|

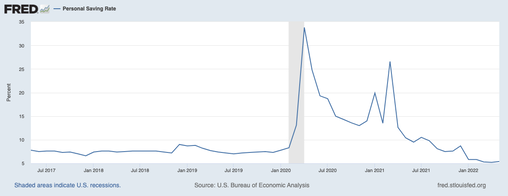

Sluggish isn’t a term we’ve associated with housing for a few years, but that was the characterization used by FreddieMac on July 21, 2022. The company wrote, “Consumer concerns about rising rates, inflation and a potential recession are manifesting in softening demand. As a result of these factors, we expect house price appreciation to moderate noticeably.” Few economists are expecting an implosion of home prices, though we are seeing sellers drop their prices in the places that were the most popular during the Pandemic. According to Redfin, the cities leading the price drops were Provo, Boise, Salt Lake City, Sacramento, Ogden, Tacoma, Denver, Portland, Indianapolis and Philadelphia. Cancellations D.R. Horton (a publicly traded American home builder) advised that the company’s cancellation rate was 24% in the 2nd quarter of 2022, up from 17% a year ago. On July 11, 2022, Redfin warned that 60,000 home-purchase agreements were torn up in June. At 14.9%, this was the highest percentage of buyers backing out of deals since 2017. Many potential home buyers are taking advantage of inspection and appraisal contingencies to run for the exits. Some are forced to walk away when they no longer qualify for a loan or can’t come up with a down payment. Mortgage Rates A jump in mortgage costs, combined with the highest home prices ever, are the culprits in the declines. On January 7, 2021, mortgage rates were at a historic low of just 2.65% for a 30-year fixed. In June of this year, rates soared above 6% for the first time since the Great Recession. The current rate is 5.54%. Rates could jump again after the FOMC meeting on July 26-27, 2022, when the Federal Reserve Board governors are expected to turn up the heat on the federal funds rate by another 75 basis points. Prices Housing affordability is a nationwide crisis. Home prices soared to a new record in June, to $416,000 for the median existing-home price. That’s up 13.4% from the same time last year. Rent is even more expensive than a home purchase. According to the press team at the National Association of Realtors, in May of this year, 25- to 40-year-olds were spending 50% of their income on rent, while homeowners of the same age were spending just 23%. Household savings are getting burned up by astronomical housing, transportation and medical costs. All of the savings from the Pandemic support are gone. Recession? Economists are mostly in agreement that higher interest rates are needed now and quickly to combat inflation, even though that is likely to spark a recession. The justification is that there will be some pain while we take the medicine necessary to fix the economy. (Of course, the pain always falls on the middle and lower classes.) Financial indicators are ringing the alarms that the U.S. will indeed hit a recession. We’ll know on July 28, 2022 at 8:30 am ET, when the 2Q 2022 GDP is announced, if it has already arrived. Will home prices stay buoyant, or will they sink in a recession? As mentioned above, prices are already softening, particularly in the pandemic hot spot regions. However, so far this is more a moderation of an unsustainable escalation of prices, rather than a panic drop. Homeowners will jettison a lot of goods and services in order to keep their home. However, when a quarter or half of our income is eaten up by the mortgage, homeowners are vulnerable – particularly if the labor market weakens. There is also a risk that some buyers may have taken on more home than they could really afford, or purchased a 2nd home with a business model that isn’t panning out. About a third of the purchases were from first-time buyers in June, while 16% of home purchases were from investors and 2nd home purchasers, according to the National Association of Realtors. There has been a lot of chatter about people buying new homes with the hope of getting rich on AirBnb short-term rentals. Joblessness and weakness in hospitality businesses are hallmarks of recessions. The Feds want to keep the labor market strong. However, we are already starting to see some layoffs. Tesla announced that they are reducing their workforce by 3.5%. Ford is letting 8000 workers go. It’s important to note that the labor shortage is concentrated in lower-paying jobs – not the kind of employment that can keep people in their new homes. Few economists are predicting a Great Recession type drop in home prices, largely because the speculation is lower and underwriting standards are higher this time around. However, the risk of home prices plunging increases if unemployment rises. Home Builders Beazer Homes reported revenue in the 2nd quarter that was 7.3% lower than last year due to a 22.3% decrease in home closings. As reported at the top of the blog, D.R. Horton saw cancellations of almost 25%, but was still able to report revenue that was 20.7% higher than last year, largely due to the price increases. With interest rates and mortgage rates predicted to keep rising, this could stifle the performance of home builders in 2022 and 2023. Many home builders have a lot of debt and a low credit rating. Some may not be fully factoring in the cancellations into their forward projections. For instance, in the 2nd quarter 2022 KB Home earnings call, chairman and CEO Jeff Mezger told analysts, “We believe the factors underlying long-term demand continue to be healthy, particularly with respect to demographics and the work-from-home trends, coupled with an ongoing under-supply of new homes and low existing home inventory.” Meanwhile, we’re starting to see insider selling at some of the publicly traded home builders. Jeff Mezger has sold almost $40 million in KB Home stock over the past year, as has Toll Brothers co-founder and chairman emeritus Robert Toll. Email [email protected] if you’d like to receive a copy of our Home Builders Stock Report card. Bottom Line High mortgage rates, high home prices, unaffordability, FUD (fear, uncertainty and doubt) and low cash reserves are limiting the number of buyers on Main Street these days. While home prices continued to soar in the first half of 2022, that is not expected to be the case going forward. Don’t purchase hoping for last year’s Return on Investment. If you’re selling, the right price could be key to closing the deal – particularly with the cancellation rates we’re seeing. Gone are the days of multiple bids above the asking price. If you’re considering a purchase, be sure to check out my housing webinar and podcast before entering the marketplace. There are few things worse than buying more home than you can afford when prices are at an all-time high. First-time (inexperienced) buyers are more vulnerable to this devastating money mistake. The equation has to include more than just trying to avoid high rent costs. (There are solutions for all of this that don’t lock you into buying a home at an all-time high price and being a slave to your mortgage for the next decade.) If you’re invested in REITs, now is a good time to be sure that you are not vulnerable to capital loss. Remember: the higher the dividend, the higher the risk. This is an industry that I’d underweight in my portfolio. (Remember that we also are overweighting an additional 10-20% safe in our sample pie charts.) We teach how to protect wealth from recessions at our Investor Educational Retreats. Email [email protected] to learn more. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Oct. 8-10, 2022 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master. Get the best price when you register with friends and family. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our Financial Freedom Retreat. Oct. 8-10, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price and a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, FinancialLiteracy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 25/7/2022 09:28:55 am

24% is nothing this figure will continue to rise. Additionally in the near future with interest rates over 6% there won't be any sales. The homes are overpriced, overfinanced, and will be a drag on the owners. The American nightmare. As the SEC requires mandatory scope one and 2 emissions from public companies. These conventional energy consuming "brown" homes will fall like a rock in appraisal value. These poor homeowners will be on the hook for the higher mortgage balance. Underwater is the term. AS these homeowners homes loose their value they will walk away from them and then get hit with a deficiency judgement.. A home is a shitty investment, overpriced, not energy efficient, more gov regulations, higher consumer debt committed to a mortgage. And soon gas consuming homes will be outdated. All electric homes will be all the rage...with their higher energy bills. Homebuilders will move towards attached dwellings to cut the cost... Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed