|

For the record, we have not ever shared any of our subscriber data with anyone. And we will not ever. That has been our policy since 2002, when I first started adding a splash of Green to Wall Street and transforming lives on Main Street. Also, we have never had a hack where any data was harvested. Our last hack was the equivalent of someone breaking in, and taking only a glass of water. We do not store any credit card information online.

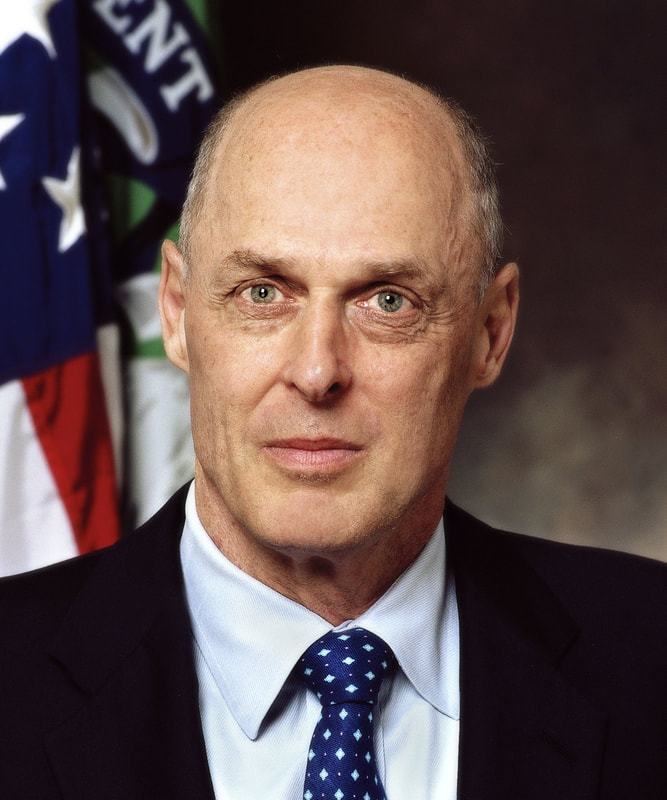

We you take your privacy seriously. Always have. Always will. Yes, it requires updating our software and changing passwords regularly and taking extra precautions. This has worked for 16 years now. It is just the way we do business – built into the everyday structure. We are a small mom shop. Imagine what a company worth half of $1 trillion ($496 million) could do to protect you if they really wanted to. Facebook generates revenue through advertising and data mining for marketers. That is their business model. When we sign up, that is what we are signing up for. All of those fun personality profiles are really data analytics that help companies (and politicians) to target us more effectively. In return, we get a lot of free things. So many that most of us cannot even consider going somewhere else. What about all of our photos? Our groups! The one upside is that now everyone knows why knowing which famous person you most resemble is not a silly, harmless fun thing to share with everyone. And why forwarding a chain letter isn’t going to bring you good luck. These are actually creepy marketing tools that allow professional profilers to spy on you even more deeply – into your inner world and what motivates you. Awareness that this foil has been exposed will only drive new innovations from marketers and politicians. Our best protection is the age-old adage, “Free is never free,” and greater wisdom and awareness into the platforms that we have all been sucked into. One more very important thing. I have seen a lot of people online looking at other social media that they might transfer over to. This area is already rife with scams and people touting privacy, who really are not capable of protecting your data. They just do not have the technological expertise. More than a few have a history of exploiting people and/or data. So always look and see who is running the company and the board, etc. If they do not have major technology people on the board, then it is very likely an opportunist exploiting the situation, rather than someone who is really capable of creating a great social network platform that can protect you better than Facebook. If you are curious about how to identify the red flags of opportunists, here’s a short hit list. 1. The company’s leaders and board don’t have any corporate experience in what they are offering. They are here because it is a hot topic. 2. A short Google search of the name of the chief executive officer or founder, alongside the words “SEC lawsuit complaints scam,” reveals some hits and damning information. Alternatively, if the name turns up nothing at all, not even a bio, then you can rest assured that that person has had his/her name scrubbed from the Internet. Neither are good signs. 3. The About Us reads like an advertorial, with little or no information about who is actually behind the operation. (I saw one new social media like this, based out of Iceland.) Legitimate companies have an easy link to learn who the major players of the company are, along with their bio and expertise. 4. The contact us page has a post office box and an 800 number, or the only way that you can get in touch with them is to fill out a form. 5. If you see all or most of the above, and the company is based out of a notorious tax haven or other place where scams have been seeded, like the Bahamas, Cayman Islands, Florida (Bernie Madoff) or Nevada, then you’ve got another red flag. Incidentally, Facebook isn’t the only business that has a creepy way of spying on you. Ever notice cute cartoons or news in an elevator? Gets a better shot of your face in the video camera. Pepper, the peppy, outgoing, robotic “technical ambassador” at the Mandarin Oriental in Las Vegas, Nevada, can detect your emotions by detecting facial, body and voice cues. She beckons guests to “Come over here,” and sighs when you don’t. Cut. But creepy, when you understand what she is programmed to do. March 2018 marks the 10th anniversary of the Bear Stearns Bailout. One of the most heartbreaking things about the Great Recession was watching it play out, when there were so many red flags and warnings that were ignored. My first real estate warning for subscribers occurred in May of 2005. Real Estate had become unaffordable. Liar Loans were catching fire. The investment banks were all worried about who was going to get caught with a bag of useless collateralized loans, but sold them any way for the high fees. Main Street jumped in the fire, tempted by commissioned real estate and mortgage salesmen who promised massive, immediate gains. While all of this played out on stage and on television, with commercials everywhere on how easy it is to be a real estate investor, behind the scenes many of the top CEOs were cashing in. In my May warning, I alerted subscribers that the CEOs of Countrywide (Mozillo), Toll Brothers and KB Home were all cashing in hundreds of millions in stock. I warned again in June of the following year (2006) that large investment bank insiders were cashing in, with Lehman Bros. insiders cashing in over $116 million. My first warning about Fannie Fae and Freddie Mac was actually years before all of that, in 2003. The “smart money” knew that Fannie and Freddie’s debt was astronomical – at 32 PE for Fannie Mae, five years before the crisis. However, the assumption was that Fannie and Freddie were backed by the government, and so the government would prop them up. In other words, financial planners continued to portray these over-leveraged stocks as “safe” to their client’s, with the added benefit of dividends, much like General Electric was portrayed until earlier this year. The truth is that everyone on Wall Street knew the housing bubble would pop. They were playing a game called “The Biggest Fool,” to see who would go right up to the edge and make a killing without being skewered when the knife inevitably dropped. In fact, one of the persons who profited the most from the housing bubble is one of the persons who is often called a hero. Remember that when a Treasury Secretary comes into office he is “forced” to sell his stock. There is a tax loophole to protect his gains when he does. Most recently Anthony Scaramucci was trying to take advantage of this, even though he’d sold his stock long before his 10-day ill-fated turn at the White House. Not one of the bank CEOs were prosecuted for the banking crisis that sank the economy into the Great Recession – even though worthless, toxic SIVs were sold with names like “High-Grade Structured Credit Enhanced Leveraged Fund” and Countrywide encouraged liar’s loans in their ads and incentivized the sales with commissions. The Goldman Sachs CEO got to sell his stock high, without taxes, so that he could become the Secretary of the Treasury, and is now considered to be a hero of the crisis, even though he was one of the architects of the toxic trading, SIVs and CDOs in the run-up to the crisis. So, what are the lessons we can learn from the Housing Bubble, the Bank Meltdown and the Great Recession? There are many…

Low interest rates, quite frankly, create bubbles. Today, we are back to bubbles. According to Alan Greenspan, there is a bubble in stocks and a bubble in bonds. Real estate prices are higher than they have ever been, as is debt. This is why Federal Reserve Board chairman Jerome Powell is so adamant about raising interest rates and tightening up monetary policy by selling off the mortgage-backed securities and Treasury Bills. If you …

Then it is time to get a second opinion on your budgeting and investing plan, and to learn The ABCs of Money that we all should have received in high school. There is a better way. Call 310-430-2397 to learn more about receiving an unbiased second opinion and about attending my 3-day Investor Empowerment Retreats. You have a to gain by using wisdom, including savings of thousands annually in your budget, and a lot to lose if you don't. Wisdom is the cure! The Perils of the 10-Page Financial Plan. What are the perils of the 10-page (or more) financial plan? Far more than I’m listing below. But here are the main problems with it.

How? (The devil is in the details.)

Red Flags If... * You lost more than 30% in the Great Recession * Your financial plan is longer than 10 pages * You are spending more than $200 a month on health insurance, life insurance, utilities or gasoline * You are having trouble contributing to your retirement due to high bills or high debt * You are relying upon a pension or Social Security as your retirement plan * Your home is worth less than your mortgage then you could be gambling with your future. It is time to get an unbiased second opinion, outside of the bank, brokerage and accounting sphere, particularly now that we have entered the 10th year of the current bull market. Low interest rates create bubbles. The last two times the world economy went eight years without a correction, most people lost more than half of their retirement. 55% of the Dow Jones Industrial Average was lost in the Great Recession, and 78% of the NASDAQ Composite Index was lost in the Dot Com Recession (taking over 15 years to get back to even). Over 10 million homes went to auction in the wake of the Great Recession. You will be told to just hang on, that the markets always come back. You will not be told that when the markets come back, you are still underwater because a 10% return on $450,000 is only $45,000. If you started with a million, then it takes over a decade to get back to even, and chances are you are caught in the next devastating recession before that occurs (as happened in 2008). What’s the solution? Why not try an unbiased second opinion from No. 1 stock picker Natalie Pace, whose easy-as-a-pie-chart nest egg strategies earned gains in both of the last two recessions and have outperformed the bull markets in between? Natalie isn’t a broker-salesman. She doesn’t sell financial products. Her goal is to empower Main Street to be the boss of your money. Blind faith in broker-salesmen, whose interests are not always in alignment with yours, has cost Americans half of their nest egg every eight years. In 2000, Dot Com investors lost 78% of their stocks. In 2008, blue chip investors lost 55% (or more). When you add in the fees and commissions charged (sometimes hidden or opaque on your statements), the losses are worse. When you know what a time-proven plan looks like, then you can be the boss of your money, instead of having blind faith in strangers to do the right thing (when they are often compensated to look after their own interests above yours). Wisdom is the cure. Call 310-430-2397 or visit NataliePace.com to learn more. Attend the Wild West retreat to learn and implement these strategies on your own, and enjoy thousands in annual savings by using smarter budgeting, investing and energy choices. For those who used Natalie Pace’s easy strategies in the Great Recession, they were able to save hundreds of thousands (or millions), when most lost 55%! "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human capital. "My husband spoke with Natalie Pace, and after a brief discussion, she charted a plan on the back of a napkin. I decided to take her advice. Soon after, we had the big crash. I was one of the few and lucky people who actually made money (instead of losing). So, thank you Natalie, for saving my retirement!" Bill and Nilo Bolden. Other Blogs of Interest (click on the blue link to read): Spring Rally or Bubble Trouble? The Truth About Tariffs. 2018 Investor IQ Test. Spring Rally Many economics support a Spring Rally. Real GDP growth is predicted to be 2.5% this year, after 2.3% growth in 2017. That is nothing to write home about. However, it’s still growth. March and April tend to be strong months on Wall Street. The debt ceiling has been raised until March 1, 2019. There’s a budget in place. And there aren’t many terrible events that are expected before May, with the exception of the March 20-21, 2018 and May 1-2, 2018 Federal Open Market Committee meetings. However, news, like:

are causing volatility in the Dow Jones Industrial Average. On Feb. 5, 2018, the Dow Jones Industrial Average experienced the single biggest point drop in its history – of 1,175. The Federal Reserve Board is predicted to raise interest rates next Wednesday, at their March 20-21, 2018 meeting. Each time interest rates hikes are mentioned of late, Wall Street freaks out and the Dow drops dramatically. So, expect volatility next week. This morning started off with a rally, but quickly descended into a sell-off of 171 points (less than 1%) after news of the Rex Tillerson firing made headlines. These events are becoming quite predictable: a drop of 500 points or more for an interest rate hike, with White House officials being worth about 180 in losses for a resignation or firing. There are far too many vacancies in key positions… The U.S. is supposed to have 7 Federal Reserve Board members. We have 3. Other Missing in Action appointees include: No chief economic advisor (Gary Cohn resigned), no Secretary of State (Rex Tillerson was fired), a stripped down Environmental Protection Agency and Department of Energy, no Ambassador to South Korea and more… In between the political chaos, the Spring Rally tries to bloom, only to slump with more mudslinging. The Dow Jones Industrial Average is currently 1600 below the high of 26,617 that was set on January 26th of this year. The Feds are Raising Interest Rates. Why and What That Means. Here's a link to the testimony of Federal Reserve Board chairman Jerome Powell on February 26, 2018, where he testified to Congress that the Feds intend to keep raising interest rates. “These interest rate and balance sheet actions reflect the Committee's view that gradually reducing monetary policy accommodation will sustain a strong labor market while fostering a return of inflation to 2 percent,” according to Powell. Why are the Feds really raising rates and selling off treasury bills and mortgage-backed securities? To stop the Bubble Economy and to allow for more fix-it tools to use in the event of another recession. (See the blog links below for additional information.) Low interest rates create bubbles. Now that former Federal Reserve Board chairman Alan Greenspan has said very clearly that stocks and bonds are in a bubble, the Reserve Board knows that they can’t fly under the radar with this bubblicious bandaid fix of the economy. How high will interest rates go? To 3.1% by 2020 (i.e. double where they are now) and 2.7% by 2019, according to the economic projections of the Dec. 13, 2017 Federal Open Market Committee meeting (FOMC). Mortgage interest rates are predicted to be hit the hardest. So if you haven’t refinanced into a fixed rate, now’s the time to do it.

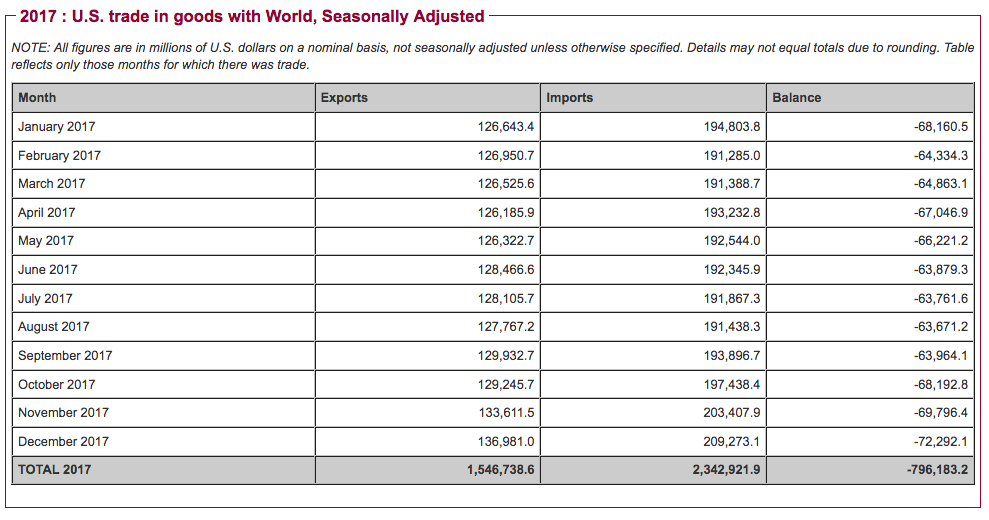

The Bottom Line Alan Greenspan said bluntly on January 31, 2018, “We have a stock market bubble, and we have a bond market bubble.” Warren Buffett has $100 billion on the sidelines because “Stocks have gotten less attractive,” and “You are paying 45 times earnings when you buy a bond.” Nobel Prize winning economist and Yale professor of economics Robert Shiller says, “The only time in history going back to 1881 when [stock prices] have been higher are, A: 1929 and B: 2000. We are at a high level, and its concerning. People should be cautious now.” 1929 was before the Great Depression. 2000 was the Dot Com Recession, when the NASDAQ Composite Index lost 78% of its value. It took 15 years for the NASDAQ to crawl back to even. Taking profits early and often in your trading portfolio is a good idea if you’re nervous about the news. Rebalancing between now and the end of April in your nest egg could be a good time for your annual rebalancing plan. If you’d like an unbiased, second opinion on your current budgeting and investing strategy, call 310-430-2397. If you want to save thousands annually in your budget and hundreds of thousands (or more) in your nest egg by adopting the strategies of the rich, then attend my 2018 Wild West or Manhattan Financial Empowerment Retreats. If you wait for the headlines that the economy is in trouble or stocks are dropping, you’ll be too late to protect yourself. By the time the President, Secretary of the Treasury and Federal Reserve Board chairman admitted that the economy was embroiled in the Great Recession – in October of 2008 – the Dow Jones Industrial Average had already dropped over 6000 points. Most people had already lost 45% or more of their retirement. Getting safe and protected is easy as a pie chart, and earned gains in the last two recessions, while outperforming the bull markets in between. Other Blogs of Interest Take the 2018 Investor IQ Test! 4 Things the 1,175 Dow Drop Taught Us Can the American Consumer Carry This Economy? Warren Buffett has $100 Billion on the Sidelines. GE Investors Lose Half. On March 1, 2018 the White House announced new tariffs, proposed to be 25% on steel and 10% on aluminum. This follows an announcement on January 23, 2018 that there will be new tariffs on washing machines and solar panels. The uproar and backlash from within the U.S. and around the world was fierce, culminating in the resignation of White House chief economic advisor Gary Cohn on March 6, 2018. Are tariffs good for jobs, workers and manufacturing? Will tariffs solve our trade deficit, which is massive – higher than it has been in a decade – at $800 billion in 2017? Will tariffs plunge the U.S. into a recession? To answer these questions, I turned to history and the experts. Below are the primary considerations, and below that additional information.

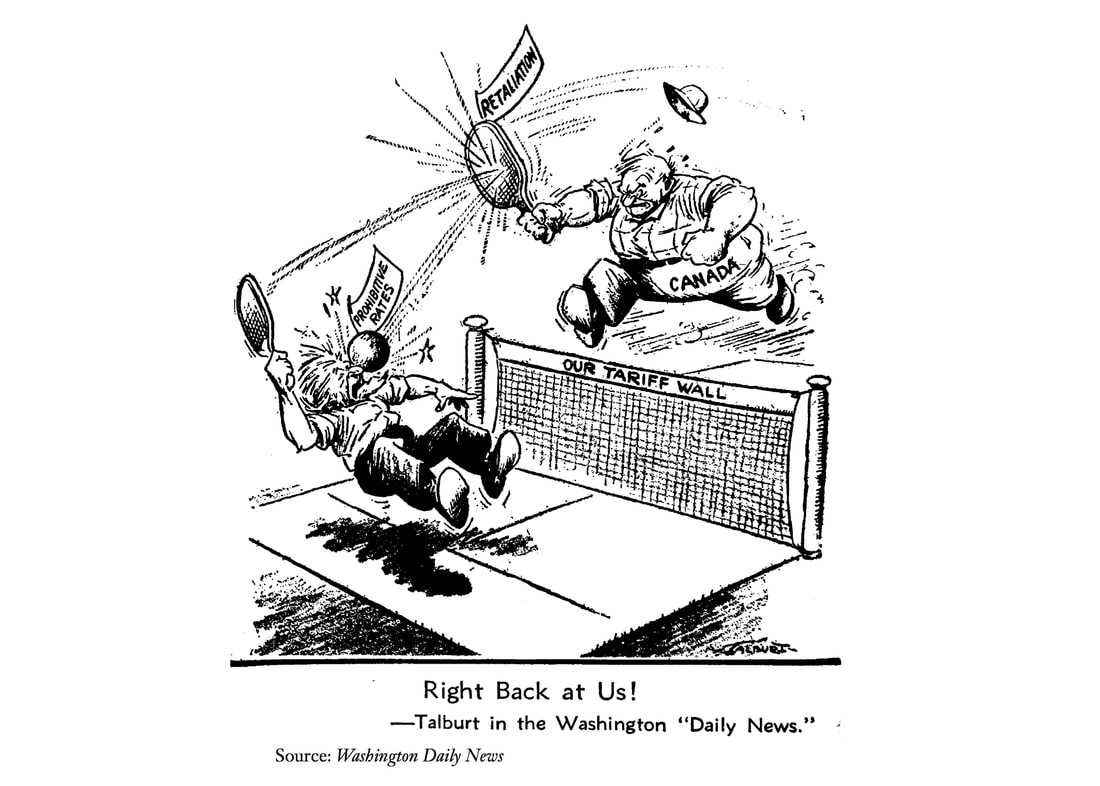

And here are more details. 1. The Tariff Act of 1930 (The Smoot-Hawley Tariff) and the Great Depression. Economists debate whether or not The Tariff Act of 1930 is a primary cause of the Great Depression. The act was signed into law on June 17, 1930, after an 18-month long debate that had begun in early 1929. Black Monday & Tuesday, with combined losses of 25%, were on Oct. 28-29, 1929. However, economists concur that, at minimum, tariffs exacerbated and prolonged the Great Depression – one of the worst economic periods in American history. 2. GATT = Economic Expansion. The General Agreement on Tariffs and Trade Agreement was enacted in the wake of World War II, beginning on January 1, 1948. The overall purpose of GATT was to promote international trade by reducing tariffs and quotas. In the wake of this, the U.S. economy prospered and began a general expansion as the world’s economic leader that spanned decades. (It was only recently that China and the European Union surpassed the U.S. economy as the world’s economic leaders.) 3. Jobs and the Economy. As Nobel Prize winning economist Robert Shiller (professor at Yale University) said on CNBC on March 2, 2018, “Tariffs hurt most people.” Sure, you can help the steel and aluminum industries, but you end up hurting the auto, airplane, construction and beer industries by making steel and aluminum more expensive. Extra costs and burdens on those industries could mean layoffs and canceled production. 4. Are We Hurting China or Canada? Steel imports from China are rather small – at 2% or under, while the U.S. imports from Canada are much larger – at 12.5%. Brazil, South Korea, Mexico, Russia, Turkey and Japan are the next in line. (Source: International Trade Administration) 5. National Security Interests. The U.S. imports about 1/3 of its steel and most of its aluminum. The big winners of tariffs on these commodities are the producers and manufacturers, but not the U.S. public. In general, the public and the U.S. labor force, will see negative ramifications from tariffs, with higher prices and corporate belt-tightening in many downstream steel industries (including potential layoffs of workers).“Low tariffs help the world to organize itself better,” Robert Shiller said. He used the example of Brits hiking a tariff on Portuguese wine and then trying to produce their own wine in a country where grapes do not grow well. “You just end up with bad wine,” he said. 6. Solar Tariffs. Tom Warner, the CEO of Sunpower, a US-based solar company, warns that projects have been canceled, costs are soaring and he’ll have to cut back instead of expanding employment – all as a result of the solar tariffs. In his 4th quarter and full year earnings report, which was released on February 14, 2018, he wrote, “Unfortunately, we are already seeing a negative near-term impact from the ruling as the increased costs due to import tariffs have delayed certain 2018 projects and made other projects uneconomical. We have also put our planned $20 million U.S. employment expansion on hold and are considering other significant cost saving initiatives to lower our overall expense structure and improve our financial performance." 7. The Trade Deficit On March 7, 2018, a Trump Tweet said, “Last year we had a trade deficit of almost $800 billion dollars. Bad policy and leadership. Must WIN again!” That Tweet indicates so much. While the trade deficit number is accurate, the idea that steel tariffs will improve it is very misleading. According to the International Trade Administration, steel imports amounted to only 1% of the U.S. trade deficit. Therefore, rationalizing the tariffs on steel imports as a way to reduce the trade deficit is a specious rhetoric. So, why announce the tariff this month, and follow it with a tweet about winning again? There will be a hotly contested special election on March 13, 2018 in the 12th district of Pennsylvania – a state that was won in 2016 by the 45th President, and one that benefits from the steel and aluminum tariffs. It appears that the only fans of the steel and aluminum tariffs are the heads of those industries and the politicians who will win votes by supporting them. It’s hard to find a fan of the solar tariffs. Gary Cohn has given the world a strong indicator of his opinion of the tariffs by walking out the door. The truth about tariffs is that just as today, economists banned together in 1929 to warn President Hoover of the ramifications of imposing tariffs to try and resuscitate a weak economy. 1,028 economists signed a letter protesting against trade restrictions with solid data supporting their stance. The data and science of free trade is one of the most clear, tried and true rules of economics, with dire examples, like the Great Depression, of what happens when we ignore those rules. The only questions seem to be: Will the current Administration Continue with its Protectionist Policies? Will Tariffs Sink the U.S. Economy? Will Wall Street Enjoy a Spring Rally or Respond with a Correction? Was this all in an effort to win a Pennsylvania House seat for the Republicans? The coming days and months will answer those questions. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed