|

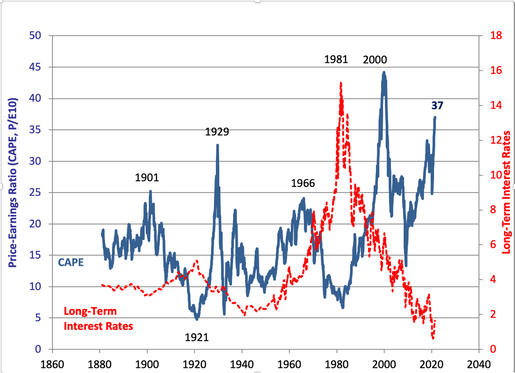

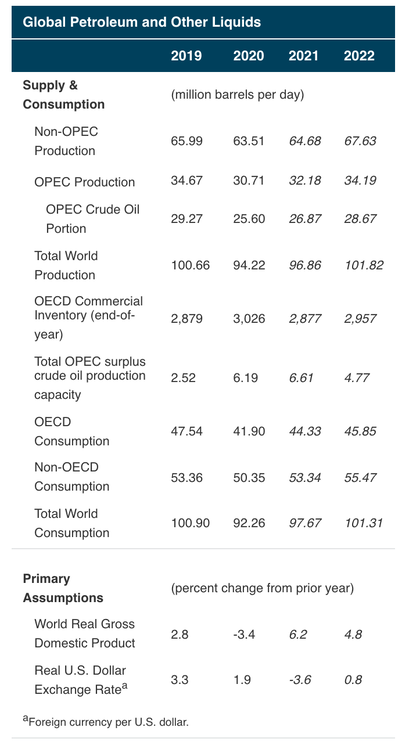

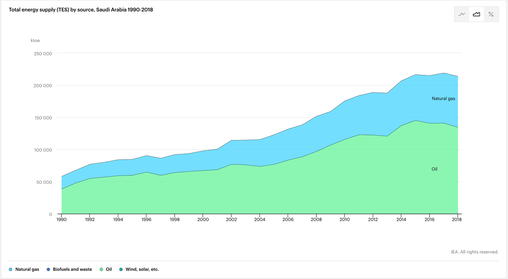

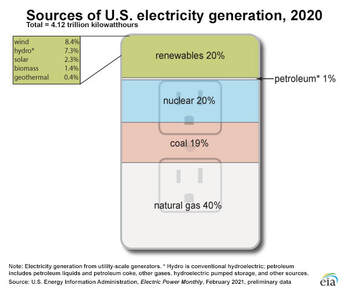

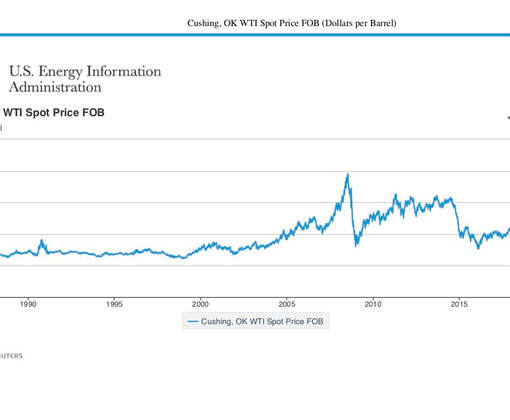

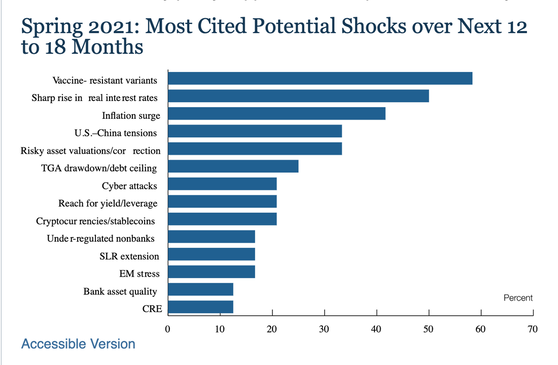

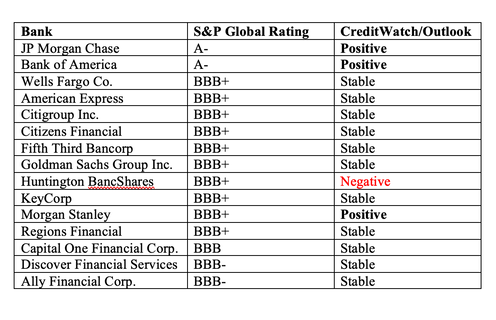

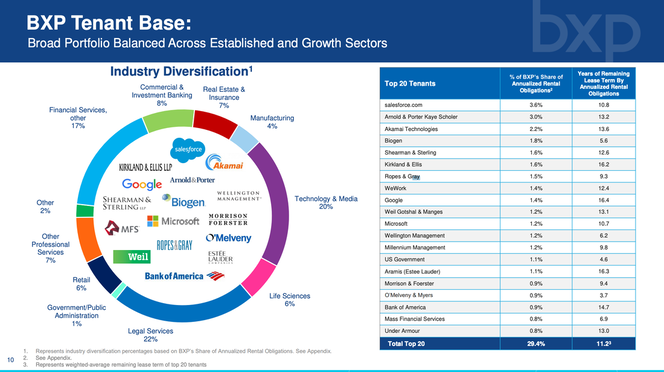

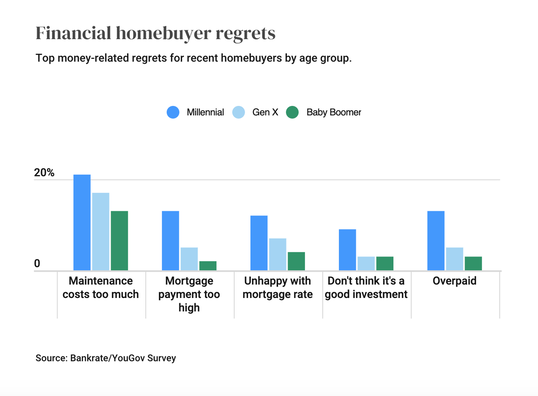

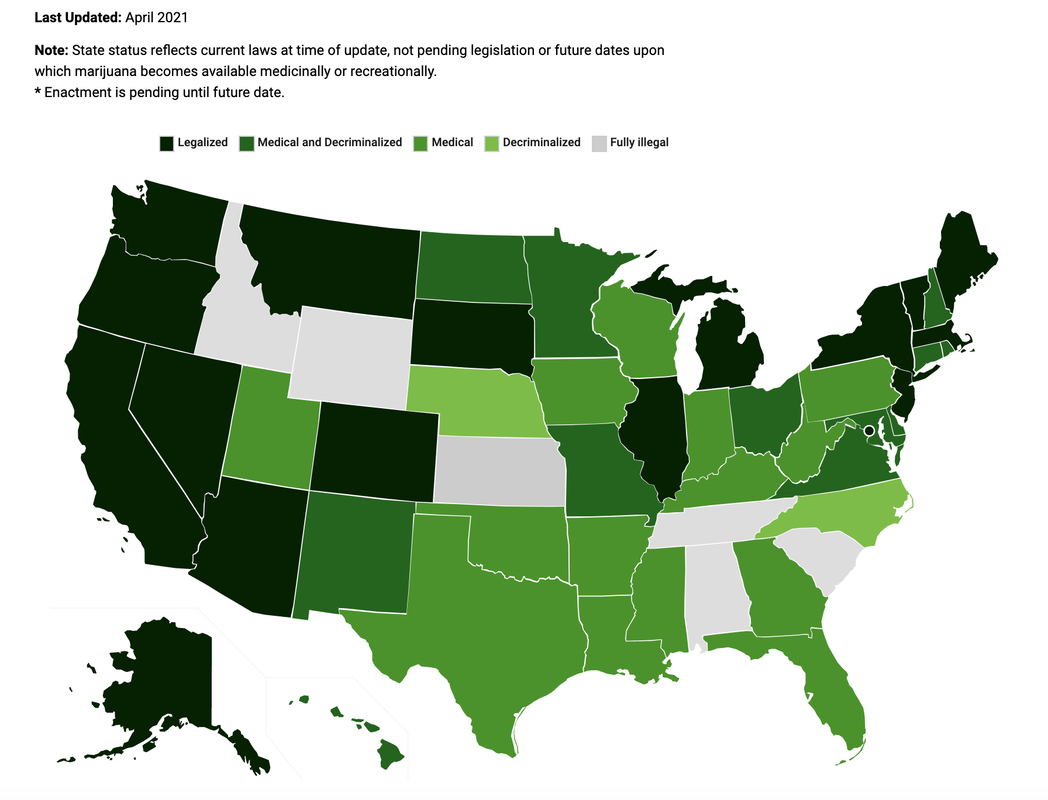

The S&P 500 hit another high today of 4302. Yesterday was a high for the NASDAQ Composite Index, with intraday trading soaring to 14,536. 2021 is predicted to be a gangbuster year for the U.S. economy, with GDP growth of up to 7.0%, according to the Federal Reserve Board. Only China’s 8.4% predicted GDP growth is higher. 7.0% growth is a level that the U.S. hasn’t seen in decades. So, does that mean that stocks will continue to hit all-time highs? There are a few hurdles along the way. However, since April 2021, when the amazing GDP predictions were first unveiled, we've removed the overweight safe from our sample pie charts. (That doesn't prevent you from overweighting safe, if you are worried about the hurdles outlined below.) Fitch Ratings Has the U.S. AAA Credit Rating on a Negative Outlook The Debt Ceiling Suspension Ends July 31, 2021 Stocks and Real Estate Are Very Expensive Not All Industries Are Created Equal We Live in a Debt World Student Loans, Rent and Mortgages Are Not Being Paid And here is a little more color on each point. Fitch Ratings Has the U.S. AAA Credit Rating on a Negative Outlook This is of concern. When the U.S. credit was downgraded to AA+ by Standard & Poor’s, on August 5, 2011, gold and silver soared to all-time highs. Stocks stumbled (but recovered). Will Fitch downgrade the U.S.? The rating agency does not have the USA listed on its 2021 sovereign ratings calendar. Yesterday, Fitch issued a press release stating that negative outlooks were not likely to be downgraded as much in 2021 as they were in 2020. So, there’s less risk of a downgrade this year, unless we have a crisis around the Debt Ceiling at the end of July, or the pandemic rages again. The Debt Ceiling Suspension Ends July 31, 2021 Treasury Secretary Janet Yellen has urged Congress to raise or suspend the Debt Ceiling immediately. Traditionally when the Debt Ceiling is not raised in a timely manner, the Treasury Secretary can use extraordinary measures to pay bills until Congress comes back from their summer break. Yellen has warned Congress that this strategy would be a disaster this year. She can’t assure them that the Treasury Department can scrape by. Funds might run out in August, if the Debt Ceiling is not raised. Under the Trump Administration’s Debt Ceiling crisis in 2017, Treasury Secretary Steven Mnuchin complained that he had to run the U.S. like a piggy bank. There is no real question as to whether or not raising the Debt Ceiling should be done. Without borrowing, the U.S. would default on paying the bills that we have promised to pay. That would result in a downgrade from Fitch, and likely Moody’s, as well. It would also mean that we would have to borrow money at a much higher interest-rate, which would toss the amazing projections of 7.0% GDP growth into the trash. At the same time, we need a plan to start reducing our debt and deficits. The current debt levels are understandable, given the pandemic, but unsustainable. (Debt was a problem before the pandemic. The 45th Administration promised to put the U.S. spending on a sustainable path, but added over a trillion a year between 2017 and 2020.) Stocks and Real Estate Are Very Expensive The recovery is already priced in. The only two times when stock prices have been higher than they are today was before the Dot Com Recession in 2000, and before the Great Depression in 1929. Real estate prices are booming. This is largely because there has been a shift toward larger homes for multi-generational housing. More expensive homes are skewing the average prices upward, even though not all homeowners are enjoying the equity gains that are revealed in the percentages. One must be very cautious and strategic about stock and real estate purchases, even though it’s very tempting to just jump in and join the party. Having a well-balanced, diversified plan for your retirement and brokerage accounts is essential. Now is the time to know exactly what you own. With regard to housing, even if you are equity-rich, it’s a good idea to review our 8-Point Real Estate Checklist. If you’re interested in cryptocurrency or cannabis, click to learn more about these industries in my blog. Not All Industries Are Created Equal As I indicated in my oil blog of this week, some industries are suffering from very high debt, very slim profit margins and negative revenue growth. The wild swings in oil prices wiped out a large number of oil and gas companies in 2020. Those that didn’t restructure their debt are still pretty beleaguered by the volatility. The commercial real estate industry, particularly retail and office buildings, are going through a structural shift that could create financial instability in our banking system. In the May 6, 2021 Financial Stability Report, the Federal Reserve Board noted that low transaction volumes may be masking declines in commercial property values. They also warned that delinquency rates on commercial mortgage-backed securities are elevated. A review of one’s portfolio should include an understanding of how exposed you are to the riskier industries. Many of these pay a high dividend (relatively speaking) in order to keep investors interested. However, if your principal is at risk of significant losses, a small dividend is hardly worth the risk. We Live in a Debt World There is so much borrowing in the corporate sector, that over half of the S&P 500 is at or near junk-bond status. In March of 2020, the Feds bought up