|

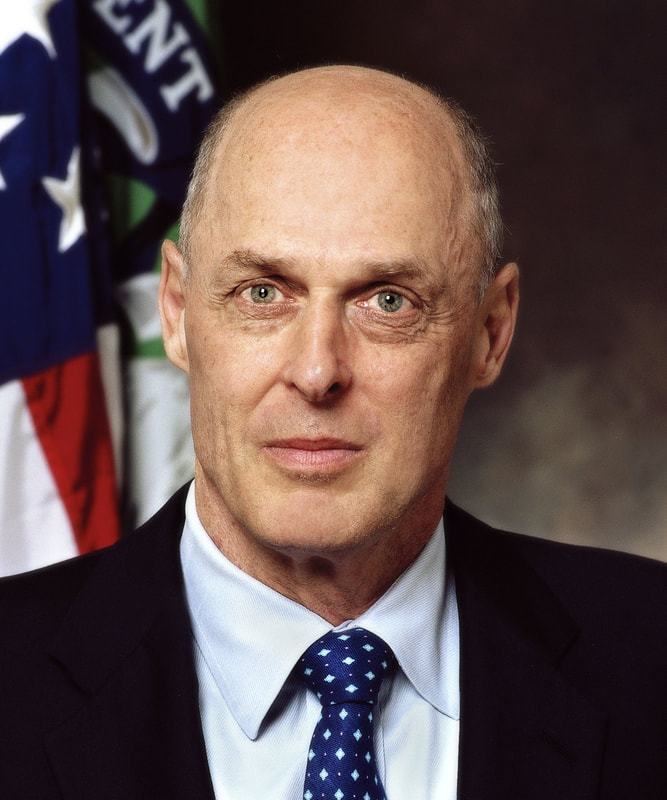

March 2018 marks the 10th anniversary of the Bear Stearns Bailout. One of the most heartbreaking things about the Great Recession was watching it play out, when there were so many red flags and warnings that were ignored. My first real estate warning for subscribers occurred in May of 2005. Real Estate had become unaffordable. Liar Loans were catching fire. The investment banks were all worried about who was going to get caught with a bag of useless collateralized loans, but sold them any way for the high fees. Main Street jumped in the fire, tempted by commissioned real estate and mortgage salesmen who promised massive, immediate gains. While all of this played out on stage and on television, with commercials everywhere on how easy it is to be a real estate investor, behind the scenes many of the top CEOs were cashing in. In my May warning, I alerted subscribers that the CEOs of Countrywide (Mozillo), Toll Brothers and KB Home were all cashing in hundreds of millions in stock. I warned again in June of the following year (2006) that large investment bank insiders were cashing in, with Lehman Bros. insiders cashing in over $116 million. My first warning about Fannie Fae and Freddie Mac was actually years before all of that, in 2003. The “smart money” knew that Fannie and Freddie’s debt was astronomical – at 32 PE for Fannie Mae, five years before the crisis. However, the assumption was that Fannie and Freddie were backed by the government, and so the government would prop them up. In other words, financial planners continued to portray these over-leveraged stocks as “safe” to their client’s, with the added benefit of dividends, much like General Electric was portrayed until earlier this year. The truth is that everyone on Wall Street knew the housing bubble would pop. They were playing a game called “The Biggest Fool,” to see who would go right up to the edge and make a killing without being skewered when the knife inevitably dropped. In fact, one of the persons who profited the most from the housing bubble is one of the persons who is often called a hero. Remember that when a Treasury Secretary comes into office he is “forced” to sell his stock. There is a tax loophole to protect his gains when he does. Most recently Anthony Scaramucci was trying to take advantage of this, even though he’d sold his stock long before his 10-day ill-fated turn at the White House. Not one of the bank CEOs were prosecuted for the banking crisis that sank the economy into the Great Recession – even though worthless, toxic SIVs were sold with names like “High-Grade Structured Credit Enhanced Leveraged Fund” and Countrywide encouraged liar’s loans in their ads and incentivized the sales with commissions. The Goldman Sachs CEO got to sell his stock high, without taxes, so that he could become the Secretary of the Treasury, and is now considered to be a hero of the crisis, even though he was one of the architects of the toxic trading, SIVs and CDOs in the run-up to the crisis. So, what are the lessons we can learn from the Housing Bubble, the Bank Meltdown and the Great Recession? There are many…

Low interest rates, quite frankly, create bubbles. Today, we are back to bubbles. According to Alan Greenspan, there is a bubble in stocks and a bubble in bonds. Real estate prices are higher than they have ever been, as is debt. This is why Federal Reserve Board chairman Jerome Powell is so adamant about raising interest rates and tightening up monetary policy by selling off the mortgage-backed securities and Treasury Bills. If you …

Then it is time to get a second opinion on your budgeting and investing plan, and to learn The ABCs of Money that we all should have received in high school. There is a better way. Call 310-430-2397 to learn more about receiving an unbiased second opinion and about attending my 3-day Investor Empowerment Retreats. You have a to gain by using wisdom, including savings of thousands annually in your budget, and a lot to lose if you don't. Wisdom is the cure! 26/6/2020 10:02:50 pm

Congratulations to them for their 10th Anniversary! Surely this would be one of the best days for them. I interviewed the owner of this building personally back in 2015 and it was really splendid experience meeting him. He has such a good personality. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed