|

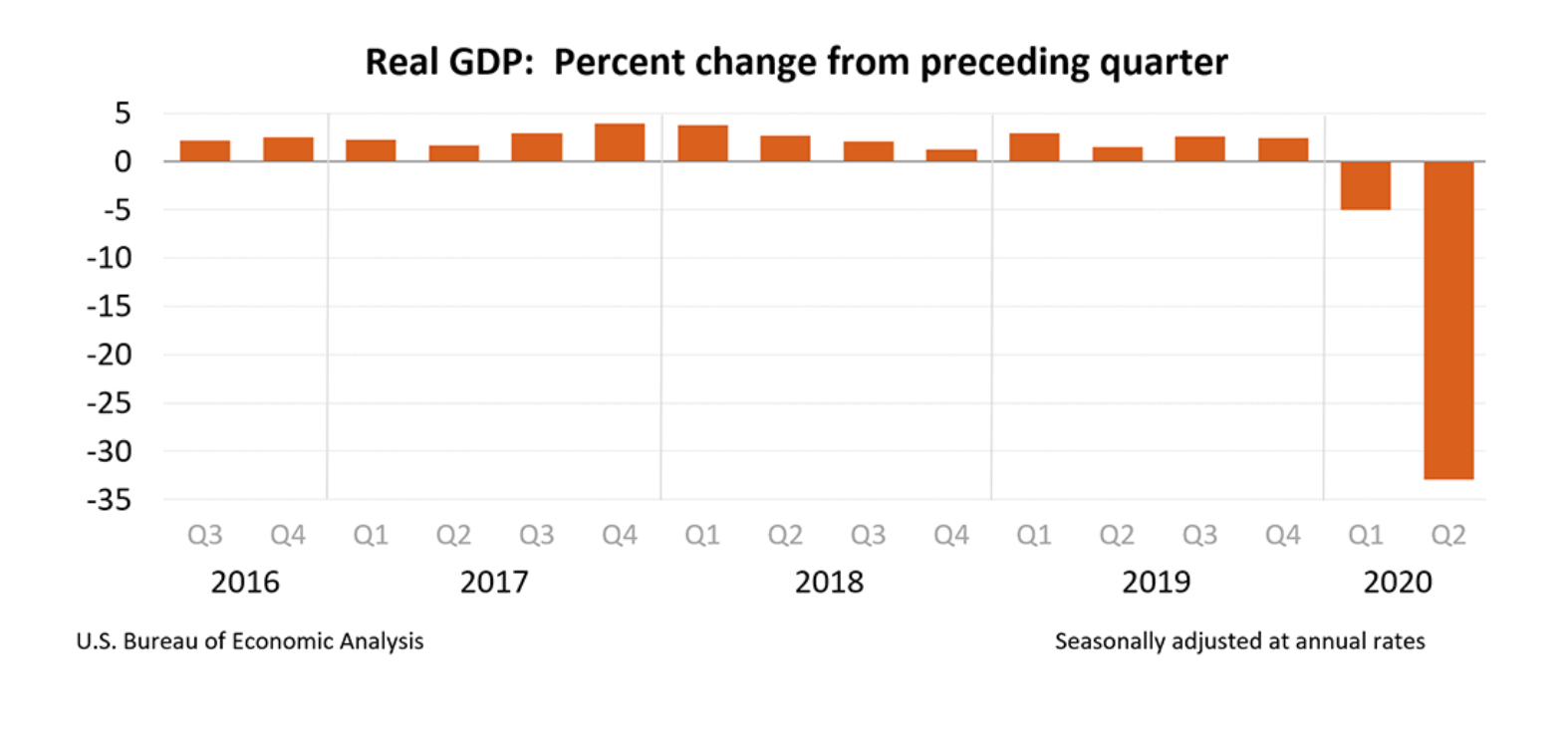

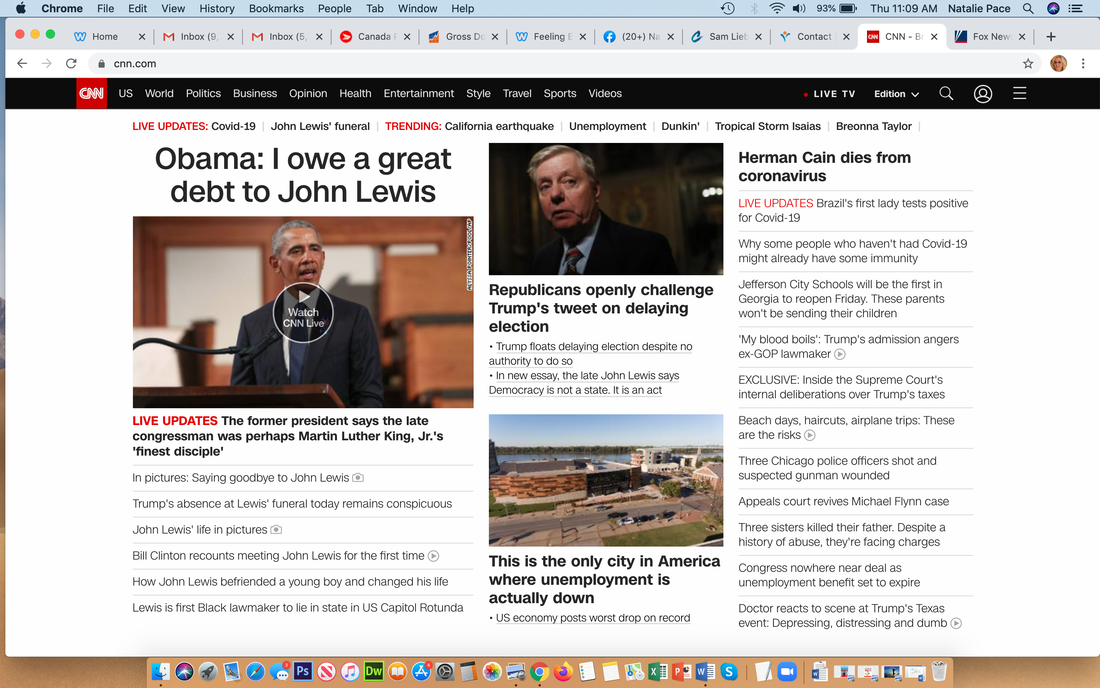

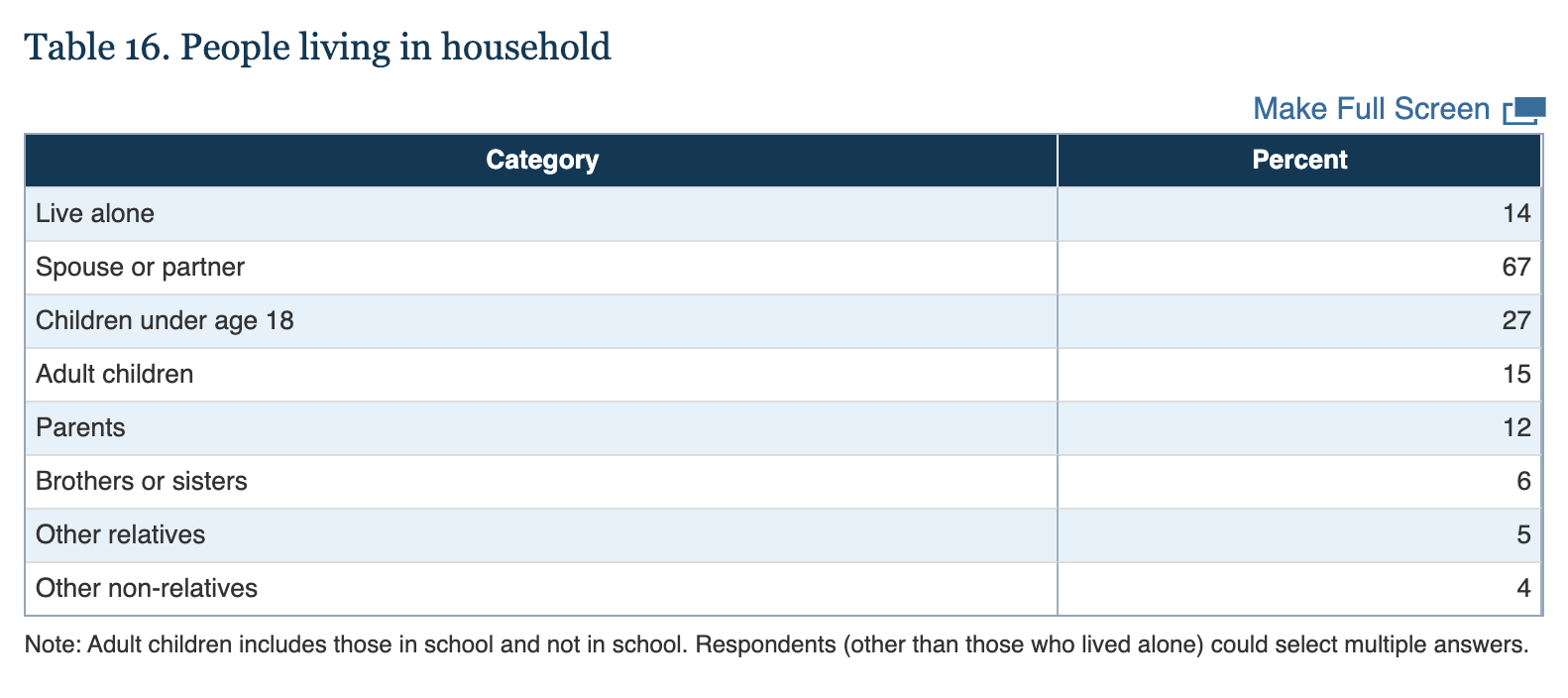

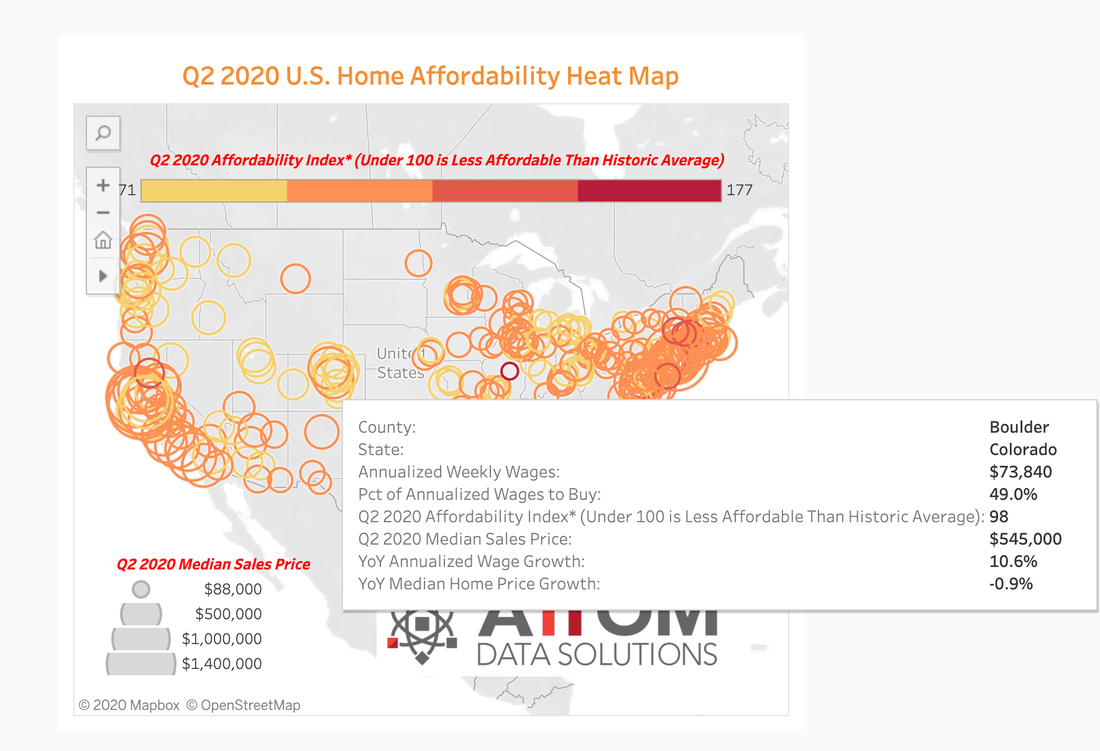

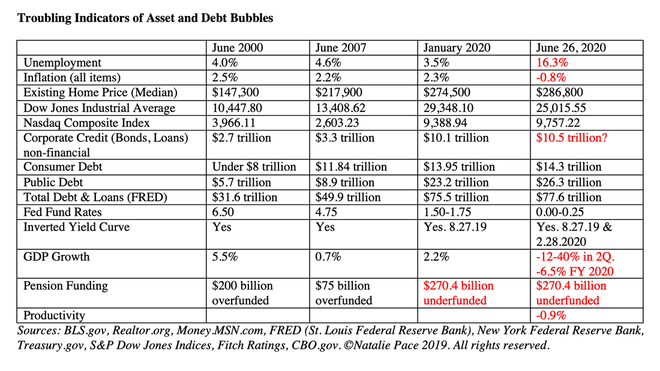

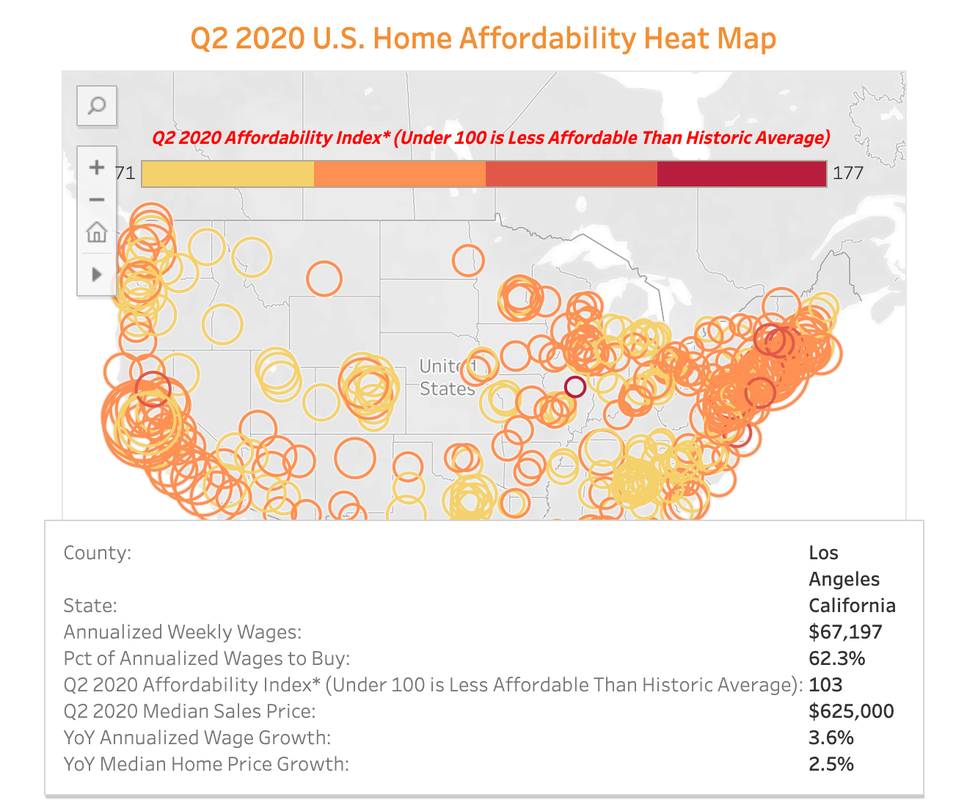

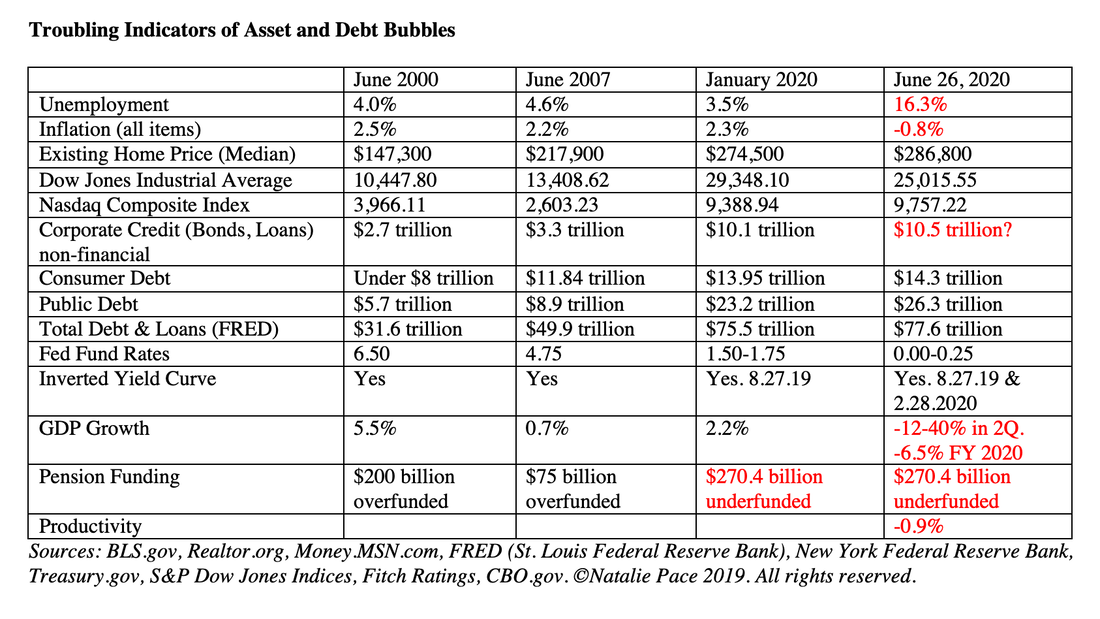

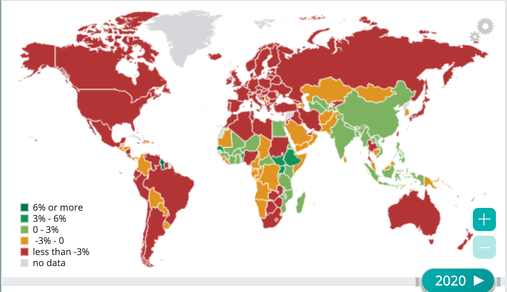

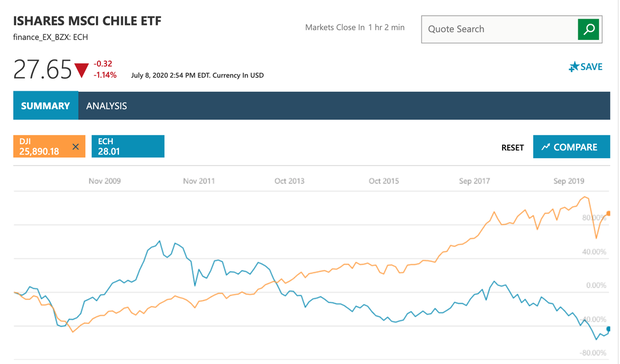

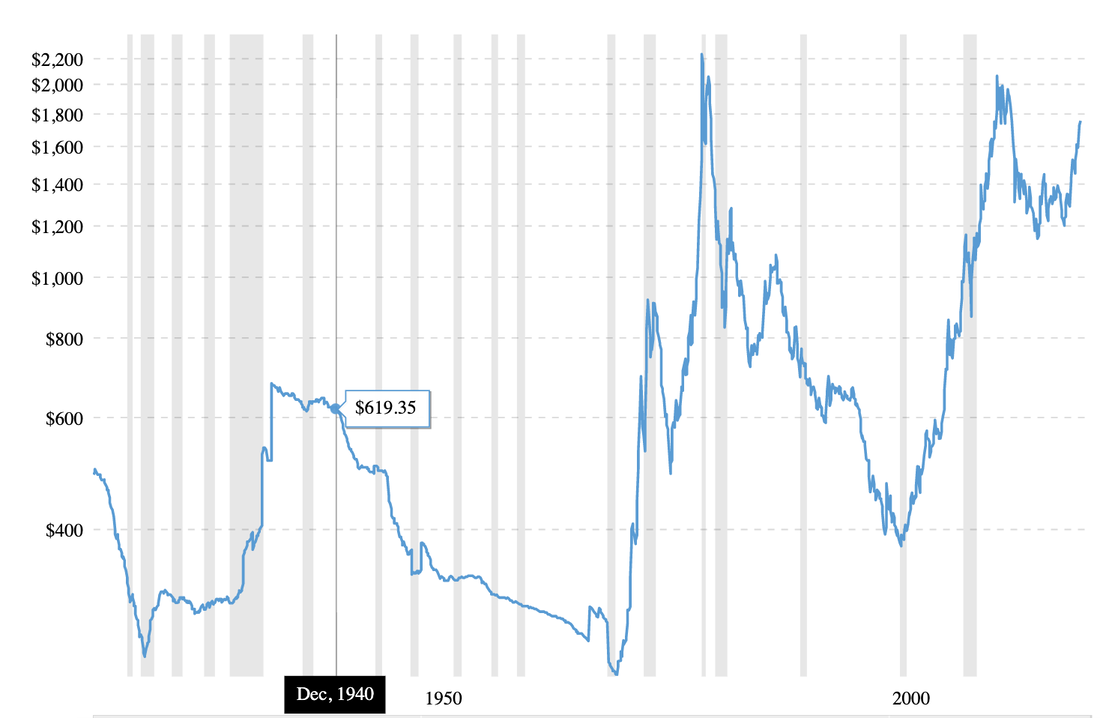

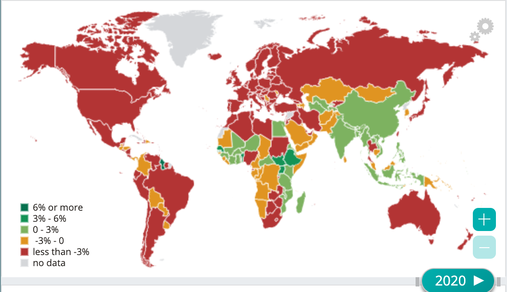

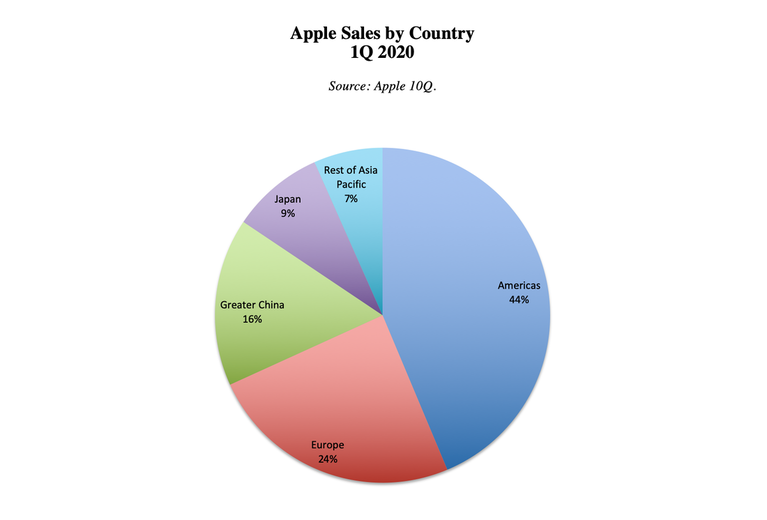

Includes 5 Tips on How to Protect Yourself from Continued Economic Fallout Due to the Pandemic. On July 30, 2020, the Bureau of Economic Analysis announced that the U.S. economy had contracted 32.9% in the 2nd quarter of 2020 (advance estimates). This was the worst quarter in recorded history (at least 70 years). It was widely expected, however the Dow Jones Industrial Average dropped 226 points (just under 1%). The tech-heavy NASDAQ Composite Index actually gained almost half a point. How does that happen? Are investors too complacent for their own good? Very Little Headline Coverage No televised media website had the -32.9% GDP contraction on the home page, not the left or right wing sites. The news didn’t even make the headline of the business sections of CNN.com or FoxNews.com. Instead attention was diverted to whether or not the White House should have tweeted about delaying the election. Interestingly, Fox News had two headline features of President Obama on the home page (giving the eulogy for John Lewis), with the caption “A Man of Pure Joy,” which is probably the best headline Obama ever enjoyed on the network. The President didn’t even mention the contraction of -32.9%, but instead unleashed a flurry of Tweets about delaying the election. Of course, his opponent Joe Biden, did mention the historic contraction, tweeting, “The last three months were the worst period for economic growth our nation has experienced in the 70 years since we started measuring it — a drop of nearly 33 percent.” Republican Whip Representative Steve Scalise was silent on the news. There was not a peep on the matter from Senate Majority Leader Mitch McConnell. Federal Reserve Board Chairman Jerome Powell (a Republican) did provide guidance in his press conference yesterday, saying “The path forward for the economy is uncertain. A full recovery is unlikely until people think it is safe to engage in a broad range of activities.” The V-Shaped Recovery? In the beginning, before the current surge of COVID-19 cases, there was a lot of talk about a V-shaped recovery. There is now debate about whether or not the recovery will be L-shaped or W-shaped. What’s important to remember about economics, which has a pretty terrible forecasting record, is, as Andrew Lo tells us, “Physics has three laws that explain 99% of the phenomena, and economics has 99 laws that explain 3% of the phenomena.” Temptation Abounds. Price Matters One thing we do know is that supply and demand are being monkeyed around with. The Federal Reserve Board has been buying up everything from Treasury bills, mortgage-backed securities, bonds, junk bonds, money market funds and even ETFs – keeping demand higher than it would otherwise be. This leads investors to believe that their retirement plans are in great shape, prompting many to adopt a Buy & Hope attitude. Newly minted day traders and younger retail investors are in love with tech stocks. However, recessions tend to educate the uninformed about the lofty prices they paid, and how that fairy tale ends like a Shakespearian tragedy. Stocks have lost more than half in the last 2 recessions. Stock prices are high, price-to-earnings ratios are high, while earnings are imploding. This typically results in a severe adjustment to price. The Hellish Future of Buying High In the real estate market, the shadow inventory is ignored while industry economists complain about a shortage in housing. There are 3.6 million homes underwater. Almost 8% of mortgage loans are in forbearance. Websites like RealtyTrac.com and Auction.com list a flurry of bank-owned homes, foreclosures, pre-foreclosures and auctions that are not on the MLS (multiple-listing service). Unsophisticated real estate buyers are being suckered in on the premise of historically low interest rates, and given all kinds of rationale to justify buying high. There are few worse mortal hells than buying real estate high and having the prices fall, leaving you with an underwater mortgage. Your credit score tanks and you’re locked into a purchase that you can’t extricate yourself from without a great deal of time, effort, expense and trouble. Real estate lost more than half in the Great Recession. Areas that didn’t implode were the ones that never saw the housing bubble pre-Great Recession. So, thinking that prices in your area never go down is likely to be an expensive assumption, particularly if prices are unaffordable in your area. (Read my blog on Equity-Rich Home Ownership to learn more.) How Soon Can the Economy Recover? Unemployment is very high, and has actually been kept lower than it would otherwise be with the Payroll Support Plan of the CARES Act. As just one example, there could be another 750,000 in the unemployment line from airlines alone. American Airlines warned that they have 20,000 more workers than they need for their fall schedule. Additionally, the world has changed. People are working from home, spending less time in their cars and have furloughed their vacations indefinitely. We have learned to bake banana bread and cook our own meals. Some of these changes might eventually come back (hopefully vacations and eating out). Others are likely to be more lasting. Square, Twitter, Facebook and Google have all announced that Work From Home is an option for many of their team. Add to that the amount of leverage (debt) in the S&P500 (over half at near or at junk bond status), and you have a toxic economic cocktail that is going to leave all of us hung over for quite a time. Real estate and stock prices are simply too high and unaffordable to withstand the forbearance, foreclosures, debt restructurings and bankruptcies on the horizon. Recessions typically take 18-24 months to bottom out. The timeline of the recovery doesn’t even begin until, as Powell noted, people start feeling safe. There may be a new normal that we all return to that includes less time in our cars and at the office. We may have an economic impact that further limits our ability to vacation (particularly if we’ve purchased a home at an all-time high or seen half of our retirement plan evanesce). Your Best Strategy Now Budget: In your budget, make sure that you can afford your life. You want to right-size your expenses and conserve your capital. Read The ABCs of Money, particularly the sections on budgeting and debt, to learn more. Home: If you own your own home, you need to make sure that you can afford it. You should also do an equity check. Learn more in my Equity-Rich Homeowners blog. If you can afford your home, you plan on staying there for another decade and you purchased it before 2013, then chances are refinancing now at a lower interest rate will save you a lot of money on the mortgage payments, which will help your budget. Nest Egg/Retirement/Passive Income: Stocks are very high-priced – way above what would be reasonable compared to their earnings. So, now is a good time to diversify and protect your retirement plan, and to know what you own and why in any liquid assets and brokerage account – even a managed plan. Do not assume that someone else is protecting you. You must be the boss of your money, know what you own and be confident that your plan is recession-proof. Fortunately, this is easy-as-a-pie-chart. You can read about this time-proven strategy in The ABCs of Money. You can call our office at 310-430-2397 to receive an unbiased 2nd opinion and potential action plan. You can join us for our October 3-5, 2020 Online Investor Educational Retreat where you can learn and implement these strategies. (It’s not a good idea to wait until October to know what you own and protect your wealth.) Do not drain your retirement account to support yesterday’s lifestyle if today and tomorrow are seeing less income. Don’t siphon your future to pay off your credit cards. Learn the ABCs of Money now so that you can design a plan that is sustainable in our new world. The sooner you adjust to the New Normal and protect your wealth, the better off your financial future will be. Learn the ABCs of Money that we all should have received in high school at our Oct. 3-5, 2020 Investor Educational Retreat. Click on the banner ad below for additional information on the Oct. 3-5, 2020 Online Financial Empowerment Retreat. Register by July 31, 2020 to receive the best price. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Price Matters. Will There be a Santa Rally? It's Up to Apple. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. The Lyft IPO Hits Wall Street. Should you tak Cannabis Doubles. Did you miss the party? 12 Investing Mistakes The High Cost of Free Advice. 2018 Was the Worst December Since the Great Depression. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 3rd edition of The ABCs of Money was released in 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. With home prices at all-time highs, if you purchased a home any time after 2009, you’re probably feeling pretty smart about your purchase – even if you’re over-extended on your budget. It’s important to remember that there are more than a few equations to consider when making a successful home investment. Below are a few case studies and evaluation tools to help you make sure that you are on the right side of those equations. 2 Successful Case Studies Las Vegas to Off-Grid Living in Nature. Alvin and Jada made a bold choice in 2017 to move to a remote wilderness area in British Columbia. After a hellish winter of living in an RV and using rudimentary toilet facilities, they built their dream-come-true off-grid home. It was a lot of work, but their hearts were calling them to this way of life. (You can listen to them in their own words in the 4-minute Earth Gratitude film. You can read about them in the Real Estate section of my book The ABCs of Money 3rd edition.) All of this was possible due to a very lucrative home investment in Las Vegas in 2011, which doubled by 2017. They essentially bought very low, and sold quite high. Had they purchased in 2005 or 2006 in Las Vegas, they would still be underwater. Buying low was the key to their dreams. Silverlake to Destination Unknown During the Great Recession, A&A had to declare bankruptcy in their business. They were able to keep their home and do a loan modification, but the payments were eating up a large chunk of their income. As long as business flows, they can do this without amassing too much debt. However, they understand that a highly leveraged lifestyle isn’t sustainable for them, since their income implodes in recessionary times. Additionally, A&A are in their early 70s . They really should be looking to retirement. However, they still owe $650,000 on their mortgage. The one good thing in their favor was that Los Angeles real estate was on fire. In July of 2020, after a year of pondering and then planning, A&A sold their home for a million-dollar profit. Their plan is to rent for a year and then move to a more affordable area for their retirement. Their hope is that prices will have tempered somewhat by the time they are ready to purchase again. With their profits, they have plenty of money to retire where they want, in a more affordable area near family, even if they were tempted to buy immediately (which they are not). They feel like they are making all the right moves for the next chapter of their lives, and are grateful to be in a position to design their future – a feeling very different from the defeat and distress of the bankruptcy in the Great Recession. More Than a Few Decade-Shattering Decisions It’s important to remember that millions of homes were lost in the Great Recession. For millions of professionals, even those with a very high income, the financial cost of paying off nonperforming, underwater income property was devastating for the past decade. So, remember that deciding to purchase or keep a home has a minimum of two vitally important questions. 1. Can you easily afford the payments? 2. Are you purchasing the home for a good price, or are you at risk of the home losing value? Being stuck with a home that is worth less than the purchase price destroys your credit, ruins your opportunities to move for career advancement, weighs heavily on your personal relationships, limits your ability to downsize or right-size your budget and has other devastating effects on your life. Analysis for Equity Rich Homeowners. The New Normal Work from home is spurring a flight from urban to the suburbs. How will this affect your home equity? Are you on the right side of that trade? Or is your equity rich position under attack? Don’t assume that you are safe. It’s important to do the math. One of the most important equations to consider is affordability. In 75% of the U.S., denizens would have to spend more than 28% to buy a home. That figure is unaffordable – even with interest rates at an all-time low. It portends a weakening in prices. Work from Home Trends Unaffordability and the ability to work from home is spurring a flight to the suburbs. This could weaken prices in urban areas and strengthen them in the surrounding community. When you have less demand, due to unaffordability and a flight to the suburbs, high housing costs in the city can drop like a knife. Home prices have dropped 8% in New York City, where it would take 75% of the average person’s salary to purchase a home dwelling. Many people are moving in with family, causing an uptick in intergenerational housing. Inter-Generational Housing. 15% of adult children are now living with their parents, compared to just 2.4% in 2015. 12% of households have their parents living with them. Yes, this is out of necessity. Yes, it keeps more money in the family, instead of making the landlord rich. So, consider this growing trend when you are thinking outside of the box for solutions to live a richer life and weather the economic storms on the horizon – even if you are equity-rich. Conservation of capital, weathering storms, helping out family – all of these things will become popular if the Corona Virus Recession deepens. Shadow Inventory More than 3.6 million homes are severely underwater, where the mortgage is 25% higher or more than the value of the home. This statistic has been increasing, even though home prices are higher than ever. This has a lot to do with loan modifications and homeowners who are striking desperate deals with the bank. Getting a loan mod that puts your mortgage far above the value of your home is a temporary solution that puts opportunity on the table for patient buyers. Sadly, the existing homeowner is at risk of having all of her assets and income bled dry, and then ultimately getting foreclosed upon any way. Almost 8% of mortgages are currently in forbearance (source: Mortgage Bankers Association). With almost 32 million Americans taking some sort of unemployment (Source: DOL.gov), there could be a lot more payment peril on tap than people realize. What Year Did You Purchase Your Home? If you purchased your home between 2009 and 2015, and you can easily afford it (i.e. it takes up less than 20% of your income), then you may be able to weather the hardships on the horizon – if your job is secure. You should continue asking the questions below, however. If you purchased your home in 2016 or after, how much equity do you have? How would you feel if the local housing market dropped by 25% or more, and you owe more than the value of your home? Can you afford (emotionally or financially) to be locked into your current home paying down an underwater mortgage for a decade or longer? Examining your exit routes now, while you have options, is a better idea than getting stuck without many ways to extricate yourself from a tough situation. Don’t rely on the myth that real estate never goes down in your area. We’re in unprecedented times. There may be more to the analysis than you are considering. Look at 20-Year Price History. The Great Recession was in 2008. Between 2007 (the high for real estate on a nationwide basis) and 2011 (the low), many areas, particularly those that soared the highest, saw real estate values sink by more than half. You have to go back 20 years to see what really happened. For instance, Boulder, Colorado never really took off before the Great Recession. Home prices increased only 18.6% between 2002 and 2007 (2.4% annualized). So, there was never a bubble to pop. That has led some people to believe that home prices in Boulder never go down, which is a false assumption when prices become unaffordable to the locals. According to AttomData.com, it would take almost half of the average person’s wages to purchase a home in Boulder. Prices have dropped almost 1% year over year. You can look at wages vs. prices, and see more data on your city, on AttomData’s interactive map. The Thrive Budget. Is your current home affordable in a post-pandemic world? Will your income be impacted severely (or has it already been reduced)? Base your assumptions on what is likely to happen, not what you hope will happen. Currently, the paycheck protection loans from the US government expire at the end of September 2020. So, a lot of people are at risk of being furloughed. If you are in this position, the sooner you right-size your life, the better off you’ll be. There are solutions. Start by personalizing your own Thrive Budget in my free web app. Read the Thrive Budget section of The ABCs of Money 3rd Edition to get additional information. Time Span? How long do you want to live in your home? Make sure it makes sense for at least the next 8-10 years. Does another area make better sense for your family, for affordability reasons, family needs or career opportunities? Every soul has her own geography. Finding that place you can afford, where you love to wake up each morning, goes a long way to helping you live a richer life, which infuses magic in all you do. If you are getting closer to retirement, can you afford to pay off your mortgage by your retirement date? When you are on a fixed income, every bill you can toss out the window is gold in your wallet. Sanctuary Home. Do you and your family love the home, the neighborhood, the neighbors and everything about where you are? Are the schools good? Is the crime low? In a post-pandemic world, any problems are likely to be magnified, due to higher unemployment. You want to be ahead of any problems that might arise. If there are things you already have a strong dislike about, those emotions may escalate if other areas of stress (less income, higher costs, lower value) emerge. Should You Sell High? If…

Then the right answer could be to sell high, or consider how you can get help with the payment (perhaps through intergenerational housing). Sometimes intergenerational housing and thinking bigger is a better answer than downsizing. Having each family member living in their own tiny cell is a very expensive proposition. If you sell and right-size now, and wait a few years for prices to come down, or if you shop in the shadow inventory now for something that is more affordable, then you could weather this challenging economic time and be in a good seat going forward. Being over-leveraged or upside-down in your budget during a recession is a very bad seat to be sitting in. Income producing in a Post-Pandemic World. If you were relying on Airbnb to make ends meet, it’s, sadly, a new world. There is less travel. The sharing economy has come to a screeching halt (outside of family and intergenerational sharing). With high unemployment and less travel, if you are going to get any income out of your real estate or home, you’ll need to be forward-thinking about it. Many states have put a moratorium on evictions, making it financially perilous to be a landlord these days. College Planning. With college loan debt of $1.54 trillion, it’s a great idea to make sure that housing is part of the equation you are considering when you map out your teen’s College Experience. I cover this more in depth in my book The ABCs of Money for College. The Four D’s. In real estate, there are 4 Ds that can cause a homeowner to sell below the market – death, depression, disaster and divorce. To those 4 D’s, we can also add, unaffordability, job loss and underwater mortgages. So, for the patient buyer, the next few years could yield ample opportunity to purchase a great home. If you’re equity-rich, then you want to be sure that you can withstand the 4 D’s, plus UJLUM, if the plethora of challenges brought on by the current pandemic add up to lower home values. The bottom line is that successful investors are always forward-thinking. Don’t look at today and rest on your laurels. Do the math on your area and in your own budget, considering job-security and all of the other points outlined above, to determine if your sanctuary home is where you are now, or where you might be in two years – given a careful strategy. Refinance at The Lowest Rate in History If you choose to stay after all that analysis, then consider refinancing now at the lowest rate in history. Chances are high you’ll get a substantial reduction on your monthly payment. We spend one full day discussing housing, income producing real estate and what's safe at my Investor Educational Retreat. Click on the banner ad below for additional information on the Oct. 3-5, 2020 Online Financial Empowerment Retreat. Register by July 31, 2020 to receive the best price. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy. Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 3rd edition of The ABCs of Money was released in 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. On July 21, 2020, United Airlines reported their 2nd quarter 2020 earnings results, writing candidly that this was “the most difficult financial quarter in its 94-year history.” United posted a net loss of $1.6 billion, and an adjusted net loss¹ of $2.6 billion. (The difference between the two is largely due to the receipt of $1.5 billion in the Payroll Support Plan of the CARES Act.) Airline Revenue is Down 86.4% American Airlines’ 2Q 2020 revenue was down 86.4%, from $11.96 billion in 2019 to $1.6 billion this year. The net loss was $2.1 billion. Without the Payroll Support Program, $1.8 billion of financial assistance and other special items, American Airlines’ pretax loss was $4.3 billion. The 3rd quarter isn’t expected to be much better. American projects “system capacity” to be down approximately 60% year over year. United, Delta, Southwest and Alaska Airlines all reported year-over-year revenue losses of 81.6% to 88.3%. Loans, Blank Checks and Taxpayer Bailouts With so many grounded flights and with the Oil Wars that took oil costs negative for a brief period, fuel costs were down almost 90% in the 2nd quarter for the airlines. Labor costs were still high, however, due to the terms of the Payroll Support Program (PSP) of the CARES Act. As Airlines.org President & CEO Nicholas E. Calio wrote on April 14, 2020, the PSP “funding will allow those 750,000 men and women to stay on airline payrolls though Sept. 30, 2020, and out of the unemployment lines.” American Airlines anticipates having over 20,000 more team members on payroll than needed to operate its fall schedule. With over 10 million employees and a combined $1.5 trillion in economic activity in 2019 (per Airlines.org), the aviation industry is a priority for the Treasury Department and Federal Reserve Board’s rescue and recovery plan. However, investors are reticent to buy back into airlines stock, with the exception of Boeing, which has almost doubled since its low on March 23, 2020. Warren Buffett was an avid airline investor pre-coronavirus pandemic. In 2019, Berkshire Hathaway owned 11% of Delta Airlines and 9% of Southwest and United. Buffett dumped all of his investments in airlines in May of 2020 stating, “The world has changed for the airlines. It’s been seven weeks since I had a haircut and more than seven weeks since I put on a tie.” Many of us are rarely leaving home, much less jumping on a plane. Buffett acknowledged that his team had invested $7-8 billion in airlines, and sold for a loss. Work From Home and Restricted Travel Some corporations, like Facebook, Twitter and Square, have already decided that Work From Home will become a permanent staple of their business. Executives have become more accustomed to video conference meetings. These changes bode well for technology, and less so for airlines, auto manufacturers, commercial real estate, the malls of America, travel, hospitality, retail and the people who work for them. However, with Zoom Video trading with a PE of 1450, Netflix with a PE of 85 and many technology companies at all-time high prices, even the more stable companies and industries are vulnerable to a downturn in stock prices. Liquidity The airlines have been beefing up their war chests. American ended the second quarter of 2020 with $10.2 billion, and is projecting a U.S. Department of Treasury CARES Act Loan in the amount of $4.75 billion to close in the 3rd quarter of 2020. Will this be enough, when current liabilities are $18 billion and long-term debt and liabilities are $68 billion? Boeing’s liabilities are $152 billion, with $94.5 billion of those current. As of the 1st quarter of 2020, cash and cash equivalents were just $15 billion. The terrible year that airlines are having doesn’t bode well for the already beleaguered Boeing. Boeing announces their earnings the morning of Wednesday, July 29, 2020. With commercial aircraft deliveries down by 60% and Defense Space & Security deliverables down 47%, the report won’t be pretty. Investors won’t be the only ones waiting for this report. The Securities and Exchange Commission has taken an interest in forensically examining Boeing’s financials. On June 2, 2020, the SEC instructed Boeing’s executives to provide more information in the next earnings reports, writing, “As cancellations are now at significant levels, please be sure to include robust quantified and narrative disclosure of the expected impacts to your backlog, results of operations and cash flows in your future filings.” The Paycheck Support Plan is Scheduled to End September 30, 2020 Will Congress extend support to the airlines through March 31, 2021? Should the airlines be allowed to right-size their operations and furlough hundreds of thousands of employees? Unions for airline pilots, flight attendants and support personnel are all asking for continued labor support. Treasury Secretary Mnuchin supports continued aid to the airlines, but the loan covenants are not as strict about targeting the funds to labor as the Paycheck Support Program was. Last week United and American both announced furloughs totaling 61,000. When will people start flying again? Will we ever return to the same levels of travel? Has work from home and video conference meetings changed the travel industry forever? Would it be better to support American individuals rather than continue to funnel money through the large corporations? The Treasury Department is currently working on getting another $1200 by August to individuals earning under $75,000/annually. 2Q 2020 GDP Growth On July 30, 2020, the Bureau of Economic Analysis (BEA.gov) will release the advance estimate for 2nd quarter GDP growth. The contraction is predicted to be unprecedented. Estimates for just how bad it will be go as low as -35%. Stocks were high-priced before the recession began. The Treasury Secretary, the White House and Republicans all point to a better than expected recovery, rather than the terrible economic news. Is that a good reason to pay twice as much for stocks as normal? A Better Than Expected Recovery? The headlines have focused on the idea that the astonishingly terrible earnings news in the 2nd quarter of 2020, which is one for the history books, was expected and that we’ve already started a recovery. However, this recovery is based on money magically showing up in the bank accounts of people who are not working, including millions of airline employees. Betting on a V-shaped recovery, when July marked a new spike in the pandemic, could be an expensive proposition. Warren Buffett’s recent sell actions tell you everything about what he believes is the truth of this heartbreaking and challenging time. He didn’t sell everything, and neither should you. Market timing doesn’t work. However, he is well-diversified, and he is overweight in liquidity. The Stock Market is Not the Economy We all want an economically strong America, and for our lives to be stable and prosperous. However, Buy & Hope has cost investors more than half of their wealth in the last two recessions. Low interest rates create bubbles and over-leverage. Over-leverage in technology companies sparked the Dot Com Recession, with real estate being at the core of the problem in the Great Recession. All assets are trading high and at risk of price correction in the Corona Virus Recession. Bonds and dividends, which are traditionally considered to be safer, are losing money, cutting the yield and have at times been illiquid. Succeeding in the 21st Century requires a new action plan. Fortunately, there is a plan that earned gains in the last two recessions and has outperformed the bull markets in between. Better still, it is easy as a pie chart. Being properly diversified and having enough safe has been a wealth preservation tool. And that is something you should want to get familiar with now before the corporate bankruptcy party moves out of the Retail Apocalypse and into the broader economy. If you'd like to protect your wealth now, join me at my next Investor Educational Retreat. Students receive a large discount. Click on the banner ad below for additional information on the Oct. 3-5, 2020 Online Financial Empowerment Retreat. Register by July 31, 2020 to receive the best price. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy. Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.

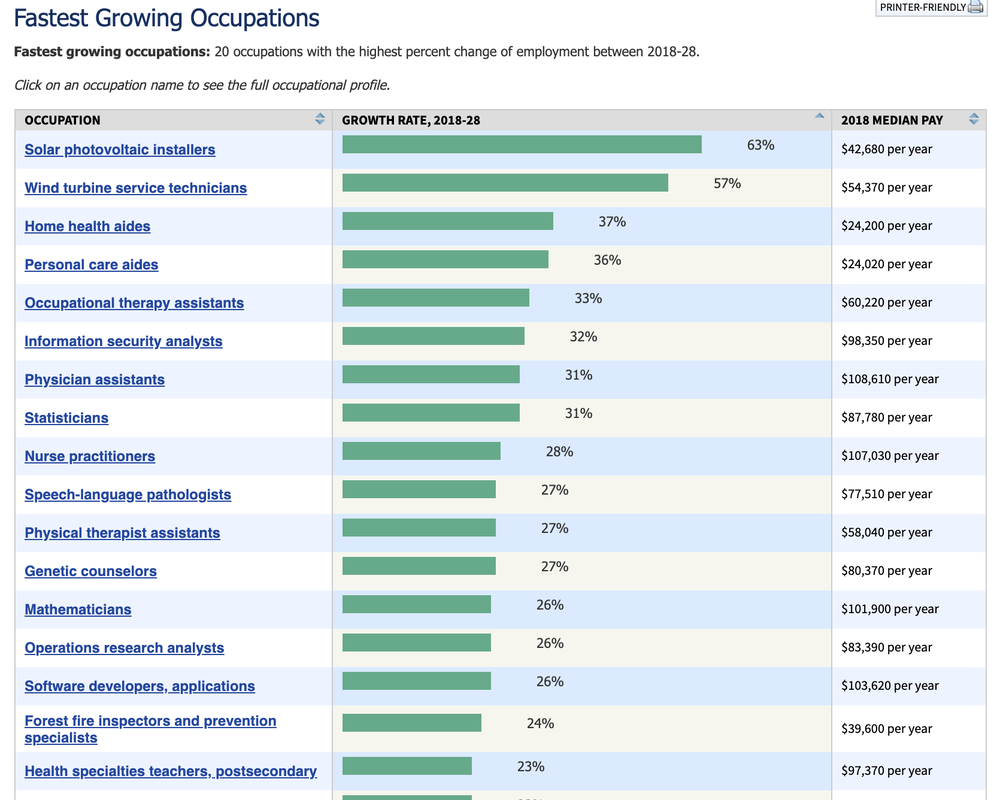

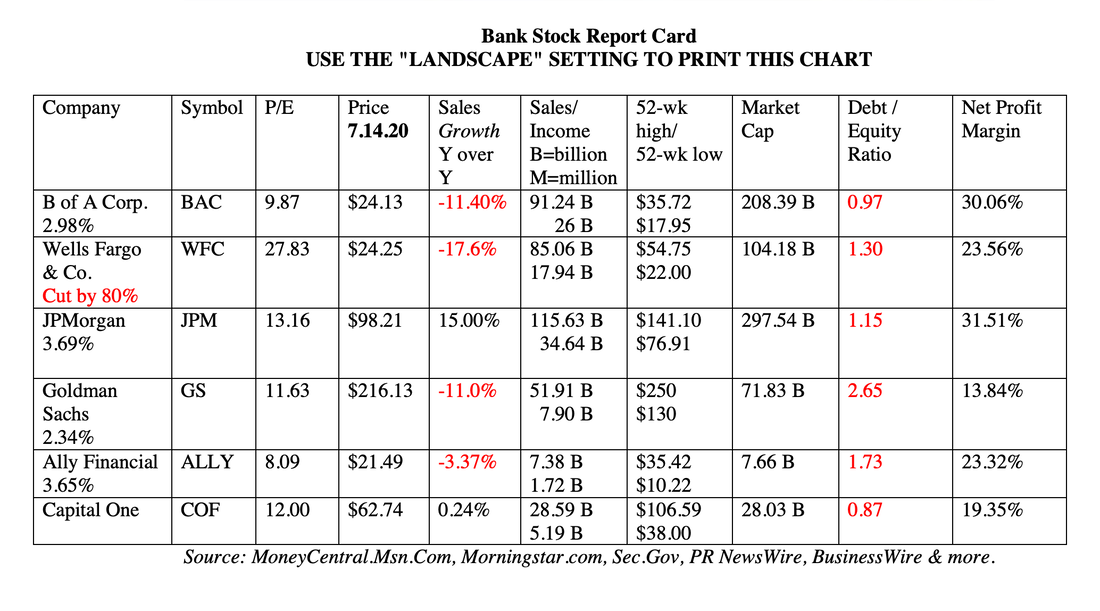

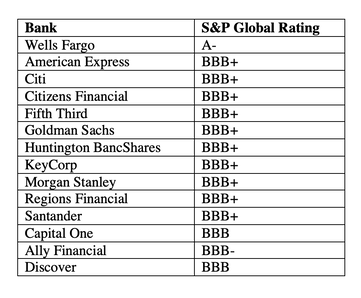

With $1.54 trillion in student loan debt and a graduation rate of just 60%, it's clear that parents and teens need to have a better game plan for higher education. So, start with the 10 questions below to get on the right track for an extraordinary college experience that should result in you getting a better degree for half of the cost. That’s going to add up to a lot less student loan debt, and an increased chance at real opportunity once you graduate. 10 Questions to Put You on the Path for College and Career Success 1. What is your ideal college experience? 2. What are you naturally good at? (Talent) 3. What do you love to create? (Passion) 4. What is the best university to get a degree in that area of study? 5. Should you consider a Gap Year? 6. Where would you like to be in six years and what is the best route to get there? 7. How are you going to earn money while you are in college? 8. In addition to scholarships and grants, are there other ways for you to earn passive income? 9. Is trade school more appropriate for you? 10. What is the student feedback on your school of choice? Here is a little bit more color on each point. 1. What is your ideal college experience? If you are going to college to get away from your parents or to party, then you need a Gap Year. Period. College is far too expensive and demanding to enroll for the wrong reasons. This is the primary reason that the drop-out rates are so high. Flunking out with a $50,000/annual price tag is the ultimate buzz kill. If you are motivated to learn and achieve, scored high on your SAT and received a scholarship to the university of your dreams, good for you. For most of us, that will not be the case. We will need to design a plan to make sure that we get the degree we want, which will result in a great lifetime career without drowning in debt. (There are ways!) 2. What are you naturally good at? (Talent) It takes hard work and dedication to rise to the top of your field. There are careers that you will naturally excel in, and others that you might never master. An extraordinary athlete might not make an outstanding astrophysicist. An inspiring artist may not rise to the top of dental school. So, what comes easy for you? How can those gifts and talents be parlayed into income? 3. What do you love to create? (Passion) When you put your heart into something, then time flies. You won’t even notice how long you’ve dropped down the rabbit hole of higher learning on the subject. As Buddha said, “Your work is to discover your world and then with all your heart give yourself to it.” 4. What is the best university to get a degree in that area of study? If astronomy and starships are your passion and talent, then you might be surprised to learn that the University of Arizona is one of the top-ranked schools. So, if your ultimate goal is to graduate from Berkeley, Harvard or Princeton, and you are an Arizona resident, should you start at U of A and transfer into the Ivy League as a Junior? If you kill it at U of A, could you qualify for grants and scholarships to an Ivy League School that might otherwise be out of reach? 5. Should you consider a Gap Year? A Gap Year is highly correlated with success in college. There are many reasons for that. If you do your Gap Year in a foreign country and become fluent in a second language, you’ll have an easy A in one of your classes. If you take an internship or apprenticeship in your field of interest, then you’ll have real world experience that gives you a competitive edge in your book learning. If you sow your wild oats and get away from your parents, you might appreciate the value of education more, and hunker down to study. In Europe, the Gap Year is rather de rigueur. 6. Where would you like to be in 6 years and what is the best route to get there? Rather than a plan that focuses on what university will have you, how can you design a game plan so that you can actually attend your dream come true university? When you set your sites for where you want to be post-graduation, you’re more likely to get there. Part of that 6-year vision should include designing a college plan that will not drown you in debt when you graduate. 7. How are you going to earn money while you are in college? Do you have enough funding from your college savings plan or from your parents to attend without having to work? (Teens/tweens: start your college fund now, with or without your parents!) Grants are typically available, but only cover a small portion of the costs. Scholarships are available, but are very competitive, and often only cover a small portion of the costs. Taking your general education coursework at a local junior college not only cuts your costs dramatically, but might be your springboard to an even better university than you could attract as a freshman. Due to the high drop-out rates, there is more room for juniors. If you’ve excelled at the junior college level, then you might qualify for some lucrative academic-based scholarships. (That is how I was able to attend the University of Southern California!) 8. In addition to scholarships and grants, are there other ways for you to earn passive income? If your money has earned money and compounded gains in a college savings plan, can you purchase a home (with your parents) and rent out the spare rooms to other college students for passive income? Wouldn’t that be a better job than working at the local fast food joint? The more that you can eliminate basic needs bills, and accumulate passive income, the more time you can devote to studying and rising to the top of the class. 9. Is trade school more appropriate for you? If you’re not academically inclined, there are many trades that are in high demand. In fact, solar PV installers and wind turbine technicians are at the top of the Jobs of Tomorrow. In many instances, getting an apprenticeship will pay you to learn and earn your certification, which is a better bargain than a for-profit university with a high drop-out rate. Go to Apprenticeship.gov to learn more about government-based programs. Ask around locally, and within family and friends, for a master tradesman who might be willing to take you under her wing for training and certification. 10. What is the student feedback on your school of choice? If you search for reviews and ratings by students, faculty and alumni, then you should get the inside scoop on whether the university you’re being courted by is really worth the dime. Those for-profit universities with very low graduation rates are also ranking very low in customer satisfaction. It’s a good idea to learn why before you fall into the same trap. Nonprofit private universities, like Ivy League Schools, have very high graduation rates and receive very high praise from students, faculty and alumni. Having everything turn up roses for you might start with separating the 2-3 stars from the 5-star reviews. College success is highly correlated with the type of university you go to. Public universities and private non-profit institutions have graduation rates of 60% and 66% respectively, while private for-profit colleges have a graduation rate of just 21%! Females are graduating in greater numbers than males in most halls of higher learning. Once you graduate, you want to be sure that your career of choice pays you well enough to afford your basic needs and your college loan debt. That equation is so out of whack that 15% of adult children are living with their parents. Millennials are delaying purchasing their first home for up to seven years longer than their parents did. This is all attributed to the very high cost of paying back student loans. So, figuring out a course of action that eliminates this possibility is essential to loving your College Experience after you graduate. Regardless of where you came from, you can step on the path to the career of your dreams. I’m living proof of that, having grown up in quite modest means and going on to graduate summa cum laude from The University of Southern California. While we may think that some universities are out of reach, designing a careful route can yield results that might surprise you. That certainly was the case for me. (I discuss this in greater detail in my College Videoconference.) For additional information on how you can design a college game plan that leads to the career of your dreams, with less than half of the student loan debt of your colleagues, be sure to read The ABCs of Money for College. Watch my College Success videoconference on YouTube.com/NataliePace. Don’t miss my next college videoconference where we’ll discuss the mistakes parents make when preparing their kids for college. Email [email protected] with VIDEOCON in the subject line to be sure that you receive the login instructions, along with the date and time. Investing smart in your college savings plan can compound gains. If you'd like to learn the ABCs of Money that we all should have received in high school, to up your investing game, join me at my next Investor Educational Retreat. Students receive a large discount. Click on the banner ad below for additional information on the Oct. 3-5, 2020 Online Financial Empowerment Retreat. Register by July 31, 2020 to receive the best price. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy. Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. What the Big Banks Aren’t Advertising in Their Earnings Reports. The headlines this week are celebrating Goldman Sachs and JP Morgan’s 2nd quarter results. Goldman’s total revenue of $13.3 billion is down by 11% year-over-year, with an increase of 2% in net earnings to $2.42 billion. JP Morgan’s revenue was $33 billion (up 15%), with $4.69 billion in net income (down 51% year-over-year). This is better than anyone would have predicted in early March, when the stock market was in a free fall. So, what happened? Are we in a V-shaped recovery? Is the worst behind us? The Federal Reserve is Buying Up Everything Prior to the Coronavirus Recession (which started officially on February 19, 2020), over half of the S&P500 companies were heavily leveraged, and were congregated at just above junk bond status – at BBB. Junk Bond Gathering 13 banks are at BBB, with Wells Fargo not far behind. This debt party included a lot of major U.S. banks. By March 15, 2020, when the Federal Reserve Board had their emergency meeting, only the most creditworthy companies were able to borrow money (according to the statement that Jerome Powell made prior to the FOMC press conference). So, the Federal Reserve Board opened up the flood gates and began flushing these illiquid markets with cash. In the July 10, 2020 report to Congress, the Federal Reserve Board revealed that over $107.3 billion had been loaned to prop up the Paycheck Protection Program, bonds, money market funds, ETFs, loans, mortgage-backed securities, corporations, municipalities and the broker-dealers who serve them. Public debt is now $26.5 trillion, a full $3 trillion above what it was at the beginning of the year. So, all is well, right? Well, this is better thought of as a noble effort to keep things running, so that there can be a more orderly exit into bankruptcy for those firms that are struggling the most. (The same thing happened in the Great Recession.) Retailers continue to file for debt restructuring in droves, with Brooks Brothers and Neiman Marcus succumbing to the Retail Apocalypse this year. Other corporations that were unable to continue operating business as usual, even with the Federal Reserve blank check, include Hertz and Chesapeake Energy. So far, there has been no run on the banks, nor have mutual fund companies activated redemption gates and liquidity fees (as many have in Europe). However, the mega banks do have more than a few phantoms in the closets that are worthy of noting, including speculation, credit loss reserves, Wells Fargo’s dividend rate cut and Goldman Sachs $2 Billion Malaysian Nightmare. According to S&P Global in their latest report on the Federal Reserve’s Bank Stress Test Results, “An idiosyncratic dividend cut by a bank to levels well below peer medians could … have negative rating implications.” Based upon new Federal Reserve Board requirements that dividends do not exceed the average of net income over the preceding four quarters, some banks may need to suspend or cut their dividends. Companies that could fall into this dividend guillotine include: Capital One, Wells Fargo, Ally Financial Inc., Citizens Financial Group Inc., Discover Financial Services, Huntington Bancshares Inc., and KeyCorp. Wells Fargo Slashes Dividend by 80% While quarterly revenue was up year-over-year by 15% to $17.8 billion, Wells Fargo reported a colossal net loss of -$4.7 billion. Not surprisingly, in the earnings press release, the company announced they would be cutting their dividend from $0.51/share to $0.10/share – an 80% haircut for fixed income investors (subject to board approval, or FRB enforcement, whichever comes first). Many of the banks that are struggling to keep their net income above their dividend payments advised shareholders on June 30, 2020 that their capital stress test results landed them at the bottom of what is acceptable. All indicated they would maintain their dividend payout at current levels. They, like Wells Fargo, may have to sing a different tune once their 2Q 2020 earnings are announced, however. Below are the companies announcing earnings this week and next.