|

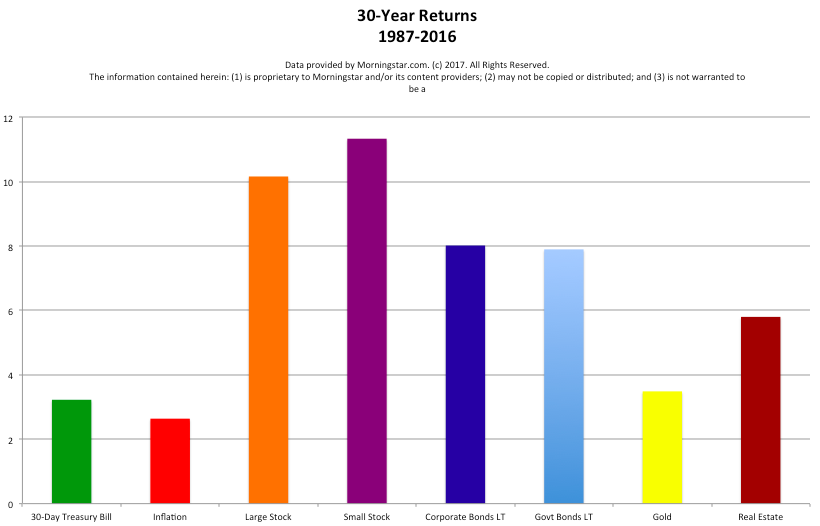

Last Wednesday night, Republicans stripped the American consumer of the right to sue banks or form class action lawsuits. This means that those people who suffered at the hands of Wells Fargo and had fake accounts set up cannot form a class action lawsuit against the bank for damages. It is also a problem for the 5.4 million Americans who are still severely underwater on their homes and the consumers who are carrying massive credit card, student loans and other forms of high-interest debt. But there are other changes to the fine print of what banks and can or cannot do that has placed your cash seriously at risk. 9 “Safe” Investments that are Riskier Than You Realize 1. FDIC-Insured Cash 2. Certificates of Deposit. 3. Predatory Lending. 4. Credit Cards. 5. Money Market Funds. 6. Life Insurance. 7. Long-term Health Care Insurance. 8. Annuities. 9. The Value of the Dollar. 1. FDIC-Insured Cash Banks are finding creative ways to earn more on your money, and to slide out from the FDIC insurance, often without you realizing it (unless you are reading all of the fine print). Here are just a few: * Changing the fees on your savings and checking, after you open the account. * Offering products that are not FDIC-insured. * Charging you to transfer money between accounts, charging egregious overdraft charges and usury interest rates that can equate to almost 30%. 2. Certificates of Deposit that are Not FDIC-Insured. Certificates of Deposit are not all FDIC-insured, particularly any higher-yielding CD, which has a risk of going down in value. Here again, you must read the fine print, and not just rely upon what the salesman (bank “specialist”) is telling you. Remember that bank specialists were pressured to set up fake bank accounts at Wells Fargo. All banks now teach tellers and others who work for them to cross sell other bank products. Few of these salesmen are properly trained on all of the fine print. If you don’t read all of the fine print, now that banks cannot be sued, you really don’t have any remedy. Arbitration almost always falls on the side of the bank, since arbitration must consider the fine print, even if you didn’t read it, understand it or if it was presented differently to you by the bank representative (something that is difficult to prove). 3. Predatory Lending. Consumer debt is higher than it has ever been, at $12.84 trillion. 5.4 million homeowners are still severely underwater on their home loans. Credit card delinquencies are as high as they were in 2009, during the Great Recession. College graduates are living with their parents, while paying off student loan debt and looking for better-paying work. While heavily indebted corporations in the U.S. can borrow at 5% or less and banks are borrowing at 1%, students and consumers are paying 7-28% interest on their debt. 4. Credit Cards. Credit cards are marketed as a great way to launch a new business. No experienced entrepreneur launches a business on 28% interest. Credit cards are also peddled to college students, who have never had to balance a budget. Far too many Americans are using credit cards to make ends meet. 5. Money Market Funds. The new tools – fees and gates –give fund boards the ability to impose liquidity fees or to suspend redemptions temporarily, also known as “gate,” if a money market fund’s level of weekly liquid assets falls below a certain threshold. In other words, you could be denied access or charged fees to the money you have in a money market fund, in the event that the bank that issued the fund is in trouble. 6. Life Insurance. One of the biggest issues with life insurance is that there is no real backstop if the insurance company goes out of business. This is the reason that AIG was the first bailout in the Great Recession – because over 50 million annuities and life insurance policies would have been worth next to nothing. Additionally, the only way that you make out with life insurance is if the worst thing happens fast, which statistically is very small. If you took the money you put into life insurance and instead funded your own retirement account, that money would be yours to keep forever. If you invested 10% of your annual income into a tax-protected retirement account, and that made a 10% return (what stocks and bonds have done over the past 30 years), you’d have more money in the account than you earn annually in 7 years, and in 25 years, your money will make more than you do. Buying life insurance is like paying rent. If you miss a payment, you get booted out. The longer you hold life insurance, the more expensive it becomes and the lower the payout will be. People always say that they can catch up and reactivate a lapsed life insurance policy. However, they are overlooking that the fact that when you are retired, you have less income, and fewer resources to do that, or that when you reactivate a policy, it is on different terms. 7. Long-term Health Care Insurance. Health savings accounts are far better than long-term health care insurance, particularly for healthy people, because the money you deposit into this tax-protected retirement account is yours to keep and the “premiums” will not rise exponentially as you age and/or face an illness. HSAs are not “use it or lose it.” They build up each year, offer massive savings on health premiums (with your higher deductible plan), and even give you a tax credit. Learn more about HSAs at IRS.gov. One more important consideration: Health is the best health insurance. 8. Annuities. Annuities are immediately worth less at the point of purchase. This is called a “surrender fee.” They act like a pension – becoming worthless to your heirs once you annuitize the payments. They are not FDIC-insured, and have no backstop if the insurance company goes bankrupt. Some can lose money, either based on market performance or with hidden fees and penalties. 9. The Value of the Dollar. The value of the dollar in purchasing power has weakened with regard to most of the asset classes (severely), and against the Chinese Renminbi, and is vulnerable to a credit downgrade from Fitch Ratings and Moody’s. (The U.S. was downgraded by Standard & Poor’s on August 5, 2011.) The U.S. stock market is at an all-time high (making stocks overvalued), and U.S. real estate is again higher than ever. The Solutions:

The first step in getting your liquid assets safe is to make sure that you keep a percentage equal to your age (at least) in FDIC-insured cash. In my nest-egg-pie-charts, I am overweighting an additional 20% safe. The second step is to start reducing as many big-ticket bills as you can. There are many ways that you can keep more of your hard-earned money without any change in lifestyle (offering the best Return on Investment available). The average American spends over $7,000 annually on car transportation (including insurance, gasoline and the car payment itself). Most Americans are spending at least $5,000 annually on utilities and gasoline, $3,000 (or more) on health insurance and more than ½ of their paycheck on housing and student loan debt. Over 5.1 million homeowners are still underwater on their mortgage. If you are getting your debt reduction, budgeting and investing strategy from the banks and insurance companies, then chances are that you are being sold into products that make them rich – many times at your own expense. Once you get safe and adopt a Thrive Budget and stop making the billionaire corporations rich at your own expense, you can start considering safe, income-producing hard assets that you purchase for a good price. Every single word in that sentence counts, particularly since stocks and real estate are higher than ever today. Think 20 years out and include the generation before and behind you. For additional ideas on these solutions, read my books, listen to the teleconference on this topic, attend a retreat and/or purchase a private, prosperity coaching session. Call 310-430-2397, or email info @ NataliePace.com to learn more. At my most recent retreat and Master Class, we identified a lot of hot stocks. Let me clarify that, however. Initially, the attendees wanted to toss the hot ones out because they were priced too high. In truth, a hot stock is a hot stock, just like ripe fruit is yummy and delicious. It's not the price that makes the fruit delicious, though you'll consider price before you buy. Likewise, great companies are hot stocks even if the price is high. Rather than toss them into the loser pile, put them on a stock shopping list. That way if prices drop dramatically, you know which companies you’re interested in buying first. As a reminder, the 3-ingredient recipe for cooking up profits is:

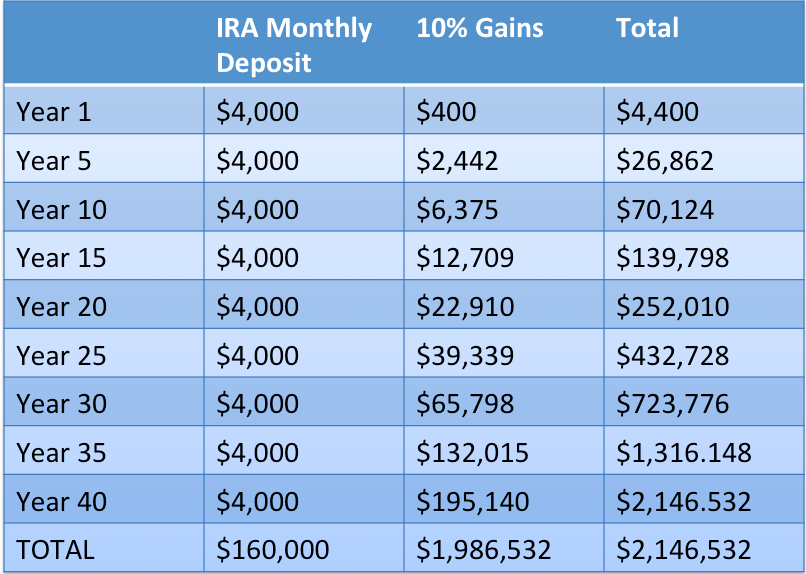

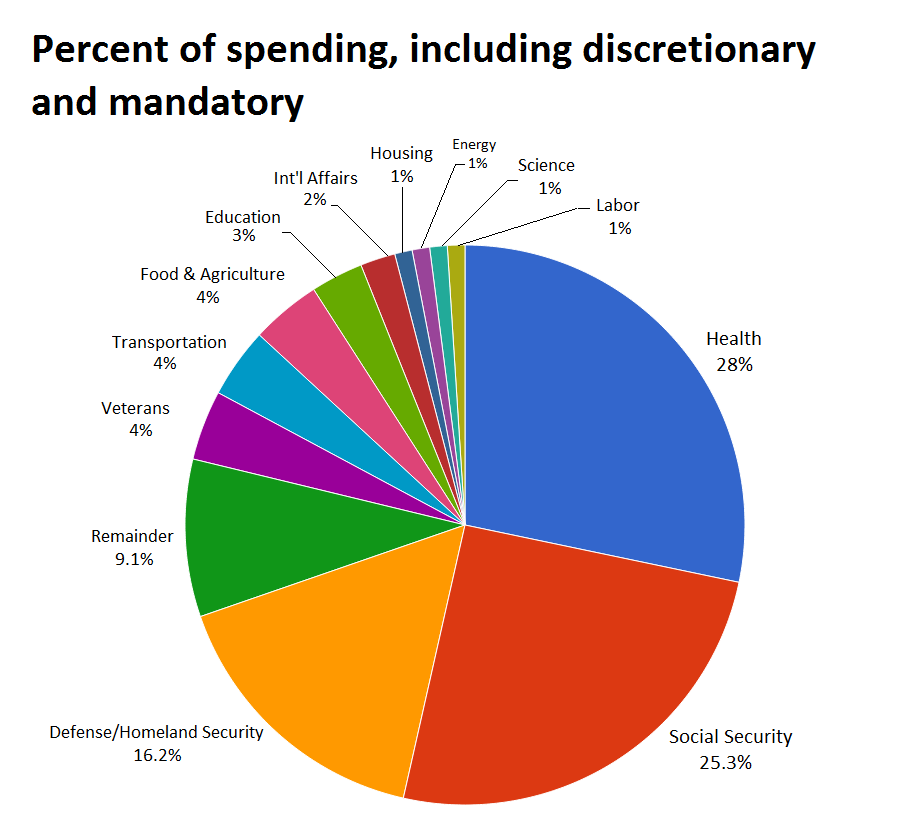

You have to take each ingredient in order. If you don’t know enough about the company, it is impossible to pick the leader. The price doesn’t tell you whether or not the company is any good. It can only help you to determine whether or not it is a good value. In general, in the 9th year of a bull market, it’s going to be very hard to buy low and sell high because most stocks are high. (There are a few exceptions.) The best you can hope for is to buy high and sell higher – a risky venture and not the time-proven adage! Impatient investors often think that prices will never come back into a buying range. Experienced investors are keenly aware that stocks have been on a rollercoaster this millennium, with corrections of 55% in the Dow Jones Industrial Average during the Great Recession (2008) and 78% in the NASDAQ Composite Index in the Dot Com Recession (2000). You don’t always have to wait for a market correction to get a great price, however. Sometimes, there is a rapid fall off the cliff in the price that happens overnight. The Ethereum Flash Crash of June 21, 2017 is a great example (crypto currency). The price dropped from $318 to 10 cents in a matter of minutes. One smart investor with a limit buy order bought at 10 cents and saw his prescience reward him before the setting of the sun. A sundry of stop loss investors would have lost their shorts, if the GDAX hadn't made a one-time exception to ignore the orders. Today, Ethereum is back at $283.75. So, what are some of those hot stocks? There was an artificial intelligence company, a marquise clean energy company, a company that targets the law enforcement community and a Chinese company. I could give you a fish in a private, prosperity coaching session (offer up the names of these companies). Or I can teach you how to fish, which will sustain you now and for the rest of your life, at my Investor Educational Retreat. Call 310-430-2397 if you are interested in either of these opportunities. What’s the Secret To Profiting on a Hot Stock? When you buy a hot stock, it doesn’t feel like a hot stock at all. Nobody likes buying low. In fact, it feels lonely because no one else is interested at all. People assume there is something inherently wrong with the company when the price is low. You might feel as though you’re walking into a burning building, with the coals still smoldering, saying “I see potential,” when just moments before others were racing out yelling, “Fire!” You have to understand why the company is going to be hot, and why you are seeing this before everyone else is. If you wait for the headline, then the price is going to be high. That is why my Stock Report Cards and Four Questions work so well. You are able to peer into the crystal ball, understanding exactly why the company is going to explode on the marketplace like a rocket, and buy the company’s stock while it is still trading for a great price. These tools can also forewarn you about stocks that everyone thinks are hot, but are poised to sink like a rock in share price. One example of this was my warning on the Snap Inc. IPO. Click to read that warning blog from February of this year. Since my warning, the Snap share price has dropped by almost half. Don’t Confuse a Bull Market With Wisdom Late into a bull market, I always get calls from people bragging about how much money that they have made. Sadly, because Wall Street has been such a rollercoaster since 2000, very shortly thereafter, I’m often receiving an SOS call. The truth is that most people shouldn’t be trading. You should be invested however, and here is the reason why. If you just save your money, you might have thousands at the end of four decades. If you invest that money, you’ll become a millionaire. Investing with a smart system means getting enough safe, diversifying, adding in the hots, avoiding the bailouts, knowing what safe is, and rebalancing annually. This might sound complicated. But it is easy as a pie chart. I teach this at the Investor Educational Retreats, too. This is the 9th year of the current bull market, so wake up and make sure that you are protected, diversified, safe and hot, and that you know what is safe in a world where bonds and money market funds are vulnerable. Do not just have blind faith in a financial professional. In a downturn, if you lose more than half of what you’ve got, your money is gone and it can take a decade or more to make up the losses. (It took NASDAQ 15 years to return to the highs set in 2000.) Are You Tempted to Buy High? The last two recessions were so deep and devastating that most investors were too gun shy to buy anything at the bottom, when everything was on sale. Those same investors who sold low to stop the pain and losses at the bottom of the market are now tempted to jump back in, even though, as we enter the 9th year of the bull market, we may be primed for another correction. That is the problem with market timing. More often than not, you're selling low and buying high. Wisdom and a solid, time-proven system allow you to profit and earn money while you sleep, while protecting what you have from recessions and losses. My easy-as-a-pie chart nest egg strategy earned gains in the last two recessions and outperformed the bull markets in between. (Click to watch Nilo Bolden's video testimonial.) This economy is far more fragile than it was in 2000 or 2008. Home prices are higher than they’ve ever been, as is debt (personal, corporate, public, municipal, financial industry), stock prices and much more. Whether you have made a killing in stocks this year, were burned by buying gold high when that asset was on a tear in 2011, are buried in debt or struggling to get ahead, there are easy, time-proven solutions that are available, which can put you on a better track to a more prosperous today and tomorrow. You can live a richer life, save thousands each year, have fun and profit (safely) on hot stocks, protect what you have, reduce your debt and even have more money for bucket list vacations. Now is the time to get money-smart, no matter what this year has been like for you! The sooner you learn and adopt the secrets of the wealthy (which is not the mainstream money group think), the faster your life transforms. Wisdom is the cure. Call 310-430-2397 to learn more. Ever wonder who is picking up the tab every time the U.S. borrows more money to pay its bills? How is it that we can magically raise the debt ceiling and, poof!, instantly more money appears? Who would loan money to a country that has doubled its public debt load over the past decade? (And did the same thing the decade prior to that.) Errr. For the most part, we do. If your 401K, IRA or savings account is invested in a Treasury bill mutual fund, ETF or money market account, you own part of the U.S. debt. The Treasury has also borrowed from “the trusts for Federal Social Security, Federal Employees, Hospital and Supplemental Medical Insurance (Medicare), Disability and Unemployment, and several other smaller trusts” (according to the World Fact Book). About 31% of the debt is owned by foreigners, with China and Japan holding about $1.1 trillion each, followed by a lot of European nations, a few Middle Eastern nations, Russia and others. Japan and China have actually reduced the amount of our debt that they hold over the last year. Saudi Arabia and Russia have both increased their holdings. Click to see the Major Foreign Holders of U.S. Treasury Securities. Get more information on how social security accounts for 28% of the public debt and is the fastest growing (cash-negative) burden on our economy, in my Social Security Blog. Is Debt Ever Good? Borrowing from Peter to pay Paul only has a happy ending when the borrowing is done to fund something that creates great value. When an excellent student borrows money to become a doctor, engineer, computer scientist, CFO (or another career with excellent earning potential), then the loan has a greater chance of being paid back. When a corporation borrows money to build factories to make products that the consumers of the world love, as Apple and Tesla have done, then the loans have a greater chance of being paid back. America has long been the world’s reserve currency, with a legacy of inventing the products that the world loves. That plays in our favor. What plays against us is that the money being borrowed today is largely funding war, health care and social security, which account for almost 70% of the annual federal budget (source: Politifact). While a country must defend itself and keep its citizens healthy and happy, we must also create the products, goods and services that the world needs and is hungry for to create a better tomorrow for the planet and all of us. In fact, the period of greatest expansion in U.S. history, under President Clinton, occurred during a relatively peaceful time for our nation. Our collective investments in the 1990s focused on developing the Internet and the smart phone, which put the U.S. at the forefront of innovation yet again. Anticipating the products of tomorrow is what kept America the strongest economy from the 1940s until 2000... A few years ago, China surpassed the U.S. in term of GDP purchasing power parity. As we slip into 3rd position on the global scale, behind China and The European Union, it's important to empower entrepreneurs, invest in Research & Development, educate our Millennials, get healthy, roll up our sleeves and work, and not just become a nation of war, borrowing and social security.

Should You Be Loaning the U.S. Money? There are certainly safer investments that you should be considering. (I do not recommend just “cashing out” now without a plan, or dumping everything into Bitcoin, gold or real estate). I spend one full day on “What is Safe?” at my Investor Educational Retreats. I also offer a second opinion on your current budgeting and investing strategy. You can read my books and blogs and listen in on my free teleconferences. (I answer questions in the second half of my monthly teleconferences.) Wisdom is the first step. Right action is also key. Quick fixes, lofty promises, free seminars and get-rich-quick schemes are more often scams and money pits. The solutions are not hard, but they do require accurate information and an effort on your part to learn and transform your own life. When someone says, "Let me do it for you," prepare to be oppressed. When someone says, "Let me teach you how," prepare to fly. Again, be very wary of anyone who says they can fix this for you, and all you have to do is to write a check and trust them. There are very few people who have the results track record to warrant your trust and blind faith. Most “fixes” are actually commission-based products, and most of the experts offering those fixes are salesmen, who are schooled in sales-speak, not economics. *This blog was updated on Oct. 10, 2017. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed