|

The Boeing 2Q 2019 earnings report was, as expected, pretty ugly. As the company admitted in the press release, revenue was down 35%, to $15.75 billion from $24.3 billion last year. The net loss was $2.94 billion, compared to net income of $2.2 billion in 2Q 2018. The 737 Max remains grounded. According to the earnings press release, “Disciplined development and testing is underway and we will submit the final software package to the FAA once we have satisfied all of their certification requirements.” Chairman, president and CEO Dennis Muilenburg stated in the press release that “During these challenging times, teams across our enterprise continue to perform at a high level while delivering on commitments and capturing new opportunities driven by strong, long-term fundamentals.” However, the devil is in the details. Below are a few operational red flags that are listed in the fine print of the earnings report (and elsewhere), but certainly not highlighted in the press release. Red Flags in the 2Q 2019 Boeing Earnings Report

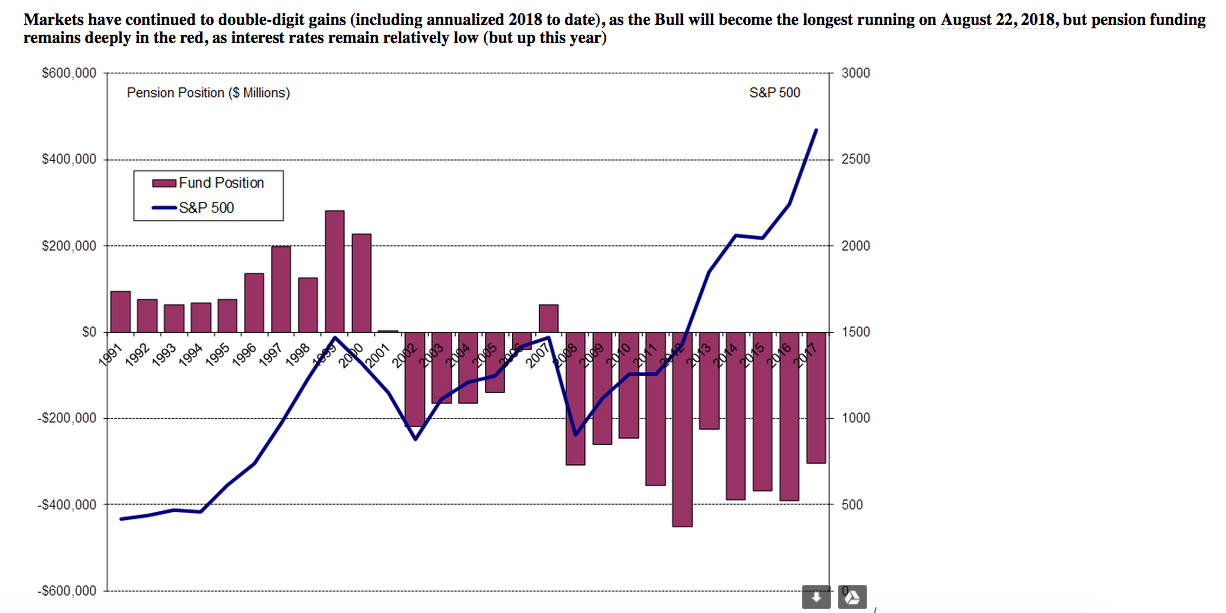

And here are the details behind each point. 1. Corporate Buybacks Boeing repurchased $2.65 billion of its shares in the 2nd quarter of 2019. In 1Q, Boeing repurchased $2.574 billion. $9.257 in shares were repurchased in 2018. 2. Increased Dividends Boeing paid $1.2 billion in dividends in the 2nd quarter. That’s 20% higher than last year. 3. Borrowed Money Boeing borrowed $4.5 billion in the quarter. Cash and marketable securities are now $9.6 billion. Total liabilities and equity, including pensions and other post-employment benefits, total $126.2 billion. FYI: The last casualty to borrow in bonds to repurchase stock and pay dividends on such a level was General Electric. As you’re likely aware, the GE dividend is now just 4 cents, and the share price has imploded by 70% from its 2017 highs. 4. Insider Selling So, why is Boeing so intent on buying back its own shares, instead of keeping the borrowed money to shore up operations, and perhaps hire more engineers and specialists, to return the 737 Max to operations? (The costs of products and services were lower this quarter than last year.) It’s clearly to keep the share price shored up and keep investors from selling the stock, by baiting them with a 2.2% yield on their dividend. Insiders at Boeing, however, have already dumped $30 million of shares since the first Lion Air crash on Oct. 29, 2018. The selling began on the exact day of the crash. 5. Pensions and OPEBs Boeing was $22.3 billion underfunded on its pensions and other post-employment benefits, as of 2017. From the 2Q 2019 earnings report, it does not look like the company used any capital to reduce this underfunding level. (We’ll get the full 2018 funding status by S&P Dow Jones Indices shortly.) In past market rallies, corporations were overfunded on their pensions. However, this time around, even with markets at an all-time high, pensions remain severely underfunded, as you can see in the chart below. 6. Price to Earnings Ratio The forward price to earnings ratio of Boeing is 28.27 – very high for a company that is losing so much money. So far, Boeing’s 3Q is not shaping up much better than 2Q was. 7. Book Value Boeing’s book value per share is now just 22 cents. Economist Benjamin Graham is signaling caution to investors from his grave. Will Boeing Pull Through? Just as General Electric is still in business, Boeing is going to pull through this. However, that doesn’t mean that there won’t be investor casualties along the way. By many value measures, Boeing is overpriced. If you’re being lured in by the dividends, it pays to remember the age-old market aphorism – “Never reach for yield.” If you’re a pensioner, and you’re being offered a buy-out, then it’s worth considering. The current underfunding status, and the apparent lack of commitment by the company to fix it while the sun is still shining, is of great concern. In the next downturn, the underfunding status will likely increase, and there will be fewer resources available to address it. That can mean a forced hair cut on pensioners, as it has for other companies faced with legacy costs, such as Boeing has. What Lies Ahead? On Friday at 8:30 am ET, the Bureau of Economic Analysis will release the 2Q 2019 GDP growth report. Current estimates have it coming in at 1.4-1.6% growth. That is far below 1Q’s 3.2%. Investors are not likely to be happy. So, making sure that your portfolio is properly protected and diversified, and that you know what’s safe in a world where both stocks and bonds lost money in 2018, is a top priority. Now is the time to fix the roof while the sun is shining (while the markets are at an all-time high). If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more. Register by July 31, 2019 to receive the best price. I'm also offering an unbiased 2nd opinion on your current retirement plan. Call 310.430.2397 or email [email protected] for pricing and information. Other Blogs of Interest The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 26/7/2019 05:50:14 am

Though The Boeing 2Q 2019 earnings report was pretty ugly and does not even show a bit of growth for the past years, this serves as a challenge for them to make up; for them to work harder in order to achieve greater things that might be waiting for them. This is pretty hard thing since some of the companies within they field are having a hard time to make up. Thus, they need to find a strategy that they can do in order for them to get better! Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed