|

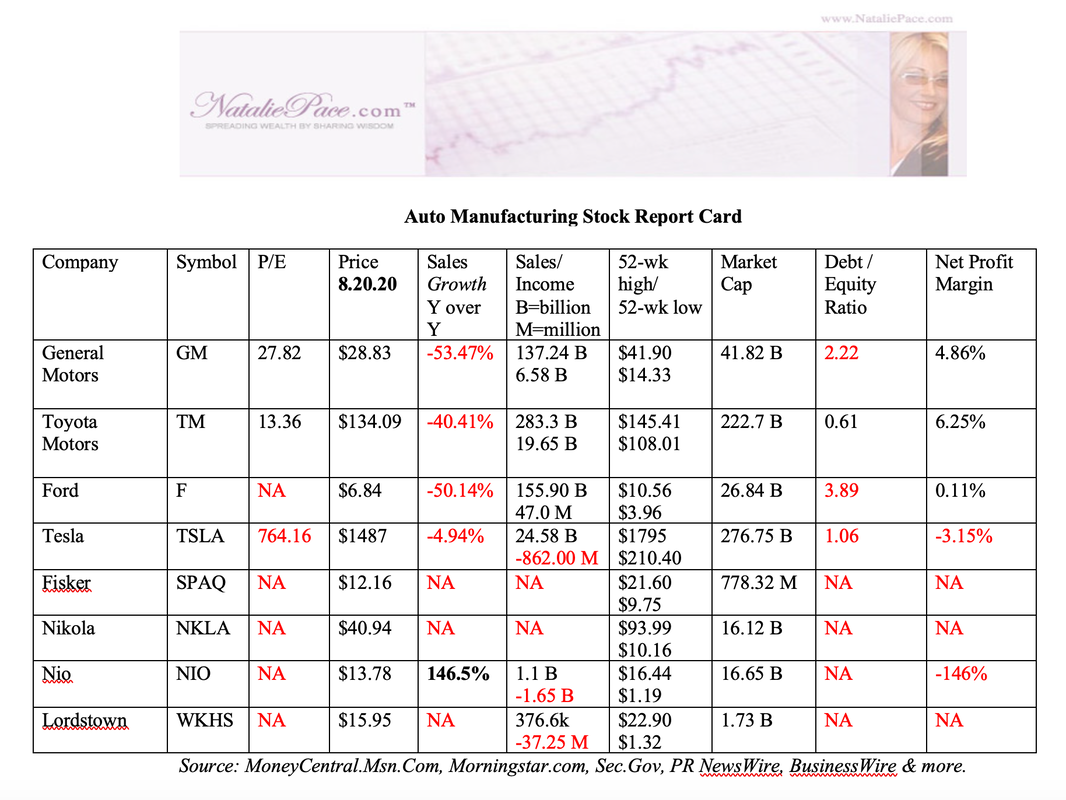

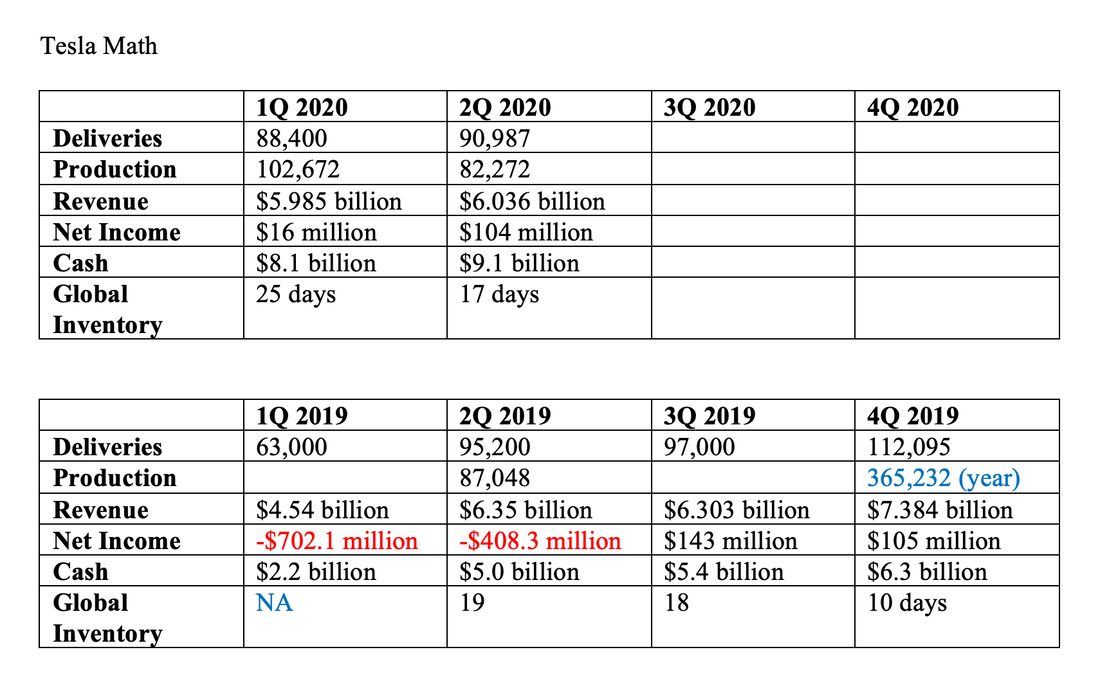

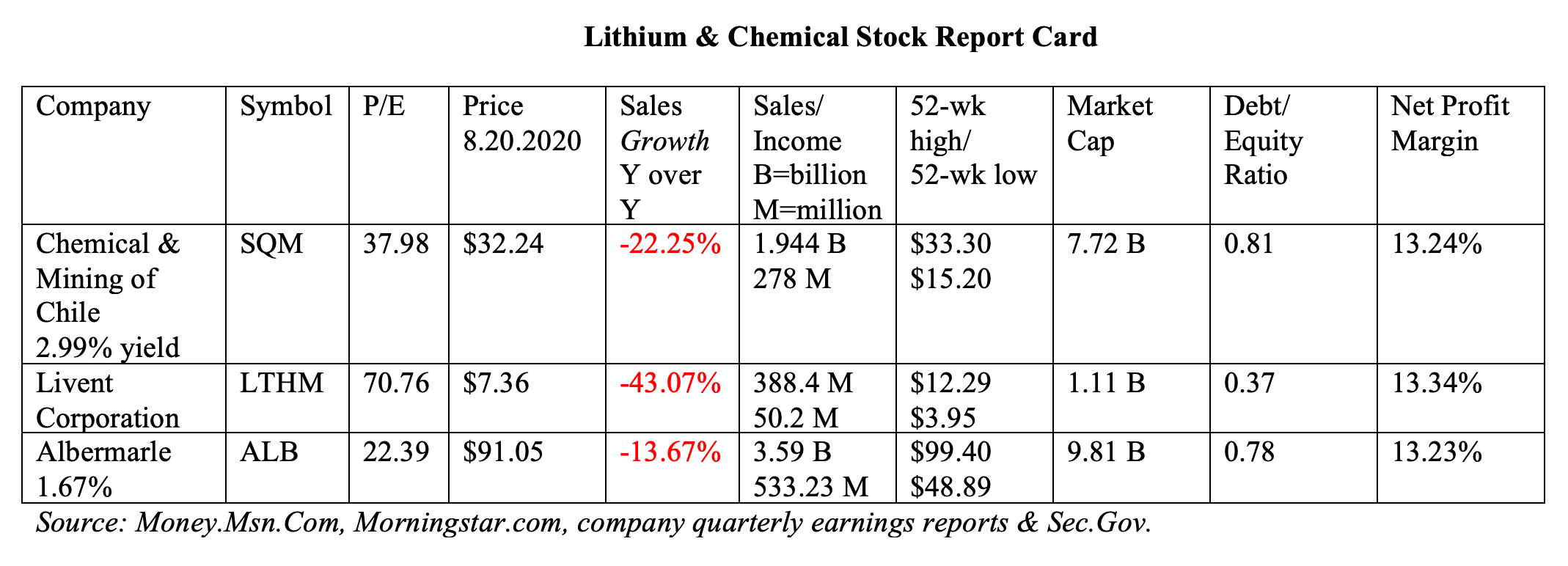

Tesla surprised investors with its resilience in the 2nd quarter of 2020, delivering 90,987 vehicles in the quarter, down just 4,213 from the same quarter last year. Tesla’s revenue was down only 5% year over year. Considering this is one of the most unprecedented recessions we’ve seen in history, the demand and delivery are both impressive. When you compare Tesla to Ford and General Motors, which saw revenue sink by half or more, the 2Q 2020 performance of Musk’s clean energy company seems almost too good to be true. Even Toyota Motors saw revenue slide by 40% year over year in the 2nd quarter of 2020. Meanwhile, China’s Nio, a Tesla electric vehicle competitor, reported an increase of 145% in revenue, from USD$218 million to USD$526.4 million. Nio delivered 10,331 vehicles in the 2nd quarter of 2020, compared to 3,553 in 2Q 2019 and 3,838 in 1Q 2020. Nio’s net loss in 2Q 2020 was -$166.5 million, with $1.6 billion cash on hand. Clearly China’s new EV manufacturer, which prices its vehicles aggressively lower than Tesla, is gaining in popularity. Tesla is still the EV leader in China, with 11,041 Model 3’s sold in July of 2020. However, Nio’s challenge is something that Tesla is surely taking notice of. A Spate of SPACs Nio is proving to be quite different from the spate of EV companies that have entered the stock market through a Special Purpose Acquisition Company (SPAC). Fisker, Lordstown and Nikola are seeing their share prices soar, largely through investor FOMO (Fear of Missing Out) rather than car sales. Fisker went bankrupt in 2013 after failing to make a dent in Tesla’s market. Apollo is betting that the company can perform better this time around, though launching the IPO SPAC in the middle of a recession isn’t the best strategy for success. Lordstown, a GM-backed EV truck, won’t have its first full year of sales until 2022. Nikola’s market value is $16 billion, despite having no sales or revenue to date. 3Q 2020 Earnings So, how will the 3rd quarter of 2020 look for auto manufacturers? For the legacy brands like Toyota, GM and Ford, 2Q 2020 was a disaster. The 3Q earnings season will start in October of 2020. If we look back to the Great Recession as an indicator of what happens to car sales in a recession, we see that even the hottest company of the day (Toyota and hybrids) saw revenue drop by 23% in 2009, from 2008. GM & Chrysler both declared bankruptcy in 2009. Toyota’s stock dropped by more than half. GM & Chrysler’s stock became worthless. So, will the 3rd quarter of 2020 hit EVs, including Tesla and Nio, hard? We won’t get our first peek into how the 3rd quarter looks for sales until Tesla’s deliveries report the first week of October. However, perusing the lithium miners’ earnings reports provides some context. While the overall positive trend for EVs is likely to continue once we get past the current economic crisis, Livent Corporation reported on August 19, 2020 that lithium demand was weak as “customers delay planned orders until later in the year.” Livent’s revenue was down 43% year over year in the 2nd quarter of 2020. Albermarle noted that “We expect the impact of low OEM automotive production to be felt more acutely in Q3 2020 [in lithium].” Car Buyers How will Work from Home, Stay at Home Orders, COVID-19, high unemployment and the current recession affect auto purchases in the 3rd quarter of 2020? The New York Federal Reserve Bank reported that there was $1.43 trillion in auto loan debt in the 2nd quarter of 2020. The delinquency rate was quite low at 2.26%. However, this statistic could be rather deceiving, due to the moratorium on collections going on. “Protections afforded to American consumers through the CARES Act have prevented large-scale delinquency from appearing on credit reports and damaging future credit access,” said Joelle Scally, Administrator of the Center for Microeconomic Data at the New York Fed. “However, these temporary relief measures may also mask the very real financial challenges that Americans may be experiencing as a result of the COVID-19 pandemic and the subsequent economic slowdown.” China appears to have arrested the current pandemic. The IMF is predicting that the Chinese economy will produce 1% GDP growth in 2020, while the rest of the world sees rates of contraction never before seen. The U.S. real GDP is predicted to contract by -8% in 2020, with Europe contracting in the -10% range. Price Matters It’s clear from the 2Q 2020 earnings reports that EVs are far more popular than old-school gas guzzlers. However, even if Nio continues its dominance in sales growth and Tesla continues to weather the storm, you are likely to be buying high if you purchase either stock at today’s prices. Most stock prices go down in a recession – even the stock of great companies. Tesla had annual sales of $24.6 billion, with a loss of $862 million in 2019. The company was valued at $350 billion on August 21, 2020. That is a higher valuation than Toyota, GM & Ford combined. Toyota, GM & Ford were all profitable in 2019, and their combined sales were over half a trillion. Tesla's current price-earnings ratio is over 1000. The current stock market rally is built on hope and forbearance policies, not real growth. It’s important to remember that the U.S. 2Q 2020 GDP contraction was the worst since at least 1974 (when the data began to be collected and reported), at -32.9%. Bottom Line Nio’s entry into the electric vehicle space in China is notable. So far, the company seems to be making all the right moves. Nio ranked highest in China’s New-Vehicle Quality Experience Index, conducted by J.D. Power in July of 2019. The company’s cars offer luxury and affordability, coming in far lower-priced than Tesla, while also qualifying for government subsidies to help Chinese buyers with the purchase. Nio’s board boasts of executives with ties to NetEase and TenCent Holdings. Nio (meaning blue skies) could be the car company to watch in the months and years to come, and is on my stock shopping list, waiting for a better price. (Special shout-out to Mitchell for finding Nio at our Oct. 2019 Retreat!) If you're interested in learning how to pick stocks from a No. 1 stock picker, and in learning essential investing tools, join me at our Oct. 3-5, 2020 Investor Educational Retreat. Click on the banner ad below for additional information on the Oct. 3-5, 2020 Online Financial Empowerment Retreat. Families receive a discount for attending together. Call 310-430-2397 or email [email protected] for to get rates. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Price Matters. Will There be a Santa Rally? It's Up to Apple. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. The Lyft IPO Hits Wall Street. Should you tak Cannabis Doubles. Did you miss the party? 12 Investing Mistakes The High Cost of Free Advice. 2018 Was the Worst December Since the Great Depression. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 3rd edition of The ABCs of Money was released in 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. 12/2/2021 07:40:14 am

24/3/2021 04:59:33 am

With the passage of time the organizations are making the best quality cars for the public and these are having good driving expiries as well. The detailed overview about the car here really tremendous and acknowledging. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed