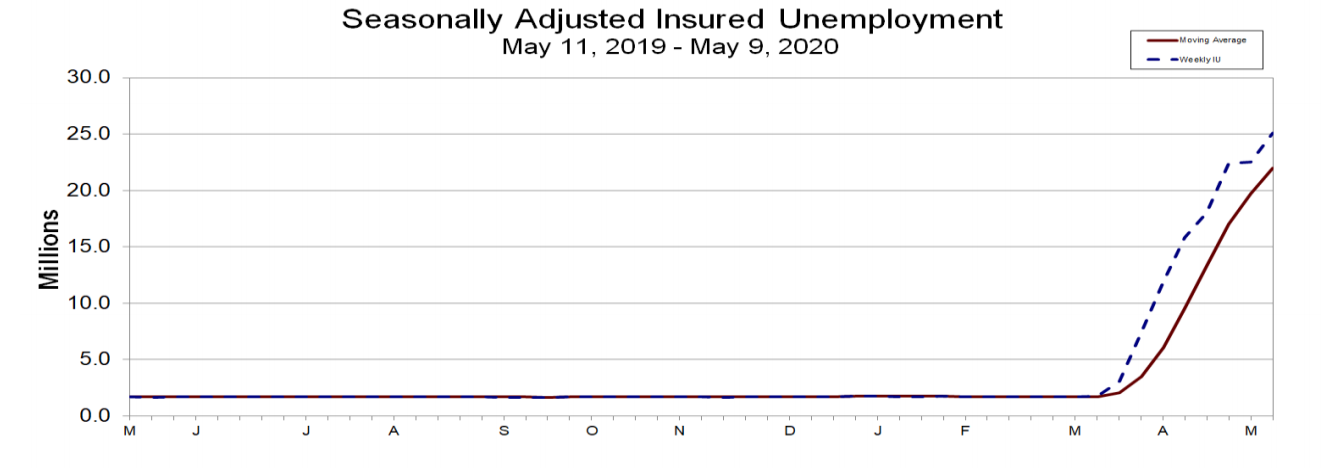

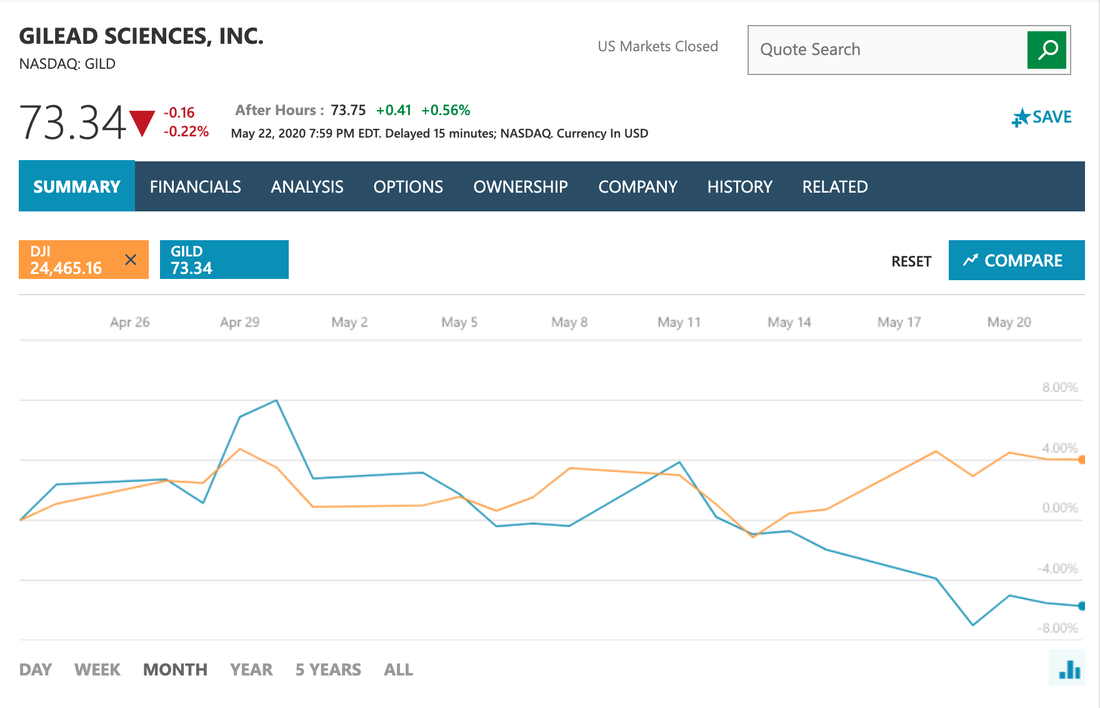

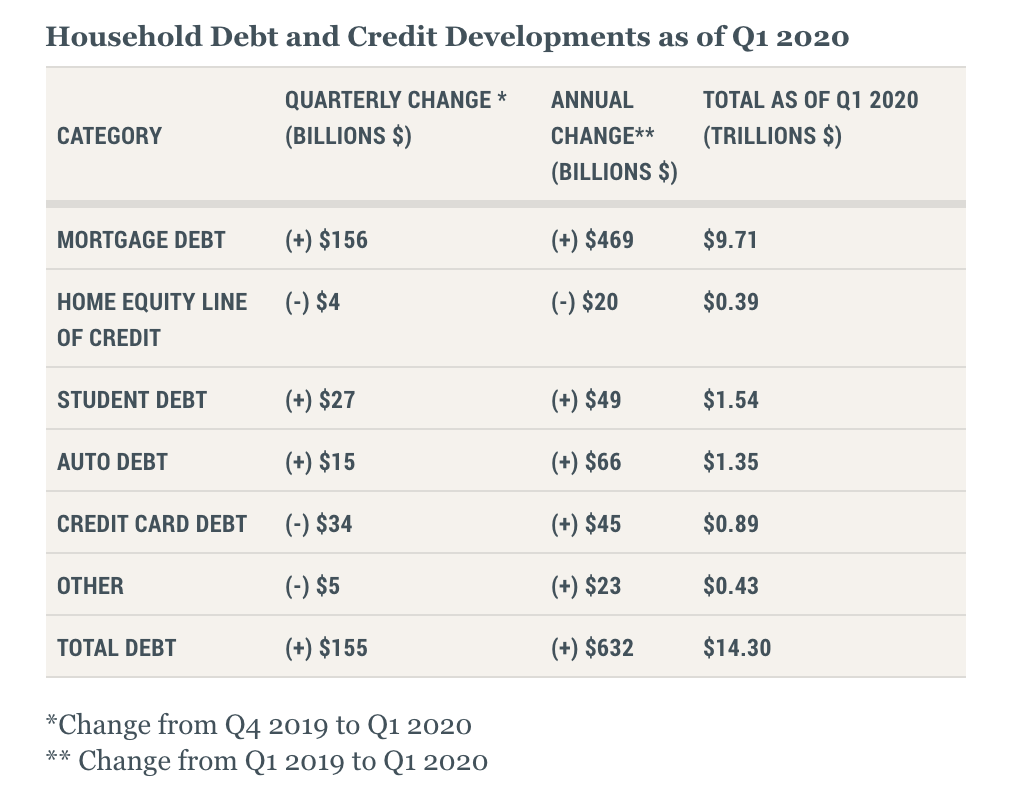

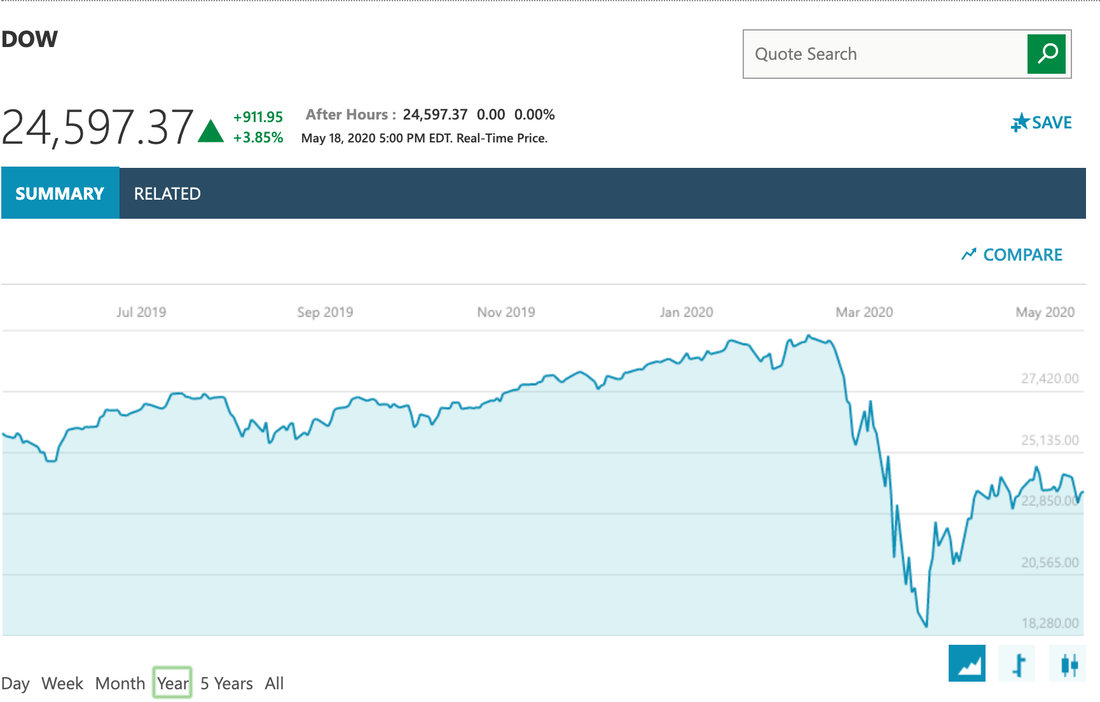

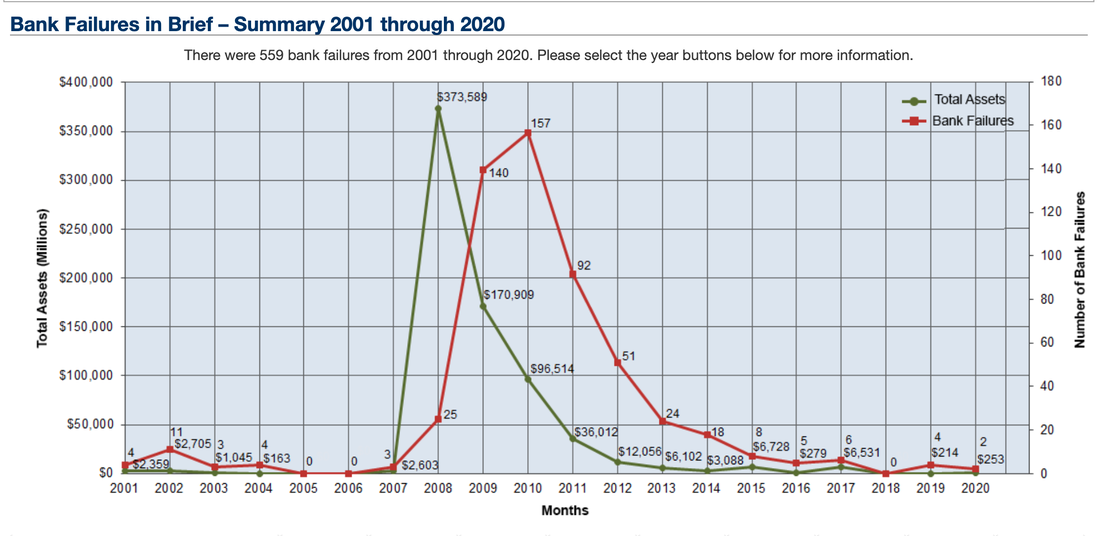

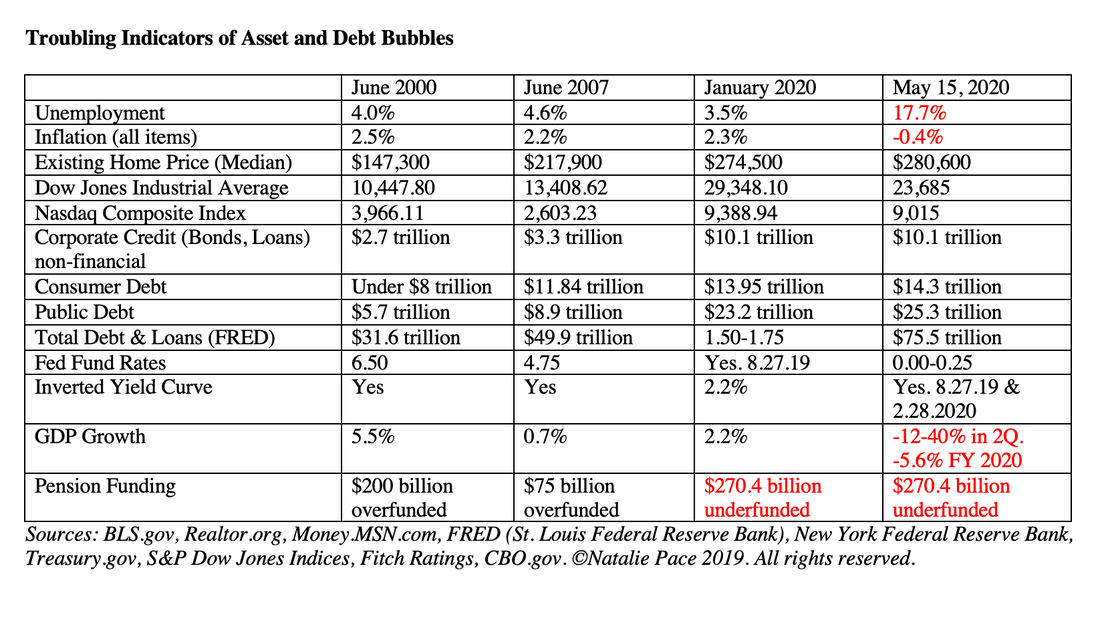

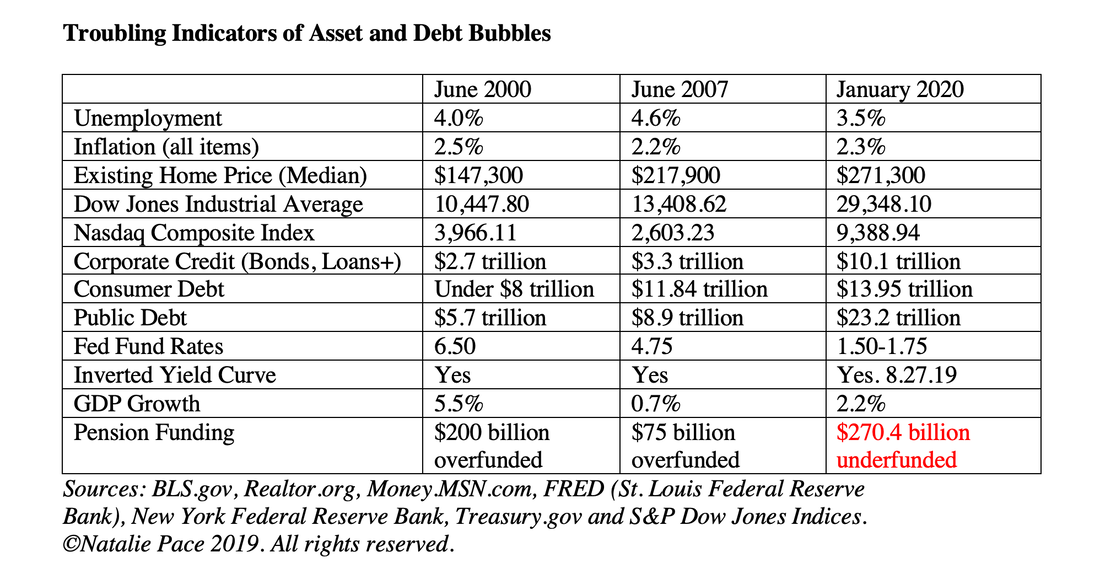

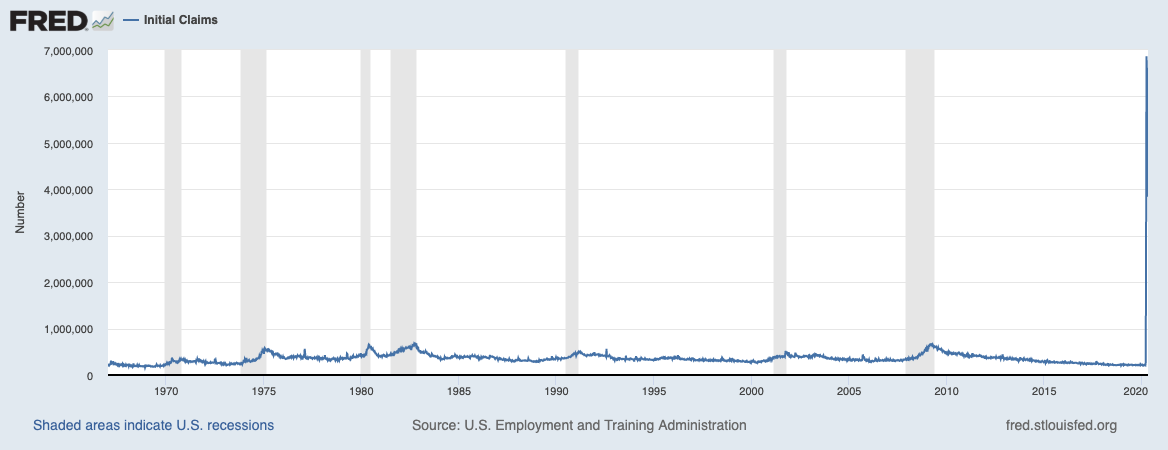

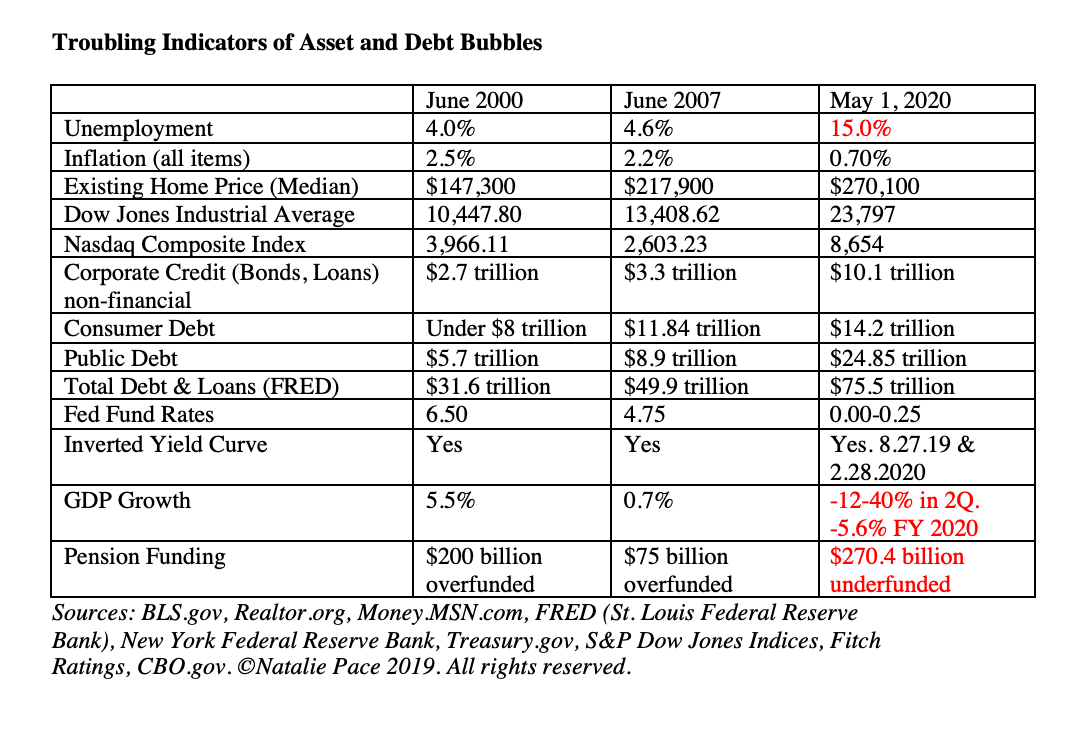

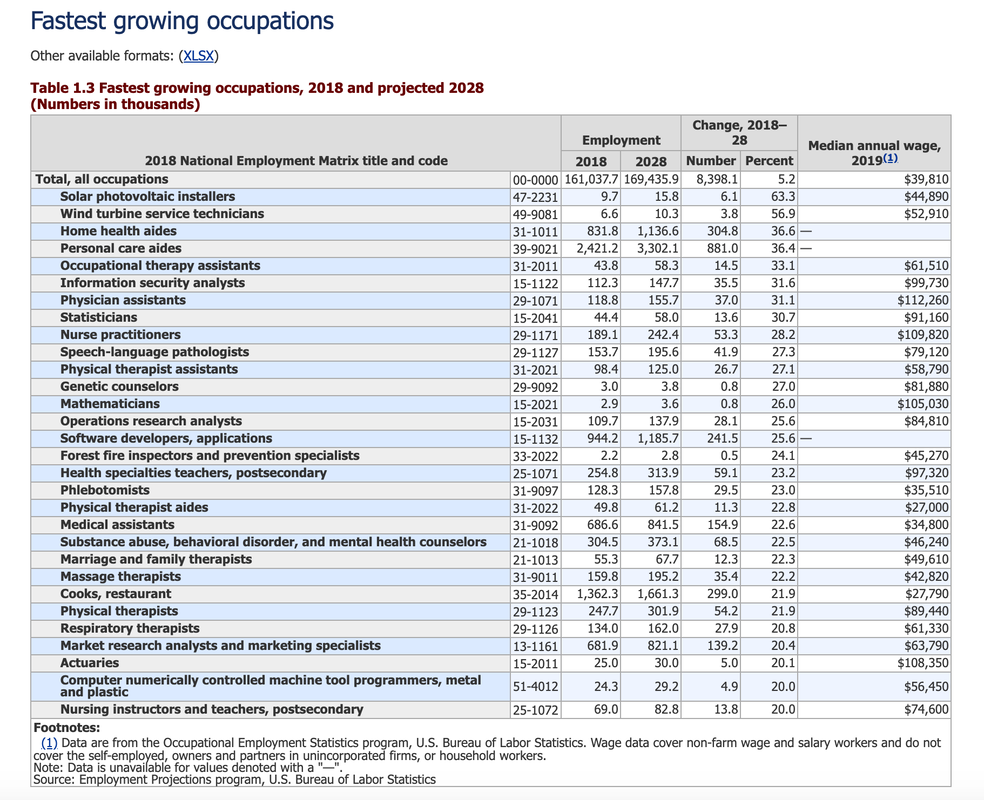

Dear Natalie: The market lured me in so I have less, but still substantial, cash. Stocks may be overpriced, but they certainly aren’t signaling to exit. Markets are hard, and trying to wait for a "crash" is hard as well. Lately the bounces have been so fast, it is done before you blink. Signed: Waiting for a Crash Dear Waiting is Not a Strategy, If you bought on March 23 (doubtful) then you could be rebalancing now to capture some gains. It’s a very good idea to rebalance your nest egg one to three times a year. At the end of April, if there has been a Spring Rally, you often have beefed up slices that can be trimmed back (selling high). At the end of September (if the current recession deepens), you might find that the slices have slimmed down, at which point you can buy more low. If you bought recently then you could be suffering from buy high, sell low syndrome. Please take a moment to read my blog on that. Pie Charts with Annual Rebalancing The long and the short of it is that market timing doesn’t work – not on the entry or the exit. Our easy pie chart plan with annual rebalancing is a buy low, sell high plan on auto pilot. Also, working with the pie chart system pulls the emotions out of it. That’s one of the reasons why this strategy earned gains in the last two recessions, and has outperformed the bull markets in between. The plan also benefits from adding in hot industries, being properly diversified and by knowing what is safe in a world where bonds and money market funds are very vulnerable. Both of those assets, and others, were bailed out by the Federal Reserve in March 2020, so you don’t have the luxury of ignorance these days. If you want to be the boss of your money, and adopt a strategy that works, you must know the basics – what I call The ABCs of Money that we all should have received in high school. It’s Never a Crash Also, the markets never “crash.” It’s always a series of unfortunate events, followed by mini-rallies. By the time you think we’re in the Apocalypse, that’s usually pretty close to the market bottom. As you can see in the two charts below, it took almost a year and a half for the Great Recession to bottom out, and over two years for the Dot Com Recession to “plunge” to its depths. The general trend was downward in both recessions. However, each “event” caused a knife-like drop, with a mini-rally thereafter. The "smart" money typically moves a few months before the headline. Before the first Safer at Home Order was issued in the U.S., a boatload of CEOs had already resigned their positions. Wall Street was on a selling spree for four months before Bear Stearns collapsed. If you wait for the headlines, you'll always be late. (That's where a balanced plan and annual rebalancing protect you, while allowing you to capture your gains.) Wall Street insiders already know that the recession becomes official on July 30, 2020, with the final revision at the end of September 2020. There was a Santa Rally after 9.11 that posted 10.4% returns. Bear Stearns collapsed on March 16, 2008, after a multi-month market plunge that began in November 2007 and cost investors -15.5% in losses. Wall Street then attempted another little rally, with April and May posting 5.84% gains. That seduction was quite expensive, however. The Dow Jones Industrial Average ultimately bottomed out at 6537 on March 9, 2009, with losses of -55% from the top in October 2007 to the bottom. The losses in the Nasdaq Composite Index during the Dot Com Recession were 78%. It took that index 15 years to crawl back to its March 2000 highs. So, it’s best not to be * Seduced by the Wall Street rollercoaster * Lured into another high-risk venture by fright from the Bitcoin and Gold Bugs * Googly-eyed over a get-rich-quick scheme involving AI or cannabis * Suckered into an “income-producing” (but capital-losing) dividend fund It is far better to let wisdom and time-proven systems be your guide. You can invest in things you believe are hot, within reason. There is a plan that allows you to play the hots, earn an income (safely, without capital loss) and even save thousands annually by adopting the wealth strategies of the rich. Call 310-430-2397 or email [email protected] to join us at our June 13-15, 2020 Financial Empowerment Retreat. Get the best price when you register by May 31, 2020. One more thing. It’s a good idea to watch (or review) my interview with Howard Silverblatt, the senior index analyst of the S&P500®. His quote is: “As far as P/E goes, let me get a tissue because I think I’m going to have a nosebleed. We’re so high now.”  Natalie Pace Online Financial Empowerment Investor Educational Retreat. June 13-15, 2020. Call 310-430-2397 or email [email protected] to learn more and to register now. Register by May 31, 2020 to receive the best price. Other Blogs of Interest Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Overnight, the pandemic upended our lives. Take a walk down 6th Avenue in New York, or Main Street in Los Angeles, or even your own neighborhood. From sitting elbow to elbow in restaurants, movie theaters, casinos and on planes, we now walk at least 6 feet apart, wear makeshift masks and work from home. Early in the pandemic, we might have thought things would blow over, and we’d soon be back to our normal routine. However, concerts and sporting events are pushed out to 2021. Over the last few weeks, there have been a slew of announcements from technology CEOs that Work from Home will be the new normal for the rest of the year, at minimum. Commercial Real Estate: What to Do With All of That Empty Office Space? Twitter’s CEO Jack Dorsey will let Twitter and Square employees work from home permanently, unless their job requires them to be physically present. 95% or more of Facebook is currently working remotely. With an aggressive remote hiring plan in place, Mark Zuckerberg predicts that half of Facebook’s staff could be working remotely in the next 5-10 years. Google’s Work from Home mandate has extended through the end of 2020. However, CEO Sundar Pichai remains excited about some of Google’s campus projects that are in the works, and believes there is still a need for “physical spaces for people to get together.” Logistics are forcing corporations to seriously consider Work from Home. Social distancing requirements mean that capacity might be limited to 25% of what it was previously. The cost of increasing office space fourfold, when everyone is right-sizing and conserving their cash, is a pipe dream. In our interview last Thursday, Howard Silverblatt noted that the expected wait time to get into his office building was at least 45 minutes, even with people using different doors to enter. Adding that to an already burdensome commute is unrealistic. Commercial real estate developers like Hudson Pacific Properties, Boston Properties, CBRE and more will likely take a revenue hit on the retail side and on the office leasing side in the 2nd quarter of 2020, as clients scramble to figure out work solutions in a pandemic. In Hudson Pacific Properties 1Q 2020 earnings call, CFO Harout Diramerian admitted that “Companies are taking a little bit longer to make decisions on their future space needs.” However, he also held out the belief (hope?) that storefront retail would recover once office buildings become occupied again. Hudson Pacific Properties clients include a Who’s Who of marquise and infamous tech companies, including Google, Netflix and WeWork. Malls Were Already in Trouble from the Retail Apocalypse A few years ago, some malls began transitioning away from retail and into commercial real estate projects. The Westside Pavilion in West Los Angeles was slated to open as a Google campus in 2021. Now those projects are threatened. Not surprisingly, REITs like Simon Property Group, Taubman and Macerich have each lost 62%, 27% and 73%, respectively, from their February 2020 share price highs. Apartment Buildings However, it’s not just commercial real estate that is empty. Certain “dorm” apartment buildings, where Millennials and Gen Z would room together to try and afford something in expensive urban cities (where the jobs are, and where they could at least ditch the cost of owning a car), have high vacancies, too. Why should young professionals spend 40% of their income on rent, when it no longer matters where they live or work from? House-Share Airbnb landlords, who considered hospitality at home their job, are slashing their prices, or listing privately to avoid paying the small percentage that Airbnb takes. Many rooms and bungalows that were operating at full capacity are now fortunate to fill half the time – at a reduced rate. Hotels Better call ahead to see if the hotel is even open! Some are operating, while others are closed. Many have state mandated rules for self-quarantining, if you are coming from a “hot spot.” All of this means that boutique hotels, especially those that were purchased recently, could be in trouble from an operational standpoint, as well as losing value on the property itself. Many hotel chains are still trading very low from where they were in mid-February 2020, with Marriott down -41%, Hilton down -32% and Wynn Resorts down by 49%. Homeowners 8.16% of mortgage loans are in forbearance, with 4.1 million homeowners in a forbearance plan as of May 10, 2020 (according to the Mortgage Bankers Association). The concentration is among FHA and VA borrowers, with 11% of Ginnie Mae loans in forbearance. The hope is that “if the economy continues to gradually reopen, the situation could stabilize,” according to Adam Fratantoni, MBA’s SVP and chief economist. AttomData points out another sobering statistic that complicates that sunny outlook. 3.6 million homes in the U.S. (1 in 15) are seriously underwater – and that is with prices at an all-time high! Existing home sales dropped -17.8% in April (source: National Association of Realtors). Prices were up, however, as there were fewer homes on the market to choose from. If you’re thinking of buying, you might want to consider that it took four years for the housing market to bottom out in the Great Recession. The current price for single-family existing homes, all types, is $286,800 – an all-time high. The price bottomed out in 2011 at just $166,100. The industry economists all point out that there is not enough supply, which will keep prices high, by their estimation. However, they aren’t factoring in the growing trend toward Intergenerational Housing, or giving enough weight to the unemployment rate. Add to that a shadow inventory that few economists are mentioning, and the underwater mortgages (which likely make up a good deal of those in forbearance), and you have a very dirty martini – one that can leave homeowners with quite a hangover. One thing that is for sure is that real estate is changing rapidly. Yes, our home is becoming everything to us. But we are also realizing that breaking our budget to stay in an unaffordable abode, whether it is a dorm rental or an underwater mortgage, is too risky. While experts tout that there just isn’t enough supply, which they claim will keep prices buoyant, consumers and the pandemic are creating new rules around how to work and live. According to AttomData, home prices were unaffordable in 66% of the U.S. counties analyzed in the 1st quarter of 2020. With over 20% unemployment, Americans are being forced to find creative housing solutions. Who Wins and Who Loses in a Post-Pandemic World? As the senior index analyst of S&P Dow Jones Indices (the S&P500) Howard Silverblatt noted in our conversation last Thursday, financials, retail and commercial real estate were all performing poorly in the index, while technology was on fire. Go to YouTube.com/NataliePace to listen back to the interview, which includes forecasts on which industries will fare well and which will need to restructure in a post-pandemic world. Whether you are thinking about Intergenerational Housing as a solution to help a friend or family member weather the economic storms, or wondering what you own in your retirement accounts, to make sure that your exposure to stocks and bonds is in your best interest, wisdom and time-proven solutions are the cure to ease your anxiety, stress and concerns. If you are interested in learning what's safe in a world where stocks, bonds and money market funds are all vulnerable to capital loss, consider joining me for my next Financial Empowerment Retreat, June 13-15, 2020. Get additional information by clicking on the banner ad below. Call 310-430-2397 or email [email protected] to learn more and to register.  Natalie Pace Financial Empowerment Retreat June 13-15, 2020. Online. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. On May 1, 2020, Gilead’s experimental COVID-19 treatment for severe cases was given emergency approval by the United States. Japan quickly followed, approving Veklury® (remdesivir). However, instead of sending Gilead’s share price to the moon, the stock dropped 13%, even while the Dow Jones Industrial Average continued a May mini-rally. Why weren’t investors impressed? It is likely due to the announcement by Gilead’s Chairman and CEO Daniel O’Day that the company was donating all of its supply to the U.S. “We’ve donated the entire supply that we have within our supply chain… We did that because we acknowledge and recognize the human suffering, the human need here, and want to make sure nothing gets in the way of this getting to patients,” O’Day said on Face the Nation on May 3, 2020. There is extreme political pressure for biomedical companies to come up with a cure, and to distribute the drugs as widely and freely as possible. Other COVID-19 Projects Adaptive Biotechnologies and Amgen are collaborating to find the “Michael Jordan” of antibodies. “We see our effort as complementary to other efforts in the industry. We don’t view this as a competition but as an all-hands-on-deck moment,” David Reese, Amgen’s executive vice president for Research and Development, remarked in an Amgen press release. Can Small Companies Afford to Work for Free? Gilead is a $92-billion company with $5.4 billion in net income and $35 billion in cash. Amgen is worth $132 billion, with almost $8 billion in annual net income (and $23.36 billion in sales). These companies can afford to give away a cure, and might even experience a Halo Affect in the bargain. But can a $5 billion company with $85 million in sales and $92 million in annual net losses like Adaptive Biotechnologies afford to give away its product? Adaptive had $213 million in cash and cash equivalents at the end of March 31, 2020. However, debt has been more difficult to access in the past few months, except for the most creditworthy companies. Capital preservation, “right-sizing,” liquidity and a “clear path to profitability” are all important business in today’s world. Cash burn in 2020 is not a luxury that companies can afford – not even biotech companies in the race for a cure. The key to Adaptive’s future will lie in speed. If the company’s “sophisticated DNA sequencing and machine learning capabilities” yield an all-star antibody or a cocktail of powerful players quickly, then Adaptive’s artificial intelligence could be useful in many biomedical therapies. Amgen is not the only large corporation courting Adaptive’s AI. Microsoft and the National Institute of Health are also partnered with Adaptive. On March 20, 2020, Microsoft announced a partnership with Adaptive to decode COVID-19’s immune response and provide open data access (i.e. free). It is very possible that the little go-to AI company that these mega-nationals are all partnered with – Adaptive Biotechnologies – has a bright future, even if its profit model is weighted toward altruism now. Inari’s IPO Inari Medical Inc. had an IPO on Friday. The company is not involved in the pandemic cure. However, with sales growth of 650% year over year, it’s worthy of mention in this biotech blog. In 2018, Inari sales were $6.8 million. Last year, they topped $51.1 million. The company makes FDA-approved devices to remove blood clots in Pulmonary Embolisms and Deep Vein Thrombosis diagnoses. The annual market for these devices is $3.6 billion in the U.S., according to Inari’s S-1 filing, with additional sales potential outside the U.S. Inari is a $2 billion small cap company with an impressive board and management, and a product that is in demand. In the 1st quarter of 2020, the revenue growth was almost fourfold, from $6.9 million to $27 million. At the current pace, sales could easily double in 2020, to over $108 million. The company generated $4.1 million in net profit in the 1st quarter of 2020. According to the Inari S-1 filing, “In the first quarter of 2020, approximately 2,400 procedures were performed using [their] products.” This compares with 4,600 in all of 2019. Dr. Victor Tapson of Los Angeles’ Cedars Sinai Medical Center, who was a co-principal investigator in the Flare study, said in a press release, “The results of the Flare study mark an exciting advancement in the treatment of acute pulmonary embolism patients. Until now, there has not been an approach to rapidly restore flow to reverse right heart strain without the use of thrombolytic drugs and their inherent risk of bleeding complications.” Inari’s IPO priced at $18/share, and had doubled to $36 by the time it hit the big boards on Friday. Inari looks like a small fish that could become quite a Samson of the sea. However, it is difficult for even great companies with first-mover advantage in an exciting innovation to swim upstream, if the markets crash. So, when you are determining your buy price and exit strategy, the following questions are appropriate for both Inari and Adaptive Biotechnologies. What can the company do? What can the industry do? What will the general market do? Full Disclosure: I own Adaptive Biotechnologies stock. If you are interested in learning how to pick winning stocks, or what's safe in a world where stocks, bonds and money market funds are all vulnerable to capital loss, consider joining me for my next Financial Empowerment Retreat, June 13-15, 2020. Get additional information by clicking on the banner ad below. Call 310-430-2397 or email [email protected] to learn more and to register.  Natalie Pace Financial Empowerment Retreat June 13-15, 2020. Online. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Hertz declared bankruptcy today. Neiman Marcus and J.C. Penney are in Chapter 11 as well. Who will be next? Are stocks overpriced? Are you anxious about money? Have you recently lost some or all of your income? Are you worried about protecting your wealth and retirement? Having a plan, and knowing what is really happening from a Wall Street insider, can replace fear with wisdom, which is the stepping stone out of stress and into a data-driven, time-proven action plan. Meet Howard Silverblatt, the senior index analyst of S&P Dow Jones Indices, who is responsible for the statistical analysis and commentary of the S&P 500® (and other indices). Howard has been working at Standard and Poor’s since 1977. So, if you’re wondering where the markets are headed, how you can protect your retirement, or ways you can help out a struggling family member or recent college grad, Howard and I cover all of this in the interview below. Go to YouTube.com/NataliePace2 to watch the complete video conversation. Natalie Pace: You may not have seen it all. However, you have seen Black Monday 1987, the Dot Com Recession and the Great Recession. So, polish up your crystal ball, and tell us what’s happening. How does the pandemic compare to past weakness on Wall Street? Howard Silverblatt: The main difference is the speed in which it turned. Corona has totally changed our lives. It has changed business models, our ability to work and introduced liquidity issues. Many companies are deciding that people don’t have to work in the office. There’s nothing like the speed of the mindset change in modern times. NP: So, it’s understandable that people are stressed, anxious and confused. Our lives have been upended. The pandemic has hit Main Street very, very hard, with the high unemployment, at over 20%, quarantine, and being with family members 24/7. It seems too good to be true that Wall Street has such a strong rally going. What is going on behind the scenes that we should know about? HS: This quarter, the as-reported GAAP earnings per share is coming in at $12.50 per share, as compared to $35.53/share in the last quarter. So, we are down two-thirds. Imagine your paycheck, that you are still getting paid but you are taking a two-thirds cut on it. Corporate earnings have taken a significant cut. NP: It seems disconnected that earnings have tanked, but stock prices are soaring. Is Wall Street overpriced? HS: As far as P/E goes, let me get a tissue because I think I’m going to have a nosebleed. We’re so high now. Historically, we’d be at 17 or 18 on the high side. Now, we’re in the 22 or 23 range. Again, earnings are down a lot now, and are expected to be pretty bad next quarter as well. 2020 has basically been written off. There is a hope that we’ll hit the bottom in 2Q and then turn up in the third and fourth quarters. So, we’re selling on forward outlooks for 2021. It’s a very high multiple that we’re putting on there. If we do not see that improvement with the 3Q numbers, we’re going to have to reprice. That repricing could be costly. We would expect more volatility, such as the way we had in February and March. NP: During the Great Recession and the Dot Com Recession before that, when markets dropped by more than half and took so long to recover, people lost their homes. Some weren’t able to retire. And yet if we sell stocks and get more liquid, and the markets come roaring back like they did in April, we feel like an idiot. HS: Know your own risk tolerance and liquidity. Everyone wants to make a buck. The bottom line is, “If you can’t afford to lose it, don’t bet it.” NP: Market timing doesn’t work. Buy & Hope has been like riding a rollercoaster this entire 21st Century. How can the average person gauge what they should be doing? HS: Diversification is important. Technology is up, but you have 37% losses in energy. It could be an index, or a basket. There are a lot of instruments out there. With dividend stocks, don’t get the highest yielding one. Get one that is going to keep paying you. Find someone whom you trust to help you. It’s not that easy to do. When you see all of the professionals having trouble doing it right, it tells you that it is not that easy. NP: Are there certain industries that are more in favor? HS: Technology is sitting at the forefront. If you go to the manufacturing part of IT, like semiconductors, they have to worry about opening up the plant. They have to ship products, unload the boat and get it to the shops. E-commerce is more in demand, while many retail stores are completely closed. Utilities have money coming through. I don’t even want to see my electric bill this month. I’ve got four monitors running in my work-from-home office. NP: What will separate the winners from the losers? HS: Liquidity is key now. Money will get corporations through the situation. Also, is my store open? If my store is closed, I’m not doing very well on sales. I still have rent. I still have costs and inventory. I have another season coming up. NP: So, retail, airlines, sports, hotels and bars – these are all activities that are either closed or operating at a fraction of the capacity they were at in early February. We’re also working from home and driving a whole lot less. HS: Retail is a very risky area. Retail has been hit by a lack of sales. If they own their own real estate, that has now deteriorated in terms of value. Malls are in trouble, with so many stores closed up. Energy is another risky area. We have a supply problem, too much, with much lower demand. Oil has gotten hit by both sides. The airlines have had an enormous hit. It’s going to take years to come back. They may not get those business travelers back. Financials are doing terrible. NP: Some financials are more vulnerable than others, right? I would assume that some smaller banks may have to restructure, as will mortgage providers and credit card companies. Insurance companies had to be bailed out in the last recession. The large banks are having an earnings issue. However, so far, they are saying that liquidity isn’t a problem. HS: I’ve never seen a financial company that ever said they did not have good liquidity, right up to the point where the Fed forced a merger down their throat. Credit card and car loan defaults are predicted to increase. How do I make money on a loan, and even cover my costs, when rates are so low? NP: What about the younger generation? Should they be investing? HS: When my kids first started working, I opened up a Roth IRA for them. Unlike me, who has somewhat of a pension, they are responsible for their own retirement and their own healthcare. Investing when you are 22 is so much easier than when you are 35 with a mortgage, or 45 with kids in college or 55 and looking to retire. Time is on your side for compounding. NP: What about someone who recently graduated from college or lost their job? Do you have any tips on how to help Millennials and Gen Z, who are facing all of the challenges of Gen X and Boomers, with student loan debt lopped in on top? HS: My son is with me now. He’s 23. He just graduated. He went on vacation. When he came back, he looked for a place. Now he’s back home. In my daughter’s building, there are only about 40 tenants left out of about 400. They all went back to mom and dad. People are thinking, “If I can work from anywhere, why am I paying 40% of my income to rent?” NP: Thank you, Howard, for sharing your wisdom and experience with such clarity and transparency. We appreciate it! Whether you are thinking about Intergenerational Housing as a solution to help a friend or family member weather the economic storms, or wondering what you own in your retirement accounts to make sure that your exposure to stocks and bonds is in your best interest, wisdom and time-proven solutions are the cure to ease your anxiety, stress and concerns. You can watch my full video interview with Howard at https://www.YouTube.com/NataliePace2. Learn more about easy, time-proven budgeting and investing strategies at https://www.NataliePace.com. If you are interested in learning what's safe in a world where stocks, bonds and money market funds are all vulnerable to capital loss, consider joining me for my next Financial Empowerment Retreat, June 13-15, 2020. Get additional information by clicking on the banner ad below. Call 310-430-2397 or email [email protected] to learn more and to register.  Natalie Pace Financial Empowerment Retreat June 13-15, 2020. Online. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. The Great News Since the low on March 23, 2020, when the markets dropped 38.4% from their February 19, 2020 highs, we’ve seen an extraordinary rebound in U.S. equities. If you sold everything, you might be ruing the day. This is an example why market timing doesn’t work. If you trimmed back in February and protected your money, then you might find that some slices have plumped up quite nicely for you. That’s a sign that now might be a great time to do another rebalancing. Market Timing Doesn’t Work Market timing doesn’t work because you’ll always be too early getting out and too late getting back in. What does work? Proper diversification, keeping enough safe, knowing what is safe in a world where bonds and money markets are vulnerable. Another reason that market timing doesn’t work is that it is a plan that relies too much on your emotions. If you jumped out in March out of fear, you’ll be tempted to jump back in now out of FOMO (Fear of Missing Out). A properly diversified plan keeps an appropriate amount at risk, with exposure to different types of funds, so that you can always benefit from rallies, and always protect yourself from routs. Sell in May and Go Away? Sell in May and go away is an age-old Wall Street aphorism. It came about because summer is typically low volume and can be weak. September is often the worst performing month. Over the 10-year period, May has averaged losses of -1.23%. The losses tend to be more pronounced when there has been a rally in the months leading up to May. April 2020 was one for the history books, with returns of 12.68%! This was the best performance since January of 1987, which posted returns of 13.18% gains. However, the rally doesn’t make up for the losses of February and March. The Dow Jones Industrial Average closed at 24,597 today (May 18, 2020). That is still 17% lower than the high of 29,569 set on February 19, 2020. However, it is a strong enough rally that you might be seeing some of your slices looking nice and plump, and ripe for the taking. Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot When you are rebalancing 1-3 times a year, each time has a slightly different strategy. Selling now could be an exercise of trimming back and capturing gains. If summer and September post losses, then you might be buying low in the Back to School Stock Sales, in hopes of a Santa Rally. The most important thing to do when rebalancing is to mock up what you have into my pie chart strategy – putting all of your large growth in one slice, all of your large value into another slice, and the same for any mid caps, small caps and hot industries or countries. Doing this makes it very easy to see what you have. When you compare what you have to a sample, personalized pie chart of what a properly diversified plan looks like, all that you have to do is to trim back the plump slices (sell high) and beef up the thin slices (buy low). You can create your own personalized pie chart using my free web app. There is a badge on the home page of NataliePace.com that guides you through the process. Annual (or 1-3 times a year) rebalancing is a buy low, sell high plan on auto-pilot. Using the pie chart system takes the emotions out of it. When you work off of the holdings statement, then you are activating emotions that are going to be harmful to your fiscal health. Red lights signal you to stop or warn you that you have losses, prompting you to want to sell low. Green lights signal, “Go, Go, Go!” spurring you to put your foot on the gas and perhaps buy more (high). Rebalancing in May Before are 5 tips to preserve your wealth, while keeping the appropriate amount at risk (for potential gain). Most of the time when you are rebalancing in May, it will be after a Spring Rally. That means that it is potentially a great time to take your profits. 5 Rebalancing Tips 1. Mock up a pie chart of what you have. 2. Personalize a pie chart of what you should have. 3. Make what you have look like what you should have. 4. Don’t assume that anyone else is doing this for you. Get a 2nd opinion if you don’t know what you own, or if you aren’t sure how to mock up what you have into a pie chart. 5. Learn what’s safe in a world where bonds are losing money and are illiquid, and where money market funds have redemption gates and liquidity fees. Receive an Unbiased 2nd Opinion on Your Current Plan FYI: I’ve been doing 2nd opinions for a few years now. I have yet to find one plan, whether it is self-directed or managed by a professional, that is properly diversified. If you would like an unbiased 2nd opinion (I don’t sell financial products), then call 310-430-2397 or email [email protected]. Crystal Ball 2020? What lies ahead? That will be addressed in an upcoming blog and videoconference. Email [email protected] with VIDEOCON in the subject line to be sure that you receive notice. This Thursday at 4:00 pm ET, I’ll be hosting the senior index analyst of S&P Dow Jones Indices – Howard Silverblatt in a special video conference. Learn what data and history tell us about today, and our best strategy moving forward. If you are interested in learning what's safe in a world where stocks, bonds and money market funds are all vulnerable to capital loss, consider joining me for my next Financial Empowerment Retreat, June 13-15, 2020. Get additional information by clicking on the banner ad below.  Natalie Pace Financial Empowerment Retreat June 13-15, 2020. Online. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  Dear Natalie. Does the Bank Bail-In Plan put my FDIC-Insured deposits at risk? I recently read a blog that said the IMF has approved a bank bail-in plan that allows them to seize FDIC-insured deposits. Signed: Whom can I trust? Dear Trust Results: I’m starting my answer off with the reminder to trust results. Before you read anything, grade your guru. Does s/he have a background in economics or an impressive track record for more than 15 years? Is s/he endorsed by real people and experts, or is s/he simply a self-proclaimed expert? The reason that I’m starting here is that I saw a number of red flags when I looked at the writer of the blog. The writer uses a pen name, hides his identity, calls himself a Jack-of-all-trades, has no background in economics or finance (but rather in engineering) and doesn’t know even basic financial terms. When I read the blog itself, my suspicions were confirmed. This writer has based his entire premise upon one inaccurate claim. (I’m not naming the blogger or linking to his blog specifically. This could be something claimed by anyone.) Here is what the blog claimed: “During the recent G20 meeting (mid-November), the member nations decided that your bank deposits will become property of the bank if a crisis takes it down.” He quoted from an IMF document that described that the IMF could “restructure the liabilities of a distressed financial institution by writing down its unsecured debt and/or converting it to equity.” He then claimed that unsecured debt includes deposits. That is a false claim, and it is also refuted by the very document that he quotes from. As one other point, he wrote his blog in 2019, whereas the IMF document he refers to is from 2012 (i.e. not recent). Unsecured debt refers to bonds and loans that are specifically “unsecured.” This is a common financial term. (It appears that the blogger is not aware of the definition of it, however.) In the IMF document it specifically states, “To improve transparency and avoid uncertainty, only subordinated and senior unsecured debt should be subject to bail-in. Insured/guaranteed deposits, secured debt (including covered bonds), and repurchase agreements should be excluded from restructuring… Pre-restructuring shares are completely written off, but deposits, repos, and other short-term funding are not affected by the bail-in power.” (Bold emphasis added.) I’m linking to the IMF document so that you can read it yourself. One of the most important things to understand is that “debt” does not include deposits. Deposits are not loans or bonds. Real-World Examples of How This Works Did you know that there have already been two bank failures this year? The First State Bank in West Virginia became MVB Bank on April 3, 2020. Ericson State Bank in Nebraska became part of Farmers and Merchants Bank on February 14, 2020. We can expect more to come, as the current pandemic crisis unfolds. During and after the Great Recession, between 2008 and 2012, 465 banks failed. Depositors kept their money. Shareholders lost everything. Bondholders were given a “haircut” on their principal investment, and oftentimes were given new stock in the new bank. That is why it is so important to re-evaluate your stock and bond portfolio, and strategy, now. Most depositors don’t even notice because the sign on the door changes, and operations continue under the new name. If you want to see how deposits are treated, check out the First Federal Bank failure from 2009 for details. You can also refer back to my blog on FDIC, SPIC, money market funds and cash under the mattress. Money Market Funds and Certificates of Deposit In 2017, there was a new rule applied to money market funds allowing them to apply redemption gates and liquidity fees. Redemption gates and liquidity fees were designed to prevent “runs” on money market funds. If the fund gets into trouble, it can suspend your ability to withdraw your cash and/or charge you a fee to withdraw your money. Since the funds did indeed get into trouble in March 2020, it is very important that you understand what those terms mean, and that money market funds can lose money. They, like all mutual funds and insurance products, are not FDIC-insured. The current Money Market Mutual Fund Liquidity Facility ends on September 30, 2020, unless the Federal Reserve Board agrees to extend it. Certificates of Deposit can be FDIC-insured or not. So, you have to read the fine-print on your CD to determine what the terms are. There can be an opportunity cost for CDs. If you need or want the money before the term ends, your early withdrawal penalty fee can be far above what the return on the investment is. High-yielding CDs are typically not FDIC-insured, and are often subject to capital loss if the underlying index it is tied to loses money. This is also true of annuities and other insurance products. Getting Safe is a 2-Step Process Getting safe is a two-step process. Hard assets will hold their value better than paper assets in the years to come. However, hard assets are expensive right now, and vulnerable to capital loss, too. If you buy them too high, you’ll lose money. If you’ve borrowed to buy them, you could lose the hard asset to boot. So, the first step to getting safe is to keep your money. FDIC-insured cash is safer than “debt” of all kinds, money market accounts and non-insured CDs. After you keep your money, start looking for safe, income-producing hard assets that you can purchase for a good price (when prices correct). Liquidity affords you the opportunity to buy low. What are some safe, income-producing hard assets that you can purchase for a good price? That is something that we spend one full day discussing in my Investor Educational Retreats. In short, you have to think about Return on Investment differently. You’ll also need to apply 21st Century strategies. What worked just a few months ago, like buying a place and putting it on Airbnb for top dollar, has put a lot of opportunists in financial despair. Wisdom and time-proven strategies are the cure. Avoid reading blogs before you grade your guru. If you are interested in learning what's safe in a world where stocks, bonds and money market funds are all subject to capital loss, consider joining me for my next Financial Empowerment Retreat, June 13-15, 2020. Get additional information by clicking on the banner ad below. Other Blogs of Interest Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  Dear Natalie: After learning more about the risk in bonds, I decided to trim back on a few. I was showing a gain for my bonds when I initiated the sell order. However, when the sell went through, it was for a loss. What happened? Signed: How Does a Gain Become a Loss in the Same Trading Day? Dear Gains: There was a liquidity squeeze behind the scenes in March. As the Federal Reserve Board explained in their Financial Stability Report of today, “The ability of creditworthy households, businesses, and state and local governments to borrow, even at elevated rates, was threatened.” With economic activity closing down due to the pandemic, and so much leverage in the bond market, investors feared that corporations, states and local governments would all need to borrow in order to shore up budgetary gaps. When a new bond is issued in a crisis, typically the rate will have to be higher. That means that existing bonds can become illiquid, or worse, require a haircut, where you receive only a portion of your original investment back. The Federal Reserve Board noted in today’s report that: “Asset prices remain vulnerable to significant price declines should the pandemic take an unexpected course, the economic fallout prove more adverse, or financial system strains reemerge.” In other words, the economic challenges are probably not over. In fact, many economists believe that the worst of the financial fallout of the crisis is still on the horizon. If the worst is still to come, then, even though getting liquid might have cost you a little, waiting could cost you much more. Below is a more detailed explanation of what is happening in the bond market in particular, and in the economy at large. Bond Risk Illinois was just downgraded to the lowest rung of speculative, just above default. When you hear Congressmen talk about letting states go bankrupt, Illinois could be the state they are referring to. However, Illinois is not the only state that is facing budgetary challenges. Five states, 10%, were just one or two rungs above junk status before the coronavirus recession hit. (Email [email protected] for details.) With the loss of tax revenue nationwide, all states face a liquidity challenge. Even states with AAA status (32%) will need to borrow money to meet current demands, after months of very low tax revenue, which is now exacerbated by 18% unemployment. In the corporate bond market, 11.4% of the S&P500 are currently at speculative status, including some recent downgrades, such as the Ford Motor Company. 227 companies (45.4%) are at the lowest rung of investment grade – just above junk bond status. That leaves only 216 companies (43.2%) that are rated A and above, or unrated. Again, with the stresses in the financial system, most companies are going to need to borrow money to make it through the hard times. For many existing bondholders, that creates credit risk and potential illiquidity. We’ve seen Berkshire Hathaway and Apple issue more debt. Disney has suspended its dividend and share buybacks, as have the airlines and auto manufacturers. In short, for bonds, keep the terms short and the creditworthiness high. Underweight bond funds and money market funds. (Click for additional blogs and details.) Credit and Term Risk Most municipalities, and many corporations, like to borrow long-term – for 30 and even 40 years. So, if you have bonds on the “safe” side of your portfolio, you may have long-term bonds in there. Or you may have a bond fund. These are vulnerable to both capital loss and liquidity. As I mentioned, if the state or company has to borrow more money, which they will, new investors will want to be paid for taking on the additional risk. That means the new bond will have to offer a higher interest rate, and potentially a shorter term, as well. This is true even when the Fed Fund rate is at zero. They have to do this due to the heightened credit risk. The bond covenants may put the new issuance in front of you, in the case of a restructuring. In this scenario, existing bondholders find that their bonds are worth a lot less on the secondary market if they want or need to sell (you experienced this), and may become illiquid (you can’t sell, even at fire sale prices). In the case of Greece, when the country was bailed out by the European Union, the existing bondholders received only about a third of their principal back. Those were the terms of the bailout. That put MF Global out of business. (Google MF Global to read up more on this.) Liquidity Risk This is what happened to you. You wanted to sell your bonds, but there weren’t any interested buyers in the room. Eventually, your broker was able to execute the trade, but at a lower price. The alternative would have been holding onto these bonds. If the crisis deepens, then the liquidity could dry up further, and you would have had to lower your rates even more to bait a buyer. Ford bondholders recently experienced this first hand. Investors were willing to loan money to Ford for 30-year or even 40-year terms for a yield of 5-6%. When Ford was downgraded to speculative status, junk, on September 9, 2019, existing bondholders were put into a perilous position. They could sell at a steep loss, or hold until term and pray that Ford doesn’t have to restructure in the meantime. The pandemic heightens the risk, and lowers the price that they can exit their positions for. What Lies Ahead? Economists warn that the current recession will not be a V-shaped rebound. The U.S. economy shrank by -4.8% in the first quarter of 2020, and that was with only 15 days in lockdown. The current (2nd) quarter includes at least two months of Stay at Home or Safer at Home Orders. The 2nd quarter is predicted to contract another -12% sequentially, which could be as high as -40% year over year. Sadly, that is a contraction for the history books that rivals the Great Depression. The Financial Stability Report does a good job of presenting the Framework of the current pickle we’re in, writing: Elevated valuation pressures tend to be associated with excessive borrowing by businesses and households because both borrowers and lenders are more willing to accept higher degrees of risk and leverage when asset prices are appreciating rapidly. The associated debt and leverage, in turn, make the risk of outsized declines in asset prices more likely and more damaging. Similarly, the risk of a run on a financial institution and the consequent fire sales of assets are greatly amplified when significant leverage is involved. There was too much debt and borrowing from Peter to pay Paul, in every corner of the developed world, before this pandemic hit. Corporations, nations, states, cities and citizens were all borrowing to make ends meet. (Corporations were also borrowing to pay dividends and buy back their own stock. Click to read more on Financial Engineering.) Good husbandry advocates that you fix the roof while the sun is still shining, and save for a rainy day. No one did that. Here we are. Liquidity will be your friend if “outsized declines in asset prices” materialize. If you are interested in learning what's safe in a world where stocks, bonds and money market funds are all subject to capital loss, consider joining me for my next Financial Empowerment Retreat, June 13-15, 2020. Get additional information by clicking on the banner ad below. Other Blogs of Interest Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Tomorrow, New Age Beverages, Tilray and GW Pharmaceuticals announce earnings. What should investors expect? (Innovative Industrial Properties announced 1Q 2020 earnings on Wednesday, May 6, 2020.) The last earnings reports of Tilray, New Age Beverages and GW Pharmaceuticals were astonishing, with GW Pharma reporting an eye-popping increase in sales to $109.1 million for the 4th quarter, compared to just $6.7 million in the same quarter of 2019. Tilray’s year-over-year revenue increase was 202%, with 323% revenue growth at New Age Beverages. Everyone is waiting for the FDA to allow CBD use in the U.S., and some guidance is forthcoming “soon.” However, currently CBD is illegal on a nationwide basis, despite what states choose to do. That means that most CBD products in the U.S. are not coming from the publicly traded cannabis companies, largely because they want to remain in compliance with their listing standards. The flood gates will open when (if?) CBD is legalized. (Currently only GW Pharmaceuticals’ epilepsy RX is legal.) Forward Outlook While many industries are under lockdown, the cannabis industry, including the supply chain, has been deemed an essential business. Still there are stresses within the system. It has always been more difficult for cannabis companies to raise money and open a bank account – and even more so today, when so many corporations need a handout. Having an experienced executive team, with an ability to raise money in a young (recently legal) industry, while tightening the budgetary belt and focusing R&D and expansion on the most scalable products, is key. Aphria is in the hands of Irwin Simon, the founder and former CEO of Hain Celestial, with Walter Robb (the former co-CEO of Whole Foods) on the board. Tilray has an exemplary international advisory board and executive team. New Age Beverages has a license to use the Bob Marley brand for many beverage products, including a line of CBD beverages. On the revenue side, the question is how much will COVID-19 impact earnings? Aphria: Aphria suspended their forward guidance. For the quarter ended February 29, 2020, Aphria’s sales growth almost doubled from $73.6 million to $144.4 million, year over year. Net income was $5.7 million. Based upon the previously issued guidance, the company was expecting an impressive increase in revenue for 2020 in the range of $575 to $625 million, from $237 million in 2019. For the nine months of the 2020 fiscal year, revenue was already up to $391 million. If the company is able to hit the high end, despite suspending guidance, then the revenue growth in the next quarter should be 89% year over year. Expect the fiscal 4Q and full year 2020 earnings report around August 1, 2020. GW Pharmaceuticals: Most of GW Pharmaceuticals current revenue comes from one epilepsy drug. The real questions for tomorrow’s earnings call are: “How big is the market place for Epidiolex? Now that the DEA has descheduled the drug as a controlled substance, will more patients suffering from epilepsy receive the CBD-based drug?” GW Pharmaceuticals had $536.9 million in cash and cash equivalents, at the end of 2019, with a net loss of $24.9 million. If sales in the 1st quarter of 2020 are similar to the 4th quarter of 2019, then the year-over-year increase will be impressive, at 278%. The company’s sights are now set on bringing nabiximols, a treatment for multiple sclerosis, to the U.S. Their distribution partner in the U.K. is Bayer. Novartis is another partner. GW Pharmaceuticals has been successful in navigating the regulatory road map of the DEA and the FDA with Epidiolex. Will it have similar success with Savitex (the brand name of their nabiximols)? Innovative Industrial Properties: While cannabis has been allowed to operate as an essential business, as of May 2, 2020, IIP was forced to work with 3 of their 21 tenants to provide temporary rent deferrals. The company advises that this amounts to just 3% of their revenue. As long as the stress is limited, then the revenue growth can still be impressive. Last year, in the 2nd quarter, Innovative earned $8.6 million in revenue. New Age Beverages: New Age is projecting revenue growth of 6-10%. This is a screeching halt from last quarter’s revenue growth of 323%. The company is exiting some of its brands, including Coco Libre. Last year, they announced that the Marley brand of CBD beverages wasn’t going to be launched in the U.S. due to regulatory walls. Though they had shelf space in Walmart and 7-Eleven, they discovered that their “new age” products, including the Marley brand, were not top sellers there. (I must have been in the minority for the organic Marley coffee.) Will the Noni products – an immune builder that decreases inflammation in the body – gain a greater audience? Will Nestea become popular again? Will the U.S. magically legalize CBD products and beverages? While tomorrow’s earnings report will not be as stellar, investors will be focused on the projected growth of their Noni +CBD products, the direct sales campaign and any other exciting news that New Age can conjure up. New Age’s modest earnings report may already be priced into their stock. The company’s share price is trading near the 52-week low. The market cap, at $147 million, is lower than their annual sales, of $254 million. Their cash and cash equivalents were at $60.8 million at the end of 2019. Tilray: Revenue increased 278% year over year in 2019, and 202% in the 4th quarter for Tilray. At the current pace, Tilray’s revenue will double in the 1st quarter of 2020 – providing there wasn’t a severe impact from COVID-19. Tilray has a partnership with Anheuser-Busch and LaBatt for CBD beverages. Their leadership team is strong, with experience from Revlon and Molson Coors. They recently partnered with Columbia University on an Rx treatment for women suffering from breast cancer. Tilray raised $90.4 million on March 13, 2020, through an equity offering priced at $4.76. The share price has since recovered quite well. The current price is $7.78. They are projecting positive EBITDA by the 4th quarter of 2020, and cash flow positive in 2021. Buy? Sell? Hold? So, should you buy, sell, hold or mix it up between a few of these strategies? Start by asking the following 3 questions. Questions: What can the company do? What can the industry do? What is the general marketplace doing? Many of these companies are absolutely on fire, with executive teams who can innovate, deliver the products and raise capital until the companies are cash flow positive. The industry is growing leaps and bounds, too. However, there is still a lot of illegal trade going on, as well. It’s not all coming up roses for publicly traded cannabis companies, despite the popularity of their products and the robust increases of their sales. When the stock market dropped like a knife between February 19 and mid-March of this year, Tilray lost 85% of its value. Aphria sank by 63%. New Age Beverage imploded by 61%, and GW Pharma lost 42%. Most of the companies are still trading near their 52-week lows. However, if investors get wind of the recession and sell their stocks, cannabis stocks could take another hit. Bottom Line These cannabis companies are doing great in an explosive industry. However, their share price is on the Wall Street rollercoaster. In that environment, a buy low, sell high plan works well, as does using a limit-order capture gains strategy. The right answer might not be all or nothing. And it never hurts to have a Stock Shopping List in case investors are disappointed with the earnings reports, or the general marketplace just drags everything south. if you are interested in learning stock picking, or taking this information deeper, consider joining me for my next Financial Empowerment Retreat, June 13-15, 2020. Get additional information by clicking on the banner ad below. Join me for a Free Videoconference this Monday, May 10, 2020, to learn 4 essential strategies to recession proof your life. Whether you wish to protect your job, home, wealth or future, these strategies will position you best now and in the years to come. Email [email protected] to for login instructions. See below for additional blogs you should be reading.  Visit NataliePace.com to learn more. Call 310-430-2397 or email [email protected] for pricing, additional information and to register. Other Blogs of Interest Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. With over 21.8 million Americans filling for unemployment, and millions more who are underemployed, chances are that you or someone you love is experiencing financial hardship. Every industry from General Electric, to the airlines, to the automakers, to retailers and beyond, have already laid off workers or will be trimming back as soon as their bailout package covenants allow them to. (There will likely be hundreds of thousands of individuals laid off in the airline industry on September 30, 2020, when the Direct Payroll Assistance funds of the Cares Act expire.) We’re hearing a lot about corporations having to “right-size” (i.e. lay off) their labor force for a post-pandemic world, in order to keep operating. This is necessary for households, too. The sooner we right-size our lives for the recession, the better off we will be. Below are six areas to address immediately. 6 Ways to Recession Proof Your Life Protect Your Wealth Preserve Your Nest Egg Safeguard Your Home Right-size Your Budget Negotiate Your Debt Learn a New Skill And here is a little more color on each point. Protect Your Wealth Unemployment has soared to unprecedented levels (15% as of April 25, 2020). Asset prices, which were in a bubble before the current crisis, will have to adjust themselves. That means that the stock market and the real estate market are both going to be under downward pressure. Are you sure your nest egg is recession proof? Are you over-leveraged on your home? Did you recently purchase income property that isn’t paying for itself at a lofty price? It’s time to protect the wealth you have. Examine your assets with a forensic eye, like a CFO would. Be the boss of your money. Do not assume that someone else is doing this for you. Nobody cares about your money as much as you do. If you need help with this analysis, call 310-430-2397 or email [email protected]. Preserve Your Nest Egg In recessions, it is imperative to preserve your nest egg by 1) having enough safe, 2) knowing what is safe in a world where bonds are losing money and money market funds have redemption gates and liquidity fees, and, 3) being properly diversified in your at-risk portion. If you’ve just checked off boxes in your 401(k) and you don’t know what you own, or if you have allowed someone else to manage it for you, it is unlikely that you are properly protected and diversified. Now is the time to know exactly what you own and why you own it, rather than relying upon blind faith that you are in good hands. The other part of preserving your nest egg is to protect it from financial predators. This is not just from scammers, phishers, salesmen, opportunists and from bad investments. You must also protect your retirement accounts from the debt collector, the credit card company, the banks and any other corporations and individuals that you owe money to. Your first obligation is to protect your family’s future, not to making everybody else rich. It is important to understand the laws of the land, and to protect and preserve your nest egg as if it were your life boat to a better land. It very well could be. Do not drain your nest egg to keep your business alive, to make credit card companies happy or to stay in a home you can’t afford. Seek out solutions that will sustain you over the long-term, rather than adopting a disastrous near-term Band-aid fix. That solution will include your future, in addition to the obligations and debts that you have. Safeguard Your Home If you were having trouble paying the mortgage or rent before the current crisis, then now is the time to face reality, even if you still have your job. It is a far better idea to embrace intergenerational housing, take on a roommate, or downsize, than it is to keep paying above what you are capable of, taking on more debt and digging yourself into a desperate hole. Right-sizing your life at the core can actually be very freeing. Most of the time thinking bigger and adding in family members or friends will yield better results. When I was a young single mother struggling to make ends meet, I got a bigger house in a better neighborhood that I shared with another single mother. My costs were reduced by at least a third. I had someone to look after my child when I ran to the grocery store. We shared cooking duties, so I only had to cook every other week. There can be blessings, when life shakes up our status quo. Right-Size Your Budget Below is a link to a free web app, so that you can see what a Thrive Budget® looks like. Basically 50% of your income should be used to survive and 50% to thrive. If you are spending 75% or 80% of your income to survive, then you’re going to feel very vulnerable and constantly fear shattering the screen of your smart phone, or any other unexpected expense that you just don’t have the money to cover. Forget about café lattes and avocado toast. That isn’t the problem. Most of us are not shopaholics. Cutting out café lattes might save you hundreds, if you are truly splurging every single day. However, the real problem is the thousands that get siphoned away for big-ticket expenses, like housing, transportation, healthcare, health insurance, insurance of all kinds and even food. Wages have stagnated over the last decades, while the cost of essentials has skyrocketed. Budgeting solutions will not be found in the mainstream self-empowerment books and TV shows. (If they were, why are you in the fix you are in?) Continuing as you are in an unsustainable lifestyle, and borrowing on credit cards to try and make ends meet, is a disastrous scheme that doesn’t end well. It’s important to take a sober look at your big-ticket bills, and adopt innovative solutions. There are some easy ways to do this, and others that will require brave choices. It all starts with knowing what is possible. You can learn more time-proven budgeting solutions in the Thrive Budget® section of The ABCs of Money. Negotiate Your Debt Most of the debt solutions being offered by credit card companies, mortgage providers, and utilities are temporary. Often, they just tack the payments you miss onto the back end, and then charge you interest on that – making things worse down the road. Is it possible that your debt is in need of restructuring? Is it possible that you can negotiate hard to get the bank or credit card company to accept a much lower closeout deal? (If you do, be careful of the fine print. Sometimes they will sell your debt to a debt collector, in addition to taking your offer.) Should you be selling your too expensive overpriced home and downsizing? If you are drowning in debt, you need to know the laws of the land and also the rules of FICO scores. Debt to assets ratio accounts for 1/3 of your FICO score. You could continue to make payments on time, and still have a score that plummets. There is a debt section in The ABCs of Money that can help you to navigate out of the bind you are currently in, and into a better tomorrow. Learn a New Skill Whether you are out of work, or lucky enough to still be working, learn a new skill. Become adept at using tools that are going to be useful in the days ahead. Obvious things to master include: getting familiar with video conferencing, learning to code, polishing up on your Excel skills or becoming more tech or social media savvy. The jobs of tomorrow include clean energy, medicine and climate change. Should you learn how to install solar panels or become a wind turbine technician? Are you interested in being a physician assistant? Should you focus your engineering degree toward fire safety or a clean energy grid? Below is a graph of the jobs of tomorrow. Waiting for politicians to solve problems is often frustrating and futile. It is always a short-term fix. The sooner that you right-size your life, the better able you will be to survive the recession and to soar during the recovery. Liquidity (protecting your wealth) will allow you to purchase assets at a much lower price in the years ahead. Refusing to believe that we are in a recession will be a costly assumption. So be careful of getting your news from the headline news and politicians. If you wait for the headlines that we’re in a recession it will be too late. The experts already know that we are in a contracting economy. Main Street won’t get the headline that we are in a recession (which we are already in) until July 30, 2020. I will be hosting a fireside at five on Monday, May 11, 2020 to discuss these strategies in greater details. If you would like to join us, please call 310-430-2397 or email [email protected] for log-on and pricing information. I am also hosting an online Financial Empowerment Retreat June 13-15, 2020. Click on the flyer below for additional information, including testimonials and the 15+ things you'll learn and start to master. See below for additional blogs you should be reading.  Visit NataliePace.com to learn more. Call 310-430-2397 or email [email protected] for pricing, additional information and to register. Other Blogs of Interest The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |