Safari Doctors is a community-based social enterprise, working to advance healthcare in Lamu, Kenya. Since 2015, our mission has been to provide innovative, community-driven healthcare solutions that promote well-being for marginalized communities. https://www.safaridoctors.org. Wiki Commons license. Used with permission. Giving Tuesday Tips to Make Your Charitable Donation a Win-Win-Win (for the people served, the organization servicing, and for you the donor, too. Today is Giving Tuesday. My Instagram feed is surfeited with weepy celebrities, crying on cue for their passion project. It’s effective for fundraising. Many have surpassed their GoFundMe projects 10 times over. But is it the most beneficial use of your hard-earned dollars? Some projects have very high overhead, with too small of a percentage of the donations flowing through to the people they serve (many have admin fees of 90% or more!). Others have a superstar celebrity, but sketchy business practices. CharityWatch even has a list of F-rated Veteran’s Charities. So, the first challenge is to make sure your 501c3 is really using your contribution for good purposes. However, there are a few other considerations that will make your charitable donation a triple win, for the people served, the organization servicing, and for you, the donor, too. While true giving is done without any expectation of anything in return, that kind of selfless gesture almost always has a halo effect. Tips for Your Charitable Giving 1. Time and Talent are Valuable, Too. If you can’t give money (or even if you can) consider donating at least an hour of your time this week. Doing this will also give you firsthand knowledge of how much impact the organization you are donating to really has. 2. Charity is the Best Networking. A lot of people are tempted to hand out a small amount of dough to a lot of different charities. However, your donation will have more impact if you concentrate your giving into something that really resonates with your heart, commit for a few years, and donate your time and talent too. The people you rub elbows with at the charity events will be “your people,” expanding your personal brain trust. You might even sit on a board or join a working committee, which can offer you career advancement skills that might help you get a raise and a promotion. All of my personal career leaps were as a direct result of the support I received for my charitable giving. While raising funds for my son’s local public school, some of the moms helped me to launch the Women’s Investment Network, LLC. After devoting 20 years of self-funded boots on the ground research into sustainability, our EarthGratitude.org project attracted A-list contributors, including H,M. King Charles III (when he was The Prince of Wales), H.H. The Dalai Lama, Sia, Ed Begley Jr., Queen Diambi, Deepak Chopra, EARTHDAY.ORG, and many other visionaries and organizations that are helping to heal our planet. 3. Business Giving. Are you donating through your business? We offer need-based scholarships to our financial freedom retreats. We also allow others to donate to help people attend. While over-giving might bankrupt your enterprise, you might find that donating 10% of the profits (or in-kind products/services) can be very effective marketing. 4. Charitable Giving Gives Back in ways that are priceless. Sometimes it’s just a memory – something wasn’t tax deductible, but paid a high dividend in your personal consciousness and karma. Other times, as was the case with Women’s Investment Network, LLC and EarthGratitude.org, it can directly lead to an opportunity that you wouldn’t have otherwise had. We recently received this note from one of our scholarship recipients. “You have helped a total stranger for FREE. You have allowed me to participate in your membership for no additional cost. And I don't want to fail myself and you...” CT. 5. Buried Alive in Bills With No Room for Charity? It’s easy to feel that you are the one in need of charity! Today’s world of inflation means that a lot of us are struggling to survive and running out of money before the end of the month. Housing is unaffordable, and so are transportation, food, insurance, utilities and other basic needs. On the one hand, you can’t give what you don’t have. On the other hand, if you never give, you never experience abundance, or tap into the magical flow of prosperity that giving and receiving have to offer. The first step is to adopt a Thrive Budget (learn more in The ABCs of Money 5th edition. The 2nd step is to play The Gratitude Game, one chapter each day, to step out of making everyone else rich at your own expense and of living hand-to-mouth, and step into living a richer life and earning money while you sleep. You can be very frugal and still be in trouble in a world where basic needs are breaking the budget. Wisdom and right action are the cures. Charities to Consider Again, please donate to the organization that best addresses a need that resonates with your own heart. I am focusing my time, talent and money on healing our planet. If that resonates with you, below are just a few charitable orgs that have important projects to consider supporting. The blue-highlighted links below lead over to the org's website. EarthGratitude.org Our 2022 Online Global Earth Gratitude celebration reached almost 10 million people, offering videos and celebration from some of the contributors already listed above. Help us reach even more in 2023! Email [email protected] with Earth Gratitude in the subject line to learn more. There are also marketing and title sponsor opportunities, which could benefit you or your business. EARTHDAY.ORG (particularly their Canopy Project) The world's largest environmental organization. Ocean Conservancy Science-based solutions for healthy oceans. Green our Planet (student gardens) Compton Community Garden (community garden in a food desert) Ron Finley The Ron Finley Project is teaching communities how to transform food deserts into food sanctuaries, Kiss the Ground (regenerative agriculture) Rainforest Alliance Working with indigenous communities to protect rainforests. Our Holiday Gifts to You This year, our team is offering free Natalie Pace ebooks as our annual holiday gift to you. The free downloads will be available Dec. 1-5, 2022 only. Mark your calendar. The ebook links are directly below. Feel free to present these stocking stuffers to your friends and family as well. (Just forward this blog, and they will have access to the links.) The Power of 8 Billion: It's Up to Us. The ABCs of Money. 5th edition. The ABCs of Money for College. Put Your Money Where Your Heart Is. 2nd edition. The Boss of Time (children's book, to be illustrated by your child) New Year, New You Financial Freedom Retreat If you're interested in learning 21st Century time-proven investing strategies for building and protecting your wealth, and managing challenging economic times (from a No. 1 stock picker,) join us for our Jan. 20-22, 2023 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price when you register with family and friends. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our New Year, New You Financial Freedom Retreat. Jan. 20-22, 2023. Email [email protected] to learn more. Register on Giving Tuesday (Nov. 29, 2022) to receive a complimentary private prosperity coaching session (value $300). You'll also receive a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Is Your Pension Plan Stealing From You? Is your health insurance at risk? The Seattle Times reported in August that many experienced Boeing engineers were planning to retire this month to avoid having their lump sum retirement amount slashed by as much as $200,000. Why would anyone take the lump sum rather than just keep working and take the monthly pension in a few years? There are plenty of reasons listed below. Additionally, if a Boeing engineer is close to retirement and loses $200,000 of his lump sum, it could take years to make up the losses. Pensions Don’t Offer Much of an ROI* I recently learned that I had some money remaining in a pension plan dating back to my post-university substitute teaching stint. The interesting thing is that the interest over a 23-year period was 37% lower than the contribution was. That parceled out to under 2% annualized, which makes very little sense compared to an annualized return of over 10% in stocks over the same period. When I asked for the breakdown of the return by year, I was advised that 2021’s interest rate was just 0.19% – in a year when the S&P500 scored 27%! *Return on Investment As you can see in the chart below, compounding gains are what can lead us to a life of financial freedom. In this example, the person is making just $40,000 a year, and putting 10% of that ($4,000) into a tax-protected IRA that is earning a 10% annualized return. So, if our pensions are mostly contributions and only a small (noncompetitive rate) of interest, then the company is taking the gains for itself and leaving pensioners with very little upside. (Pension monies are invested. However, the gains stay with the employer rather than being passed through to the pensioners.) This is partially why so many new millionaires and billionaires are in the technology and biotechnology sectors – because they have self-directed IRAs, rather than pensions. (It is reported that Peter Thiel has over $4 billion in his Roth IRA.) You should be able to see what kind of interest rate your pension provider is offering you in the annual Retirement Progress Report. If you’re not receiving an annual report, call your provider and request one. If you had a former job with any government agency or school, you might have some money in their fund that you are owed. It’s worth looking into. Is Your Plan Severely Underfunded? Will You Receive a Fraction of What You Were Promised? Even more concerning than the low interest rates offered by pension plans is the risk – something that many employees and investors are not fully aware of. In May of 2009, Delphi Technologies (a spinoff from General Motors) restructured their debt, terminated their pension plan and handed retirees over to the Pension Benefit Guaranty Corporation. Some pensioners received what they were promised, but many did not, due to the Maximum Guarantee of the PBGC being lower than the amount that they were promised. (Click to see those tables.) According to the PBGC 2022 annual report, “In Full Year 2022, PBGC paid over $7.0 billion in benefits to more than 960,000 retirees in terminated single-employer plans. PBGC also assumed responsibility for the benefit payments of nearly 8,000 current and future retirees in 32 single-employer plans during 2022.” (Yes, another 32 plans were terminated and turned over to the PBGC in 2022.) In 2019, the PBGC reported that 84% of recipients received the full amount. So, if you’re expecting a modest pension, you might be under the Maximum Guarantee of the PBGC. (It pays to check.) How Do You Know if Your Employer is in Trouble? With over half of the S&P500 at or near junk bond status, it’s a good idea to check on the fiscal health of the company you work for, particularly if you’ve been promised a pension. How can you check up?

Here’s How Boeing Ranked 1. Check the credit rating of your companyBoeing is one of the 30 components of the Dow Jones Industrial Average. The company is at the lowest rung of investment grade with a negative outlook, at BBB- (according to S&P Global). A credit downgrade will make borrowing more expensive for Boeing – something that is an issue, due to the amount of debt that Boeing is currently carrying. 2. Check the amount of debt your company owesAccording to the most recent earnings report, Boeing has over $153 billion in debt and liabilities. Meanwhile, the company is only valued at $104 billion. (So, the liabilities are higher than the value of the company.) Over $14.6 billion is for pensions and retiree healthcare, with about $58 billion in debt. Boeing’s 787 airlines are still grounded. Boeing expects to incur costs of $2 billion for this, with the bulk of the liability coming toward the end of 2023. Additionally, airlines – Boeing’s biggest customer by far – don’t fare well in recessions. 3. Check to see if the pensions and OPEBs* are underfundedMost corporate pension plans were fully funded in 2021, according to a report by Milliman. However, that is the result of a stellar market last year. Most pension funds have spent the last decade underfunded, with the last year of full-funding in 2007. In 2018, Boeing was $20 billion underfunded on pensions and OPEBs. This was before the 737 Max crisis. The same year that pensions were underfunded, the Boeing board and C-Suite repurchased $9 billion of Boeing stock and paid $4 billion in dividends. I’m using Boeing as an example. However, as I mentioned, over half of the S&P500 is at or near junk status. If you’re being offered a pension, then chances are you are working for a company that has been around for quite a while, is carrying a lot of debt and may have a low credit score. (Companies founded after 1980 offer 401ks instead of pensions, where employees can get a higher ROI, but can also lose money in recessions.) Airlines, auto manufacturers, old-school communications, etc. are all in this boat. Ford and the airlines (with the exception of BBB-rated Southwest) are all rated as junk bonds, while AT&T and Verizon are at the lowest rung of investment grade (BBB). Multiemployer Funds and Government Employees The White House bailed out some distressed multiemployer pension funds on July 6, 2022. Pew Research indicates that state pensions were underfunded by $1.25 trillion in 2019. New Jersey, Illinois, Hawaii, Alaska and New Mexico have the highest percentage of unfunded pension compared to personal income, while South Dakota and Wisconsin were the only two states that were overfunded on their pensions. None of this makes headlines in a bull market – but it certainly does in a recession, or when cities and counties declare bankruptcy. So, you might wish to consider putting the funds under your own roof now while the sun is still shining – before the next recession is declared or becomes apparent (if you’re able to). *Other Post-Employment Benefits Corporate health care benefits Most companies do not prefund their healthcare liabilities. During bankruptcies, these benefits are very vulnerable to getting reduced or canceled. So, if your employer will allow you to get a higher deductible plan that allows you to start building up your own Health Savings Account that’s a very good idea to consider (for Americans). Try to build up the funds in your HSA as best as you can and not dip into it for expenses unless you absolutely must. Healthcare is the biggest cost in retirement, and is one of the biggest reasons why retirees end up declaring bankruptcy. So the more that you can have in your own retirement plan, which no one can reduce or take away, the better off your future will be. The added benefits of HSA plans are that they also offer a tax credit. You can even invest the money for additional upside without capital gains taxes, if you dot the i’s and cross the t’s of the rules properly. It’s a good idea to get at least two or three years of your deductible in the account in cash before investing, just in case. Should You Roll Your Pension Over Into an Individual Retirement Account? The risks of letting a company or government take care of your future are that the pension promise might be broken, and you could receive less than you believe you are owed, and that you’re unlikely to benefit much from compounding gains or interest. The risk of rolling over to an IRA is that you’ll not be a good steward of your future, and either you or a financial planner will not properly protect your nest egg. This is a real concern. It’s easy to make money in bull markets and easy to lose in recessions. Most economists and business leaders believe that we’re headed into a recession. Most brokers ride the Wall Street rollercoaster, performing with the index – which could be headed down. Fortunately, there is an easy-as-a-pie-chart investing strategy that earned gains in the Dot Com and Great Recessions, when most people lost more than half of their wealth. Once you properly diversify and protect your wealth, you’ll just need to rebalance once or twice a year. (You can learn this time-proven 21st Century system at our Jan. 20-22, 2023 New Year, New You Financial Freedom Retreat.) Which Brokerage is Right for You? Be careful choosing your brokerage. It’s a good idea to find one that has a high credit rating, offers FDIC-insured cash, has low trading fees for self-directed investors, has a large selection of holdings for you to choose from and makes it easy for you to rebalance regularly (i.e. does not compensate its broker/salesmen for offering Buy & Hold products). If you are going to roll over the funds that will provide for your future, then be sure that you educate yourself on the basics of investing. A diversified plan with regular rebalancing (at least once a year) works quite well. We’re overweighting an additional 20% safe to protect from a potential recession. It’s also critical to know the basics of life math (that we all should have received in high school) so that you can be the boss of your money, rather than having blind faith that a broker-salesman is protecting you. Bottom Line While offering a 0.19% interest rate is not technically stealing, it is definitely highway robbery in a world where CDs and Treasury bills are paying above 4%. (The interest rate for my plan in 2022 was 0.43%.) Pension providers don’t invite you to rollover your pension elsewhere, but many (not all) do have an application where you can do just that. If this is of interest to you, be sure to get help from the brokerage where you wish to roll the funds into, and to receive guidance from your accountant to be sure that you do not create a taxable event. (You’re not “cashing it out,” you’re rolling it over.) Most companies that offer pension plans are the ones that are the most heavily indebted. Some of those end up terminating their plans during a bankruptcy restructuring, at which time retirees are forced to rely upon the Pension Benefit Guarantee Corporation. If your pension is rather modest then chances are you’re going to be below the maximum guarantee. However if your pension is pretty high, it could be above what PBGC will pay you. Again, during recessions, all investments are vulnerable to capital losses. So, anyone with a 401(k) or IRA needs to make sure that they are properly protected and diversified. Not all pension plans will let people take a lump sum and roll their money over into their own IRA. However, if your plan will, then you might be providing yourself with a higher ROI, compounding gains and a lower risk profile. Of course, this will require you educating yourself and being the boss of your money. How much have you lost this year (in your paper assets)? If you are over 50 and you've lost more than 10%, then your plan is not properly protected and diversified. Click to access our free easy-as-a-pie-chart web app, where you can personalize your own sample pie chart. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Jan. 20-22, 2023 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price when you register with family and friends. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our New Year, New You Financial Freedom Retreat. Jan. 20-22, 2023. Email [email protected] to learn more. Register with family and friends to receive the best price. You'll also receive a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. A Billionaire’s Fall, FTX Crypto Contagion & 6 Red Flags to Heed Before You Invest in Anything.14/11/2022

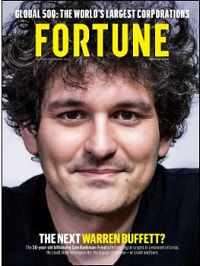

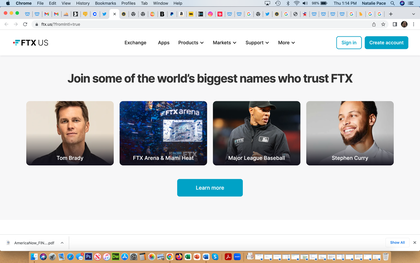

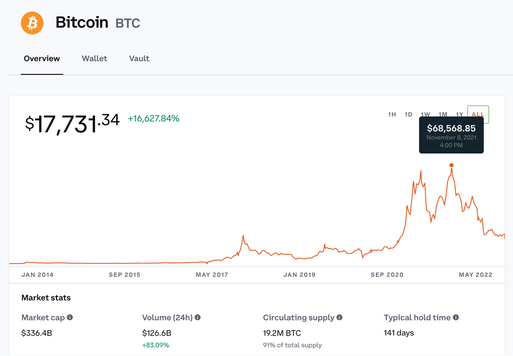

A Billionaire’s Fall, FTX Crypto Contagion & 6 Red Flags to Heed Before You Invest in Anything. On November 11, 2022, FTX filed for bankruptcy. Sam Bankman-Fried went from the cover of Fortune magazine in August/September 2022 as a “billionaire” to public enemy #1 on his Twitter feed. His companies, FTX and Alameda Research are in bankruptcy. A last minute bailout by Binance was scuttled due to “mishandled customer funds and alleged US agency investigations,” according to a Tweet by Binance CEO Changpeng Zhao. The FTX and Alameda bankruptcies are also affecting Solana, a coin that Alameda Research had an alleged 10% stake in. As Francisco Memoria with Cryptoglobe wrote on Nov. 10, 2022, “A Solana whale is in liquidation and currently has over 2.4 million SOL in collateral backing a 44.87 million USDC debt. With the price of Solana rapidly plunging, the whale’s forced sale could lead to further downside.” Solana has already slid -94% this year, right in stride with FTX’s token FTT. By comparison, Bitcoin and Ethereum are down -74% year over year (a fall that will definitely cause more fallout in the cryptosphere). There have been a lot of allegations of illicit self-dealing between SBF’s companies, but also between companies that he “rescued,” including a $377 million loan from Voyager Digital to FTX. In a tweet sent by Binance CEO Changpeng Zhao, he writes, “FTX didn’t ‘bail [Voyager] out’ or return the money.” It’s very early in the game, and we’re likely to hear a lot more about what happened in the months ahead (or in a Netflix documentary in two years). Everyone is wondering whether SBF and FTX “should be compared to the fall of Enron, Lehman Brothers, Bernie Madoff or MF Global,” i.e. was the disaster a result of fraud, leverage or just a terrible investment strategy? And where is the missing money? Crypto Contagion The implosion of the Terra not-so stablecoin, and the collapse of Three Arrows Capital and Voyager Digital in May of this year began the ripple effect. However, SBF, FTX, Alameda and Solana are unlikely to be the only victims of the crypto winter. Savers who were told their deposits at Voyager were FDIC-insured have learned that they are not. Although CZ has been very vocal recently about the failings of SBF, Binance was an early investor in FTX’s seed and Series A rounds, according to Coindesk. It is unclear how much Binance still has; CZ says Binance still has "a bag" of FTT. (Binance’s attempt to cash out on November 6, 2022 precipitated the run on FTT.) Users and investors alike are all waiting in line for the new trustee, who oversaw Enron’s bankruptcy, to return their money. Sequoia Capital has already written down their $213.5 million investment to zero. How does the average investor avoid a sketchy business before the bankruptcy? How do you know to question a claim that your funds are FDIC-insured (such as happened at Voyager)? Below are a few common investing mistakes. You can learn even more in the 2nd edition of Put Your Money Where Your Heart Is.

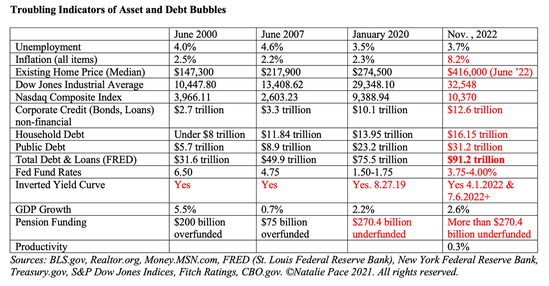

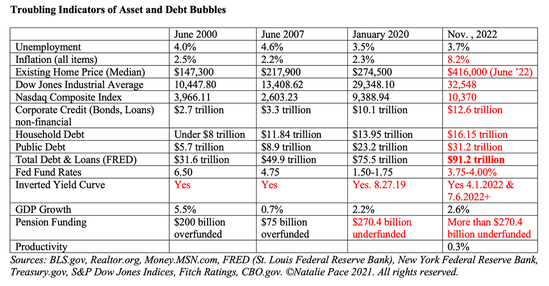

Before we get into the details on each of the above red flags (all of which were present with FTX and SBF), let’s talk about the prognosis for cryptocurrency in general. Fiat Currency and Safe Havens At this time the strength of the dollar and the resilience of the US economy are negative for assets that sell themselves as a safe haven. After being burned by safe havens, the idea of getting a decent Return on Investment for a T-Bill is enticing. (Learn more about this in my blog, “Crypto, Gold, Silver: The Not So Safe Havens” and my videoconference with a special warning on T-Bills. Click to access.) However, the theory behind decentralized money and the concerns about the U.S. debt are not unfounded. As you can see in the chart below, the U.S. (and the world) are in the nethersphere in terms of leverage. In the Federal Reserve Financial Stability Report, it was noted that borrowing by businesses and citizens were at high levels. At this time, businesses still have a lot of cash and consumer debt is concentrated in people with good credit scores. However, a recession, inflation and higher borrowing rates with tighter terms, could spark a disaster. Also, U.S. Central Bank losses began in September of 2022, and are expected to continue for the next few years. This will likely mean that the Federal Reserve Central Bank will suspend payments to the U.S. Treasury, resulting in about $115 billion not being paid in annually (based upon 0.05% of 2021 GDP). However, it could also mean that the central bank will ask for support from the government. The Federal Reserve Board had an emergency closed board meeting on Oct. 3, 2022, likely to discuss this. On that same day, Fitch Ratings issued a press release. Currently, the U.S. has an AAA credit rating with Fitch Ratings. However, the rating agency notes that should the bank seek indemnity for large losses or to recapitalize with government funds, that may impact “its policy credibility.” It’s important to remember that gold and silver soared to all-time highs in 2011, after S&P Global downgraded the U.S. from AAA to AA+. Should the AAA rating of the U.S. be called into question or put on a negative outlook, safe havens should become popular again. And here is more information on each of the common investor mistakes listed above. 1. Read the Fine Print Although Voyager Digital made false and misleading statements that depositors’ money was FDIC-insured, it was not. Click if you’d like to understand why the FDIC and SEC issued a Cease and Desist Order to Voyager. How would you have known before depositing your money? Banks are FDIC-insured, while exchanges and brokerages are not. Voyager Digital was not an FDIC-insured bank; they had a relationship with one. It’s not uncommon for brokerages to have an agreement with a bank that is FDIC-insured. However, if the brokerage itself goes belly-up, then the FDIC doesn’t come to the rescue. This only happens if the bank does. So, knowing the creditworthiness of your brokerage, how long it’s been in business, and whether or not it is making or losing money is key. If the brokerage is publicly traded, that information should be easy to find. In a world with so many companies at or near junk bond status, it pays to know the credit score of every financial institution that you deal with. 2. The Bahamas Why would a company move operations from Hong Kong to the Bahamas, like FTX did? For less oversight. (Hong Kong was under British rule for a century and has a strong background in finance.) When you have C-level executives who want less scrutiny that’s a red flag. An inside source told Coindesk that ““The whole operation was run by a gang of kids in the Bahamas.” 3. Young Founder/CEO with no Babysitter Once an entrepreneur hits a certain milestone, and certainly before they reach billionaire status, there needs to be an experienced team on board. While the CEO/founder might understand the product or service that they are innovating, they will not have all of the skills necessary to navigate governance, liquidity, crypto winters and a series of unfortunate events. Larry & Sergey had Dr. Eric Schmidt (Novel) and Arthur Levinson (Genentech). Mark Zuckerberg had Marc Andreessen (Netscape) and Sheryl Sandberg (Google & Larry Summers). Who was babysitting SBF and the FTX billions? 4. Celebrity Endorsements Kim Kardashian was quite infamously fined $1.26 million by the SEC on Oct. 3, 2022 for a crypto pump-and-dump scheme that she was paid to promote. Ambassadors and influencers are compensated. Tom Brady and Gisele may have received FTX equity with little or no investment. FTX paid to be the name sponsor of the Miami Heat and the FTX Arena. 5. Board Issues FTX’s board included Lucas Moskowitz, the Deputy Legal Counsel of Robinhood, with a CV that includes the SEC. Moskowitz is surely engaged in some heated conversations with some of his former colleagues at the SEC, as is the chairman of the board Larry E. Thompson. While the board was heavy on regulators and derivatives traders, the board was missing business experience and acumen. (Moskowitz had regulatory not business experience.) 6. Never Confuse a Bull Market With Wisdom SBF was called a “trading wunderkind” by Fortune magazine. However, he’s only 30 years old. He was in high school the last time the U.S. (and world) experienced an extended contraction. We’ve been in a secular bull market since March of 2009. (Thanks to trillions printed and passed out to everyone with a pulse, the pandemic recession was the shortest on record, at just two months.) It’s easy to make money in bull markets and easy to lose money (and go bankrupt) in the winter of an asset’s discontent. Crypto Winter How will the crypto contagion affect Coinbase, Binance, Square, Tesla and other companies that are involved with Bitcoin and decentralized finance? We’re already seeing severe revenue fallout in Coinbase and Marathon Digital Assets and a revenue decline at Robinhood. These companies are down in revenue by -53%, -75% and -1.08% respectively. Year-over-year revenue growth is still positive at Nvidia (+3%), Paypal (+11%), Block (+17%), Goldman Sachs (+22%), Tesla (+56%) and Interactive Brokers (+114%). However, will the crypto winter and contagion cause a blight? I am personally underweighting crypto, financial services and companies that are still carrying a lofty P/E, which takes most of these companies off my plate. BOTTOM LINE Regulators are crawling all over the wreckage of FTX, Alameda Research and Sam Bankman-Fried. The recovery and distribution of the companies’ assets are in the hands of the same person who oversaw the Enron restructuring (John J. Ray). Will Sam see the same fate as Jeffrey Skilling? Are we looking at the sequel of Bernie Madoff? My heart is with anyone tainted by this scandal. (We offer need-based scholarships to our Financial Empowerment Retreats.) My hope is that if you weren’t, that you’ll heed this cautionary tale to skirt the scene of the next investing disaster. Full Disclosure: I own crypto, gold and silver assets. However, I use a diversified system to help me capture gains at the highs and add more at a lower price at the lows -- something anyone can learn at our Financial Empowerment Retreats. How much have you lost this year (in your paper assets)? If you are over 50 and you've lost more than 10%, then your plan is not properly protected and diversified. Click to access our free easy-as-a-pie-chart web app, where you can personalize your own sample pie chart. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Jan. 20-22, 2023 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price when you register with family and friends. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our New Year, New You Financial Freedom Retreat. Jan. 20-22, 2023. Email [email protected] to learn more. Register with family and friends to receive the best price. You'll also receive a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Over the last year, crypto has tanked, gold has lost momentum, and silver remains stuck near a 10-year low. Gold was the worst performer over the last decade, while Bitcoin has been on a spine-splitting rollercoaster. With so much economic turmoil happening, including:

Why in the world aren’t people fleeing to safe havens to protect their wealth? It has a lot to do with hope, a Stimmy Check hiatus, chasing ROI (Return on Investment), and having an oil and gas independent nation buttressed between two large oceans and two friendly neighbors. The sinking of our so-called safe havens has a lot to do with the following phenomena.

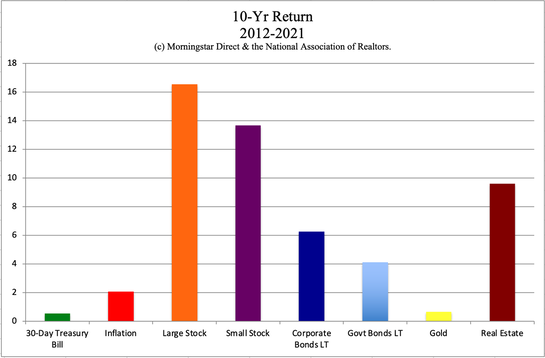

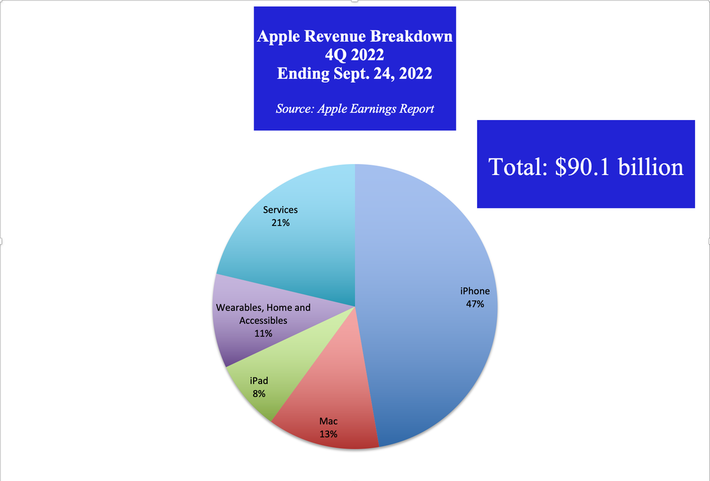

Click on the blue-highlighted words to learn more about T-Bills, and whether or not we’re likely to have a recession. What will it take for gold, silver and crypto to shine again? Safe haven investments get very popular when people fear that everything is going to hell in a hand basket. If you think of the last decade for gold and silver, it can be summed up with the phrase: “the longest secular bull market in history.” When stocks are high, no one is swooning over gold. When gold soared to its 20th Century peak of $800/ounce in 1980, the U.S. economy had roadblocks of oil embargoes, runaway inflation, a Fed Fund Rate of almost 20%, high gas prices and stagflation. On September 5, 2011, when gold peaked at $1895/ounce and silver reached for $50/ounce, it was right after the S&P Global rating agency downgraded the U.S. sovereign credit rating from AAA to AA+. (That occurred on August 5, 2011.) Both times, investors flooded into gold, buying at the height of the frenzy, and (sadly), had their futures buried in losses for the next decade. It took over a quarter of a century for gold to recover to the $800 range after 1980. (It didn’t happen until November of 2007.) Cryptocurrencies are marketed to Main Street as the only thing that will be of value when the dollar becomes worthless. Yet, crypto has a very high correlation with stock market performance and a much shorter holding period than most HODL investors are aware of. If you look closely at the chart above, you'll see that Bitcoin's average holding time is only 141 days (less than 5 months). When stocks plunged by -38% in the pandemic, Bitcoin fell off the cliff, too, sinking to a low of under $3,858/coin by March 12, 2020. The volatility in crypto is caused by the large investors capitalizing on the HODL sentiment of cryptophiles. Despite the promise that decentralized currency has for the future, currently it’s used more as a Get Rich Quick trading platform, rife with ruses, whales and opportunists posting as influencers. Main Street investors who sink everything they’ve got into a Hail Mary safe haven investment can bankrupt themselves. Our easy-as-a-pie-chart nest egg strategy helps the over-zealous investor to have a more rational approach. It’s equally important to rebalance regularly, to capture your gains at the high, rather than just waiting and watching them evanesce. Proper diversification with regular rebalancing is a time-proven 21st Century investing strategy that works particularly well for the volatility of hot industries, like crypto, gold and silver. Will These Safe Haven Assets Ever Reward Investors Again? Crypto is definitely out of favor. However, that’s a déjà vu that has played out multiple times. Crypto still has some heavy players on its team, including Andreessen Horowitz, Square, Elon Musk, Coinbase, Tesla, and even countries like the U.S., China and Russia, who are all developing their own coins. It also has a lot of scam artists and fraudsters. Joff Paradise and his cronies of the Trade Coin Club Ponzi scheme were charged by the SEC on Nov. 4, 2022 (finally). The U.S. dollar is strong. However, the winds can change very quickly, particularly in wartime, and especially when we seem caught in 1980s The Sequel. In fact, this week’s videoconference is going to focus on the most recent Federal Reserve Financial Stability Report, which has some new areas of concern ringing warning alarms, including bonds, money market funds and Treasury bills. The entire world is mired in debt. However, the U.S. has the most debt by far of any AAA-rated sovereign. Gold & Silver Outlook: Prices are Down, So is Revenue Revenue for gold and silver mining companies is down. However, prices have fallen even further than revenue, sending yields soaring. BHP Billiton has a price-earnings ratio of under 7 (very low), while Rio Tinto’s is closer to 5. In the 3rd quarter 2022 earnings report, Rob McEwen, the Chairman and Chief Owner of McEwen Mining, addressed the low valuation of his company. According to McEwen, “Another way to look at MUX is that its current share price of $3.66 reflects the low end of potential value of the company’s ownership in McEwen Copper and you get all the other assets for free.” Since that statement, McEwen has rallied to $4.44/share (up 21%). Dividends Rio Tinto and BHP Billiton are offering very high dividends, with yields above 12% currently. You can also get a robust dividend by going into an Australian ETF, which affords you a little more diversity than an individual company offers. iShares Australian ETF, symbol EWA, is paying 8% yield. By comparison, the iShares Global Gold Miners ETF (RING) is paying a 2.99% yield. Remember, however, that everything can sink in a recession. What protects you is keeping the appropriate amount safe (another central theme in our Financial Freedom Retreat). Copper: The New Oil Copper is being called the new oil by Goldman Sachs because this metal is used in electric vehicles and a lot of other things that are part of the clean energy revolution. Many of the mega mining companies like Rio Tinto and BHP Billiton deal in gold, copper and silver (and other materials). McEwen Mining has a 68% interest in McEwen Copper, which owns one of the world’s largest undeveloped deposits in Argentina (Los Azules) and another in Nevada (Elder Creek). Copper is yet another reason why it’s going to be difficult to time the recovery of gold and silver mining. Copper could heat up and cast a glow on the materials industry. Bottom Line As long as the dollar is strong and stocks are resilient, safe havens are likely to be ignored. However sentiment can shift rather rapidly. So rather than trying to wait and see, it might be a good idea to add a little more at a low price (and a low P/E) to your safe haven holdings. Be sure to use your pie chart system to guide you on the right ratios. Also be aware that safe havens are very out of favor right now, and could stay grounded, or even go lower, as the first wave tends to run in tandem with stocks in a decline. However, if stocks truly tank (as they have in all of the 21st Century recessions), and people are disgusted with the amount they’ve lost, the emotional safe haven plays can blast off pretty fast. If you’re a crypto, gold or silver investor who has been through these cycles a few times, you should know by now that when hope is lost, it’s a good time to buy low. When everyone thinks the party won’t end, it’s a good time to sell high. You can do all of this while still HODL a slice or two, once you learn the pie chart system that we teach at our Investor Educational Retreats. Full Disclosure: I own crypto, gold and silver assets, as well as some materials-rich country ETFs. How much have you lost this year (in your paper assets)? If you are over 50 and you've lost more than 10%, then your plan is not properly protected and diversified. Click to access our free easy-as-a-pie-chart web app, where you can personalize your own sample pie chart. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Jan. 20-22, 2023 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price when you register by Nov.. 13, 2022. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our New Year, New You Financial Freedom Retreat. Jan. 20-22, 2023. Email [email protected] to learn more. Register by Nov. 13, 2022, to receive the best price. You'll also receive a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Will Ted Lasso Save Apple’s Holiday? Apple Warns that December Quarter Will “Decelerate” from September. During the Apple September 2022 quarter earnings call on October 27, 2022, Luca Maestri, the CFO of Apple, warned that “total company year-over-year revenue performance will decelerate during the December quarter as compared to the September quarter for a number of reasons.” Foreign exchange is predicted to negatively impact revenue by 10 percentage points, and “Mac revenue [is expected] to decline substantially year over year,” largely due to a robust comparison with the 2021 holiday season. Holiday Spending Holiday spending on electronics is predicted to be softer this year, down to 24% of consumers wanting a tech gift, compared to 27% in 2020. This could be another headwind for Apple. What Would Decelerating Look Like? The September quarter posted 8% year-over-year revenue gains of $90.1 billion. Most of the revenue came from the iPhone, at $42.6 billion, with Services in second ($19.2 billion), followed by Mac ($11.5 billion), Wearables ($9.65 billion), and then iPad ($7.2 billion). If the December quarter’s year-over-year revenue growth slows to 5%, the holiday sales quarter would come in at $130.2 billion. That would still be an all-time high. Apple would sing that song, accompanied by the analysts. Apple buybacks would continue. A Santa Rally could be in the cards, if investors don’t get too spooked by the November and December rate hikes, and the recession on the horizon. Foreign Exchange However, it’s important to remember that decelerate is a rather nebulous word. Apple isn’t offering guidance per se, and that the CFO mentioned twice that there would be a 10 percentage point headwind on FX. By comparison, the FX effect in the September quarter was 70 basis points – less than 1%. It was clear on the call that most analysts are expecting growth, even if it is low single digits. So, even a small amount of growth should appease Wall Street, when it’s reported around January 27, 2023. The problem is that if Apple knows that its holiday season is a miss on expectations, the company may stop their share repurchases – likely in December. It wouldn’t be the first time that Apple projected low single-digit growth, and then missed. The Holiday Slowdown in 2018 On January 29, 2019, Apple reported that their 2018 holiday sales quarter had declined by -5% from the December quarter of 2017. That had a lot to do with Huawei, which had jumped to the 2nd most popular smart phone in the world. It was a miss on expectations. However, the sell-off began in early December, almost two months before the announcement. Buybacks Throughout 2018, Apple had a robust buyback plan in play of $19.3 billion to $22.9 billion each quarter. In the December quarter of 2018, share repurchases dropped by half to $10.1 billion (source: S&P Dow Jones Indices), with almost no buybacks in December of 2018. When Apple stopped buying, Wall Street saw the worst December since the Great Depression. The S&P500 dropped -9.2%. Apple repurchased $25.2 billion of their common stock in the September 2022 quarter. If they slow or cease buybacks in December, the markets will drop. Mac Sales According to Luca Maestri, “We expect Mac revenue to decline substantially year over year during the December quarter.” Mac sales were stronger in the September 2022 quarter than they were in the 2021 holiday season, at $11.5 billion, compared to $10.4 billion. There might have been more back-to-school Mac buying than there will be wrapped gifts under the tree. Ted Lasso Will the iPhone, iPad, Wearables and Services make up for the expected decline in Mac sales? Will Ted Lasso be released in time to save the day? There is no official release date for the popular, Emmy-Award winning series. Filming began in March. On Halloween, Twitter lit up with images of the crew all dressed up as Ted Lasso for filming in Richmond. Was it a wrap? Can the post production team get everything in the can for a drop before December 31, 2022 (when the December quarter ends for Apple)? 14 Weeks Compared to 13 There is one bright spot that could help the company meet expectations. Apple will have an extra week of earnings in the December quarter this year – comparing 14 weeks in 2022 to 13 weeks in 2021. Of course, a miss on earnings will resonate even more with analysts, if it happens. Recession? The Federal Reserve Board is widely expected to increase interest rates another 75 basis points on November 2, 2022, with the Fed Fund rate hitting as high as 4.4% in 2022, and 4.6% in 2023 (according to the FOMC Summary of Economic Projections from September 21, 2022). With inflation still running way too hot, particularly shelter inflation (rents), it’s possible that the SEP will show higher rate hikes in 2023. (I’ve heard Paul Voelker’s name mentioned more in 2022 than in my entire career.) We’ll get the next look at their crystal ball on Dec. 14, 2022. Rapid rate hikes are correlated with recessions. As I’ve mentioned repeatedly throughout the year, the NBER (the organization tasked with calling the recession) is notoriously slow. If you wait for the headlines that we are in a recession, it will be too late to protect your wealth. It’s a good idea to adopt a time-proven, 21st Century plan now – to fix the roof while the sun is still shining. Join us for our online New Year, New You Retreat Jan. 20-22, 2023. Email [email protected] or call 310-430-2397 to learn more and register now. Register by Nov. 13, 2022 to receive the best price. Bottom Line Will there be a Santa Rally in 2022? Or will we see a repeat of December 2018, when Apple knew they were going to miss earnings expectations, stopped buybacks and sparked a Wall Street sell-off to the tune of -9.2%? Does the fate of our holiday season lie in the hands of the Federal Reserve Board or Jason Sudeikis? (There is likely to be plenty of pressure on the Ted Lasso team to drop the 3rd season before Christmas.) Either way, now is the perfect time to have a recession-proof plan that protects your wealth, while still allowing you to stay in the game. September plunged -9.34%. October recovered some of those losses with 8% gains. Stocks are still down -20% from their January highs. However, with rate hikes and a continued economic slowdown are on the horizon, it’s a better idea to plan for continued challenges than to hope for an unlikely recovery. 21st Century recessions tend to be a series of unfortunate events, with plunges, followed by lackluster rallies and then more drops. When the NBER finally names the recession, stocks are closer to the bottom. If you sell then, you’re likely to be selling low. The Buy & Hope price tag can be losses of half or more of your wealth in most 21st Century recessions. Wisdom and time-proven systems are the cure. The time is now. How much have you lost? If you are over 50 and you've lost more than 10%, then your plan is not properly protected and diversified. Click to access our free easy-as-a-pie-chart web app, where you can personalize your own sample pie chart. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Jan. 20-22, 2023 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price when you register by Nov.. 13, 2022. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our New Year, New You Financial Freedom Retreat. Jan. 20-22, 2023. Email [email protected] to learn more. Register by Nov. 13, 2022, to receive the best price. You'll also receive a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed