|

All eyes are on the Federal Reserve today and tomorrow to see if Chairman Jerome Powell and his colleagues will kowtow to Presidential Tweets and pause on the rate hikes, or if they will do what everyone expects them to do and raise the Fed Fund rate another 25 basis points. We’ll know tomorrow at 2:00pm ET, when the FOMC press release will be released, along with a new Summary of Economic Projections. Will the Feds Raise Interest Rates? On September 26, 2018, the FOMC participants projected that 2018 would end with the Fed Fund rate at 2.4%, with 3.1% on tap for 2019 and 3.4% to be the projected target by 2020. On Wednesday, November 28, 2018, Federal Reserve Board chairman Jerome Powell spoke to the Economic Club of New York, saying, “Interest rates are still low by historical standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy‑‑that is, neither speeding up nor slowing down growth.” This was a slight shift in his language, which the markets interpreted to mean that he might slow the interest rate hikes going forward. Few expected that to mean a pause in December, however. Former Federal Reserve Chairman Alan Greenspan said today on CNN that the economy is slowing, which indicates that lowering interest rates is an appropriate path. When asked about the risk of being too late to respond to the changing economy, Greenspan said, “It is a risk that you balance against the risk of being to early.” Either way, Greenspan is confident that the economy will dictate the policy, not White House pressure. Should the Federal Reserve Raise Interest Rates? The complaints from the White House are centered around the stock market volatility. As of yesterday, December’s performance of the S&P500 was -7.27%, the worst since 1931 (-14.53%). However, the dual mandate of the Federal Reserve is to keep inflation low and employment high, both of which are the case right now. As to Greenspan’s point about not being too early or too late, the expectations for economic growth are that the 4th quarter will slow down, but still be positive. Economic Growth The forecasts for 4th quarter 2018 GDP growth range between 2.4 and 2.9%. That’s pretty tepid compared to 3.5% GDP growth in the 3rd quarter and 4.2% in the 2nd quarter (source BEA.gov). However, it is still growth. On December 21, 2018, the 3rd estimate of 3rd quarter GDP growth will be released. It is expected to come in around 3.5%. (The 4th quarter GDP growth advance estimates won’t be available until January 30, 2019.) As long as the Feds can point to an economic reason for raising interest rates, they are likely to for the following three reasons: 1) higher rates are needed to have more room for lowering in the next recession, 2) leverage has become more speculative, and, 3) asset bubbles form when rates are too low for too long. Where The Feds Would Like the Rate to Be As you can see from the chart below, before the last two downturns (which cost stock investors more than half of their assets), the Fed Fund rate was much higher. At just 2.0-2.25%, there isn’t enough wiggle room to help boost economic growth by lowering interest rates. That is why the Feds are raising rates as quickly as they can, while also winding down their own balance sheet. Incidentally, the Federal Reserve reported a cumulative (unrealized) loss on its domestic SOMA securities holdings for October of $66.5 billion, compared to a gain of $80 billion in December of 2017 (page 7). Leverage In the Financial Stability Report that was released on November 28, 2018, the Federal Reserve indicated that they were watching leverage on a number of different fronts, including:

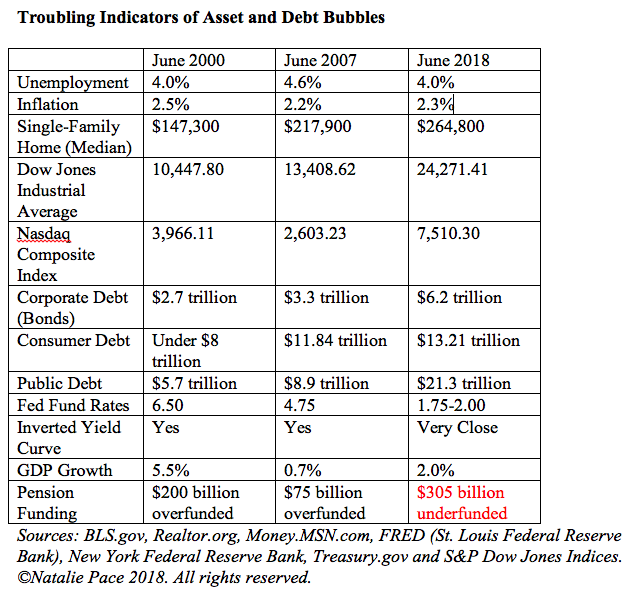

All of that leverage has amounted to losses on the bond side, already. That makes 2018 even more problematic than 2000 and 2008 because during the last two recessions, investors earned gains in bonds (while their equity/stock side lost more than half). Asset Bubbles As I’ve indicated in many blogs over the past two years, low interest rates create bubbles. Stocks, bonds and real estate are all bubblicious. See the chart below. Even with the volatility in the stock market, stocks are still near their all-time high, and many are trading at high multiples. Financial Engineering Financial engineering, largely in the policy of corporate share repurchases, has been used by many corporations to reduce their share count, which in turn makes their EPS look strong, and lowers their price to earnings ratio (by reducing the share count). According to Howard Silverblatt, the senior index analyst at S&P Dow Jones Indices, “[The] first three-quarters of 2018 buybacks rose 52.6% to $583.4 billion from $382.4 billion in 2017, and was 1% shy of the annual record, set in 2007 of $589.1 billion. This policy of borrowing from Peter to buyback stock has resulted in Standard and Poor’s lowering the credit rating of Lowe’s last Wednesday. Since over half of investment-grade corporations are at the lowest rung, if the downgrades continue, this will become very problematic. Corporations will have a more difficult time borrowing from Peter to buyback their own stock, and the price tag will be higher. Without the support of corporate buybacks, stocks could continue to weaken. The Bottom Line It is all speculation of what the Federal Reserve Board will do until tomorrow (Wednesday) at 2:00 p.m. However, based on the numbers, I’d be surprised if there wasn’t a rate hike. The Feds know that the market expects an increase, so there shouldn’t be a rout in stocks based on their decision. And the GDP report that follows on Thursday will make headlines for still being relatively strong. Once the new projections are released, I’ll post those on my social media (Twitter and Facebook). I will offer a report on how that will affect 2019 in my December 27, 2018 teleconference, “Crystal Ball 2019.” A diversified, hot plan that is annually rebalanced and underweights the over-leveraged companies and municipalities is your best defense against a market downturn. Sadly, most people are not diversified, are heavily invested in companies that are drowning in debt and are still using Buy and Hope, instead of Annual Rebalancing and Modern Portfolio Theory. (Many broker-salesmen say they are using MPT; few are, however.) That’s why your first and best step is to Know What You Own. If you’re interested in an unbiased 2nd opinion, which includes a report of what you own, outlining areas of strength and weakness in your current plan, call 310-430-2397 or email [email protected]. Happy Holy Days! Making sure that your financial house is secure enough to withstand the economic storms that are raging will help your winter celebrations to be more bright. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a massive discount on a private coaching package (and 2nd opinion), when you register for a retreat by December 23, 2018. Other Blogs of Interest Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed