|

On April 3, 2019, Tesla issued a press release on their first quarter 2019 vehicle delivery count. At 63,000, it was down 31% from the deliveries in the 4th quarter of 2018 (90,700). Production was also lower, at 77,100 vs. 86,555 respectively. That combined with the SEC’s full-court press on Elon Musk’s Tweets sparked a sell-off of Tesla stock, bringing the share price down near its 52-week low. Should You Buy, Sell, Hold or Avoid Tesla Stock? Tesla’s volatility is a reminder that in today’s world, if you’re going to invest in individual stocks, you should have the following strategies in mind. (Remember that successful nest egg investing is a different strategy; call 310-430-2397 to learn time-proven wealth building systems.)

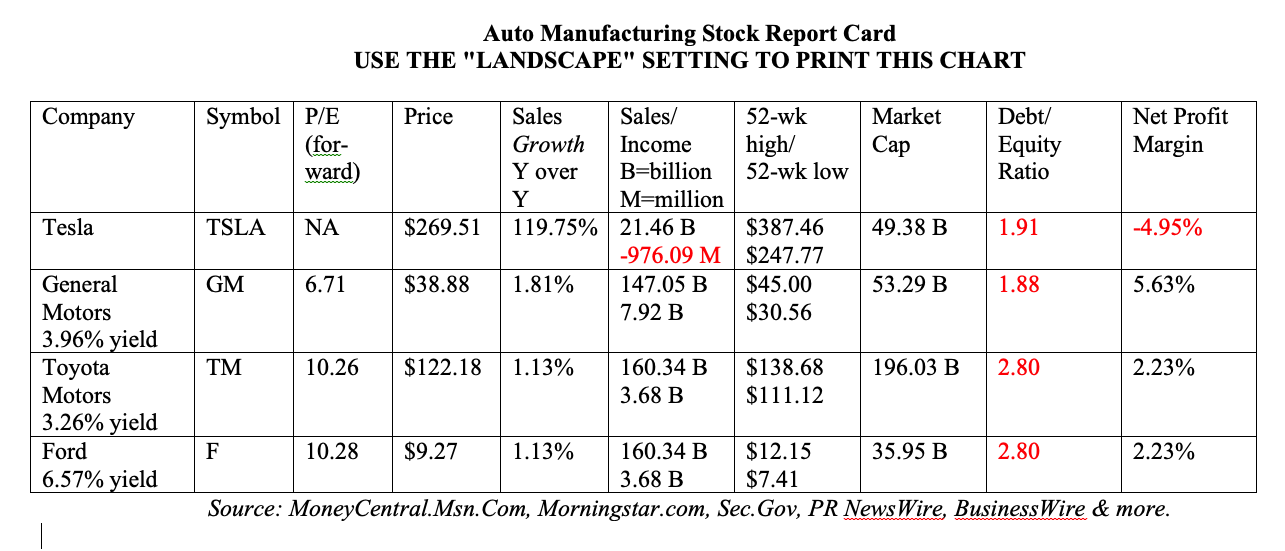

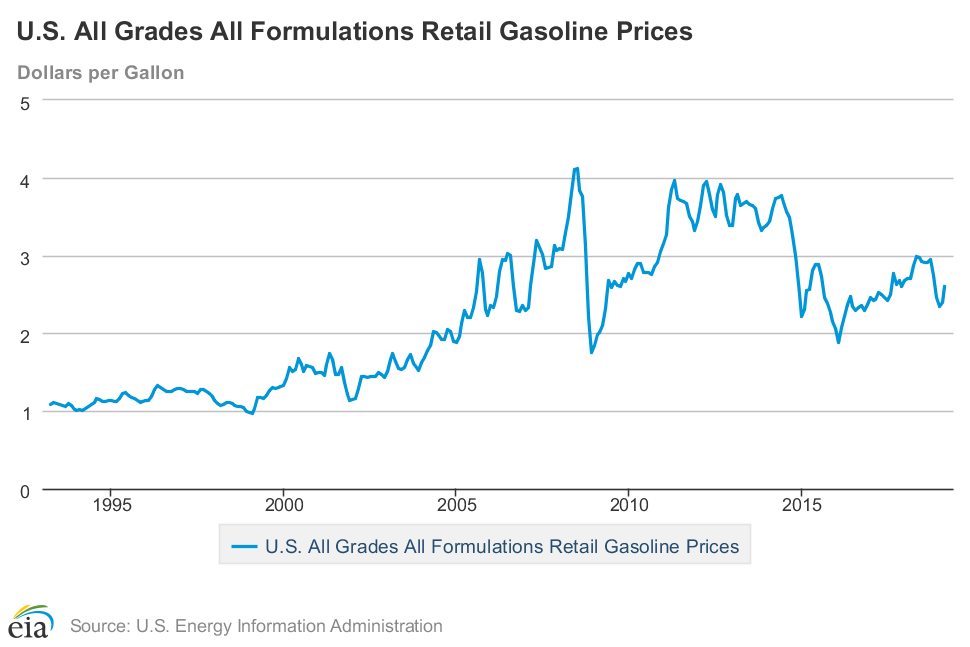

Below is additional information on each point. What is Tesla’s Outlook for 2019? Growth Tesla is projecting +45%-65% growth – from 245,400 vehicles in 2018 to an expected 360,000-400,000 vehicle deliveries in 2019. That kind of growth this late in the business cycle is outstanding. Only cannabis is showing stronger growth than this. (Click to access the Cannabis blog.) Additionally, Tesla’s Shanghai Gigafactory is projected to be up and running in 2019, by year’s end. Although the first quarter deliveries news took Wall Street investors by surprise, first quarter weakness was predicted in the forward outlook section of the 4th quarter and full year 2018 Letter to Shareholders. On January 1, 2019, Elon advised shareholders that “The gap between production and deliveries in Q1 will create a temporary but predictable dip in our revenues and earnings.” Profitability In the 4th quarter of 2018, Tesla was cash positive, generating $139 million in net income. The 1st quarter 2019 could experience a net loss, due to the lower deliverables and a one-time restructuring charge. A 30% drop in auto revenue (based upon the same percentage drop in deliverables) would result in revenue in the $5.330 billion range. A massive pullback in revenue, and a revert back to cash negative operations, will not be welcome news to investors, when the actual numbers are confirmed in the 1st quarter 2019 earnings report, around May 7, 2019. Full-year 2019 is predicted to be cash-positive for Tesla, with a “25% Model 3 non-GAAP gross margin at some point in 2019,” according to the January 1, 2019 letter to shareholders. The Auto Manufacturing Industry Much has been made of Tesla’s debt. However, Ford and General Motors have much higher debt to equity ratios, with the additional burden of pensions and other post-employment benefits. (See the Stock Report Card below.) Though Tesla will likely be cash-negative in the first quarter of 2019, Tesla’s margins are not far from the low margins that are endemic in the auto manufacturing industry. (High volume; low margins, similar to retail.) Tesla is the clear winner in the industry in terms of outstanding sales growth. This trend could accelerate with oil prices on the rise. (Click to read my oil blog.) In 2018, there was a surge in the sales of trucks, which accounted for 70% of dealership sales (source: National Automobile Dealers Association). A decade ago, 52% of the market was cars, with 48% light trucks. NADA Chairman Wes Lutz explained the trend, writing, “One of the main factors for this shift has been continued low oil and gasoline prices and the fact that crossover utility vehicles are nearly as fuel efficient as their sedan counterparts.” This has caused Ford and GM to all but abandon their sedans and lean heavily into their trucks. Meanwhile, the Tesla 3 sedan was yet again the best-selling mid-sized premium sedan, selling 60% more units than the runner up. The auto industry is expected to have 16.8 million new vehicle sales in 2019. As consumers continue to understand just how reliable and fun Tesla vehicles are, and how much cheaper it is to fuel an electric car vs. a gas guzzler, the trend might shift toward Tesla, just as it did to the Prius in 2004, when oil prices began to rise. Even now, with gas prices still relatively low at $2.59/gallon on average, the fuel savings of owning a battery electric vehicle (BEV) can be half or more over gas-powered vehicles (source: University of Michigan). The Macro Economy The global economy, including the U.S. economy, is predicted to slow down in 2019. 2018 saw GDP growth of 2.9%. 2019 GDP growth is predicted to slow to 2.1%. The Federal Reserve Bank of New York forecasts that the 1st quarter of 2019 growth may stall out to just 1.4% growth, with 1.9% growth in the second quarter of 2019. The Elon Musk Hearing. What About That Tweet? Clearly the SEC is making a full-court press on Musk – something that seemed apparent to Judge Alison Nathan. “Put your reasonableness pants on,” she advised both parties on April 4, 2019 at the hearing where the SEC had hoped to hold Musk in contempt of their previous settlement. What’s at the heart of the renewed SEC attack on Musk? A tweet he sent out saying that production would be at 500,000 autos by year’s end. Musk was quoting a statistic that was listed in the 4Q 2018 letter to Shareholders, which stated, “Barring unexpected challenges with Gigafactory Shanghai, we are targeting annualized Model 3 output in excess of 500,000 units sometime between Q4 of 2019 and Q2 of 2020.” Musk’s Tweet was corrected a few hours later to be more precise. All of this occurred after the close of trading. There has been a lot of speculation around whether Musk violated the terms of a settlement with the SEC where all of his Tweets are to be previewed by an internal investor relations person for accuracy prior to posting. However, a case can be made for this material information being available a full month before the Tweet in question. (How I wish there was an agency fact-checking our politicians with this kind of zeal!) The judge gave both parties two weeks to come up with a reasonable settlement. This is clearly not the decisive victory that the SEC wanted. While not a win for Musk either, it was at least not another nightmare. Investors were relieved by the news. Tesla stock is up 2.7% today. Think Capture Gains, Not Stop Losses When you are on a rollercoaster with as many ups as downs, if you set stop losses, you are losing every time the market pulls back, which is often. This is a losing formula. If you set capture gains, you are winning every time the market rises, which is just as often as the pullbacks! This is a winning formula. Take your profits early and often this late in the business cycle. If it’s a rock star industry, like cannabis, you might keep some skin in the game in case the stock goes to the moon. However, for most companies and industries, there is more downside potential than upside. With stocks at an all-time high, and price-to-earnings ratios higher than ever, there aren’t many bargains to be had. So, it’s better to err on the side of liquidity, which allows you to buy low on weakness, rather than worry about missing a market rally party, which might be almost over. Apply the 3-Ingredient Recipe for Cooking Up Profits ®.

So, Should You Buy, Sell, Hold or Avoid Tesla Stock? The Tesla 1Q 2019 earnings report is likely to be ugly. That will be issued around May 7, 2019. The 2nd quarter 2019 earnings report will benefit from the 10,600 vehicles that Tesla had in transit at the end of the first quarter. At the low end of Tesla’s forecasts, deliveries for the remaining three quarters of 2019 would be 99,000 on average (with the 4th quarter on track for 500,000 annualized, at 125,000/quarter). After the first quarter miss and weakness, that would be a pleasant surprise for investors. So, the Fourth of July deliverables report from Tesla could spark fireworks. In short, if there is continued weakness in the Tesla share price, particularly after the earnings report around May 7ish, 2019, I’d be tempted to buy in, with a limited investment, to capitalize on the upside surprise expected in July 2019. I’d adhere to the age-old, tried-and-true market aphorism of taking my profits early and often, based upon the headwinds of the macro economy. I would also employ a Capture Gains mentality over the Stop-Loss (losing) game plan. And I wouldn’t bet the farm. You don’t have to understand economics to employ a time-proven easy-as-a-pie chart nest egg strategy that earned gains in the last two recessions (when most people lost more than half) and outperformed the bull markets in between. Blind faith that someone else is doing this for you can be very expensive. (It’s a good idea to get a second and third qualified, unbiased opinion on your current plan, rather than just trusting that your money manager has protected you.) Wisdom is the cure. (Click to read more about the High Cost of Free Advice.) As the landscape changes rapidly, time proven systems will be your ally. Join me at my Colorado Investor Edu Retreat, where we’ll examine how to protect your assets, learn what's safe in a world where stocks and bonds are in a bubble and invest profitably in high growth opportunities (like cannabis). Call 310-430-2397 or email info @ NataliePace.com to learn more about the retreat, or to request an unbiased second opinion on your current budgeting and investing plan! Other Blogs of Interest Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.

Sean

5/4/2019 04:18:21 pm

Well written! Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed