|

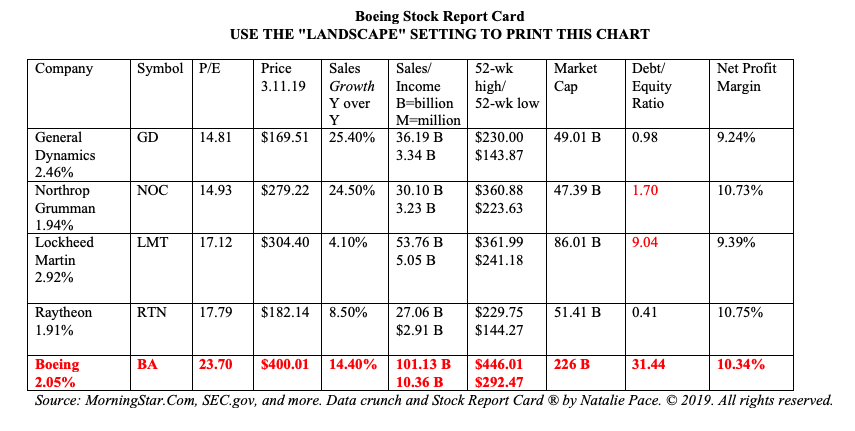

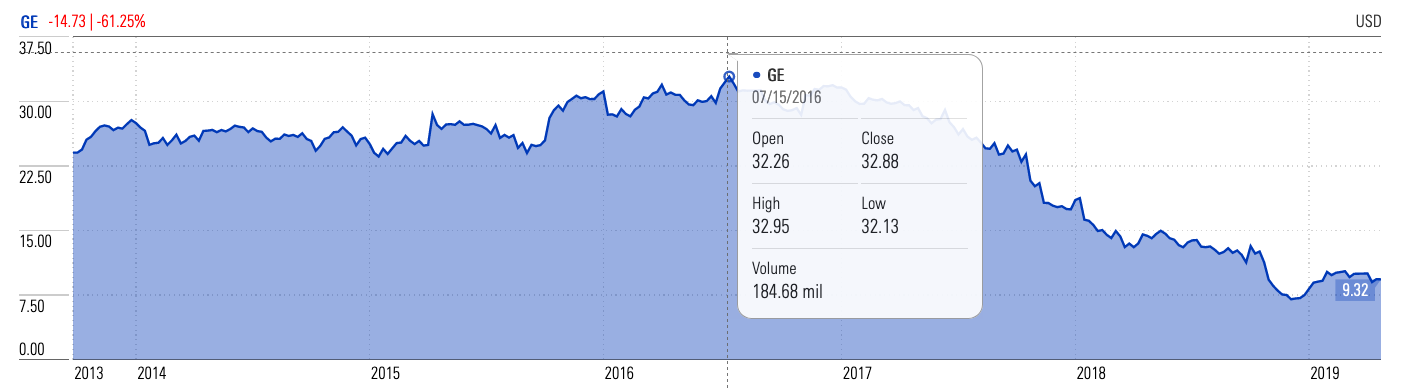

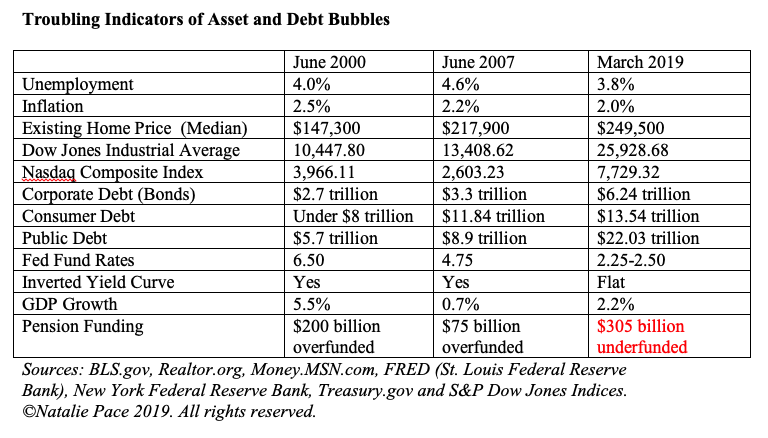

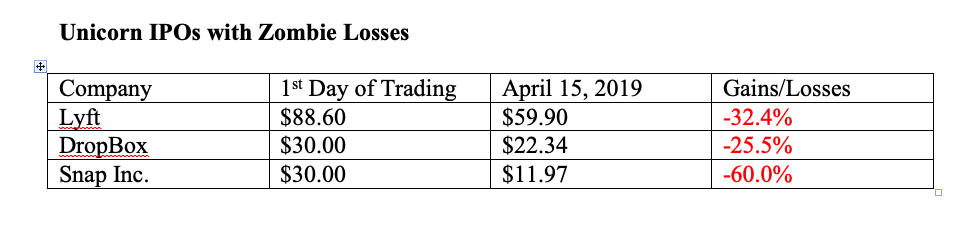

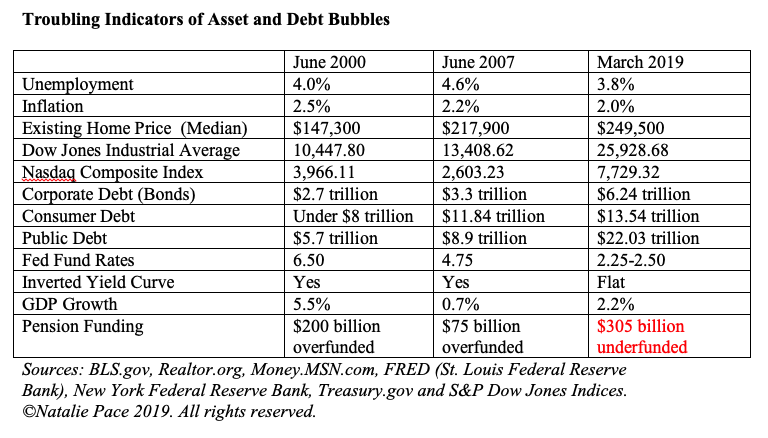

On Friday morning, April 26, 2019, at 8:30 am ET, the Bureau of Economic Analysis will release the 1st quarter 2019 GDP growth advance estimate. 2019 is predicted to slow worldwide, and the U.S. is not immune to that. U.S. GDP growth in 2019 is predicted to slow to 2.1%, as the affects of the tax cut wear off and the problems of tariffs, BREXIT and the late stage in the economic cycle kick in. Estimates for the 1st quarter GDP growth range from 1.4%-2.8%. On the low end, investors will likely take a defensive stand, and stocks could sink. If growth hits 2.8%, sophisticated managers will know that is largely as a result of financial engineering, as the rally in stocks is largely a result of corporate buybacks. So, there is no guarantee than an upside surprise near 3% growth would spark more buying. Financial Engineering is Not Real Growth. Boeing has borrowed money to buyback its own stock, rather than hire ample staff to do the job right. This rewards shareholders in the short term. However it harms regular folks and the company itself in the medium and long-term. There is no greater tragedy than the loss of 346 innocent travelers. Boeing is trying to buy their way through this crisis, as they work to get the software safety upgrade for the 737 approved and the airplanes delivered. So far Boeing stock has been very buoyant, still trading near an all-time high of $375.46/share, as of April 24, 2019. However, how long can the company borrow to buyback stock? Boeing’s debt/equity ratio is the highest in the industry at 31.44. The company has warned that they will have to restate their 2019 financial guidance at “a later date.” 1Q 2019 revenue was down 2% due to the canceled and delayed aircraft deliveries. (The Ethiopian Airlines crash was on March 10, 2019, so the cancellations and issues will show up more in the next earnings report.) Boeing’s net earnings were down 13%, while the earnings per share took a 10% haircut year over year. Boeing spent $2.3 billion on share repurchases and $1.2 billion on dividends (a 20% increase) in the 1st quarter. This is about $1.4 billion more than the company earned. General Electric was another company that kept raising their dividends and buying back their own stock, on an unsustainable path to where they are now – with a share price worth less than 2/3rds of what it was a few years ago, and almost no dividend. Buybacks Hit An All-Time High, Just Like 2007 All Over Again According to S&P Dow Jones indices senior index analyst Howard Silverblatt, corporate buybacks are at an all-time high, running a whopping 68.6% above last year. Apple spent $88 billion in 2018 on stock repurchases and dividends. The company’s net income was $59.53 billion. Oracle spent $32.75 billion on buybacks, with $3.82 billion in net income. Banks were in the top ten spenders, led by Wells Fargo, with $29.153 billion spent on buybacks and dividends and $20.69 billion in net income. Amgen, Microsoft and Facebook were also big buyback spenders. Amgen’s spending topped its net income by $13 billion, while Microsoft spent almost $14 billion more than it made. Buybacks Were the Fuel Before the Great Recession, Too The cost of buying into a financially engineered asset bubble is enormous. Stocks dropped by more than half in the last two corrections. Real estate dropped by half or more in many cities (around the world) during the Great Recession, such as Stockton, California, Detroit, Michigan, Las Vegas, Nevada, Miami, Florida and Phoenix, Arizona (to name a few). Low Interest Rates Create Bubbles Low interest rates create bubbles. As you can see in the chart below, asset bubbles were the rocket fuel of the last two recessions – and the leading indicators of the correction. Inflation and unemployment were both low in 2007 and 2000. The asset bubbles today are even more troubling, particularly when you look at debt and underfunded pensions. Bonds are in trouble this time around due to the amount of credit risk (debt) in the world. Over half of the investment grade corporate bonds are rated at the lowest level. One canceled order or customer could take the company into junk bond status. Also, the Feds don’t have enough room to lower rates and help the economy went it hits troubled waters, as it inevitably does. If the Federal Reserve Board is not able to raise interest rates before the next correction, the correction itself could be longer, deeper and more harrowing. Business cycles are cyclical. This is the late stage of the current expansion by most measurements. Asset bubbles have made real estate and stocks unaffordable for many Americans. (If you’re not aware of the high price to earnings ratio in stocks, it will pay to get educated on this.) According to Robert Shiller, a Nobel Prize winning economist and Yale’s professor of economics, “The only time in history going back to 1881 when [CAPE] has been higher are, A: 1929 and B: 2000.We are at a high level, and its concerning. People should be cautious now.” Retiring Boomers are putting pressure on the entitlement expenditure. BREXIT and tariffs will affect the U.S. economy negatively. (Tariffs have increased our trade deficit and taken it to an all-time high.) As former Federal Reserve chairman Alan Greenspan noted in an interview on CNBC on April 12, 2019, “The CBO is putting out huge forecasts of the deficit and nobody seems to mind. They will mind when it gets monetized [as inflation].” So, what do you do when you see financial storms brewing on the horizon? You fix the roof while the sun is still shining, relying upon time-proven systems that work. Buy and Hope has been riding the Wall Street rollercoaster up and down, losing more than half in each Recession, and then barely crawling back to even again before the next financial crash. You can’t afford those kind of losses this time around, particularly when the solutions are so simple. Wisdom is the cure. If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. I'm also be hosting a Real Estate Master Class in Denver on April 26, 2019 and an Investor Educational Retreat April 27-29, 2019. (You'll have to act fast to join me there!) Click on the flyer links below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more and to register now. Other Blogs of Interest The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  A dozen Indonesian students gathered at the U.S. Embassy in Jakarta (at left in the split-screen video monitor) had the opportunity to query their American high school counterparts on their interests, experiences and culture during the interactive video link-up recently at NASA Dryden's Aerospace Exploration Gallery in Palmdale, Calif. Photo c/o NASA. May 12, 2019. Wiki Commons. Used with permission. We’ve had a series of Initial Public Offerings recently that would have been better labeled as Liquidity Events. Venture Capitalists and early stage investors (including the founders of the company) need to turn their paper money into real currency and things (like homes & nest eggs). So, they go public. Many of these companies are staples of our new sharing, connected and gaming economy, such as Lyft, DropBox and Snap Inc. (Click on the blue highlights for my original IPO warnings on Lyft and Snap Inc.) However the challenge for investors is often more one of valuation, or profitability. If you get caught up in the story of how the company is transforming the landscape of our lives, and fail to look at the fundamentals of sound business, you might drink the Kool-Aid and wake up with losses. So, is Zoom more of a Lyft or more of a Google? Google’s IPO was one of the strongest of all-time. The company had a strong executive team and board, had doubled in revenue growth and was profitable. Google launched in 2004 – just two years into the bull market, so it also had the wind at its back in terms of macro movement. Let’s line up the numbers of Zoom … Zoom has many strengths. The company is the best-in-class. It is achieving viral marketing of its video conferencing by offering free conferences to everyone (with limited time and number of attendees). Many of those freebies, and the friends they invite in, are becoming paid subscribers. The company is also profitable, bringing in $7.6 million in net income for fiscal year 2019. Revenue doubled year over year (up 118%), to $330.5 million. Zoom was named #2 Best Company to work for by Glassdoor in 2019, and Eric S. Yuan, Zoom’s CEO has been racking up the awards for his leadership. However, there is an issue with the board. It’s overweighted with finance people, and underweighted with technology leaders, government relations specialists, product visionaries and marketing geniuses. So, whereas Google was finding ways to diversify its revenue stream under the experienced guidance of Eric Schmidt, it appears that Zoom is focused mainly on subscriptions. This will be a problem if the economy weakens, and individuals find that basic expenses outweigh their desire to convene. Also, when you get too many finance people in the room, there can be too much focus on monetization, and not enough on innovation. The worst example of this was the Sears Holding Co. board. So far, Zoom is doing everything right. However, Microsoft is likely to awaken and want to make Skype more competitive, and this is where the technology and government relations oversight can be key. Zoom shares are expected to hit the NASDAQ stock exchange this week, with trading to start at $28-$32/share. According to Business Insider, at the high end, that would make Zoom Video Conferencing (symbol: ZM) valued at $8.25 billion. Investors have become too complacent with lofty valuations. At the current growth rate, Zoom’s revenue should grow to over half a billion this year. However, the actual earnings ($7.6 million) are a small fraction of the valuation. Even if the earnings triple or quadruple as revenue scales, the valuation of $8.25 billion is still rather rich. If the market were going up, then perhaps you could make a case of buying Zoom high, in the hopes of selling higher. However, there are at least 10 events and economic concerns going on this year that could drive general market weakness. (Click to read those.) So, here’s another unicorn that might be worth more to look at (or to use) than to own, at this time and price. By looking behind the splashy painting, and into the fine print of the numbers, you, too, can identify the Unicorn IPOs from the Zombies. It's no accident that my track record on these IPOs is so high. (Lyft and Snap weren't the only IPOs I said to avoid. Google wasn't the only one I touted on television.) If you'd like to learn these strategies firsthand, join me at my Colorado Investor Educational Retreat this April 27-29, 2019. I'll also be hosting a Real Estate Master Class the day before (April 26, 2019). Click on the flyer links below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more and to register now. Other Blogs of Interest 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Fix the Roof While the Sun is Shining. The 10 Events That Will Drive (or Tank) the Economy in 2019. John F. Kennedy Jr. famously said, “The time to fix the roof is while the sun is shining.” As we enter the 11th year of this recovery, it is definitely time to do a full assessment of our roof, testing where the vulnerabilities lie and fixing them now. Most Americans are going to need an outside opinion for this. Why? Would you hire the roof contractor who let the storm flood your home last time? If you lost more than 30% in the Great Recession and you haven’t made any changes to your plan, then now is the time to get an unbiased, second opinion. And here’s why. There are at least 10 areas of economic vulnerability – many which are not in the headlines yet – that make 2019 a rather precarious year for stocks and bonds. The 10 Events That Will Drive (or Tank) the Economy in 2019.

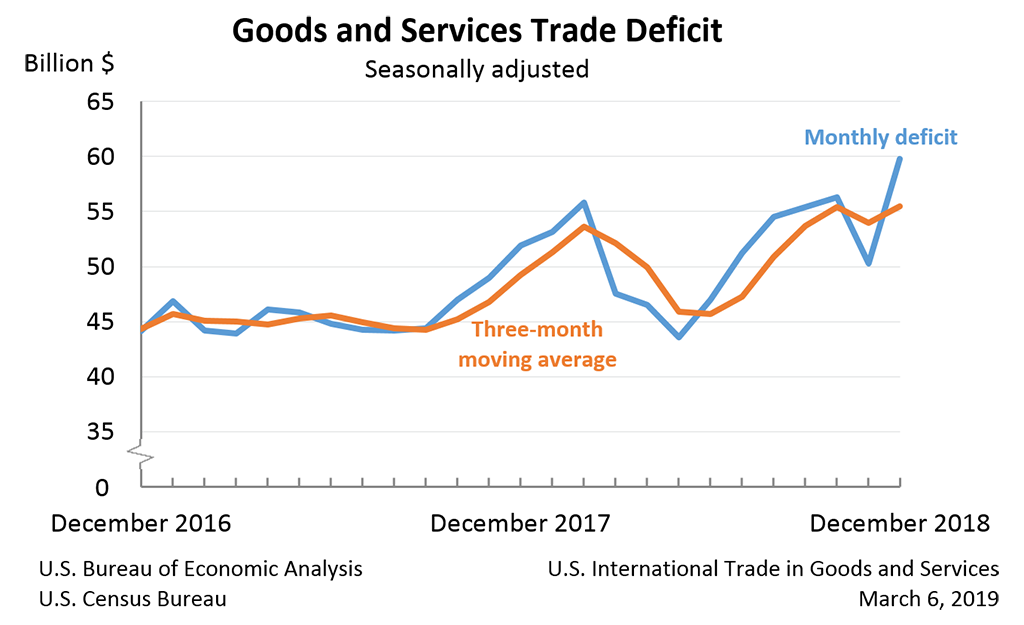

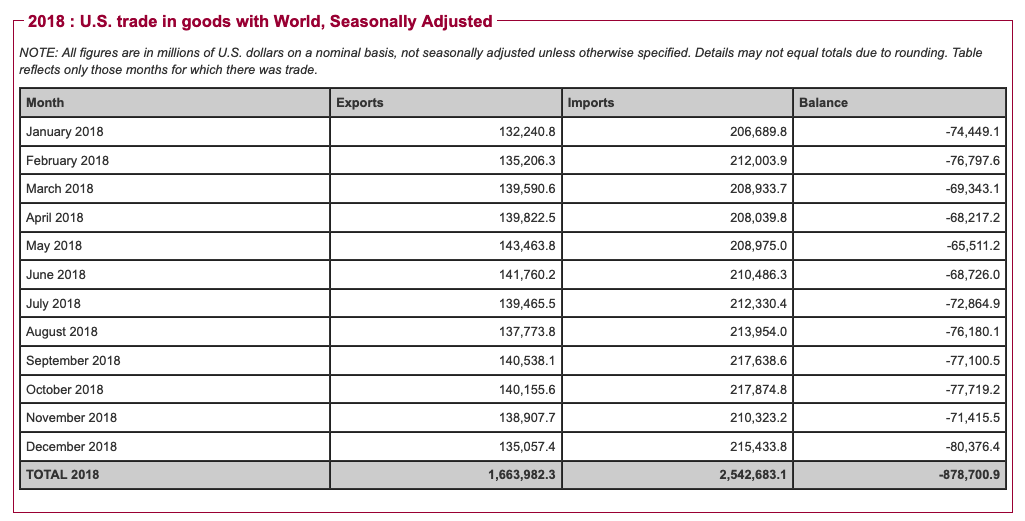

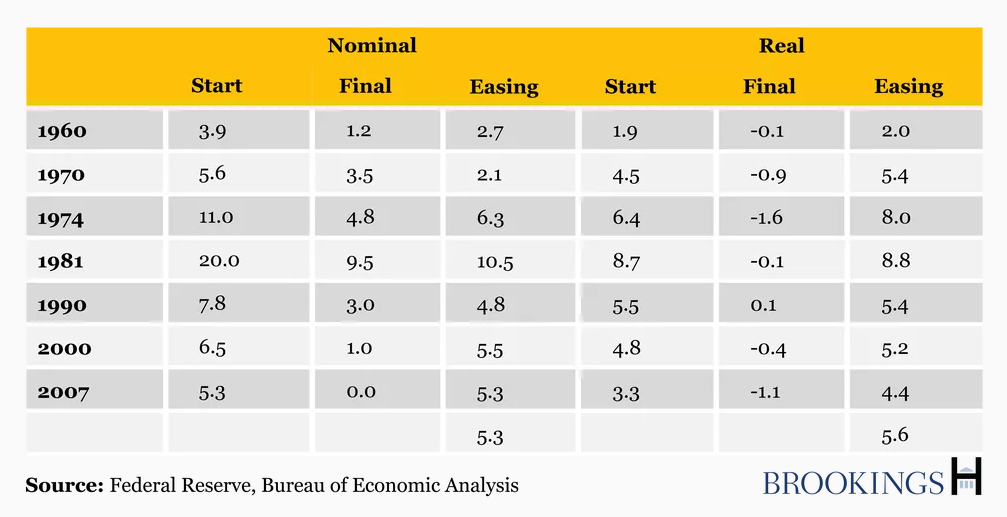

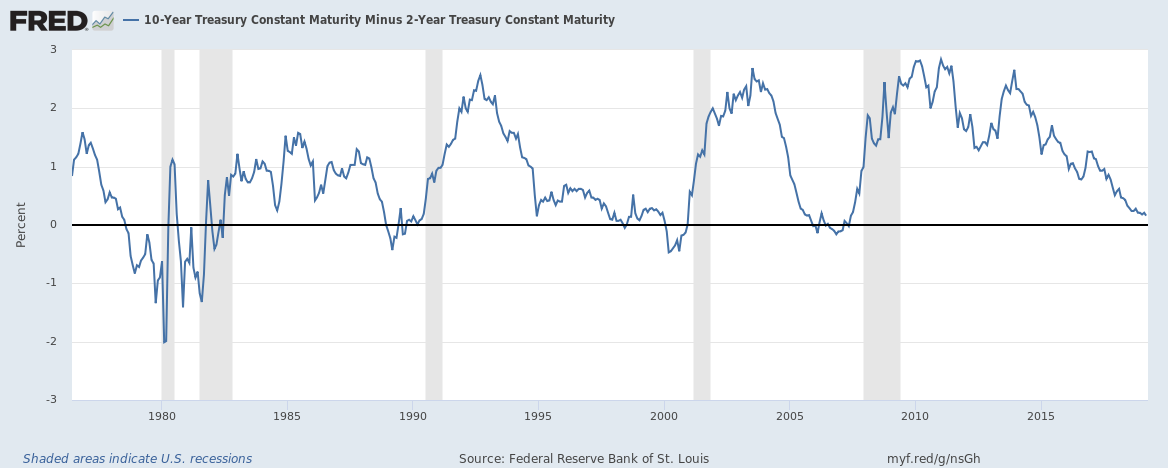

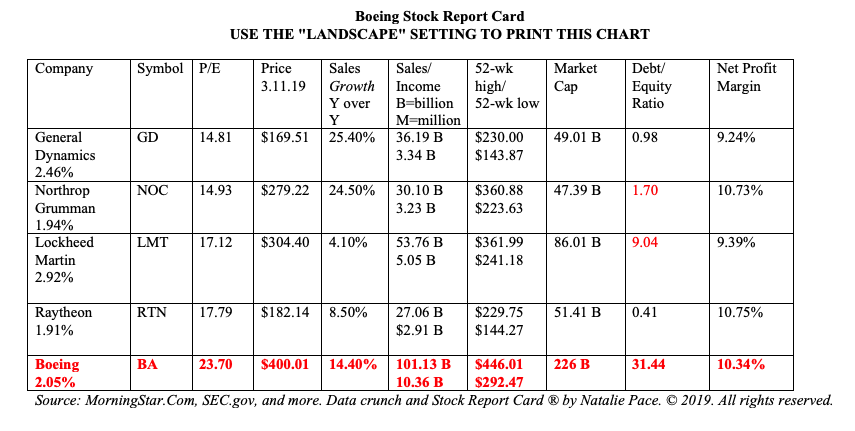

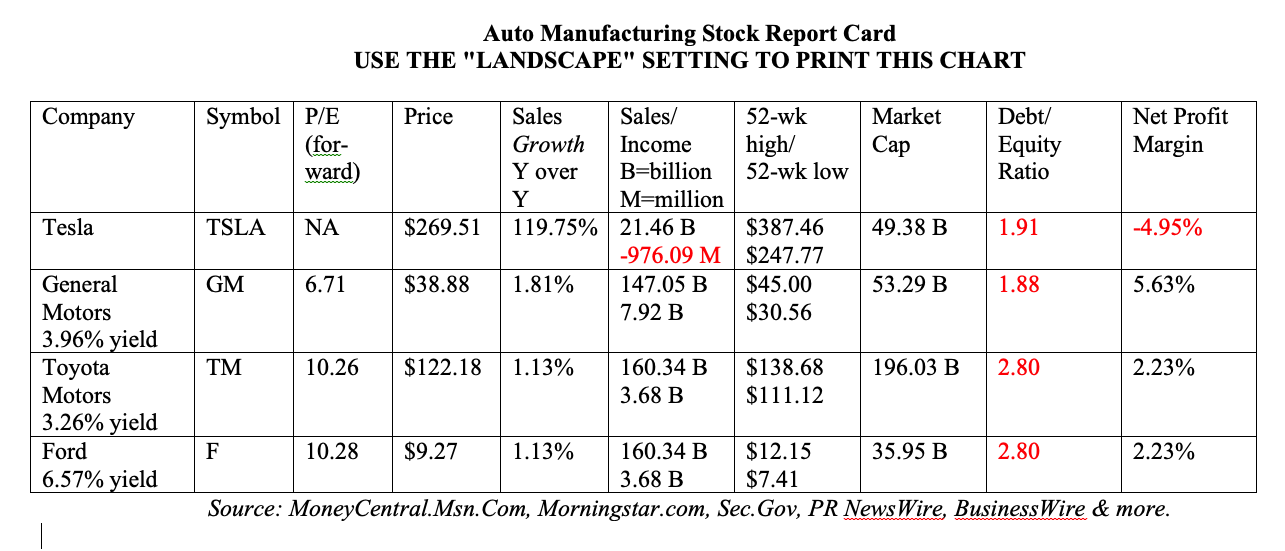

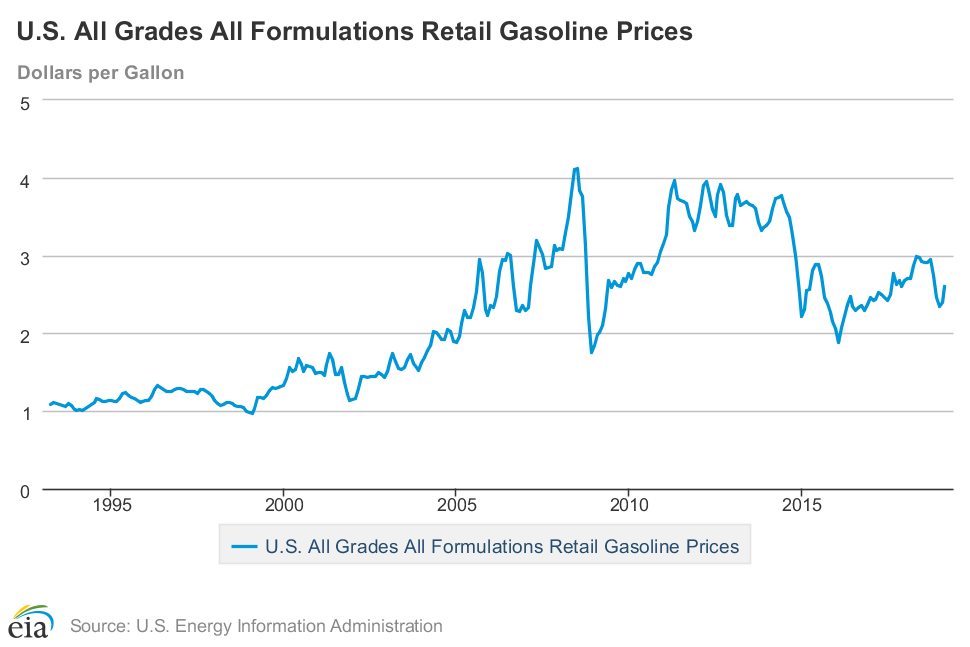

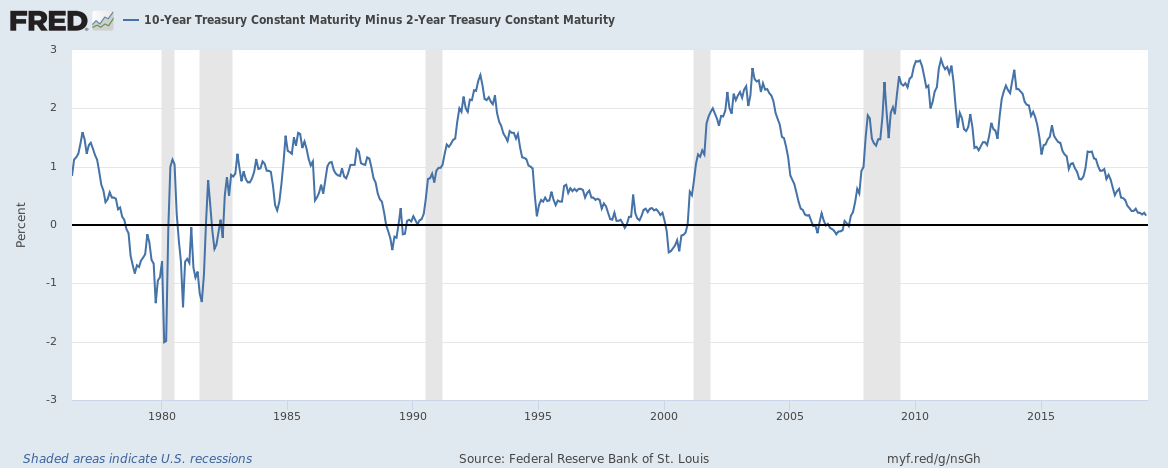

And here are the facts on each point. The 10 Events That Will Drive (or Tank) the Economy in 2019. 1. Stagnant GDP Growth. GDP growth in 2018 was 2.9%. 2019 GDP growth is predicted to slide down to 2.1%, with the 1st quarter 2019 GDP growth to fall somewhere between 1.4-2.3% (potentially under 4Q 2018’s disappointing 2.2% growth). The 1Q 2019 GDP growth report will be released on April 26, 2019. Investors aren’t fond of low GDP numbers. 2. The Debt Ceiling Was Hit on March 1, 2019. The debt limit was hit (again) on March 1, 2019. Most Americans aren’t aware of this, and it was under-reported in the mainstream media. Trying to locate a copy of the letter that Treasury Secretary Mnuchin send to Nancy Pelosi is next to impossible. (Click on Mnuchin to access.) The U.S. public debt is now at $22 trillion. Add in consumer debt, corporate debt and loans and municipal and state debt, and that number skyrockets to over $72 trillion. The U.S. must raise the debt ceiling before it runs out of money to pay its bills, which is predicted to be around September 30, 2019, give or take a few weeks (source: CBO.gov). If the debt limit is not raised before that X date, the U.S. risks a credit downgrade. Wonder who owns all of this debt? You do! Click to read my blog outlining the foreign and domestic holders of the U.S. debt. FYI: Russia sold off almost all of their U.S. treasuries in April of 2018 and has been stockpiling gold. 3. Will the U.S. Keep AAA Rating with Fitch Ratings? During the last Debt Ceiling crisis in 2017, Fitch Ratings warned, “If the debt limit is not raised in a timely manner prior to the so-called “x date” Fitch would review the US sovereign rating, with potentially negative implications.” This possibility was reiterated by Charles Seville, a senior director at Fitch, in January of 2019, during the government shutdown. Both Fitch and Moody’s expect the Debt Ceiling to be raised before the Treasury runs out of money, which is predicted to be sometime in August. (Last time, the White House made a deal with the Democrats, against their own party, to raise the Debt Limit.) In that event, the Debt Limit won’t generate a downgrade, but is a reminder of the unsustainable path of debt that the U.S. is currently teetering on. If X date is hit without a deal, both agencies will likely review the U.S. AAA credit. Fitch is more likely to downgrade than Moody’s. 4. Putin/bin Salman Oil Partnership. There is a very high correlation between oil prices and recessions. So, the lower prices of gasoline and other petroleum products over the last few years have been helpful to economic growth by giving consumers a little room in their budget for other spending. However, on December 7, 2018, Putin and Saudi Arabia Prince Mohammed bin Salman (the one accused of killing journalist Jamal Khashoggi) agreed to cut oil production. This is intended to increase the price of oil. If it works, this will be a drag on the economy. 5. China/U.S./EU Trade War & Tariffs. Tariffs hurt economies. Currently, the U.S. government is imposing tariffs on China and has threatened to impose them on Canada and Europe. The auto manufacturing and solar industries have suffered a dramatic increase in the cost of their parts. Farmers have suffered. And the U.S. trade deficit has skyrocketed to heights never seen before. 6. Interest Rates. Low interest rates create bubbles. Check out the Asset Bubble Chart below. Low interest rates will also create a massive problem for the Federal Reserve during the next recession. As former Secretary of the Treasury Lawrence H. Summers explains it, “Interest rates are reduced by 5 percentage points to combat recessions” Therefore, in the next recession, we risk “policy impotence” because there just isn’t enough room to lower rates enough to goose growth. Summers doubts that quantitative easing alone can do the trick. 7. Flat or Inverted Yield Curve. An inverted yield curve is 100% associated with recessions for the last half a century. Part of the reason for that, as Liz Ann Sonders, the chief investment strategist for Charles Schwab explains, is that having the short-term rate (the rate at which banks borrow) and the long-term rate (the rate at which banks can lend) be inverted means that banks lose money. So, financials are out of favor at this time, too, from an earnings perspective. However, the banks are buying back their own stock at records not seen since pre-Great Recession. According to Howard Silverblatt, the senior index analyst at S&P Dow Jones Indices, Wells Fargo spent $29.153 billion on buybacks and dividends in 2018, which is $8.46 billion more than the company earned (at $20.69 billion). 8. Escalating Public Debt (and debt of every nature really). See above for the details on the $72+ trillion in total debt and loans in the U.S. As Alan Greenspan said in an interview on CNBC on April 12, 2019, “The CBO is putting out huge forecasts of the deficit and nobody seems to mind. They will mind when it gets monetized [as inflation].” 9. Housing Market Slowing (source: The National Association of Realtors) Home sales are down in 2019, with the most recent report from February 2019 home sales slowing 1.8% over last February 2018. The main issue is unaffordability. Sales prices are at an all-time high, with the median existing home price for all-types of homes at $249,500, up 3.6% from a year ago. (Refer to the above Asset Bubble Chart.) 10. Policy Impotence in the 11th year of the Bull Market. Despite ample evidence that 5% Fed Fund rate is the basis needed before a recession, and growing evidence that inflation above 2% would actually be healthier for the economy, the Administration keeps Tweeting for lower interest rates. In the short run, that might make the economy look stronger than it is (something that all politicians like to brag about, regardless of which side of the aisle they sit), by promoting more asset bubbles. Additionally, we see 1% GDP growth for every 10% increase in stock prices (according to Alan Greenspan in his April 12, 2019 interview). In the long run, lowering interest rates prematurely would be a devastating move, causing policy impotence to help make the “landing” of a correction/recession “softer.” In the 11th year of a bull market, during a global economic slowdown, this risk becomes increasingly pronounced. Learning how much you have at risk, and how safe and diversified you currently are, from a qualified, independent, unbiased source, could protect you from another financial catastrophe, such as occurred in 2008 and 2000. As you can see from the 10 points above, the economy in 2019 is far more precarious than it was in 2000 or 2008. Real estate prices are higher, stock prices are higher, bonds are in a bubble, the trade deficit is higher and debt is absolutely astronomical. Wisdom and time-proven strategies are the cure. The economic landscape can change rapidly. Time proven systems will be your ally. Join me at my Colorado Investor Edu Retreat, where we’ll examine how to protect your assets, learn what's safe in a world where stocks and bonds are in a bubble and invest profitably in high growth opportunities (like cannabis). Call 310-430-2397 or email info @ NataliePace.com to learn more about the retreat, or to request an unbiased second opinion on your current budgeting and investing plan! Other Blogs of Interest Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. To date, LYFT investors have suffered losses of almost 35%. As many late-cycle IPOs tend to be – the LYFT IPO was important as a liquidity event for insiders, even though it has cost investors who are new on the scene. Founders and venture capitalists can only hold paper money for so long before they want to turn it into a home or jet or something. This is what I warned about two weeks prior to the Lyft IPO. Click to see that blog. So, is Uber driving along the same road? On the face of it, Uber would appear to be a better investment. The company’s board is made of veteran global VIPs who know how to navigate sensitive government relations – something that is critical to the future of Uber, Lyft and ride-share in general, as the business premise itself is being challenged in many countries on many fronts. One of the fundamental challenges that ride-share faces is the classification of the drivers as independent contractors. Many European countries believe that drivers are employees the minute they turn on the ride-share app. Uber argues that they are a technology company that enables individuals to make a little dough on the side. That argument lost in England (Uber is appealing to the Supreme Court), in Switzerland and has run into tax problems in The Netherlands. At stake are mountains of expenses, including taxes, benefits and driver expense reimbursement. If drivers worldwide were classified as employees, it’s hard to imagine Uber or Lyft surviving. Since ride-share is so popular with people, it’s also hard to imagine countries wanting to kill this movement. Lyft will benefit from Uber’s ability to trail blaze through the red tape, while keeping their business model in tact. Uber’s independent chairman Dr. Ronald Sugar, the former chairman and CEO of Northrop Grumann, is no stranger to getting governments on board with his vision. To assist him, Uber has also stacked the board with other global CEOs, including Wan Ling Martello, the former CEO of Nestle AOA (Asia, Oceana and Africa) who is also an Alibaba boardmember, John Thain (former CEO of Merrill Lynch, during the makeover) and H.E. Yasir Al-Rumayyan, the manager of the sovereign wealth fund of Saudi Arabia. By the numbers and with such a very strong executive and board team, Uber buries Lyft in potential. (Lyft has a strong board, but is still run by its co-founders.) Uber is expected to come in with a $100-$120 billion valuation. Lyft’s value has dropped to under $20 billion. Uber was profitable in 2018, with $997 million in net income, whereas Lyft lost almost a billion ($911.4 million). Uber’s 2018 revenue was $11.3 billion, compared to Lyft’s $2.2 billion. However, Lyft benefitted greatly from Uber’s brand crisis in 2017, when former CEO Travis Kalanick, along with other executives and board members, were accused of basically being trogolodytes, stuck in the Stone Age with regard to their attitudes toward women. In 2018, while Uber scrambled to replace the executives under attack, including Kalanick, Lyft’s revenue more than doubled. Given the negative headlines that tarnished Uber’s brand, the company posted strong growth of 43%. Uber leapt into action to turn the ethos and culture around. Uber’s board now boasts of 3 women and 5 board members of color (including CEO Dara Khosrowshahi, who is Iranian). Mr. Khosrowshahi is a very respected CEO, formerly of Expedia, who is an M&A and growth master. Perhaps the strongest indicator that the brand has recovered is that we’re still “Uber-ing it” instead of Lyft-ing or catching a cab. Uber still has Kalanick and a few of his cronies on the board. However, the overall trend-line is that Uber is aimed at becoming the next blue chip – a worldwide brand with a vision and product pipeline that is transforming transportation and will be leading innovation for the next half century. So, should you buy into the Uber IPO? At some point, you will definitely want to be an Uber shareholder. However, any IPO in the 11th year of a late-stage business cycle risks rewarding insiders at the expense of the new investors. Uber’s potential spans the stars and includes autonomous vehicles and even flying cars. However, as with any rewarding investment, it’s important to purchase your shares at a great price. Should a company with $11.3 billion in revenue carry a value of $120 billion – on par with Nvidia and Paypal? Or is the whole lot overpriced? Alan Greenspan, Warren Buffett, Robert Shiller and multiple other economists have been warning for over a year that stocks are in a bubble. We might have grown numb to astronomical P/E ratios. However, the markets tend to humble those who ignore valuations in favor of hype. For my money, I’ll catch a ride with Uber after the insiders cash in their shares and the pricing is more on my side. Uber filed its S-1 yesterday and has launched its roadshow. Shares should be publicly available sometime over the next two weeks. Many, but not all, of Uber’s insiders have a 180-day lockup period. The economic landscape can change rapidly. Time proven systems will be your ally. Join me at my Colorado Investor Edu Retreat, where we’ll examine how to protect your assets, learn what's safe in a world where stocks and bonds are in a bubble and invest profitably in high growth opportunities (like cannabis). Call 310-430-2397 or email info @ NataliePace.com to learn more about the retreat, or to request an unbiased second opinion on your current budgeting and investing plan! Other Blogs of Interest Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. On Friday, April 5, 2019, after the markets closed (companies like to release bad news this way), Boeing announced that the company would cut production of its 737 airplanes from 52 per month to 42 per month. According to Boeing’s CEO Dennis Muilenberg, “We're adjusting the 737 production system temporarily to accommodate the pause in MAX deliveries, allowing us to prioritize additional resources to focus on software certification and returning the MAX to flight.” In the same press release, the company admitted that the 737 aircraft's “MCAS function” was a “link” in a chain of events that caused the Lion Air Flight 610 and Ethiopian Airlines Flight 302 accidents. Boeing is working on a software update “that will prevent accidents like these from ever happening again.” As might be expected, investors responded by selling off the stock in after-hours trading on Friday, continuing the sell-off today. The stock is trading at $374.61, down 16% from the all-time high of $446.01 on March 1, 2019. The all-time high occurred just 10 days before the Ethiopian Airlines fatal (and heartbreaking) crash on March 10, 2019. Since then, more and more bad news for Boeing has unfolded. But the stock has stayed fairly resilient. How’s that the case? Buybacks In short, buybacks. The 737 production is not the only thing that Boeing will have to cut. Boeing has one of the biggest buyback programs on Wall Street. On the Boeing investor’s home page, the company boasts that it has given out $50 billion over the last five years in buybacks and dividends. Link The problem with excessive spending on buybacks and dividends is that, at least in 2018, the amount given back was more than the company made. In other words, like many dividend-paying, debt-laden Blue Chips, Boeing has been using buybacks to prop up their own stock, which makes their earnings look stronger than they really are, and lowers the price-to-earnings ratio (by reducing the share count). In 2018, Boeing repurchased $9.3 billion in shares and paid out $4.6 billion in dividends, for a total cost to the company of $13.9 billion. Since the net income of 2018 was only $10.45 billion, Boeing paid out $3.45 billion more than it earned. At the end of 2018, Boeing’s cash was down to just $7.6 billion, from $11.7 billion in 2014. That’s flying a little too close to the trees, considering the production cutback. So, it’s likely that Boeing will be borrowing as quickly as possible. That would trigger a rating for the debt issuance, which will be negatively impacted from the production cut and the grounding of Boeing’s largest revenue generator, the 737. This doesn’t mean an automatic downgrade, but it will be included in the analysis. The 737 accounted for 70% of the planes delivered in 2018, at 580 out of 806. The company may wish to postpone raising debt until they get the all-clear on delivering the 737 again. In this scenario, they may have to preserve capital and postpone share repurchases, allowing the stock to trade freely on investors’ whims. As you can see from the attached Stock Report Card, Boeing already has an astronomical debt/equity ratio and the highest price to earnings ratio of its peers. So, given the amount of debt that Boeing already has, combined with all of the lawsuits over the plane crashes and a worldwide grounding of the 737, Boeing may find their loan or bond covenants with strings attached – such as the money can’t be spent on buybacks or dividends. The last company to make headlines for paying out more in buybacks and dividends than it earned in income was General Electric. General Electric’s dividend has been slashed to 4 cents, and the share price has dropped by more than 70% from where it was in 2017. Boeing’s capital situation, and a pause in the company’s share repurchases, could affect the share price as much or more than the 20% reduction in 737 production. Boeing is authorized to repurchase up to $20 billion of its own stock. However, the math doesn’t add up on executing that at this time. Boeing executives and staff will be working around the clock to get the software fixes needed to get the 737 back in the skies as quickly as possible. Boeing is a stalwart brand (until these latest tragedies) with products that are very much needed in today’s world. There are a slew of government insiders on the Boeing board to help facilitate a fast approval once the 737 is ready to fly. However, whenever that occurs, which could be within a few short months, the prudent investor will be looking at the balance sheet to determine whether or not that 2.10% dividend is worth gambling your principal on at this time. The production slowdown will impact earnings for at least a few quarters going forward. Boeing is not the only debt-laden blue chip that is spending a lot more propping up its stock and paying out dividends than it is earning in net income. Stay tuned to my blog at NataliePace.com/Blog for a more complete report later this week. As the economic landscape changes rapidly, time proven systems will be your ally. Join me at my Colorado Investor Edu Retreat, where we’ll examine how to protect your assets, learn what's safe in a world where stocks and bonds are in a bubble and invest profitably in high growth opportunities (like cannabis). Call 310-430-2397 or email info @ NataliePace.com to learn more about the retreat, or to request an unbiased second opinion on your current budgeting and investing plan! Other Blogs of Interest Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. On April 3, 2019, Tesla issued a press release on their first quarter 2019 vehicle delivery count. At 63,000, it was down 31% from the deliveries in the 4th quarter of 2018 (90,700). Production was also lower, at 77,100 vs. 86,555 respectively. That combined with the SEC’s full-court press on Elon Musk’s Tweets sparked a sell-off of Tesla stock, bringing the share price down near its 52-week low. Should You Buy, Sell, Hold or Avoid Tesla Stock? Tesla’s volatility is a reminder that in today’s world, if you’re going to invest in individual stocks, you should have the following strategies in mind. (Remember that successful nest egg investing is a different strategy; call 310-430-2397 to learn time-proven wealth building systems.)

Below is additional information on each point. What is Tesla’s Outlook for 2019? Growth Tesla is projecting +45%-65% growth – from 245,400 vehicles in 2018 to an expected 360,000-400,000 vehicle deliveries in 2019. That kind of growth this late in the business cycle is outstanding. Only cannabis is showing stronger growth than this. (Click to access the Cannabis blog.) Additionally, Tesla’s Shanghai Gigafactory is projected to be up and running in 2019, by year’s end. Although the first quarter deliveries news took Wall Street investors by surprise, first quarter weakness was predicted in the forward outlook section of the 4th quarter and full year 2018 Letter to Shareholders. On January 1, 2019, Elon advised shareholders that “The gap between production and deliveries in Q1 will create a temporary but predictable dip in our revenues and earnings.” Profitability In the 4th quarter of 2018, Tesla was cash positive, generating $139 million in net income. The 1st quarter 2019 could experience a net loss, due to the lower deliverables and a one-time restructuring charge. A 30% drop in auto revenue (based upon the same percentage drop in deliverables) would result in revenue in the $5.330 billion range. A massive pullback in revenue, and a revert back to cash negative operations, will not be welcome news to investors, when the actual numbers are confirmed in the 1st quarter 2019 earnings report, around May 7, 2019. Full-year 2019 is predicted to be cash-positive for Tesla, with a “25% Model 3 non-GAAP gross margin at some point in 2019,” according to the January 1, 2019 letter to shareholders. The Auto Manufacturing Industry Much has been made of Tesla’s debt. However, Ford and General Motors have much higher debt to equity ratios, with the additional burden of pensions and other post-employment benefits. (See the Stock Report Card below.) Though Tesla will likely be cash-negative in the first quarter of 2019, Tesla’s margins are not far from the low margins that are endemic in the auto manufacturing industry. (High volume; low margins, similar to retail.) Tesla is the clear winner in the industry in terms of outstanding sales growth. This trend could accelerate with oil prices on the rise. (Click to read my oil blog.) In 2018, there was a surge in the sales of trucks, which accounted for 70% of dealership sales (source: National Automobile Dealers Association). A decade ago, 52% of the market was cars, with 48% light trucks. NADA Chairman Wes Lutz explained the trend, writing, “One of the main factors for this shift has been continued low oil and gasoline prices and the fact that crossover utility vehicles are nearly as fuel efficient as their sedan counterparts.” This has caused Ford and GM to all but abandon their sedans and lean heavily into their trucks. Meanwhile, the Tesla 3 sedan was yet again the best-selling mid-sized premium sedan, selling 60% more units than the runner up. The auto industry is expected to have 16.8 million new vehicle sales in 2019. As consumers continue to understand just how reliable and fun Tesla vehicles are, and how much cheaper it is to fuel an electric car vs. a gas guzzler, the trend might shift toward Tesla, just as it did to the Prius in 2004, when oil prices began to rise. Even now, with gas prices still relatively low at $2.59/gallon on average, the fuel savings of owning a battery electric vehicle (BEV) can be half or more over gas-powered vehicles (source: University of Michigan). The Macro Economy The global economy, including the U.S. economy, is predicted to slow down in 2019. 2018 saw GDP growth of 2.9%. 2019 GDP growth is predicted to slow to 2.1%. The Federal Reserve Bank of New York forecasts that the 1st quarter of 2019 growth may stall out to just 1.4% growth, with 1.9% growth in the second quarter of 2019. The Elon Musk Hearing. What About That Tweet? Clearly the SEC is making a full-court press on Musk – something that seemed apparent to Judge Alison Nathan. “Put your reasonableness pants on,” she advised both parties on April 4, 2019 at the hearing where the SEC had hoped to hold Musk in contempt of their previous settlement. What’s at the heart of the renewed SEC attack on Musk? A tweet he sent out saying that production would be at 500,000 autos by year’s end. Musk was quoting a statistic that was listed in the 4Q 2018 letter to Shareholders, which stated, “Barring unexpected challenges with Gigafactory Shanghai, we are targeting annualized Model 3 output in excess of 500,000 units sometime between Q4 of 2019 and Q2 of 2020.” Musk’s Tweet was corrected a few hours later to be more precise. All of this occurred after the close of trading. There has been a lot of speculation around whether Musk violated the terms of a settlement with the SEC where all of his Tweets are to be previewed by an internal investor relations person for accuracy prior to posting. However, a case can be made for this material information being available a full month before the Tweet in question. (How I wish there was an agency fact-checking our politicians with this kind of zeal!) The judge gave both parties two weeks to come up with a reasonable settlement. This is clearly not the decisive victory that the SEC wanted. While not a win for Musk either, it was at least not another nightmare. Investors were relieved by the news. Tesla stock is up 2.7% today. Think Capture Gains, Not Stop Losses When you are on a rollercoaster with as many ups as downs, if you set stop losses, you are losing every time the market pulls back, which is often. This is a losing formula. If you set capture gains, you are winning every time the market rises, which is just as often as the pullbacks! This is a winning formula. Take your profits early and often this late in the business cycle. If it’s a rock star industry, like cannabis, you might keep some skin in the game in case the stock goes to the moon. However, for most companies and industries, there is more downside potential than upside. With stocks at an all-time high, and price-to-earnings ratios higher than ever, there aren’t many bargains to be had. So, it’s better to err on the side of liquidity, which allows you to buy low on weakness, rather than worry about missing a market rally party, which might be almost over. Apply the 3-Ingredient Recipe for Cooking Up Profits ®.

So, Should You Buy, Sell, Hold or Avoid Tesla Stock? The Tesla 1Q 2019 earnings report is likely to be ugly. That will be issued around May 7, 2019. The 2nd quarter 2019 earnings report will benefit from the 10,600 vehicles that Tesla had in transit at the end of the first quarter. At the low end of Tesla’s forecasts, deliveries for the remaining three quarters of 2019 would be 99,000 on average (with the 4th quarter on track for 500,000 annualized, at 125,000/quarter). After the first quarter miss and weakness, that would be a pleasant surprise for investors. So, the Fourth of July deliverables report from Tesla could spark fireworks. In short, if there is continued weakness in the Tesla share price, particularly after the earnings report around May 7ish, 2019, I’d be tempted to buy in, with a limited investment, to capitalize on the upside surprise expected in July 2019. I’d adhere to the age-old, tried-and-true market aphorism of taking my profits early and often, based upon the headwinds of the macro economy. I would also employ a Capture Gains mentality over the Stop-Loss (losing) game plan. And I wouldn’t bet the farm. You don’t have to understand economics to employ a time-proven easy-as-a-pie chart nest egg strategy that earned gains in the last two recessions (when most people lost more than half) and outperformed the bull markets in between. Blind faith that someone else is doing this for you can be very expensive. (It’s a good idea to get a second and third qualified, unbiased opinion on your current plan, rather than just trusting that your money manager has protected you.) Wisdom is the cure. (Click to read more about the High Cost of Free Advice.) As the landscape changes rapidly, time proven systems will be your ally. Join me at my Colorado Investor Edu Retreat, where we’ll examine how to protect your assets, learn what's safe in a world where stocks and bonds are in a bubble and invest profitably in high growth opportunities (like cannabis). Call 310-430-2397 or email info @ NataliePace.com to learn more about the retreat, or to request an unbiased second opinion on your current budgeting and investing plan! Other Blogs of Interest Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. On March 28, 2019, Wells Fargo announced that their CEO Timothy Sloan had resigned on March 26, 2019 effective immediately. The board has elected an interim CEO and president (C. Allen Parker) to take his place for now. Mr. Sloan will retire from the company on June 30, 2019. Just like that, Sloan has been erased from the website. If you click on the link to his bio, it actually redirects to Parker. The abrupt departure of any CEO at the end of the quarter (and just a few weeks before the 1Q earnings report is released) is a massive red flag. Succession plans usually allow generously for a transition period. Immediate departures are alarming. Add in the fact that Sloan was Wells Fargo’s CFO and COO prior to being named the CEO and you’ve got a neon sign brighter than the Vegas Strip. The fake account scandal revealed a corrupt corporate culture. However, instead of bringing in new blood, Wells Fargo actually promoted the executive (Sloan) who most bragged about all of the new accounts on earnings calls to investors during the height of the scandal. So, why the rush for “fresh perspectives” now? All signs point to problems with Wells Fargo’s first quarter earnings report. All of the banks, including Wells, have been issuing new debt over the last few months. Could this be to beef up their cash positions to buffer against the rough tides of an inverted yield curve? Will earnings be negatively impacted now that the loans banks offer pays them less than their own borrowing rate? Inverted Yield Curve Over the past few years, many banks have been on a field day, reporting solid earnings growth and outstanding profit margins. In the last quarter, Wells Fargo’s revenue was only down 4.09% (for obvious reasons), while their profit margins were a solid 24.37%. Goldman Sachs, Bank of America and Citigroup all reported revenue increases of 14.0%-18.5% year over year, with profit margins in the 19%-31% range. However, the yield curve inverted on March 20th, and has been flat throughout the first quarter of 2019. That will have a very negative on bank revenue and income. The inverted yield curve is also 100% correlated with recessions for the past half century. Will Wells Fargo Post A Terrible Earnings Report? The departure of a CFO turned CEO, at the end of a quarter that we already know is going to be squeezed (GDP is predicted to drop under 2.0% in the 1st quarter of 2019), is never a good sign for earnings. We won’t know how bad Sloan’s earnings report card really is until Friday, April 12, 2019 at 8 am ET. However, this abrupt event is definitely inauspicious for Well’s Fargo’s 1st quarter 2019 earnings report. Buybacks May Save the Share Price Wells Fargo repurchased 375.5 million shares of their own stock in 2018, for around $21 billion (source: S&P Dow Jones Indices). That was more than double the amount that the company spent on share repurchases in 2017. Clearly the company plan under Sloan was to keep their share price afloat with their own buybacks. In 2019, it may be more difficult to continue at that aggressive pace. With $9.5 billion given out in dividends and $21 billion in share repurchases in 2018, Wells Fargo’s “return to investors” of $30.5 billion was higher than the company’s net income of $22.4 billion. General Electric was slammed for that policy, once investors learned of it (after the company slashed their dividend and the share price imploded by 2/3rds). Again, we’ll know more about how all of this impacts Wells Fargo’s earnings on April 12, 2019. Before then, it’s a good idea to double-check your own holdings and funds to make sure that you are not over-exposed to this beleaguered bank. If you wait for the headlines on these red flags, it will be too late to protect yourself. You don’t have to understand economics to employ a time-proven easy-as-a-pie chart nest egg strategy that earned gains in the last two recessions (when most people lost more than half) and outperformed the bull markets in between. Blind faith that someone else is doing this for you can be very expensive. (It’s a good idea to get a second and third qualified, unbiased opinion on your current plan, rather than just trusting that your money manager has protected you.) Wisdom is the cure. (Click to read more about the High Cost of Free Advice.) As the landscape changes rapidly, time proven systems will be your ally. Join me at my Colorado Investor Edu Retreat, where we’ll examine how to protect your assets, learn what's safe in a world where stocks and bonds are in a bubble and invest profitably in high growth opportunities (like cannabis). Call 310-430-2397 or email info @ NataliePace.com to learn more about the retreat, or to request an unbiased second opinion on your current budgeting and investing plan! Other Blogs of Interest Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed