|

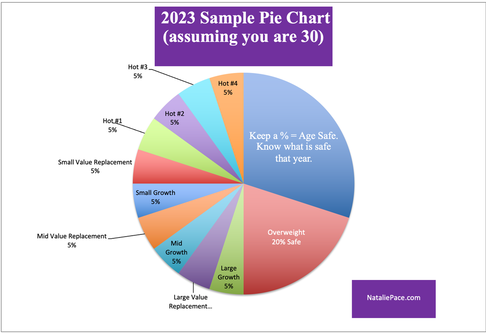

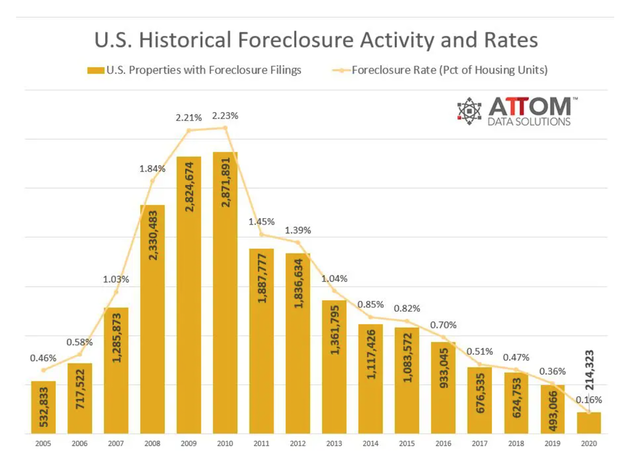

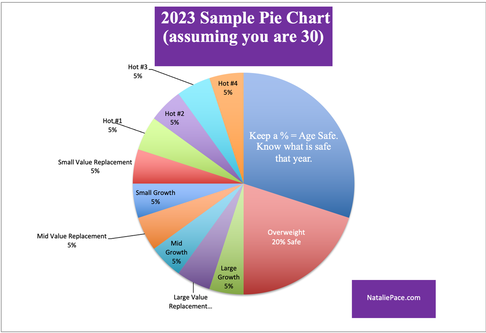

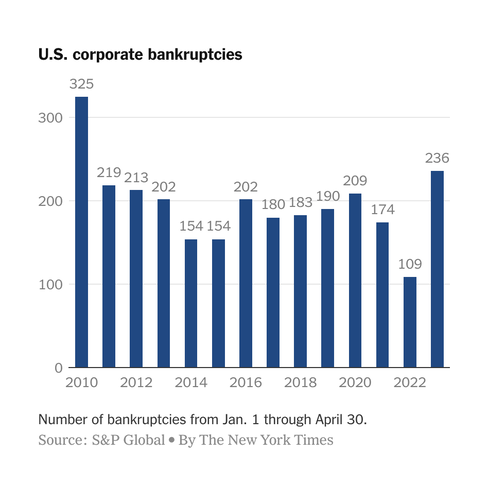

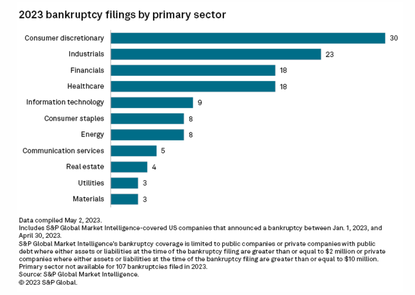

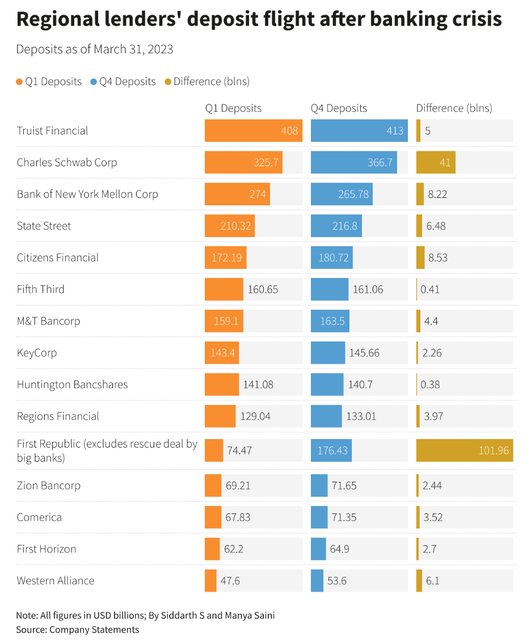

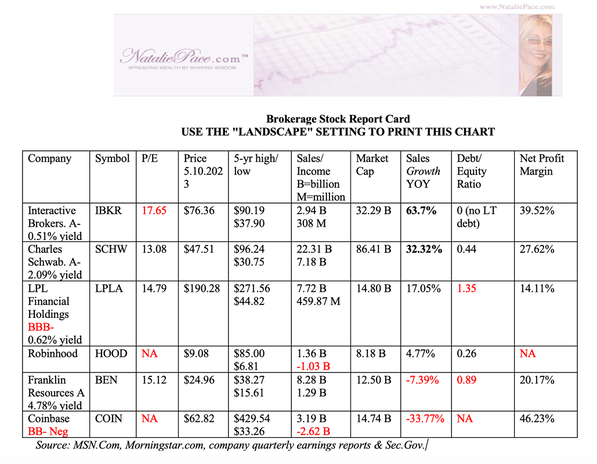

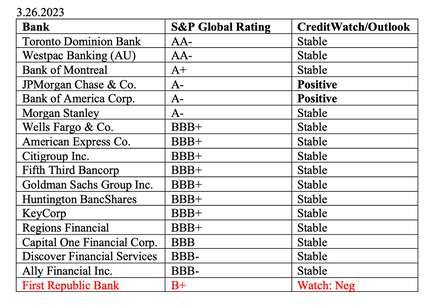

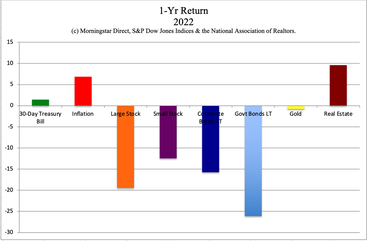

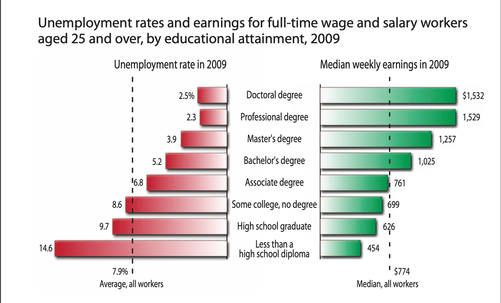

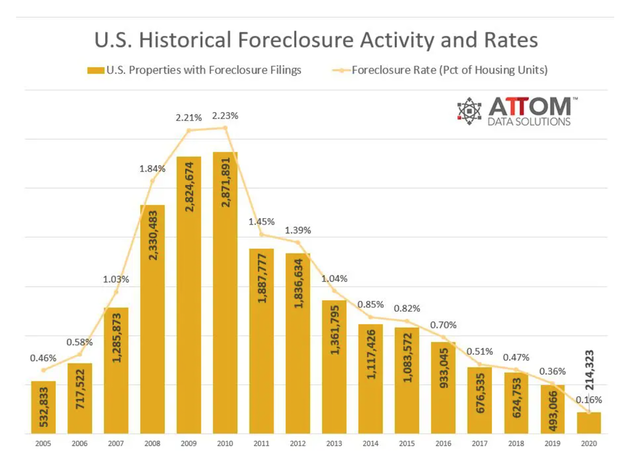

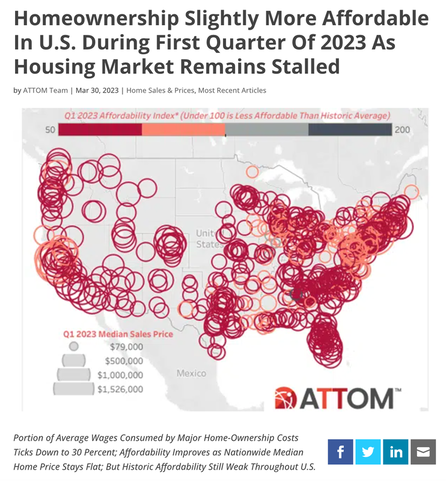

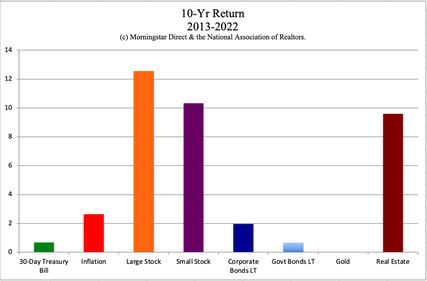

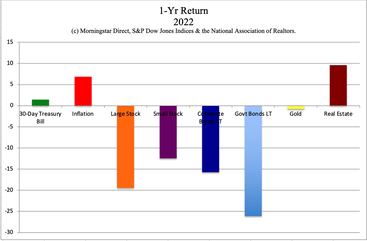

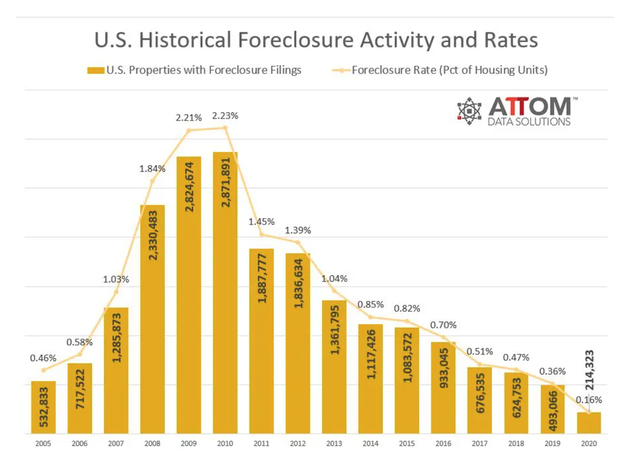

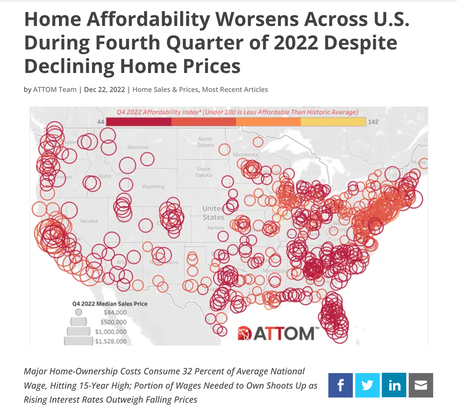

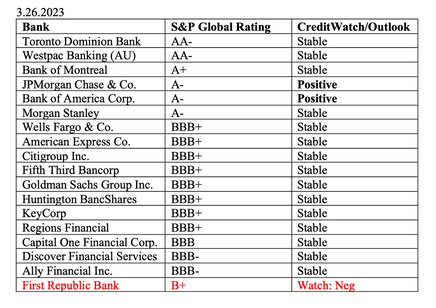

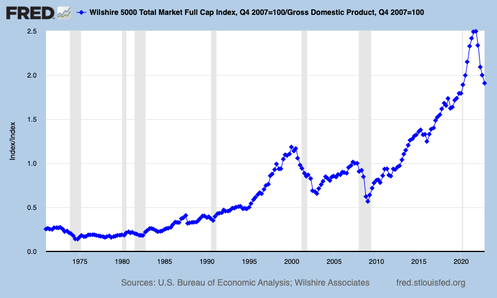

Hundreds of Thousands of Dollars in Losses. Investors Ask Natalie. Recently our team received an email from someone who had over one hundred thousand dollars of losses over the past year and a half. She had been referred by someone who received a 2nd opinion from me back in 2018, who is grateful that our strategies have protected her wealth and given her “sanity and peace.” The request was to help her understand why she was losing so much money, and how to prevent further losses – particularly as she had previously always just invested in whatever her father’s advisor told her to. Are You in a Similar Position? Have you lost $100,000 or more in your retirement plan, or your managed brokerage account? Have you checked on the performance of your portfolio? Are you afraid to face the truth? Are you hoping that someone else is protecting you, without any checks and balances or oversight? 2022 Was a Terrible Year for Stocks and Bonds With long-term government bonds losing -26% and stocks losing -20% last year, a $1 million portfolio could’ve lost $200,000 or more. If this is what happened to your plan, then it’s riding the Wall Street rollercoaster – winning in bull markets and losing a lot in bear markets. (There’s a better plan. Keep reading.) While it’s tempting to just want to hang on and hope to make up losses, history teaches us that recessions cost investors a great deal more than that. (There is a recession predicted in 2023. The powers that be always say that it will be mild, until, of course, banks start failing and contagion sets in.) The Dot Com Recession shaved 78% off of the value of the NASDAQ Composite Index 78%, and then took 15 years to recover. The Great Recession cost the Dow Jones industrial Average 55% of its value, and then took about seven years to recover. During the pandemic, the S&P500 dropped 38% in less than five weeks. What Works in a Recession? During the Dot Com and the Great Recessions, simply overweighting safe allowed investors to earn gains instead of losing more than half of their wealth. Bonds were performing quite well, and kept the portfolio buoyant. This time around, bonds are losing even more than stocks, which makes a potential recession even more problematic for investors. (Bond and mortgage-backed securities losses have played a large role in the failures of Silicon Valley Bank, Signature Bank, First Republic Bank and Credit Suisse, and could start impacting insurance companies, hedge funds and other financial services corporrations.) Though protecting our wealth on the safe side is tricky, it is doable. A carefully crafted plan will also help us to save thousands annually in our budget, to boot. 2023 Recession-Proof Strategies to Protect & Outperform So, what can we do to protect our wealth, even if we have already experienced losses in our portfolio. Is it too late? It’s no fun to have losses of 20%. However, doing nothing could put half of our wealth (or more) at risk. The truth is: the sooner that we adopt time-proven strategies, the better. Rather than rely on a whistle and a prayer, or blind faith that somebody else is protecting our wealth for us (when the losses suggest otherwise), we can learn the life math that we all should’ve received in high school, and create a future that is healthier for us personally, as well as our collective well-being. Below are just a few ways that we can do this. Adopt a Thrive Budget® Protect and Diversify Our Retirement Plan Know What We Own and Why Know What is Safe Anticipate Volatility And here is more information on each of these points Adopt a Thrive Budget® The Thrive Budget® is rather easy to follow in terms of the math, but requires brave choices. If we want to fly in this life, we have to lighten our load. The truth is, if we follow the conventional path of getting a college degree, securing a job, buying a house, paying our student loan debt, investing in our 401(k), then buying life, car and home insurance – our budget doesn’t add up. We might have to put food on credit cards. Did you know that most people under 40 are spending 30-50% of their income on housing alone! That is unaffordable and unsustainable. A lot of conventional personal finance books chastise us for buying too many café lattes and avocado toast, while overlooking the fact that basic needs in today’s world just don’t add up. Of course, if you’re drinking a $5 coffee every single day, you could save over a thousand dollars a year by not doing that. However, the real problem is the tens of thousands of dollars (or more) that we spend on health insurance, housing, transportation, gasoline, utility bills – basically all the things that we think of as our basic needs. Many of us are essentially slaving away at our jobs to make the landlord, the tax man, the gasoline station, the health insurance company, the insurance salesman, the utility provider, the car manufacturer and other companies rich, while we spin on the hamster wheel of life not getting ahead. HENRY (High Earner, Not Rich Yet) has been coined to describe this sad phenomenon. Smarter choices on the big-ticket spending allow us to clean up this Augean Task. You can read about the various tools that promote our fiscal health, and lead to living a richer life in the Thrive Budget® section of The ABCs of Money, 5th edition. I will be hosting a special free videoconference on this topic, June 8, 2023, at 5 PM ET, 2 PM PT. If you’d like to join us live, just email [email protected] with VIDEOCON in the subject line. You can watch it back at https://www.youtube.com/nataliepace. Whether we are a young professional, a college student, parents who are living in the sandwich generation, or someone who is getting ready to retire, now is the time to set up our financial house, so that we can withstand any economic storms on the horizon. Protect and Diversify Our Retirement Plan A properly diversified investment plan protects us from losses, while allowing us to participate in bull runs and hot trends. If your portfolio lost 20% or more last year, that’s a sign that your portfolio is not properly protected and diversified. Our time-proven, 21st-century strategies actually earned gains in the Dot Com and the Great Recession, and outperformed the bull markets in between. It’s a little trickier this time around with bonds being the worst performers on Wall Street. However, while tricky, it is doable to protect your wealth from losses, especially if there’s a recession, by making some strategic adjustments to your plan now. This plan is less time and money than most of us spend worrying and obsessing over the dire headlines, or being enticed by too-good-to-be-true schemes. Our time-proven, 21st Century strategy is literally easy-as-a-pie-chart, with regular (1-3 times a year) rebalancing. You can read about these strategies in the Stocks and What’s Safe sections of The ABCs of Money, 5th edition. You can learn them and implement them at our next Investor Empowerment Retreat, which is scheduled for June 10-12, 2023. You can also reach out and get your own unbiased 2nd opinion. Email [email protected] for pricing and information. The June Retreat will likely be the last retreat before October. Summers are typically weak on Wall Street. So it’s a good idea to batten down the hatches of our financial house before we head out on vacation, so that we can have a great time, free from worry and stress, and return home, knowing that we don’t have a giant problem waiting for us. Testimonial "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics Know What We Own and Why Learning the life math that we all should’ve received in high school means that we don’t have to have blind faith that somebody else is protecting our wealth for us. Most managed brokerage accounts ride the markets. It’s easy to make money in bull markets and easy to lose a lot very quickly in bear markets. Once we know the basics of a healthy investment strategy, then the foundation of our wealth plan is established. We can keep building and learning throughout our lives, knowing that the base is solid and secure. Learning the ABCs of money that we all should’ve received in high school is easier than algebra. It allows us to be the boss of our money. Whether we start with an unbiased 2nd opinion on our current plan, or with the 3-day retreat, as Benjamin Franklin said, “An investment in knowledge pays the best interest.” When everything is at risk, we can have devastating losses. Those losses affect everything we own. FICO scores plunge, causing interest rates to soar – if we can get any loan other than on a credit card. The reason most people don’t buy low (a well-known investment rule) is that they can’t. They lose too much money in the recession and are barely hanging on. Buying low is out of the question. Did you know that over 20 million homes were foreclosed on directly before and after the Great Recession? When we wait for the headlines that the economy has turned, it is too late to protect our wealth. Typically, we’re much closer to the bottom of the bear, so acting at that time would be selling low. It’s a much better idea to fix the roof while the sun is still shining. Know What is Safe At a time when banks are failing, when insurance company products, like annuities, are not FDIC-insured, and bonds are losing more than stocks, it’s important to have a carefully designed strategy for protecting our future. The safe side of our plan is not supposed to lose principal value, and yet, as mentioned at the top of this blog, long-term bonds were the worst performers on Wall Street in 2022. Protecting our wealth by knowing what is safe in a Debt World where there is far too much leverage, assets are overvalued and financial services companies are vulnerable is tricky, but doable. That’s why we spend one full day on what’s safe at the Investor Educational Retreat. Anticipate Volatility Recently, one of my coaching clients talked to me about the stocks in his portfolio. He had lost about $30,000 of his $3 million in liquid assets. It’s easy to look at the red minus signs, and fret that we’re a terrible stock picker and perhaps shouldn’t invest at all. However, when we put the $30,000 in stock losses in context of his entire portfolio, he lost 1% of his portfolio, at a time when many folks lost 20% or more. Having the appropriate amount invested (and overweighting safe) protected him from losses, while positioning him to buy low. (Market timing doesn’t work. Most people are too late getting in or out, and end up buying high and selling low.) A properly diversified plan is one where we don’t expect to be perfect. We anticipate that equities might be weak in a recessionary year, and overweight an additional amount safe as protection against a downturn. This preserves our capital for future purchases, and protects us from losses. We are currently overweighting 20% safe in our sample pie charts. We must also understand why banks are failing, why insurance companies could also be a problem, and protect our safe side from weakness in all of the financial services providers. This plan takes us out of FUD (Fear. Uncertainty. Doubt.) and into a successful strategy. The task then becomes to drown out the nonstop financial noise, and focus on staying true to the plan – to “stick to our knitting.” We offer free Thrive Budget® and Easy-as-a-Pie-Chart® investing web apps. Just email [email protected] to receive the links. Bottom Line The price of 21st Century recessions can be devastating. Hoping to earn back losses in the bull market isn’t a smart idea; it’s just riding the Wall Street rollercoaster. This could be a disaster at any stage in life, but is particularly problematic the closer we get to retirement. Fortunately, a time-proven, 21st Century strategy that earns gains in recessions and outperforms the bull markets in between is easy as a pie-chart (which is why it is enthusiastically recommended by Nobel Prize winning economist Gary S. Becker). Email [email protected] or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep, ESG and home buying solutions that will transform your life and heal our planet at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. June 10-12, 2023. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. This is likely the last retreat before Oct. It's a great idea to protect your wealth before you go on summer vacation.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. Early Bird pricing ends May 30, 2023. There is very limited availability.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Artificial Intelligence Report. Micron Banned by China. Intel Slashes Dividend. Artificial intelligence is one of the hottest industries in the world today. ChatGPT dropped November 2022, and since then has spread like wildfire. For many entrepreneurs, our virtual assistant has become as indispensable as the C-Suite executive secretary. At the same time, Intel slashed their dividend by 66% in February, and on Monday Micron Technology was banned in China. Revenue is plunging for all AI companies. So, how does AI look for investors? Is this an industry you should be leaning into or underweighting? Are AI stocks on sale or overpriced? Is the revenue rout temporary, or will it be reversed? Micron Technology Micron was banned in China on Sunday, May 21, 2023. The company said that it expects a revenue impact in the single digits. However, the CFO Mark Murphy also indicated that about a quarter of Micron’s revenue comes from companies headquartered in China, either directly or indirectly. The Chinese ban comes at a time when Micron was already losing revenue, with the 1st quarter revenue down -53%. Before the ban, the company was projecting $3.7 billion in revenue for the June quarter of 2023. That’s likely to be a miss now. Revenue could plunge by -60% or more year over year. Micron has a lot of cash on hand – $9.8 billion as of March 2, 2023. However, they burned through $2.3 billion in the first quarter. Will the company have to slash their dividend (like Intel) to conserve capital through the challenging climate they find themselves in? The share price has held strong since the unexpected news of the Chinese ban. Micron shares, like other high-profile technology companies, are still very expensive, with a price/earnings ratio of 48. TikTok Banned by Montana It is worth noting that Micron was banned just a few days after TikTok was banned in Montana (on May 17, 2023). Details of whatever the Micron security breach is that the Chinese regulators are concerned about have yet to emerge. However, we are seeing continued stress between Chinese and U.S. relations, which is still weighing on Chinese equities that are traded on the NYSE or NASDAQ stock exchanges. Intel Intel cut its dividend by 66% on February 22, 2023, slashing it from 36½ cents per share to 12½ cents. According to the Intel press release, “The improved financial flexibility will support the critical investments needed to execute Intel’s transformation during this period of macroeconomic uncertainty.” Intel is another company that saw revenue decline year over year. In the most recent quarter, revenue was down -36%. The 2nd quarter projections are for $11.5-$12.5 billion in revenue, -18-25% lower than last year’s $15.32 billion. The results should be announced around July 27, 2023. Advanced Micro Devices AMD is projecting lower revenue in the 2nd quarter as well, down -20-24% year over year, from $6.6 billion in 2022 to $5.3 billion. The biggest weakness came from AMD’s client processor business, which saw revenue decline by -65%. Gaming revenue declined by -6%. Meanwhile, this company is trading at a very elevated share price. With net income of just $1.32 billion last year, AMD is valued at $174 billion by Wall Street investors. Will Nvidia Stop Buying Back Its Own Stock? Nvidia will release its earnings report tomorrow, May 24, 2023, after the markets close. The company is projecting that revenue will decline by -21.6%. This will mark the 3rd straight quarter of revenue and net income declines. However, the company is still trading at an all-time high, with an outlandish price/earnings ratio of 179. Nvidia has been a darling on Reddit for over a year and a half. However, the resilience of the stock, and its meme stock throne may be coming to an end. Nvidia has been on an aggressive stock buyback spree. Between May 23, 2022 and January 29, 2023. Nvidia repurchased $17.12 billion of their own stock. After that flurry of shopping, they are left with only $7.23 billion authorized to repurchase stock through the end of 2023, unless the board authorizes more. With revenues down by -21% percent and net income down by -53% in the first quarter of this year, the company may be lucky to hang onto their modest annual dividend of $0.16. It’s unlikely they’re going to be able to authorize more share repurchases, unless the economy and revenue rally unexpectedly. Should a company that earns less than $5 billion a year in net income be worth $763 billion? ChatGPT ChatGPT is an OpenAI project that made headlines in November – with not all of them being good. Though the AI chatbot can write term papers for students, it can also have a rather cavalier attitude about outrageously inaccurate information. These “hallucinations” have also been racist, misogynistic and misguided. The valuation of OpenAI is about $29 billion. Elon Musk was a board member, and Microsoft has invested $19 billion in the nonprofit/for-profit hybrid endeavor (according to Wikipedia). What About an AI ETF? Investing in individual companies that are offering artificial intelligence could prove to be a problem. Many of the stocks are still very expensive. Most of the companies are losing revenue and net income, and burning through cash, at a time when borrowing is cost-prohibitive. On the other hand, artificial intelligence is here to stay. It’s become embedded and essential in so many of our products, from gaming, to smart phones, automobiles, marketing, law-enforcement, data centers and beyond. The Artificial Intelligence ETF offered by iShares, symbol IRBO, is currently trading in the range of $30 a share. It hit its high of 51 in February 2021. If we invested in IRBO previously, chances are that the slice has gotten smaller, as the share price plunged. (This is why rebalancing is so important. If your slice becomes two, sell one high!) Rather than just fill up the slice now to be fully invested, with a recession on the horizon and continued weakness in AI projected, a better strategy might be dollar cost averaging. Basically, whatever the amount is that you would have in your slice, divide that by 12 and do a monthly purchase, or divide it by three and do a quarterly purchase. That way, if the value of the ETF weekends, you’re are buying more at a lower price, rather than just watching your investment go down. If you’d like to add a slice of artificial intelligence to your diversified plan, the same strategy might be a good idea. Take it slow and easy. Bottom Line AI is here to stay. Dividends, however can be here today and gone tomorrow, such as we saw with Intel in February 2023. Share prices can plunge as well, as we saw in the pandemic recession, when most of the AI companies dropped to prices that are half or more below where the shares are trading today. Nobody is predicting the 2023 recession to be as terrible as the pandemic, due to a tight labor market, and continued consumer spending. However, we’re taking a cautious approach, nonetheless, and overweighting 20% additional safe in our nest egg pie chart strategy. If you’d like to mock up your own personalized pie chart, email [email protected] with Free Web Apps in the subject line. Our web applications are complimentary to you. We’re happy to send you a link so that you can start learning how to protect and grow your wealth with time-proven, 21st Century strategies. Email [email protected] or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep, ESG and home buying solutions that will transform your life and heal our planet at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. June 10-12, 2023. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. This is likely the last retreat before Oct. It's a great idea to protect your wealth before you go on summer vacation.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. Early Bird pricing ends May 30, 2023. There is very limited availability.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Bankruptcies Soar. Insurance Company Risks. Buffett and Branson Losses. Insurance companies are taking on high risk, according to the Federal Reserve’s Financial Stability Report, which was released on May 8, 2023. Warren Buffett (Berkshire Hathaway) lost almost $23 billion last year. Virgin Orbit filed for bankruptcy on April 4 (Richard Branson’s company). Discover how all of this ties together. It’s hard to invest successfully when everything is going down in value. Warren Buffett lost almost $23 billion last year. Virgin Orbit filed for bankruptcy last month. According to S&P Global, U.S. corporate bankruptcy filings are the highest this year that they’ve been since 2010. I mention all of this for a multitude of reasons. It’s important for us personally to protect our wealth, in a world where banks are failing, stocks are falling, bonds (traditionally considered safe) are illiquid and losing value, with the added risk that our insurance and annuity policies are not as safe as many of the policyholders are banking on. All of this is interrelated because the weakness in banks is as a result of lending to businesses that are up against the ropes, and holding long-term bonds that are losing value. Which Businesses are the Most Impacted by the Bankruptcies? As you can see in the chart above, consumer discretionary has seen the most companies go belly-up so far in 2023, with Bed, Bath and Beyond (a former meme stock darling) being one of the more high-profile. Industrials (like Virgin Orbit), financials (SVB, Signature, First Republic, Credit Suisse) and health care have significant insolvencies, too. So far, real estate looks pretty safe. However, empty office buildings, particularly in metro areas like San Francisco and New York City, are a looming threat. As I mentioned in my Real Estate blog a few weeks ago, it’s no accident that Silicon Valley Bank and First Republic (both San Francisco area based) and Signature Bank (based out of Manhattan) were the first to be seized by the FDIC. This is a problem for life insurers (who also sell annuities) because many are heavily invested in real estate mortgage loans, including partially empty office buildings. The Risks to Insurance Companies According to the Federal Reserve’s Financial Stability Report, “Life insurers continue to allocate a high percentage of assets to instruments with higher credit or liquidity risk, such as high-yield, corporate bonds, privately placed corporate bonds, and alternative instruments. These assets can suffer sudden increases in default risk, putting pressure on insurer capital positions.“ If Warren Buffett can lose $23 billion in a year, how creditworthy is the life insurance company that is in charge of our annuity and or life insurance? How much did they lose last year or are at risk of losing this year and going forward? Are insurance companies, including Berkshire Hathaway, at risk of failing in 2023, like some banks have? What happens when they do? Is there a federal agency that protects insurers like the FDIC protects depositors? How Healthy are Insurance Companies? The earnings in most insurance companies are starting to show weakness. Some companies like Berkshire Hathaway, Prudential Financial and Lincoln National lost a lot of money in 2022. Others, including AIG, Lincoln National and Corebridge have seen their income and earnings plunge in the most recent quarter. You have to wade through a lot of cheerleading in the AIG 1st quarter 2023 results before you get to page 3, where they admit that their pre-tax loss was $231 million compared to pretax income of $5.7 billion a year ago. AIG is the parent company of various life insurance companies. It’s a good idea to check just which company, and their credit rating and earnings outlook, owns our future. Exposure to Long-Term Bonds, Commercial Real Estate & Mortgage-Backed Securities The losses at AIG came from investments, rather than sales of their insurance retirement and annuity products. According to the 1Q earnings report, AIG’s total invested assets amount to about $285.2 billion. (The company’s market value is only $38 billion.) Of that total, commercial mortgage loans total about $34 billion, with $8.6 billion invested in office loans. Almost half of AIG’s office exposure is in NYC, which is one of the areas where companies are reducing their office space and/or attempting to sublease unused floors. It’s common for insurance companies to have large holdings of corporate bonds, mortgage backed securities, real estate, and other alternative investments. This worked in a low-interest rate, low-default environment, but can become very problematic in a Work-From-Home, inflationary, high vacancy, expensive borrowing, potential recession year. Again, in the Financial Stability Report, the writers stress, “Life insurers continue to have elevated liquidity risks, as the share of risky and illiquid assets remained high.” Which companies are the Most at Risk? Lincoln National, AIG and Corbridge are all at the lowest rung of investment grade, just above junk-bond status. The other insurers on our stock report card are rated A or A-. At minimum, it’s important to know the credit rating of your insurance company. However, it’s also prudent to be aware that First Republic Bank was rated A- before it failed. It went directly to junk without warning. If you’d like to receive my Insurance Company Stock report Card, just email [email protected]. Not FDIC-Insured Life insurance products are never FDIC-insured. They are backed solely by the company. AIG and other insurance companies had to be bailed out in 2008. Will they be bailed out in the next crisis? Will insurers be short-changed? Is this a risk you wish to take? Now would be a very good time to rethink our exposure to insurance, annuities and other products offered by life insurance companies – before they face trouble and start making headlines. The exposure to default is not the only risk one takes on with insurance companies. There might be hidden fees. There can be fine print where our benefits might be reduced, while our premiums increase in certain circumstances. (One of my friends had a million dollar life insurance policy that over time was reduced to just $250,000. They were paying $20,000/year in premiums for more than 15 years – money that could have been compounding, if invested, instead of siphoning off their wealth.) The older you get, the higher the premiums soar, and the greater risk of a reduction in benefits. Of course, if the unfortunate happens early on in the policy, it is a windfall. Annuity products are one of the few investments where your money goes down by 9% or more the minute you buy the product. They call it a surrender fee. (Gold and silver coins, and new cars fall into the money pit of losing a lot at the purchase point, too.) We might think, “Well, if I just hold it for a decade, then I’ll have made XYZ annualized return.” However, are we factoring in that the company itself might get into trouble before then, or that life might hand us an opportunity or a challenge where the money might be put to better use or needed elsewhere? FINRA.org does a very good job of talking about the pluses and drawbacks of annuities. Click to access their information and education. Also, read the fine print and factor in the risk of turning over your future without having a safety net, like the FDIC. Safety nets are a good idea in the Debt World that we find ourselves in. Warren Buffett’s Attitude about the Losses A couple of times in the Berkshire Hathaway 1Q 2023 earnings report the executives write that they “believe that investment gains and losses on investments in equity securities …are generally meaningless.” It appears that at least part of the losses in 2022 were from put options, which have expired. So, that chapter might be behind them. In the most recent quarter, earnings are up 21% year over year. Berkshire Hathaway is a very diversified company, with ownership in Geico car insurance, railroads, Heinz, energy, Apple, utility projects, and other equity investments. Their stock portfolio includes a lot of banks. So continued weakness in banks will definitely impact Berkshire Hathaway. However, the company has a $125 billion cash cushion, so they can buy time through troubled periods. Additionally, Berkshire’s diversification model and emphasis on safety above yield is a time-proven, recession-proof strategy. I wouldn’t put all of my eggs in the Berkshire basket, particularly at this moment when the company is trading near its all-time high. However, even with the risk and weakness of most insurance companies, one could make a case of having a slice of Berkshire – for the investor who is okay with owning a company that invests in fossil fuels and plastic chemicals. Bankruptcies Are at a 13-Year High Again, with: