|

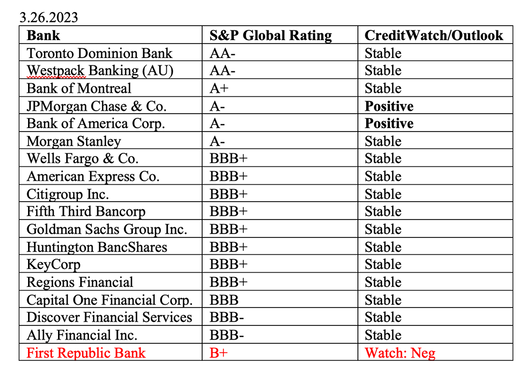

Are There Any Safe Green Banks? Investors Ask Natalie. Dear Natalie, In my coaching session, we discussed choosing a bank that is FDIC-insured, has an A or higher credit rating, and one that offers interest on my savings. I was considering transferring to Chase or Bank of America. However, a friend brought to my attention that these banks are heavily invested in fossil fuels. She told me to check out green banks. Do you have recommendations for a bank that meets the solvency and interest requirements that is also environmentally friendly? Thank you! Signed, Green Saver Dear Green Saver, I firmly believe that we should be putting our money where our heart is. I also believe that we should be able to keep our money, and not have it overly at risk or worrying us, as has happened for depositors over the past few weeks. Bank Failures Small, regional banks (like the ones listed on the Green Banks List you provided) are more susceptible to bank failures than the big banks. With the failures of Silicon Valley Bank and Signature bank, solvency is a serious concern. To put this into perspective, 489 banks failed during and after the Great Recession, between 2008 and 2013. They were all regional banks. The big banks were bailed out. Jerome Powell, the Federal Reserve Board, the Treasury Department and the FDIC are all saying that even uninsured depositors are safe if a bank fails. However, the FDIC-insured limit is still just $250,000. There is some fine print in the Silicon Valley Bank FDIC notification that indicates uninsured depositors may not have immediate access to all of their money. (Click to read the FDIC press release.) Green Washing & False Advertising It’s tempting to look at a list of green banks and just want to put our money there. However, we’ve seen time and time again how labels can be very deceiving. ESG funds are missing the E (environment) and actually have 20% or more polluters in the index. (Click to read that blog.) The fund companies that claim to be socially conscious often invest in fossil fuels, big pharma, fast food and other companies that have a big CO2 or waste footprint. (We will discuss this in the Financial Empowerment Retreat April 22-24, 2023.) Whenever there is a beautiful carrot dangling in front of us, a lot of times there is trouble, green washing, false advertising or outright scams lying on the other side of the bait. So, just using the criteria, green or divested of fossil fuels to select our bank could be very perilous to our financial health, and not actually help to wean us off of oil addiction. Who is Running the Company, and Who is in Charge of Oversight Yes, there are some new, very small banks that claim not to be invested in fossil fuels. However, we’re going to have to do a forensic analysis of who runs the bank, how long they have been running the bank, how much experience they have, how much control and oversight they have, how many shares they personally own, and whether or not they have problems in their background. My spot check revealed business practices that were far too lax for me to feel comfortable in giving any of these banks my money. The banks on the list are so young that each one I checked didn’t have a credit rating. One was only a year old, with less than 20 employees! Another had no board listed on its website. CrunchBase showed only two employees and one adviser/board member employed at the bank – i.e. no oversight or accountability. The Bank for Good vetting process doesn’t appear to include much in the way of making sure that the people running the bank are doing so in a professional manner – something that is KEY when you’re thinking about stowing your life’s fortunes in their hands. Are Big Banks Invested in Fossil Fuels? Yes. However, so are most investors, most workers, all taxpayers, and anyone with a life insurance policy or annuity. According to CU200, Fidelity, Dimensional, Blackrock, Vanguard, State Street, Life Insurance Corp. of India and Capital Group (American Funds) are among the 10 investors with the most influence over the world’s fossil fuels. The Rainforest Action Network cites JPMorgan Chase, Citi, Wells Fargo, and Bank of America as being responsible for one quarter of all fossil fuel financing identified over the last six years. According to RAN, “RBC is Canada’s worst banker of fossil fuels, with Barclays as the worst in Europe and MUFG as the worst in Japan.” Below are the current credit ratings of a few U.S., Australia and Canadian banks. Consumption and Fossil Fuels (Oil, Gas, Plastic, Polyester…) We drive. We use plastic. We wear polyester. A vast majority of us have a single-use problem. Over half of each barrel of oil goes for petrochemical products, like plastic, polyester, rubber, asphalt, etc. Therefore, if we really want to reduce CO2 and convince banks and other investors to stop profiting from polluters, we’re going to have to change our awareness and habits to stop voting for fossil fuels with our purchasing dollars. That would do a lot to stop banks and the financial services industry from investing in fossil fuels. If there aren’t any profits to be made, they won’t invest. I strongly encourage each of us to read The Power of 8 Billion: It’s Up to Us, and to commit to reducing our personal CO2 footprint by 30% this year. Going Green with Our Green Does that mean we should throw our hands up in defeat and turn our accounts over to the big banks that are destroying our planet? No. We can do a lot better with our investments, our life insurance, our annuities, our bank deposits, and as importantly, our consumption choices. Going green with our bank deposits, while also protecting our wealth is tricky because the most highly rated U.S. banks (Bank of America and JPMorgan Chase) are the worst about investing in fossil fuel companies and projects. It’s also important to remember that most investors, taxpayers and anyone with a retirement account (particularly those target date funds) are invested in fossil fuels. Greening our investments is something that we teach at our Financial Empowerment Retreats. (You’re attending in April and will learn important ways to do this then/there.) Putting Our Money Where Our Heart Is Activism can and should include putting pressure on the banks and fund companies to divest from fossil fuels, to stop using fossil fuels ourselves, and to limit the business that we do with the worst offenders. Since banking green is so tricky and fossil fuels are so pervasive in all of our lives, I’ll offer a few examples of how we might do this in my Green Banks videoconference on Thursday, April 6, 2023. If you’re not already registered to receive the logon instructions, just email [email protected] with VIDEOCON in the subject line to join us live. I will also be hosting a videoconference this Thursday on Where to Stash Your Cash that will include 7 things to do to protect our wealth and future. You can watch this on YouTube.com/NataliePace, or listen on my Apple or Spotify podcasts. Bottom Line Divesting our lives of fossil fuels has to go farther than just selecting a green bank. The money and investments that we don’t think about, particularly those in our retirement accounts, need to be confronted just as much as the banks that host our ATM cards. Educating ourselves on the power we hold as consumers, changing our habits, and learning how to put our money where our heart is will offer the tipping point we’re looking for. Excluding some of those things could keep things at the status quo. Once we learn this essential life math (that we all should have received in high school), it becomes the way life is, and gives us each a shot at healing our home planet and conserving the flora, fauna and animals that live here with us. It will also save most of us thousands of dollars annually, when we learn how to rethink our big-ticket spending, particularly on energy. I’ll see you in April at our investor empowerment retreat, Green Saver. (Invite your friend to learn how to bank and invest green, too!) In 3 life-transformational days, you’ll learn a whole lot more of how you can achieve what you are looking for with a carefully crafted plan, and by taking a hard look at the woman in the mirror and asking her to change her ways. Most of us need an energy audit. Few of us, particularly Americans, Canadians, Australians and anyone living in the Middle East, have a low carbon footprint. (Europeans have a footprint about 2/3rds lower than Americans, Canadians and Australians. Africans have the lowest CO2 footprint, with the highest impact of climate change. The Middle East has the highest CO2 footprint per capita by far. All this and more is outlined in The Power of 8 Billion: It’s Up to Us.) Email [email protected] or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep and home buying solutions that will transform your life and heal our planet at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. April 22-24, 2023. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed