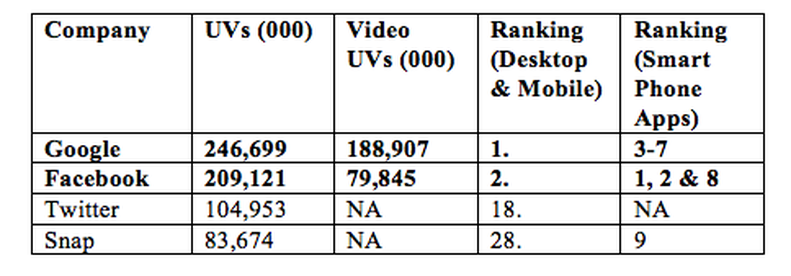

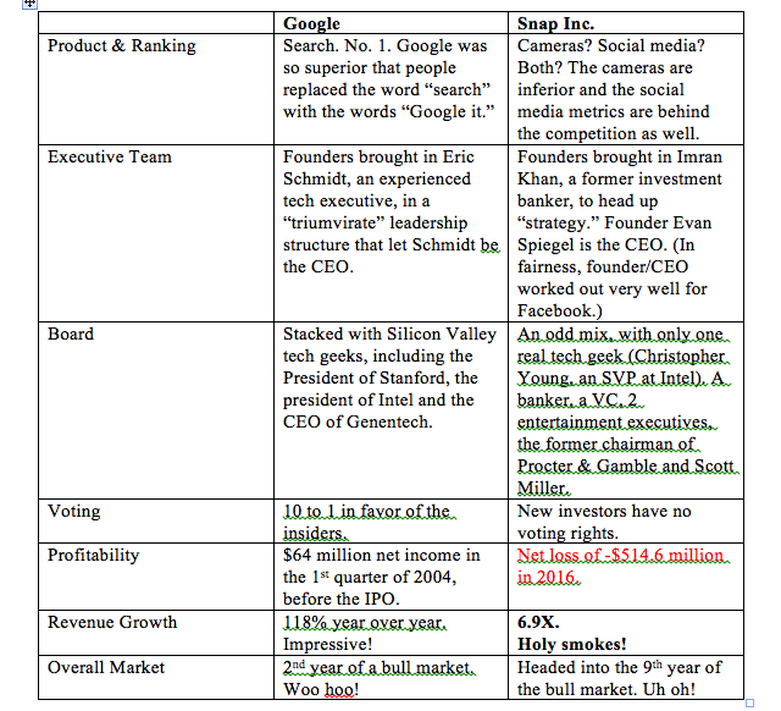

Will the Snap Inc. IPO be a spectacle, or will the disappearing app offer a disappearing IPO? To put the Snap IPO into better perspective, I lined up some of the key metrics alongside the uber-successful Google IPO on August 19 of 2004. The next gen social media platform Snapchat is now known as Snap Inc., a camera company. Snap Inc. intends to reinvent the camera because, according to the IPO filing, it is their “greatest opportunity to improve the way people live and communicate.” Hmmm. With that being said, you’d expect their first camera product to be drop-dead impressive. The attractive models wearing the new Snap Inc. Spectacles video recorder sunglasses are definitely eye candy. But a tech company has to be far more than skin deep. Twitter has proven that even when a tech company offers something unique and does it well (and is the 45th President’s favorite late-night toy), they need to be cash positive to catch an investor’s eye. Snap is struggling in both areas. Unique they have in spades. It’s the technology and cash burn that are of concern. Spectacles are fashion-forward sunglasses with a video recorder that gives a unique “first-person shooter” perspective. Spectacles started out as one of the hottest tech products of the year, going for as high as $1000/pair on eBay in November 2016. Since then, however, in only three months, the average sales price on eBay has dropped down to retail – at $130/pair. You can easily purchase your own Spectacles at Spectacles.com. When it comes to actual performance, the reviews of Spectacles fall flat. They look good. They’re fun. But the novelty wears off rather quickly. According to Avery Hartmans of Business Insider, “If you're buying them for everyday use, you might be disappointed… The camera is below-average.” Problems include that the camera doesn’t record well in low-light situations. HD is an option, but requires a lot of extra work. The social media side is stronger than the actual video capability, i.e. you might want to Snap Video a concert or a goofy stunt, but probably not a scenic landscape. Sometimes your hair flies in front of the camera. Who would dream of surfing or skydiving with Spectacles for their videos? The reviews and user experience of Spectacles is very different from the launch of, say, the iPhone. The novelty of smart phone technology is still jaw-dropping a decade later. So, does this doom the Snap Inc. IPO, which is scheduled to price on March 1, 2017 (Wednesday) after the markets close? Will investors want to court a company when their premiere product is more of a beautiful one-night stand? Snap Inc. revised their projections downward for the IPO on Feb. 17, 2017, according to Reuters, but still believes the market value of the company will come in at $19.5-$22.3 billion. Is Snap Inc. worth twice as much as Twitter and $20 billion more than GoPro? Below is where Snap lines up with users, compared to Twitter, Facebook and Google. As you can see by the media metrics, most Millennials are more active on Google, Facebook and Twitter. FYI: Facebook’s video/photo app Instagram is included with the parent company metrics. Comscore.com December 2016 Snap has one very attractive asset, which might seduce investors – revenue growth. In 2015, revenue was about $58.7 million. Last year, the company brought in $404.5 million – a jump of about 6.9 times. That is drop-dead impressive. If you go to the Snap app, there are actually more ads now than status updates. The ads are inviting, rather than offensive, on first look. Snap’s chief strategy officer Imran Khan boasts that Snap lets users "play with brands." Of course, that assumes that customers actually want to be sold stuff while they’re being entertained – a premise that users have been trying to escape for the past century. I, for one, didn’t stick around to play. When I found myself bombarded with ads, after I tried to look at some behind-the-scenes video of the Oscars Best Picture debacle, I ended my search abruptly and have been reticent to try checking out other updates since. To put the Snap IPO into better perspective, I lined up some of the key metrics alongside the Google IPO on August 19 of 2004. Data Crunch by Natalie Pace.

The problem with novelty products is that the shine can fade fast. The issue with companies that are having difficulty defining themselves, and are being forced to monetize quickly, so that the insiders can turn their paper profits into houses and cars, is that the customers may feel sold out. Since the chief camera product is not impressive – though it looks cool – and the main monetization plan is still advertising, it seems like a major misstep for Snap to be redefining itself as a camera company right before the IPO. Even a popular camera company like GoPro is only valued at $1.4 billion – not $20 billion. Snap is hot and perceived as a very innovative company, so it could get a bump from chatter on the investor boards. However, whereas Google took off like a rocket and has rewarded investors with a 10 times return on investment, Snap could easily be more like the Groupon IPO, which roared onto the scene and then lost 80% of its value over the coming year, and has been at the bottom of its trading range ever since. Whether Snap remains a “camera company” or returns to social media, it has little hope of competing with Facebook and Twitter (or even GoPro) without major technology innovation. Can a group led by entertainment executives and bankers hope to compete with tech giants backed by Andreessen Horowitz and Facebook? MySpace tried that route back in 2006, and it wasn’t a happy ending. Perhaps the best move that Mark Zuckerberg made was to uproot himself from Harvard and plant himself in Silicon Valley. The laid-back, look-cool Southern California vibe will only work if the executives discover the next Satoshi Nakamoto to run technology and innovation, and that’s less likely to happen on Venice Beach than it is in Palo Alto. In short, I’d let tomorrow’s Snap Inc. IPO update disappear, and check back later in the year (late September) to see if goofy and cool has become something more substantive, at a better valuation and price.

Rita Starnes

28/2/2017 06:57:20 pm

Thank you Natalie!

Hugh

1/3/2017 02:21:09 am

Thanks Natalie for your insight . 😊 19/2/2019 07:37:20 pm

Snap Inc. or simply "Snapchat" had its peak at the late 2015 and early 2016. But since Instagram had the very same features as Snapchat, we saw that some of the social media users chose Instagram instead, leaving Snapchat challenged. But up to these days, they are still making new filters which are impressive. Thus, I cannot say that Instagram has fully taken over Snapchat. There are still filters that cannot be done by Instagram, so I don't think Instagram is going to fade anytime soon. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed