|

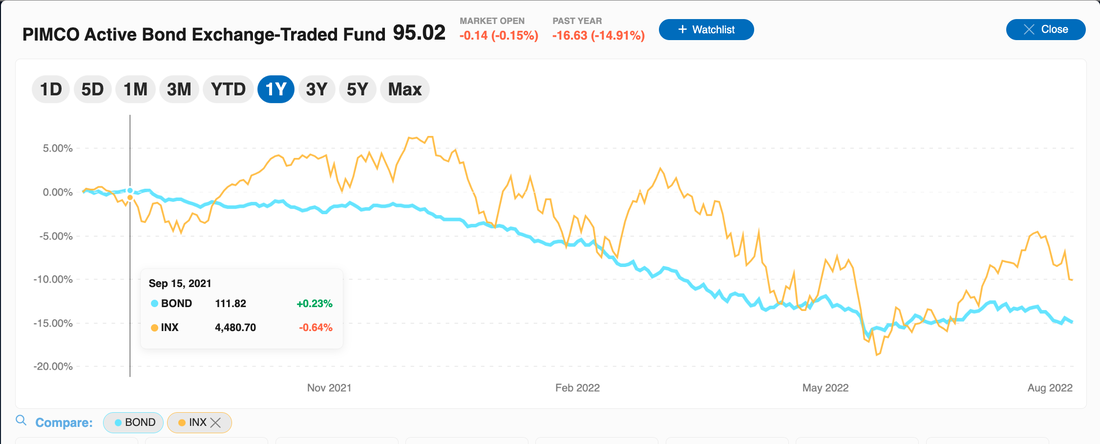

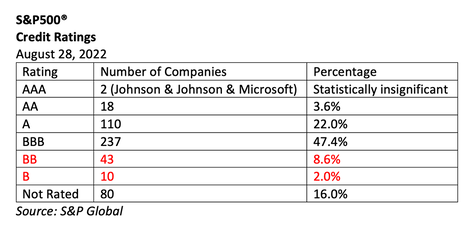

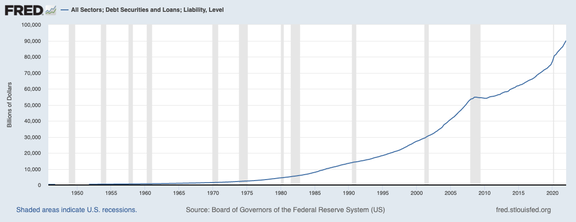

What’s Safe in a Debt World? Not Bonds. “I’m more concerned with the return of my money than the return on my money,” Will Rogers. Bond funds reported their biggest weekly outflow in eight weeks last week, according to Reuters. The Pimco Active Bond exchange-traded fund (Symbol: BOND) is down 15.2% over the last year, with losses in tandem with the S&P500®. The safe side of our portfolio is supposed to protect our wealth – something that really isn’t happening with bonds or bond funds these days. Why? There is too much risk in the world – both credit risk and interest rate risk. Bonds have an inverse relationship with interest rates. As interest rates rise the value of your bond decreases. There is also a great problem with leverage and debt. We’ve never seen these levels in the United States. Ever. Over half of the S&P500® companies are at or near junk bond status. This is not a statistic investors are seeing in the headlines. Here's another bit of news that rarely makes the news cycle. There is over $9 trillion in debt loans outstanding in the U.S. As you can see from the graph below, this is off the charts in terms of historical leverage. Below are 12 essential strategies to protect your wealth from the economic storms on the horizon. Multiple economists are now in consensus that the US will experience a recession in 2022. We may already be in a recession now. (Click to learn more.) According to The Conference Board, “Economic weakness will intensify and spread more broadly throughout the US economy in the second half of 2022. [We expect] a recession to begin before the end of the year.” 12 Essential Strategies for Protecting Wealth in 2022 1. Bonds are Illiquid and Negative Yielding. Underweight bonds. Keep the terms short and the creditworthiness high. Traditionally bonds are considered the area of safety. These are what broker-salesmen offer anyone with a low risk tolerance for losses. However, clearly, that is not what is happening. As mentioned above, Pimco’s bond fund has been losing money in tandem with the stock market. Lack of liquidity is a big problem because if we wish or need to sell the bond, there might not be any buyers, or we may have to drop the price (lose money). Some people are purchasing bonds that will last longer than they will live. (Are you a senior purchasing a 40-year bond?) As mentioned above, over half of the S&P500® is at or near junk bond status. There aren’t a lot of creditworthy companies asking for money. 2. Money Market Funds Can Lose Money, and Have Redemption Gates and Liquidity Fees. Money market funds are another traditionally safe asset. In many 401(k)s, this is one of the few options for safety that we can select. However, money market funds are funds, and they can lose value just like every other fund can. Additionally, if the fund company itself has liquidity problems, or too many people want redemptions at the same time, there are policies in place that allow the fund company to stem that flow by imposing a redemption gate or a liquidity fee. That means that you may have to pay to have access to your money, or you may not be allowed access at all for a period of time. These funds are quite a bit riskier than most people realize. Additionally, when you factor in the expenses, the yield they offer for that risk is rather anemic. 3. Annuities have Surrender Fees, Hidden Fees and Are Not FDIC-Insured. One of the most highly leveraged industries in the U.S. is the insurance industry. According to the Federal Reserve Board’s Financial Stability Report, which was released in May, “Leverage at life insurers remained near its highest level of the past two decades. Life insurers continued to invest heavily in corporate bonds, collateralized loan obligations (CLOs), and CRE debt, which leaves their capital positions vulnerable to sudden drops in the value of these risky assets.” Annuities are not FDIC-insured. Many times they have hidden fees. And they are one of few investments that loses 9-10% the minute you purchase them (those surrender fees). If you want or need access to your money over the next decade, you’re going to take a big haircut. It’s also important to remember that AIG would’ve gone bankrupt if the US had not bailed the company out in 2008. AIG is the biggest annuity provider. Many companies with different names are actually owned by AIG. If you are going to own an annuity, it would be important to know the company’s credit rating, as well as to look deep into the fine print to make sure that you’re not being eaten alive by fees. Broker-salesmen make a good commission (up to 10% annually) for selling individuals into annuities. 4. Dividends Don’t Pay When Your Principal Plunges. I was recently on stage with someone at a major conference who “specializes” in high-yield stocks for the income. He said that the share price always sorts itself out, if you just buy and hold. That’s simply not the case. Warren Buffett famously sold all of his General Electric stock just a few months before the company cut its dividends. The stock market is still trading close to an all-time high. However, GE is still down over 2/3 from its $243 highs of late 2016. It’s never a good idea to lose principal in the hopes of earning a small amount of “income.” The higher the dividend, the higher the risk. 5. Capital Preservation. A lot of people are being sold into risky, money-losing assets as “safe” with the sales pitch that if you don’t try to earn some income, your money is losing buying power, and you’re not keeping up with inflation. What they’re not telling you is that you are at risk of losing money in addition to buying power, and are not getting much of a return to take on that risk. It is important to preserve your capital in recessions. When you lose too much money, your credit score plunges, your lifestyle changes, your relationships suffer and you might have to take on a 2nd job or delay retirement. 6. Liquidity Affords Us the Opportunity to Buy Low. Most people don’t buy low because they can’t. When we lose too much money in a recession, we have to hope and pray that our investments crawl back to even, rather than being one of the few who preserve their capital and can go on a buying spree at a very reduced price. So rather than get sold into risky, money-losing assets with the fear of inflation hanging over our heads, our mantra should be to preserve our capital because it affords us the ability to buy low. (There are tricks to reducing the impact that inflation has on our lives. Learn more in the Thrive Budget section of the 5th edition of The ABCs of Money.) 7. Keep a Percentage Equal to Our age Safe. I do a lot of unbiased 2nd opinions. There is not one that I’ve done where people have the appropriate amount safe. The standard rule is to keep a percent equal to your age safe. The closer we get to retirement, the less time we have to recover from losses. This is another reason why it’s important to know what safe in a Debt World. When bonds are losing money, or annuities are reducing in value due to the hidden fees, we need to have a different plan for the safe side of our portfolio. That is why we spend one full day on What’s Safe in our Financial Empowerment Retreats. Email [email protected] with Retreat in the subject line to learn more. 8. Overweight Safe During Times of Economic Hardship. We are overweighting 20% safe in our sample pie charts due to the risk of recession. This one simple trick is how people earned gains in the Great Recession and the Dot Com Recession. If you’re 50 and you’ve overweighted 20% safe, if the stock market loses half, your losses are only about 15%. The bonds earned gains in the Great Recession and the Dot Com Recession, making up for the losses on the equity side. It is more difficult to get safe this time around. However, liquidity is one of the essential elements of weathering the economic storms on the horizon. 9. Keep the Money in the Family. One thing that separates very wealthy families from the rest of us, is that they tend to think multi-generational. They plan 100 years in advance. They educate their children in financial matters. They don’t spend a lot of family money on rent and landlords. I am sure that Millennials and Gen Z are very sick of living with their parents, and vice versa. However, there are many solutions to consider when you think outside the box, and make keeping the money in the family a top priority. Check out our real estate blogs, podcasts and videoconferences, as well as the Real Estate section of the fifth edition of The ABCs of Money. 10. Safe Income Producing Hard Assets That You Purchase for a Good Price. One area of safety is to purchase safe, income-producing hard assets that you purchase for a good price. When we first introduced this mantra in 2011 (when real estate was at a decades-low price), only those with liquidity (money) could take advantage of it. Most of those people have seen the value of their investments more than double. Now, with real estate at an all-time high, it’s difficult to purchase anything for a good price. However, there are other low hanging fruit. If you live in a sunny state, then solar panels can save thousands annually. The payback time can be as low as 4-7 years. Be sure to get your megawatt usage down as low as possible before you get the quote. (Learn more in The ABCs of Money.) If you don’t live in a sunny state, then insulating better and using LED lighting can also save thousand annually. Energy efficiency upgrades offer tax credits up to 26% in 2022. Also, think about how you can reduce the amount you spend on gasoline. Can you ride a bike, walk or take public transportation more? Should you consider moving closer to work? The average person spends almost $8000 a year owning a car, when you factor in the car payments, car insurance, maintenance, parking, tickets and gasoline. What kind of investment can you make to lower that CO2 footprint, which can also give you more room in the budget for things you like more than gas stations? Would a solar-powered electric vehicle be right for you? There are tax incentives of up to $7,500 to purchase certain qualifying models. (Click to access information.) 11. Proper Diversification. Proper diversification is really important. Most people don’t have much diversification at all. We have the same type of holding over and over again. Even if we have 18 pages of individual stocks, we might be concentrated only in large-cap stocks, with just a smattering of diversity. Our sample pie charts have 10 funds: small, medium, large, value and growth, and four hot slices. The hot slices allow you to get invested in things that can remain more buoyant in recessions, such as consumer staples or utilities, or might even be good hedging tools that could increase in value. We spend one full day on the nest egg pie chart strategy in our Investor Educational Retreats. Our next one is October 8-10, 2022 online. (You can attend from anywhere, in the comfort of your own office or living room.) Register now and receive a free 4-part webinar on how to get safe, which you can enact now, before the retreat. 12. Regular Rebalancing. Regular rebalancing is essential for protecting our wealth. If we are not rebalancing at least once a year, then we are at risk of riding a Wall Street rollercoaster. During the Dot Com Recession, the NASDAQ Composite Index lost 78%, and took 15 years to recover. That means that a million dollars sank to just $220,000. Everyone who was partying on their AOL gains in 1999, were in big trouble at the bottom in 2002 – except those of us who rebalanced at least once a year. During the Great Recession, the Dow Jones Industrial Average lost 55% and took about 7 1/2 years to recover. We don’t want to use bull markets to make up losses. Simple rebalancing is one of our best tools to prevent that, along with keeping the right amount safe, diversifying and knowing what is safe in a Debt World. Bottom Line It’s important to know what is safe in a debt world. This basic financial literacy allows us to be the boss of our money, rather than having blind faith that someone else is doing this for us. It’s time to employ a time-proven, 21st Century system (listed above) to protect our wealth now. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Oct. 8-10, 2022 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master. Get the best price when you register with friends and family. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our Financial Freedom Retreat. Oct. 8-10, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price and a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, FinancialLiteracy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

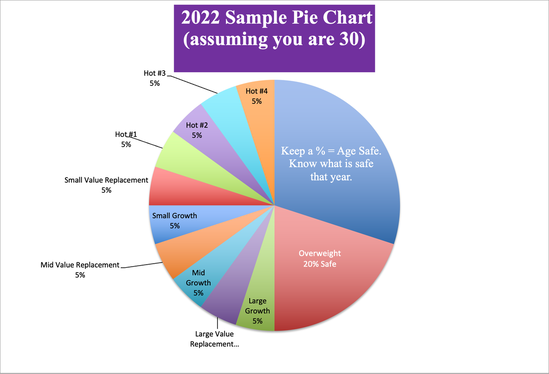

RSS Feed