|

At my most recent retreat and Master Class, we identified a lot of hot stocks. Let me clarify that, however. Initially, the attendees wanted to toss the hot ones out because they were priced too high. In truth, a hot stock is a hot stock, just like ripe fruit is yummy and delicious. It's not the price that makes the fruit delicious, though you'll consider price before you buy. Likewise, great companies are hot stocks even if the price is high. Rather than toss them into the loser pile, put them on a stock shopping list. That way if prices drop dramatically, you know which companies you’re interested in buying first. As a reminder, the 3-ingredient recipe for cooking up profits is:

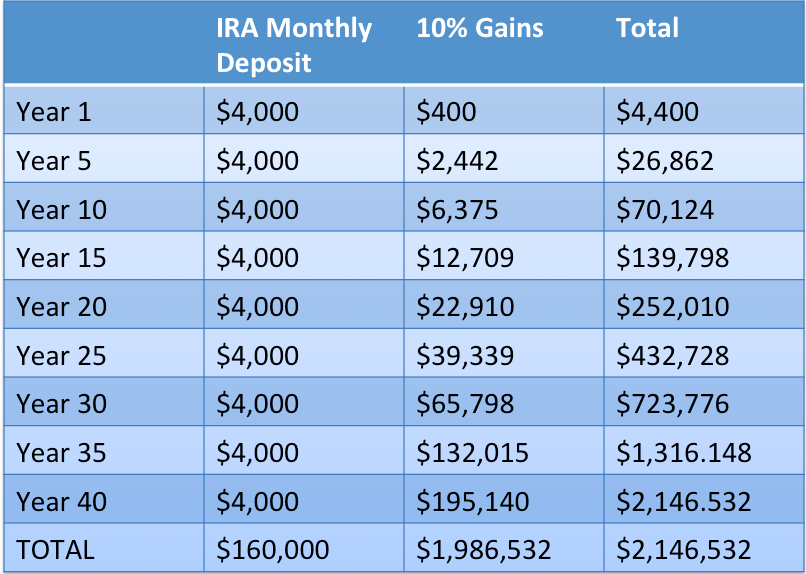

You have to take each ingredient in order. If you don’t know enough about the company, it is impossible to pick the leader. The price doesn’t tell you whether or not the company is any good. It can only help you to determine whether or not it is a good value. In general, in the 9th year of a bull market, it’s going to be very hard to buy low and sell high because most stocks are high. (There are a few exceptions.) The best you can hope for is to buy high and sell higher – a risky venture and not the time-proven adage! Impatient investors often think that prices will never come back into a buying range. Experienced investors are keenly aware that stocks have been on a rollercoaster this millennium, with corrections of 55% in the Dow Jones Industrial Average during the Great Recession (2008) and 78% in the NASDAQ Composite Index in the Dot Com Recession (2000). You don’t always have to wait for a market correction to get a great price, however. Sometimes, there is a rapid fall off the cliff in the price that happens overnight. The Ethereum Flash Crash of June 21, 2017 is a great example (crypto currency). The price dropped from $318 to 10 cents in a matter of minutes. One smart investor with a limit buy order bought at 10 cents and saw his prescience reward him before the setting of the sun. A sundry of stop loss investors would have lost their shorts, if the GDAX hadn't made a one-time exception to ignore the orders. Today, Ethereum is back at $283.75. So, what are some of those hot stocks? There was an artificial intelligence company, a marquise clean energy company, a company that targets the law enforcement community and a Chinese company. I could give you a fish in a private, prosperity coaching session (offer up the names of these companies). Or I can teach you how to fish, which will sustain you now and for the rest of your life, at my Investor Educational Retreat. Call 310-430-2397 if you are interested in either of these opportunities. What’s the Secret To Profiting on a Hot Stock? When you buy a hot stock, it doesn’t feel like a hot stock at all. Nobody likes buying low. In fact, it feels lonely because no one else is interested at all. People assume there is something inherently wrong with the company when the price is low. You might feel as though you’re walking into a burning building, with the coals still smoldering, saying “I see potential,” when just moments before others were racing out yelling, “Fire!” You have to understand why the company is going to be hot, and why you are seeing this before everyone else is. If you wait for the headline, then the price is going to be high. That is why my Stock Report Cards and Four Questions work so well. You are able to peer into the crystal ball, understanding exactly why the company is going to explode on the marketplace like a rocket, and buy the company’s stock while it is still trading for a great price. These tools can also forewarn you about stocks that everyone thinks are hot, but are poised to sink like a rock in share price. One example of this was my warning on the Snap Inc. IPO. Click to read that warning blog from February of this year. Since my warning, the Snap share price has dropped by almost half. Don’t Confuse a Bull Market With Wisdom Late into a bull market, I always get calls from people bragging about how much money that they have made. Sadly, because Wall Street has been such a rollercoaster since 2000, very shortly thereafter, I’m often receiving an SOS call. The truth is that most people shouldn’t be trading. You should be invested however, and here is the reason why. If you just save your money, you might have thousands at the end of four decades. If you invest that money, you’ll become a millionaire. Investing with a smart system means getting enough safe, diversifying, adding in the hots, avoiding the bailouts, knowing what safe is, and rebalancing annually. This might sound complicated. But it is easy as a pie chart. I teach this at the Investor Educational Retreats, too. This is the 9th year of the current bull market, so wake up and make sure that you are protected, diversified, safe and hot, and that you know what is safe in a world where bonds and money market funds are vulnerable. Do not just have blind faith in a financial professional. In a downturn, if you lose more than half of what you’ve got, your money is gone and it can take a decade or more to make up the losses. (It took NASDAQ 15 years to return to the highs set in 2000.) Are You Tempted to Buy High? The last two recessions were so deep and devastating that most investors were too gun shy to buy anything at the bottom, when everything was on sale. Those same investors who sold low to stop the pain and losses at the bottom of the market are now tempted to jump back in, even though, as we enter the 9th year of the bull market, we may be primed for another correction. That is the problem with market timing. More often than not, you're selling low and buying high. Wisdom and a solid, time-proven system allow you to profit and earn money while you sleep, while protecting what you have from recessions and losses. My easy-as-a-pie chart nest egg strategy earned gains in the last two recessions and outperformed the bull markets in between. (Click to watch Nilo Bolden's video testimonial.) This economy is far more fragile than it was in 2000 or 2008. Home prices are higher than they’ve ever been, as is debt (personal, corporate, public, municipal, financial industry), stock prices and much more. Whether you have made a killing in stocks this year, were burned by buying gold high when that asset was on a tear in 2011, are buried in debt or struggling to get ahead, there are easy, time-proven solutions that are available, which can put you on a better track to a more prosperous today and tomorrow. You can live a richer life, save thousands each year, have fun and profit (safely) on hot stocks, protect what you have, reduce your debt and even have more money for bucket list vacations. Now is the time to get money-smart, no matter what this year has been like for you! The sooner you learn and adopt the secrets of the wealthy (which is not the mainstream money group think), the faster your life transforms. Wisdom is the cure. Call 310-430-2397 to learn more. 28/12/2018 10:09:36 am

An interesting discussion is worth comment. I think that you should write more on this topic, it might not be a taboo subject but generally people are not enough to speak on such topics. To the next. Cheers 20/4/2020 03:21:42 am

As customers need to understand that the products that sell in high price doesn’t mean they are actually good in quality. As these are tactics of the seller to sale their products. They sale their products with different tag line same as “hot sale”. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed