|

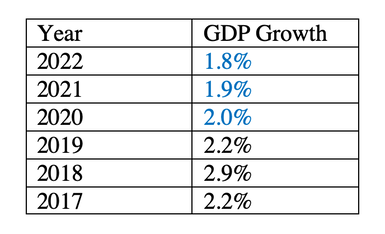

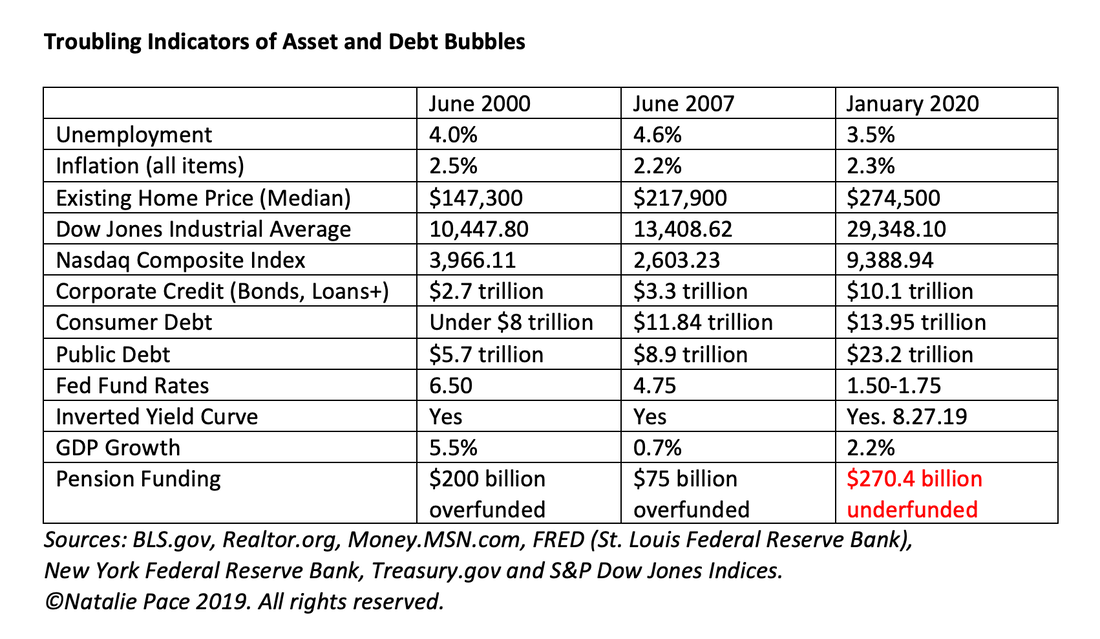

AI is On Fire. Is it Time for S’More? Or Will the General Marketplace Drag Everything Down? Artificial intelligence and machine learning are affecting all parts of our lives, from autonomous vehicles, to the way that social networks decide which ads we see, and how law enforcement tracks down criminals. The industry is on fire. Should you buy in? Advanced Micro Devices just announced 4Q 2019 earnings, with revenue of $2.1 billion, which is up 50% year over year from 2018’s $1.42 billion. Net income was also impressive at $170 million, versus $38 million in the 4th quarter of 2018. Nvidia is projecting revenue growth of about 34%, when the company announces earnings around Feb. 21, 2020. AMD announced earnings after the markets closed. Investors responded by selling off. The share price dropped 4.12% in after-hours trading today. Hmmm. Why are investors getting cold feet over one of the hottest companies and industries on the street? This is where AI has something in common with cannabis 2018. It’s got a lot to do with valuation, and less to do with quarter by quarter fluctuation. AMD announced that the next quarter will have $1.8 billion in revenue, which represents year over year growth of 42%, but is a sequential drop of about 15%. AMD explains the sequential drop as seasonality and the calm before the next gen product release. By comparison, Apple announced revenue for the last quarter of $91.8 billion, and forecasts that the next quarter revenue will be $63-$67 billion. That’s a 27% sequential drop! If customers like Dell, IBM, Nokia and others are choosing an AMD competitor, and the sequential drop is an indication that AMD is falling behind the pack, then it’s understandable that investors would opt out. However, investors are far more likely to get skittish if they are “out over their skis.” If you worry that you might have overpaid to begin with, or that your recent windfall might evanesce, then you’re more likely to bail out with as much as you can as quickly as possible. Should a company with full year income of $341 million be worth $56 billion, with a price to earnings ratio of 245? (The historical average price to earnings ratio is about 17.) Nvidia’s price to earnings ratio is 68. Artificial intelligence is definitely an industry of tomorrow, something that is reflected in our daily lives and in the revenue growth. The question is only one of price. You could have purchased Nvidia for $131/share last May. Should you be jumping in today for $250/share? AMD has more than doubled, to $52 from $19. However, can the AMD share price remain high if the general marketplace weakens? That’s another headwind that investors have to factor in. 4Q 2019 U.S. GDP Tomorrow, the Federal Reserve Board will release their statement on the economy. The governors are widely predicted to hold rates where they are. On Thursday, January 30, 2020, at 8:30 am ET, the Bureau of Economic Analysis will release the advance estimate of the 4th quarter U.S. GDP growth. Projections are coming in at 1.2-1.8%. That’s a very weak showing, which is likely why the Dow Jones Industrial Average is down 651 points since the high set on January 17, 2020. Stock futures are down, predicting a slight sell-off again tomorrow. In the late stage of the business cycle, even with one of the hottest industries in the world, price matters. Incidentally, I did find one AI company, which is trading near its 52-week low, that is partnered with Microsoft on face recognition. Join me at my Stock Master Class Feb. 7, 2020 and my Investor Educational Retreat from Feb. 8-10, 2020 in Cocoa Beach, Florida to learn essential tips for increasing your trading success, to adopt time-proven strategies for protecting your future, and assets and even to discover how to save thousands annually in your budget with smarter big-ticket choices. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. Win a Seat at a Retreat The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Add up everything you have in your retirement accounts (401K, IRA, insurance, annuity, savings, etc.) and in your home equity (the difference between the value of your home and what you owe on it), and then divide that by half. $250,000 401K $ 50,000 IRA $200,000 Equity in Home $500,000 TOTAL $500,000 divided by half = $250,000 Then ask yourself these questions: “Are you willing to risk losing half of your wealth?” “How would you feel if $250,000 vanished over the next twelve to eighteen months?” That's what is at stake. In the last 2 recessions, investors lost more than half of their liquid assets. The Dow Jones Industrial Average dropped 55% in the Great Recession. The Nasdaq Composite Index sank 78% in the Dot Com Recession. Over 10 million homes have changed hands since 2007, and 3.5 million mortgages are still underwater (the loans are 25% or more higher than the value of the home). Investing in the 21st Century requires a new strategy. Last Century ideas, like Buy & Hope, haven’t worked since 2000 and are unlikely to work until we cycle through the astronomical debt we’ve amassed, so that economic growth can kick in again. On January 30, 2020, the Bureau of Economic Analysis will release the advance estimate of 4th quarter 2019 GDP growth in the U.S. This report is expected to be under 2%. The Atlanta Federal Reserve Bank is forecasting 1.8% growth, while the New York Federal Reserve Bank believes the number will be closer to 1.2%. 2% GDP growth is nowhere near enough to pay for the tax cuts of 2017. (Americans were promised GDP of 3%, as a conservative estimate.) Rather, the massive increase in public debt, which has soared to $23.2 trillion, is slowing, rather than growing, the economy (as was promised). Below are the projections from the Federal Reserve Board for 2020-2022, and the GDP growth rates for 2017-2020. GDP Growth in the U.S. 2017-2022 Yes, real estate prices and stock prices are back to an all-time high, while unemployment is at a historic low. That’s really great. However, that was the case in 2000 and 2007, too, before the last two catastrophic downturns. The pundits tout high stock prices and low unemployment as evidence of a great economy, without including the red flags that are clearly seen in the chart above. When asset rallies are fueled by low interest rates, rather than by economic growth or an increase in wages, bubbles form, just as they did in the previous two recessions. If you are too young to remember what happened in the Dot Com Recession and the Great Recession, the charts at the beginning of this blog offer a dire warning. According to AttomData, the average wage earner cannot afford to buy a home in 74% of U.S. housing markets. According to Nobel Prize winning economist Robert Shiller, the only two times that the historic CAPE ratio of stocks has been this high was in 2000 and 1929, before the Dot Com Recession and the Great Depression, respectively. The Asset Bubble chart (above) reveals that the amassed debt, and the underfunded pensions, along with other historically high leverage, makes us more vulnerable today than we were in 2000 or 2008. When prices become unaffordable, asset bubbles tend to pop. As you can see from the chart above, Asset Bubbles were all inflated before they popped in 2000 and 2008, even while unemployment was low and the economy was still growing. However, interest rates this time around are starting out much lower than they did before the previous two recessions. That means that even the “safe” side of your retirement plan is at risk because the Federal Reserve doesn’t have any room to cut rates to boost growth. On November 13, 2019, when Federal Reserve Chairman Jerome Powell testified before the Joint Economic Committee of Congress, he warned, “The current low interest rate environment may limit the ability of monetary policy to support the economy.” Ford was downgraded to speculative bond status in 2019. General Electric has lost 2/3rds of its value over the past two years. These are not one-off events. Over 50% of corporate bonds are at the lowest rung, just above junk bond status. In fact, corporate bonds have lost money over the past few years. This is a long way of saying that, rather than celebrating or being complacent that your home and retirement plan have gained back the losses they suffered in the Great Recession, it’s a good idea now to make sure that you keep those gains this time. Buy & Hold is really just riding the Wall Street rollercoaster, up and down. It’s a far better idea to fix the roof while the sun is still shining. There are certain years when protecting what you have could be your biggest payday (and not doing that could be your biggest nightmare). So What Works? Our easy-as-a-pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. They cost less time and money, while allowing you to sleep at night knowing your assets are protected, and you are earning money while you sleep safely. Click to watch Nilo Bolden talk about just how easy protecting your wealth is. Scroll to the end of this blog for additional, true testimonials, some from economists and VIPs, others from Main Street. So, how can you learn The ABCs of Money that we all should have received in high school? You can read about these strategies in my bestselling books. You can call our office at 310-430-2397, or email [email protected], to receive an unbiased 2nd opinion on your current plan. Or you can join me at an upcoming Investor Educational Retreat, where you can learn this time-proven system, implement it in 3 life-transformational days and go home with a plan that works immediately and for the rest of your life. Investor Educational Retreats We are having a Florida Beachfront Retreat Feb. 8-10, 2020, an Earth Day Retreat in England April 24-27, 2020, an iconic Santa Monica Beach Retreat June 5-7, 2020 and a Wild West Arizona Adventure Oct. 10-12, 2020. Visit NataliePace.com for additional information on these retreats. Register by Jan. 31, 2020 and you’ll receive a complimentary coaching session, valued at $300. Call 310-430-2397 or email [email protected] to learn more and to register now. Be the Boss of Your Money Nobody cares about your money more than you do. It’s important for you to be the boss – to know what you own and why, and to adopt a strategy that is right for you at this stage of your life. Do not have blind faith that someone else is doing this for you, particularly if their plan lost you 25% or more in the last downturn. Wisdom is the cure, and is critically important at this late stage of the business cycle, as we enter the 12th year of the current bull market. Testimonials “My husband spoke with Natalie Pace, and after a brief discussion, she charted a plan on the back of a napkin. I decided to take her advice. Soon after, we had the big crash. I was one of the few and lucky people who actually made money (instead of losing). So, thank you Natalie, for saving my retirement!” Nilo Bolden, executive director at a law firm in Century City, CA We asked Natalie Pace for a second opinion on our investment portfolio. She researched and reviewed each stock and fund. She then explained to us in plain English how we were positioned in the market and how high our risk exposure was. Her knowledge was so profound that we decided to take her retreat in Arizona. My husband was still quite skeptical, but 20 minutes into the retreat he turned to me and said "Thank you." Stocks and investing are no longer rocket science. We are finally able to take control of our money. We give thanks just about every day that we met Natalie. I feel like I live on a different planet. I'm so grateful. Thank you for changing our lives, our peace of mind, our future and our vision of what is possible - not to mention our stomach acid. We made a tectonic shift with you. AC & AM "College students need the information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, chairman, TD AMERITRADE “Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided in [Natalie Pace’s] book. This is why I recommend it with enthusiasm.” Dr. Gary S. Becker. Dr. Becker won the 1992 Nobel prize in economics. University Professor, Department of Economics and Sociology and Professor, Graduate School of Business, The University of Chicago “Provides almost fool proof methods for growing wealth over the long haul.” Success magazine. “Our CFP manipulated us into investing in private placement REITs. I now know that these are very high risk. Many of these companies have been cash negative for years, borrowing from one investor to pay off another, and paying brokers a high commission to do that. We put in the paperwork last year to cash out of these. Nothing!!! Then we redid the paperwork in August, so we could get the next payout for December. They say that you can only get out of these things twice a year. If you miss the window you have to wait again. We did everything by the book. Once again trusting this would be taken care of. Waiting…waiting…nothing. David, the salesman who put us into these investments, is not even returning our calls!!!! We both have called every week for several weeks now and nothing!!! D&T (read more of this story by clicking here) Other Blogs of Interest 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. Win a Seat at a Retreat The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Are you an Einstein in investing? A complete novice? Check your Investor IQ with the 25 questions below.

Answers are listed in the article "Investor IQ Test Answers 2020" in my blog at https://www.nataliepace.com/blog/. Email info @ NataliePace.com or call 310-430-2397 if you have any questions about this test, or about the answers, or if you are interested in learning time-proven investing, budgeting, debt reduction, home buying solutions that will transform your life.  Learn the ABCs of Money that we all should have received in high school and watch how fast your life transforms. Call 310-430-2397 or email [email protected] now. Photo of Natalie Pace at the Penthouse in Santa Monica, CA. Other Blogs of Interest Answers to the 2020 Investor IQ Test. Win a Seat at a Retreat The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Answers to the 2020 Investor IQ Test. by Natalie Pace. Jan. 20, 2020 1. What is the most important question you should ask your Certified Financial Advisor before hiring him/her? "How much of my portfolio should I keep safe?" This question will help you to determine whether you are dealing with a trusted professional who is looking after your best interest, or a salesman who is looking to make a quick buck. The answer to this question, as we enter the 12th year of the current bull market, is, "A percentage equal to your age for sure. But this late in the business cycle, we might consider overweighting even more safe." One more important thing. Bonds are highly leveraged, subject to credit risk and vulnerable to capital loss. So, you need to understand what’s safe, rather than just relying upon bonds to keep you safe. Now is the time to clearly know exactly what you own and why. Consider getting an unbiased 2nd opinion. Call 310-430-2397 or email [email protected] for pricing and details. 2. What are 3 red flags that your financial plan is in peril?

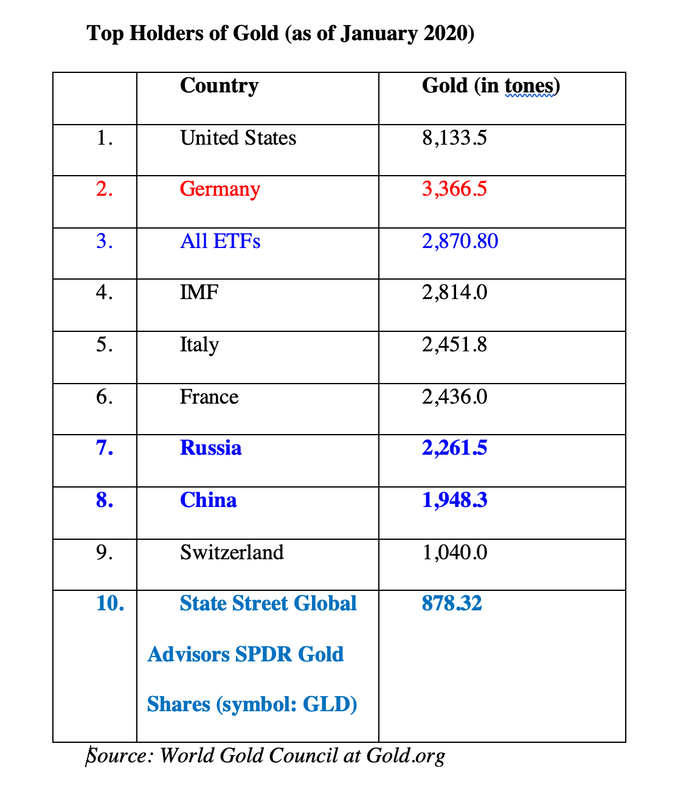

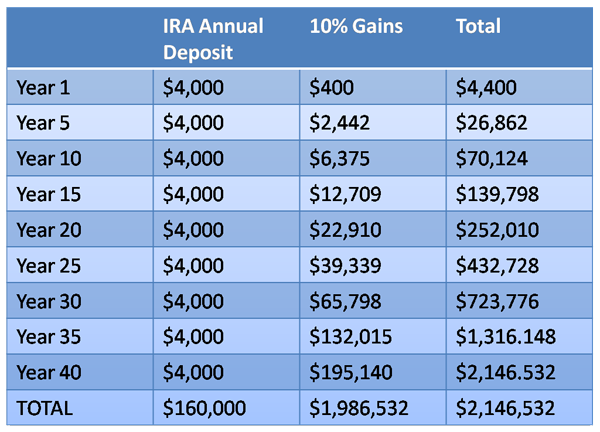

A percentage equal to your age. Consider overweighting more safe when the economy is stumbling or a bull market is going into its 12th year (as is the case in 2020). In today’s world, it is important to know what’s safe. Bonds lost money in 2018, and are riskier than most investors realize. Money market funds have redemption gates and liquidity fees. 4. What's safe? Hard assets will outperform paper assets in a world where there is too much paper money, financial inequality and broken promises floating around. So, the mantra is “safe, income-producing hard assets that you purchase for a good price.” It’s hard to buy real estate at a good price in 2020. You don’t want to be all in on hard assets because you also need liquidity and cash flow. That is why some of the best hard asset investments are those that reduce your monthly expenses (for life). I spend one full day on What’s Safe at the Investor Educational Retreats. Educate yourself now on the best income-producing hard assets that are right for you now, so that when prices are more attractive, you know what you want and have the means to move on it. Call 310-430-2397 to learn more. 5. What is the average return of stocks over the last 10 and 30 years? Large cap stocks earned 13.56% annualized over the last decade and 9.96% over the 30-year period. Small cap stocks performed at 12.4% and 11.2%, respectively. (Asset performance graphs, and more, are available to 2019 Retreat Attendees.) 6. What is the average return of gold over the last 10 and 30 years? Gold returned 2.69% annualized over the 10-year period and 4.37% over the last 30 years. While gold doesn’t look like much on paper, gold mining stocks doubled in 2016, and are currently on sale for 75% off. The all-time high of $1,895/ounce in gold occurred in September of 2011, the month after Standard and Poor’s downgraded the U.S. credit. 7. What is the average return of real estate over the last 10 and 30 years? Real estate prices are higher today than they were before the Great Recession – meaning real estate is largely unaffordable. According to AttomData, average income-earners are unable to purchase in their community in 74% of U.S. cities. During the Great Recession, about 10 million homes changed hands, and 3.2 million U.S. homes are still underwater. There is nothing worse than buying high in real estate! It can ruin your life for decades. Over the last decade, real estate has performed at 5.80% annualized. (The losses of the Great Recession are no longer included in this statistic.) Over a 30-year period, real estate increase 6.1% annualized. 8. What was the top performing investment in 2019? Bitcoin rose almost 14X in 2017. Cryptocurrency burned investors in 2018, with losses of up to 82%! However, after starting 2019 at $3700, Bitcoin ended the year at $7191, almost doubling, for gains of 94%. That’s the best performing investment, by far. 9. How long will it take for you to have a nest egg as big as your annual salary if you put 10% of your income into a tax-protected (and financial predator proof) individual retirement plan and invest in stocks and bonds*? 7 years. Based upon 10% average annualized returns of stocks and bonds over a 30-year period, which is about what those assets have done over the 30-year period, from 1990-2019. 10. How long will it take for your nest egg to earn more than you earn, if you put 10% of your income into a tax-protected (and financial predator proof) individual retirement plan and invest in stocks and bonds*? 25 years. Based upon 10% average annualized returns of stocks and bonds over a 30-year period, which is about what those assets did from 1990-2019. 11. What’s the best investment strategy in a slow-growth, high-debt world? Hard assets hold their value better than paper assets when there is too much paper floating around. Market timing doesn’t work. Pouring everything into real estate can be vulnerable, as you still need liquidity. It’s not a good idea to just put everything into cash and real estate. So, learn how to diversify properly (you don’t need 18-pages of holdings), avoid the Bailouts, add in hot industries, keep enough safe, overweight safe in volatile times and rebalance 1-3 times a year. Most, but not all, hard assets are overpriced right now, so it offers a good period of time to research and determine exactly what is right for you. There are some excellent hard assets that are worth considering, which is why I spend one full day on this topic at the Investor Education Retreats. Value capital preservation more than reaching for yield. It will allow you to buy low when things are on sale. 12. Which countries hold the most gold? The United States is the top holder of gold worldwide, by far, with 8,133.5 tons, followed by Germany, All ETFs, the International Monetary Fund, Italy, France, Russia and China. China and Russia have been on a gold buying spree since 2008. Reports are that they will start trading oil and other commodities using their own currency backed by gold, breaking free from the dollar. (Click to read my report on Russia and Gold.) There are multiple reports that the U.S. banks and brokerages have been selling their client’s gold assets (sometimes without permission) in a price fixing scandal, which has kept gold prices in the U.S. and Europe lower than the rest of the world. Deutsche Bank settled a lawsuit, and agreed on Dec. 2, 2016 to name names of other banks that were price-fixing gold. 13. Are annuities safe? Insurance products, including life insurance and annuities, aren't insured by the FDIC. If we had not bailed out AIG in 2007, more than 50 million annuity holders would have been in real trouble. Your annuity product is only as safe as the insurance company that is selling it to you. Recessions are hard on insurance companies, so we may see some troubled insurance companies in the next recession (as we did in the Great Recession). Insurance products are like being a renter. If you can’t pay, you get tossed out. Many people pay for life insurance their entire working life, and then can’t pay when they retire – when they are really most in need. If you put that money into your own tax protected account, you could save on taxes, compound your gains, and it would be there for you when you retire, even offering some income, in addition to the capital. 14. What were the top performing and the worst months for stocks over the past five years? July, November and February performed best over the 5-year period (in that order), on average. December, August & May were negative months. 2019 Retreat Attendees receive charts of the top-performing months and election year trends. If you’re interested in learning more about our 3-day, life transformational investor educational retreats, call 310-430-2397 or email info @ NataliePace.com. 15. What was the top performing 2-month period for stocks over the past twenty years? March & April – the Spring Rally – performed the best over the 20-year period, but saw only a 2% rise in the 5-year trend. December 2018 was the worst performing December in history, killing the historical returns of the Santa Rally. Understanding seasonal trends can help you with your annual rebalancing in your nest egg, and with your selling strategy for your trading. I spend one full day on what’s hot, teaching you how to identify the best investments of the year, in my Investor Educational Retreats. 16. What was the worst investment in 2019, NASDAQ, gold, the Dow Jones Industrial Average, bonds, cannabis or real estate? Cannabis was the worst investment in 2019 – with many companies losing half or more of their value. Canopy Growth dropped to a low of $13.81, from heights of $50/share in 2019. Learn more about Cannabis in my January 2019 blog and teleconference. 17. Which year is expected to perform better, 2019 or 2020, based upon historical returns of election years? 2020 is an election year. Traditionally, election years are strong performers. However, the 10 and 20-year returns are wiped out due to the Great Recession (losses of 55%) and the Dot Com Recession (losses of up to 78% in the NASDAQ). 2000, an election year, was the beginning of the Dot Com Recession. 2008, an election year, ushered in the devastating Great Recession. The post-election year (2021) is looking strong over the 10-year period, but is typically one of the weaker years. 18. How many companies are in the Dow Jones Industrial Average? 30 companies. Many are household brands. And many are carrying far more debt than the value of the company. Leverage has begun to concern economists. Over 50% of the corporate bonds are at the lowest rung, just above junk bond status. If you don’t understand how much debt corporations are holding, it’s time to learn The ABCs of Money that we all should have received in high school. General Electric isn’t the only blue chip that is likely to slash its dividend and lose market value. Ford Motor Company isn’t the only name brand about to be downgraded to junk bond status. Click to access the names of the 30 companies. The Dow Jones Industrial Average was launched in 1896. 19. How many Dow Jones Industrial Average companies were bailed out or went bankrupt in the Great Recession? Most don't realize that 20% of the companies of the Dow (6 companies: AIG, American Express, Bank of America, Citi, JP Morgan and General Motors) were bailed out or went bankrupt in the Great Recession. Others, like General Electric and Ford, received support. New Chips, like Apple, Google, Amazon, Facebook and Netflix, are far safer, and higher performing, than Blue Chips, both in terms of growth, but also in terms of the fiscal health of their balance sheets. Learn more about how to add in performance and avoid the bailouts in your funds and retirement account at the Investor Educational Retreat and in The ABCs of Money. Since the Great Recession, the NASDAQ Composite Index has offered far superior returns than the Dow Jones Industrial Average, even factoring in dividends. In fact, the higher the dividend, the higher the risk. 20. How much did investors lose during the Great Recession? The Dow Jones Industrial Average lost 55% in the Great Recession. Yes, the markets have come back. But it is important to realice that Buy & Hope has lost more than half in both of the last two recessions. You can’t afford to lose more than half every 8-10 years, crawl back to even, only to lose more than half again. It’s time to step off of the Wall Street Rollercoaster and into time-proven, easy systems that work. Buy & Hope is a last century plan that hasn’t worked in the New Millennium and will not work going forward. Returns of the Dow Jones Industrial Average Oct. 2007 – March 2009 21. How much did investors lose during the Dot Com Recession? Investors lost up to 78% in the Dot Com Recession, when the Nasdaq Composite Index dropped to a low of 1,114. Returns of the Nasdaq Composite Index March 2000 – October 2002 22. Does Buy & Hope work? If not, what does? Buy & Hope has been losing more than half in each recession since 2000. Due to the amount of debt and leverage, and the slow rate of growth, Buy and Hold will not work going forward (until those problems are dealt with and cycled through). Our easy-as-a-pie-chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. Working off of the pie charts, instead of the brokerage statement, allows you to take the emotions out of the plan, and rely, instead, upon a time-proven system. Email [email protected] or call 310-430-2397, if you’d like a customized, sample pie chart. Annual rebalancing is also a key component of this plan. Annual rebalancing is a buy low, sell high system on auto-pilot for your nest egg – prompting you to do what you should be doing each year. 23. Why is it that so many investors are unable to Buy Low and Sell High? Buy low, sell high is a mantra that everyone knows. So, why do so few investors do it? There are a few reasons…

1. Start with what you know and love 2. Pick the Leader 3. Buy low; sell high (easy to say; hard to do) This recipe, along with my Stock Report Card, Four Questions, market strategies and data drilling are how I earned the ranking of number one stock picker. The recipe is easy. Learning how to use these tools requires practice. You must begin by locating and analyzing data, which is actually less time and far more informative than reading articles, which have a fraction of the information and might be written by a novice. Come to my next Stock Master Class on February 7, 2020, the day before the Florida beachfront Investor Educational Retreat to learn firsthand (from me) how easy and effective this strategy is, and why it has worked through bull and bear markets for more two decades now, while most strategies have bankrupted investors. Call 310-430-2397 or email [email protected] to learn more. 25. What are the Four Questions for Picking Winning Stocks? The Four Questions for Picking Winning Stocks. 1. What’s the product? 2. Who’s the customer? 3. Can the company continue to make a superior product going forward and get it to their customer at the best price before the competition? 4. Who’s the CEO and can s/he motivate the employees to make the best product faster, better and cheaper than the competition? As you can see, three out of four questions can be answered by being a good customer of the company. The 3rd question will benefit from you completing a Stock Report Card, and understanding how to use the data. So, the more you know about a company (ingredient #1 of the recipe for Cooking Up Profits), the easier it is to pick the leader. In Put Your Money Where Your Heart Is, I used these questions and tools to compare two companies. Google scored an A (in 2006, when it had only been publicly traded for 2 years). The Wall Street darling Blue Chip, which I gave a D- to, went on to declare bankruptcy (General Motors). FYI: Using the Stock Report Card and 4 Questions, I identified both of these trends years before these major events occurred. The book was written in 2006, three years before GM went bankrupt. In fact, I applauded Google on national television before its IPO, when most pundits pooh-poohed it. This is the power of asking the right questions, rather than just listening to the mainstream media. Join me at an upcoming Financial Empowerment and Investor Educational Retreats. Call 310-430-2397 or email [email protected] to learn now. Yesterday our team was told yet another story about someone who lost it all by trusting in the "free" advice of a financial advisor. Learn the truth about commissions & conflicts of interest & how to get a 2nd opinion now in the guest blog “They Trusted Him. Now He Doesn’t Return Phone Calls.” Know what you own. Protect your future now! Data Sources: (c) 2020 Morningstar Direct and The National Association of Realtors. All rights reserved. Used with permission. The information contained herein: (1) is proprietary; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar, the National Association of Realtors, Natalie Pace, nor any content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Other Blogs of Interest Win a Seat at a Retreat The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Everyone is a winner in our 2020 New Year New You Sweepstakes. (See the full list of prizes below.) The Grand prize is a complimentary seat at a Financial Empowerment Retreat, valued at $1,650. (You have four retreats to choose from in 2020). Simply email [email protected] with the subject line Enter Me in the 2020 Sweepstakes! You will be automatically entered to win. No purchase is necessary to enter. If you’d like to up your odds, then write a review of Natalie Pace’s new book, The ABCs of Money for College. Send us a link to your review on Amazon, and we’ll enter you five more times in the Sweepstakes. The Kindle version is available for just $3.49. The print edition can be purchased for $8.99. Your review of The ABCs of Money for College is important to us, and even more important for parents who wish to prepare their children, tweens and teens for college. The more you share and review, the greater the chance that this important information gets into the hands of those who need it most. Act now. Entries must be received by January 31, 2020. The drawing will be held, and winners will be notified, the first week of February. List of Prizes Retreat Seat (value up to $1650). ½ off Retreat Seat (value $825). 2nd opinion on your current budgeting and investing plan (value up to $1795) 3 50-minute private prosperity coaching sessions (value $900). 50-minute private prosperity coaching session (value $300). Everyone is a Winner Every person who enters the sweepstakes can choose to receive a complimentary 21-day Gratitude Game audio program: 21 days to a healthier, wealthier, more beautiful you and/or a 4-part Sustainability Teleconference series, where you can learn how to save thousands of dollars annually with smarter big-ticket choices. Thank You! Your presence in our community, with a dedication to financial literacy and sustainability, means the world to us. We work hard to keep you informed and empowered, and you help us to spread the word of this important information. Thank you so much for your review of The ABCs of Money for College! We need your help in spreading the word about this important book. The Retreat Sweepstakes entry period expires January 31, 2020. Anyone who has emailed us on or before January 31, 2020 will be entered in the drawing. Winners will be chosen and notified on or before February 29, 2020. There is no cash value for the prizes. 2019 was a wild ride for cannabis with multiple highs and hangovers. Tilray has been on a steady slope from the heavens to reality since it rang up $300/share in October of 2018. Today, Tilray closed at $15.83/share. Canopy Growth has whipsawed between $20/share and $53/share multiple times over that same period, and is now close to its 5-year low. MedMen, a popular cannabis retailer in California (and other states), saw its shares sink into penny stock territory in November 2019. Have investors sobered up from the high valuations of October 2018? Were hedge fund’s profit taking responsible for the burning up of Main Street investors? Or are there fundamental headwinds that need to be factored in before leaping into pot stocks? Capital Crunch The end of 2019 was a period of sobering up for all companies, not just the marijuana industry. WeWork’s valuation was slashed from $47 billion to $8 billion. Unicorns, like Snap Inc., that have been cash negative for years are being required to show a clear path to profitability before accessing more capital. Ford bonds were downgraded to junk. After years of a free ride, bond and loan covenants were finally showing some backbone and demanding more than just an exciting story. So, imagine trying to get funding if your product isn’t even legal at all in 17 U.S. states. Most cannabis companies get around this by basing themselves out of Canada. However, the legal issues, and rapidly changing landscape around THC, CBD, medical marijuana and recreational cannabis, complicate everything from banking and funding to product sales and distribution. So, the companies with experienced, creative executives and board members have a competitive edge over founder/CEOs, particularly heading into 2020 when the industry has seen the traditional capital markets dry up. Aphria has Hain Celestial’s founder/CEO Irwin Simon at the helm. Tilray’s advisory board is stacked with international policy superstars. Medmen’s new CFO Zeeshan Hyder, whose background includes eBay, Citi, Eli and Edythe Broad, and First Bev, has initiated a 5-point plan to be EBITDA positive by the end of this year. Meanwhile, Canopy Growth’s founder/CEO Bruce Linton (in July 2019) got the boot and will be replaced with Constellation Brands’ former CFO David Klein. Cannabis Has an Exciting Story Aphria’s revenue growth was 849% year over year in the last quarter. Tilray’s revenue increased five-fold. Even with a pullback on CAPEX, Medmen is still planning on adding another 13 retail stores and doubling revenue in calendar year 2020 (on a run rate basis). Canopy Growth was one of the few companies where sales were lower in the most recent quarter sequentially. In the 2nd quarter earnings call, CEO Mark Zekulin (who is leaving the company and being replaced by David Klein) dialed back on a target of having $250 million in revenue with 40% margins by the 4th quarter, saying that objective was “unlikely.” Innovation and First-Mover Advantage Innovation is also key to the next phase of the industry’s cycle. Canopy Growth’s partnership with Constellation Brands is expected to yield THC and CBD beverages as alternatives to traditional spirits. So, while the short-term will be sobering, once these products drop, if they are embraced as an alternative to beer and wine, then Canopy Growth’s star could shine. Tilray is releasing CBD beverages in partnership with Anheuser-Busch (Labatt Breweries) and Authentic Brands. Meanwhile, Cronos’ partnership with Altria is suffering from the health concerns surrounding vaping and Altria’s $4.5 billion write-down of their Juul investment. Valuations, Cash Burn and Cash on Hand In addition to understanding the product, the customer and who is running the show, it’s important for investors to buy low and sell high. It’s more difficult to know how to value companies that are in rapid growth mode and are largely cash negative. However, without a sound exit strategy, you might be stuck with expensive stock, when the company finds that it’s vision for the future was slightly impaired. (That’s one of the most common mistakes investors make: not having an exit strategy.) As the industry is definitely in the middle of a capital crunch, it is also key to make sure that the enterprise isn’t flying too close to the trees and is well-capitalized. Additionally, there must be a pathway to profitability. Bruce Linton was booted because the board, with ample influence from Constellation Brands, wanted to see a more focused approach to growth. Mergers and Acquisitions are great for growth, however, only if they are rowing in the same direction and are complimentary to the existing product line. The Bottom Line Many cannabis stocks are trading near multi-year lows. However, picking the winners is still imperative to successful investing, as is being a patient buyer and an opportunistic seller. Go to BlogTalkRadio.com/NataliePace to listen to my teleconference on Cannabis 2020. I’ll have another BlogTalkRadio update on January 23, 2020 at 9 am PT (noon ET). Aphria announces fiscal 2nd quarter 2020 results on January 14, 2020 at 8:00 am ET (before the markets open). If you'd like to learn stock strategies, join me at my Stock Master Class Feb. 7, 2020 and my Investor Educational Retreat Feb. 8-10, 2020 in Cocoa Beach, Florida. Other Blogs of Interest Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Does Your Commute Pollute More Than Planes? Includes 5 Tips on How to Live a Green Life. There are many benefits to living green, and ample opportunities for each one of us to shift out of our last-century habits – many of which are not planet-friendly – and into a life-style that is just as exciting, comfortable and easy, while being far more carbon-neutral. Here are just a few of the benefits of living a green life…

To start the process, simply begin with the 4 R’s of Living Green.

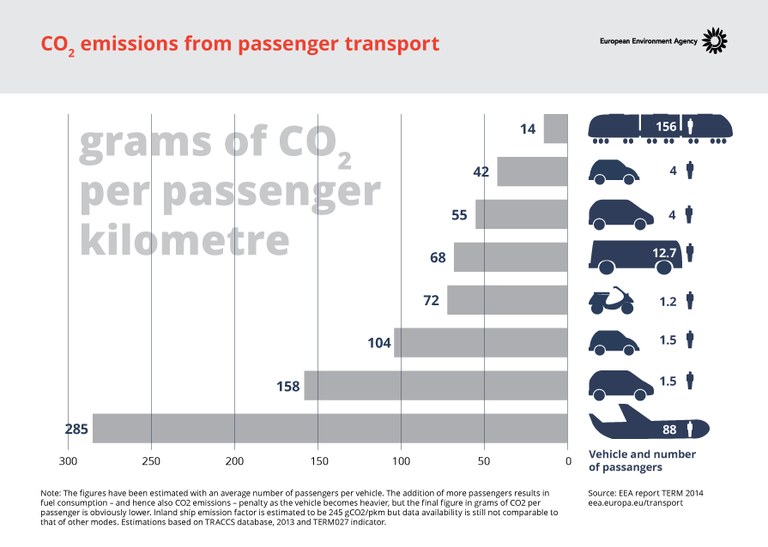

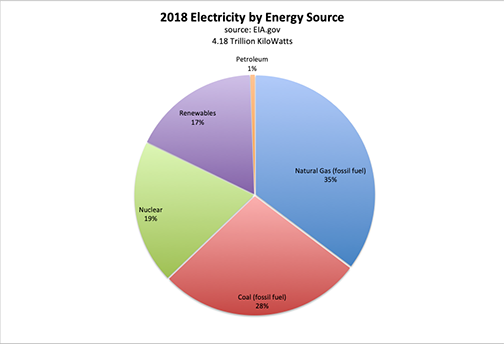

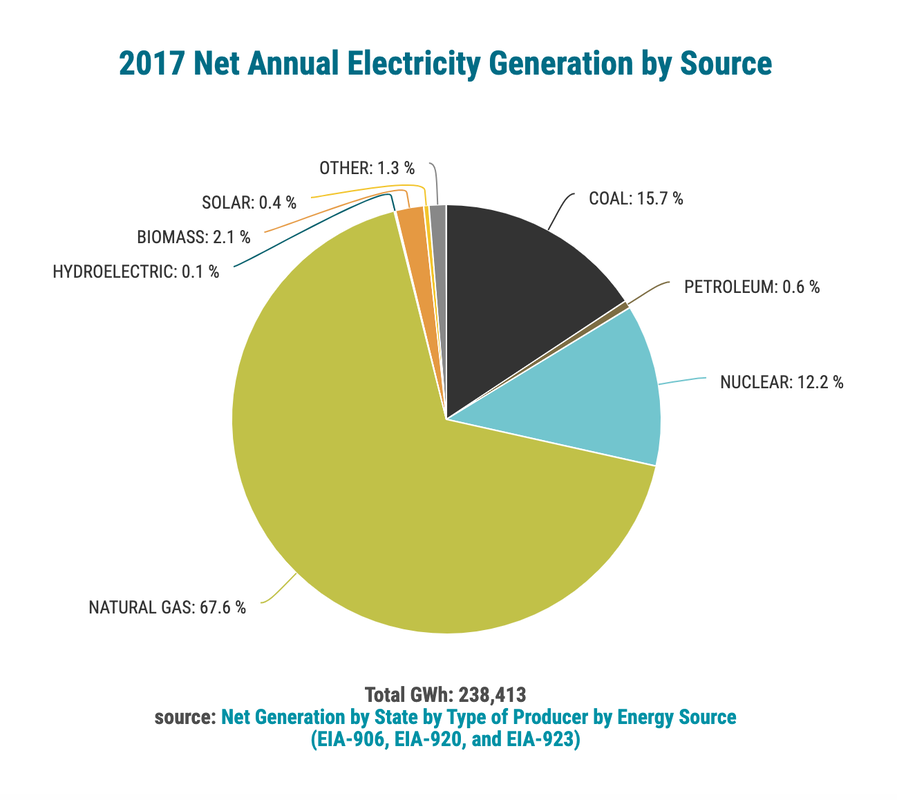

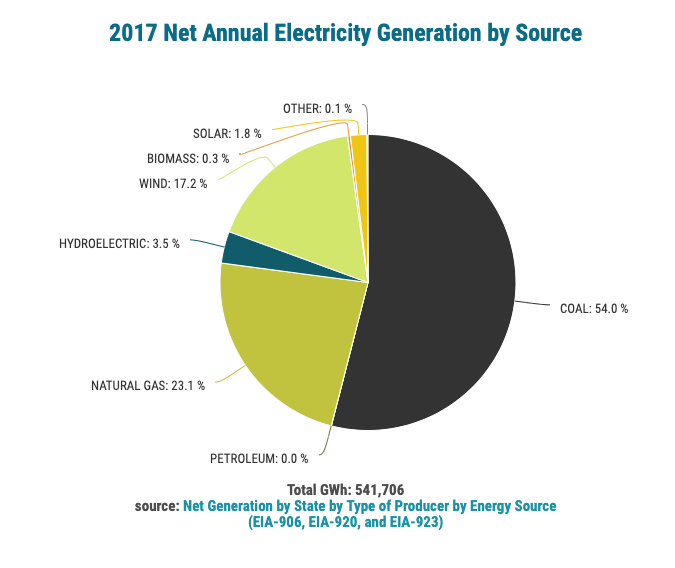

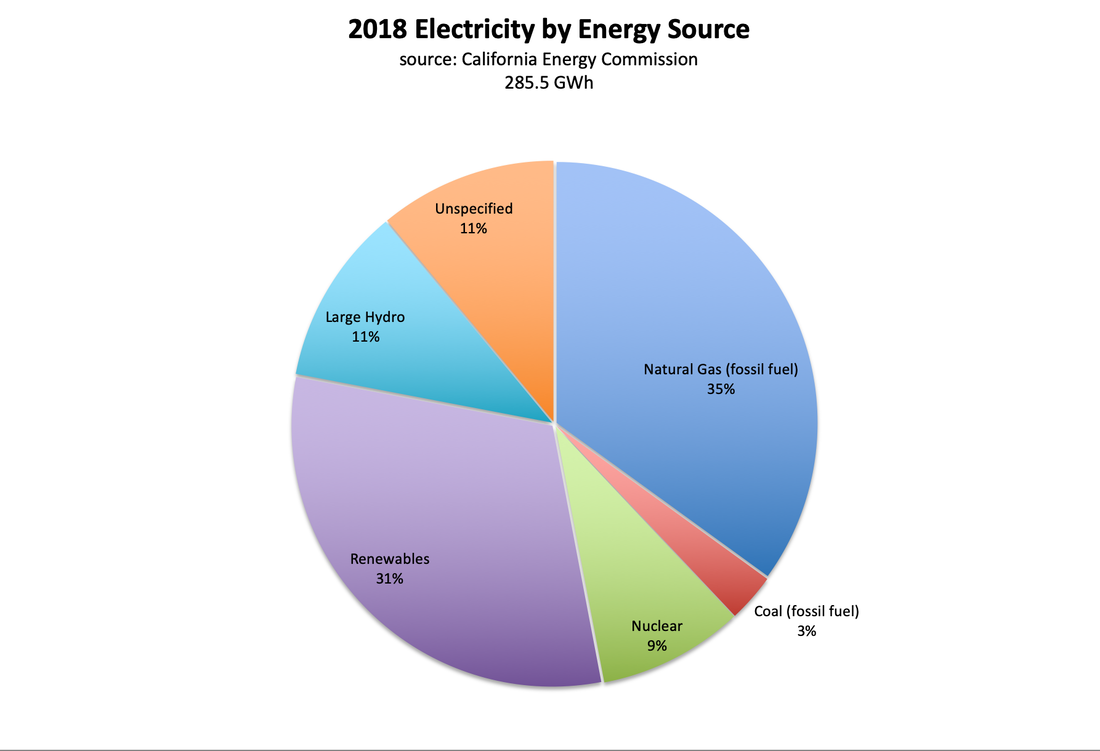

Refuse plastic, fossil fuels, water waste and pollutants every chance you get. Reduce consumption. This includes our wardrobe, our landscaping & our transportation. Reuse containers. Buy food in bulk. Bring our own to-go box. Support local Farmer’s Markets. Recycle. Many cities are now even composting food waste, which makes up 20% of the garbage in America. So, how can you save thousands annually and enjoy greater health by starting with the first of the 4 R’s – Refuse? Below are a few examples of how refusing to go with the status quo can change everything and become the new normal, with ample personal and Mother Nature gain and benefits. Transportation There has been a lot of focus on plane-shaming, and less focus on the pollution caused by the daily commute. When you factor in that most people are in a single-occupancy vehicle, the grams of CO2 used per km could be as high as 220g. That puts the carbon footprint of a single commuter higher than if that same person were in a plane. (The 285 g CO2 per km figure cited by the European Environment Agency assumes 88 passengers, whereas most U.S. planes have a much higher occupancy rate, at closer to 115 passengers.) So, if you’re plane-shaming, while commuting to work every day, then it’s time to look at the man in the mirror. A single-use vehicle is as polluting as travel by air – more so if you do it every day. Can you opt for mass transit, cycling, ride-share or an e-scooter? Should you move closer to work? Yes, you’ll have to rethink your life from the core of your foundation. The savings of ditching the car could add up to $7,500 annually, when you add up the cost of the car payment, car insurance, gasoline, maintenance, parking, tickets, etc. However, if you do, then the savings can fuel you to a much richer life. The lifestyle choice of biking and walking more will keep you healthy, fit and strong. Li Watkins, a bike commuter in Dorset, England, notes that she gained 10 pounds when she was commuting by car! If you can videoconference instead of flying, you can save yourself and/or the company thousands of dollars in airfare, lodging and per diem, while doing the right thing by the planet. You might even rethink your vacations to support a more planet-friendly approach. However, if you have eliminated your daily commute, you might feel better about exploring another part of the world now and again. Power Transmission The bigger the appliance, the more fuel needed to power it. This applies to planes, trains and automobiles, space craft, and also home appliances, elevators, escalators and air conditioning. Choosing renewables over fossil fuels is a big part of the solution. However, refusing to use big appliances that you don’t really need is an even bigger piece of the equation. Refusing to take the elevator, and opting for the stairs, promotes good health for you and the planet. Taking the train, instead of driving yourself to work, dramatically reduces your carbon footprint – even if you’re driving an electric car. Did you know that the power grid in the U.S. is still 62% fossil fuels and 19% nuclear? In some states, the mix is even higher, with 83% fossil fuels in Florida and 77% fossil fuel in Colorado. That compares to 38% fossil fuels and 42% hydro and renewables in California. Check up on your state by going to SPOT, sponsored by the Center for the New Energy Economy. So, can you take the stairs, choose mass transit for your daily commute, better insulate your home, walk to the store for your milk and toilet paper daily, turn down the thermostat at work each evening and at home during the day, and install a timer or on/off switch on your water heater? The savings of these smart energy choices can be in the thousands annually. Making a green life, green in the sense of money, too. Plastic There are many ways to say no to plastic.

Remember: there is no excuse for single use. Personal Habits Refuse to follow last century thinking.

Housing The Nuclear Family is outdated, as is the McMansion. Intergenerational housing is becoming en vogue. So, how can you rethink your family lifestyle in ways that will have each family member saving a lot of money, while still enjoying personal space? What are the benefits of sharing common spaces, like the dining room and kitchen, and perhaps even cooking duties? Can you stop making the landlord rich, when you bring the family into one home, instead of having everyone living in their own tiny (and expensive) pod? These are just some of the ways that we can refuse to be trapped in an unsustainable lifestyle that was created for the last century – from a cost of living standpoint for us as individuals and from a planet depleting standpoint in our general collective. It’s time to stop passing the blame off onto others and to be the change we wish to see. There is a lot of currency in change, for a richer life today, and to pass on a nurturing, flourishing home planet to the generations to come. Get additional information in my 4-part Living Green Teleconference series, every Tuesday at 3:00 pm PT in January 2020. Email [email protected] or call our offices at 310-430-2397 to register now. Download your free Future Earth and Clean Living ebooks by clicking on the book covers directly below. Learn more about 2 eco-communities designed by Nature’s Prince, aka The Prince of Wales (click on the blue-highlight to access). Learn how to live a green, rich life, while putting your money where your heart is, at my Investor Educational Retreats. Call 310-430-2397 or email [email protected] to learn more now. Choose from February in Florida (beachfront), April in Poundbury, England (for an Earth Day celebration) or June in Santa Monica, California (100% solar-powered since 2018!). Other Blogs of Interest Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Do you have a high deductible on your health insurance plan that worries you to death? Is health insurance costing you an arm and a leg? Did you already get into trouble with health care costs, and are on a collision course to bankruptcy? Are you draining your retirement plan to pay off a hospital stay? Learn strategies to cut your health insurance costs, increase your personal assets and protect your nest egg in the blog below. Cut Your Health Insurance Premiums. Save Thousands Annually. If you are healthy and spending an arm and a leg on health insurance, then it’s time to look into a high deductible health insurance plan with a Health Savings Account. The benefits of this plan are many. The savings could add up to thousands of dollars annually on your health insurance premiums, but the benefits don’t stop there! Benefits of HSA