over 1200 individual bonds and took sizable positions in many junk-bond ETFs in order to prevent a meltdown in the marketplace. There weren’t any buyers and the market had become illiquid. On June 2, 2021, the Federal Reserve Board notified everyone that they are going to begin selling their holdings. The distress in the bond industry is a reminder that, sadly, the safe side of your portfolio is carrying far greater risk than many people realize. Bonds are not safe in today’s Debt World. There a risk of illiquidity and negative yield in the bond portfolio. There is also a risk of redemption gates and liquidity fees in money market funds. Again, it is essential to know what you own now. Fix the roof while the sun is still shining. You do not want to wait until the economic storms arrive to discover that your financial house has major leaks. If it leaked in March 2020, that’s a sign that you need to do some repairs now. Student Loans, Rent and Mortgages Are Not Being Paid Almost five million renters and homeowners didn’t make their payments in March 2021 (source: MBA.org). 41.4% of student loans weren’t paid, as well. Consumer debt is at an all-time high. Unemployment rates remain elevated. Bottom Line You want to be invested the year that the US economy grows 7%. However, many people already have too much at risk in equities, with the safe side of the portfolio carrying greater risk than is prudent, as well. The higher the dividend, the higher the risk. Know what you want and why. Fix the roof while the sun is still shining. Join us for our Oct. 9-11, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn how to evaluate your funds, including dividend and value funds, what's safe in a Debt World, how to make a smart investment in real estate, pick hot funds and companies (like crypto, cannabis and our 2021 Company of the Year), and how to incorporate hard assets and safe havens into a well-diversified wealth plan. You'll discover how to protect your wealth and save thousands annually in your budget with smarter big-ticket choices. The retreat is a complete Money Makeover that will transform your life forever. Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now. Register with your friends and family to receive the lowest price.  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Families and friends registering together receive the best price. Click for testimonials & details. Other Blogs of Interest 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Everyone is a winner in our 2021 Financial Freedom Sweepstakes. (See the full list of prizes below.) The Grand Prize is a complimentary seat at an Online Financial Empowerment Retreat, valued at $895. Two Grand Prizes will be awarded. Simply email [email protected] with the subject line Financial Freedom Sweepstakes! You will automatically be entered to win, provided you email us before July 11, 2021. There is no purchase or other action required. However… 3 Ways to Have Better Odds of Winning 1. If you’d like to up your odds, then write a review of Natalie Pace’s books, The ABCs of Money and/or The ABCs of Money for College. Send us a link to your review on Amazon, and we’ll enter you five more times in the Sweepstakes for each review that you write. The Kindle versions are available for under $5.00. Do this now. The entry period closes on July 11, 2021. 2. Anyone who attends Natalie Pace’s Financial Freedom Videoconference this Thursday (July 1, 2021) will also receive 5 additional chances to win. Natalie Pace will discuss important Debt Reduction and Thrive Budget strategies on that videoconference. If you’d like to attend this videoconference live, then you must be sure that you are on a VIDEOCON list. (Send an email to [email protected] with VIDEOCON in the subject line if you are not already on the list.) 3. If you like the recording of the Videoconference, which will be posted on https://www.youtube.com/nataliepace after the event, then we will also enter 5 additional chances for you to win. Be sure to include your name in the comments so we know who to award the tickets to. Act now. Entries must be received by July 11, 2021. The drawing will be held, and winners will be notified, on or before July 21, 2021. Tell Your Friends! If you know anyone who has children, has a job, rents or owns a home or is interested in investing, why not notify them of this sweepstakes? Who doesn’t want to protect their wealth, get a better degree for half of the cost, adopt a Thrive Budget, save thousands annually with smarter big ticket choices and earn money while you sleep? List of Prizes Admission to an Online Retreat (value up to $895) ½ off Retreat Seat (value $450) 2nd opinion on your current budgeting and investing plan (value up to $1795) 6-pack of coaching (value up to $1495) 50-minute private prosperity coaching session (value $300). Everyone is a Winner Every person who enters the sweepstakes will receive a complimentary 21-day prosperity video coaching series. This series is updated annually. Thank You! Your presence in our community, with a dedication to financial literacy and sustainability, means the world to us. We work hard to keep you informed and empowered, and you help us to spread the word of this important information. Thank you so much for your reviews and your presence at our retreats, videoconferences and on social media! We need your help in spreading the word about how important it is to learn the ABCs of Money that we all should have received in high school. The Retreat Sweepstakes entry period expires July 11, 2021. Anyone who has emailed us on or before July 11, 2021will be entered in the drawing. Winners will be chosen and notified on or before July 21, 2021. There is no cash value for the prizes. 2021 Sweepstakes prizes are good through Dec. 31, 2022 only. You must use your prize within 12 months. Testimonials "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. "We asked Natalie Pace for a second opinion on our investment portfolio. She researched and reviewed each stock and fund. She then explained to us in plain English how we were positioned in the market and how high our risk exposure was. Her knowledge was so profound that we decided to take her retreat in Arizona. My husband was still quite skeptical, but 20 minutes into the retreat he turned to me and said "Thank you." Stocks and investing are no longer rocket science. We give thanks just about every day that we met Natalie. I feel like I live on a different planet. I'm so grateful. Thank you for changing our lives, our peace of mind, our future and our vision of what is possible. We made a tectonic shift with you." AC & AM "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM "Thank you Natalie for saving my retirement," Nilo Bolden.  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price when you register by June 30, 2021. Click for testimonials & details. Other Blogs of Interest Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. A recent survey by Citrix revealed that 90% of Gen Z and Millennials do not want to return to the office full-time. While some are okay with flex work, over half prefer to work at home full-time. Add in the popularity of electric vehicles, and you might think that the oil industry is doomed. Fortunately for the industry, and sadly for anyone who is concerned about the environment, oil and gas consumption is expected to reach pre-pandemic levels in the fourth quarter of 2021 (source: EIA.org). Before you race to your brokerage account to purchase some oil and gas stock, there is a lot more to the story to consider. With so many people working from home or switching to hybrids and electric vehicles, how in the world is consumption expected to be even higher in 2022 than it was in 2019? The answer is population growth, particularly in developing countries like China and India. Saudi Arabia actually burns oil for its electrical needs. Oil, followed by natural gas, make up most of the power generation in the country. About 40% of the US power generation is natural gas. 60% of U.S. power is sourced from fossil fuels (natural gas & coal). Less than 1% of the power generation in the U.S. is sourced from petroleum. Strong Demand Does Not Equal Strong Profits The oil industry has been plagued with wild swings in prices, low or negative profit margins and catastrophes for most of the 21st century. Massive Losses & Debt The industry was already on the ropes before the pandemic – so much so that by mid-2000, there was a wave of bankruptcies. Chesapeake Energy, Extraction Oil and Gas, Whiting Petroleum, Noble Corporation, Diamond Offshore and Valaris are but a few of the bankruptcies in the industry. Occidental teetered very close to the tip, as did Transocean. Neither company is out of the woods on having to restructure their debt. Both are junk bonds. All oil and gas companies lost a massive amount of money in 2020. BP lost over $20 billion. Exxon Mobil lost over $22 billion. Occidental lost over $15 billion. Meanwhile, Occidental’s market value is only $31 billion. A number of companies in this industry received a downgrade from S&P Global recently. Exxon Mobil and Chevron were downgraded to AA- this year. Exxon Mobil was removed from the Dow Jones Industrial Average on August 31, 2021. In a research report on May 25, 2021, S&P Global described the issues facing the oil and gas industry, writing that “energy transition, price volatility, and weaker profitability are increasing risks for the oil and gas producers.” The Secretary General of OPEC admits as much, noting in a press release on May 31, 2021, “There are many moving parts when it comes to factors affecting the global oil market, such as the pace of change during the COVID-19 pandemic.” Price Stability? The EIA is projecting that oil prices will remain near current levels, averaging about $68 a barrel through the end of 2021. In 2022, they are projecting that Brent will average $60 a barrel. It is unclear whether these projections are factoring in a meaningful shift towards electric vehicles and working from home. Many business and government leaders are trying to push everyone to return to a pre-pandemic lifestyle, while consumers and workers are recalcitrant to get sucked back into the office and long commutes. Additionally, as the pandemic schooled all of us in 2020, Acts of God can change the game entirely overnight. No one predicted that oil would drop into negative territory, as it did in April 2020. Clean Skies, Healthy Air and Climate Change In 2020 when the world stopped driving and flying, the skies were bluer than they had been in my lifetime. There was a 7% in global carbon emissions. If the projections are right, however, the gains will all be reversed in a few short months. The oil industry is trying to promote a circular carbon economy as its solution for climate change. The rest of the world is leaning into renewable clean energy rather than fossil fuels. Even in more “normal” years, fossil fuels have all kinds of costs and damage associated with the industry. There are oil spills, many of which never make the headlines. Combustion engines pollute our air. Respiratory illnesses plague our population in far greater percentages than ever before. And that is not even taking into consideration the climate change that has occurred from putting too much carbon into our atmosphere. Last Century Products I’m sure all of us are very happy that we don’t have to ride our horse to go on a vacation or to get to work. A century ago, even though electric vehicles were better back then, too, the choice was made to manufacture gas guzzlers. Today, electric vehicles are the future. General Motors has promised to take its fleet 100% electric for a future of “zero crashes, zero emissions and zero congestion.” Tesla Motors has been the leader for over a decade, but has many all-electric Chinese challengers, such as Nio. Put Your Money Where Your Heart Is. Invest in the World of Tomorrow. Successful investing is about gazing into the future and imagining, investing and creating the products and services to get us there. None of us are that interested in investing in typewriters these days. There will come a time when oil goes the way of the typewriter. It doesn’t look like it’s going to happen in 2021 or 2022, unless an unexpected catastrophe occurs. However, the very high debt levels, combined with very slim profit margins, are indicative of an industry that is over-leveraged and on the ropes. No one wants more pollution, climate change and dirty energy (outside of the oil industry and its lobbyists). The Higher the Dividend, the Higher the Risk The companies paying the highest dividends are also those with the greatest losses, the slowest revenue growth and the most debt. This is important to realize not only for your individual holdings but also for your dividend or value funds. If your principal is at risk of capital loss, 4-5% annual yield is not adequate compensation to take on the risk. So be aware that dividend-paying companies today are not the darlings they were a couple of decades ago. Bottom Line With stock prices in most of the oil and gas companies trading near their 52-week highs, now is a great time to evaluate whether this industry is right for you. Make sure your portfolio analysis also includes a look at your dividend and value funds. Join us for our Oct. 9-11, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn how to evaluate your funds, including dividend and value funds, what's safe in a Debt World, how to make a smart investment in real estate, pick hot funds and companies (like crypto, cannabis and our 2021 Company of the Year), and how to incorporate hard assets and safe havens into a well-diversified wealth plan. You'll discover how to protect your wealth and save thousands annually in your budget with smarter big-ticket choices. The retreat is a complete Money Makeover that will transform your life forever. Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now. Register by June 30, 2021 to receive the lowest price.  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price when you register by June 30, 2021. Click for testimonials & details. Other Blogs of Interest Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Bank Stress Tests. Fed Bond Sales. Debt Ceiling. Credit Downgrade? All Happening This Summer. The Federal Reserve Board will release the results from their bank stress tests this Thursday, June 24, 2021. This is expected to be a routine release. Since the last test showed strength in the banks and the stock market has been on a roar, there is unlikely to be any surprises. On June 30, 2021, banks may start repurchasing their own stock again – something that has fueled market gains for the past decade. That’s a tailwind for stocks, as is the great news that the U.S. economy is predicted to grow 7.0% in 2021 – the highest GDP growth in decades. The only country scoring higher is China (at 8.4%). Economic Storm Clouds The skies are blue for the economy this summer, with a few economic storm clouds on the horizon. Debt, asset valuations, structural shifts in a few industries, the Debt Ceiling, inflation and other bugaboos threaten to scuttle the smooth sailing into YOLO Shoot the Moon Eden. Below are a few economic storm clouds to watch out for, and a few reasons why you always want to be properly protected and diversified. (Call our office at 310-430-2397 or email [email protected], if you’d like an unbiased 2nd opinion whether your plan is properly diversified and protected.) Insurance Companies & Hedge Funds are “Highly Leveraged” Banks Are at the Lowest Rungs of Investment Grade Asset Prices are “Elevated” Feds Selling Bonds Margin Trading Debt Ceiling Insurance Companies & Hedge Funds are “Highly Leveraged” It is the nonregulated financial services industries, particularly insurance companies and hedge funds, that are of the greatest concern to financial stability. According to the Federal Reserve Board’s Financial Stability Report, which was released on May 6, 2021, “The leverage of some NBFIs [nonbank financial institutions], such as life insurance companies and some hedge funds, is high, exposing them to sharp drops in asset prices and funding risks.” Money market funds, bond and bank loan mutual funds are also at risk of “funding strains and sudden redemptions.” Life insurance companies tend to invest in corporate bonds, Collateralized Loan Obligations and commercial real estate. CRE is experiencing a structural shift (empty office buildings), and corporations are highly leveraged. (Over half of the S&P500 is at or near speculative status, at the lowest rung of investment grade.) Hedge funds are pretty opaque with regards to regulatory oversight. Meltdowns, such as happened with Archegos Capital Management in March of 2021, rarely come with any warning and can drag down stocks. Banks Are at the Lowest Rungs of Investment Grade Perhaps a better peak into the health of the banks is to look at their credit scores. Surprisingly, even though they are passing stress tests, many are at the lowest rung of investment grade. Revenue is down, risk is up and valuations are pretty pricey in the banking industry. Many banks have risk exposure to empty office buildings, vacant fashion malls and consumer debt. Companies and consumers borrowed to get through the pandemic, pushing debt levels to astronomical status. With the wind-down of the eviction and foreclosure moratoria, and with less unemployment benefits and easy money showing up in consumers’ checking accounts, stress could start showing up in housing, commercial real estate and credit card debt. In March of 2021, almost 5 million Americans didn’t make a housing payment, and over 26 million people skipped their student loan payment. Consumer debt keeps hitting new highs each month (source MBA.org). According to the Financial Stability Report, “Shares of commercial and industrial (C&I), CRE, and residential mortgage loans in loss mitigation have remained elevated.” Office buildings are still empty, even with the Return to Normal protocol happening across the U.S., and some (mostly banking) CEOs demanding their employees return to the office. Since bankers and REIT owners are smart enough not to flood the marketplace with empty buildings for sale, low transaction volumes are masking declines in property values, except in isolated incidents. (Read my article on the Times Square building that plunged 80% in value.) The Feds acknowledged this in their report. When the funding runs out and the business has to restructure, the value plunges overnight. Asset Prices are “Elevated” The markets have already priced in an amazing recovery year for 2021. According to the Federal Reserve’s Financial Stability Report, “Valuations are generally high.” As the report warns, “Asset prices may be vulnerable to significant declines should investor risk appetite fall, progress on containing the virus disappoint, or the recovery stall.” Between February 19, 2020 and March 23, 2021, the Dow Jones Industrial Average plunged 35% -- before most investors knew we were in a pandemic. Wall Street zips faster than Main Street and retail investors can respond, particularly when there is this much leverage in the system. Feds Selling Bonds One of the biggest problems during the dramatic drop and economic crisis of March 2020 was that bonds froze up. (So did money market funds, and even Treasury bills.) Bonds became illiquid. The Feds initiated a bond purchase program where they scooped up more than 1,200 distressed individual bonds and numerous junk bond ETFs. As of June 2, 2021, the Feds will now begin selling the bonds they purchased. The market is perceived to be functioning well enough for this to occur without any hiccups. It’s also a red flag for retail investors that you need to know what you own on the safe side of your nest egg. Illiquid, negative-yielding assets are not as safe as you believe. Margin Trading Retail investors are more leveraged today than ever (source: FINRA). When stocks are in the money, this is less of a problem than when things head south. The amount of leverage in margin trading provides fuel for a rapid, robust reverse of direction, if any bad news should make investors more risk-averse. Those trading on margin will be the most vulnerable. However, all investors could be impacted. Debt Ceiling The current U.S. Treasury borrowing authority ends on July 31, 2021. Congress will have to raise the Debt Ceiling (again) before that time to prevent a government shutdown. The fact that Fitch Ratings currently has the U.S. AAA credit rating on a negative outlook is yet another threat to smooth sailing to the land of endless market gains. This will become more problematic if the Debt Ceiling is not raised in a timely manner. Bottom Line 2021 should be an extraordinary recovery year for the U.S. However, it could also be rife with hurricanes. Have fun. But, also make sure that your financial home is secure enough to withstand any economic storms that might hit. Join us for our Oct. 9-11, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn what's safe in a Debt World, how to make a smart investment in real estate, pick hot funds and companies (like crypto, cannabis and our 2021 Company of the Year), and how to incorporate hard assets and safe havens into a well-diversified wealth plan. You'll discover how to protect your wealth and save thousands annually in your budget with smarter big-ticket choices. The retreat is a complete Money Makeover that will transform your life forever. Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now. Register by June 30, 2021 to receive the lowest price.  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price when you register by June 30, 2021. Click for testimonials & details. Other Blogs of Interest Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. California Reopens. For Tourists. Office Buildings are Still Ghost Towns. Open for Tourists On June 15, 2021, California reopened. I’m saying “for tourists” because although offices were open for business, too, nobody showed up (continue reading for details). California Governor Gavin Newsom made the announcement at Universal Studios in Hollywood, CA, surrounded by minions and a troll. I visited Fisherman’s Wharf in San Francisco on June 14, 2021. Happy travelers were everywhere, laughing at sea lions and posing for pictures. The restaurants, like Fog Harbor Fish Company, had a wait list. If you’re headed to Disneyland and you are vaccinated, you don’t even need to wear a mask. Offices are Still Ghost Towns Since I was in San Francisco, I headed over to the Salesforce Tower to see who would show up for work at the office, and how long the lines to get into the building would be. When you have these towers that reach 1000 feet or more into the sky, combined with social distancing protocol, the elevator commute time alone can be prohibitive. Less than a handful of people entered the Salesforce building at 8 a.m., flashing their health approvals on their mobile phones. The gondola leading up to the public park was empty, but still running. (Fortunately, someone turned it off by the time I came back about an hour later.) Almost all of the local restaurants that support the office workers were closed. The sole food option was an Acai Bowl food truck. There was nobody in line. I walked over to Embarcadero for breakfast. There things were moving. Dozens of Millennial joggers, with their cell phones secured to an arm band or designer activewear, loped along the shore. At 8:45, the ferry let off a boatload of passengers, most of which appeared to be essential workers. I decided to see if the 9 a.m. start time might yield more staff to enter buildings. At 8:55 am, I followed the only professional on the street, a prematurely balding banker-type, who carried his lunch in a brown bag in one hand and a cold brew in the other. He hustled to make it to the Google building by 8:58. I waited for a few minutes to see who else might show up. Another 9 people entered One Market Plaza. Back at Salesforce, a dozen young tech workers entered the building between 9:15 and 9:25. In the public park on the roof of the Salesforce Transit Center (70 feet in the sky), three small groups of professionals were having Walk and Talk meetings (by small I mean 2-3 people in each group). It was easy to distinguish these groups from the smattering of mothers, fathers and grandparents pushing toddlers to the Toddler Tuesday song and dance event scheduled for 10 am. On Monday, June 7, 2021, Salesforce CEO Marc Benioff announced on CNBC that more than half of his staff (50-60%) will work from home – up from about 20% before the pandemic. According to Benioff, “The past is gone. We’ve created a whole new world, a new digital future.” In a study by Citrix, 90% of Millennial and Gen Z workers do not want to return to the office full-time, and over half wish to work from home full-time. In the press release, Citrix concludes, “As the data makes clear, today’s business leaders are clearly disconnected from what the Born Digital [Millennials and Gen Z] really want from work.” Work-from-Home clearly creates challenges for the commercial real estate industry, which has more than recovered in share price from the pandemic, but still faces serious fiscal challenges and heightened vacancies in their buildings (even when the space is still under lease). While corporate C-levels are upbeat on their earnings calls, focusing on the long-term lease commitments and their market-leading capabilities, many are quietly selling stock. Recent C-Suite, board and institutional insider stock sales include Cushman & Wakefield, CBRE, Boston Properties, Colliers and Hudson Pacific. Most of these companies, with the exception of Hudson Pacific, have share prices that are trading at all-time highs (above pre-pandemic levels). In this industry, the share prices are high, price-to-earnings ratios are outlandish, revenue is down, debt is heightened, the business model is suffering a structural blow, and credit ratings are at the lowest rung of investment grade (BBB). Cushman & Wakefield was downgraded to B+ (junk) by S&P Global on March 23, 2021. What Will Happen to All of The Empty Office Buildings? While CRE CEOs are reporting to shareholders that their mostly empty office buildings have tenants that are “waiting to see” what the future holds, many CEOs, like Benioff, Jack Dorsey (Square and Twitter) and Mark Zuckerberg (Facebook), are clear that Work-from-Home has become a permanent part of life. A bank C-level located in New York City anonymously reported that his company negotiated to reduce the office space to a third of what it was pre-pandemic, adopting a new Work-From-Home and desk-share model. Meanwhile Doug Linde, the president of Boston Properties reported in the 1Q 2021 shareholder earnings call that “the office tenants are deep into planning for their return to the physical in-person work environment as we approach the back half of 2021.” Companies looking to get rid of office space are driving rents down. Sublease availability increased 61.7% year-over-year in New York City during Q1 of 2021, higher than it has been in 3 decades, according to a Savills report released on March 31, 2021. Some building owners have plunged their properties into remodeling. Others are focusing on biotechnology and health care (which now has an emerging Teledoc option). Not every empty mall or building can become a data center or Amazon warehouse. Boston Properties president Doug Linde admits that there is a lot of subleasing activity, saying, “There is a lot of sublet space on the market, but a large portion of it is not accessible because of short term, unworkable existing conditions or, quite frankly, the user discomfort with the lessors’ profile.” Salesforce is Boston Properties’ #1 client, with WeWork as its #8 client. Companies entered into decades-long lease agreements before the pandemic changed the way we all do business. This was the fundamental problem that squashed the WeWork IPO in August of 2019. Sophisticated investors thought that The We Co.’s business model of taking on long-term leases, with only short-term commitments from entrepreneurs and startups, was going to be a problem in the late stage of the business cycle. Those long-term leases provide some support for the CREs in the short-term. Interest rates are low. Stocks are high. Terms are relatively easy. Only a portion of their leases will come up for renewal in 2021 or 2022. Extricating from a long-term lease is a strategic maneuver for any company looking to downsize their office space. However, if Activision Blizzard is any example, the companies are in trouble once the leases do come up. Activision abandoned their Boston Properties campus in Santa Monica on March 26, 2021. What Could Possibly Go Wrong for the Building Owners? Tenant bankruptcies, high levels of sub-leasing and interest rates are the biggest risks to CREs in the near and mid-term. (Over the long-term, office buildings will have to revise their business model for a post-pandemic world, if they manage to survive on reduced rent revenue without declaring bankruptcy.) Low interest rates, mortgage-backed securities purchases by the Feds and the Secondary Market Corporate Credit Facility kept these debt-laden commercial real estate companies off of the ropes during the pandemic. (All of the companies I examined were rated in the BBBs or lower.) When interest rates rise, it will make borrowing more expensive and difficult – which is one of the primary reasons that Jerome Powell assured everyone today that interest rates could remain low until 2023 (inflation and pandemic permitting). The Feds announced on June 2, 2021 that they will begin selling off their SMFFC holdings. According to the press release, “SMCCF portfolio sales will be gradual and orderly, and will aim to minimize the potential for any adverse impact on market functioning by taking into account daily liquidity and trading conditions for exchange traded funds and corporate bonds.” Vornado and Boston Properties’ bonds are part of the portfolio that will be sold. The Higher the Dividend, the Higher the Risk REITs are a risky move in a post-pandemic world. Most companies are heavily indebted, are trading at unsustainably high multiples and have slow or negative revenue growth. They pay high dividends and commissions to keep investors and brokers interested, respectively. Many are unaware of the risks they are taking on, particularly since the structural shift to Work-from-Home is being under-reported. Those companies that have a competitive advantage (such as outdoor space for relaxed social meetings and LEED status) and fiscal husbandry should fare better than companies with older energy-hog buildings with higher debt. Figuring out what to do with the empty buildings and how to negotiate with their tenant customers will take a few years to sort out. Are the CRE CEOs clueless or simply reassuring investors until they have good news about an innovative transition plan to report? Bottom Line If you are working from home, enjoy only having to dress waist up for your work week! If you are investing in REITs, it’s best to factor in the impact that the Work-from-Home trend is having on office buildings. If you’ve been hearing that Zoom and Teladoc meeting software are going to be irrelevant as people head back to work, that’s not what is what is showing up in the data or what I’m seeing in my boots-on-the-ground research. Join us for our Oct. 9-11, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn what's safe in a Debt World, how to make a smart investment in real estate, pick hot funds and companies (like crypto, cannabis and our 2021 Company of the Year), and how to incorporate hard assets and safe havens into a well-diversified wealth plan. You'll discover how to protect your wealth and save thousands annually in your budget with smarter big-ticket choices. The retreat is a complete Money Makeover that will transform your life forever. Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now. Register by June 13, 2021 (Sunday) to receive the lowest price and a complimentary, private, prosperity coaching session (value $300).  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price when you register by June 30, 2021. Click for testimonials & details. Other Blogs of Interest Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. *Updated July 10, 2024. Dear Natalie, I had a session with you, and you said to make sure my cash accounts were FDIC-insured. I found out that several of my accounts are covered by SPIC (or is it PIDC?), which my broker said was better because it will cover up to $500,000 in cash and covers stock and bond losses up to $250,000. Seems like a better deal than FDIC. Would you agree? Signed, The Acronyms Are Confusing Dear Acronym Sleuth, We’d all love to put our accounts with a brokerage that covers stock losses! However, sadly, that’s a pretty big misrepresentation of what SIPC insurance covers. That is why it is so important to read the fine print, and not just trust what the broker-salesman tells you. Have you ever heard the joke, “What do you call the person who got Cs in medical school?” (Doctor.) Below is a general breakdown of the protections offered by the various acronyms. Consult the fine print of your personal bank or brokerage agreement to know exactly what your brokerage does and does not offer. FDIC-Insured. The Federal Deposit Insurance Corporation is an independent federal agency that insures cash held in FDIC-insured banks. Many FDIC-insured brokerages and banks now offer a bank sweep program where you can actually be insured above the $250,000 maximum individual coverage. For instance, my brokerage offers FDIC coverage up to $500,000 for individuals and $1,000,000 for joint accounts. Federally-insured cash is considered to be the safest way to hold cash. In 2021, you’re not getting paid to save, but at least it is insured up to the limits. Remember that FDIC doesn't cover failed brokerages, only if the bank fails. SIPC-Insured. The Securities Investor Protection Corporation is a nonprofit corporation that helps investors when their brokerage fails. The SIPC is backed by assets of about $5.0 billion, with an additional $2.5 billion line of credit with the U.S. Treasury. (Sadly, yes, that’s billion with a b, not trillions with a t.) The fund ensures against brokerage default (not stock losses). So, if you have the misfortune of investing with Bernie Madoff (fraud) or MF Global (bankruptcy), then the SIPC is the firm that will try to recover as many of the securities as possible to distribute to the victim investors. FYI: Most of Madoff’s clients were invested for years, thinking they were earning 12% annualized and compounding. So, even though the SIPC trustee boasts of returning almost 71% of the "allowed claim credit" (money stolen ) in the Madoff Ponzi scheme (after 12 years), it is a much smaller amount than most investors believed they were owed. One more important clarification: the SIPC cash coverage is limited to $250,000 (not $500,000). Money Market Funds. Money market funds are not guaranteed by the government or by any bank. It is possible to lose money in a money market fund. There can be hidden charges and expenses. Under certain circumstances, the money market fund can impose liquidity fees (in other words, charge you to access your money. If the fund really gets into trouble and has to liquidate, redemptions will be suspended. Some funds came close to the thresholds when liquidity fees and redemption gates might have been imposed in March of 2020, which exacerbated the dash for cash. Additionally, when calculating your yield, be sure to subtract the fees. Is There Any Risk in a Money Market Fund? In 2023, the Treasury Department, Securities and Exchange Commission and the Financial Stability Oversight Council reformed the rules on Money Market Funds (again). In the early days of the 2020 pandemic, MMFs were stressed from rapid redemptions. Treasuries and bonds were also illiquid. On March 23, 2020, the Federal Reserve Board rescued MMFs, Treasuries, Mortgage-Backed Securities, bonds and select bond funds. A Money Market Fund Liquidity Facility with $10 billion of credit protection was established. The markets have stabilized today, however, the Feds want investors to understand that “MMF investors, rather than taxpayers, bear market risks.” They also want to incentivize and enable the fund companies to handle stress without relying upon government support. According to the Report from the President’s Working Group issued in December of 2020, the government “has repeatedly provided emergency liquidity to prime and tax-exempt funds and also has obscured the risks of liquidity and credit shocks for MMFs.” In July of 2024, MMFs were offering a competitive yield of a little over 5%. In your retirement fund, you don’t have an option to invest in FDIC-insured cash. So, many people with a 401K are locked into money market funds, with the hope that at least MMFs won’t be as volatile as bonds or stocks. There may be a short-term Treasury Bill fund that might offer a similar yield with slightly lower risks. If you are over 59 ½, or if you have left 401Ks at previous employers, you should be able to roll-over your 401Ks into self-directed IRAs at a brokerage that does offer FDIC-insurance and perhaps even bank Certificates of Deposit for the cash portion of your portfolio. Money Under Your Mattress. There’s an old joke in my family that someone buried their cash during the Great Depression, and the chickens dug it up and ate it! Keeping cash on hand is very risky. Wolves, thieves and chickens abound. Bottom Line So, what is safe in a world where bonds and money market funds are losing money, and you have to be careful about the acronym you choose for your cash account? In today’s world of very high-leverage (a lot of debt), getting a decent yield without losing principal is tricky, but doable. FDIC-insured cash is just the first step in a two or three-step process to make sure that you protect your assets and are positioned to earn an income on your wealth in the years to come. Protecting your assets is so important today that I spend one full day on this topic at my Investor Educational Retreats. Call 310-430-2397 or email [email protected] to learn more now. You can read testimonials, and learn the 15+ life math tools that you’ll learn and master, on the retreat flyers on the home page at NataliePace.com. Don't be caught unaware. Don't be complacent. Don't rely upon others to do it for you. It's time to know what you own and be the boss of your money. Join us for our Oct. 18-20 2024 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn what's safe in a Debt World, how to make a smart investment in real estate, pick hot funds and companies (like crypto, cannabis and our 2021 Company of the Year), and how to incorporate hard assets and safe havens into a well-diversified wealth plan. You'll discover how to protect your wealth and save thousands annually in your budget with smarter big-ticket choices. The retreat is a complete Money Makeover that will transform your life forever. Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now. Register by June 13, 2021 (Sunday) to receive the lowest price and a complimentary, private, prosperity coaching session (value $300).  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price and a complimentary private prosperity coaching session (value $300) when you register by Sunday, June 13, 2021. Other Blogs of Interest My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. My 24-year-old son is itching to purchase a condo. He believes that he can purchase for about the same price that he is paying rent. Should I help him make the down payment? Signed, Rich Dad Dear Rich Dad, A recent survey conducted by BankRate shows that 2/3rds of Millennials are having a severe case of buyer’s remorse. After the fact, they are discovering that everything costs a lot more than they were originally told, including the mortgage and the upkeep of owning your own home. (Did your son factor in the HOA fees?) They also worry that they overpaid, and they don’t believe they made a good investment. When a real estate broker-salesman tells your son that he can buy a condo for the same price that he’s renting, there is a lot of the story missing:

Buy What You Can Afford When you think about buying a home, there is a lot more to consider than just the cost of rent. Are you limiting your purchase, including all of the expenses of homeownership, to under 28% of your budget? This is the most important, but not the only, consideration. The Thrive Budget When you limit your basic needs expenditures, including taxes, to 50% of your gross income, then you have 50% to thrive. Struggling to survive is a nightmare, and could put you in financial danger if you are property rich and cash poor. Click to personalize your own Thrive Budget. Some Other Important Considerations