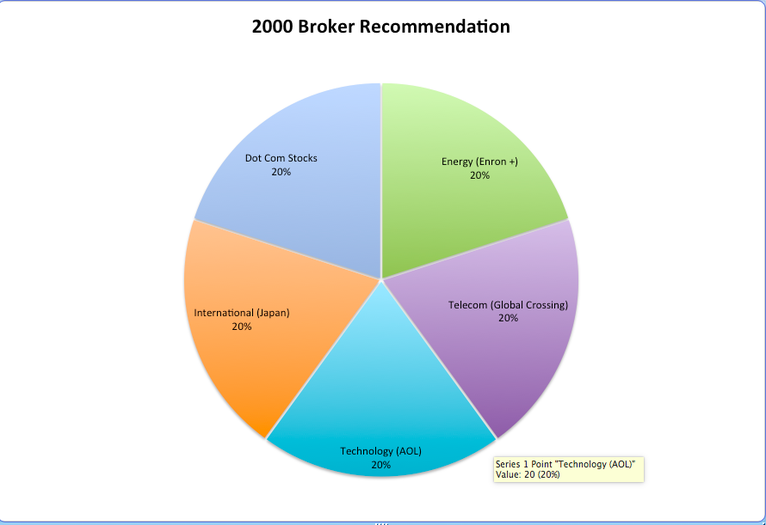

View of the Pacific Ocean from The Penthouse restaurant in Santa Monica, California USA. Photo: Natalie Pace. View of the Pacific Ocean from The Penthouse restaurant in Santa Monica, California USA. Photo: Natalie Pace. This morning I was blessed to wake up in a warm bed, and to breakfast at the Penthouse Restaurant in the beautiful beach town of Santa Monica, California, overlooking a calm blue ocean. Azure skies. A Surfer’s Christmas. Extraordinary. Awe-inspiring. Magical. I think I’ll put my toes in the frigid water and walk along the shore, drinking in a view that truly feels holy. What a great way to celebrate the Prince of Peace, the miracle of the candles, the blessing of family, and the sunshine, air, beauty and food that are our daily gifts from Mother Nature. As an aside, the Penthouse is one of the most epic views in the world, with food prices that are only slightly higher than normal. Many views this extraordinary are not available to the public, or at a price that is prohibitive. It’s definitely a place to visit when you come to the Los Angeles area (and it is where we do our Fire Ritual at the Valentine’s Investor Edu Retreat). Today, may you be rich in all of the things that money cannot buy. Family. Friends. Adventure. Offering (or receiving) a helping hand. Free hugs. I remind myself that these moments are the true holiday gift, and to drink them in. Thank God for a season dedicated to honoring peace and showing love, when we let our faith, love and fellowship bridge anything that might divide us. Gratitude is definitely the word of the day. A man recovering from a stroke is so grateful for the simple gift of organic strawberries and cookies that he tears up. I think more than anything he was simply touched to have been remembered. He also loves Harry’s Berries, and I know he will truly savor every bite! A friend recovering from surgery is so thankful that I washed her dishes that she thanked me for that even more than for the expensive wine and food basket. I am so grateful that I’ve been able to break bread with so many members of my family over the past few years, that my work allows me the freedom to be a nomad, crisscrossing the globe, rich in experiences, blessed with the wisdom of sustainable visionaries and world-renowned economists, and that I am able to deliver that information back to you. I am honored and blessed that you value these time-proven systems and my forensic, investigative analysis, and that you gift me your presence and your trust. What a treasure it is to have a “job” that consists of finding everyday solutions for everyday people to live a richer life, protect their assets, earn money while they sleep and provide for a better tomorrow. This is definitely my dream come true job. Happy Holy Days! May wisdom and right action be your talisman in 2017, and peace, love, fun and family be your treasure in the coming Holy Days. Below are a few blogs that might inspire you on Boxing Day. Feel free to leave me a Christmas message in the comments section of this blog at NataliePace.com or on my Twitter and Facebook pages. God Bless the Child, and Ron Finley. 2017 Crystal Ball: Real Estate, The Trump Rally, Gold, Annuities & More. Link. Earth Gratitude. 21 Visionary Leaders Offer Simple Tips for Saving Money and Living Green in a free, downloadable mini ebook. Life’s a Beach. When You Make It So.  Santa Monica Beach Pier This holiday, gift yourself the present of a life transforming experience in one of the most stunning, spiritual and fun cities in the entire world. Join No. 1 stock picker Natalie Pace at an intimate boardroom Investor Educational Retreat in the beautiful beach town of Santa Monica, Feb. 11-13, 2017. Now through midnight Christmas Eve, save 20% off of the price. Call 310-430-2397 or email [email protected] to learn more now. Only 5 seats remain available. Venice Beach, California. Where we play The Billionaire Game. Expand your possibilities. Learn how to live a richer life, provide better for your future and have thousands more every year in your annual budget (for fun and bucket list vacations). How? Stop making the billionaires rich at your own expense. Richard is saving tens of thousands of dollars on health insurance annually. J.A. is saving $4,800 a year on his mortgage. Mark used to spend $800/month on utilities ($9600). He now pays zero. Tracy made so much money on stocks that she spent a year traveling the world. Nilo earned gains during the Great Recession, when most people lost more than half of their net worth, with a system so simple that it was drawn up on a napkin. Love yourself. Bring someone you love. The Valentine's Investor Educational Retreat makes the perfect gift. And it pays for itself in budget savings alone within the first few months. For those or you who save and protect your nest egg, this fun and informative retreat could protect tens or hundreds of thousands of dollars. The Investor Educational Retreat is a complete money makeover that provides you with the blueprint for the life of your dreams. Living a richer life starts with wisdom. Call 310-430-2397 to learn more about how you can transform your life with The ABCs of Money that we all should have received in high school. The are many reasons why you want to do this now. Testimonials "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble," Joe Moglia, Chairman, TD AMERITRADE. "Since I met Natalie last Oct., at a work event, I've had a staggering year. Thank you and best wishes to you and your staff." Investment Consultant "One of the unexpected take-aways [from your retreat] has been a renewed sense of invigoration and attitude towards rebuilding and moving into the next adventure...” Sterling "I was one of the few and lucky people who actually made money, instead of losing more than half, in the Great Recession. So, thank you Natalie, for saving my retirement!" Bill and Nilo Bolden. "Thanks to Natalie, I can take a year off from life and simply connect to my life mission. Without income from my stock investments, I wouldn't be able to do this. You guys are changing lives. Thank you for your valuable work!!!” Tracy. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend it with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human capital.  My Gift to You. No Strings Attached. This holiday season, I am gifting you two new free online apps to help you adopt a Thrive Budget and personalize your own Nest Egg Pie Chart . See below for details. My Why Over the last few weeks I have been hearing some heartbreaking stories. Some from people who were duped by slick self help salesmen into investing their life savings, which were lost. To add insult to injury, this financial wound often cost them their personal home and forced them into bankruptcy. Few relationships survived. Others were sold into high-risk dividend-paying stocks, REITs and bonds that cost them half or more of their nest egg in the last recession. Retirees were forced to work at part-time minimum wage jobs to make ends meet. New people are falling for these same old tricks again, as time ticks closer to the next market correction. (It's been 8 years. The last two times that happened, the crash cost investors over half of their nest egg. Many lost their home as well.) Performance of the Dow Jones Industrial Average January 2008 - May 2009. Source: Finance.Google.com. (c) Google. Used with permission. On the other hand, Nilo earned gains in her 401K during the Great Recession with an easy plan that I drew up on the back of a napkin. Richard is saving $20,000 a year on his family health insurance. Mark took his electric bill down to zero from almost ten thousand annually. Two of our hot slices doubled this year and are poised to continue to do great going forward. The solution is wisdom. Protecting your nest egg is easy as a pie chart. Adopting a Thrive Budget takes you from buried alive in bills, drowning in debt and making the billionaires rich at your own expense to living a rich life, providing far better for your future and more bucket list vacations. My Gift to You My gift to you this holiday season is to help start you out on your path to financial wisdom with two online apps that quickly and easily show you what your personal Thrive Budget and nest egg pie chart look like. (Links are directly below.) The Thrive Budget App http://old.nataliepace.com/pie/thrive.php The Nest Egg Pie Chart App http://old.nataliepace.com/pie/pie.php You simply plug in your annual income to learn what you should be spending on basic needs. Add in your 401K, IRA and savings accounts (your “liquid assets”) to see how much you should be investing in stocks. The Pathway to Financial Wisdom This isn’t the end of the road of your pathway to financial wisdom. It’s the start. These apps offer the blueprint. If you want to be the boss of your life and money, then you’ll have to learn how to go from where you are financially to where you should be. The DIY of building this sustainable and rewarding life are outlined in my books and at my 3-day Investor Educational Retreats. The Valentine’s Retreat affords you the time and hands-on learning to get this done now, before the next recession and crash. Call 310-430-2397 or email to learn more now. These two free presents are my pleasure to gift to you this holiday season, so that you can be the boss of your life and your money, and never fall prey to the fast sale or the hard sale again. In August of 2000, a stockbroker from a major bank tried to hard sell me into stocks and funds that he said were diversified and trading for a good price. Here’s what his plan looked like.  . If I had invested in his plan, I would have lost everything. Dial-up connections destroyed Dot Coms. Enron went belly-up. Japanese stocks imploded. The telecommunications industry went bankrupt when long distant rates fell from 45 cents a minute to 10. Most of these problems were easy to see. However, with pundits blathering on about a “New Economy,” far too many fell for the sales pitch and ignored their own wisdom. I didn’t know that the broker/salesman had a conflict of interest and was just selling me those funds to make his own mortgage payment. However, I was adamant that I wasn’t going to invest my hard-earned money until I was presented with a plan that I had confidence in. My money stayed in an FDIC-insured Certificate of Deposit, earning 4.5% interest. Cash was the top-performing asset in 2000. The NASDAQ lost 78% of its value between March of 2000 and October of 2002. In August of 2001, I invested in a few companies that I believed strongly in (after much research), which were trading at rock bottom prices. I cashed out in December of 2001 – just three months after 911 – having almost tripled my money. That experience, and all of the research that I did to create it, formed the foundation of the simple pie chart system that I developed. It worked great in the Dot Com Recession, but how did the system perform in the Great Recession? Listen to Nilo Bolden describing how it worked for her. This rather simple system has worked in two of the worst recessions the U.S. has seen since the Great Depression. Buy and Hold has investors on a Wall Street rollercoaster. You can’t afford to lose more than half of your money every eight years. It takes a decade to crawl back to even (even if the markets rebound). One million becomes $450,000. With an annualized gain of 10%, or $45,000, you have to wait 12 years to get back where you started. The Nest Egg Pie Charts earn gains in recessions and outperform the bull markets in between. The Nest Egg Pie Chart Strategy

So, why isn’t this system taught in school and sold at brokerages? It isn’t as profitable for the broker/salesman as putting all of your dough into funds. Buy and Hold hasn’t worked since 2000, but it is still standard in the industry because it’s the only way that a broker/salesman can manage 600 or more clients. The Department of Labor advises that $19 billion is lost every year due to a conflict of interest in the financial services industry. (Credit card loans are another problem for another blog.) And here’s additional important information on the time-proven Nest Egg Pie Chart Strategy.

Over the years, we’ve identified many great hot industries that have sparked amazing returns. Between 2009 and 2011, gold miners tripled. We removed gold miners at the highs in 2011. Australia, Chile and Latin America soared in the wake of the Great Recession. The NASDAQ doubled the Dow – so we listed NASDAQ as a hot in 2011. Safe, income producing hard assets that you purchase for a good price are the best “safe” investment in today’s astronomically high debt world. Paper assets of all kinds are vulnerable to inflation, credit risk and currency moves. FDIC-insured cash is better than bonds as an interim move. However, BREXIT repriced the British pound and the euro overnight. If you wait for the headline, you’ll be late. Are You Beng Sold Down the River in Your Annuity, REIT, Dividend-Paying Stock? Annuities and insurance plans are offered by banks, brokerages and insurance companies that would be out of business if they hadn’t been bailed out eight years ago. There is no guarantee on these products. Most banks, brokerages and insurance companies have only a fraction of the capital to make good on their promises, and owe multiples more than their value. Annuities often have fees and complicated rules (with no guarantee). Everyone I know who is over the age of 60 has either lost their insurance policy or is now paying 4X the premiums for 1/4 of the coverage. Over the decades, if you'd saved and invested that money yourself, you'd have tens, if not hundreds, of thousands of dollars. Greek bonds, Detroit bonds, automaker bonds, airline bonds, etc. are not just a fluke. They are the result of high debt and borrowing from Peter to pay Paul. U.S. public debt is $20 trillion, with total U.S. debt ringing up to an eye-popping $63+ trillion. Many blue chips owe more than they are worth. Many dividend-paying REITs have been cash-negative for years. The higher the dividend the higher the risk. Sadly, there will always be a great pitch that costs you an arm and a leg. In 2000, it was the New Economy. In 2008, that bailing out the banks, insurance companies and brokerages would save the world. Meanwhile, 7 million Americans lost their homes, while over six million are still underwater. Today, unsuspecting retirees are being sold into high-risk REITs as a safe, income-producing investment, without being warned that the higher the dividend, the higher the risk. I examined the REITs sold to one 80-year-old woman. All had been cash negative for more than 3 years. The only solution to the conflict of interest that is inherent in the financial services industry is wisdom – The ABCs of Money that we all should have received in high school. If you want to make sure that you are:

Then join me at my Valentine’s Investor Educational Retreat. Click on the flyer below to learn more. Call 310-430-2397 with your questions and to register now, while there is still availability. (Only a handful of seats are still available.) You receive the best price when you register by December 15, 2016. Two Free Gifts Get your own Thrive Budget and sample nest egg pie charts at the links below. The Thrive Budget http://old.nataliepace.com/pie/thrive.php Nest Egg Pie Charts http://old.nataliepace.com/pie/pie.php |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed