investor call of May 2, 2019, Elon Musk declared that autopilot will transform Tesla into a $500 billion company. Elon is known for hyperbole. However, he’s also known as one of the greatest inventors and CEOs the wold has ever known. It’s important to remember that Tesla has only enjoyed one cash positive quarter in recent memory. Higher costs are going to make it harder for the company to generate cash, unless they are able to dramatically cut costs (which the company has placed as a top priority). That means another capital raise could be in Tesla’s future in the years to come, which is almost always tough on share price. There could be a great number of peaks and valleys before Tesla becomes the next Apple-like behemoth. The Macro Environment As we enter the 11th year of this current bull market, the politicians are screaming from the rooftops that the economy is strong and growth is outstanding. However, that message doesn’t seem to equate with how we feel about our lives. What is the disconnect? Housing is unaffordable for most people. Stocks are trading at an all-time high. Bonds have a massive amount of credit risk that’s under-reported. Consumer debt is higher than it was before the Great Recession. Public debt has ballooned to the moon, with $22 trillion in public debt and counting (which doesn’t include state, city or corporate debt and loans). We’ve all become keenly aware of what happens when you borrow from Peter to pay Paul. Sadly, anyone caught on the wrong side of the Great Recession has difficulty trusting what they’re hearing, when what they are seeing and smelling is nowhere near as rosy as the White House Tweets claim. We’ve heard the “Great Economy” rhetoric before – before the Great Recession and the Dot Com Recession and suffered the consequences of drinking the political Kool-Aid. The Bottom Line Do I think you can make money on investing in Tesla at $200 a share? It really depends upon you. It’s not going to be an easy road ahead. If you make money, it will be because you endure a lot of nasty headlines and stomach churning events and possibly even watching the share price go lower than you bought it for. Tesla is a company that has only two kinds of headlines – doomsday scenarios and heavenly vistas. When you see the headlines turn sparkly and shiny, you may have only a small window before the macro economic reality will cast everything into darkness again. So, what I’m really saying here, is: if you don’t know how to surf in hurricanes, you should not be investing in any individual company in the 11th year of the bull market, not even one you love. Your better strategy is to make sure that you are properly diversified and safe and protected from the next downturn. If you don’t have any hot slices in your nest egg, you might consider a hot slice of clean energy. Many of the clean energy ETFs have Tesla holdings (a small amount). Funds protect you from the volatility of any one company, but they also limit your upside, if Tesla does have a stellar second quarter at the end of July. Full disclosure: I own shares of Tesla. If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more. Register by June 30, 2019 to receive the lowest price and a complimentary 50-minute private prosperity coaching session (value $300). I'm also offering an unbiased 2nd opinion on your current retirement plan. Call 310.430.2397 for pricing and information. Other Blogs of Interest It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. I recently spoke with someone about rebalancing, and her response was, “I don’t want to day trade.” Annual balancing is not day trading. In fact, it is the most important thing that you can to preserve, protect and grow your nest egg. And here’s why.

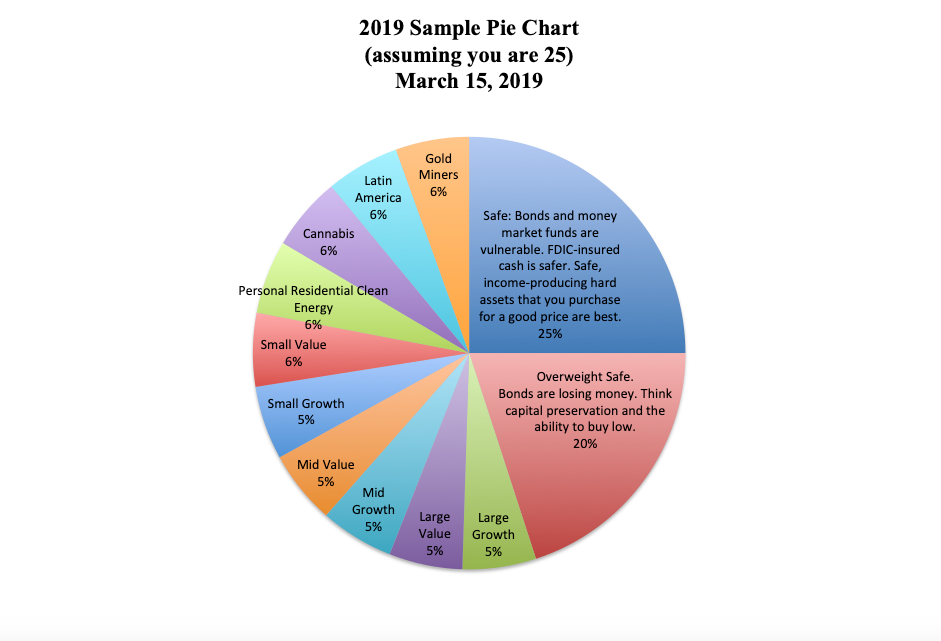

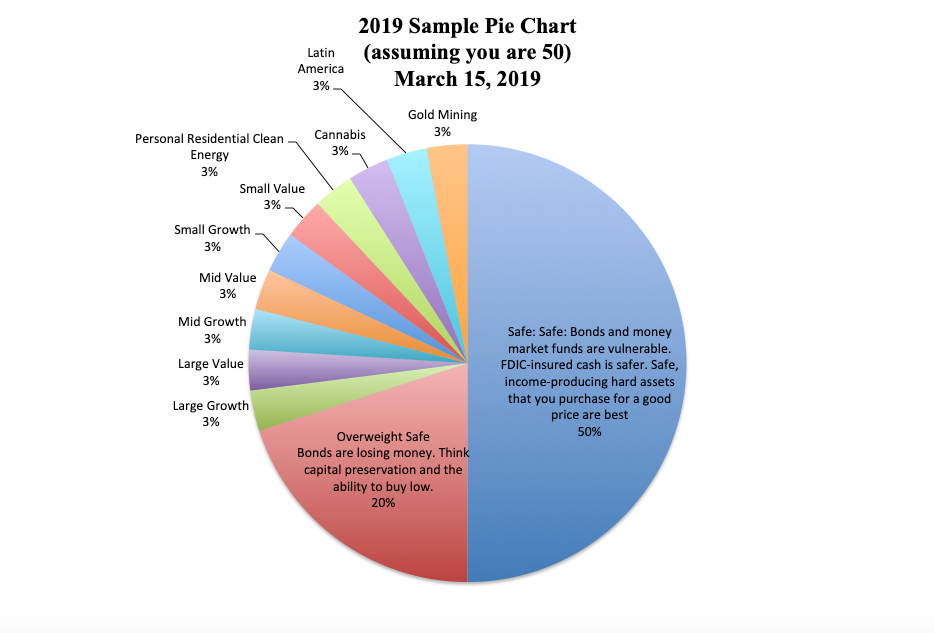

1. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot for Your Nest Egg. Annual rebalancing is not daytrading. It is a simple strategy for always being sure that you have enough safe and are properly diversified. The added benefit of annual rebalancing is that it forces you to do what you should be doing, i.e. trimming back when your assets have had a great run (selling high) and buying more when asset prices go down (buying low). The truth is that buying low and selling high is easy to say and hard to do? Why? Because it is completely against human nature. Also, when you ride the Wall Street rollercoaster up and down, you simply don’t have any money to buy low with. You have suffered so many losses that the only thing you can do is recover. (This happens in real estate, too.) 2. This Alone Would Have Protected You From the Devastating Losses of the Great Recession and the Dot Com Recession. You can’t afford to lose more than half of your assets every 8-10 years. Annual rebalancing ensures this doesn’t happen to you. Let’s say that you had a spectacular year in 2007. If you use the old-fashioned Buy and Hope plan, then you would have lost 55% in the Great Recession. The losses were even more catastrophic in the Dot Com Recession, when NASDAQ lost 78% of its value (and took 15 years to come back to even). Annual rebalancing would have ensured that you kept enough safe during both of those downturns. Those people who overweighted safe earned gains in the last two recessions and outperformed the bull markets in between. (On December 24, 2007, I posted a blog encouraging people to overweight up to 20% safe. I am encouraging extra protection again now.) 3. What’s Hot and What’s Safe Change Every Year. Getting Hot: In 2007, clean energy was the top performing industry, earning 62% gains. In 2008, it was the worst performer. NASDAQ doubled the Dow in the wake of the Great Recession, so adding an extra slice of technology really spiced up the performance of your portfolio. Getting Safe: In normal times, bonds are an easy way to get safe. However, with so much leverage in the world, bonds are quite vulnerable. Over half of the investment grade bonds are just one downgrade away from junk status. Many bond funds have 20% or more of junk bonds in them. Bonds lost money in 2018 and are vulnerable in the near future. In 2019 (and beyond), it’s very important to educate yourself on how to win in an over-leveraged world where most assets are in a bubble: stocks, bonds and real estate. 4. You Age a Year Every Year. The basic rule of investing is to always keep a percentage equal to your age safe, and to diversify your “at-risk” investments. See the sample pie charts below. 5. Your Action Plan Is Obvious Once You Are Properly Diversified. Most people are not properly diversified. Even if you have pages and pages of holdings, you might just have large cap growth and value over and over again. I’ve been doing a lot of second opinions this year, and not one person was properly diversified or had enough safe. Once you trim back all of that nonsense into a sensible, easy plan with ten diversified funds, then each year you simply:

6. Stick to Your Knitting. This is an age-old adage in investing. If you have a time-proven plan (my easy-as-a-pie-chart nest egg strategy), then you stick to it, no matter what kind of noise you hear in the media. In 1999, you would have heard a lot of self-proclaimed experts claiming we were in a New Economy when Dot Coms didn’t have to make any money at all. In 2007, you were drowned in ads offering no down, Liar’s Loans and easy access to your home equity ATM machine (even though that would send over 10 million homes to auction in the coming years). Today, you’re hearing how great our economy is doing, despite the facts that:

Of course, all of this requires you actually knowing what you own, which is why I began offering 2nd opinions. Call 310-430-2397 to learn more. Additional Tips About What’s Hot and What’s Safe

If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more. Register by June 30, 2019 to receive the lowest price and a complimentary 50-minute private prosperity coaching session (value $300). I'm also offering an unbiased 2nd opinion on your current retirement plan. Call 310.430.2397 for pricing and information. Other Blogs of Interest

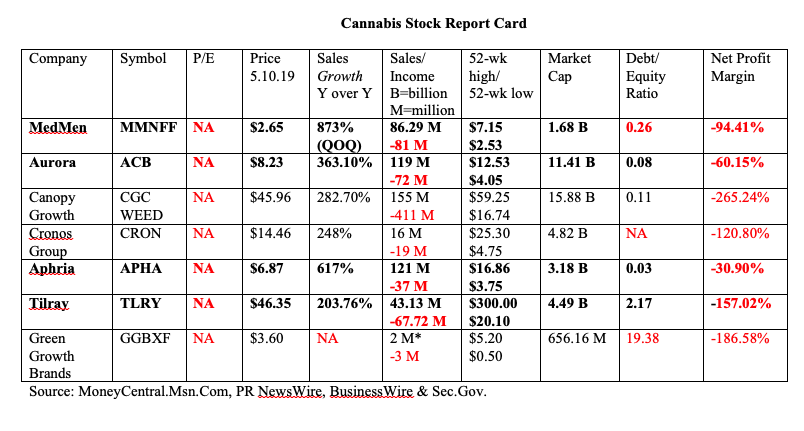

Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Each time I do an updated blog on cannabis, there’s an impressive newcomer (Green Growth Brands), a new leader (Aphria) and a former unicorn, who is trading for a song (Tilray). The most important thing to remember about investing in the fastest growing industry in the world is that the share price is extremely volatile. This is not due to the future prospects of the industry. It has a lot more to do with valuation, short sellers, and the rollercoaster nature of equities in the late stage of the business cycle. Check out the 52-week highs/lows below. As you can see, MedMen, Aurora Cannabis, Aphria and Tilray are all trading near their 52-week lows, while boasting explosive revenue growth (light years beyond any other industry). So, what’s the story? Why would these unicorns be thrown under the troll bridge? MedMen: The Cool Store Popping Up All Over Town. MedMen has had an executive exodus of late, which is typically a terrible sign. The former CFO filed a lawsuit against the company, and accused the co-founder CEO Adam Bierman and co-founder president Andrew Modlin of egregious behavior, ranging from petty bad language to potentially serious financial accounting policies. Three executives, including the COO, followed the former CFO out the door within a few short months. The executive exodus has killed the share price. However, Medmen’s growth is undeniable. There is a line outside their stores from open to close. Former LA Mayor Antonio Villaraigosa is on the Medmen board, alongside many other seasoned executives. Spike Jones filmed a stunning, poignant mini-film marking the monumental progress from Pot Prohibition and the War on Drugs to legalization. Aphria: Don’t Mess With Whole Foods Aphria has successfully rejected a hostile takeover bid by Green Growth Brands, and will even put a little money in its coffers as a result. Under the leadership of interim CEO Irwin Simon (former chairman and CEO of Hain Celestial) and president Jakob Ripshtein (former CFO of Diageo North America), Aphria is expanding and stabilizing at the speed of light. The company just added former co-CEO of Whole Foods Market Walter Robb to its board. Aphria’s share price took a hit because of a massive loss in the most recent quarter. However, as you can see from the Stock Report Card, most companies are reporting losses as they attempt to expand rapidly enough to meet global demand for products. That’s a good reason to lose money. Tilray: The Wounded Unicorn Tilray’s stock dropped to its 52-week lows in mid-April. As with the volatility in other companies, Tilray’s poor performance has a lot to do with short sellers and lofty valuations. The company is having difficulty meeting demand, but has recently addressed that issue with a spate of acquisitions and expansion plans. Tilray is set to report earnings on May 14, 2019 (after the market close). That report may not look as impressive as it could, due to the supply chain issues. However, the price is already reflecting this. Tilray’s executive team and board of directors are some of the most impressive in the industry. The advisory board includes Governor Howard Dean, the former Vice Chancellor of Germany and other global government leaders. Tilray recently inked a deal with celebrity brand marquise company Authentic Brands Group… Green Growth Brands: The New Secret On the Block Victoria’s Secret executives think cannabis is sexy. The Green Growth Brands team, which is made up of former Victoria Secret executives, made strong moves very fast, including a hostile takeover bid for Aphria, which failed. That was an expensive lesson, which will likely show up in the 4th quarter fiscal earnings report in late summer/early fall. (The next earnings release at the end of May will report earnings through March 31, 2019, and thus miss the Aphria takeover expiration.) Despite that setback, the acquisitions continue, and the Green Growth Brands website makes cannabis consumption look heavenly. Will an angelic catwalk be in the company’s future? The truth is that the cannabis industry is so hot that most of these companies are going to see splashy headlines in the months and years to come. However, with such volatility in share prices and the lofty valuations already in play for many of these companies, you’ll be best served to follow the age-old adage Buy Low, Sell High on auto-pilot (with limit orders). Many investors have enjoyed massive returns over the past year using that strategy! The returns on these cannabis companies will get you high, as long as you don’t crash hard when short sellers end the party… Also, be careful of penny pot stock scams that are still being heavily marketed by social media scam artists. If you don’t know how to use the Stock Report Card and 4 Questions to evaluate which companies are legit and which are pump-and-dump schemes, then your next move must be education. If you’d like to learn more about these strategies firsthand, join me at my Oct. 19-21, 2019 Retreat. If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more. Register by June 30, 2019 to receive the lowest price and a complimentary 50-minute private prosperity coaching session (value $300). I'm also offering an unbiased 2nd opinion on your current retirement plan. Call 310.430.2397 for pricing and information. Other Blogs of Interest Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. In the late stage of the business cycle, we start seeing an avalanche of advertising that encourages us to jump into high-priced investments. In 2017, it was Bitcoin at $20,000/coin. In 2007, it was stocks and real estate, and before that the New Economy promised that Dot Coms would be your ticket to Dream Come True Living. Today is no different. People are calling me to brag about their recent real estate purchase, or cryptocurrency, or cannabis, offering a long litany of the merits of the plan, without enough consideration to the price that they are paying. It is never a good idea to buy high. Buying high risks the following.

It’s important to remember that your strategy for purchasing real estate, stocks and bonds should be based in real data and information, not headlines, ads or the opinion of a “financial expert” who might have incentives to sell you more than you really should take on (at a high price). As you can see in the chart below, real estate and stocks are back to all-time highs, while debt (bonds) has shot to the moon. If you buy today, you are paying a premium over what you would have paid just a few years ago, and likely far above the true value of the asset. Most of these assets lose value when the economy slows or runs into a recession. Below are a few key points of how to navigate and think about these assets as we enter the 11th year of the bull market. Fast Facts for Successful Investing in Real Estate, Stocks & Bonds in 2019 & Beyond Real Estate

Homeowners are worth 46 times more than renters, so owning your own home is definitely something you want to do. However, purchasing real estate high can destroy your life for a decade or more, so buying for a good price is an essential key in the equation. Millions of homes went to auction, were foreclosed on or sold in short sales during the Great Recession. Most cities saw home prices lose more than half in the Great Recession. If you were on the Buy Side of that equation – buying low in 2009-2011– then you have doubled your money (in many cities). The 3-Ingredient Recipe for Cooking Up Profits

Learn more about the 3-Ingredient Recipe in the chapter of the same name in my first book, Put Your Money Where Your Heart Is. Stocks There is a lot of risk in stocks these days. Alan Greenspan, Professor Robert Shiller and Warren Buffett have all warned that stocks (and bonds) are in a bubble. Stocks are…

Proper diversification, keeping enough safe, knowing what’s safe in a world where stocks and bonds are in a bubble, and annual rebalancing works in your nest egg. These strategies earned gains in the last two recessions and have outperformed the bull markets in between. In individual stock investing (something you should not be doing in your nest egg), you need to apply the 3-Ingredient Recipe for Cooking Up Profits, and take your profits early and often. The Stock Report Card and 4 Questions that are outlined in my first book, Put Your Money Where Your Heart Is, can help you pick the leader. When determining the right buy low and sell high prices, you’ll consider what the company can do, what the industry can do and what the general marketplace can do. This is something that I teach in my Investor Edu Retreats. Bonds There is far too much debt in the world. Companies have borrowed money very cheaply and used that to buyback their own stock. This makes their earnings look stronger than they really are and their share price look lower than it really is. Borrowing from Peter to pay Paul has an expiration date. The leverage in corporates is at an all-time high, and has the Feds concerned.

Financial Engineering Companies like Apple, Oracle, QualComm, Cisco, Wells Fargo, Amgen, Microsoft, Citigroup, Pfizer, Abbvie and Broadcom all spent more money on buybacks and dividends than they earned in income. Apple spent $88 billion on buybacks and dividends in 2018! The rest of the companies spent between $15 billion and $32.8 billion. This is all money that rewarded investors, but didn’t add employees, invest in R&D or upgrade tools and factories. In other words, it’s a short-term financially engineered fix, rather than a long-term vision and investment toward a better business with innovative products. The last time that buybacks were at an all-time high, before 2019, was 2007. We all know how that story ended... You can educate yourself further by reading my 3 books (links are below), by receiving a 2nd opinion on your current investing plan and by attending my Wild West Investor Educational Retreat. It’s time to mute all of the noise, bad ideas and advertising that you hear constantly in the mainstream media and online. Wisdom is the cure. Listen back to my free teleconference on this subject at BlogTalkRadio.com/NataliePace. If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more. Register by June 30, 2019 to receive the lowest price and a complimentary 50-minute private prosperity coaching session (value $300). I'm also offering an unbiased 2nd opinion on your current retirement plan. Call 310.430.2397 for pricing and information. Other Blogs of Interest Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed